Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

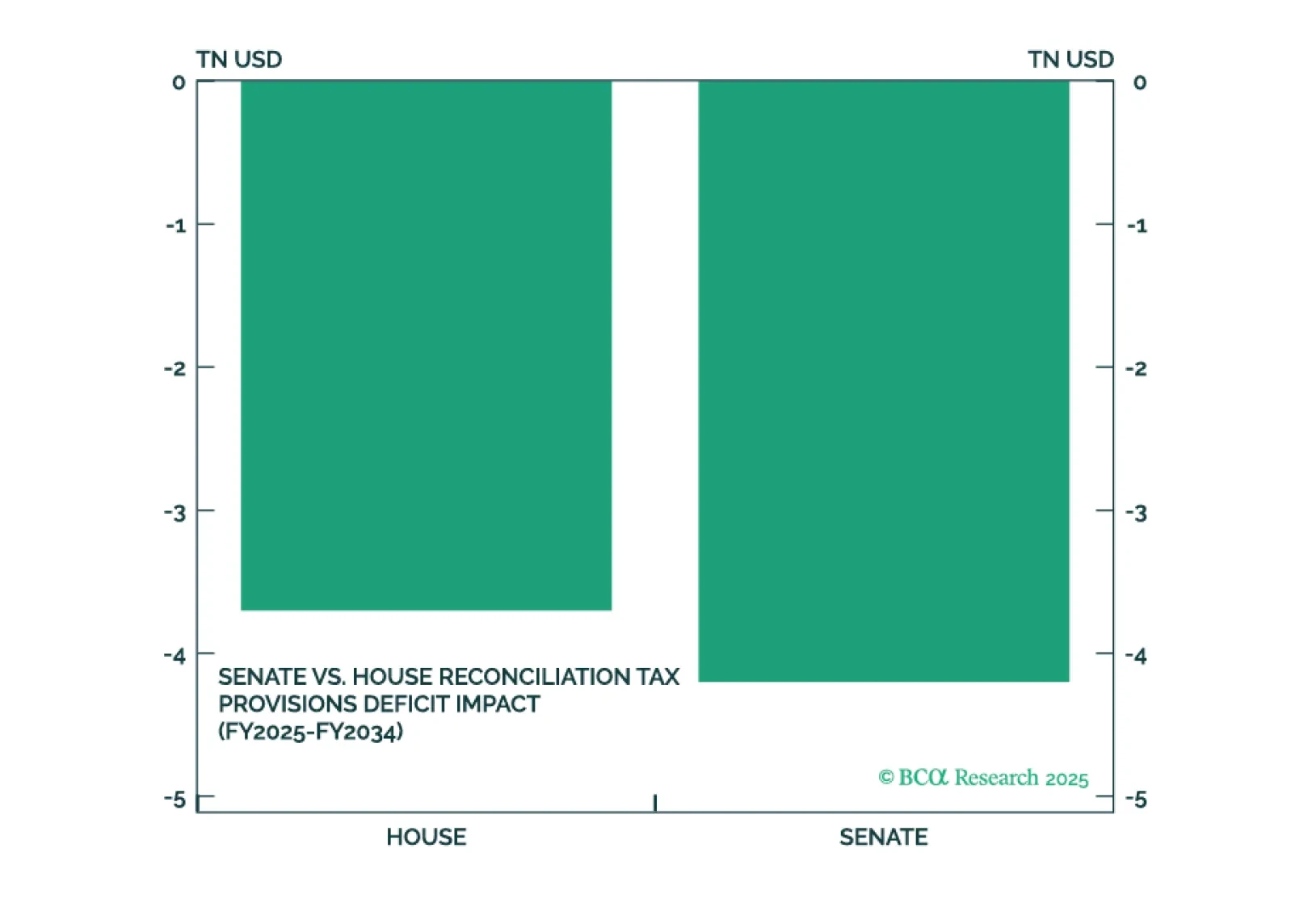

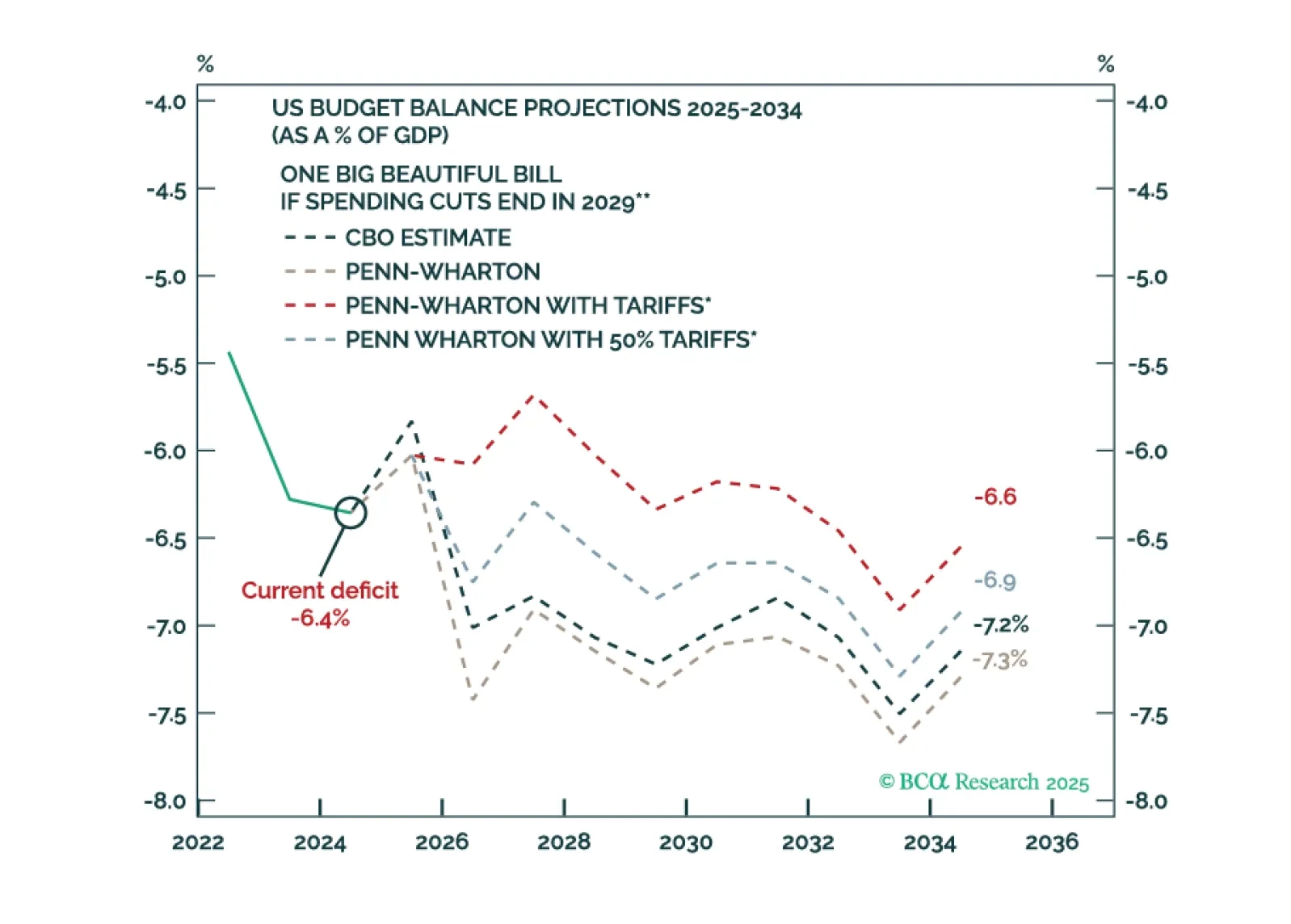

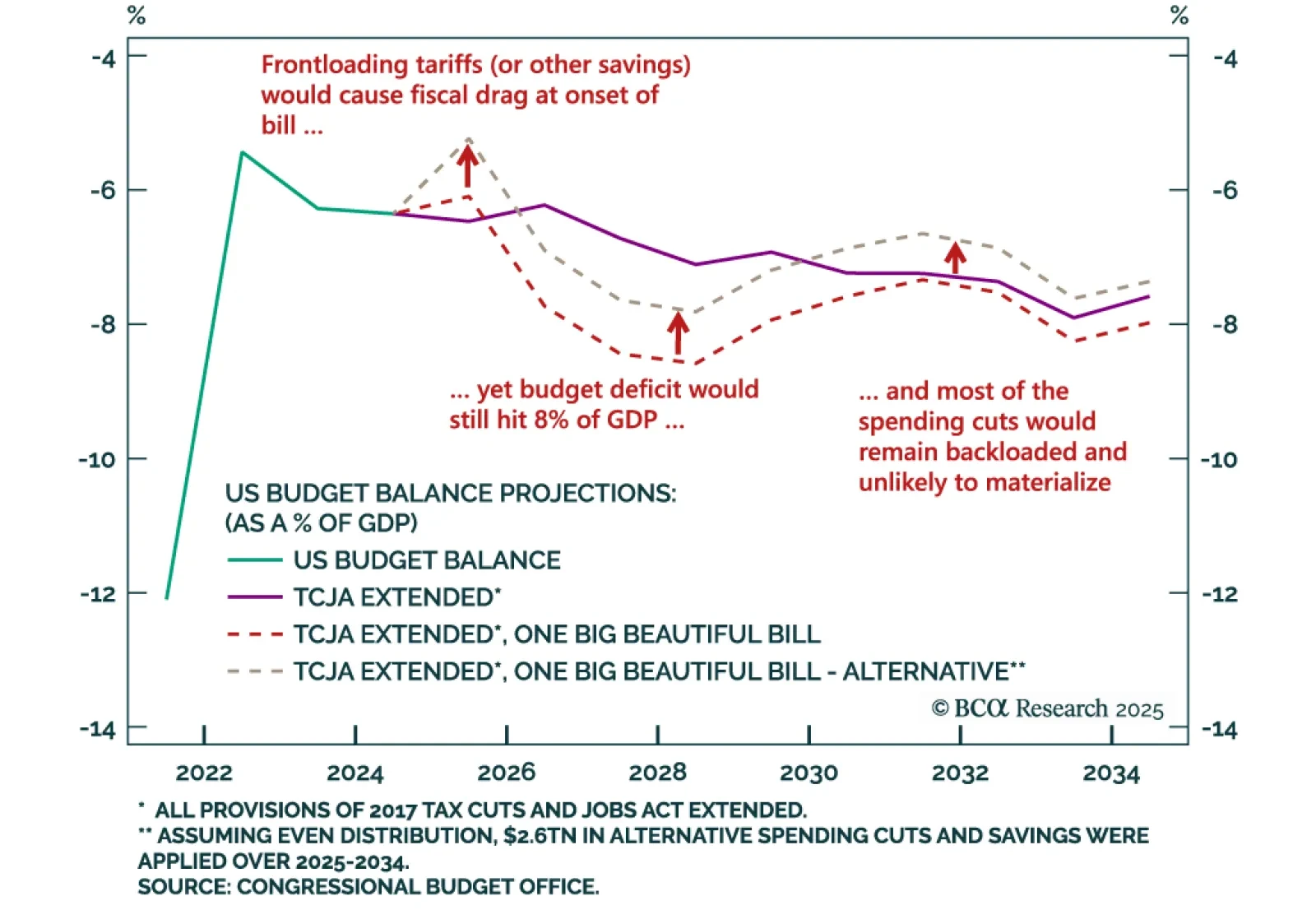

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

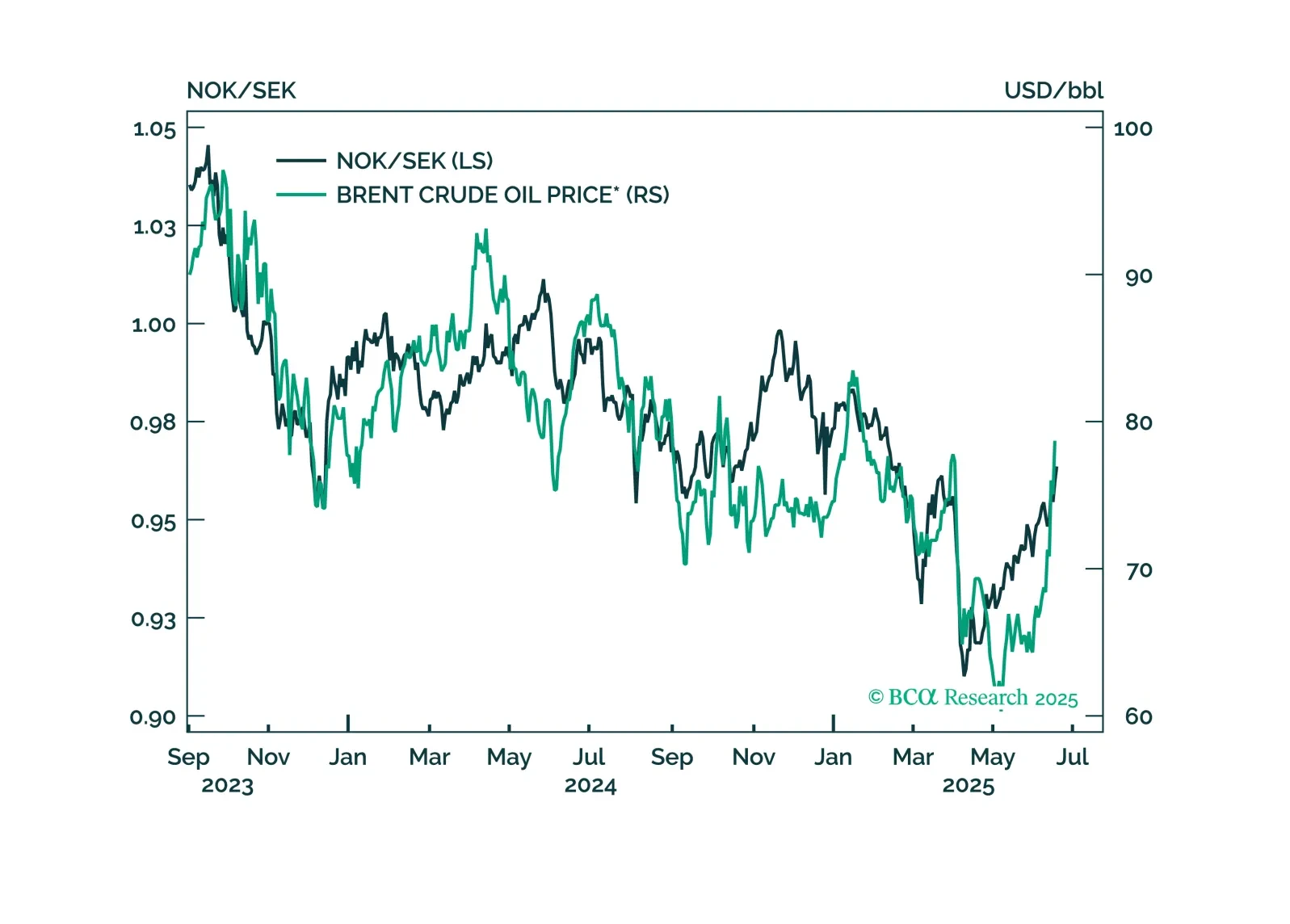

In this Insight, we look at the best trade idea from the recent rate cut by the Riksbank.

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

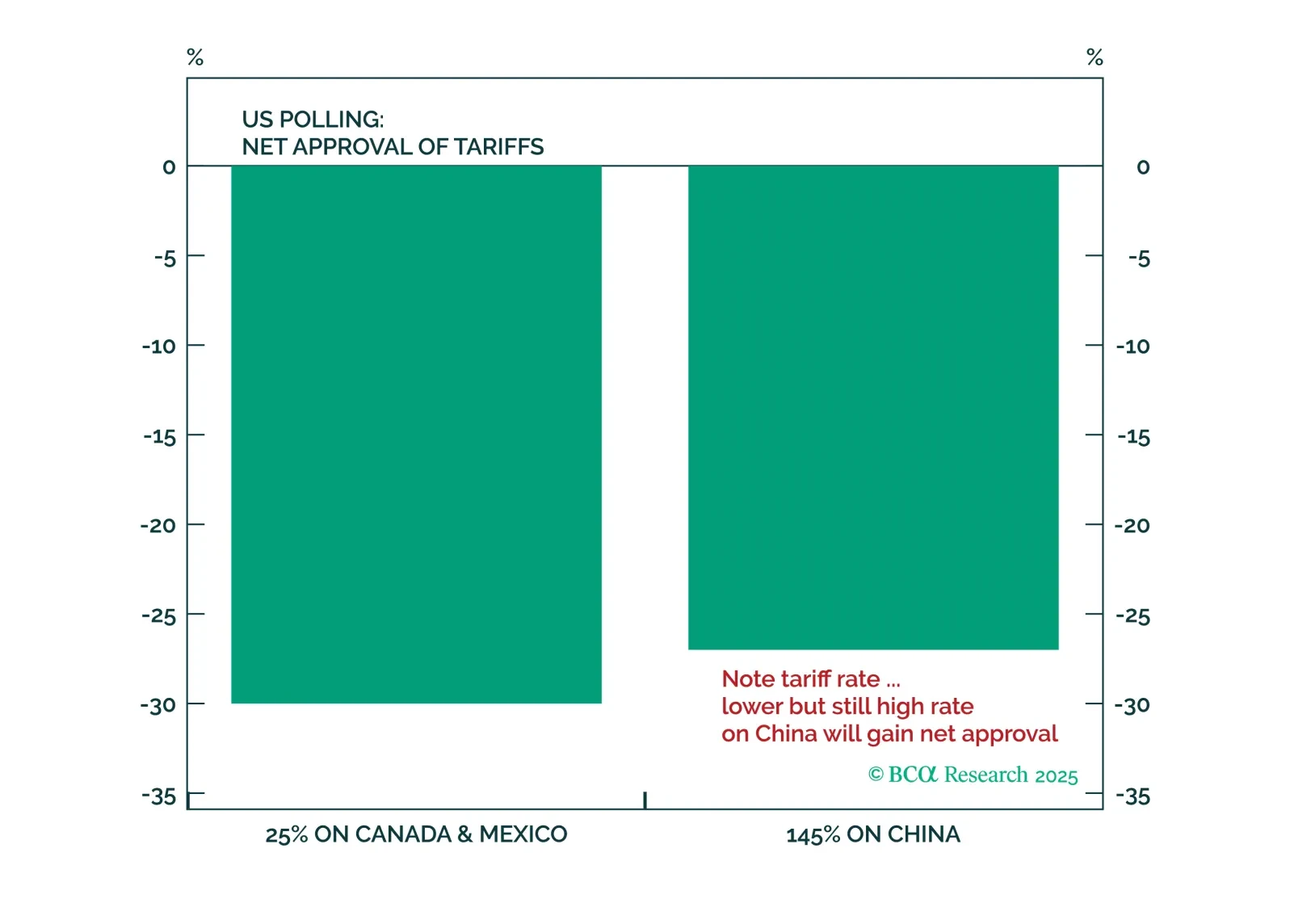

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

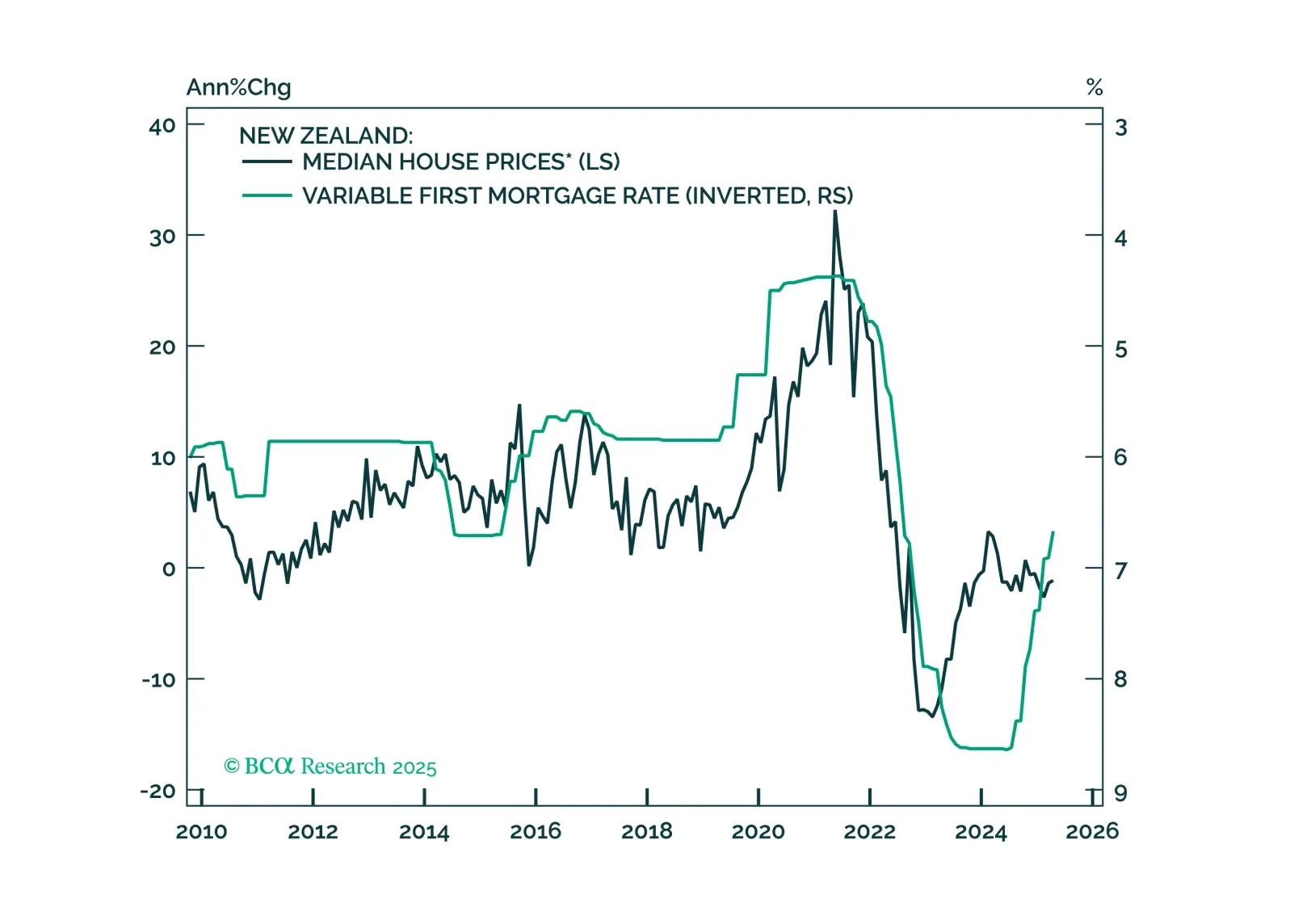

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

President Trump’s signature bill is surprising to the upside with budget deficits, as predicted by our Geopolitical Strategists. Some form of the bill is guaranteed to pass, no matter how many tries it takes. The bill…

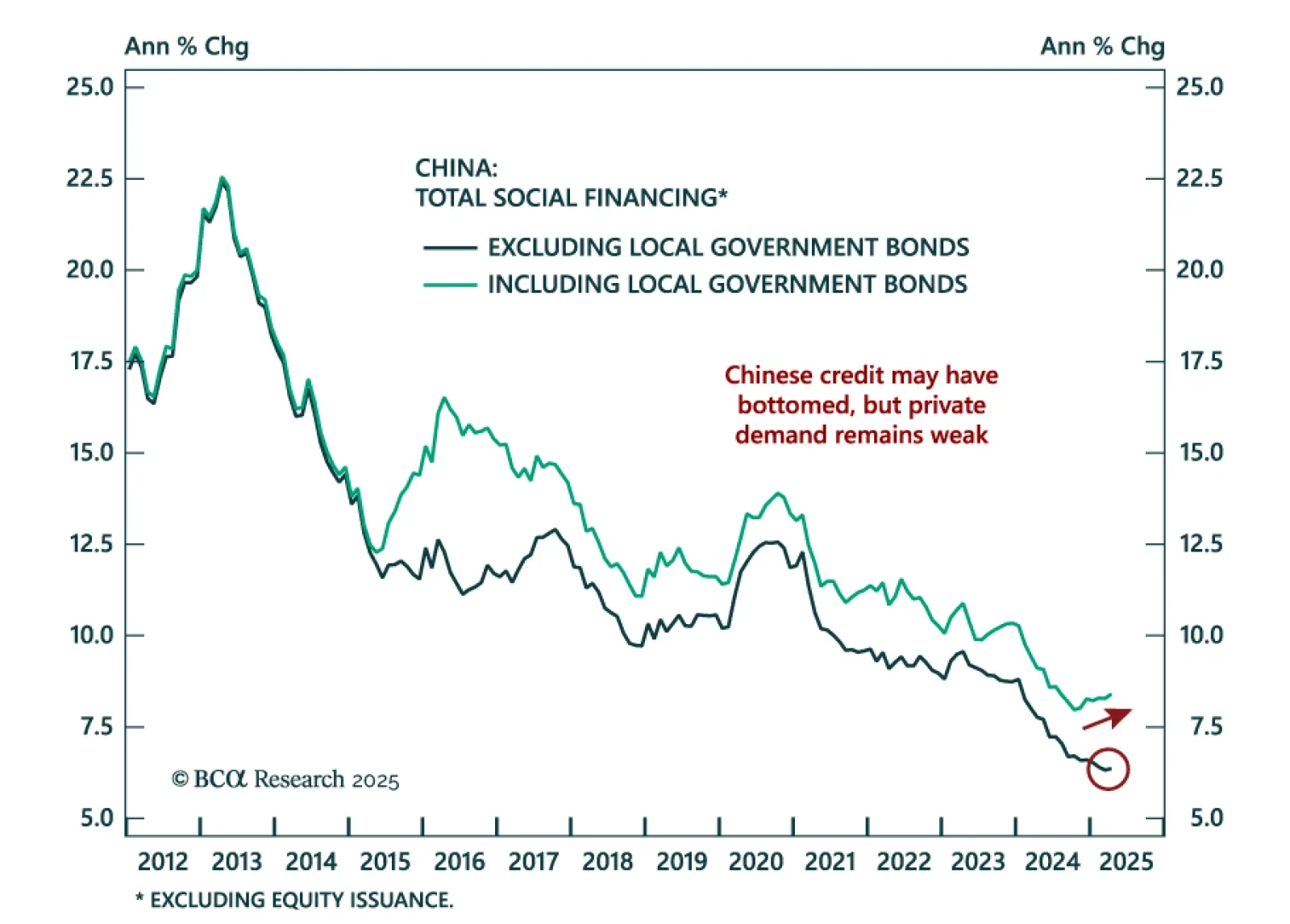

China’s weak April credit data reinforces the case for defensive positioning, with policy aimed at stability, not recovery. New yuan loans and aggregate financing both rose less than expected. While credit growth may have bottomed,…

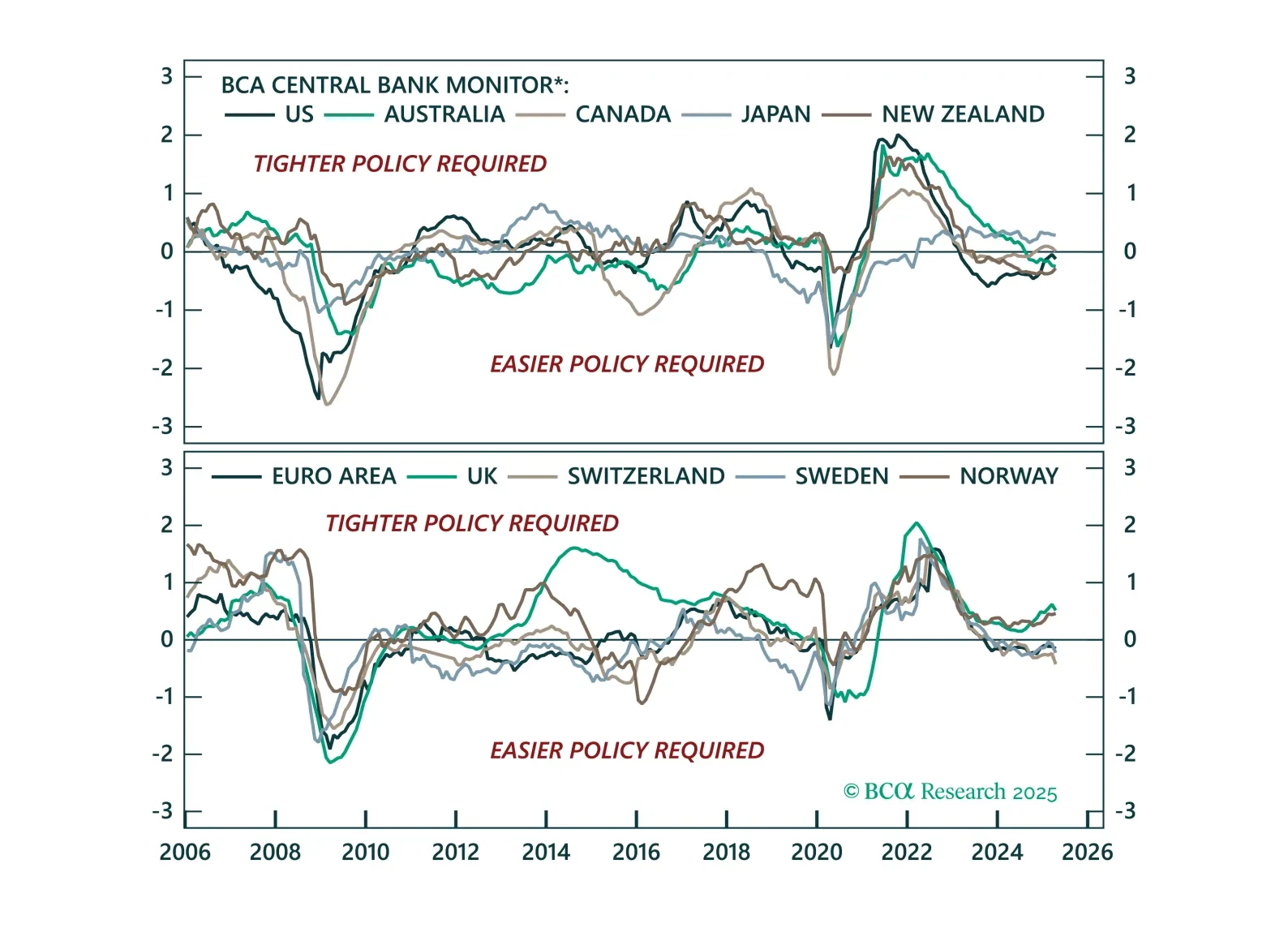

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.