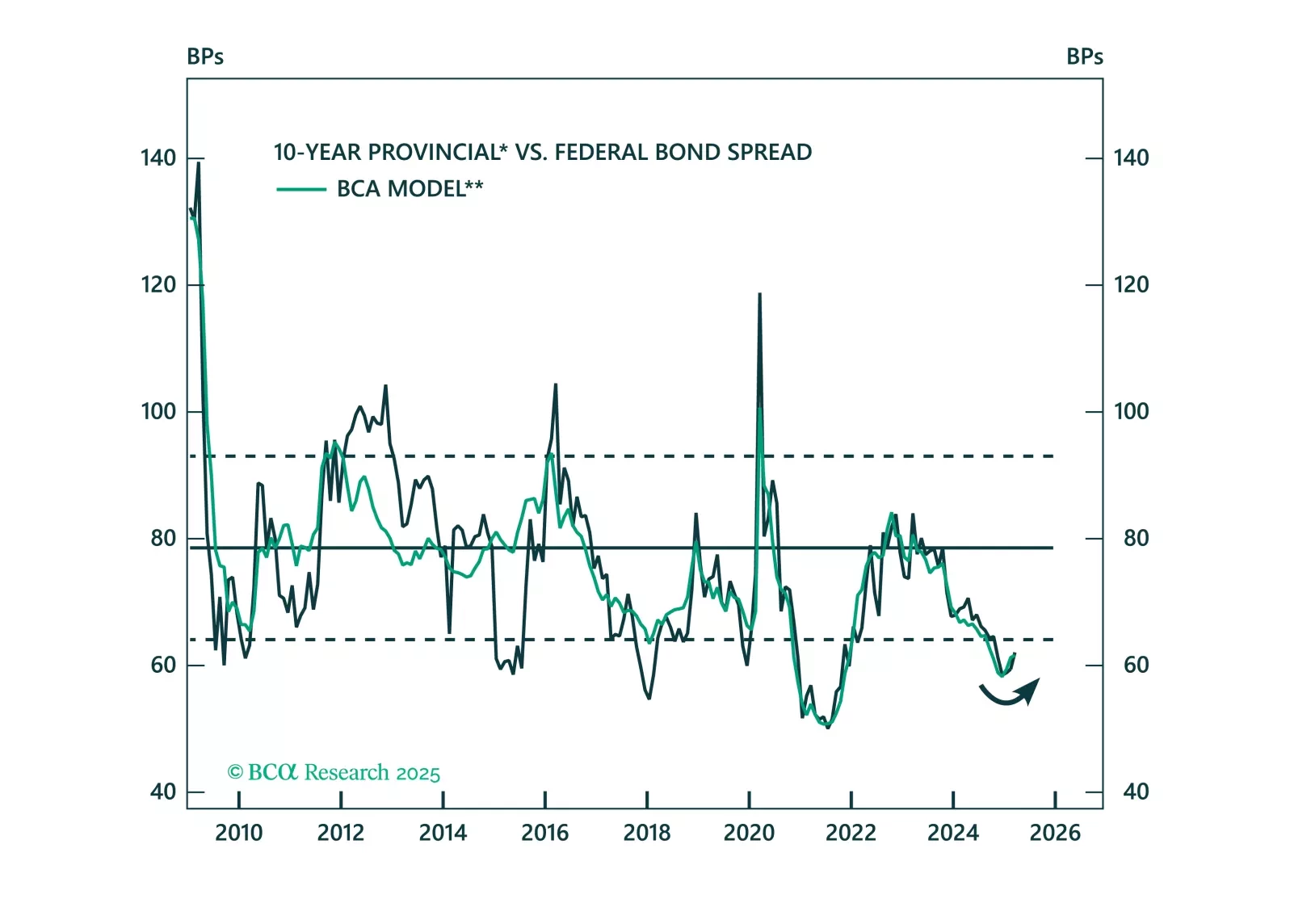

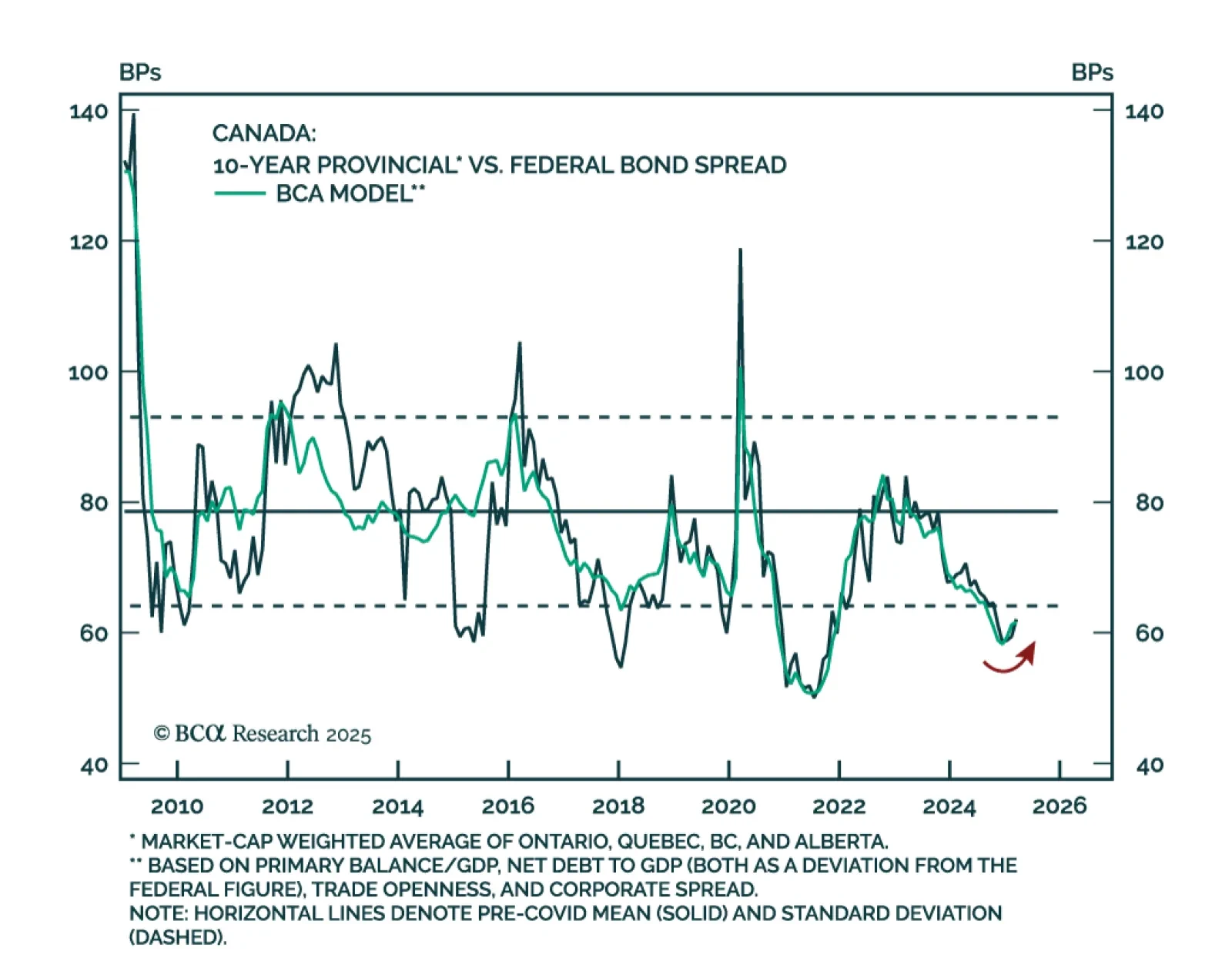

Our Global Fixed Income team wrote a primer on the Canadian provincial bond market, an overlooked yet substantial market. Canadian provincial bonds are a major segment of the country's fixed income market, with spreads primarily…

In this report, we explore the Canadian provincial bond market by developing a model to analyze its main drivers and understand the impact of a potential trade war between Canada and the US.

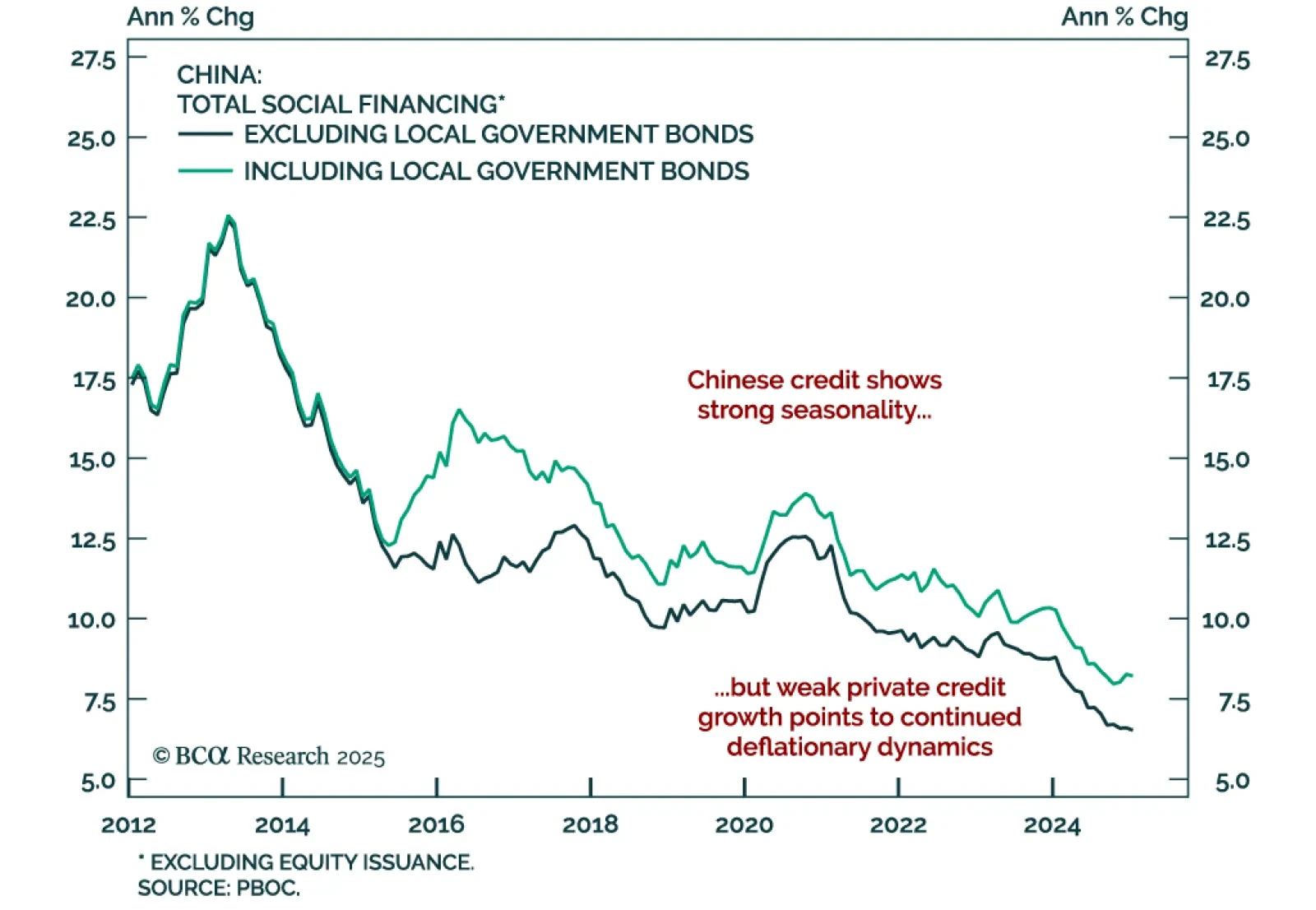

China’s January monetary and credit data was solid. New yuan loans increased by CNY 5.1 trillion, while aggregate financing was up by 7.1 trillion. M1 also increased after contracting 1.4% y/y in December. Seasonality plays a…

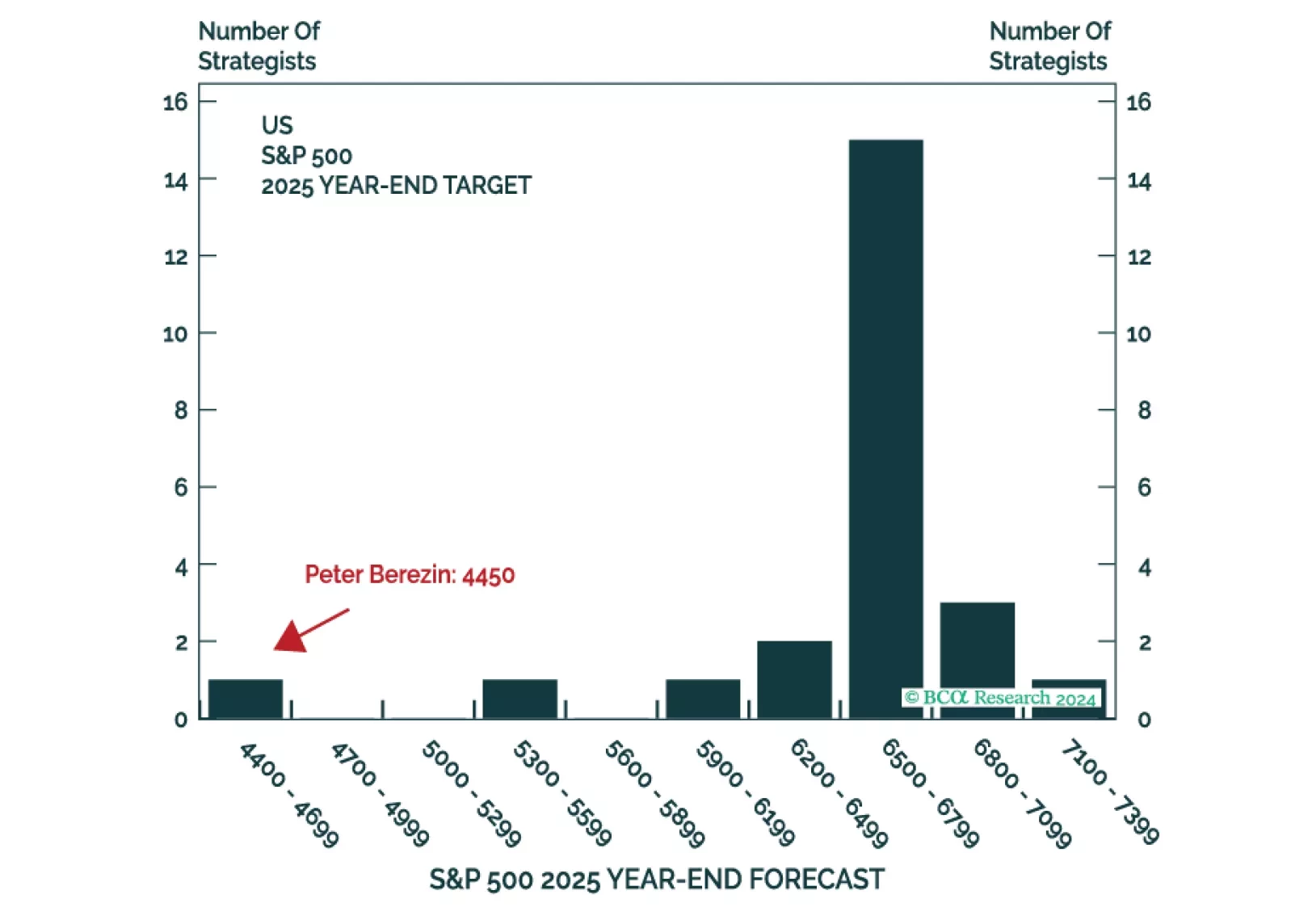

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

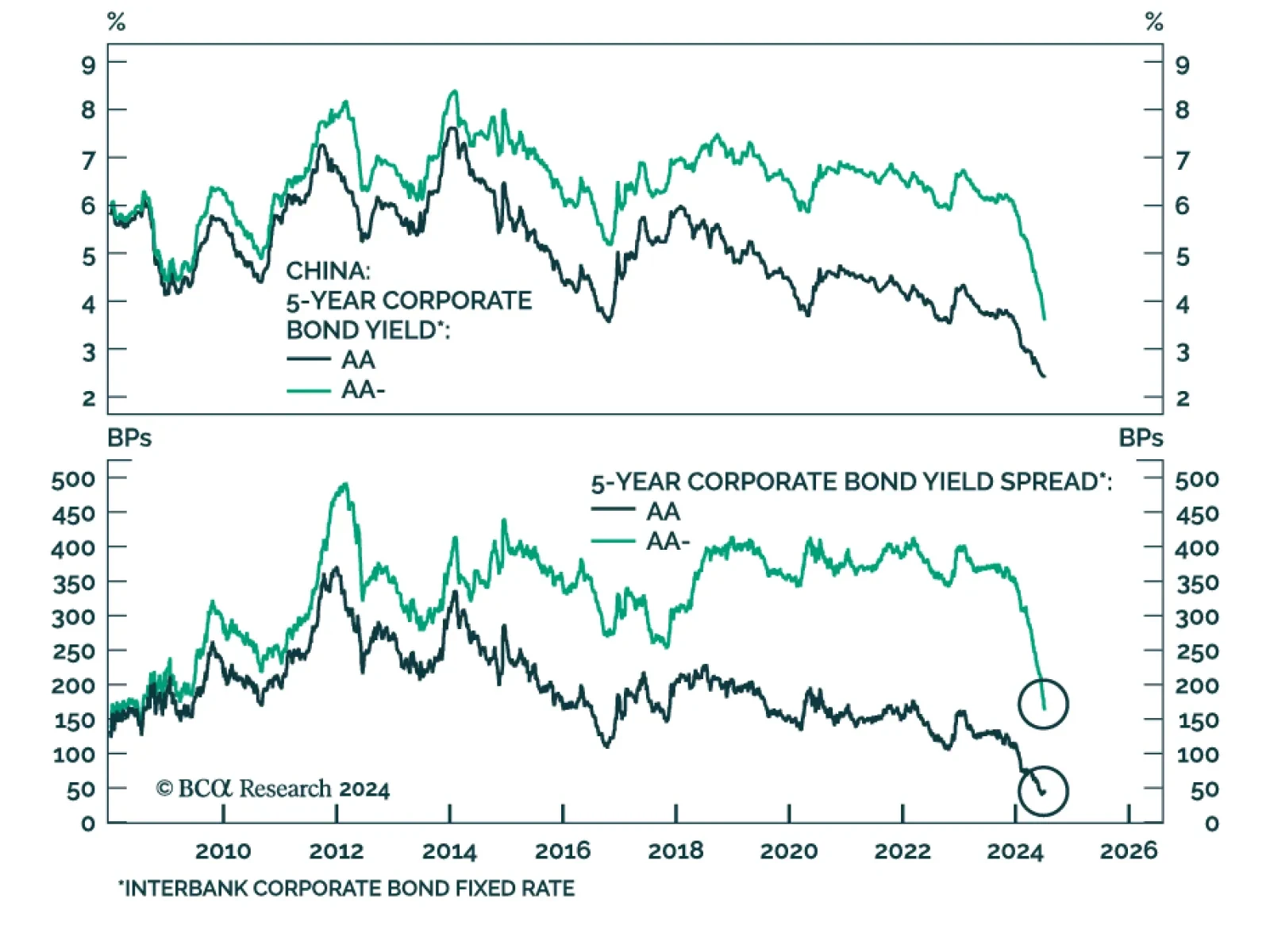

According to BCA Research’s China Investment Strategy service, onshore bonds are vulnerable to an investor sentiment reversal. Chinese 10-year government bond yields will likely trend lower to below 2% over the next 12…

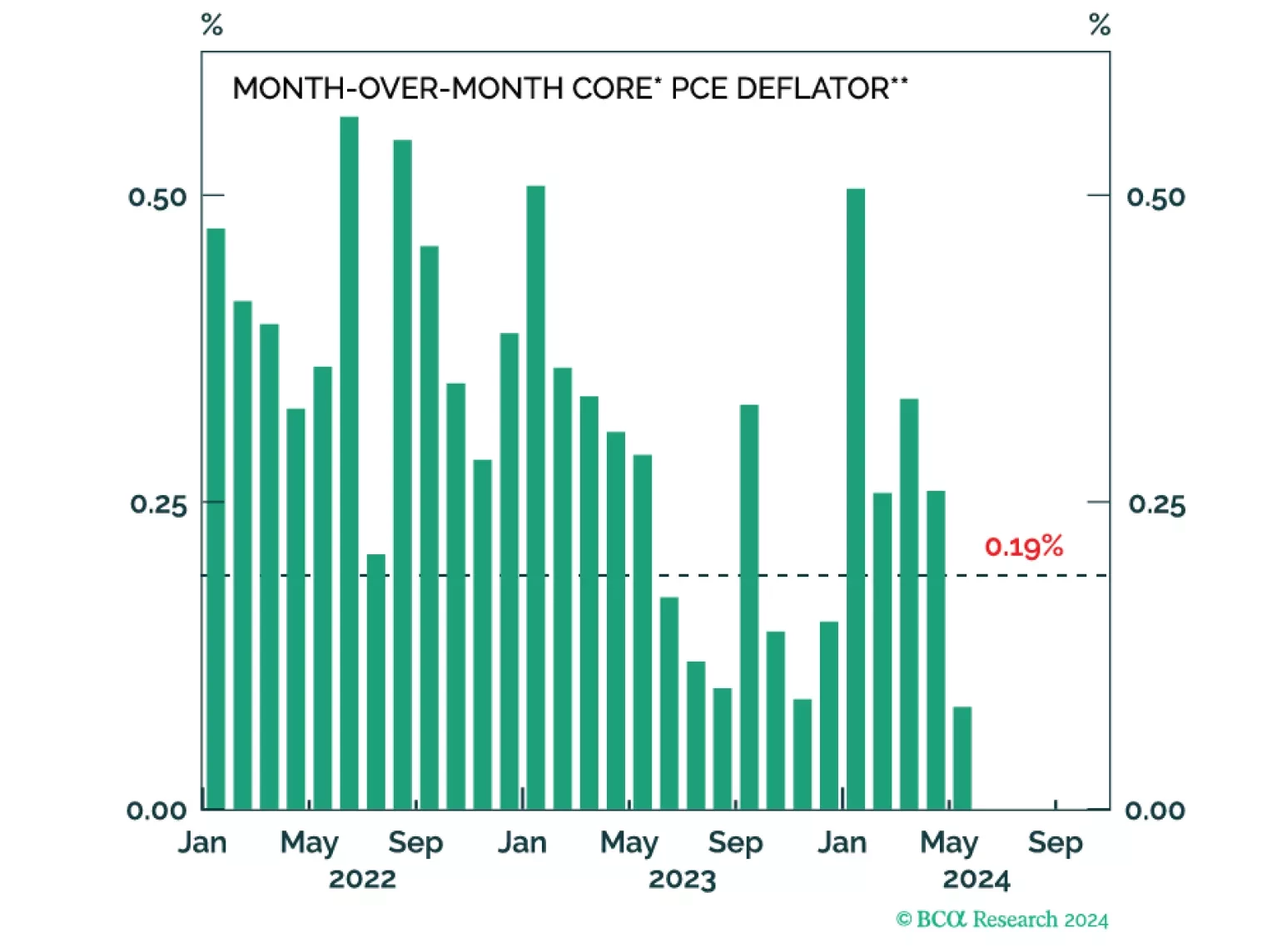

Our Portfolio Allocation Summary for July 2024.

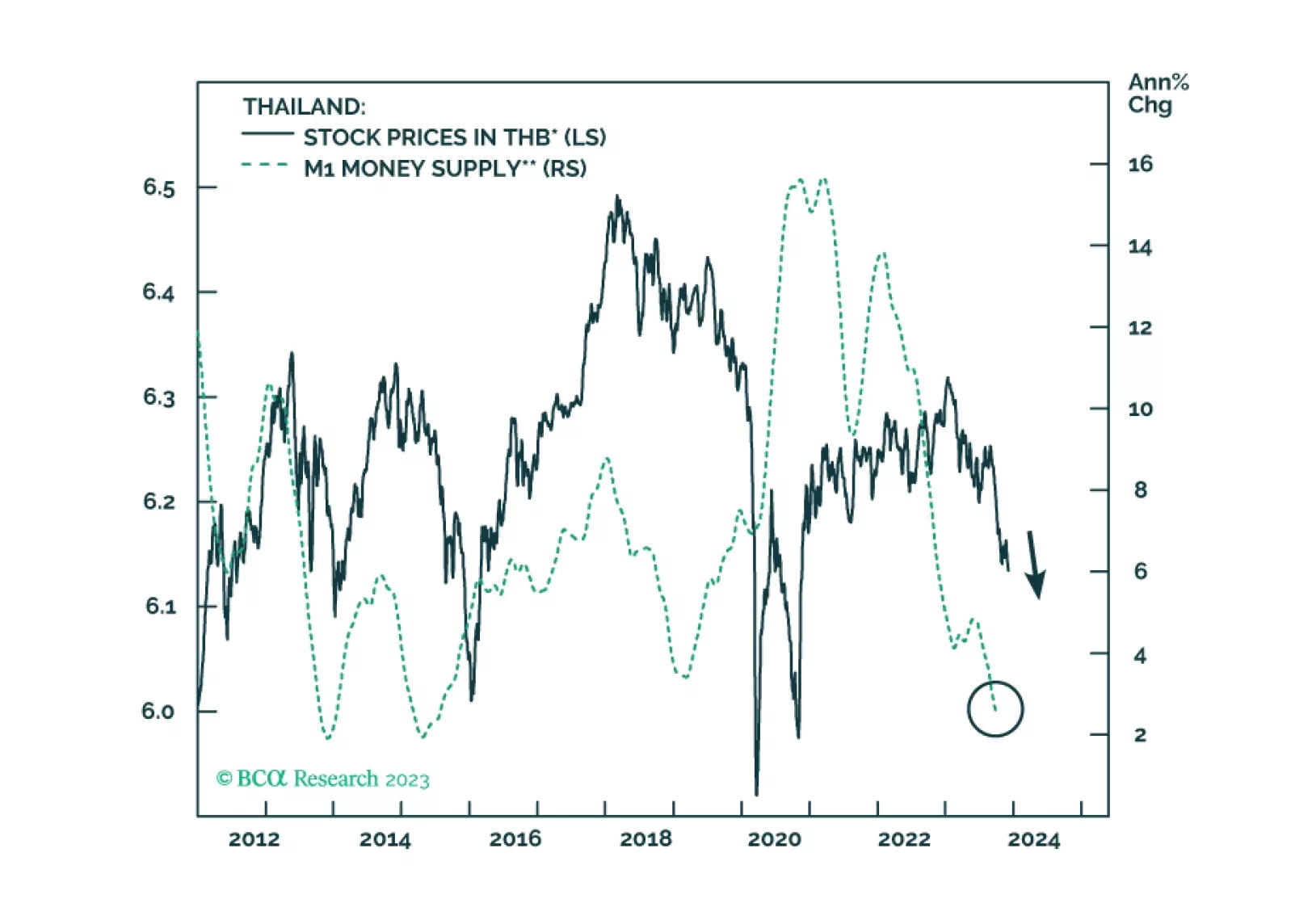

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

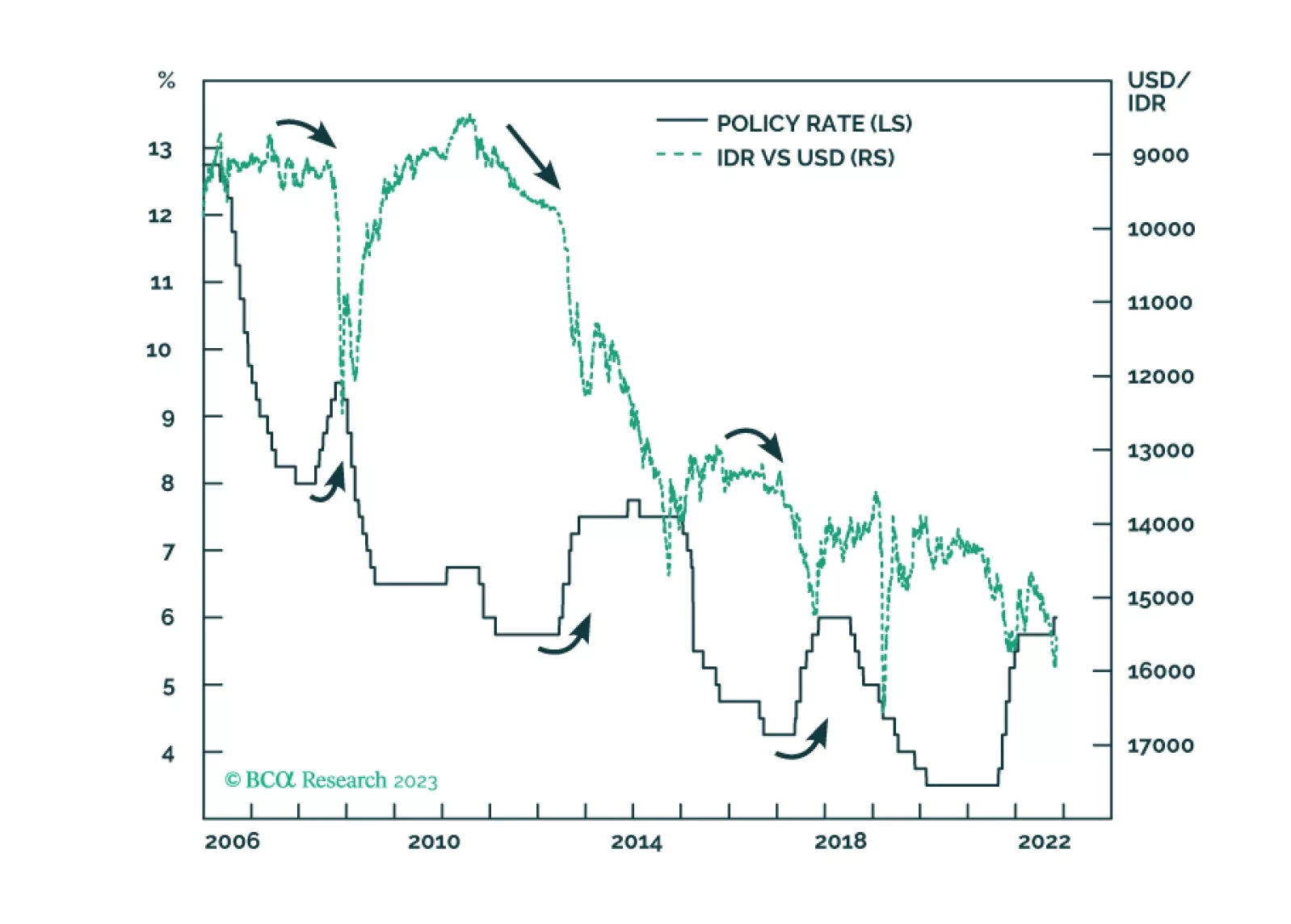

Despite very low inflation, Bank Indonesia raised its policy rates last month to support the currency. The strategy did not work before and will not work now. Stay short the rupiah.

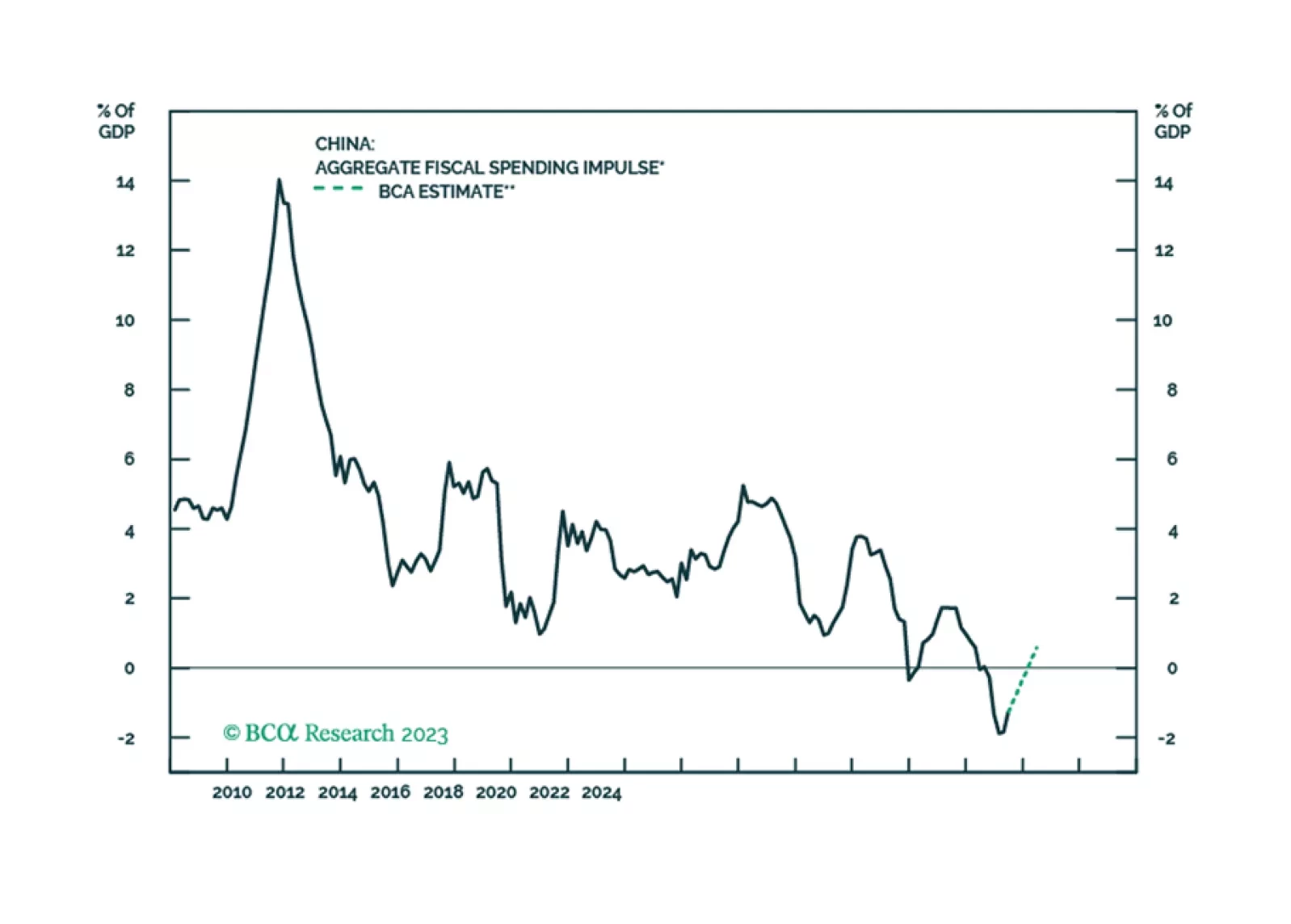

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…