Over the past two months, copper has rallied alongside risk assets and now stands 9% above its late-May trough. Here, the outlook for China’s economy – which accounts for over half of global refined copper usage…

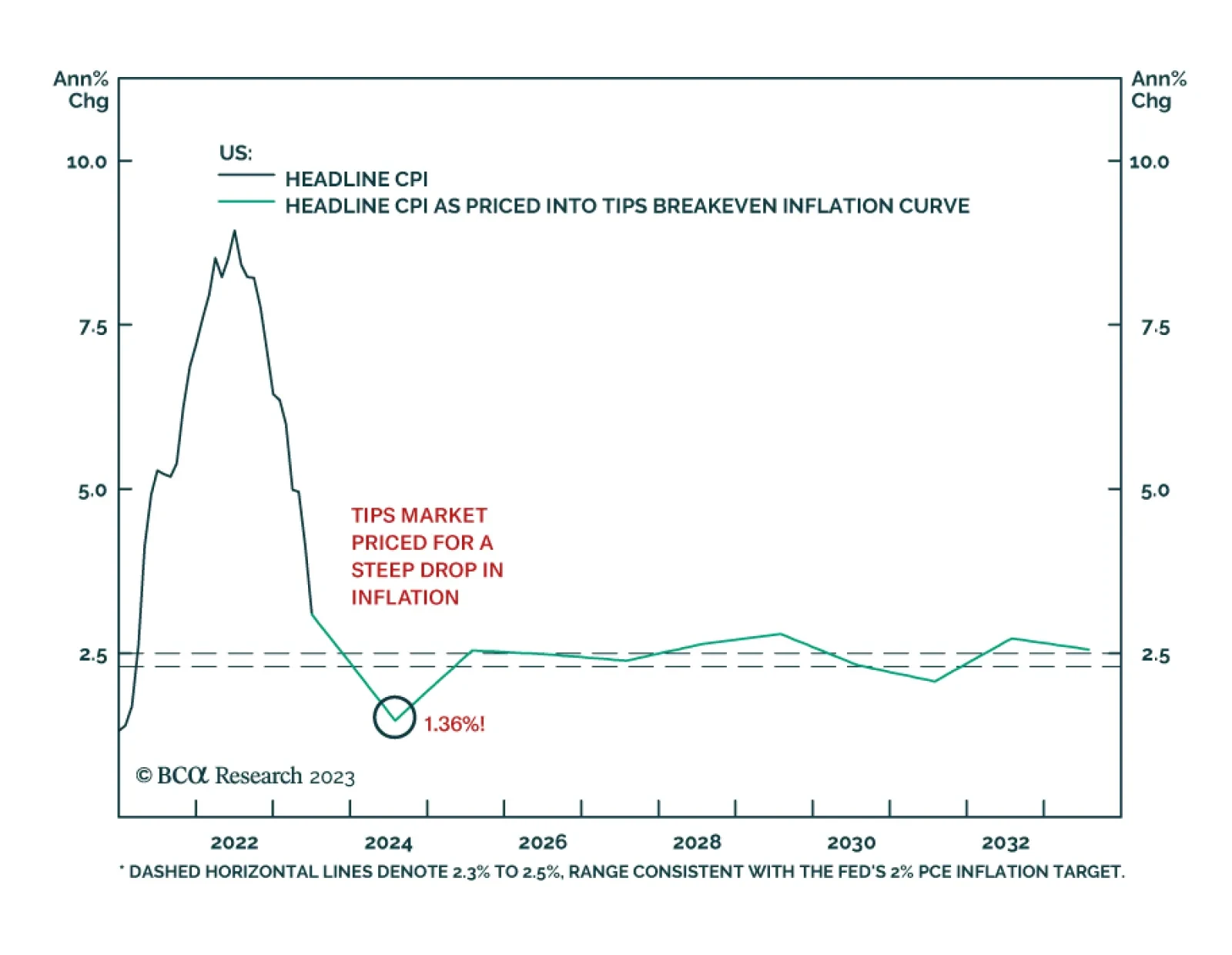

According to BCA Research’s US Bond Strategy service, inflation will fall during the next 12 months, but not by as much as markets expect. Investors should take advantage of this valuation opportunity by entering 2-year/10-…

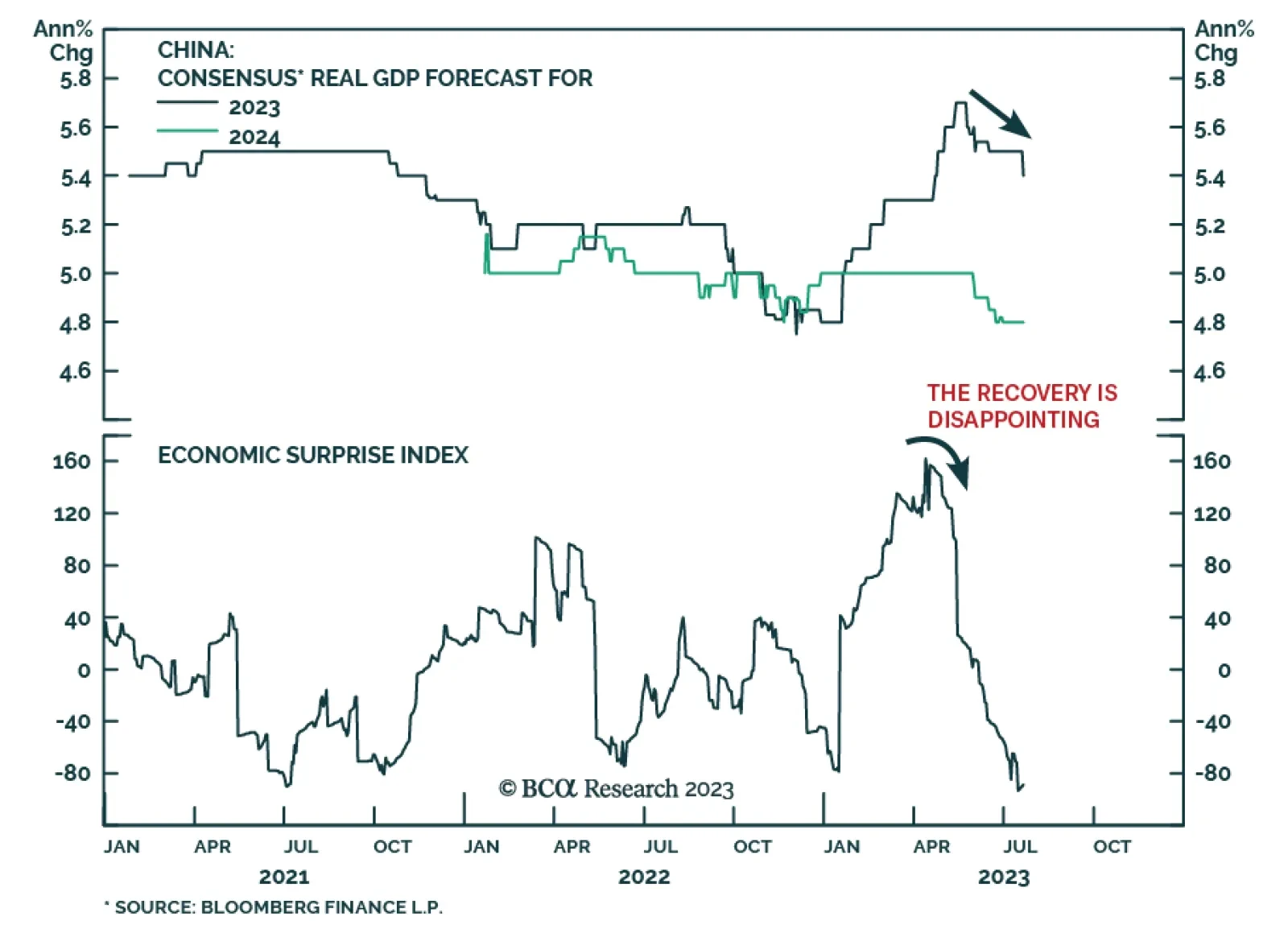

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

The snap election which took place on Sunday resulted in a political deadlock in Spain. No single party has won enough seats to form a government. More importantly, both the left-wing bloc and the right-bloc fell short of the 176-…

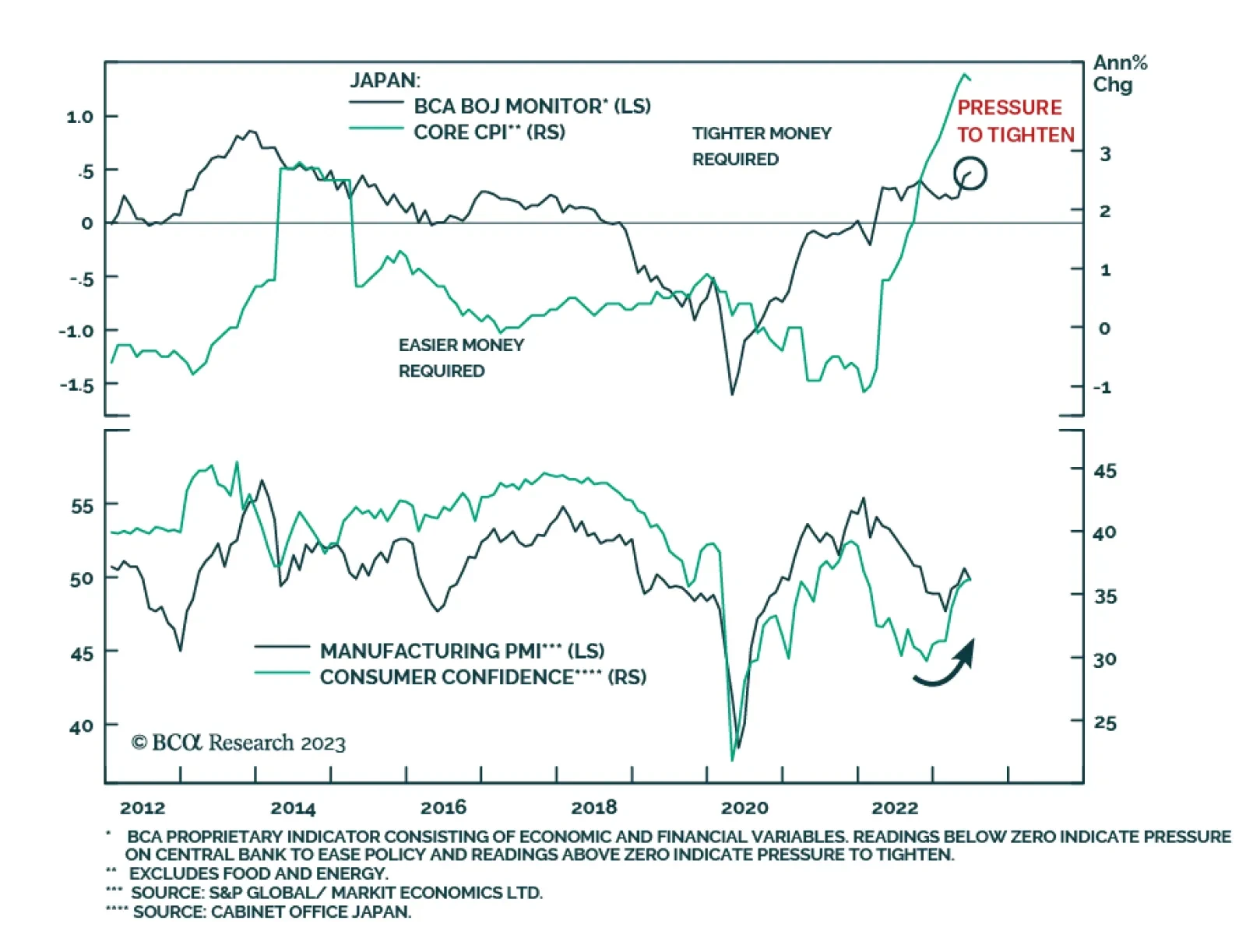

The Japanese yen slid by 2.1% vis-à-vis the US dollar last week, reversing the prior week’s rally. This latest bout of weakness comes on the back of speculation that the Bank of Japan will keep policy unchanged at…

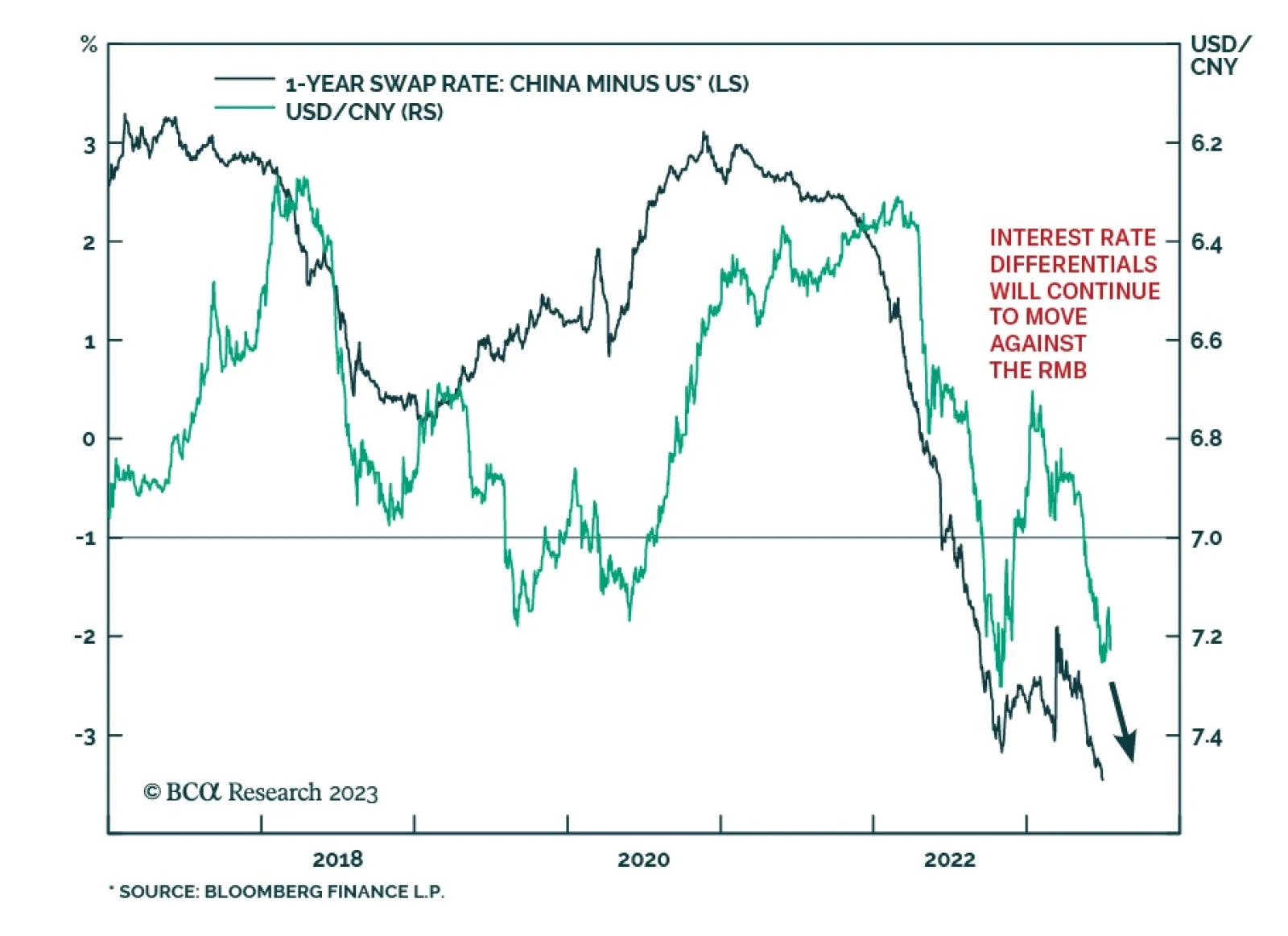

The Chinese yuan was among the best performing currencies on Thursday after authorities implemented measures to support the yuan. Specifically, the People’s Bank of China (PBoC) set its daily fixing at a stronger-than-…

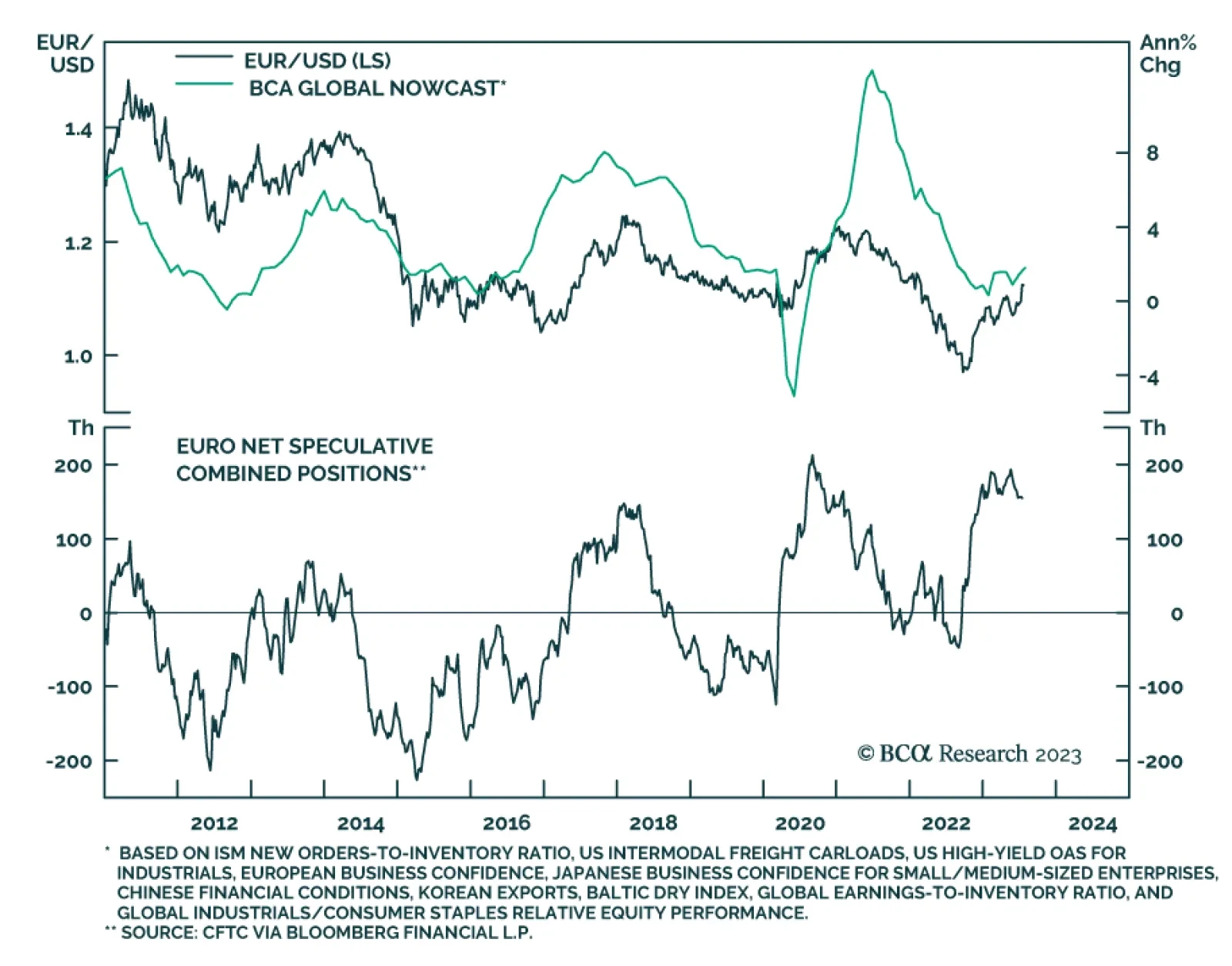

After US inflation slowed down markedly, EUR/USD broke out to 1.12, which constitutes a 16-month high. The euro is benefiting from the market expectation that the Fed will soon be done with its hikes while the ECB’s…