The tempo of China’s and the US’s military operations is picking up sharply. The risk of a sudden, perhaps unintended, escalation of military conflict, therefore, is rising in the South China Sea. So is the risk of another shooting…

Biden’s State of the Union address will mostly be blocked by a gridlocked Congress. The one point of agreement, big spending, spells trouble over the long run, even if a technical default is avoided this fall.

The Fed is betting that the usual non-linearity of unemployment is different this time, but so far, there is nothing to suggest that it is different. We discuss the key signposts to watch out for, plus the implications for interest…

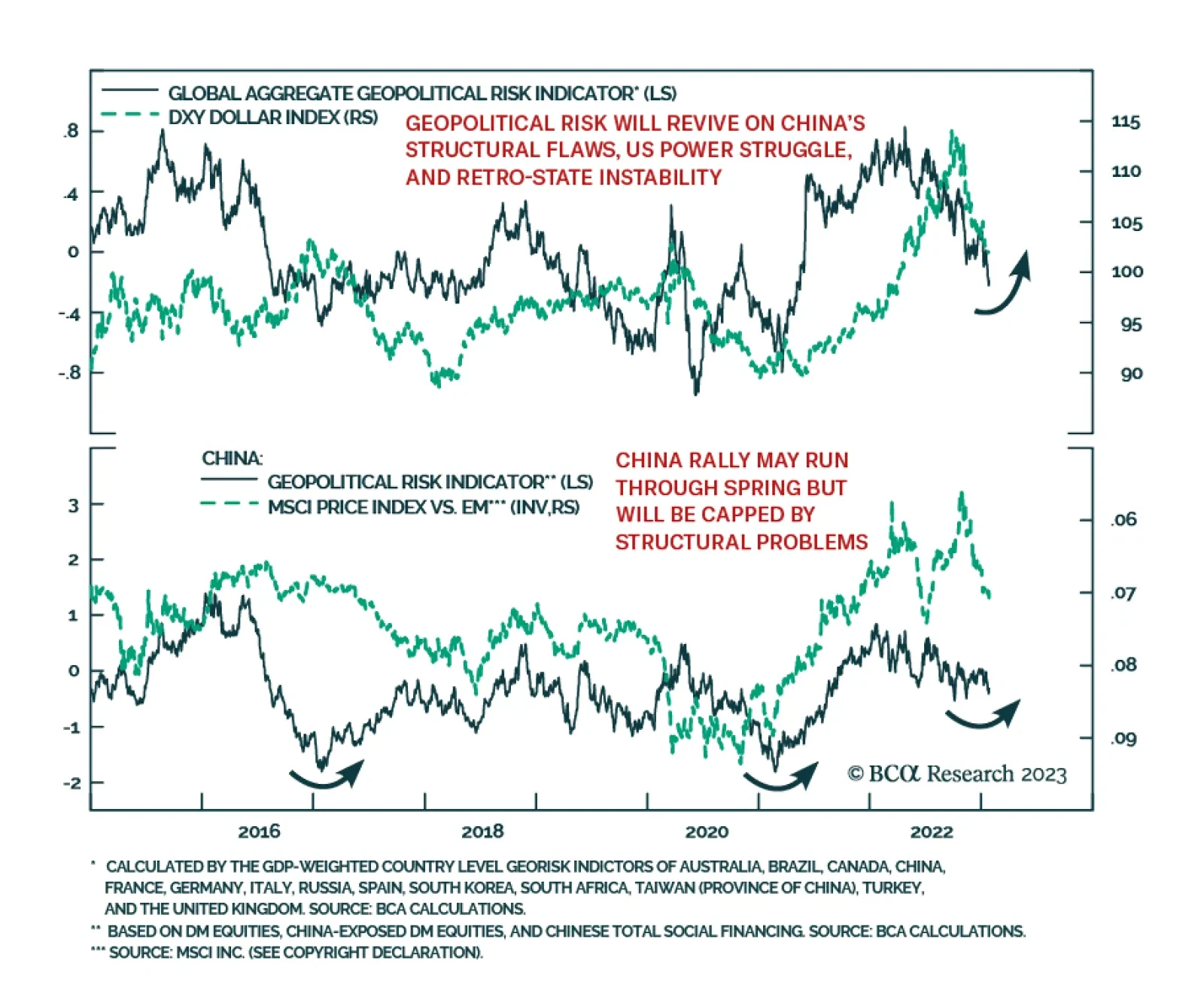

The risk-on rally is challenging our annual forecast so we are cutting some losses. But we still think central banks and geopolitics will combine to reverse the rally later this year.

President Biden’s political capital has fallen as he enters a challenging year that will include a domestic faceoff with the House Republicans and foreign crises stemming from China, Russia, and Iran. Stay defensive and prefer bonds…

According to BCA Research’s Geopolitical Strategy service, investors should remain cautious and defensive. China is reopening and stimulating its economy in pursuit of stability after several rocky years. This is…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

China's reopening is much more positive for the Chinese economy than it is for the rest of the world, as it will boost its domestic service sector activity and consumer spending much more than the industrial economy. A slowdown in…