In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

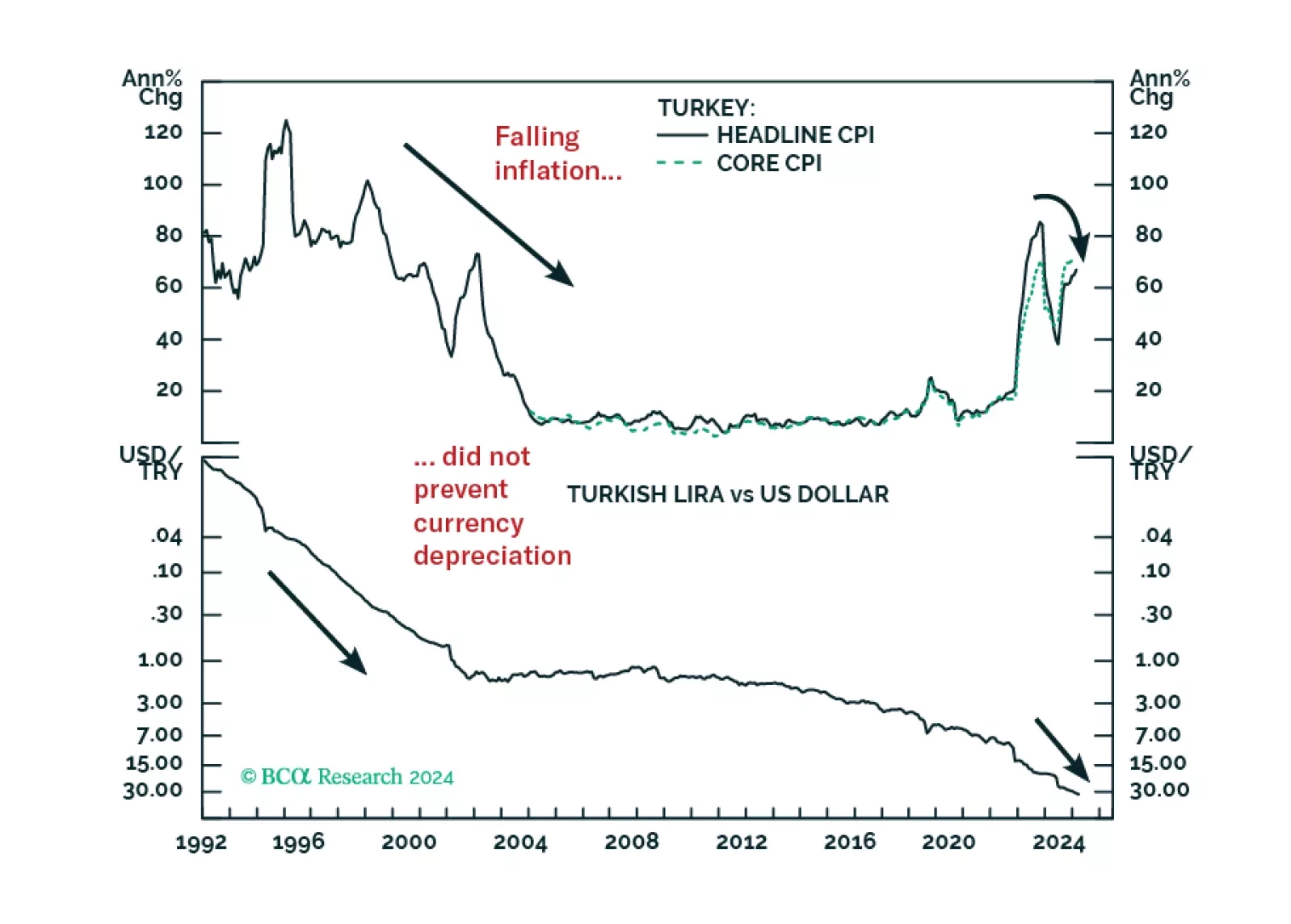

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

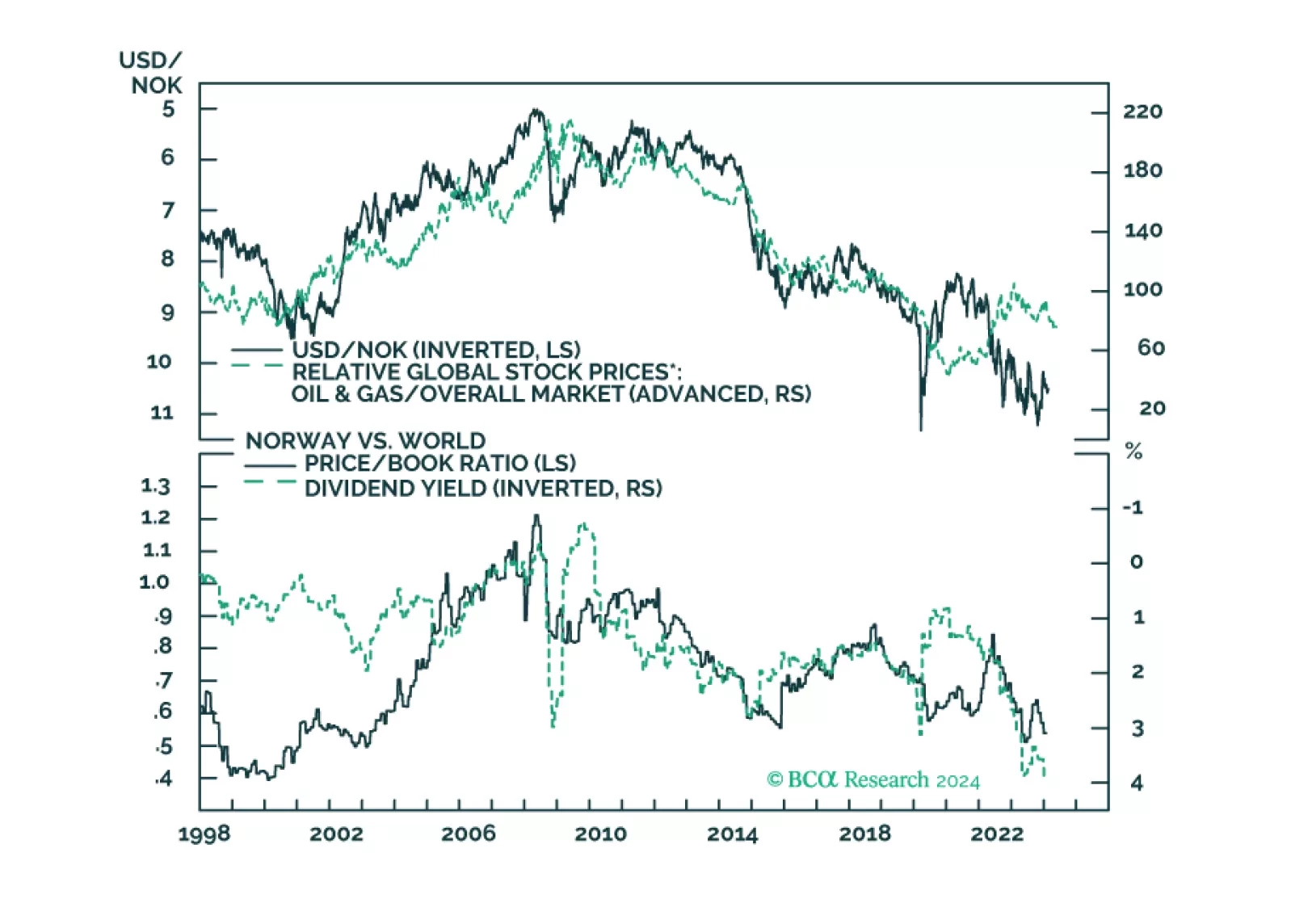

In this insight, we provide an update on the Norwegian krone, with attractive trade ideas over a long-term horizon. Shorter-term, our neutral-to-positive view on the dollar keeps us on the sidelines for USD/NOK.

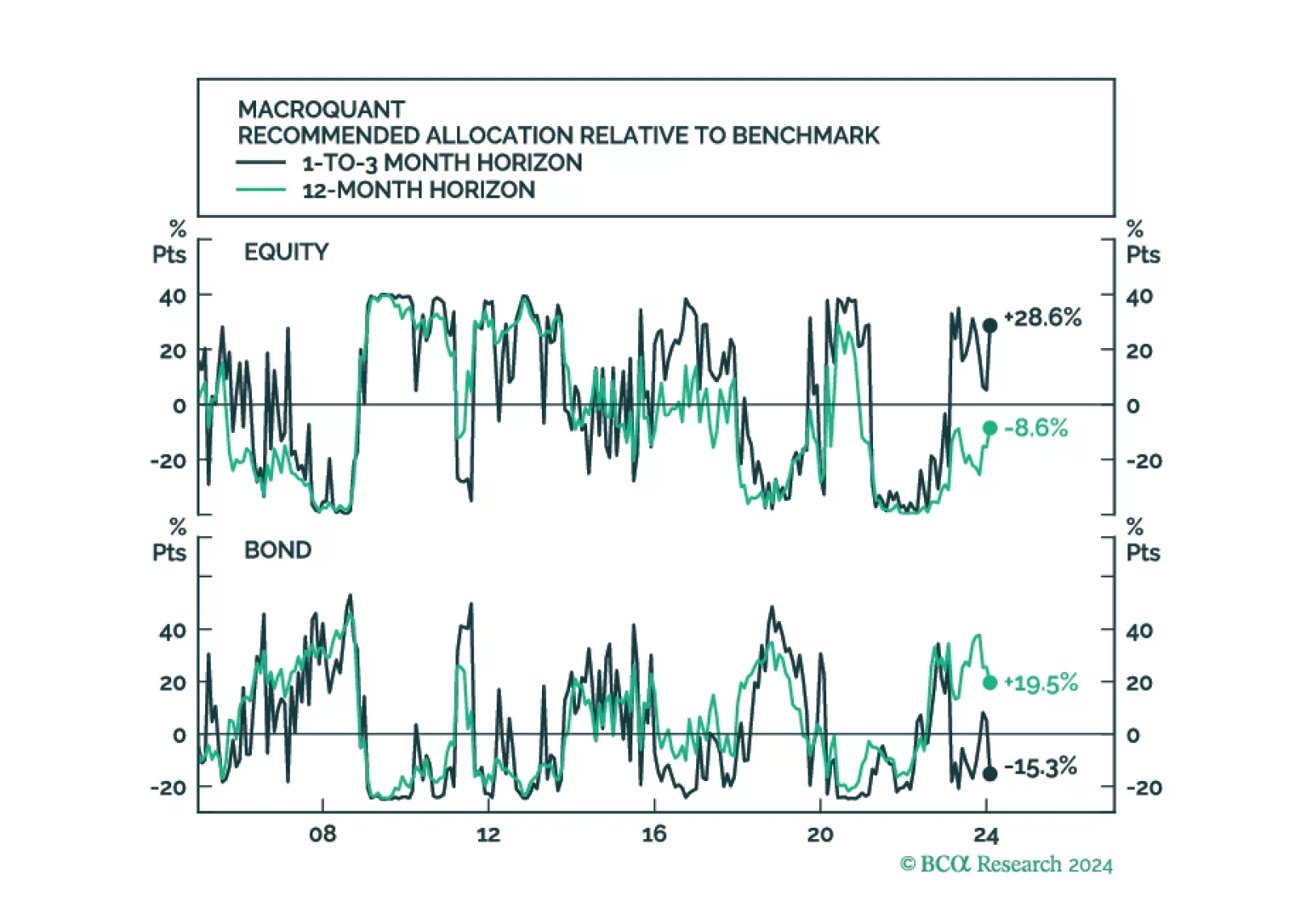

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…

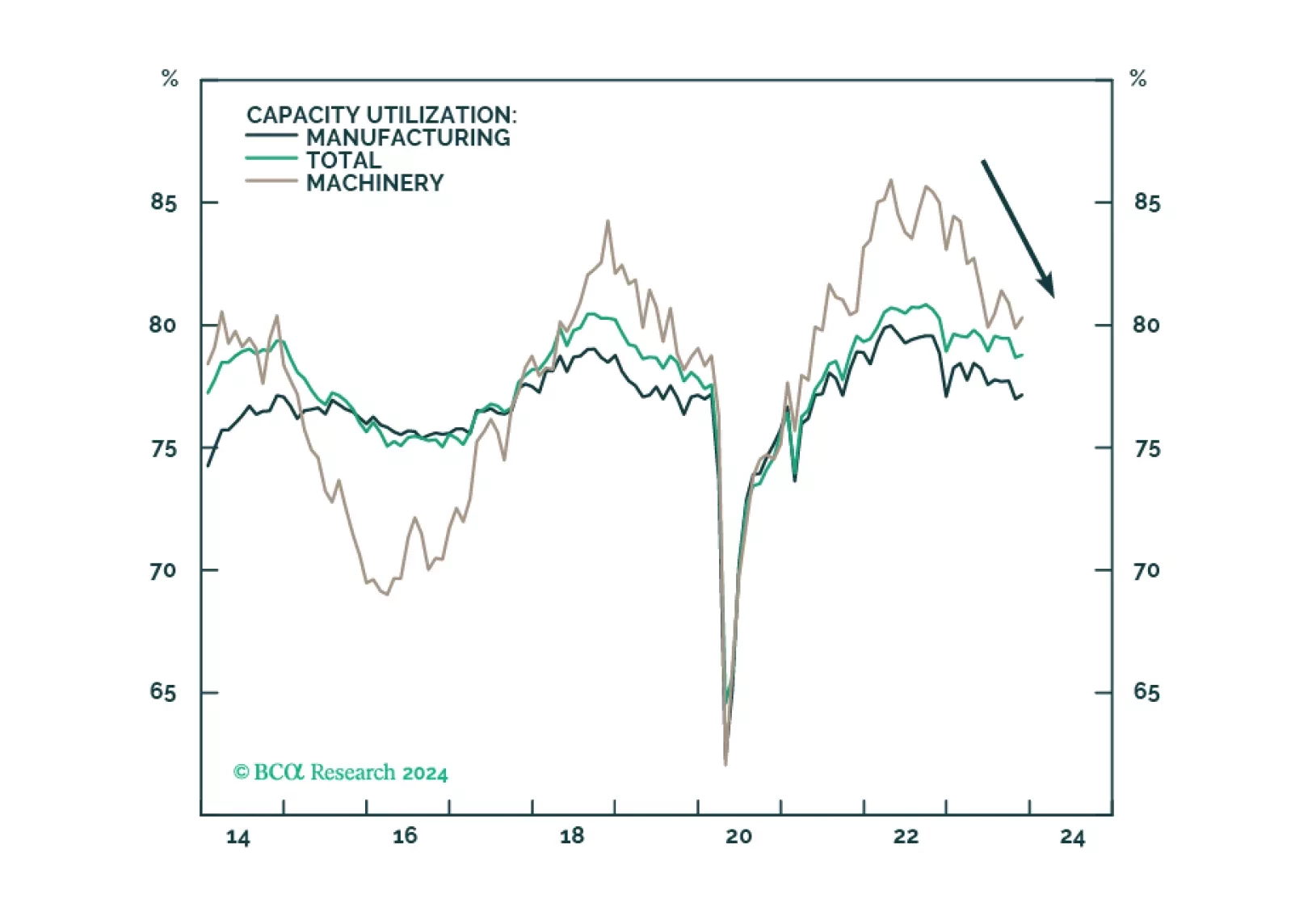

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

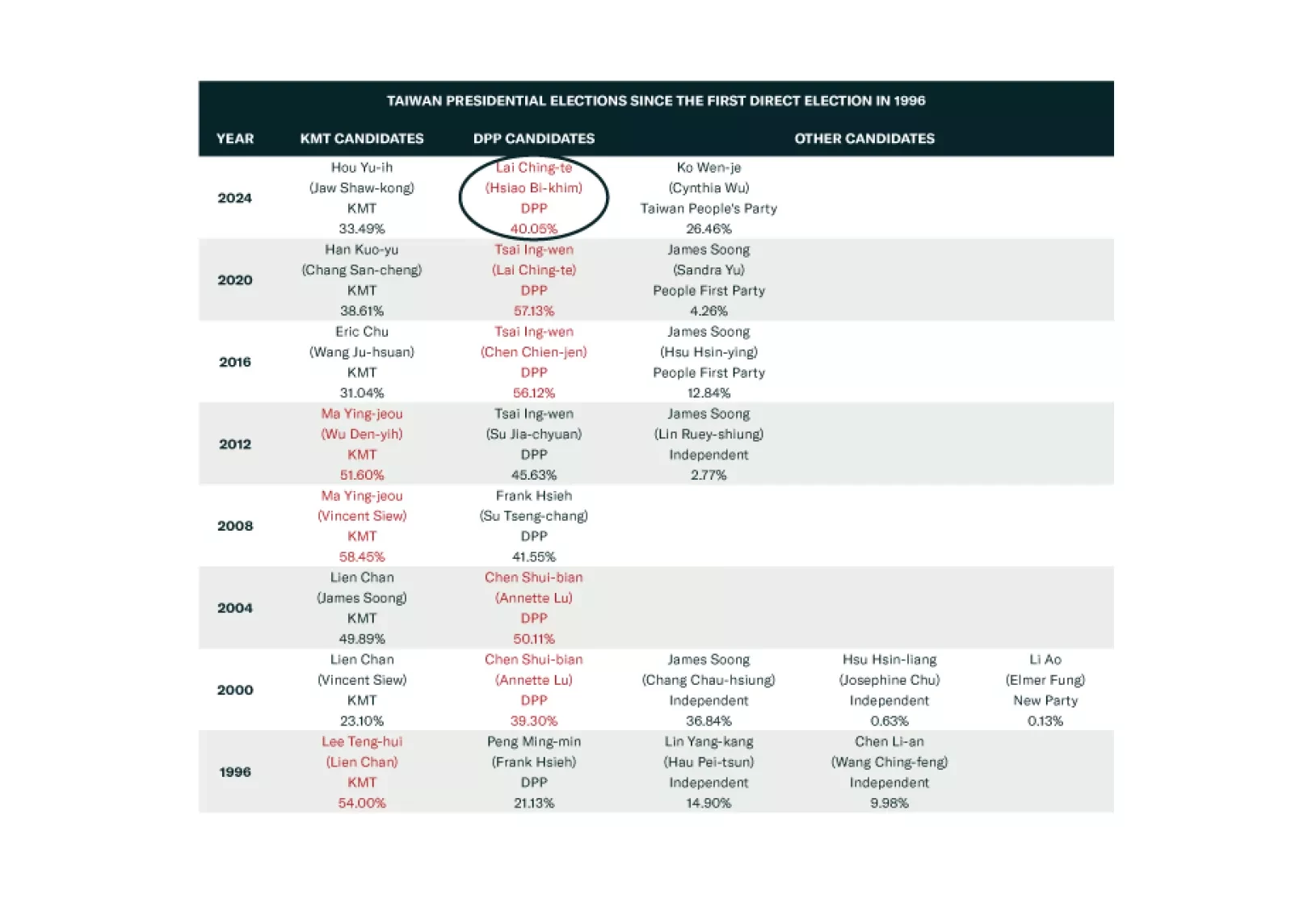

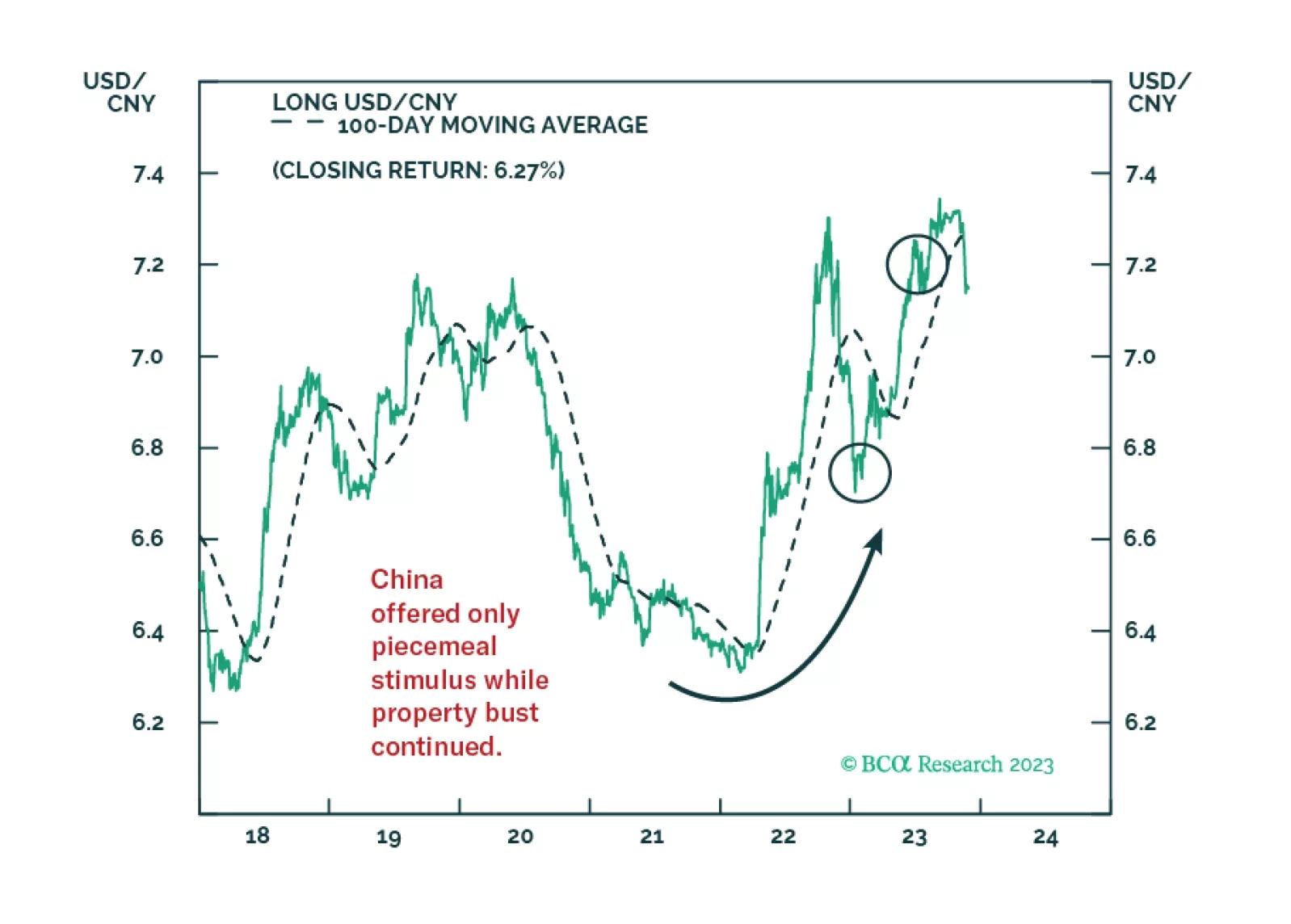

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.

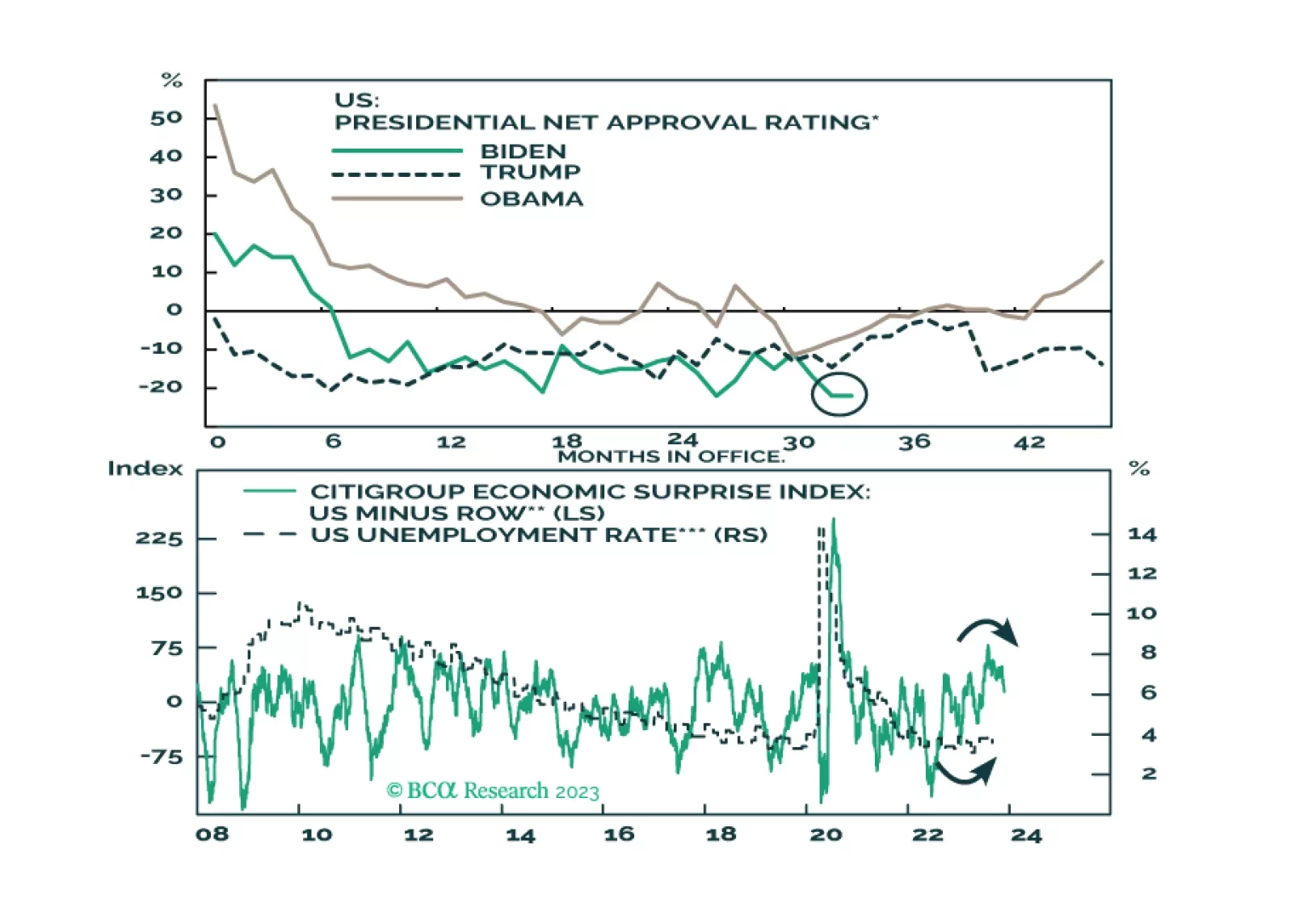

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.