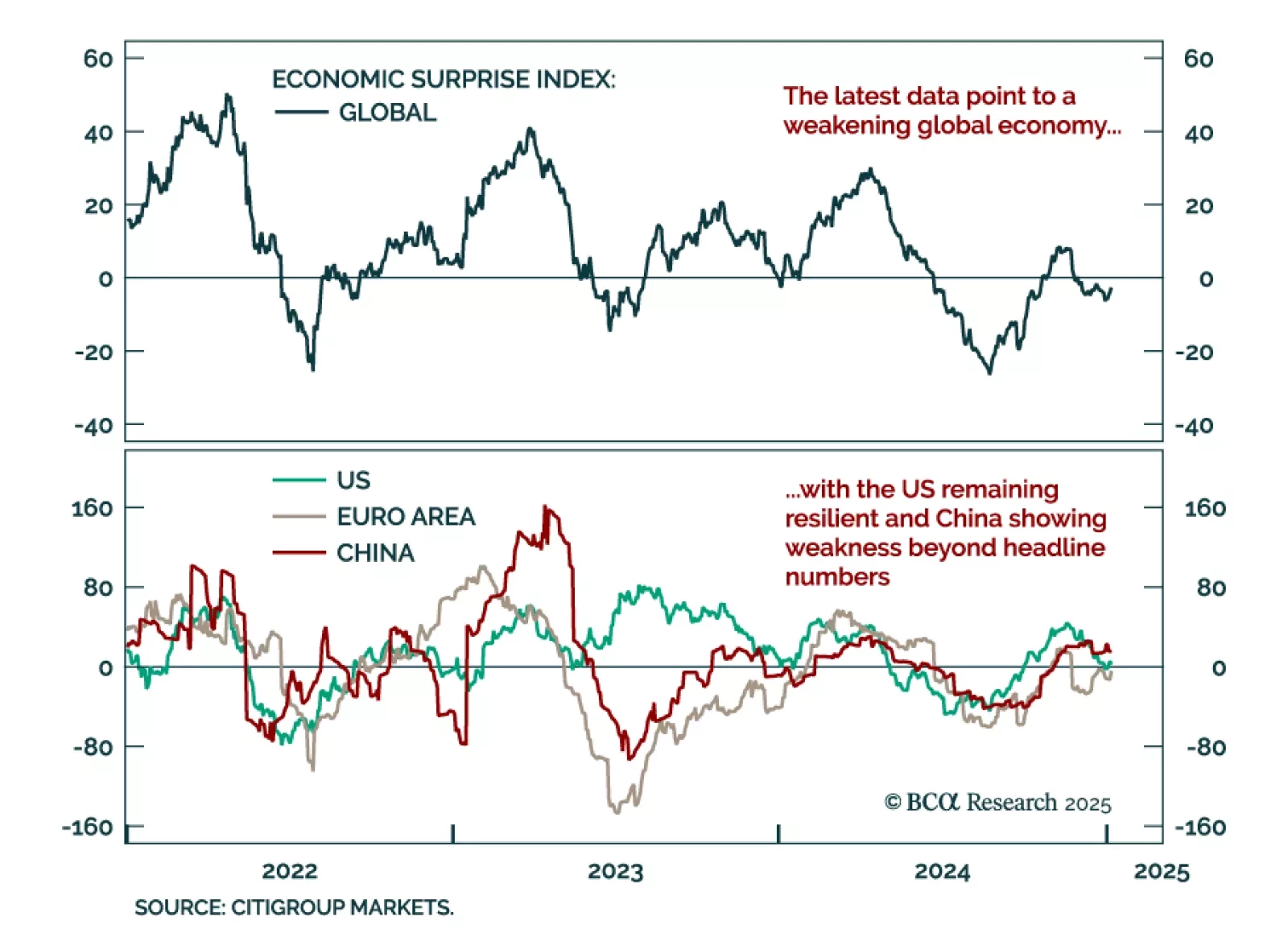

Economic data released over the holiday period extended recent trends, reflecting a softening global economy with resilient US growth, and an ailing manufacturing sector. The December global manufacturing PMI declined to 49.6…

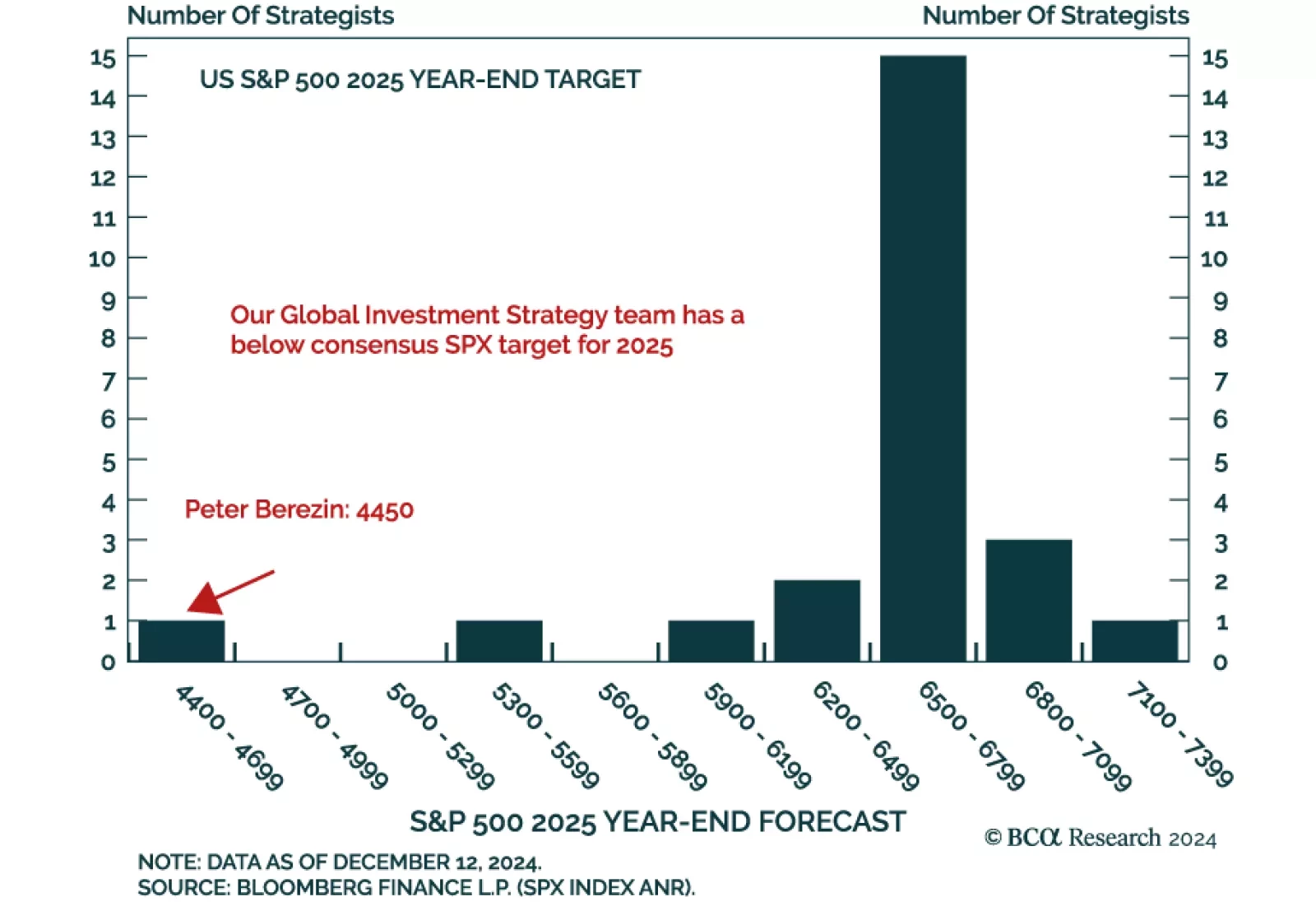

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

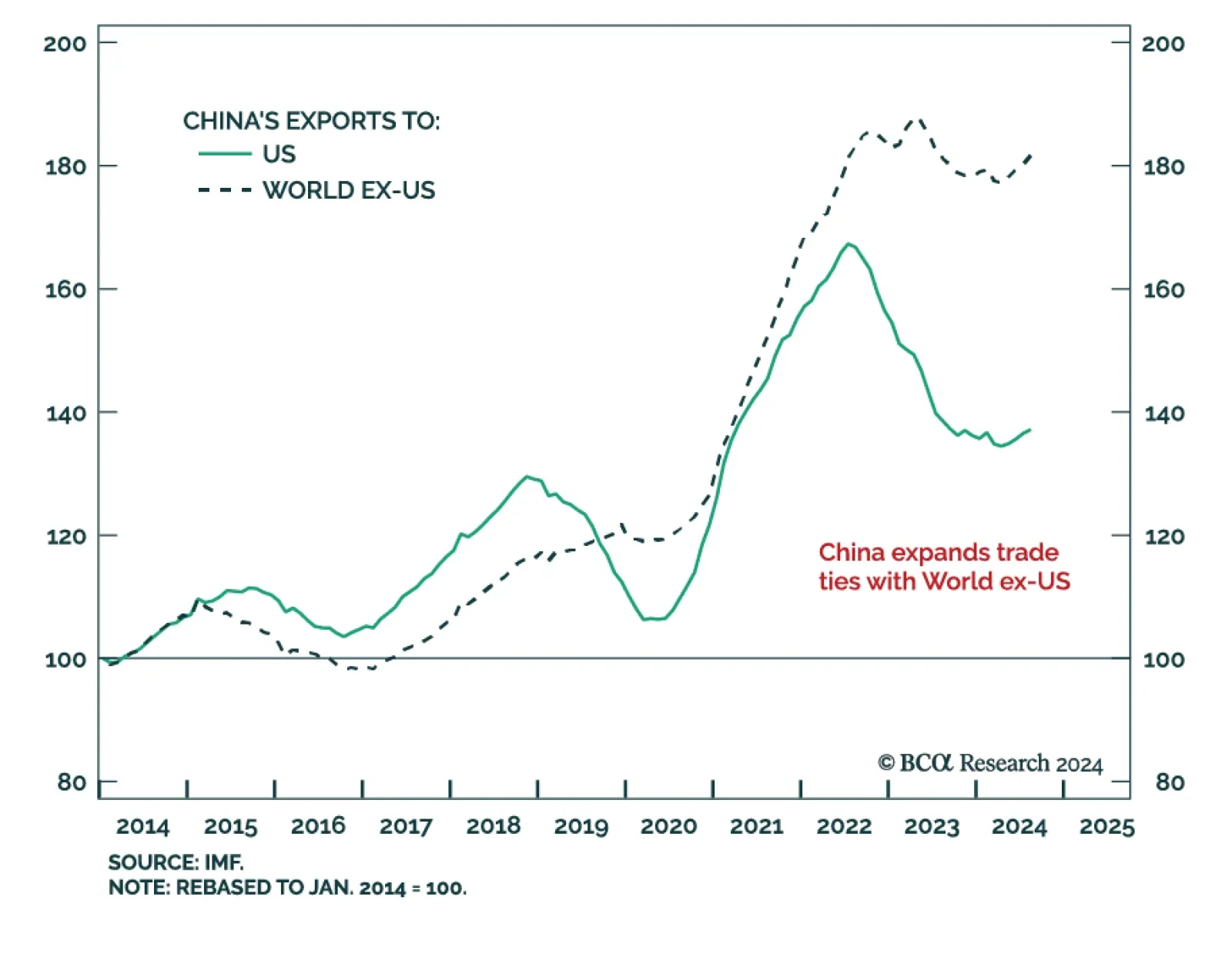

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

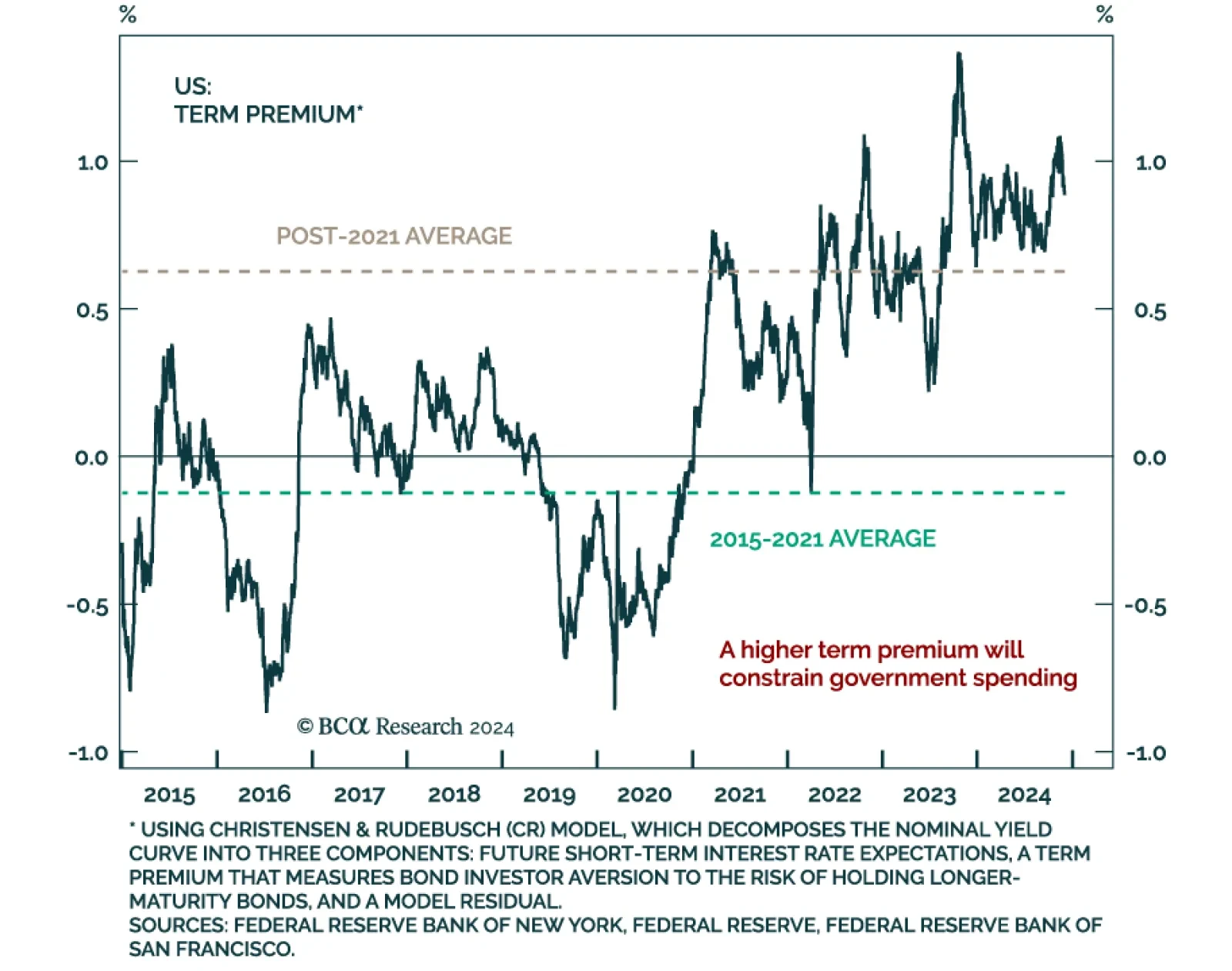

Our Geopolitical Strategy team published their annual outlook, and see three trends shaping 2025. First, Congress is expected to pass tax cuts by the end of 2025, providing a fiscal thrust of 0.9% of GDP in 2026.…

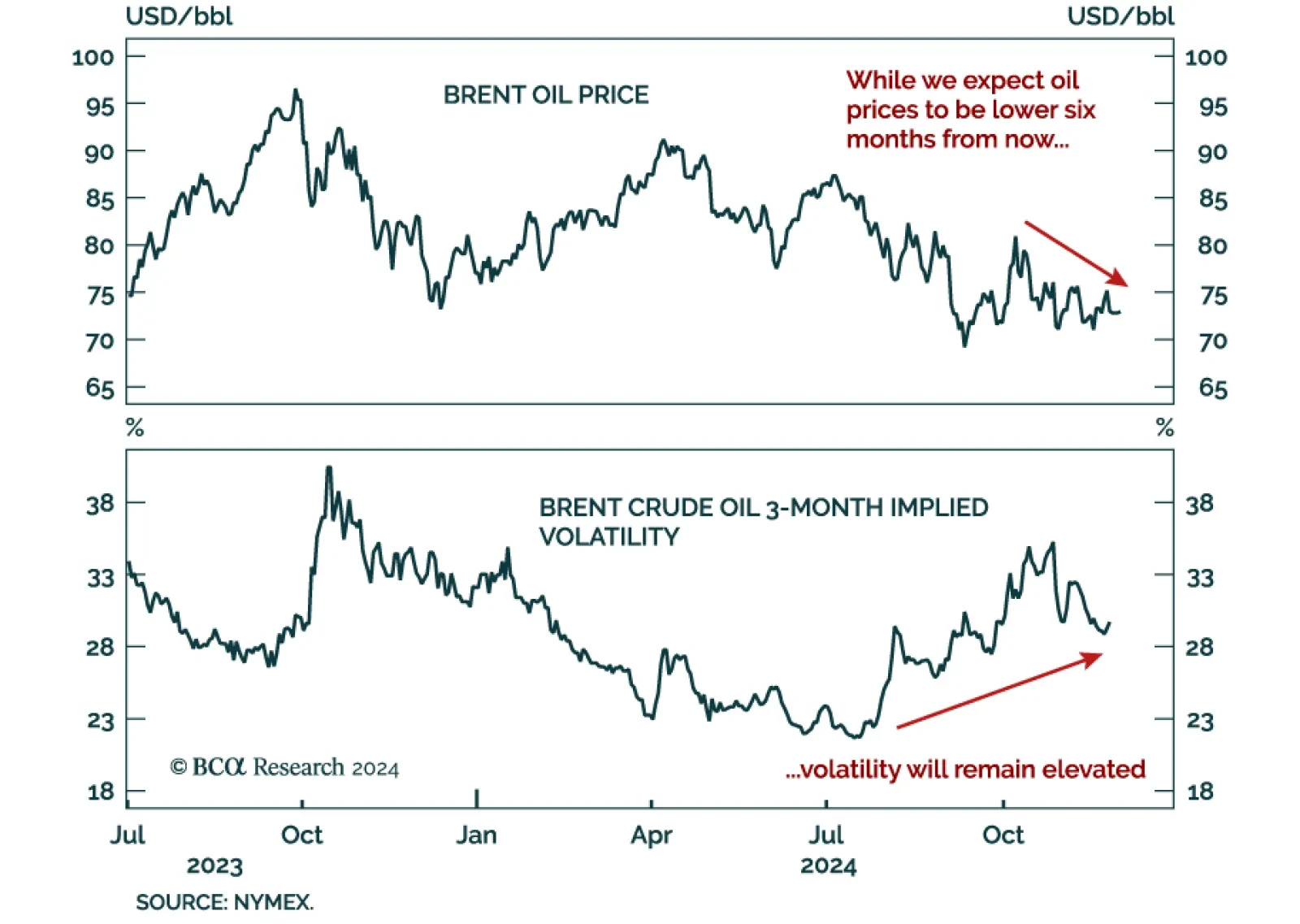

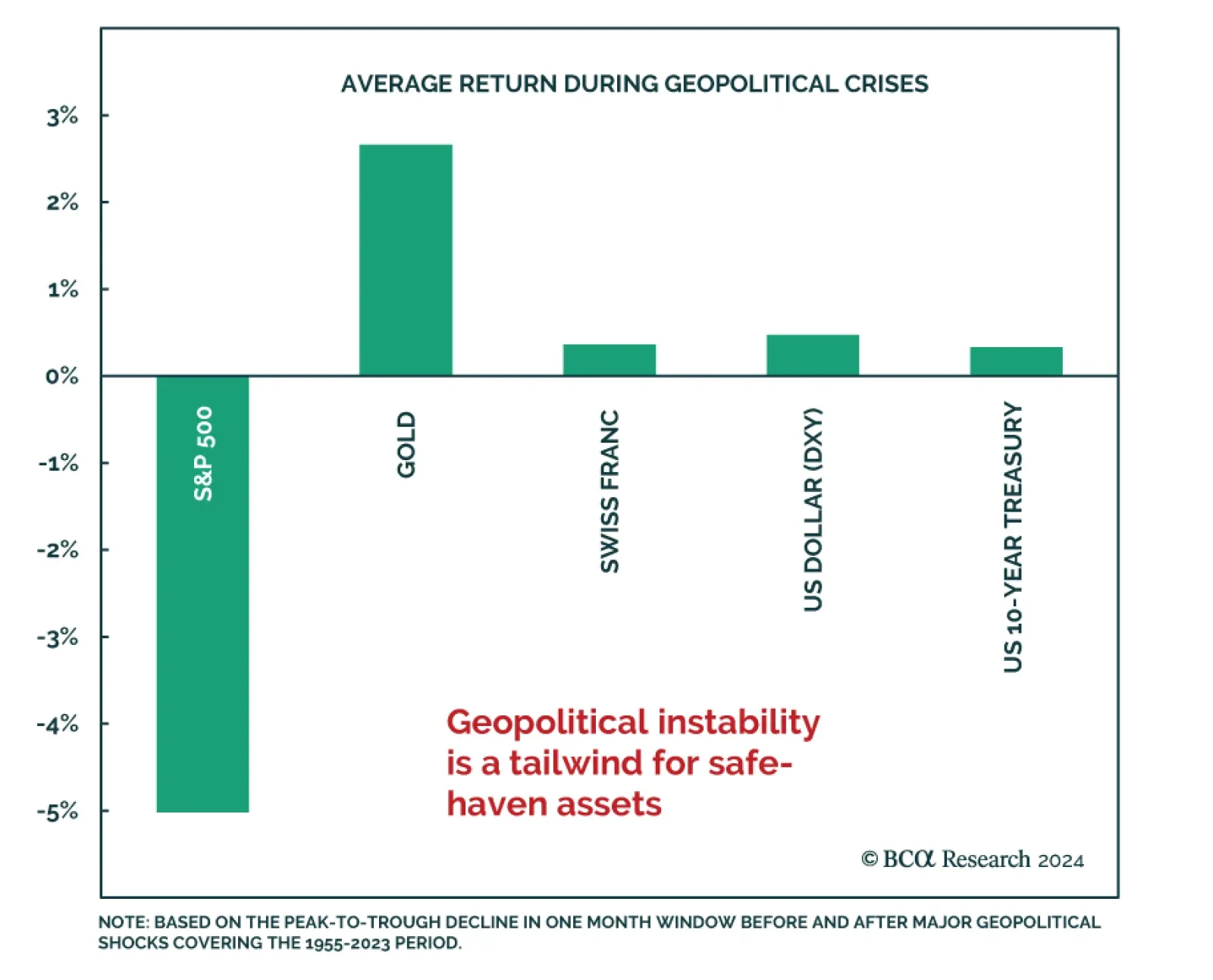

After more than 10 years of civil war, Bashar Al-Assad’s rule came to an abrupt end when rebels captured Damascus. Syria might not be a significant country in economic or financial terms, but it is part of the Middle…

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…

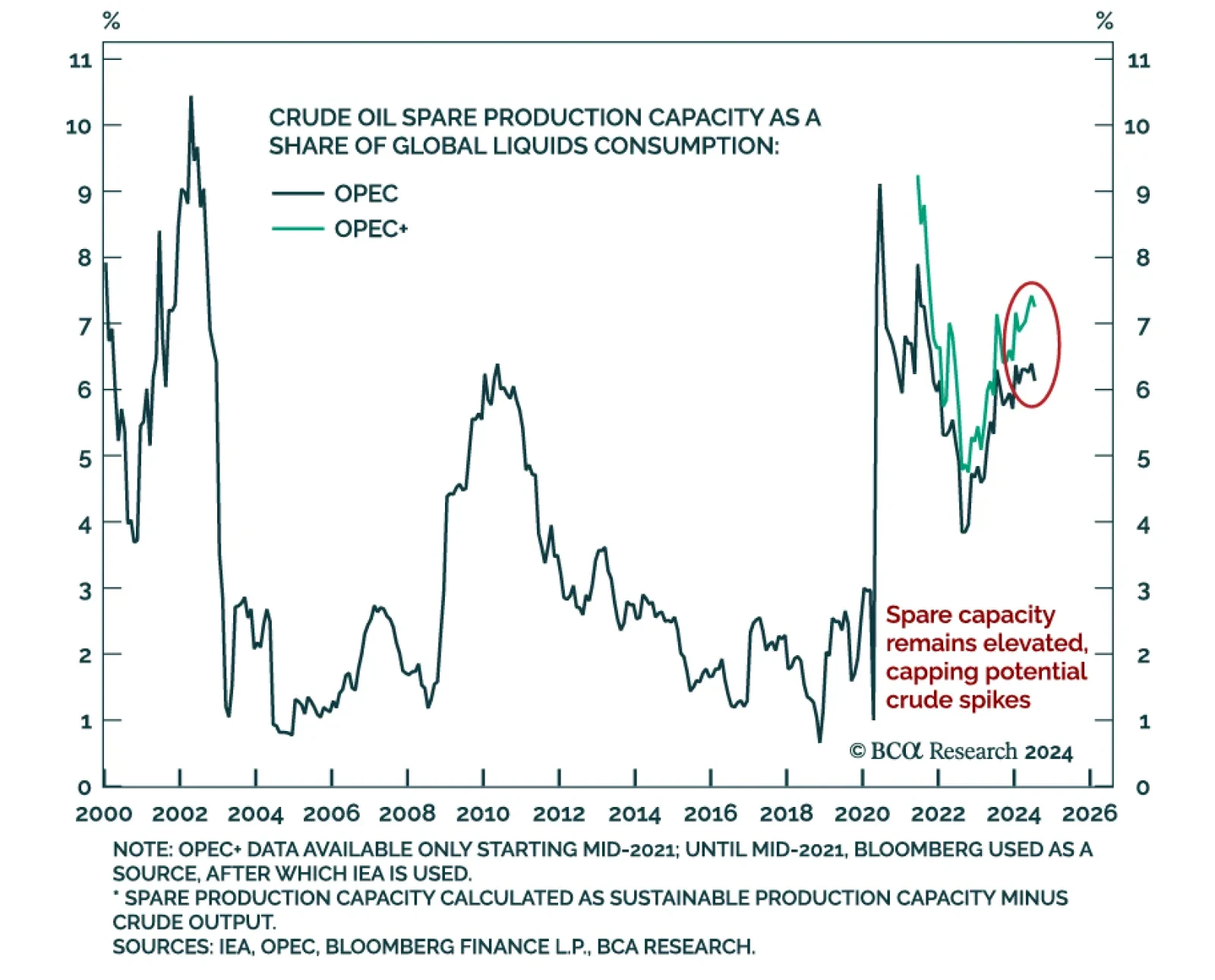

OPEC+ extended its production cuts for the third time, and lengthened the period over which it plans to bring spare capacity back online. Oil prices continue to trade near the bottom of their trading range despite the…

Our Global Asset Allocation strategists published their monthly tactical asset allocation report and foresee a change of trend for 2025. “Thin is back in” for government budgets, growth, and valuations. The post-…

South Korea is undergoing political turmoil, with President Yoon attempting to declare martial law. The situation is fluid and can change quickly, but there are a few investment takeaways. As we pointed a few weeks back, BCA…

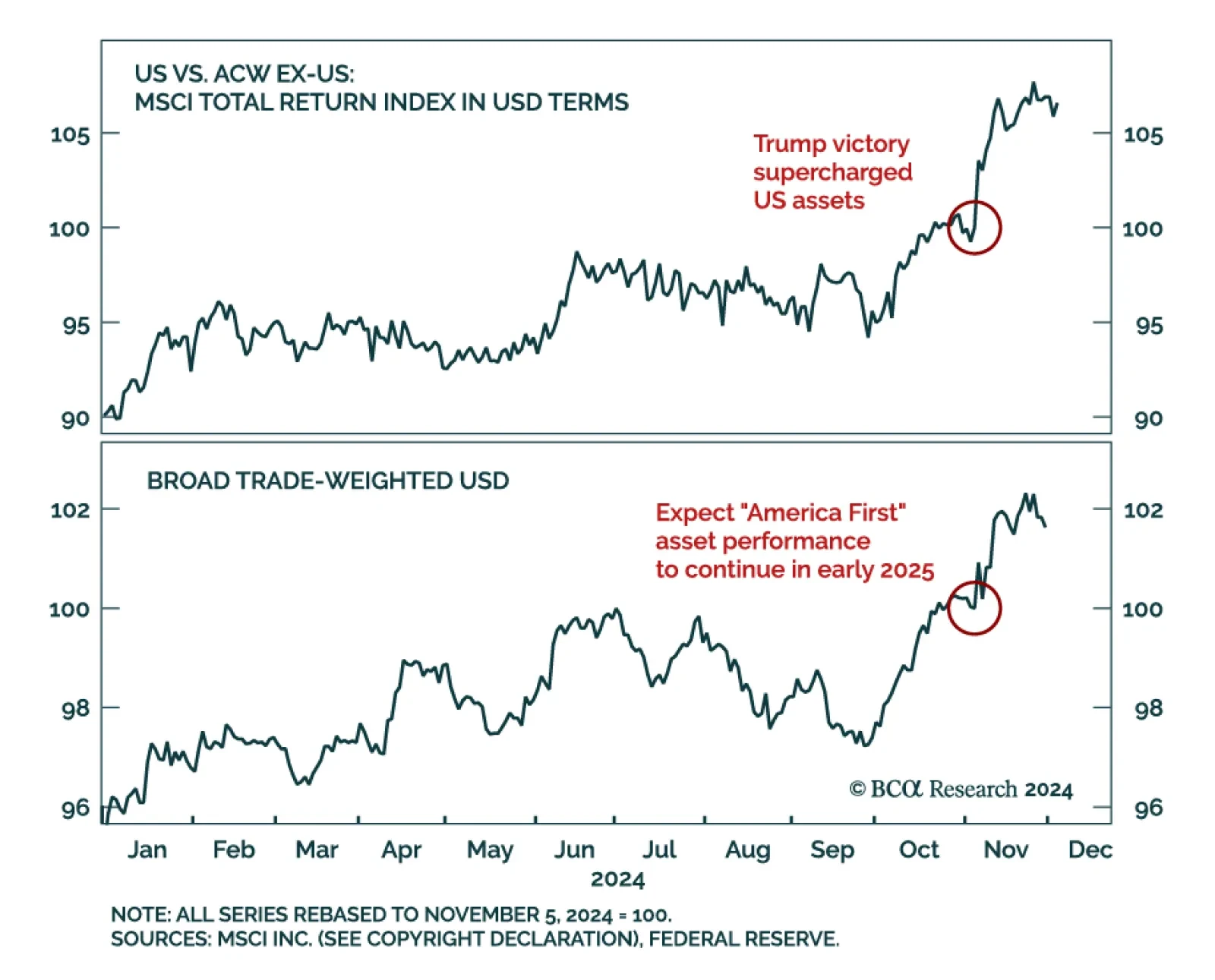

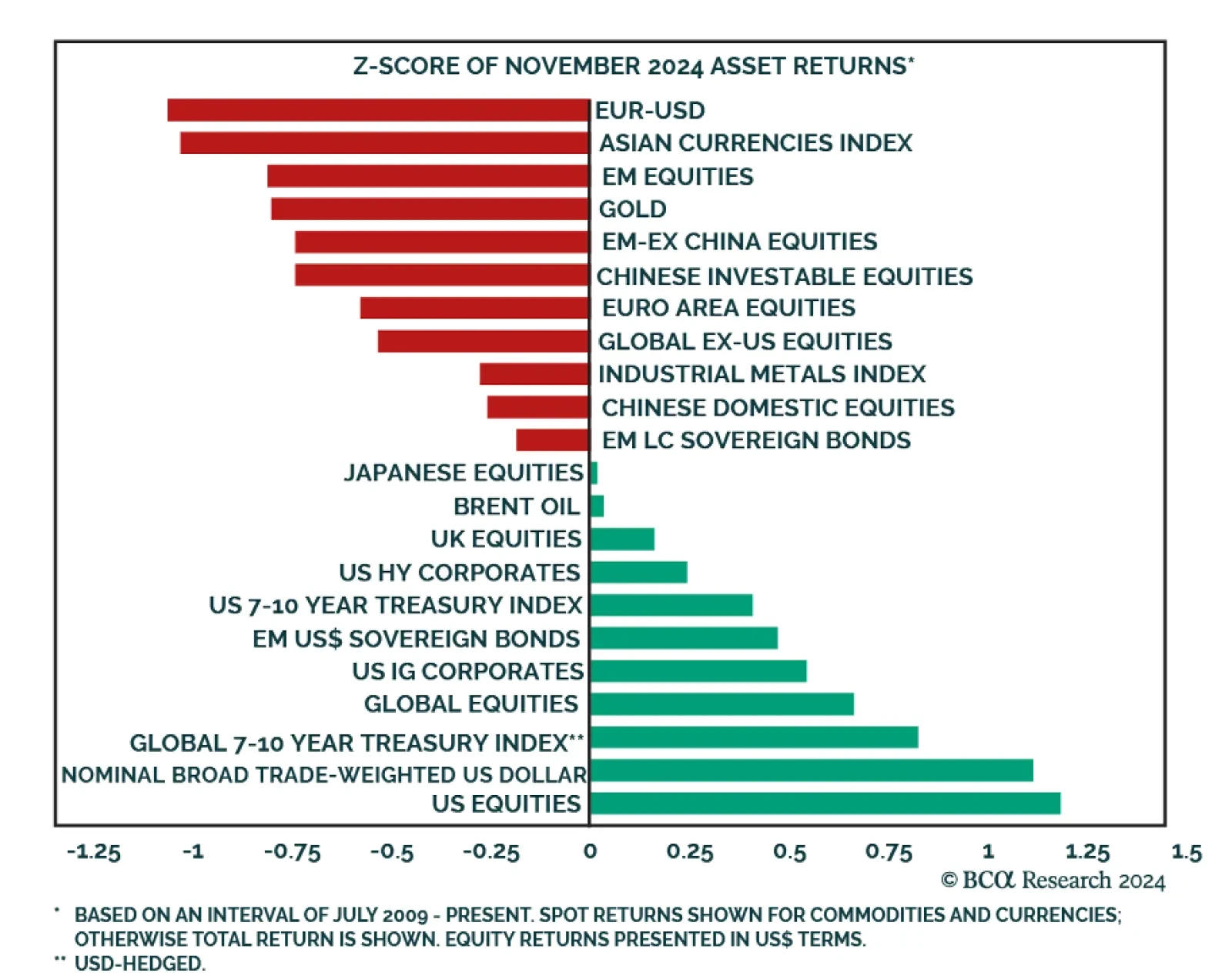

November trading was centered around the US election and its aftermath. US assets led the way, with US equities significantly outperforming their global counterparts. The US dollar strengthened considerably against both DM and EM…