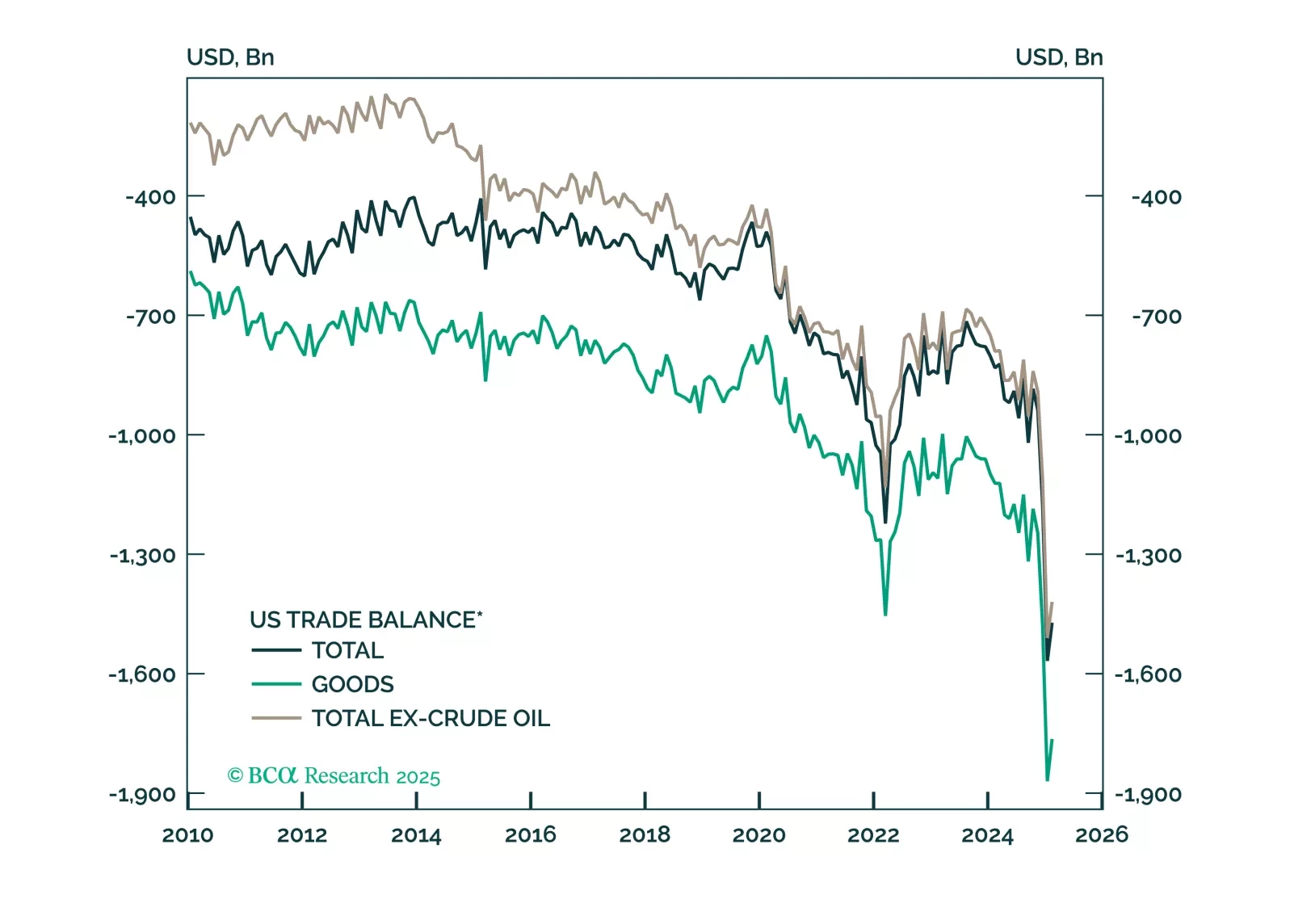

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

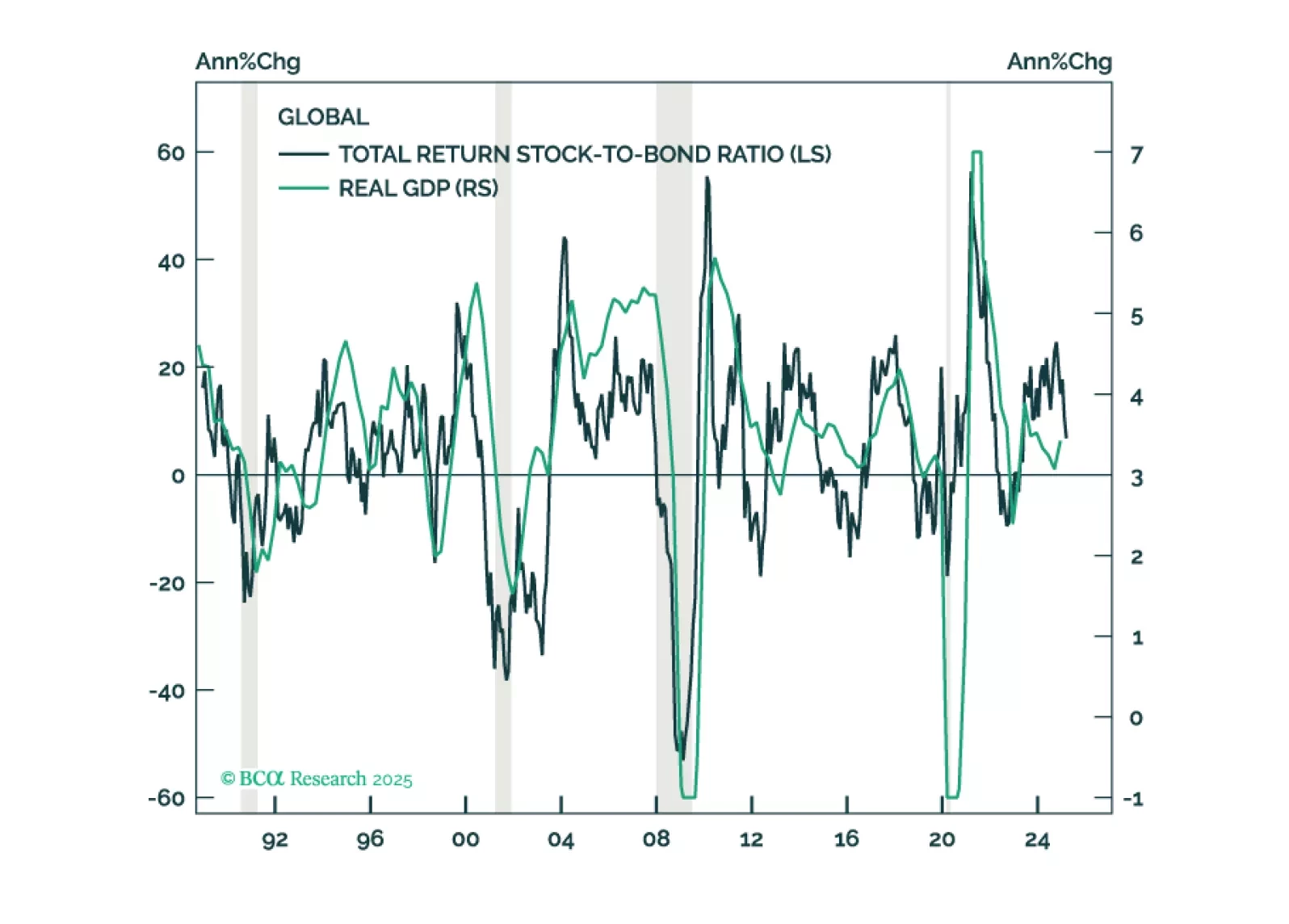

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

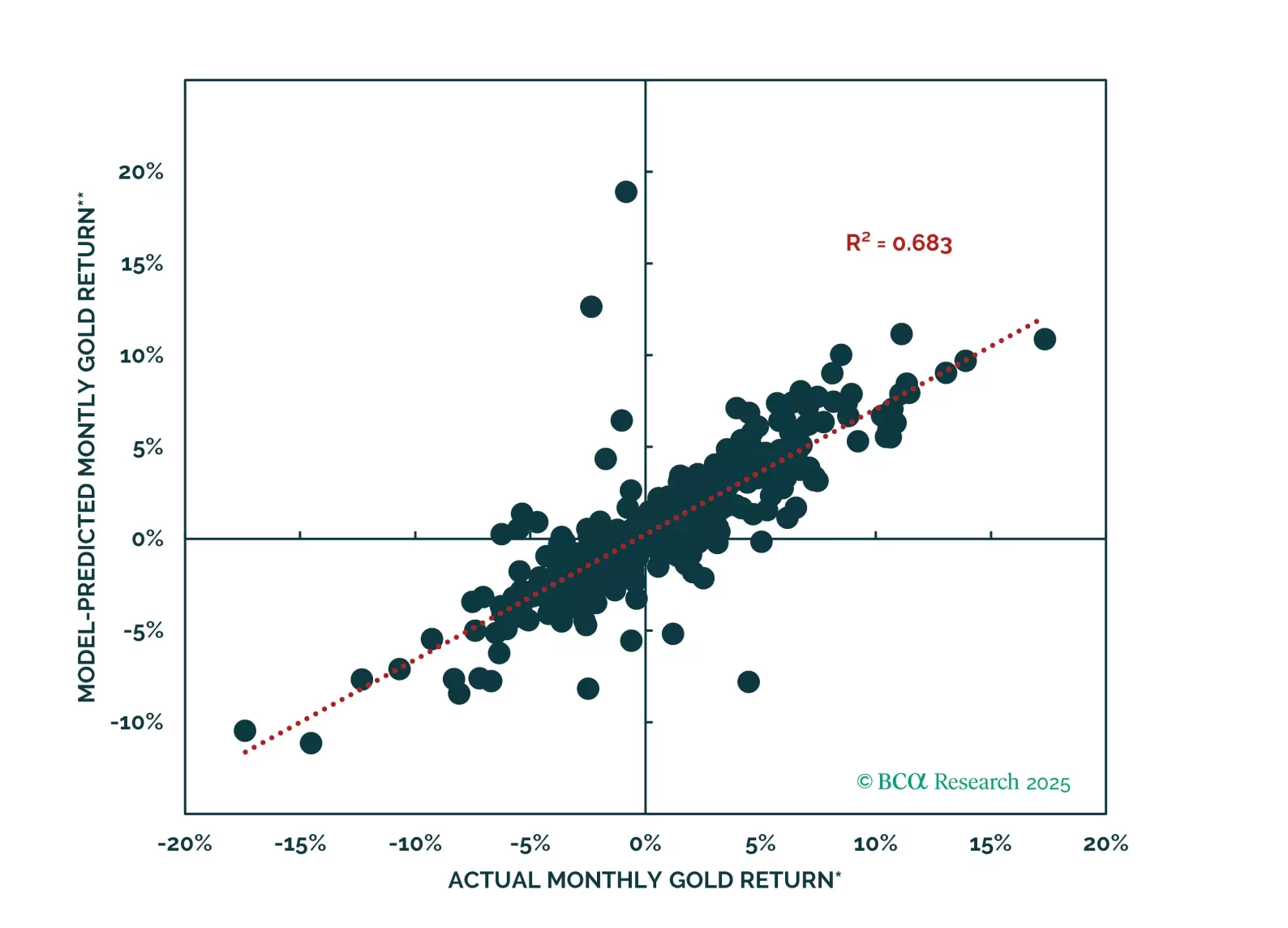

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…

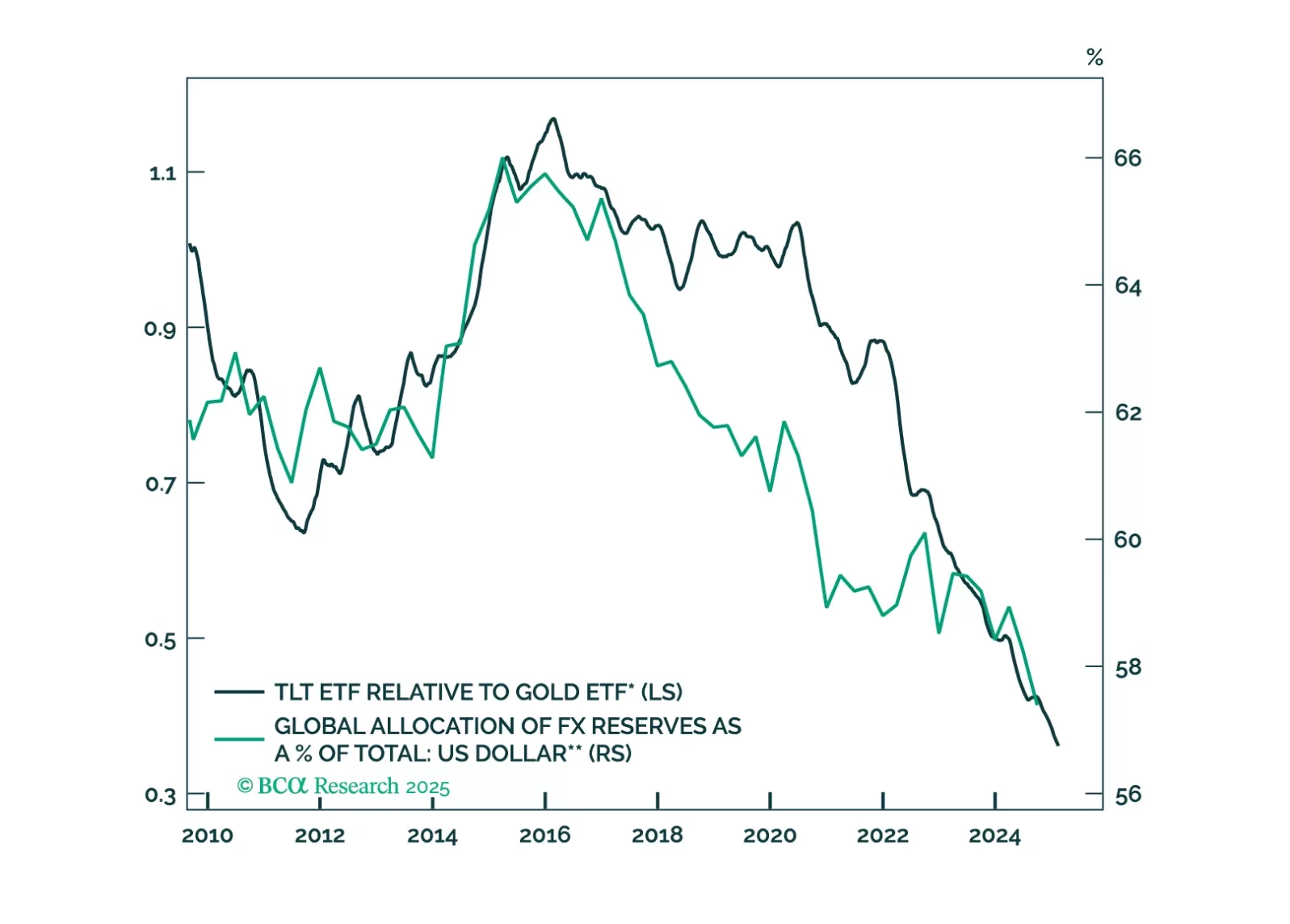

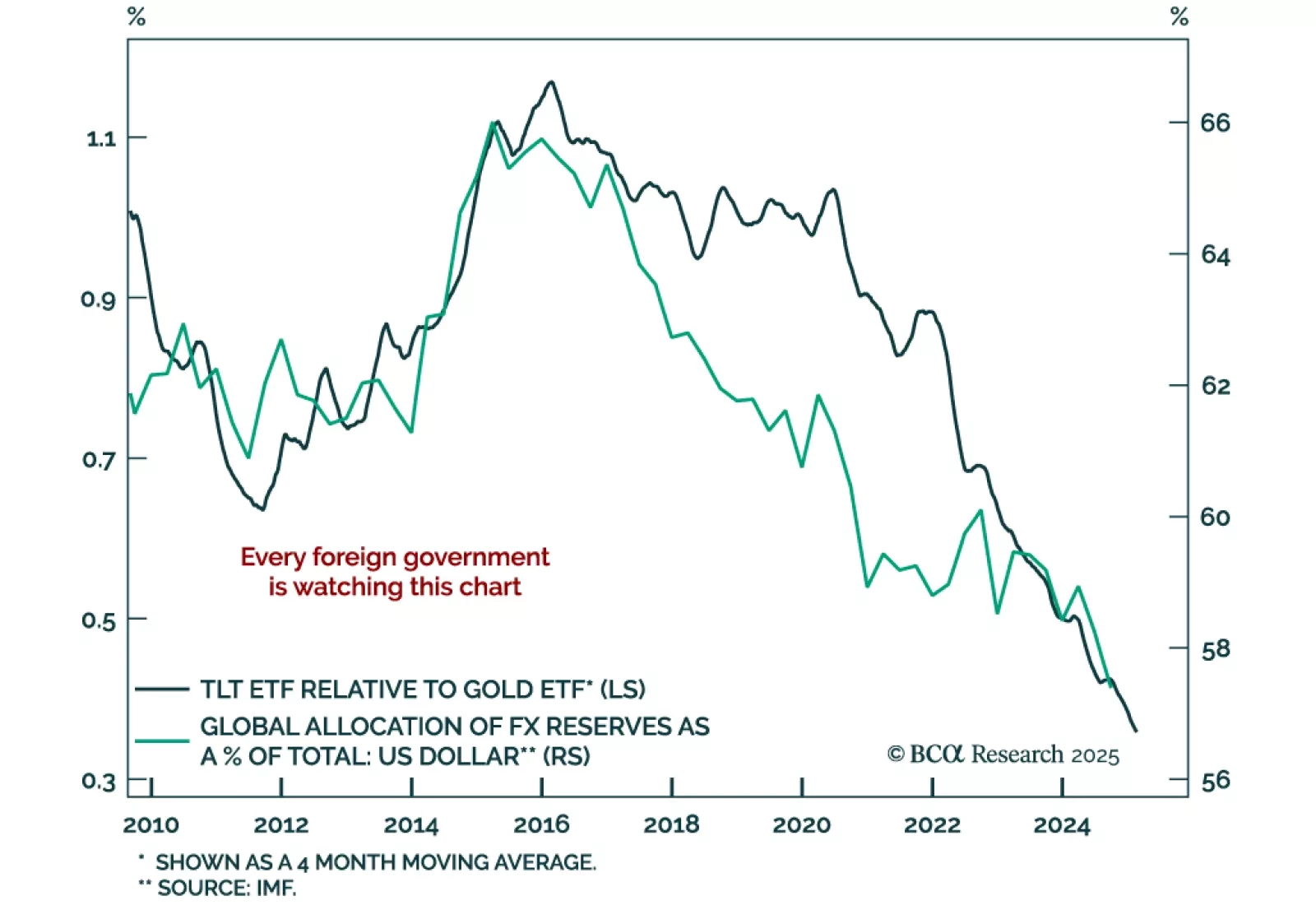

Our Chart Of The Week comes from Chester Ntonifor, Chief Strategist for our Foreign Exchange and Global Fixed Income Strategy services. A big macro trade over the last few years has been to shun US Treasuries, in favor of…

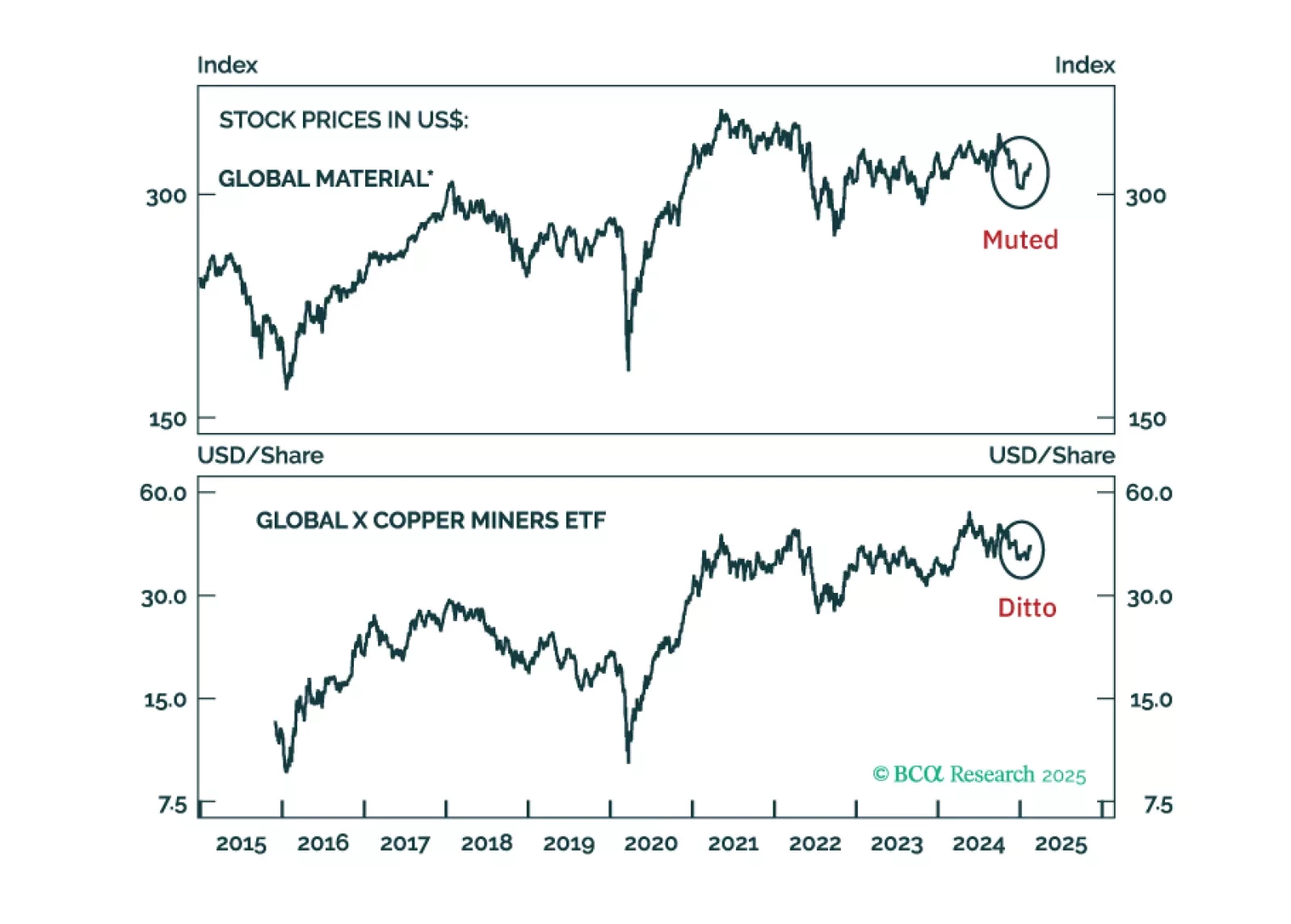

Expectations of US import tariffs drove the latest upleg in the prices of precious and industrial metals. However, there are no significant economic or political incentives for the US to impose import tariffs on these metals.…

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

This week, our three screeners cover equity plays on the run-up in gold prices, a hotter-than-expected US inflation print, and calling the top in Bitcoin.

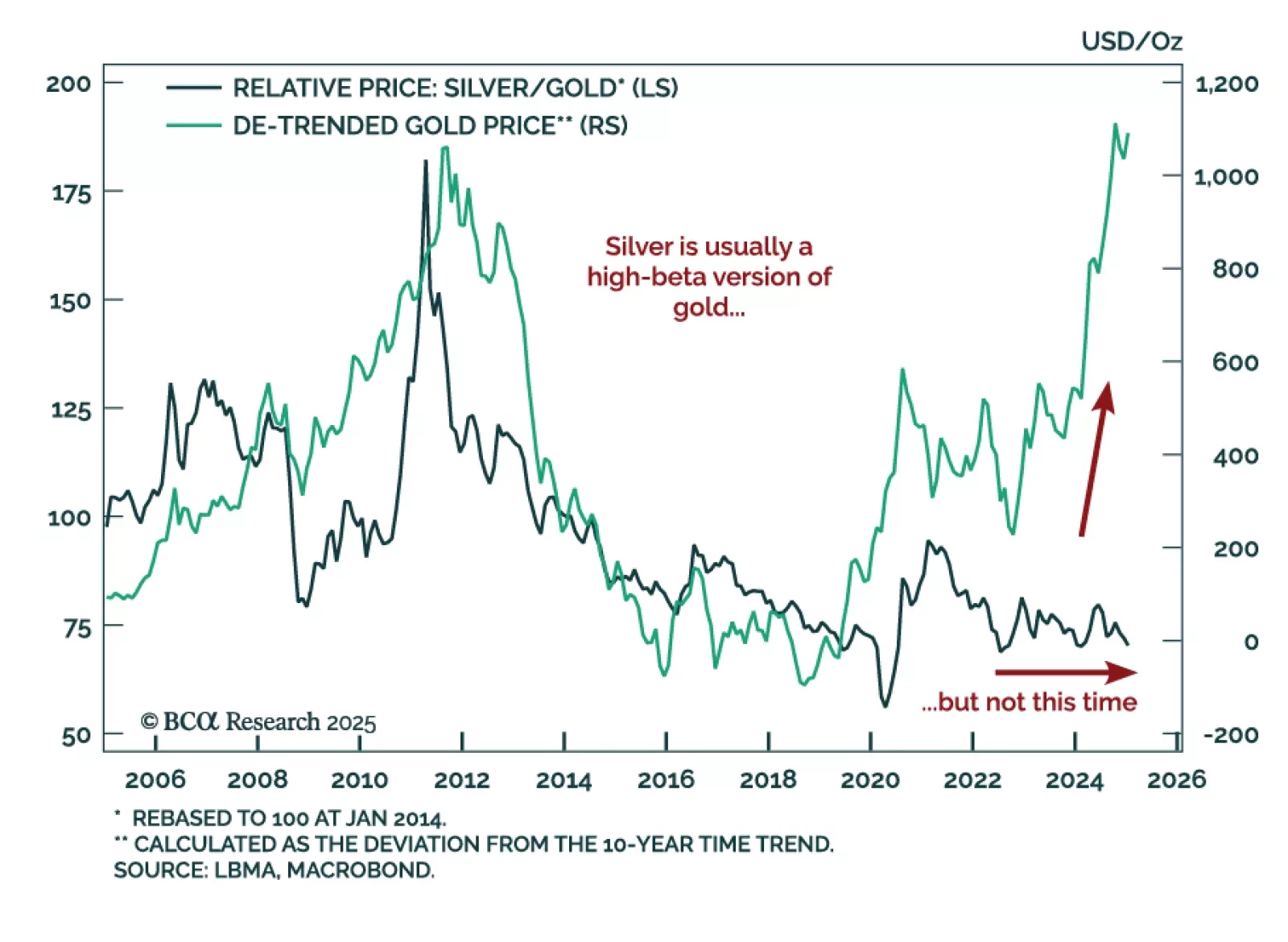

Our Commodity strategists provided an update on precious metals and the impact of US tariffs on commodities. Elevated policy uncertainty will drive a rally in precious metals over the next 12-to-18 months, but not all metals…

While the US dollar has outperformed every single DM currency in the past few months, the only monetary asset it did not outperform is gold. The greenback is up between 5-10% against DM currencies since September of last year, but…