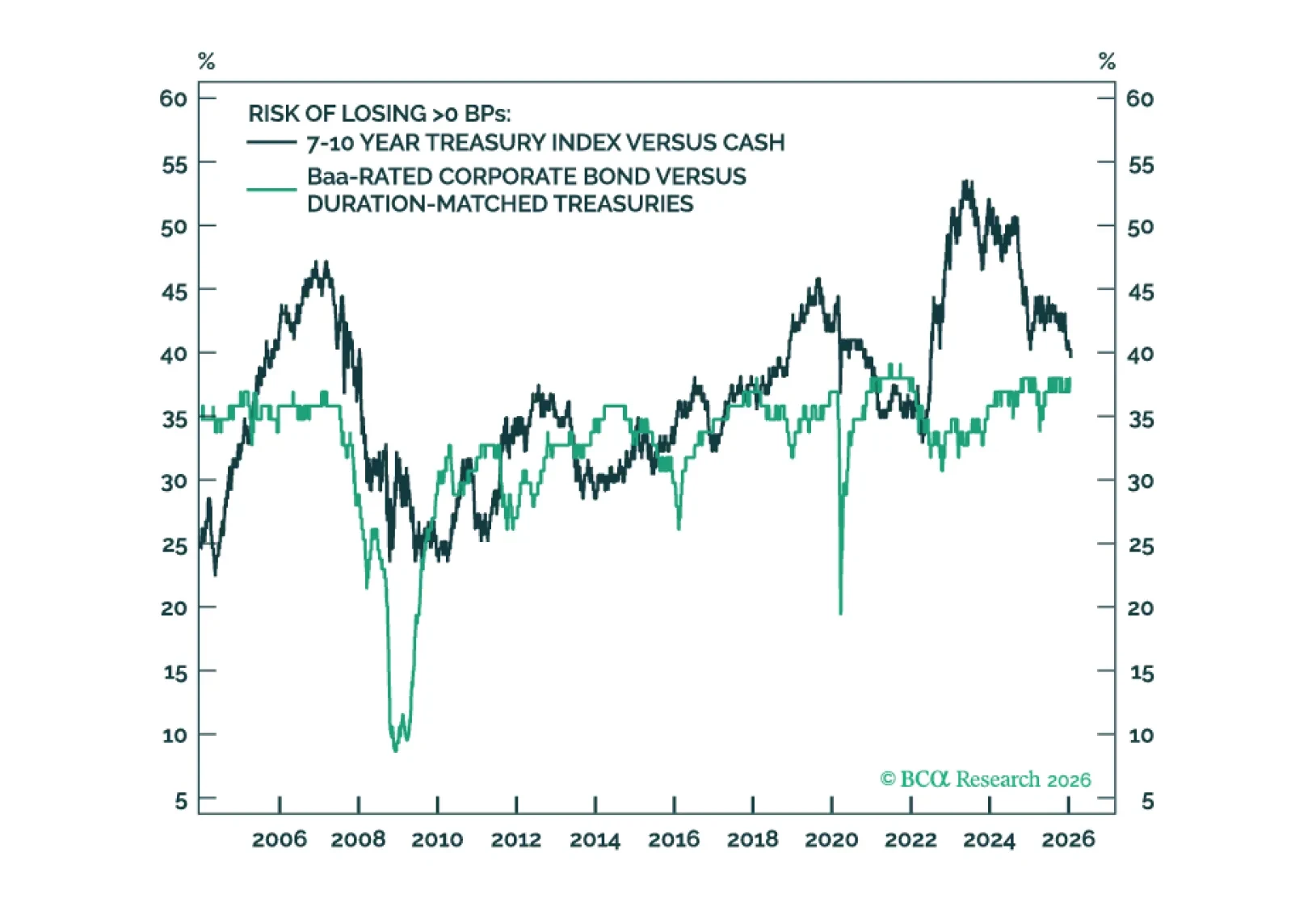

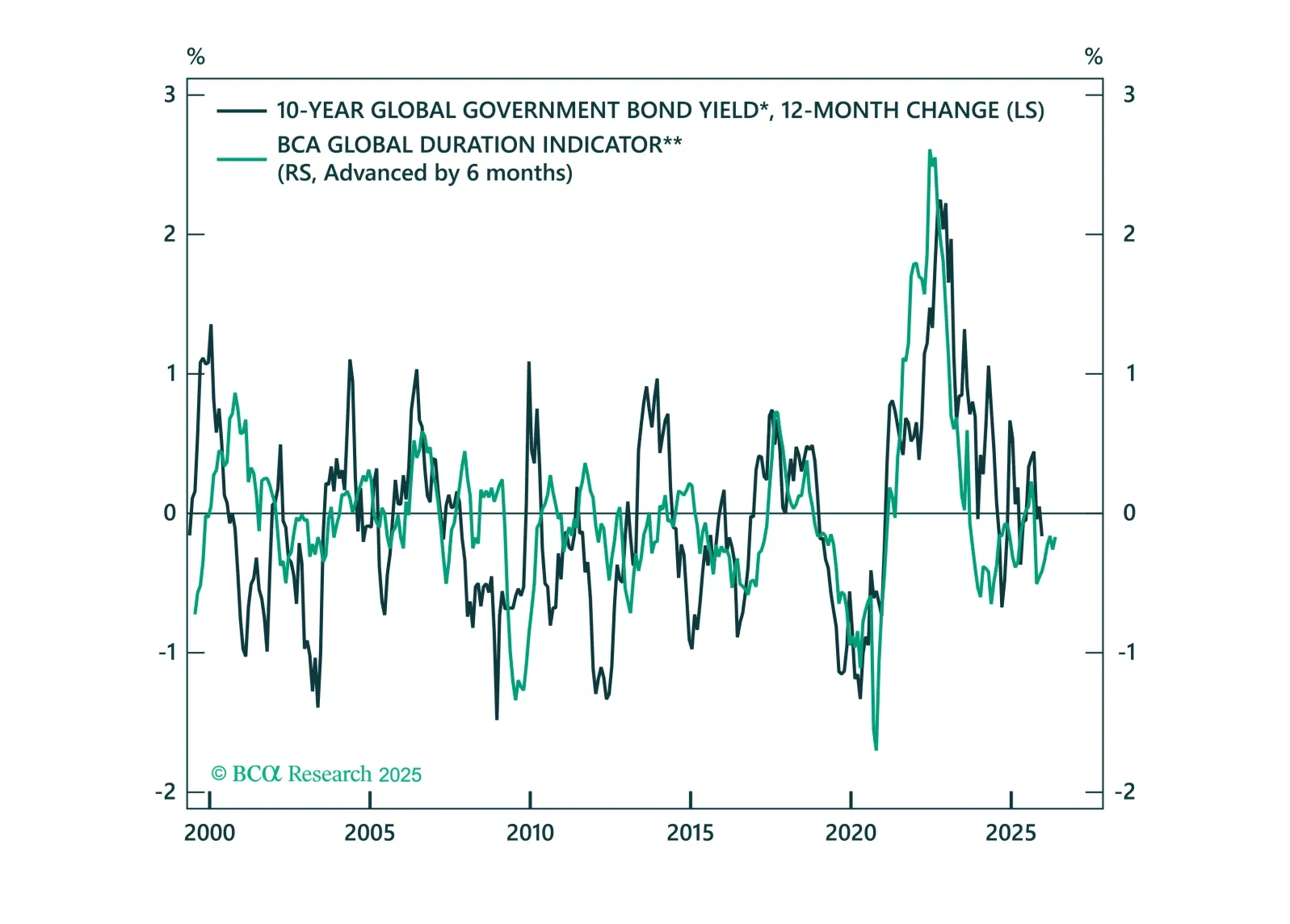

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.

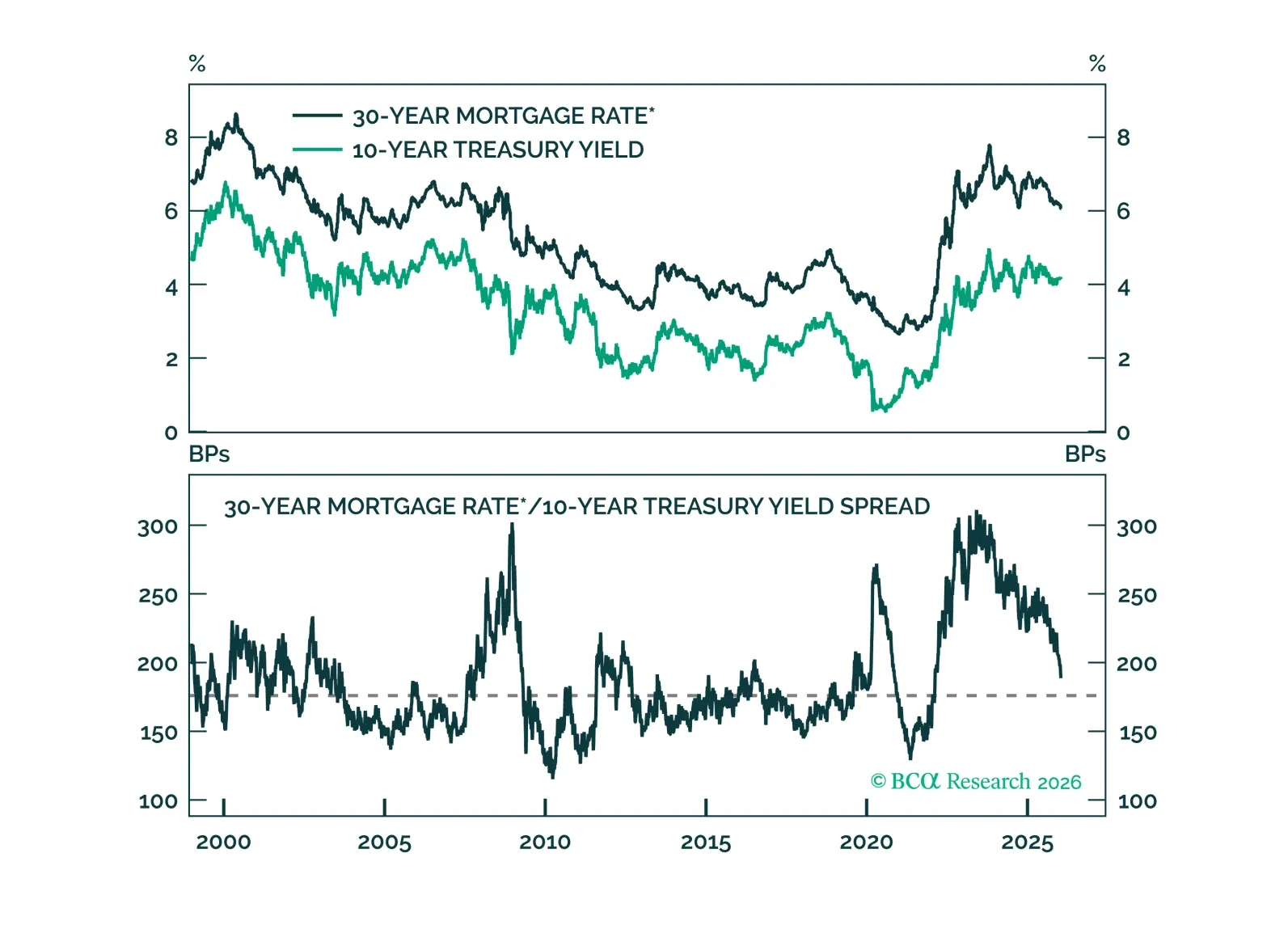

Mortgage spread tightening has run its course. Any further drop in mortgage rates will necessitate lower Treasury yields.

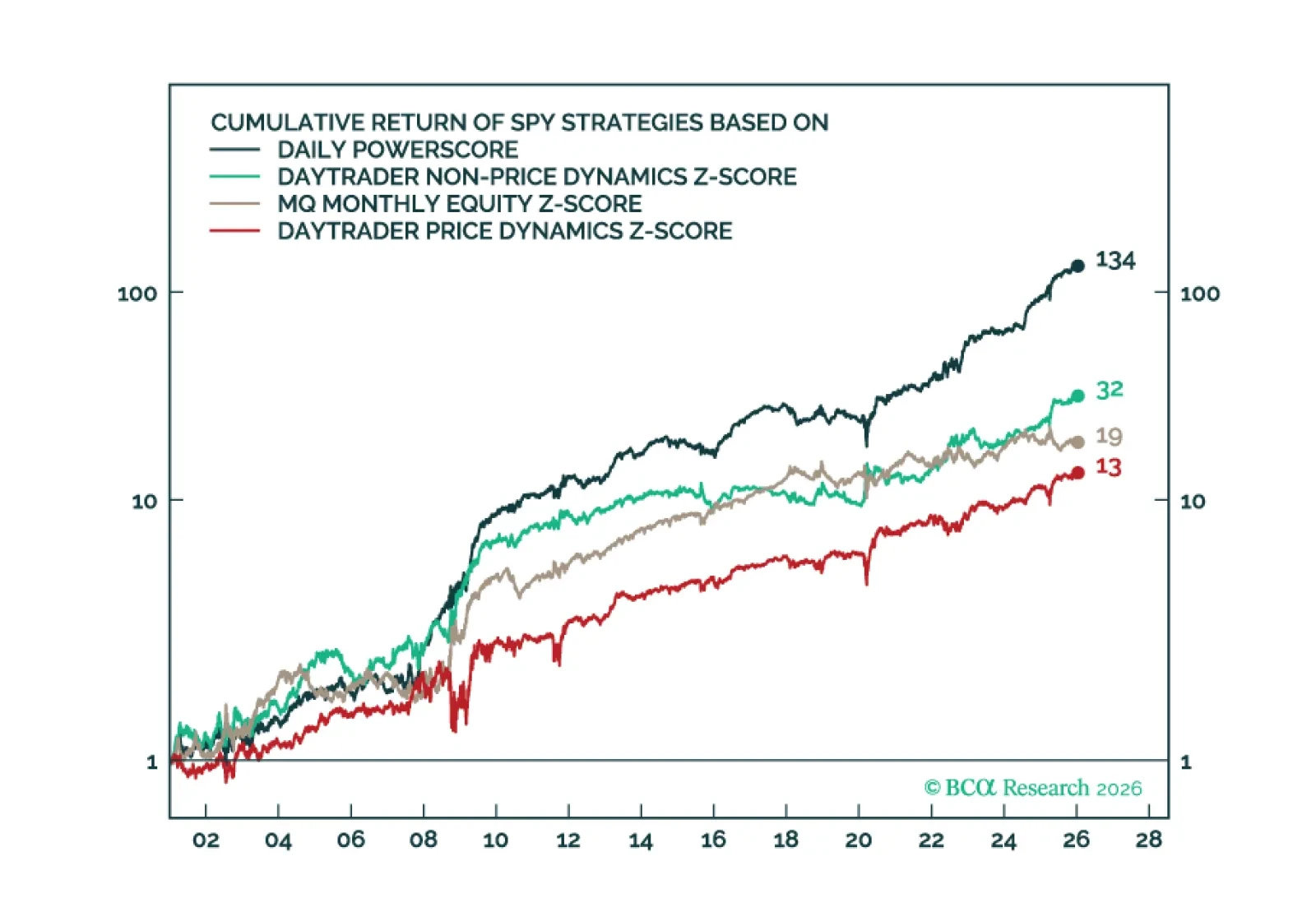

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

Our Portfolio Allocation Summary for January 2026.

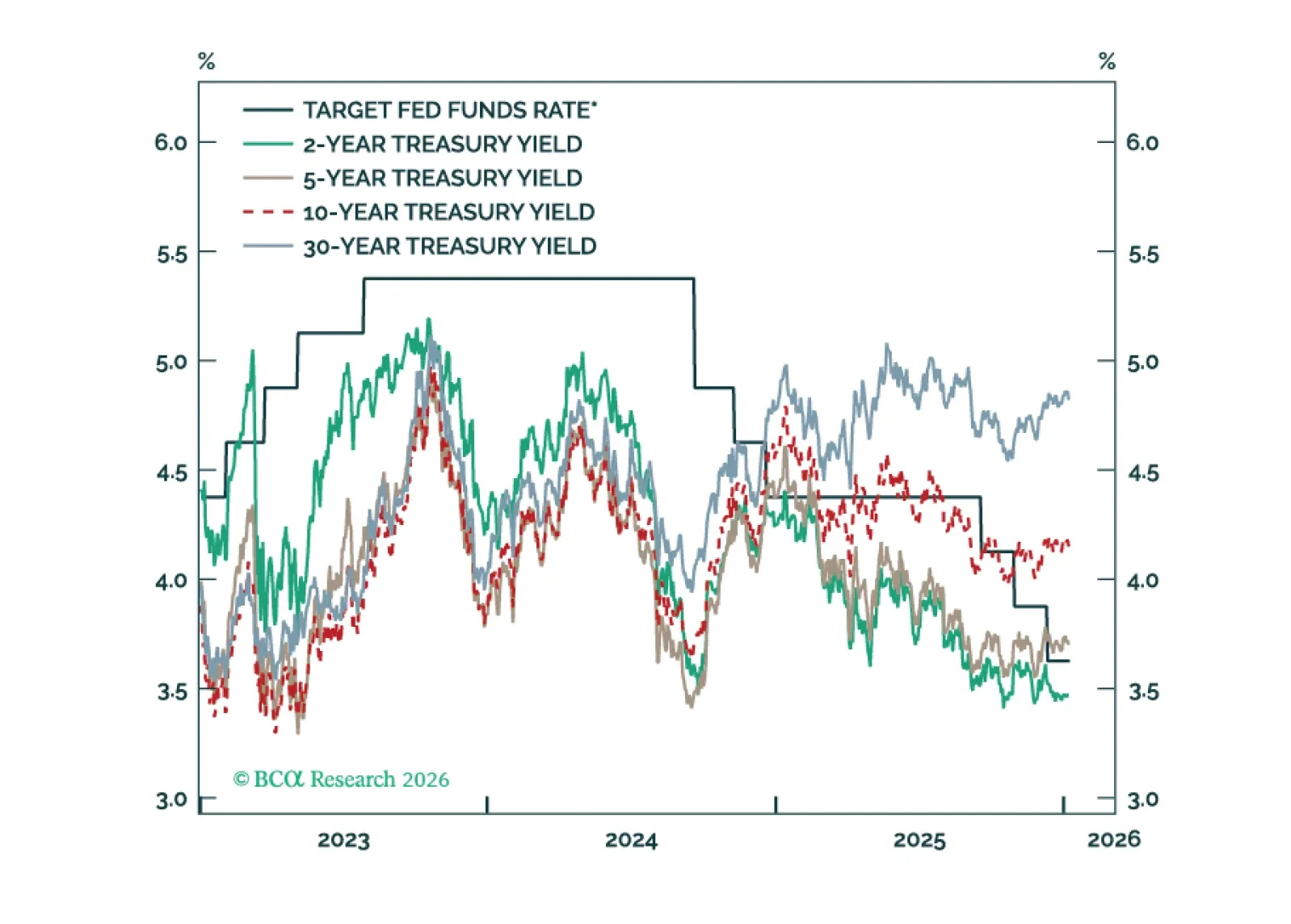

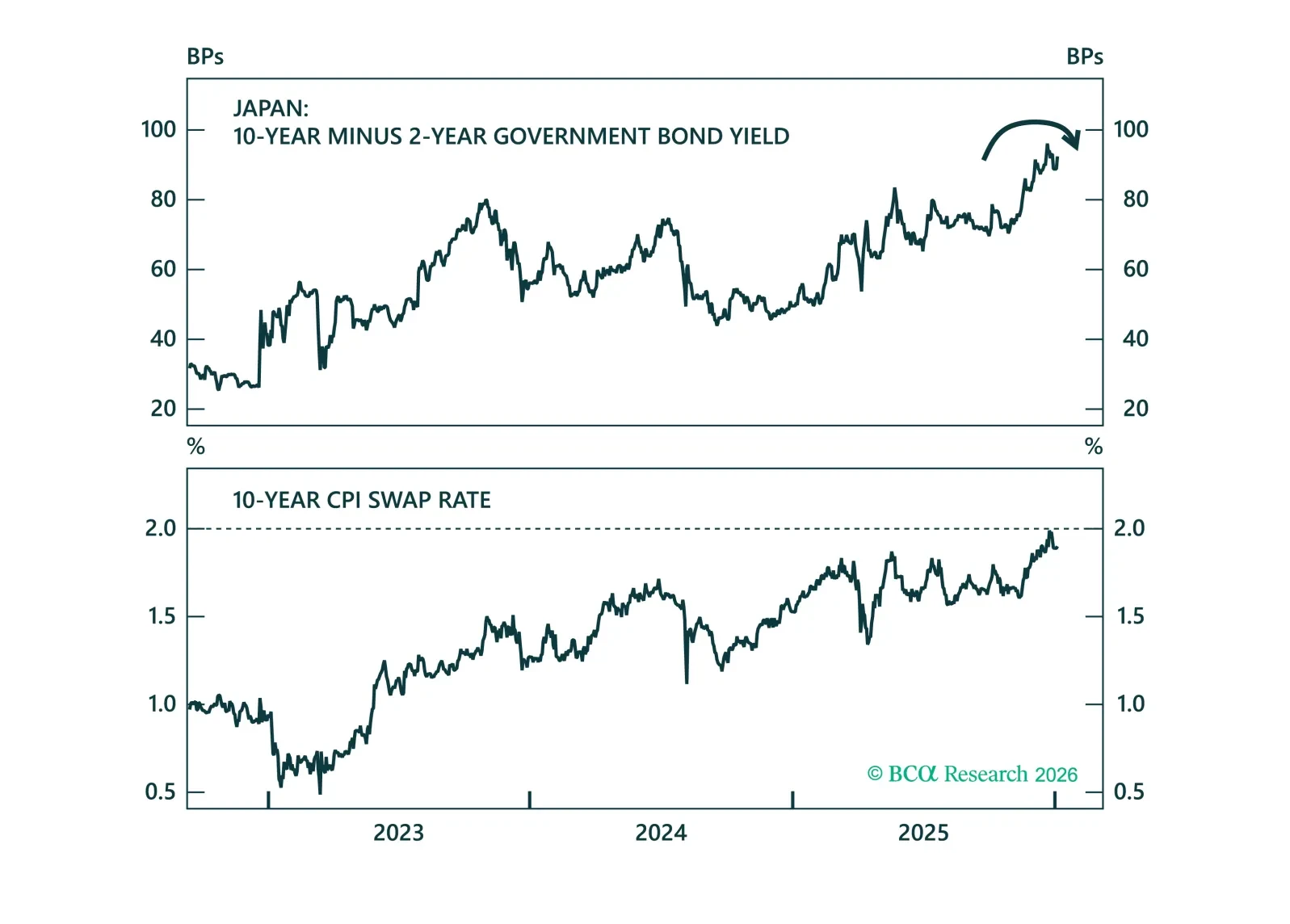

From steepening to flattening. As the BoJ continues to tighten in 2026, we show why curve flatteners are finally the right trade.

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

Our Portfolio Allocation Summary for December 2025.