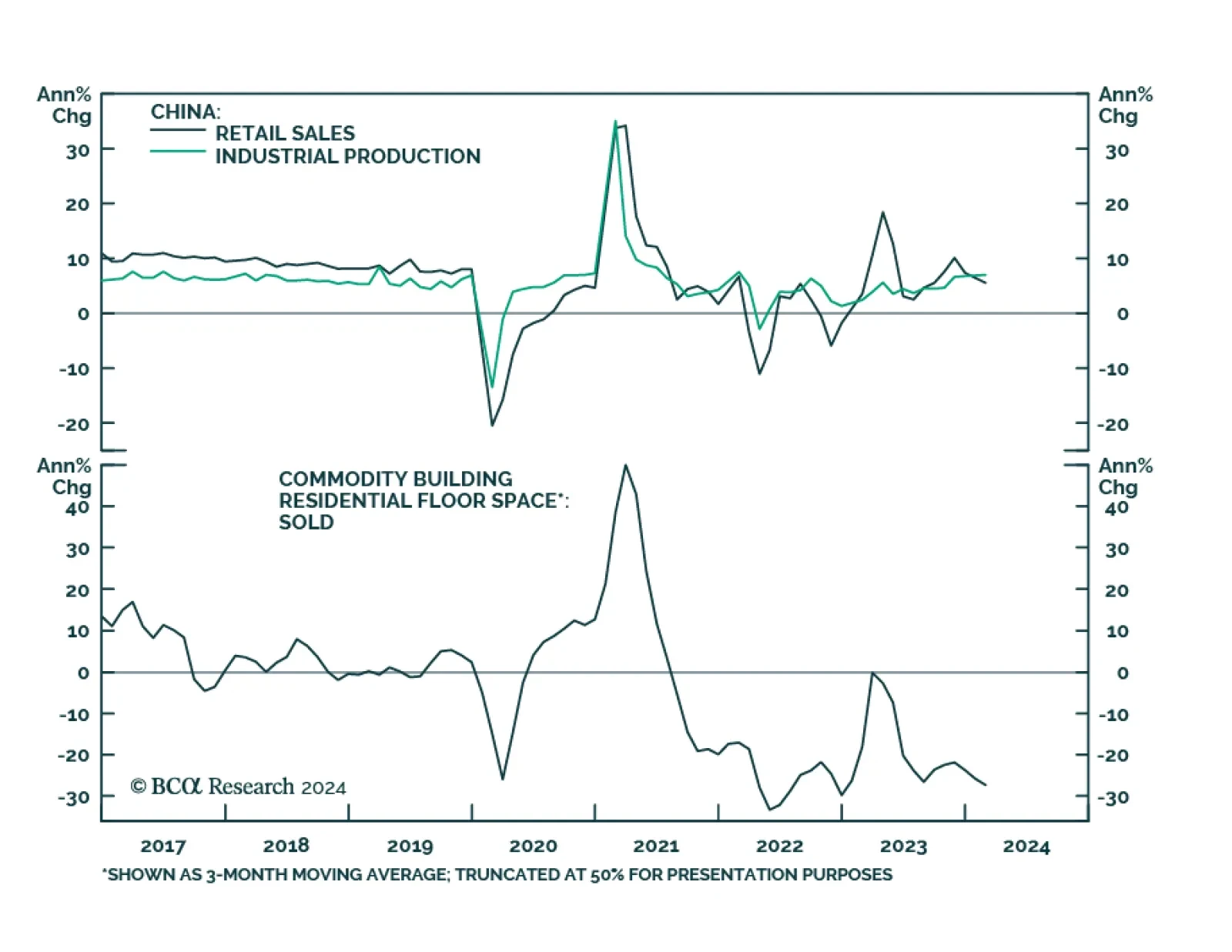

Chinese economic data releases painted a mixed picture of domestic conditions on Tuesday. Chinese real GDP growth accelerated from 5.2% y/y to 5.3% y/y in Q1 2024, beating expectations of 4.8% and suggesting that economic…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

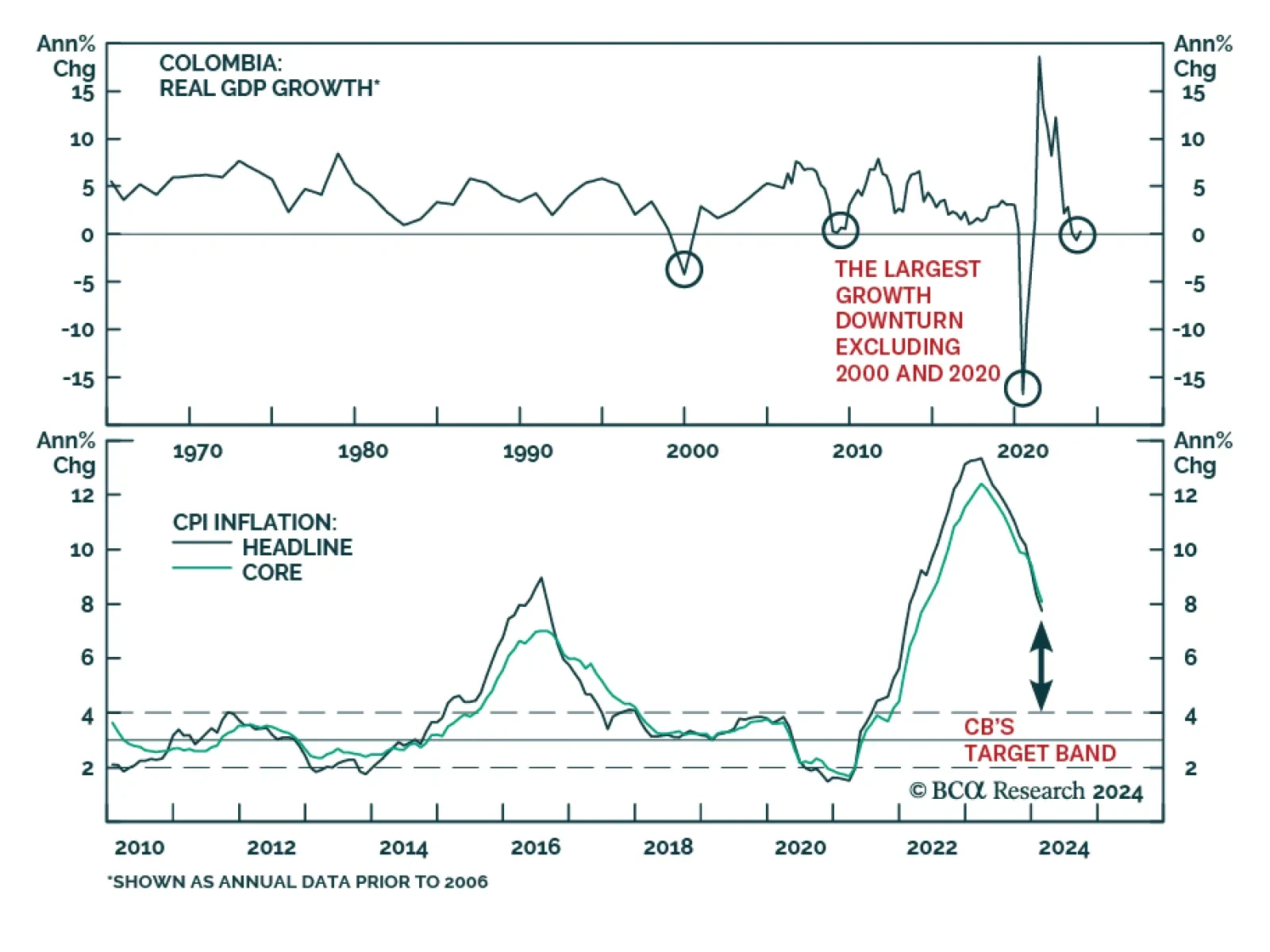

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…

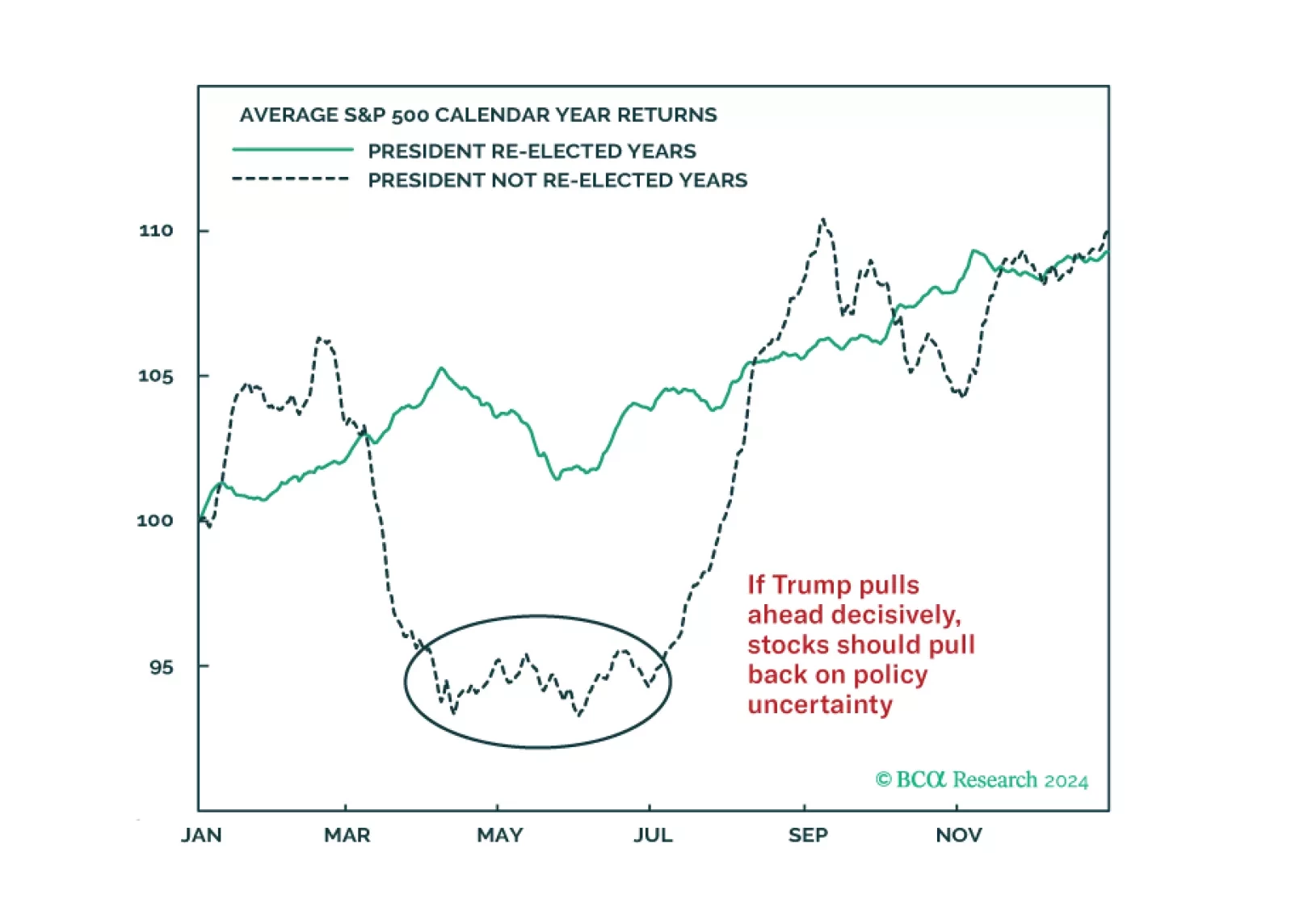

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

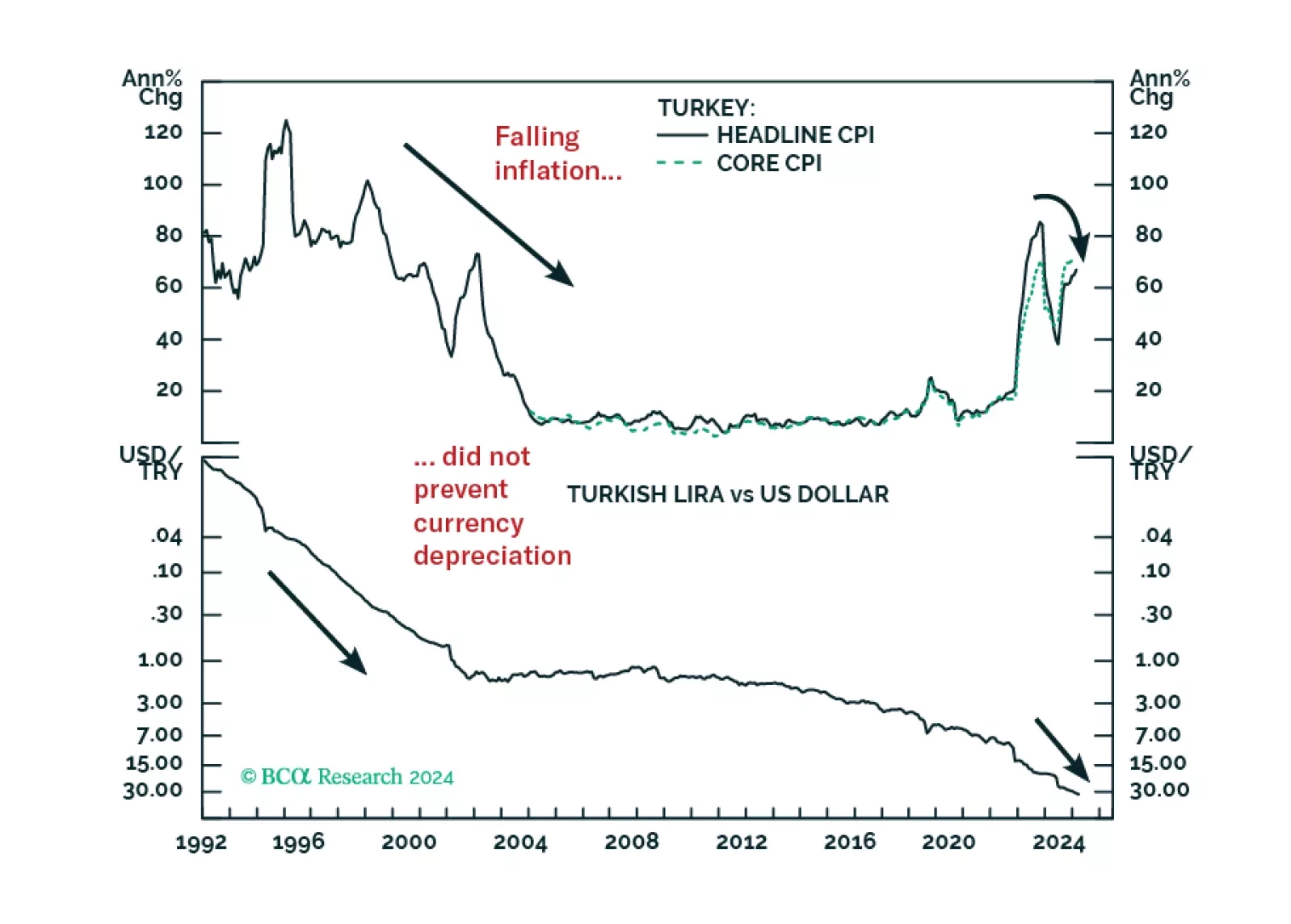

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

Chinese economic data for the first two months of the year were mixed. On the one hand, industrial production and fixed asset investment growth came in above consensus estimates, accelerating to 7.0% y/y (vs. expectations of 5.2…

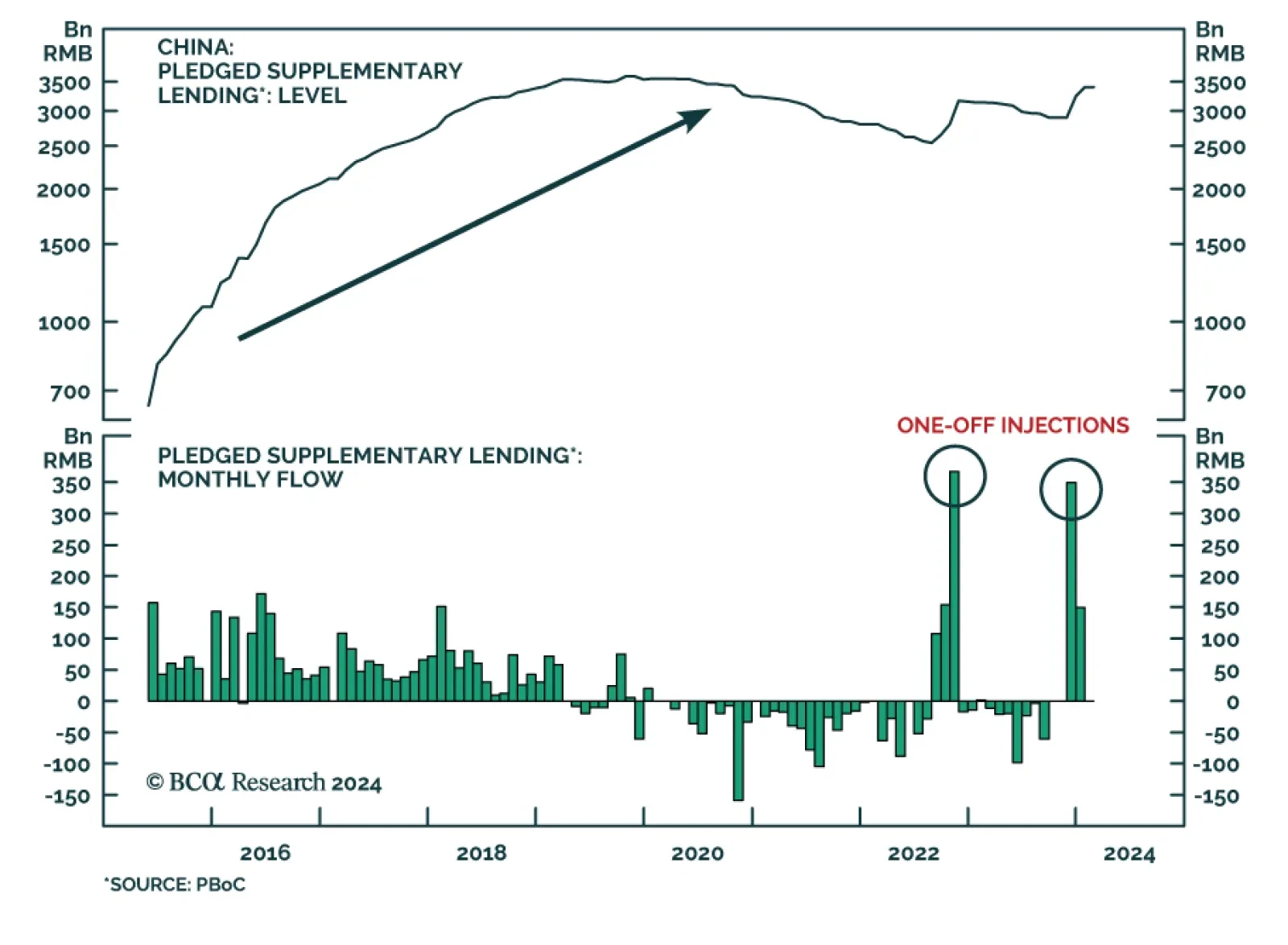

According to BCA Research’s China Investment Strategy service, a very substantial PSL financing scheme for housing, a large LG and LGFV debt swap, and considerable fiscal transfers to households—or a combination…

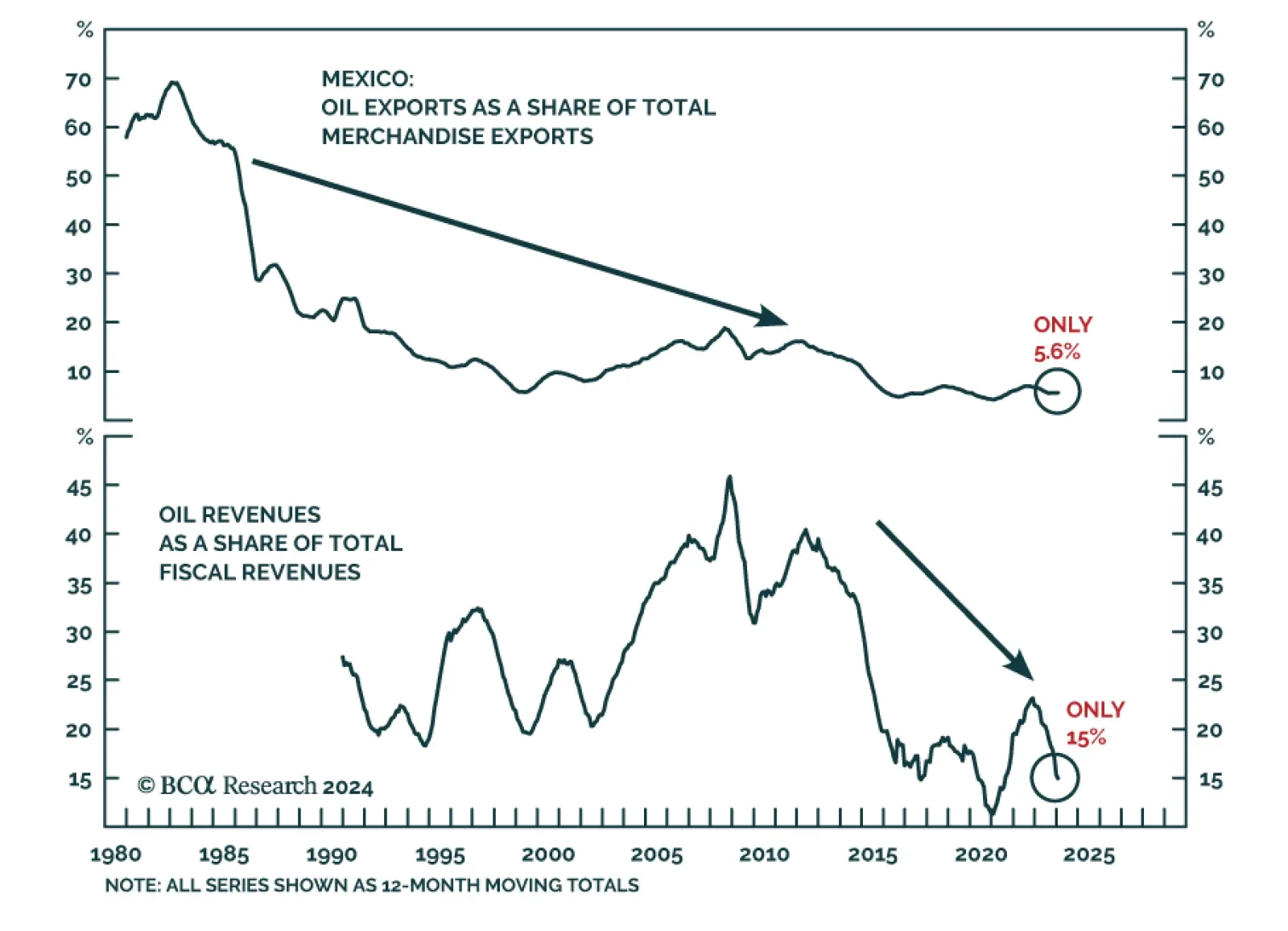

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

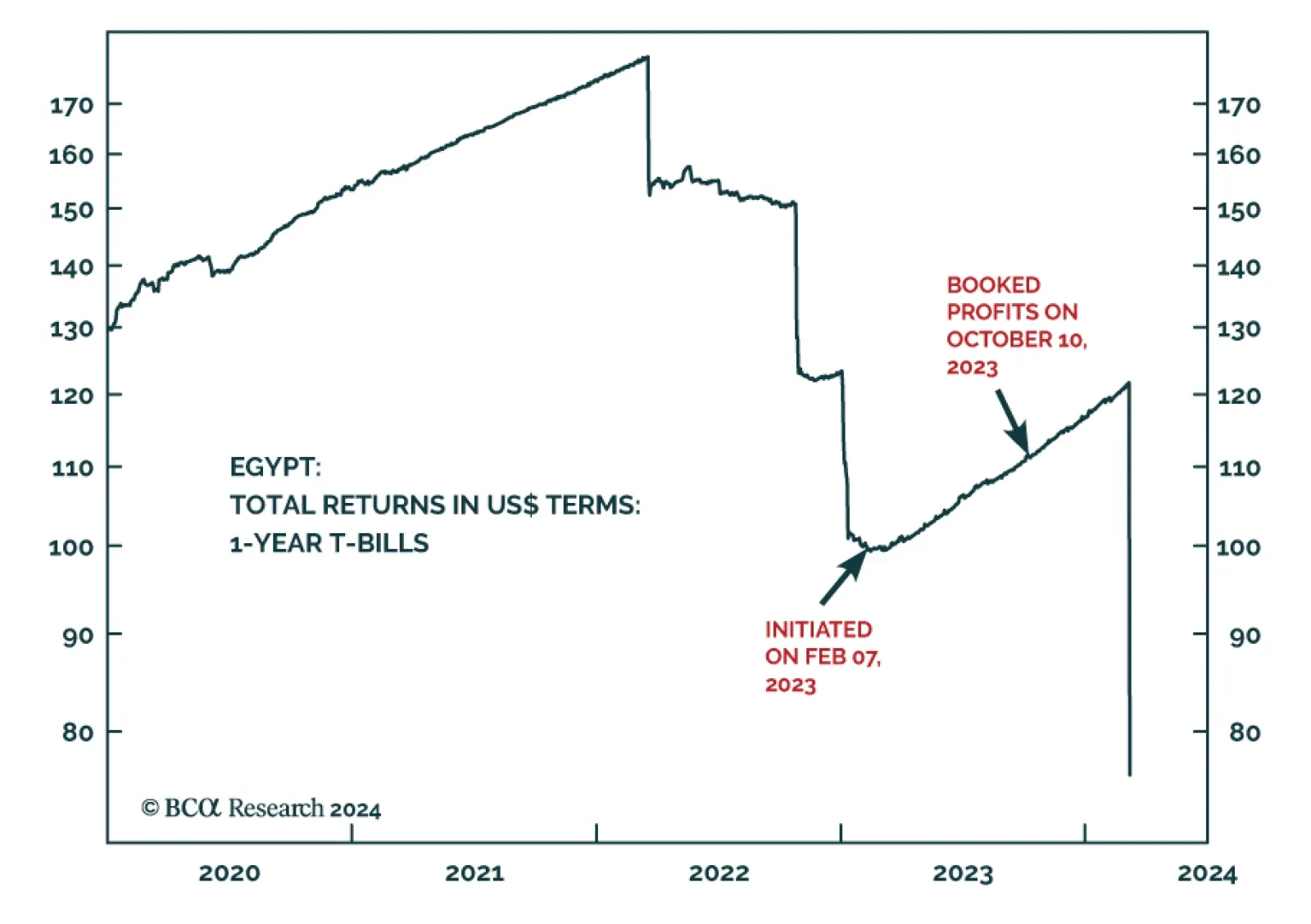

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…