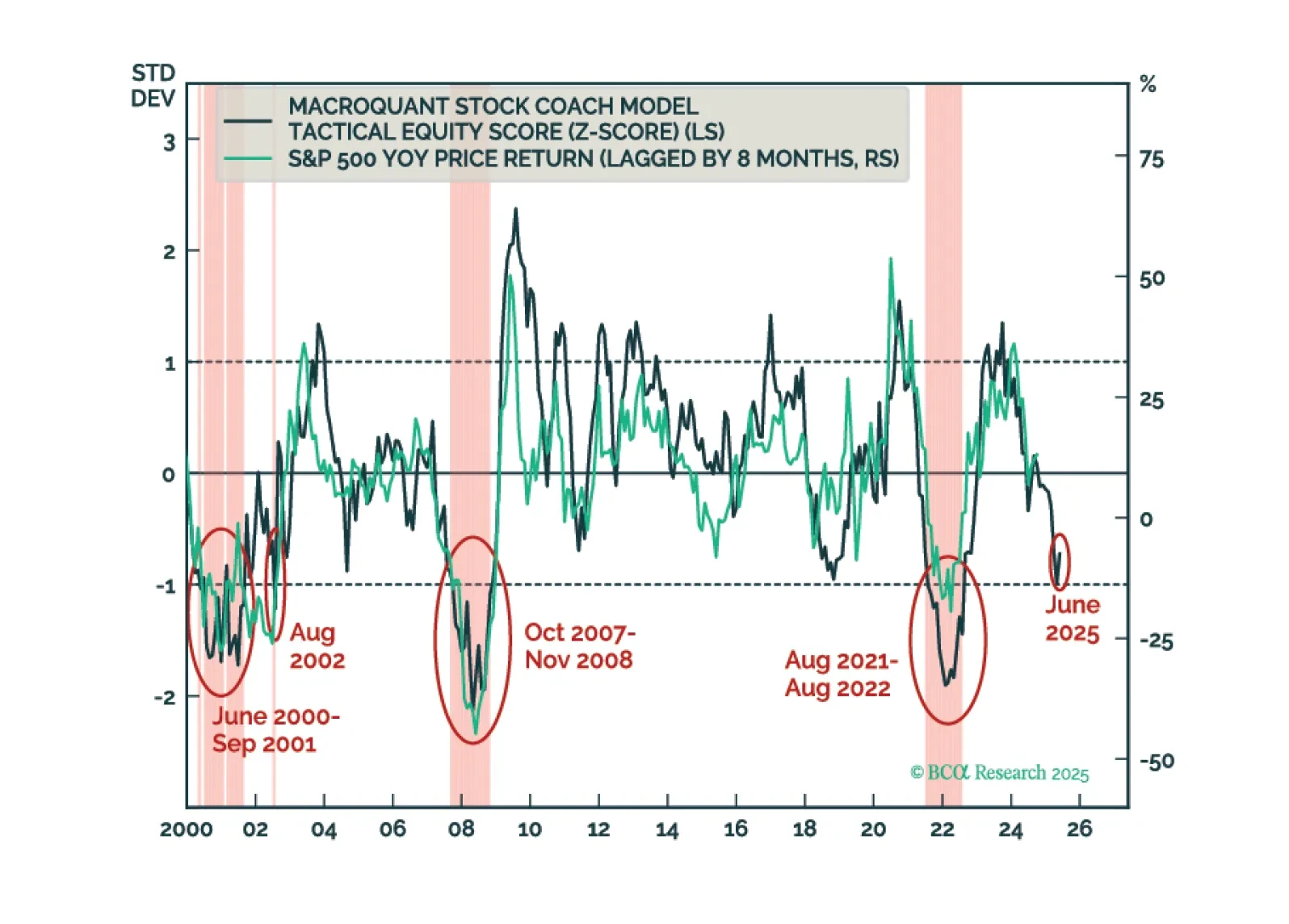

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

BCA’s US Political strategists warn that Russia presents an immediate market risk, with near-term pullbacks offering potential buying opportunities. President Trump is pivoting toward ceasefires and trade deals, supported by approval…

An update on the key themes and views that will shape commodity markets through the remainder of 2025.

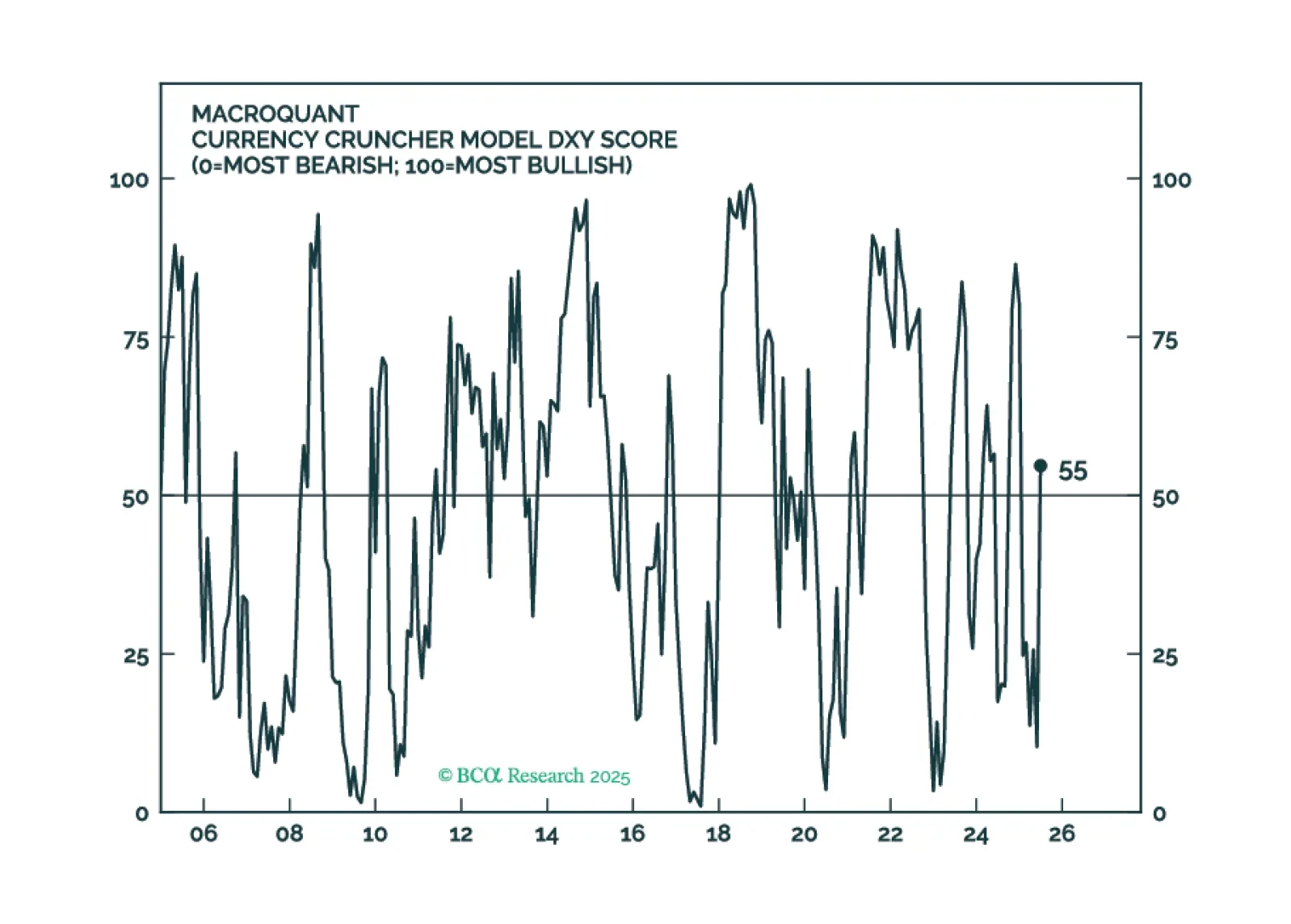

The dollar is breaking down, as capital leaves the US. The important question investors must answer is how much downside is left for the greenback, and whether depreciation will continue in a straight line over the coming months or pause (…

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

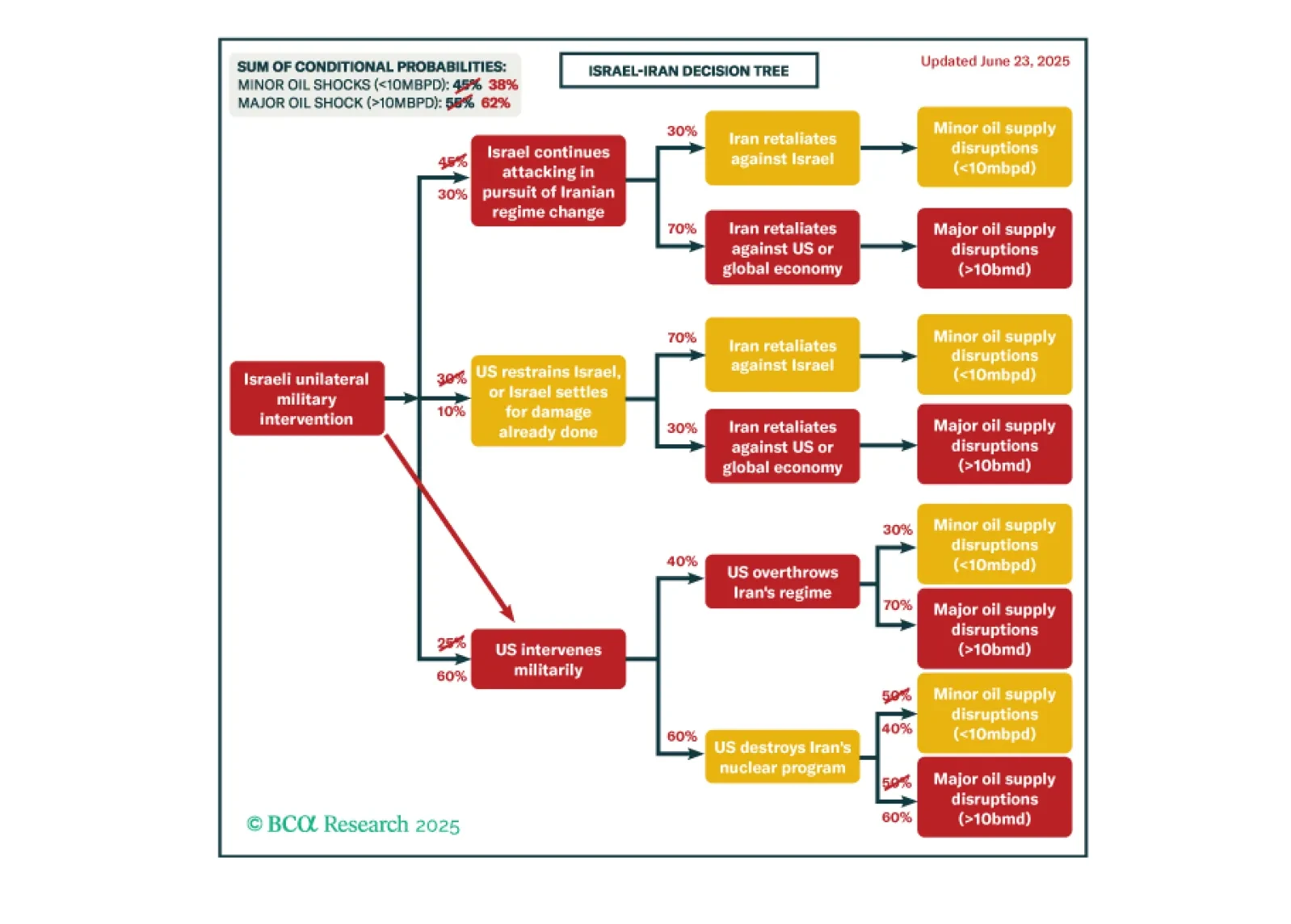

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

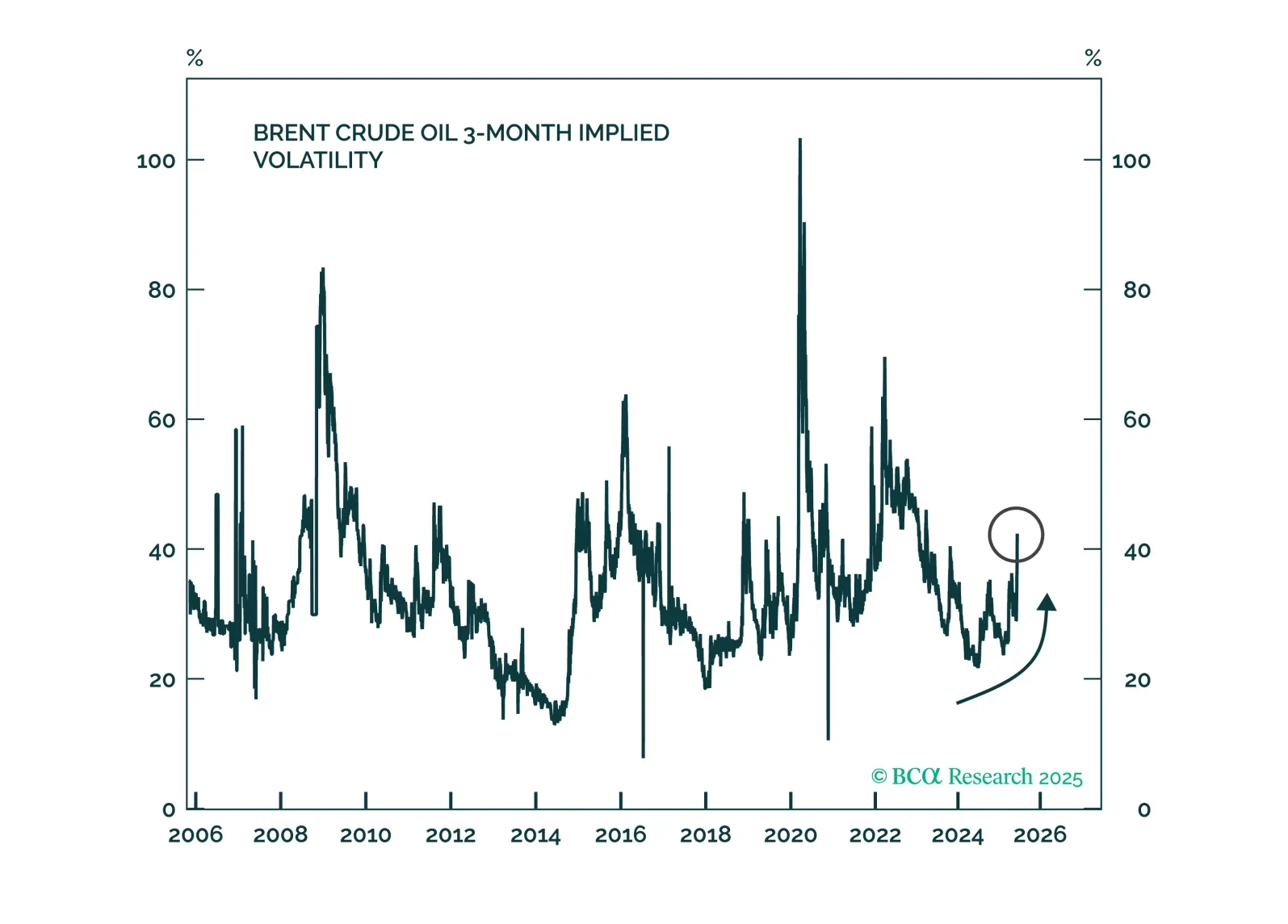

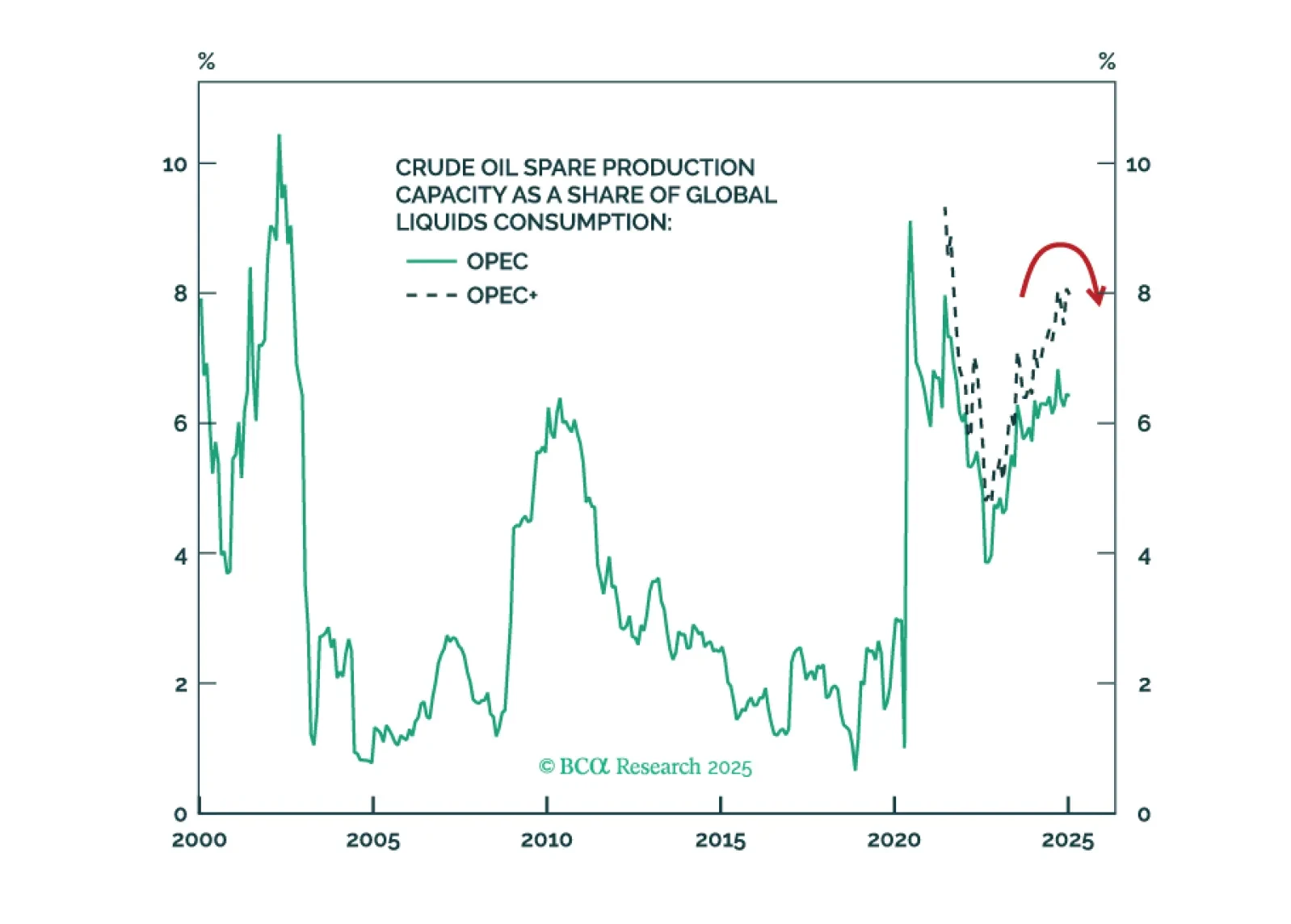

The escalating Israel-Iran conflict has boosted oil prices. We are positioning for further geopolitical escalation, uncertainty, and the economic fallout through two strategies that benefit from both near- and long-term upside.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

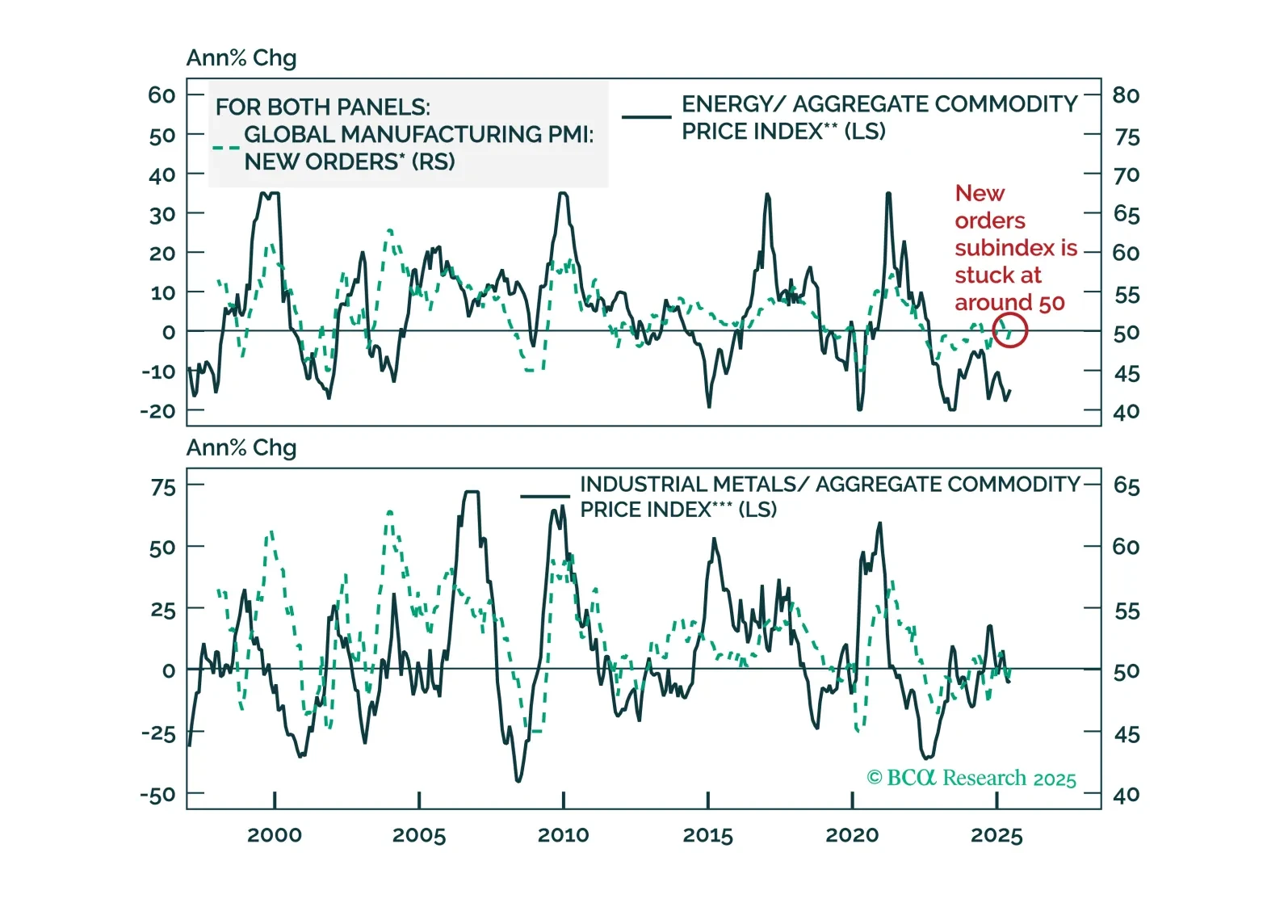

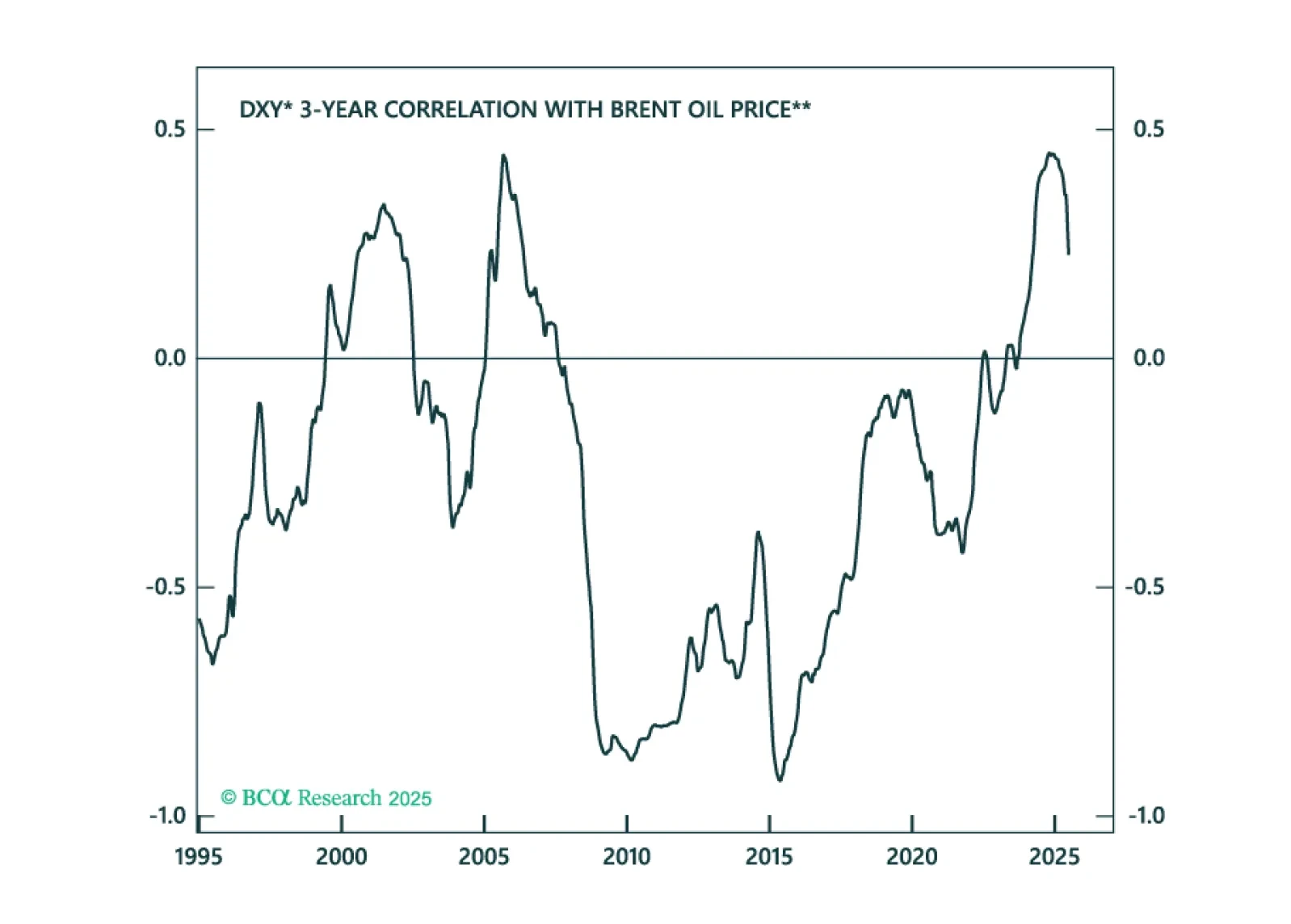

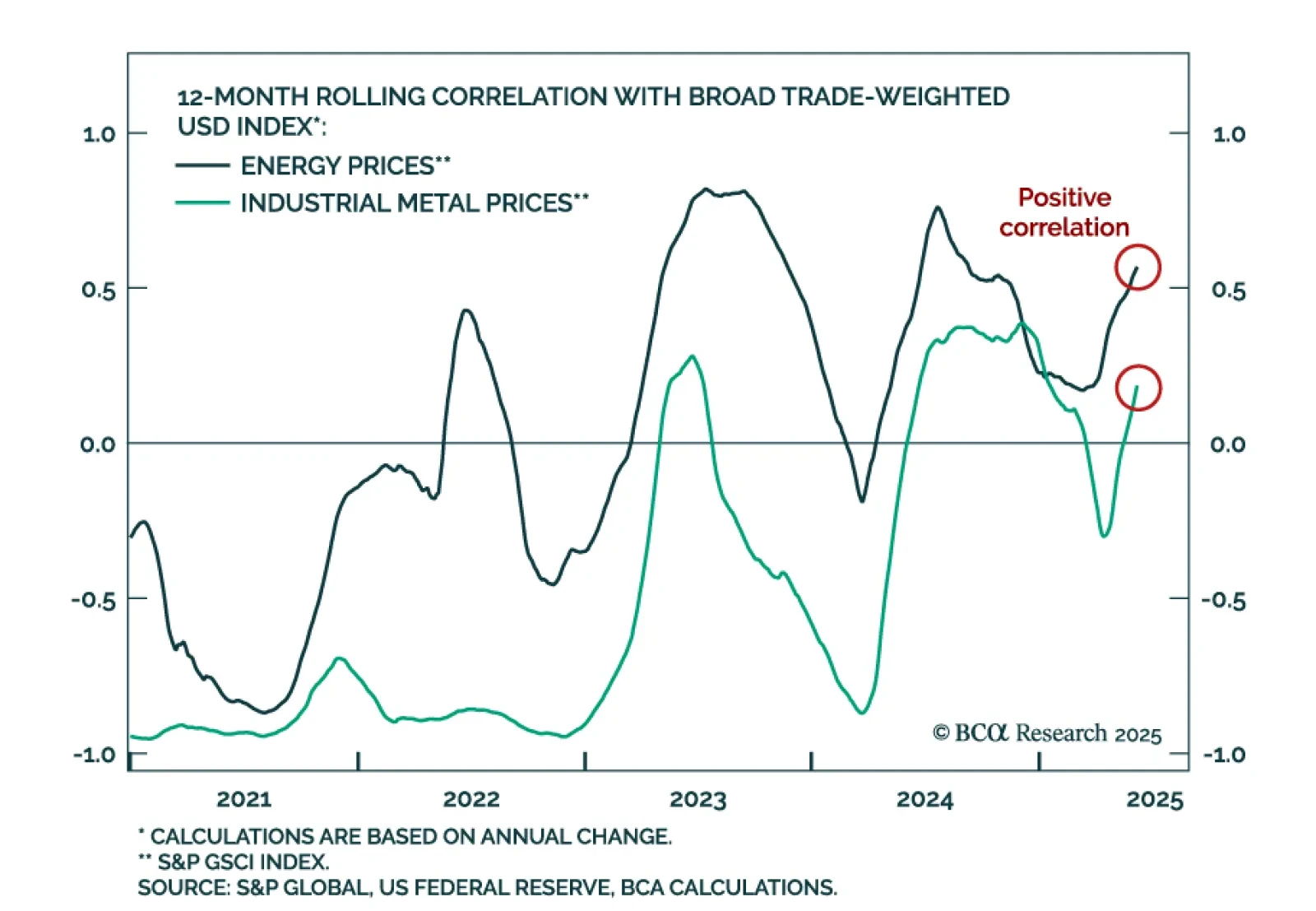

Our Commodity strategists see a breakdown of historical commodity correlations. The US dollar now shows a positive correlation with commodities, particularly energy, and a weaker dollar will no longer guarantee upside for commodity…