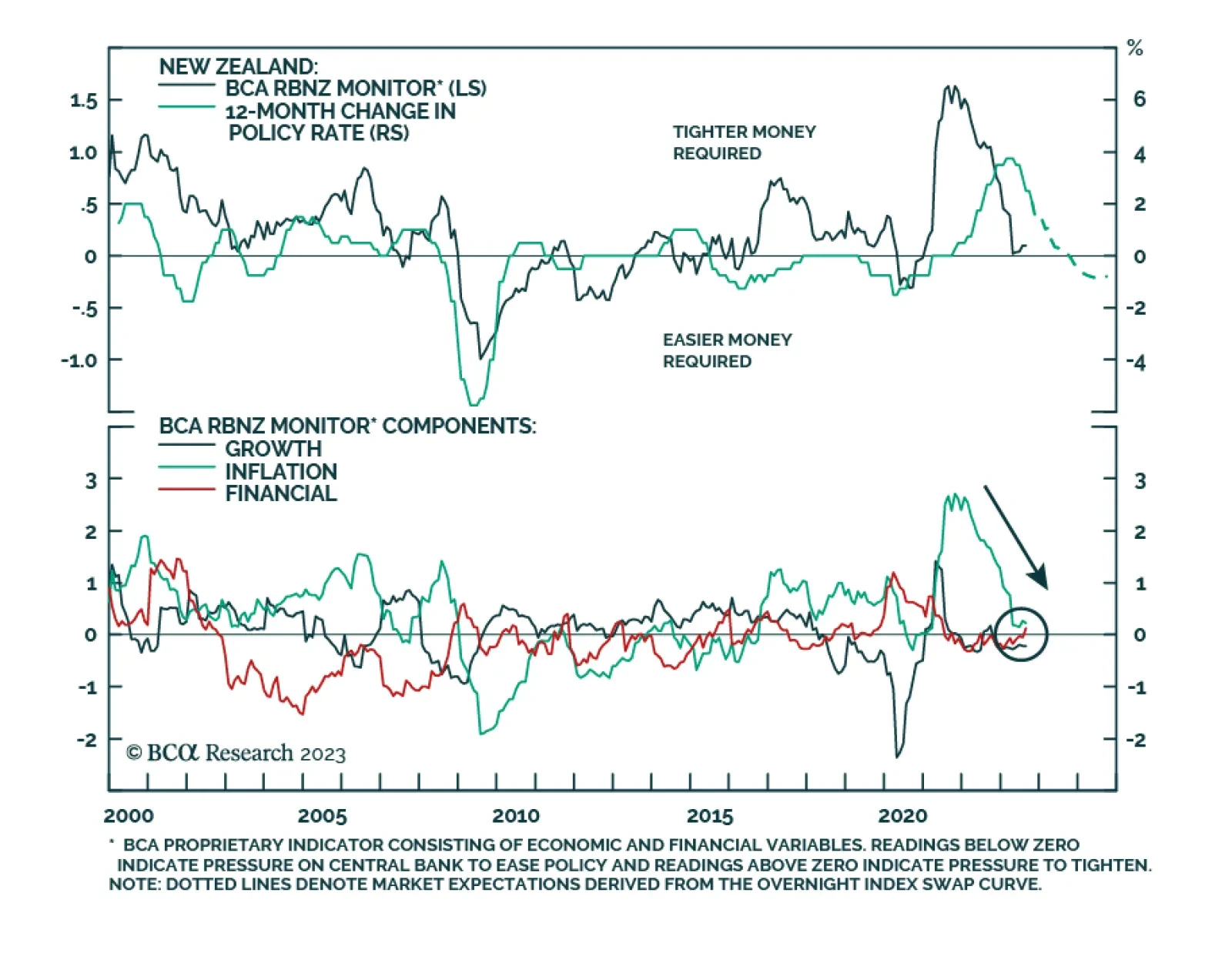

As expected, the Reserve Bank of New Zealand held the official cash rate at 5.5% on Wednesday, keeping policy unchanged for the third consecutive meeting. The press release underscored that while monetary policy is weighing on…

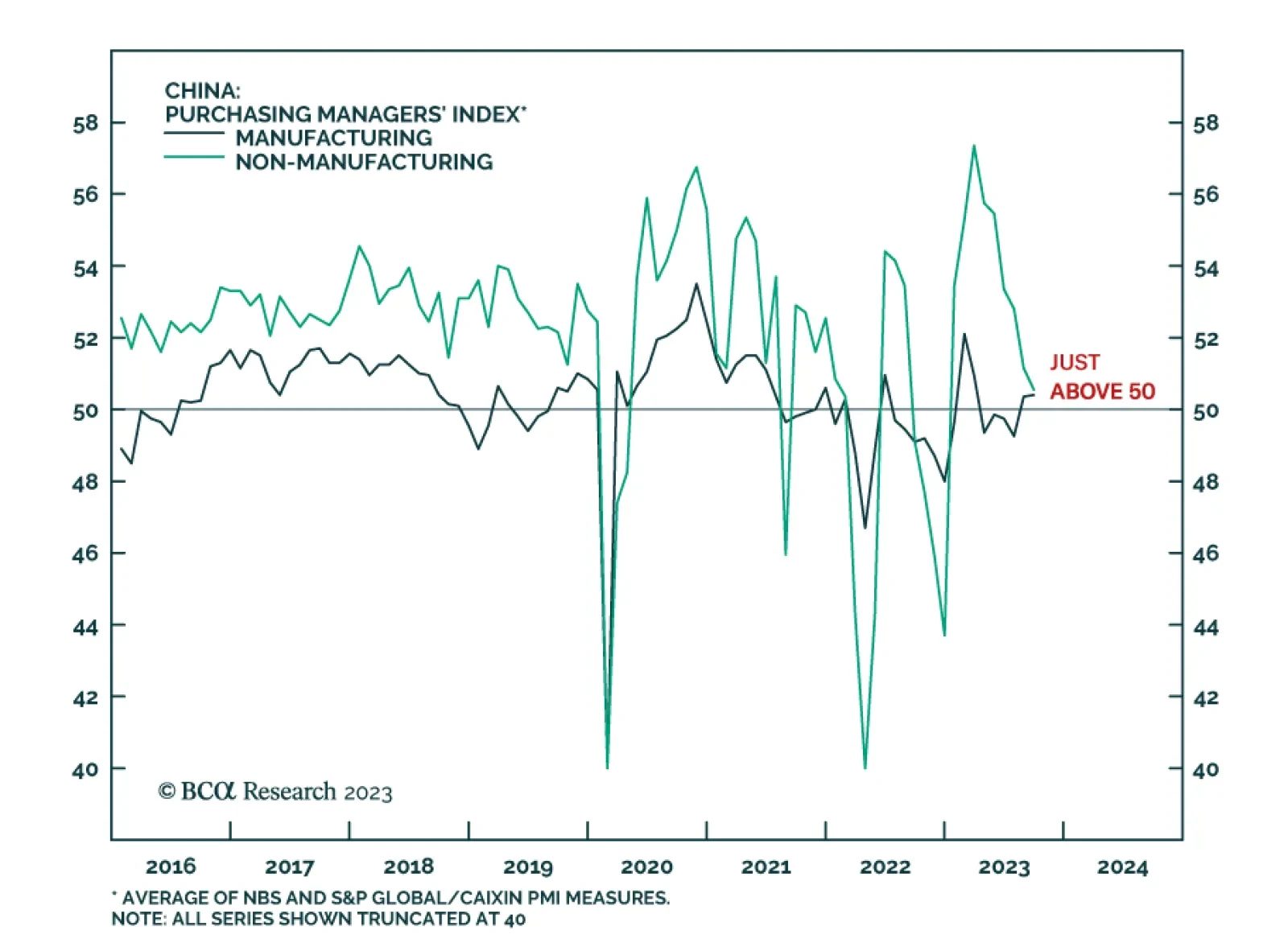

The Caixin and NBS PMIs sent mixed signals about Chinese economic conditions in September. The NBS results surprised to the upside on the back of slightly greater-than-anticipated increases in both the manufacturing (+0.5 to…

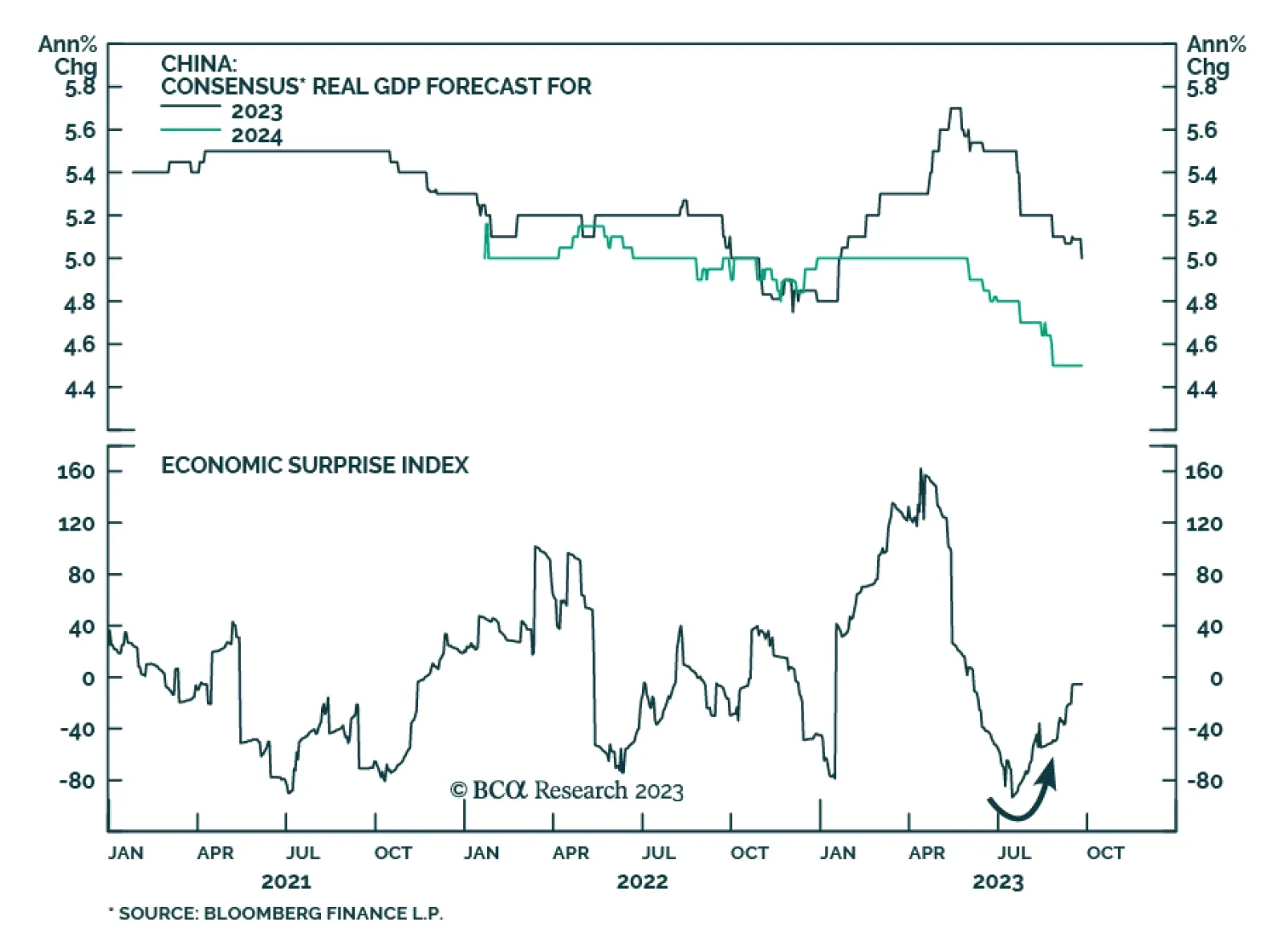

The unexpected increase in Chinese industrial profits in August sent a positive signal about the economy. Industrial profits posted its first year-over-year increase since the second half of last year, surging by 17.2% y/y…

BCA Research’s China Investment Strategy service estimates that China’s oil demand growth will decline from 12% year-on-year in the past eight months to a still robust 4%-6% in the next six-to-nine months. China…

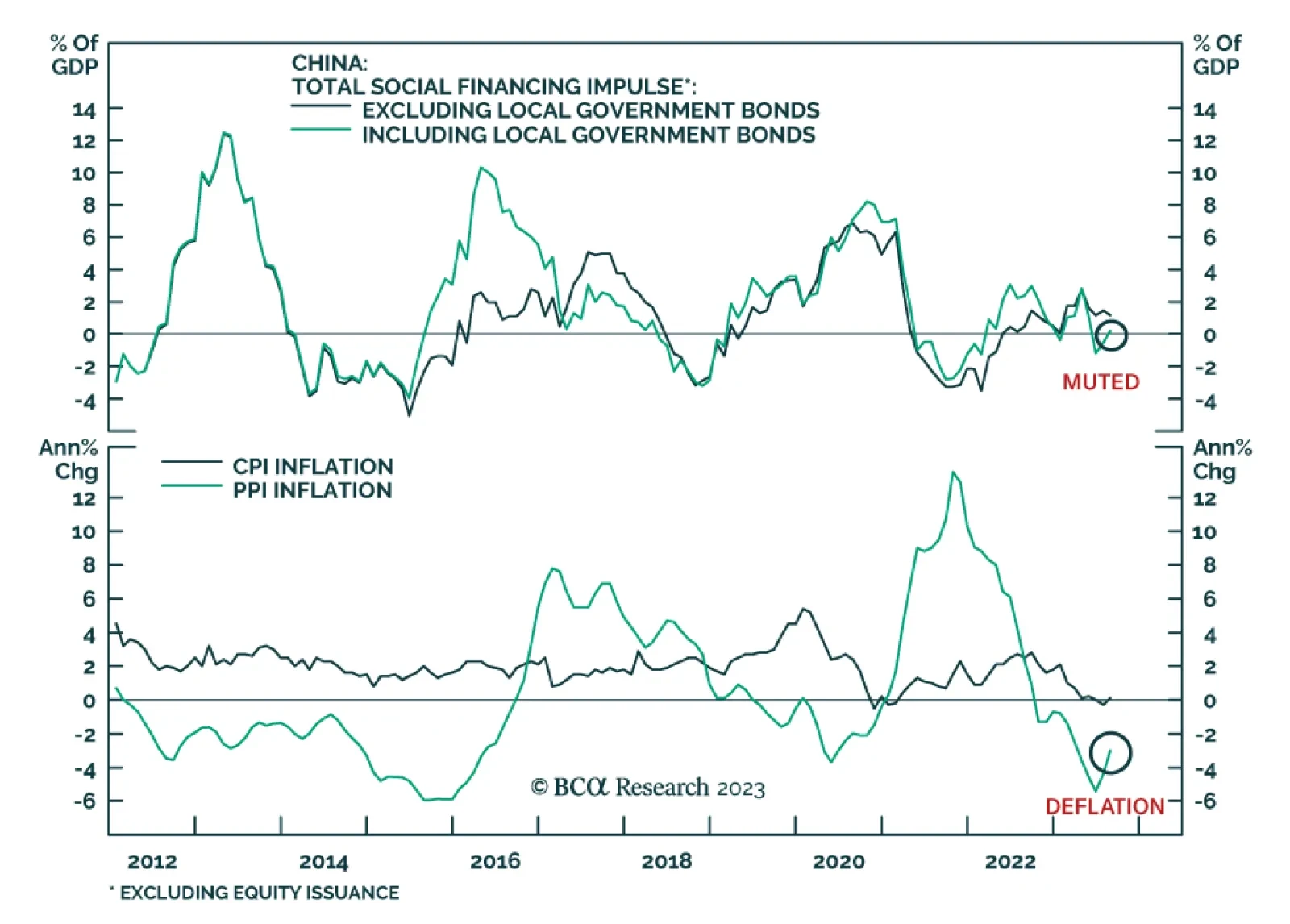

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

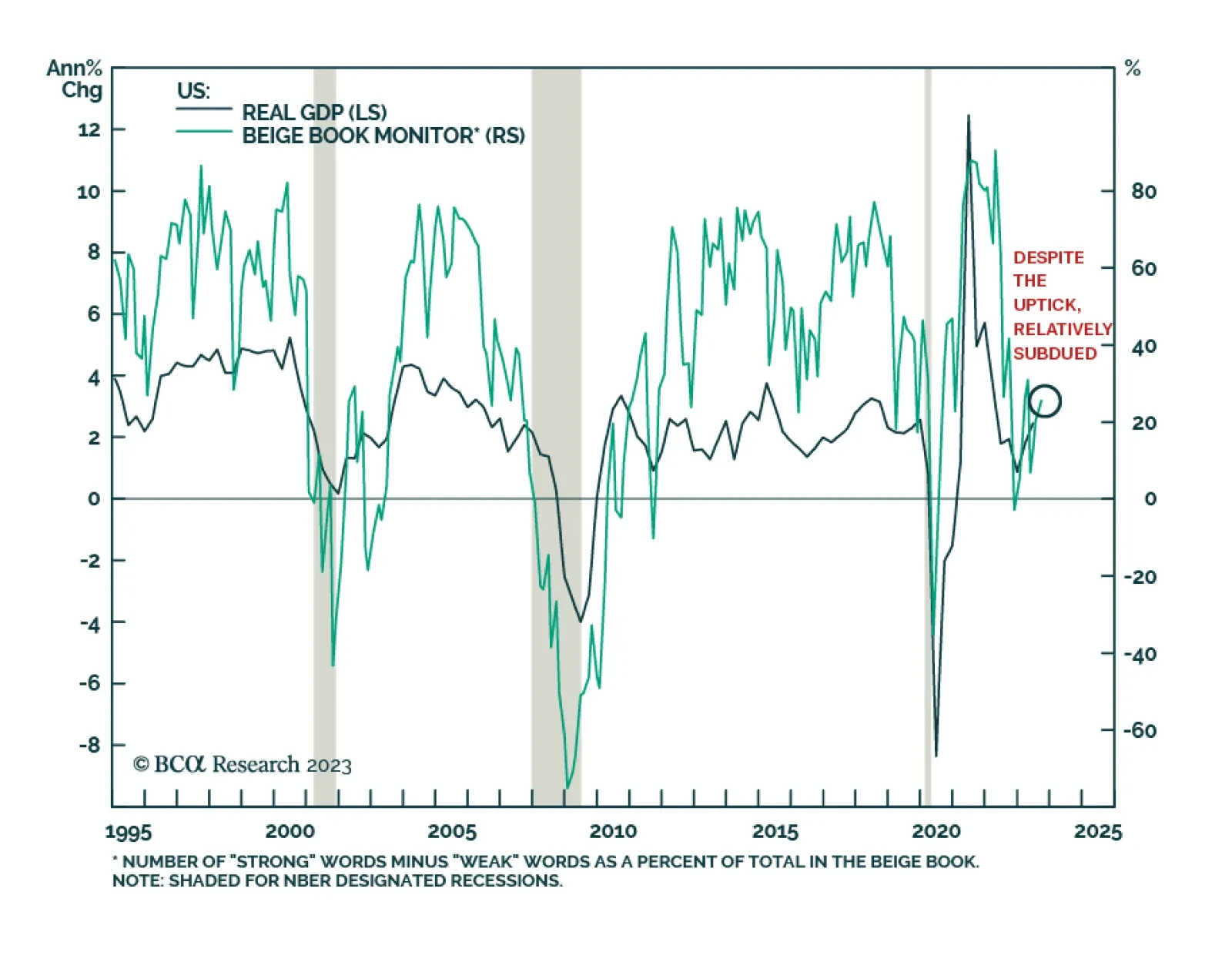

Monetary policy is difficult to calibrate: it is hard to get it just right. The Global Investment Strategy (GIS) service has been iterating that while the Fed could temporarily achieve a soft landing, there is much uncertainty…

Recent Chinese economic data show some signs of stabilization. China’s credit expansion surprised to the upside in August. Aggregate social financing totaled CNY3.12 trillion – above expectations of CNY2.69…

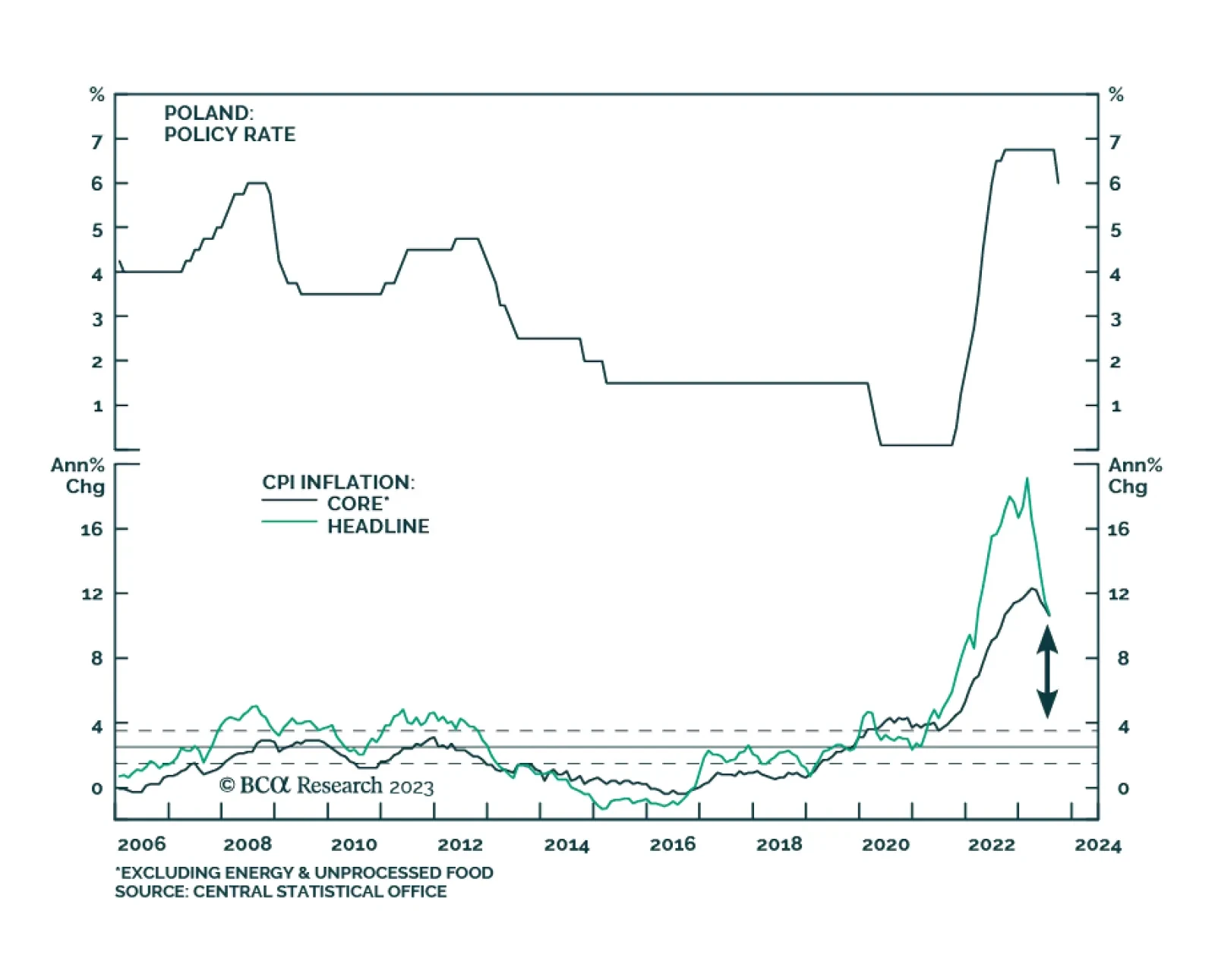

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…