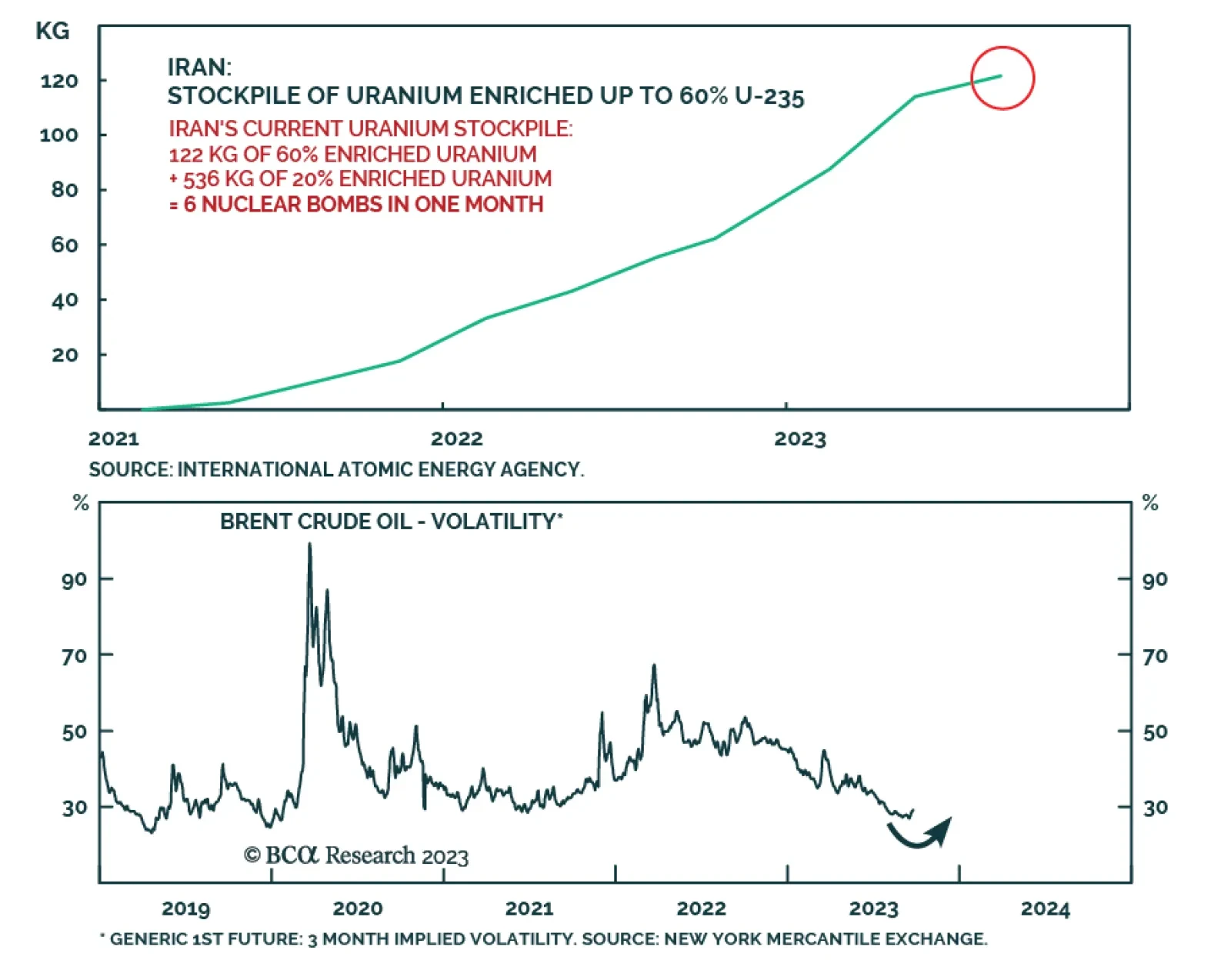

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

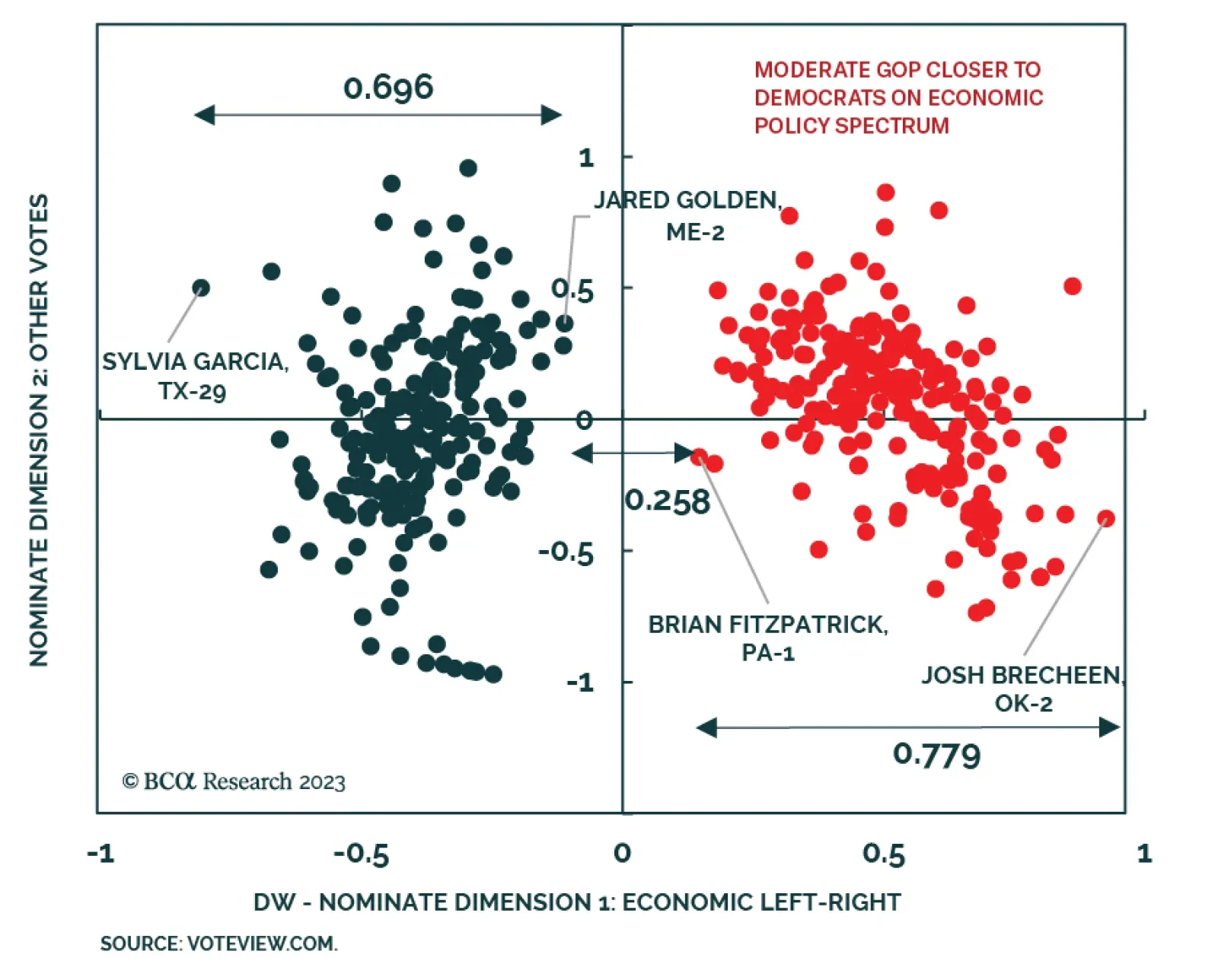

According to BCA Research’s US Political Strategy service, the odds of a US government shutdown are 50/50 and will go higher if Democrats harden their demands or if Republicans pick a populist speaker. The next deadline…

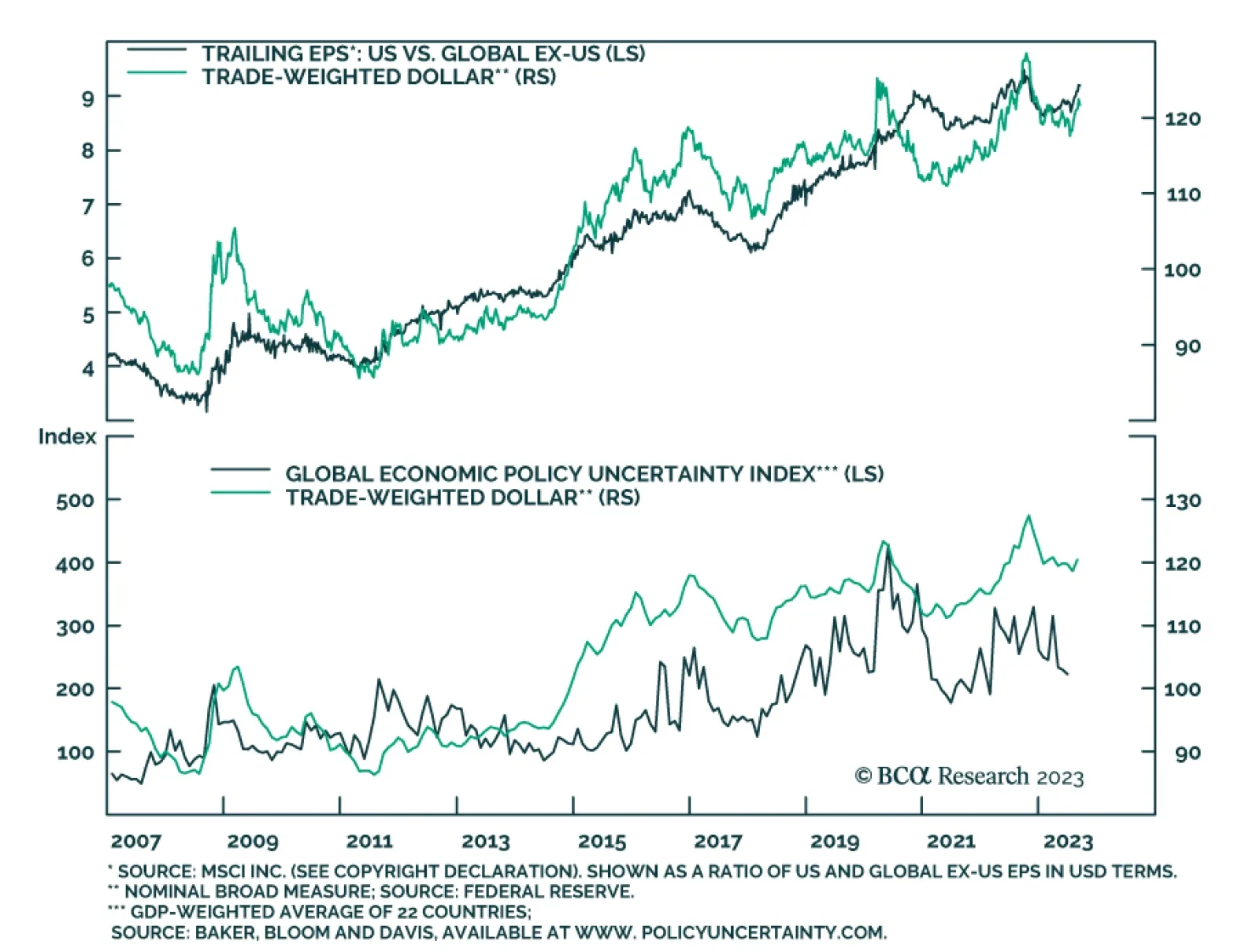

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

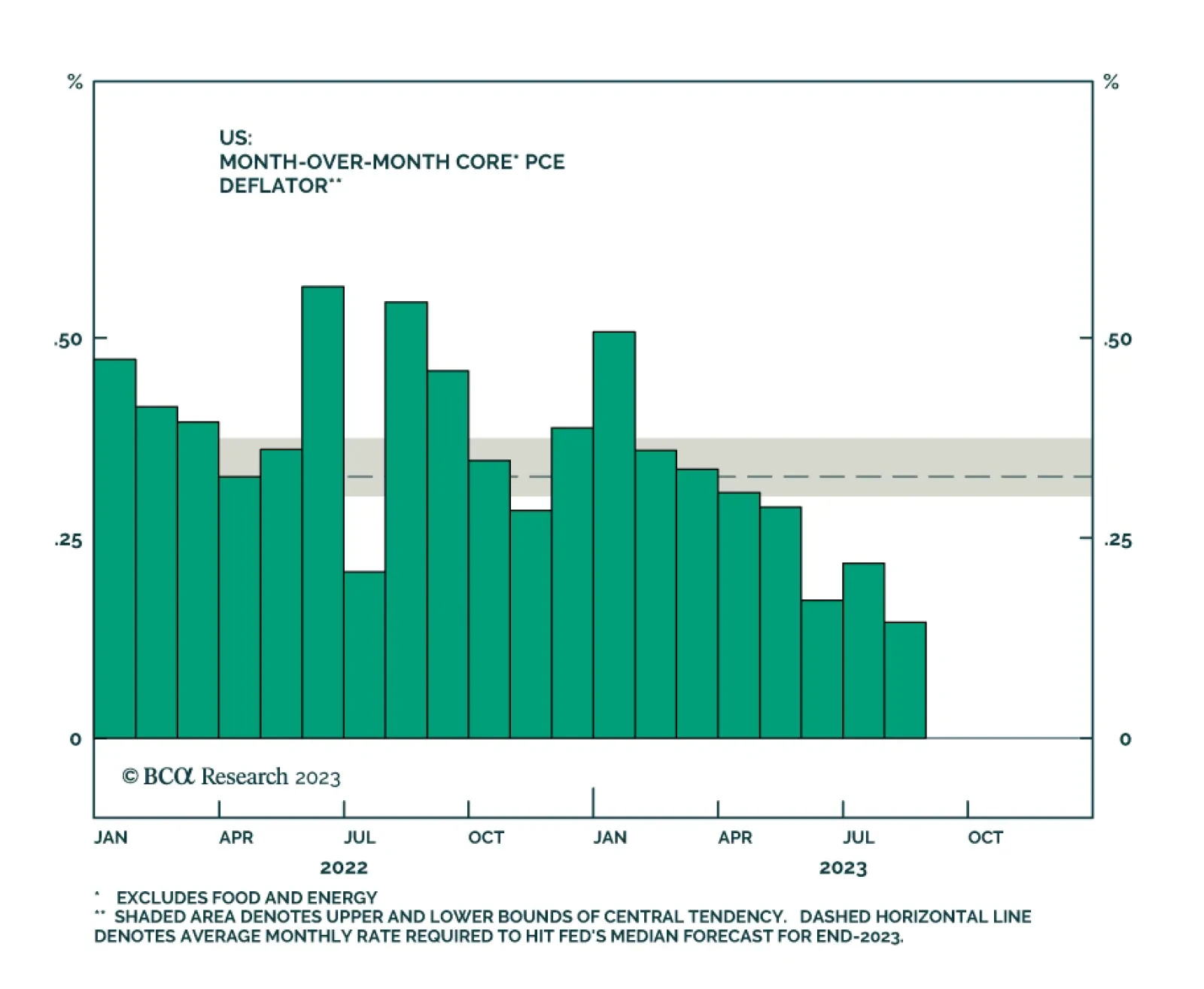

The US Personal Income and Outlays report for August sent a positive signal about the disinflationary trend. The core PCE deflator – the Fed’s preferred inflation gauge – slowed to a 33-month low of 0.1% m/m…

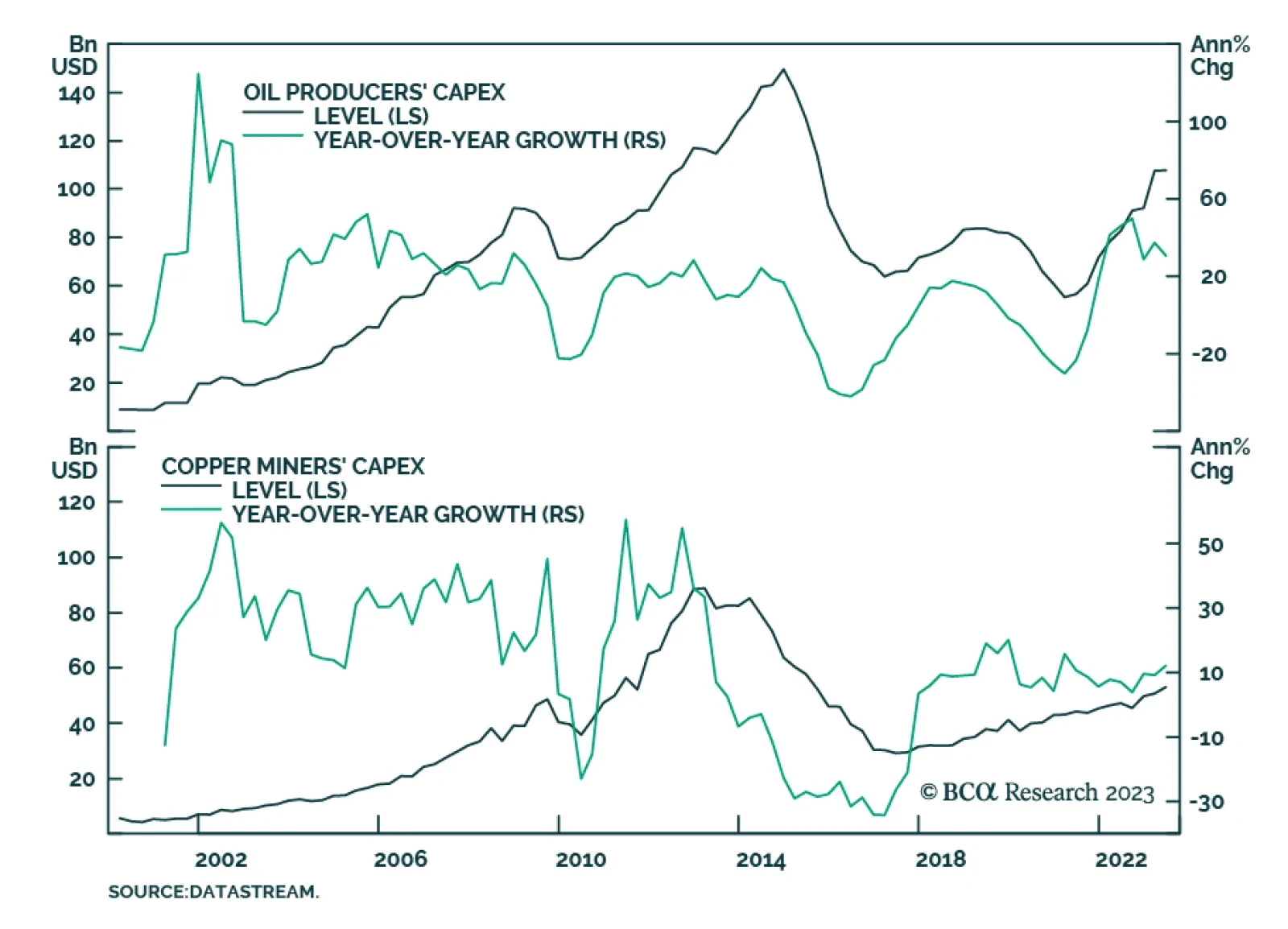

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…

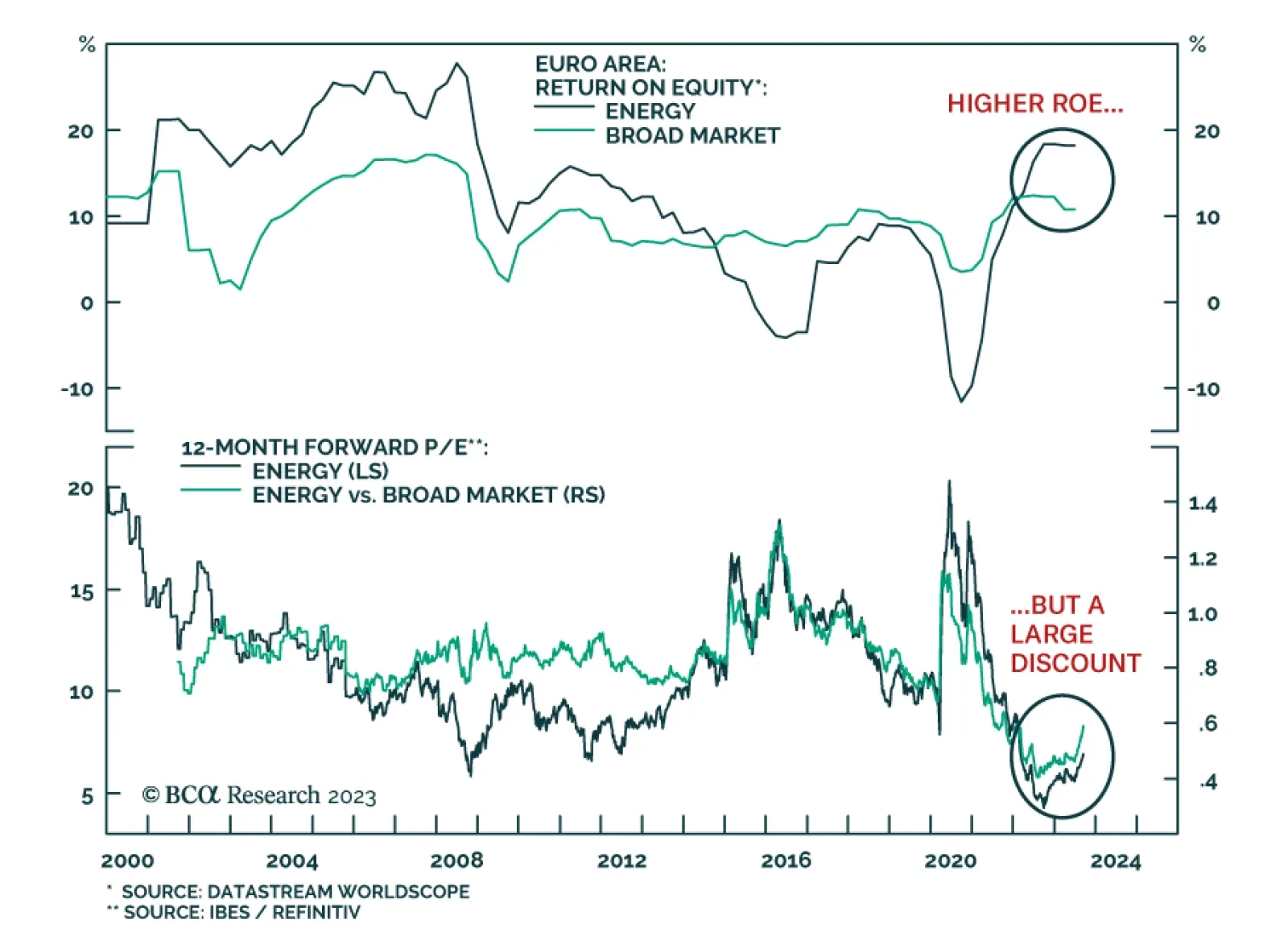

According to BCA Research’s European Investment Strategy service, energy stocks are an appealing overweight as a hedge against oil supply cuts. For now, the earnings of the energy sector continue to lag that of the broad…

Last week, the Federal Reserve signaled that it expects to deliver one last rate hike this year. Similarly, some of its European counterparts signaled that they are at or close to the end of their hiking cycles. Where does this…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.