BCA Research's Geopolitical Strategy service concludes that investors should be prepared for a risk-off episode in the near term in case Congress fails to compromise on a major new fiscal stimulus. Ultimately the US…

Dear Client, In lieu of our regular report next week, we are sending you a Special Report from my colleague Chester Ntonifor, Foreign Exchange Strategist. Chester will share his outlook on the Hong Kong Dollar. I hope you will find his…

Former Vice President Joe Biden’s picking Senator Kamala Harris of California as his running mate is not a surprise. It does not change the 2020 election equation – vice presidents rarely do and she does not hail from a swing…

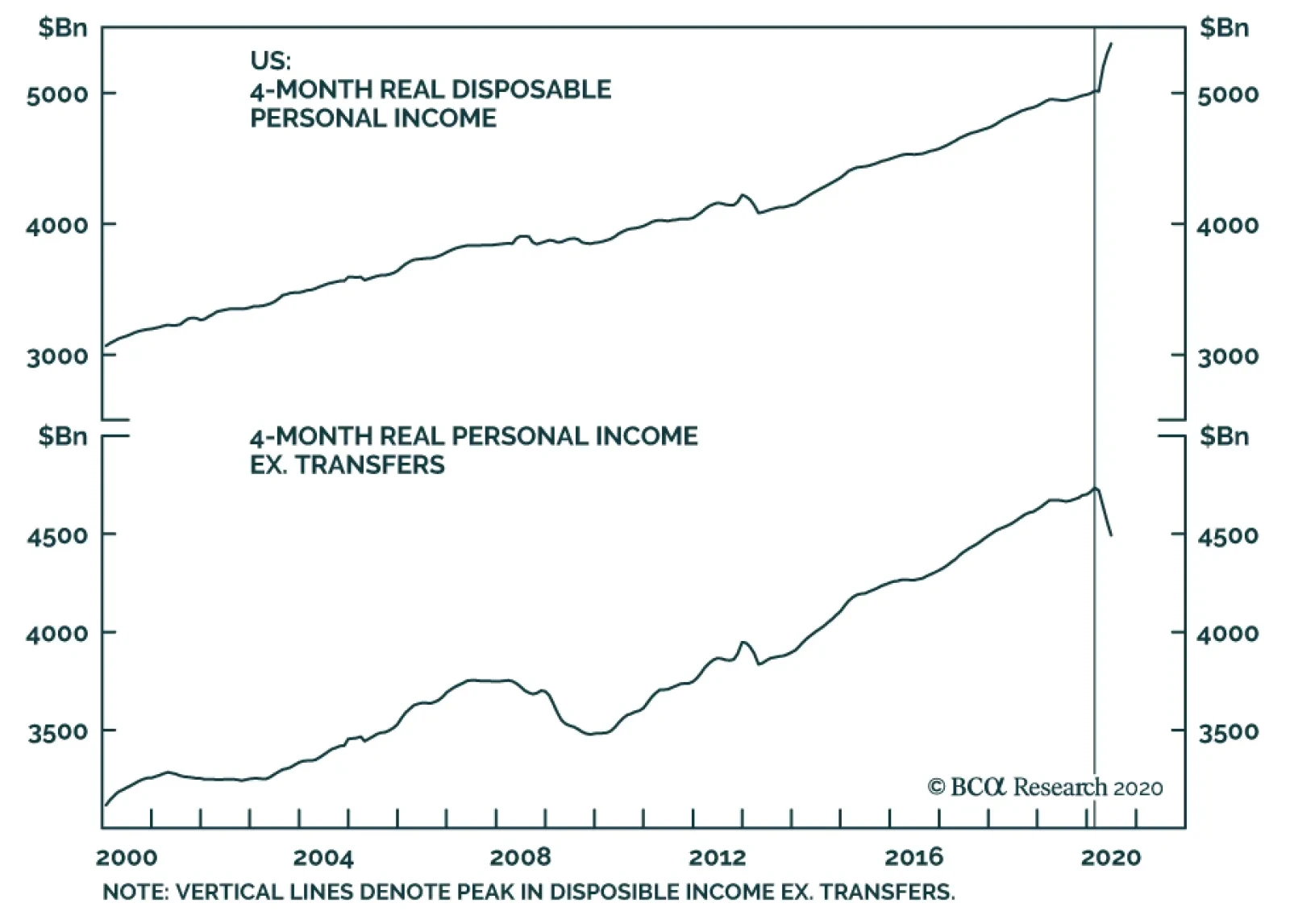

Negotiations on a new round of US fiscal stimulus appear to have stalled. Financial markets are complacent for now, but the longer the stalemate continues, the more likely it is that investors will take notice. The fact of the…

The biggest developments overnight Sunday were geopolitical. President Donald Trump signed an executive order to provide more relief to Americans. Then China fired a new salvo in the geopolitical war with the US. In a nutshell,…

Highlights Ultimately the US Congress will pass a major stimulus bill, but short-term risks to the equity rally are elevated. President Trump’s executive actions are not sufficient stimulus in the absence of an act of Congress…

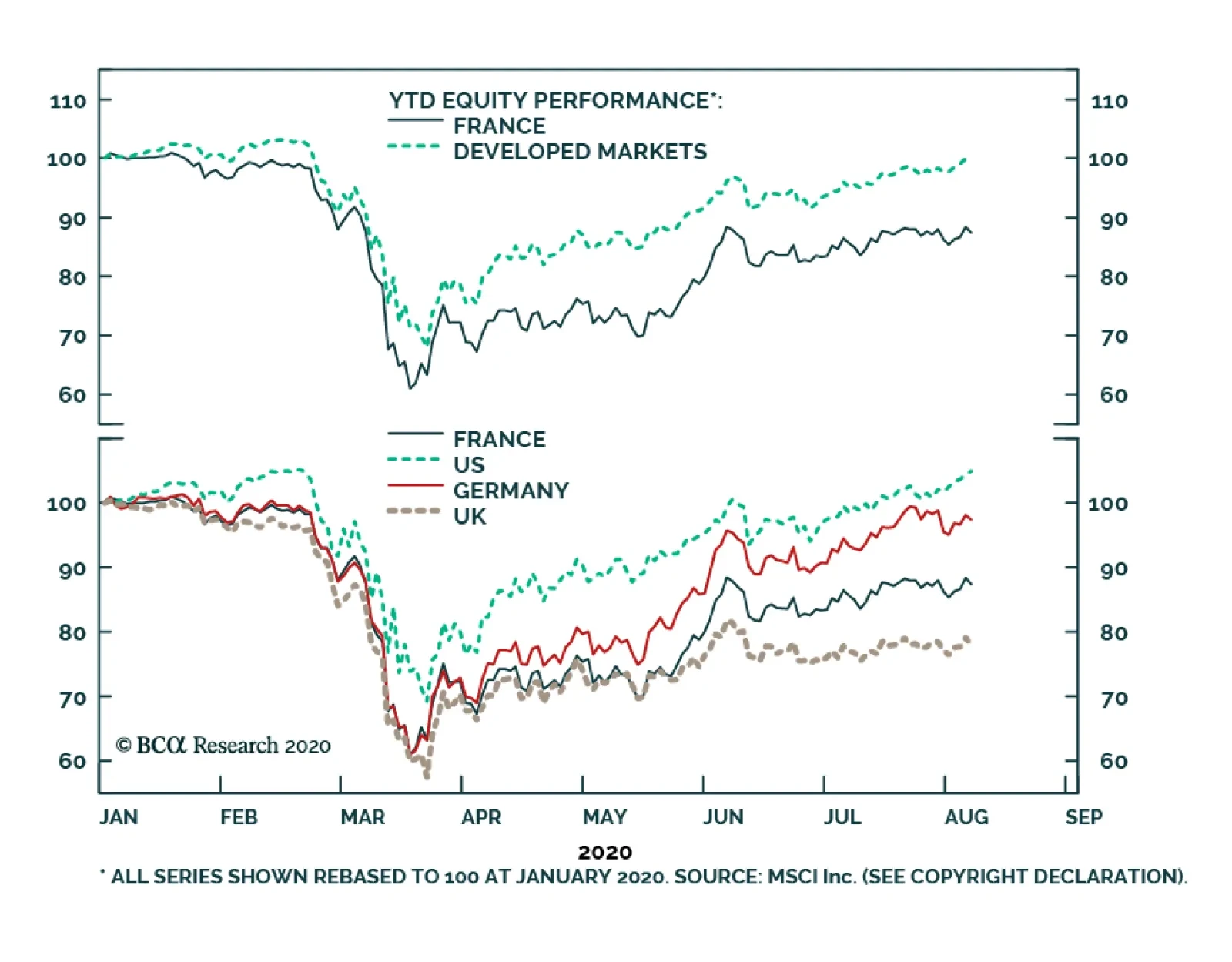

BCA Research's Geopolitical Strategy service recommends that long-term investors overweight French equities over other developed market bourses. French equities have underperformed developed market equities by 12% this…

Highlights The tech sector faces mounting domestic political and geopolitical risks. We fully expected stimulus hiccups but believe they will give way to large new fiscal support, given that COVID-19 is weighing on consumer confidence…

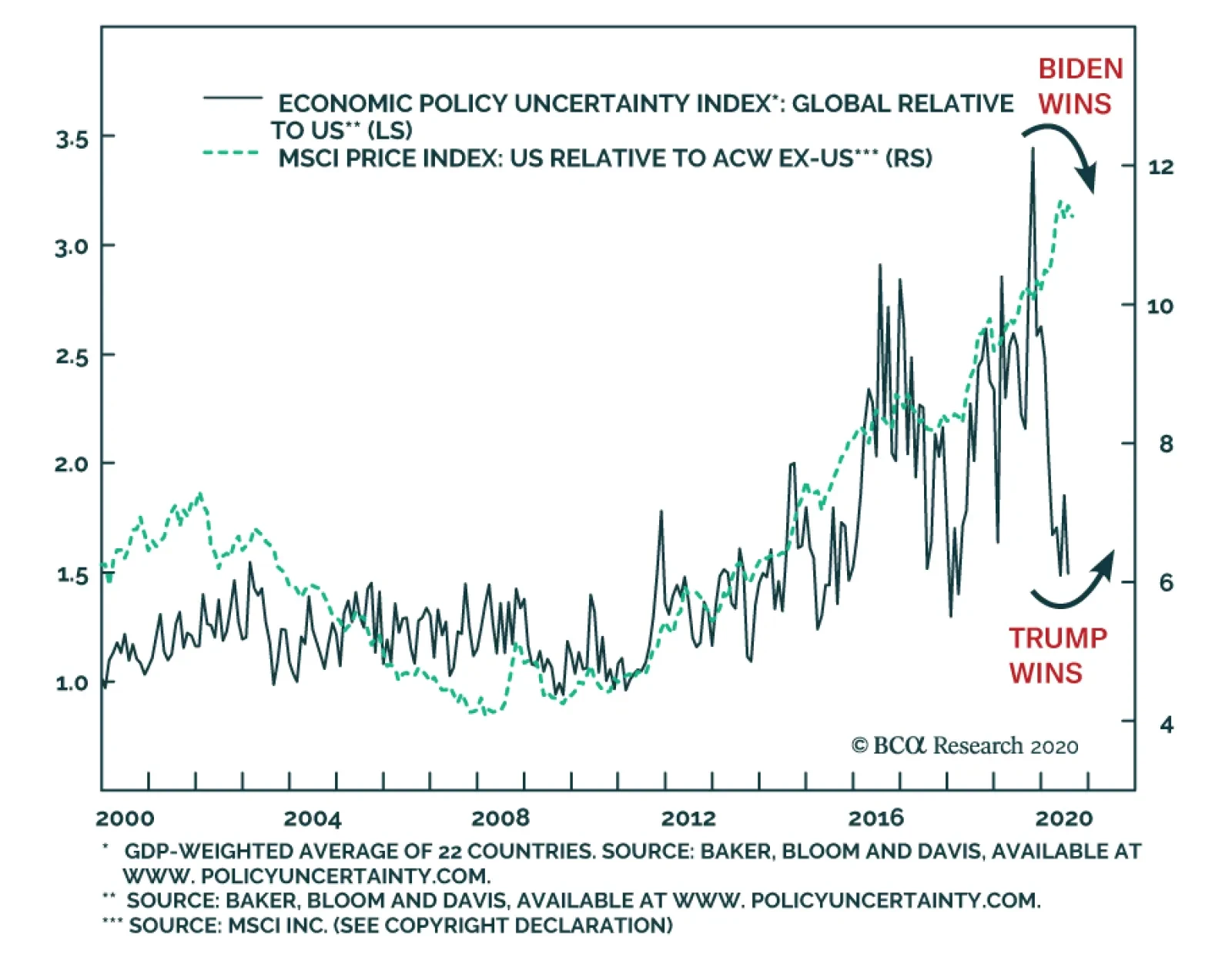

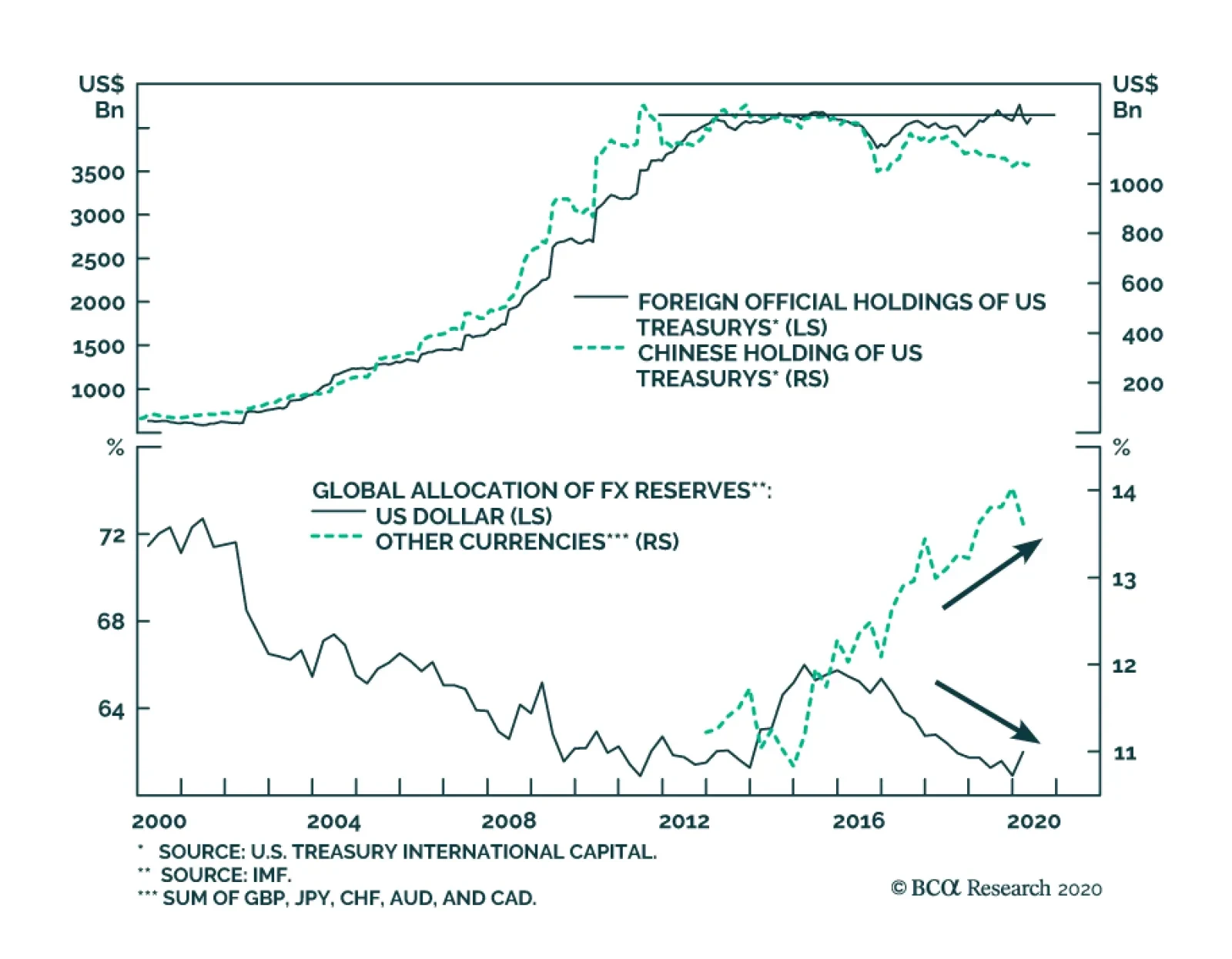

Highlights The decade-long US equity market outperformance versus the rest of the world could be nearing its end. We are upgrading EM stocks from underweight to neutral within a global equity portfolio. We reiterate the change in our…