China’s victory in getting KSA and Iran to restore diplomatic relations is of far greater consequence to commodity markets than the past weeks’ bank failures in the US. For China, further success in sorting long-standing security…

Investors in Europe and the American West are already starting to think about the implications of the 2024 election, given that sticky inflation and tighter monetary policy keep the risk of recession elevated.

The development of trading blocs and the rise of economic warfare will lead to the inefficient allocation of resources. Higher fiscal outlays and tight commodity supplies will feed into energy prices driving headline inflation. It…

US domestic politics, hypo-globalization, and Great Power Competition favor a revival of US manufacturing capacity. The industrial sector will benefit from the attempt to rebuild US manufacturing. Go long physical infrastructure and…

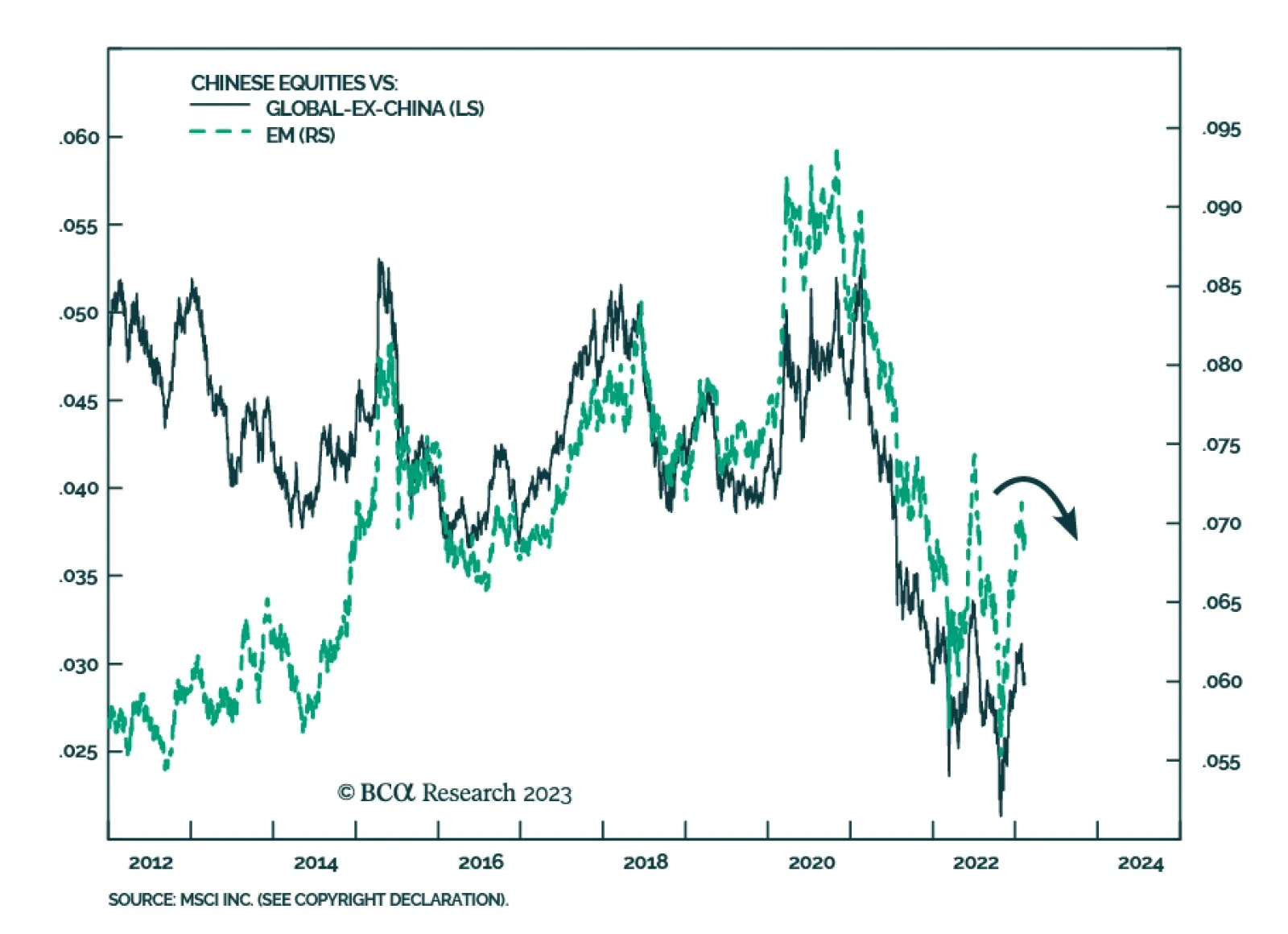

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

US-China relations hit another rocky patch this month following a series of incidents involving spy balloons and other mysterious aircraft. The US shot down flying objects that entered US and Canadian air space on February 4, 10…

Two developments this week reinforce our key views for 2023. First, Russia’s threat to reduce oil production by 500,000 barrels per day, while escalating the war in Ukraine, confirms that geopolitical risk will rebound and new oil…