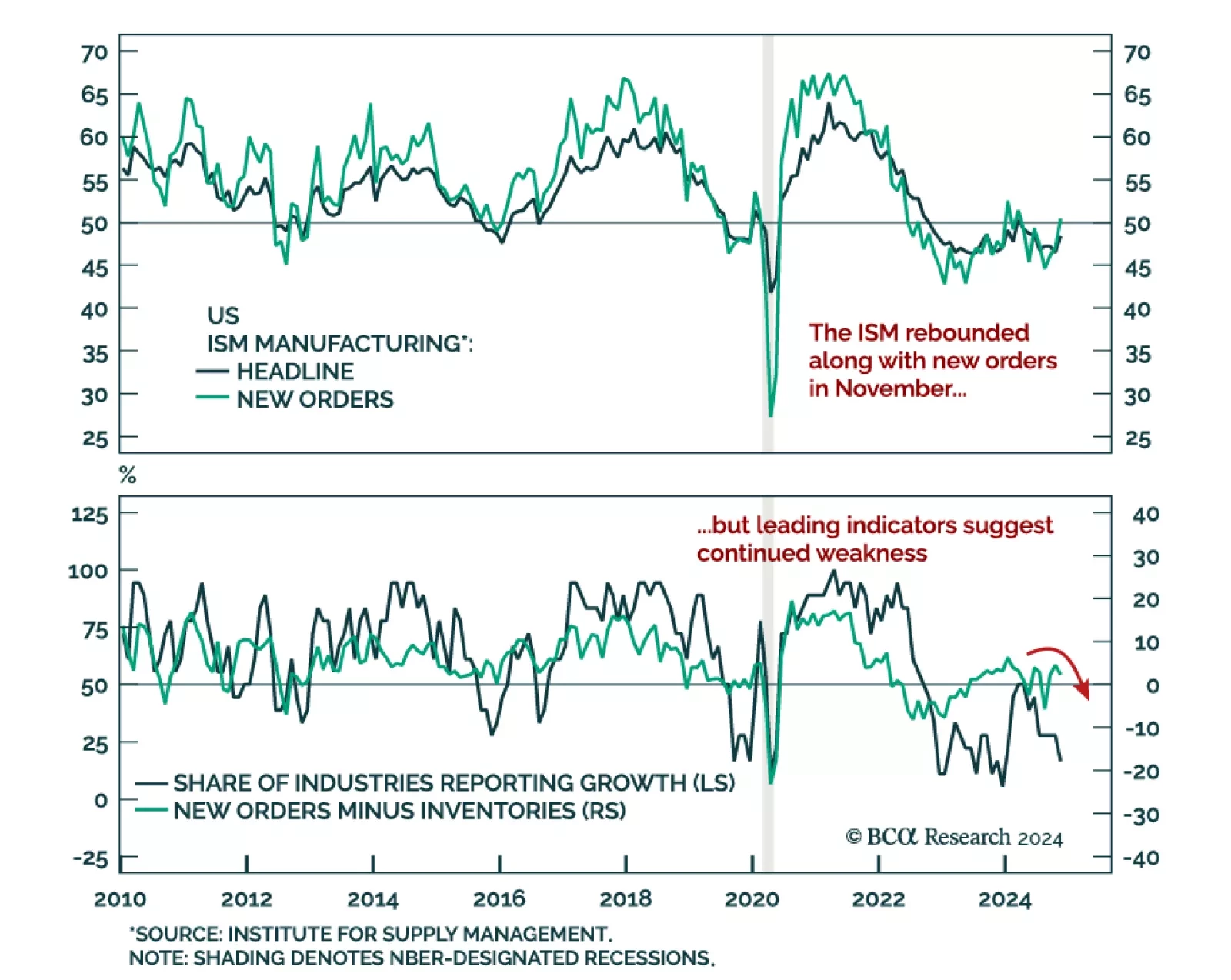

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

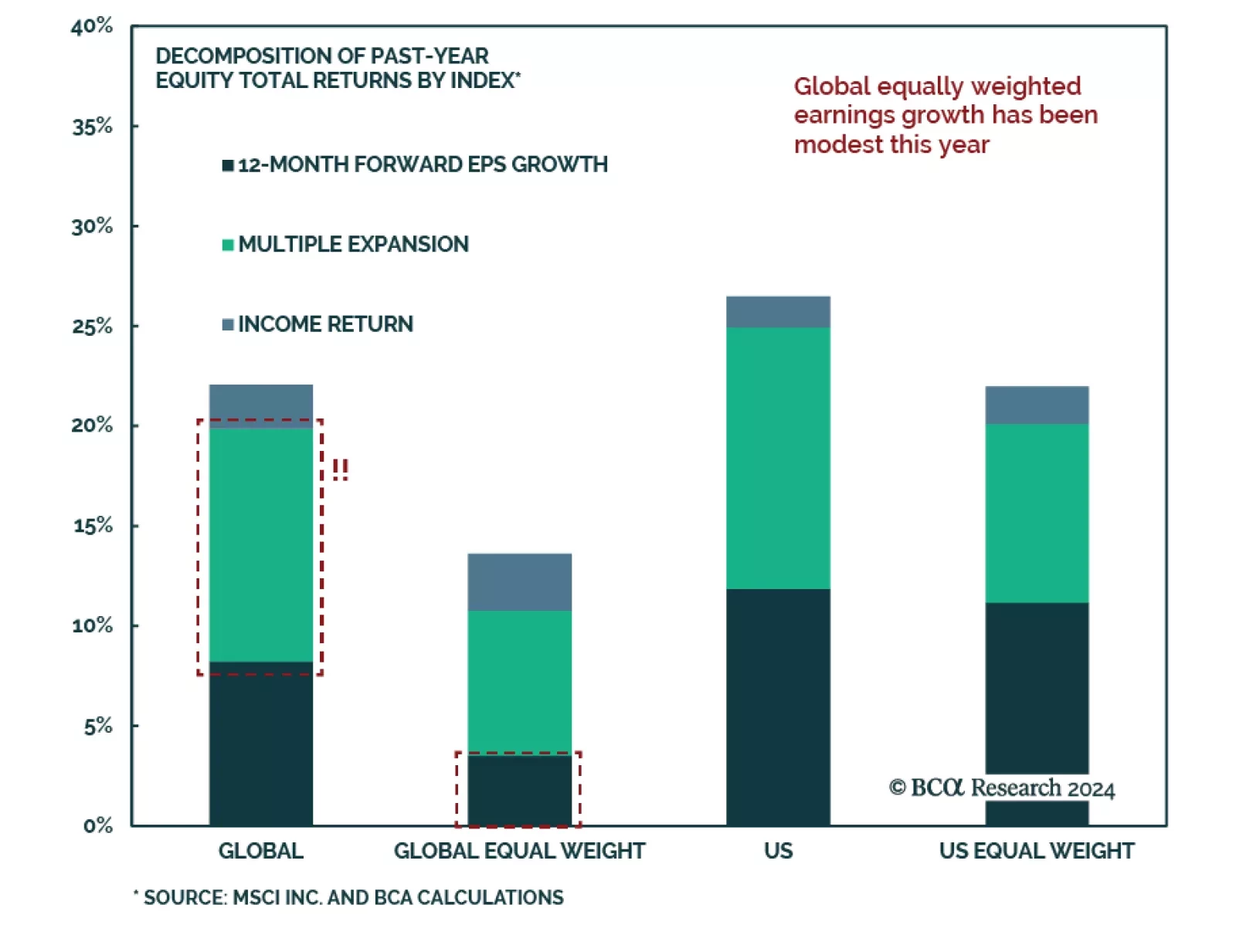

The post-COVID recovery has been one of excesses. Government deficits have ballooned, tight labor markets have led to a windfall of consumer spending, and equity valuations have soared on the back of lofty growth expectations. But…

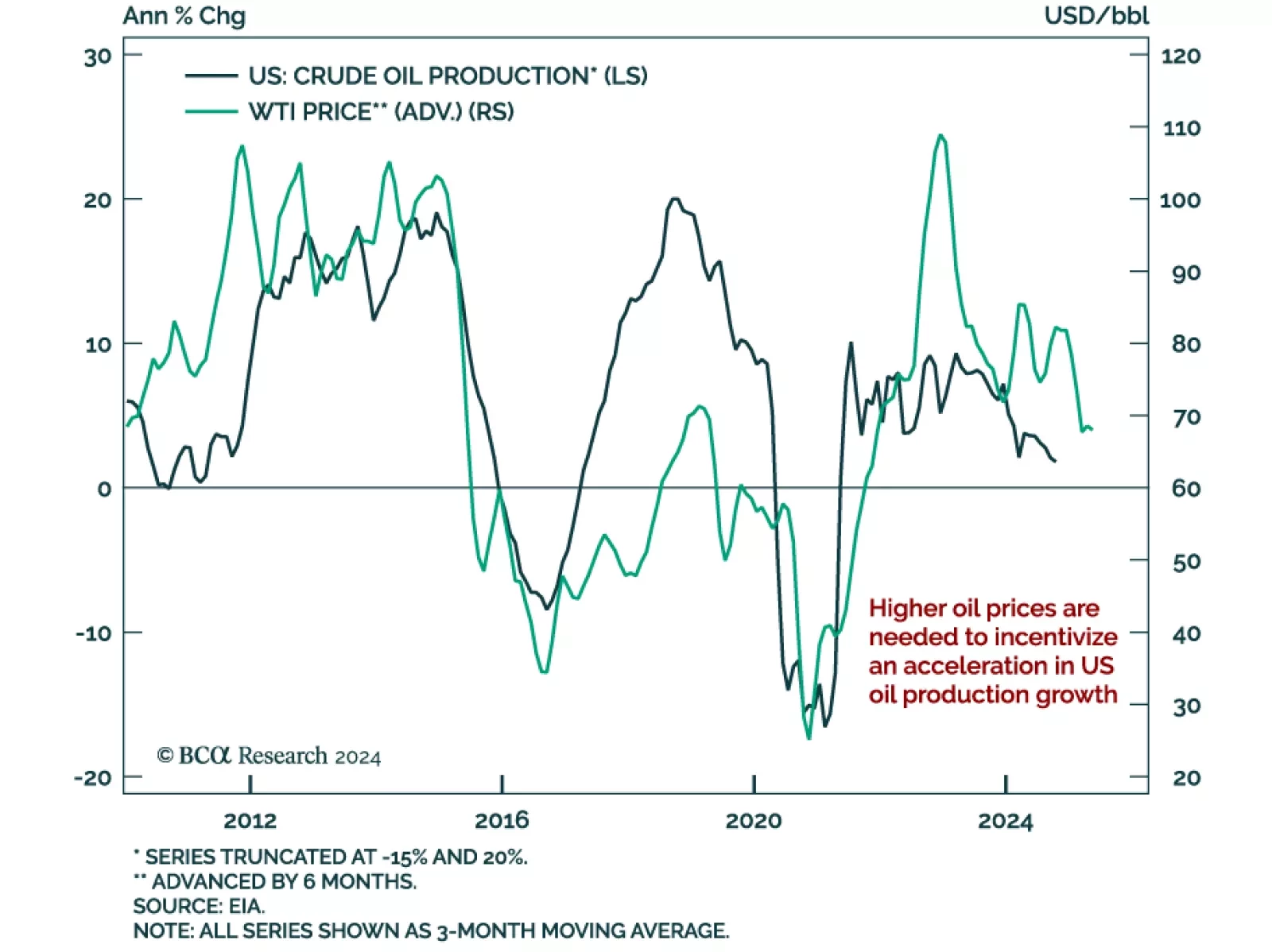

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

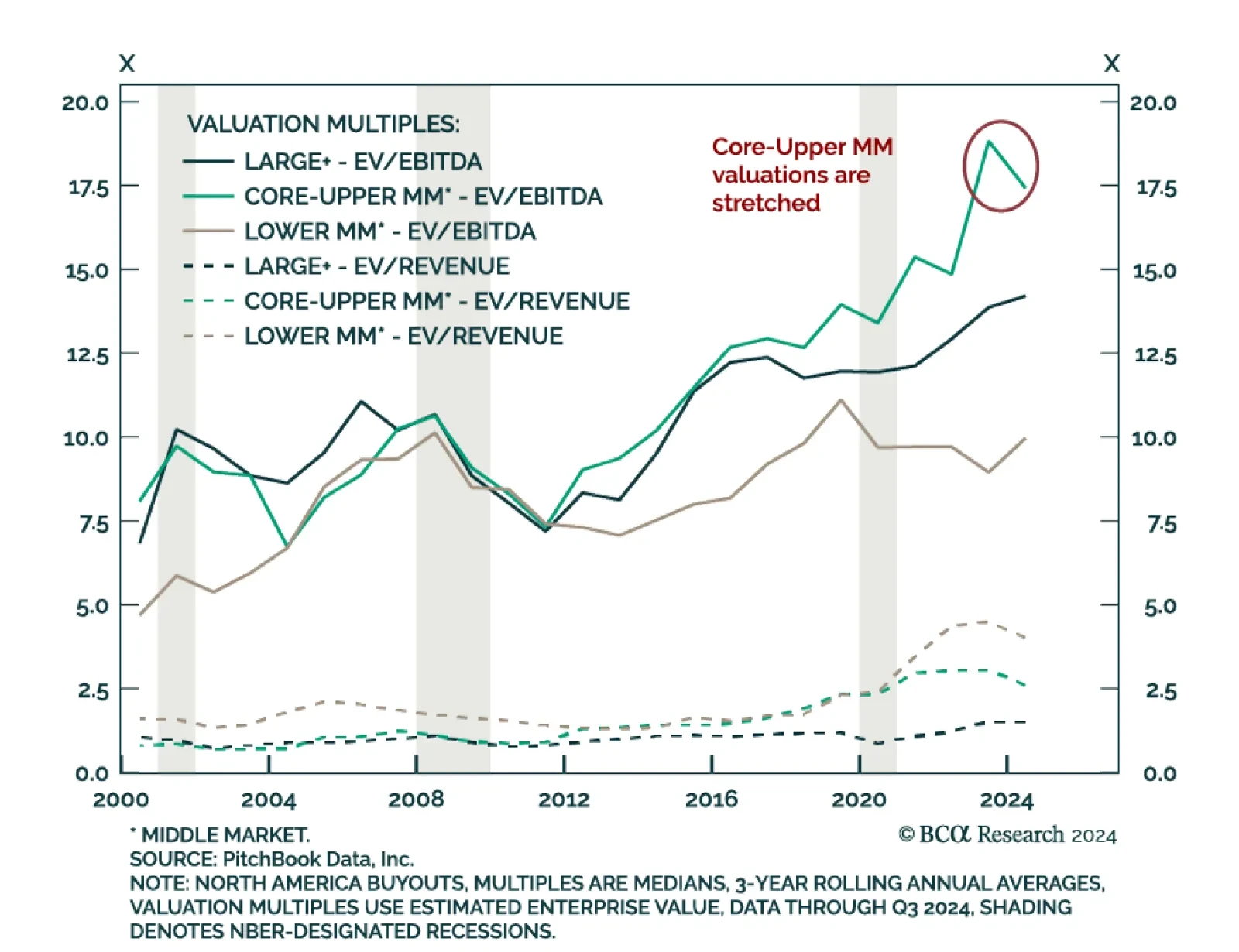

Our Private Markets & Alternatives strategists have delved into the North American Buyouts market, concluding that the investment playbook needs rewriting. The performance of Middle Market Buyouts has been exceptional,…

Our 2025 Outlook was just published. We revisit this year’s calls and discuss what we think is ahead for the global economy and markets for the next 12 months and beyond. The recent US election has significantly shifted…

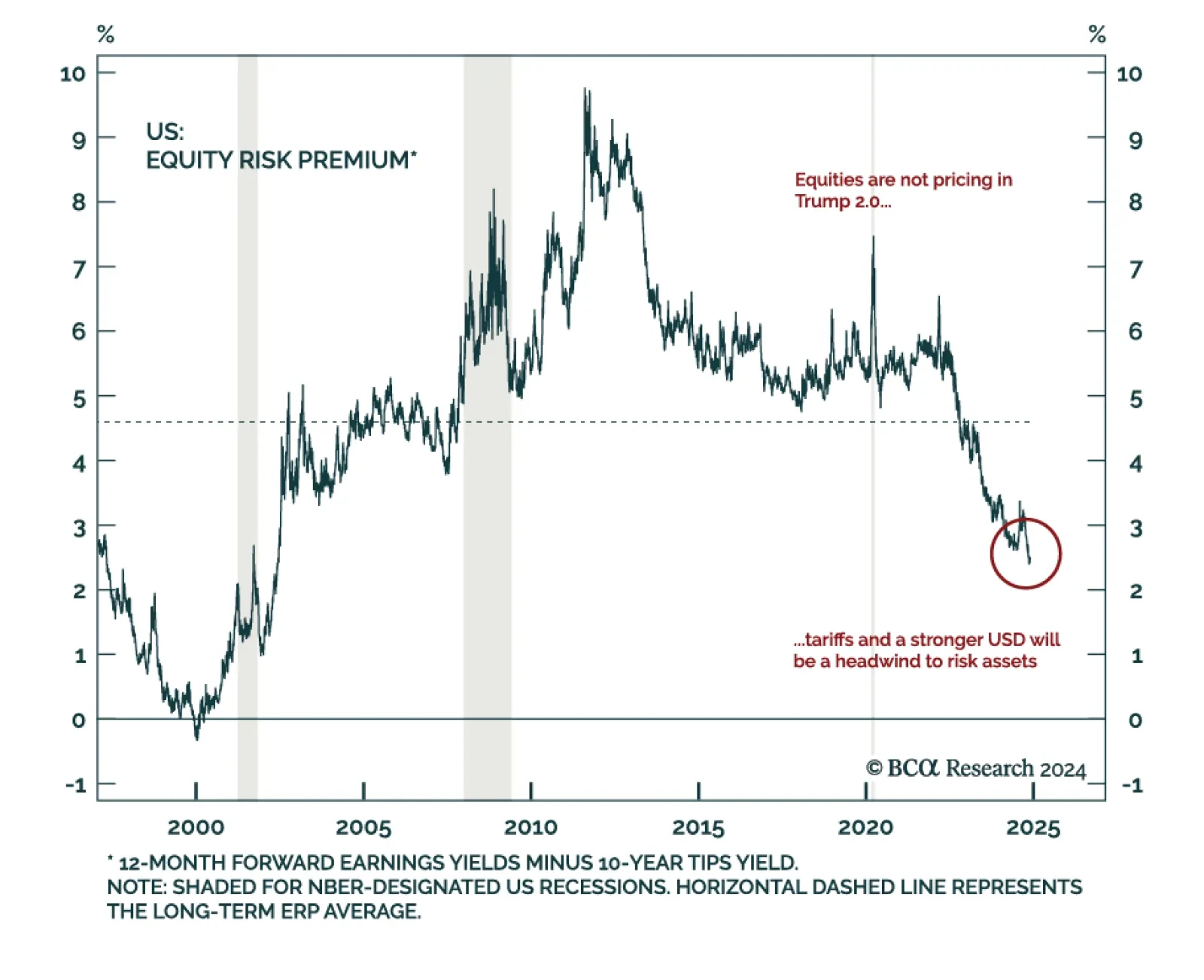

President-elect Trump jolted markets Monday night by declaring that tariffs will be implemented on imports from Mexico, Canada, and China. The US dollar strengthened while stocks fell, as did Treasury yields. Equities, however,…

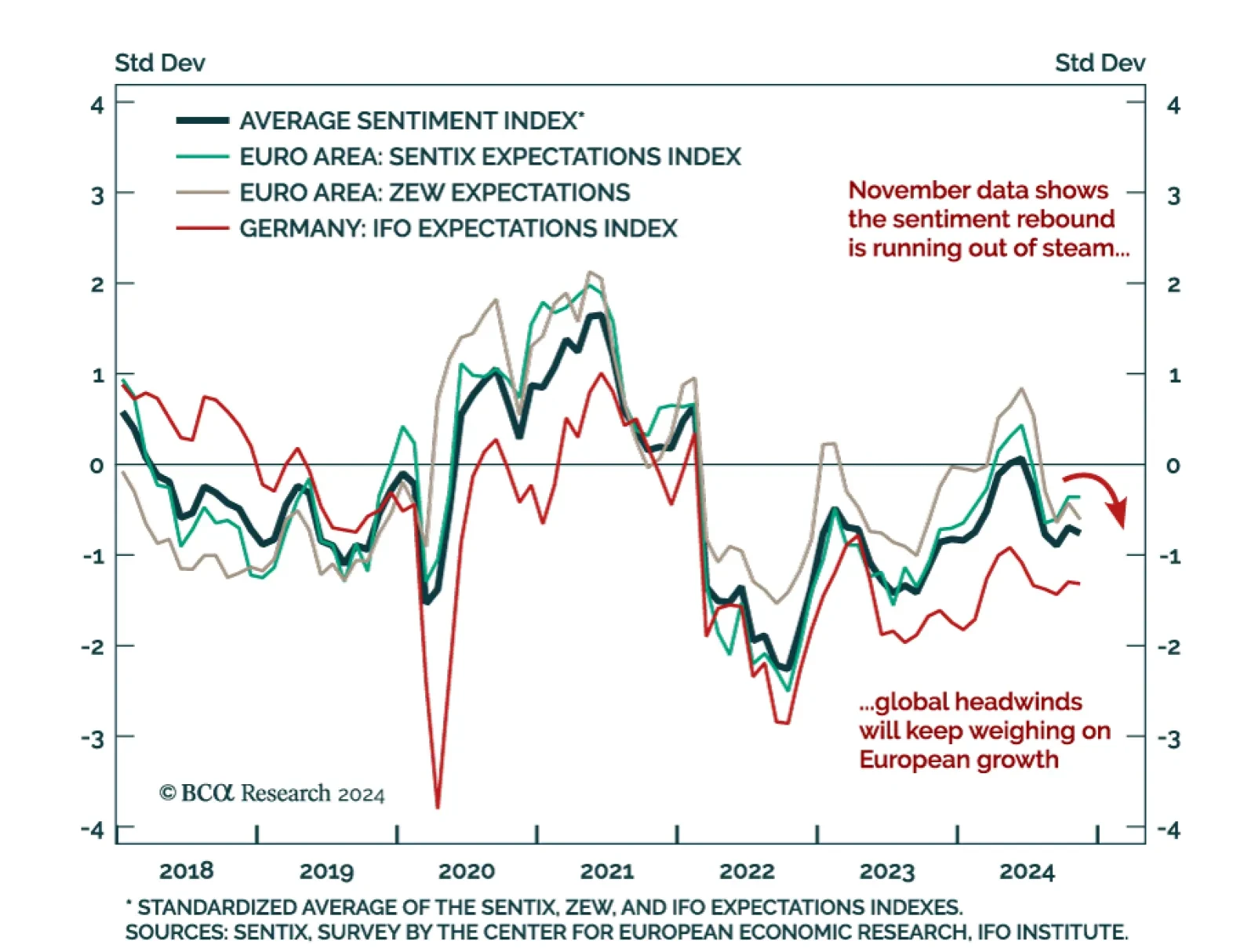

The November Ifo Business Climate index for Germany missed expectations, falling to 85.7 from 86.5 in October. Both subcomponents decreased, with the Current Assessment sliding 1.4 points to 84.3 and Expectations essentially flat…

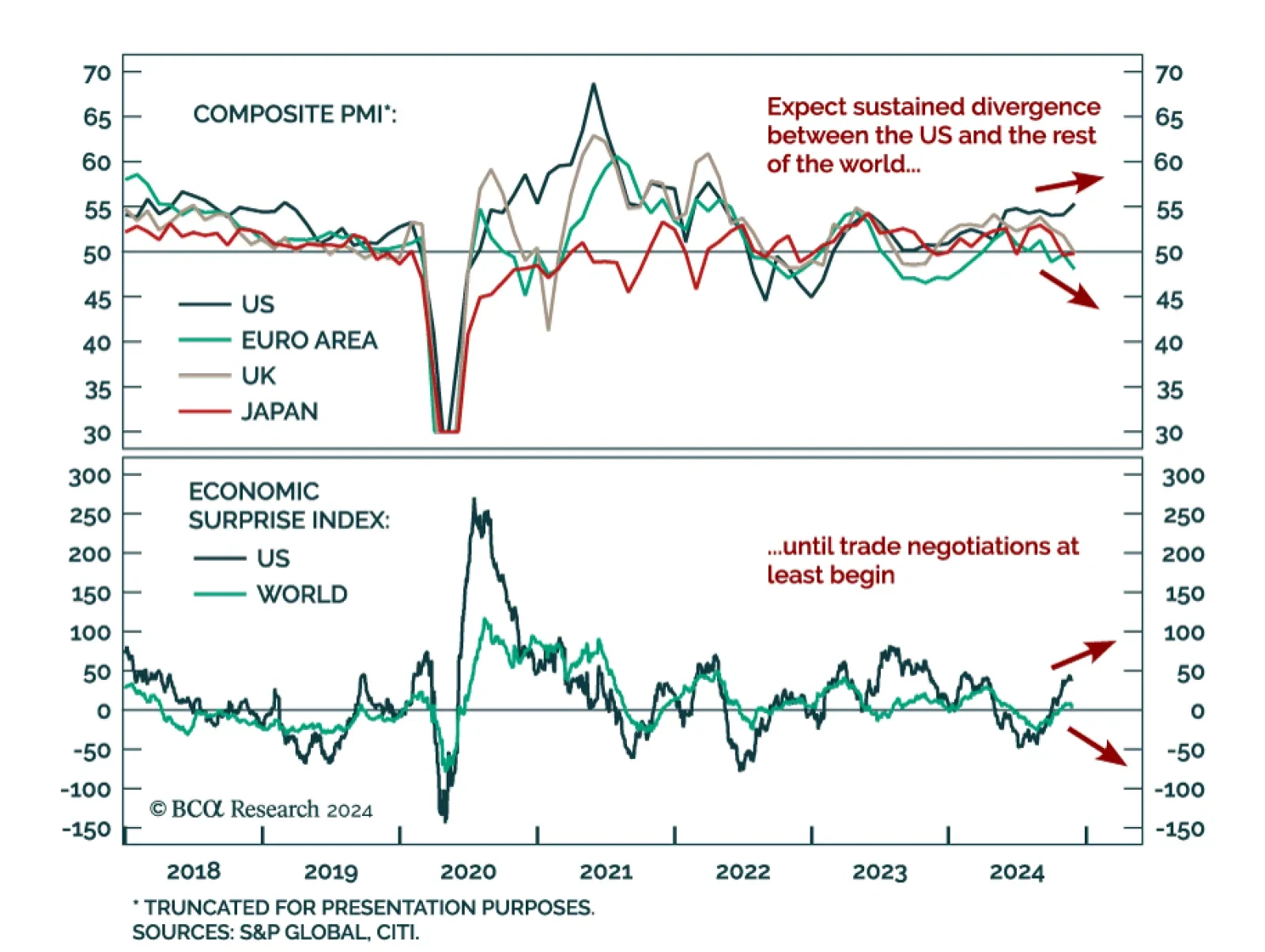

Flash PMIs for November extended recent global growth trends. US growth is holding up despite an ailing manufacturing sector, while the rest of the world shows deteriorating weak growth. The US composite beat expectations and…

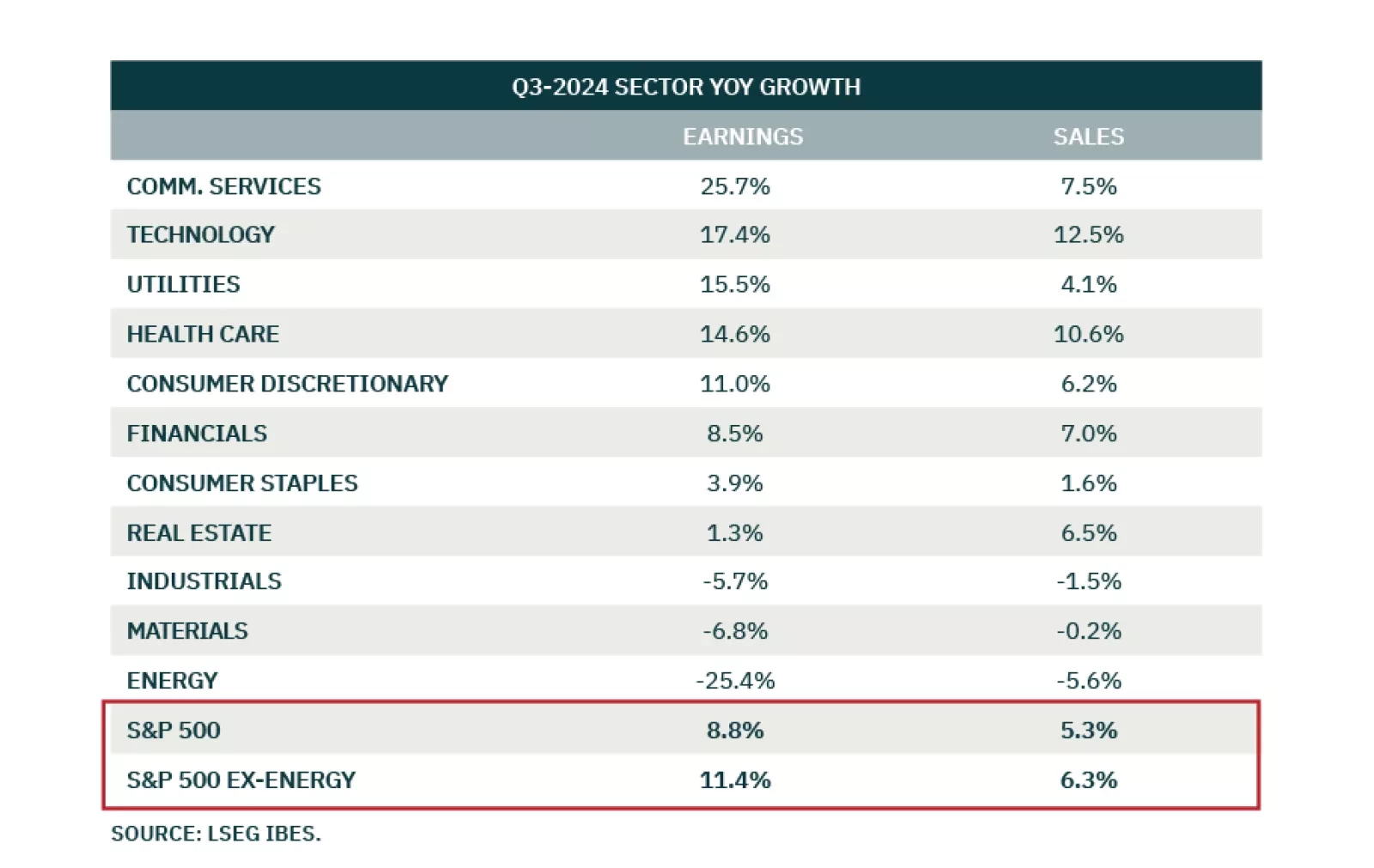

Prior to Nvidia reporting, 76% of S&P 500 companies beat earnings expectations while 61% beat on sales. Nvidia beat earnings expectations, but the magnitude by which guidance beats the most optimistic analyst expectations is…

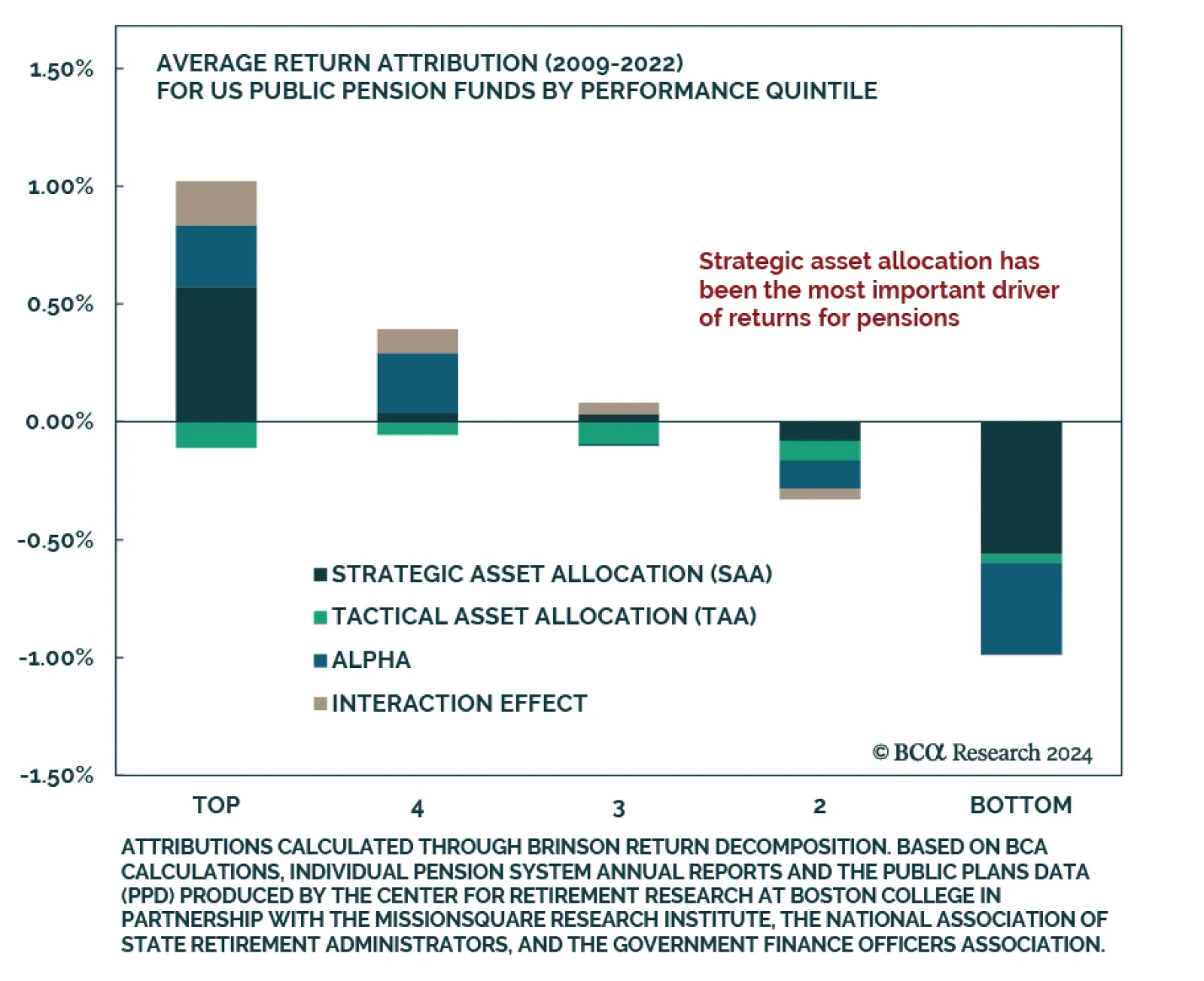

Our Global Asset Allocation team analyzed the performance and allocation strategies of 79 US public pension funds, providing insights across governance, scale, and liquidity. Strategic Asset Allocation (SAA) is the most…