The growth and inflation profiles of the three central European countries are set to diverge. The outlook for Polish and Hungarian Bonds are not attractive anymore. Book profits on them. Instead, initiate a new trade: pay Polish /…

Listen to a short summary of this report. Executive Summary Second Fastest Hiking Cycle Ever? Can the Fed achieve a soft landing, bringing inflation back to its 2% target without causing growth to…

Highlights 2022 Key Views & Allocations: Translating our 2022 global fixed income Key Views into recommended positioning within our model bond portfolio results in the following conclusions to begin the year. Target a moderate…

Highlights Chart 1Curve Flattening Is Overdone Fed Chair Jay Powell made big news last month. During Senate testimony, Powell not only signaled that the Fed is likely to accelerate the pace of asset purchase tapering when it…

Highlights Chart 1Buy The 2-Year, Sell The 10-Year Treasury yields have been volatile of late, but the biggest move has been a flattening of the yield curve led by a sell-off at the front-end. Our recommended yield curve…

Highlights Chart 1Bond Yields Still Track The "Re-Opening" Trade Bond yields rose notably in September, with the bulk of the move coming in the days after the Fed teased an upcoming tapering of its…

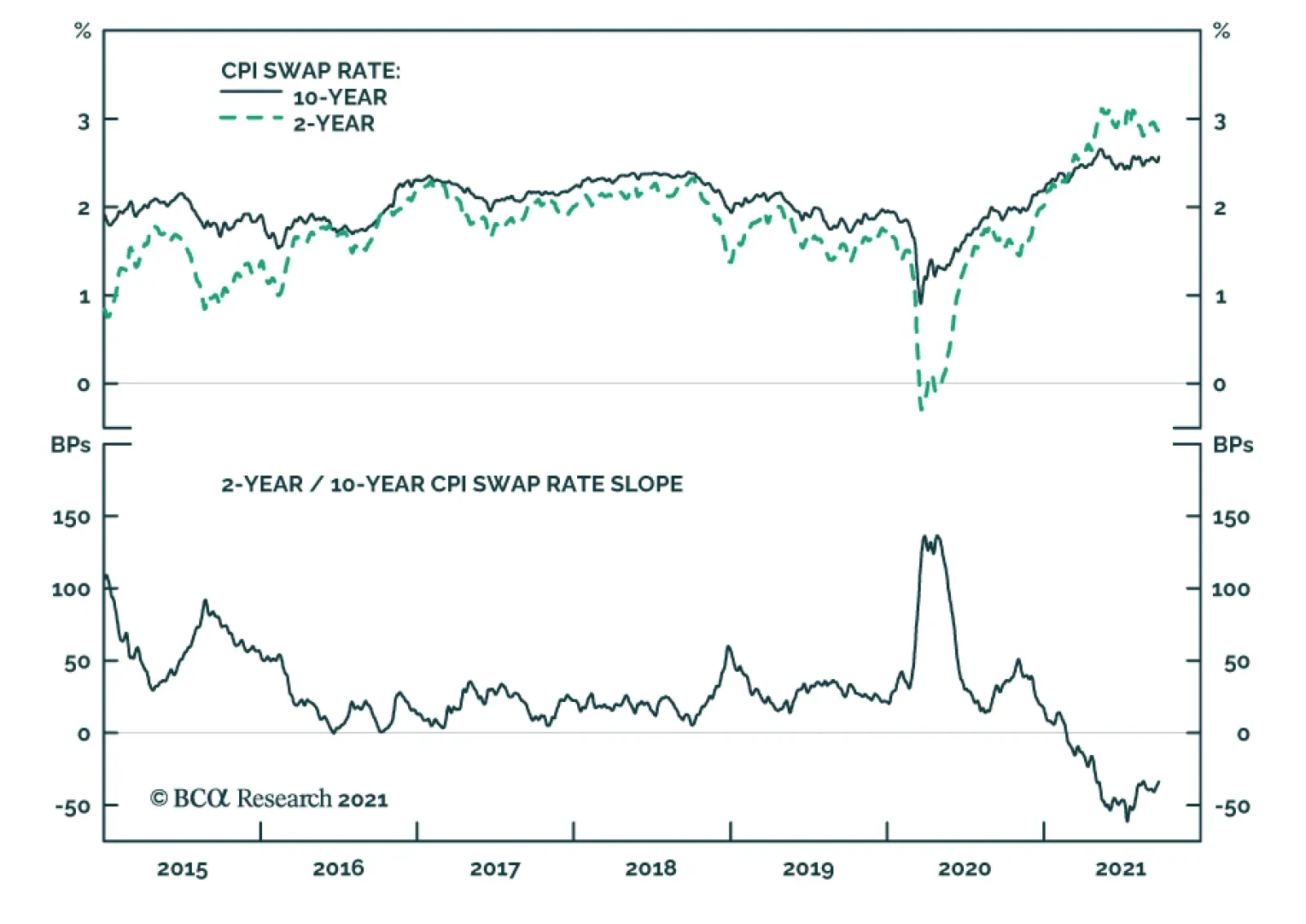

BCA Research’s US Bond Strategy services recommends investors enter 2/10 steepeners on the inflation compensation curve and/or 2/10 flatteners on the real (TIPS) curve. The increase in the 10-year nominal yield since last…