The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

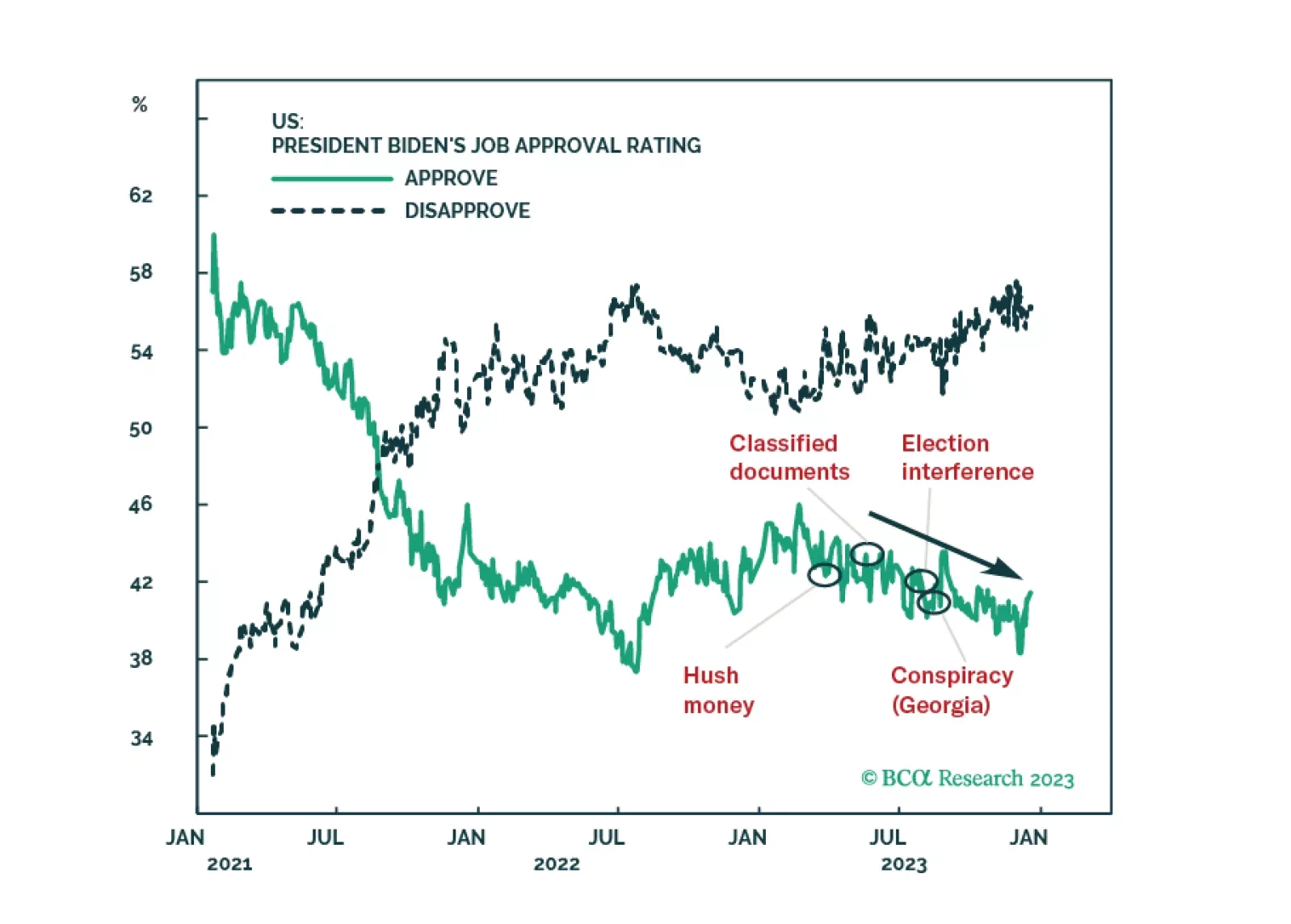

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

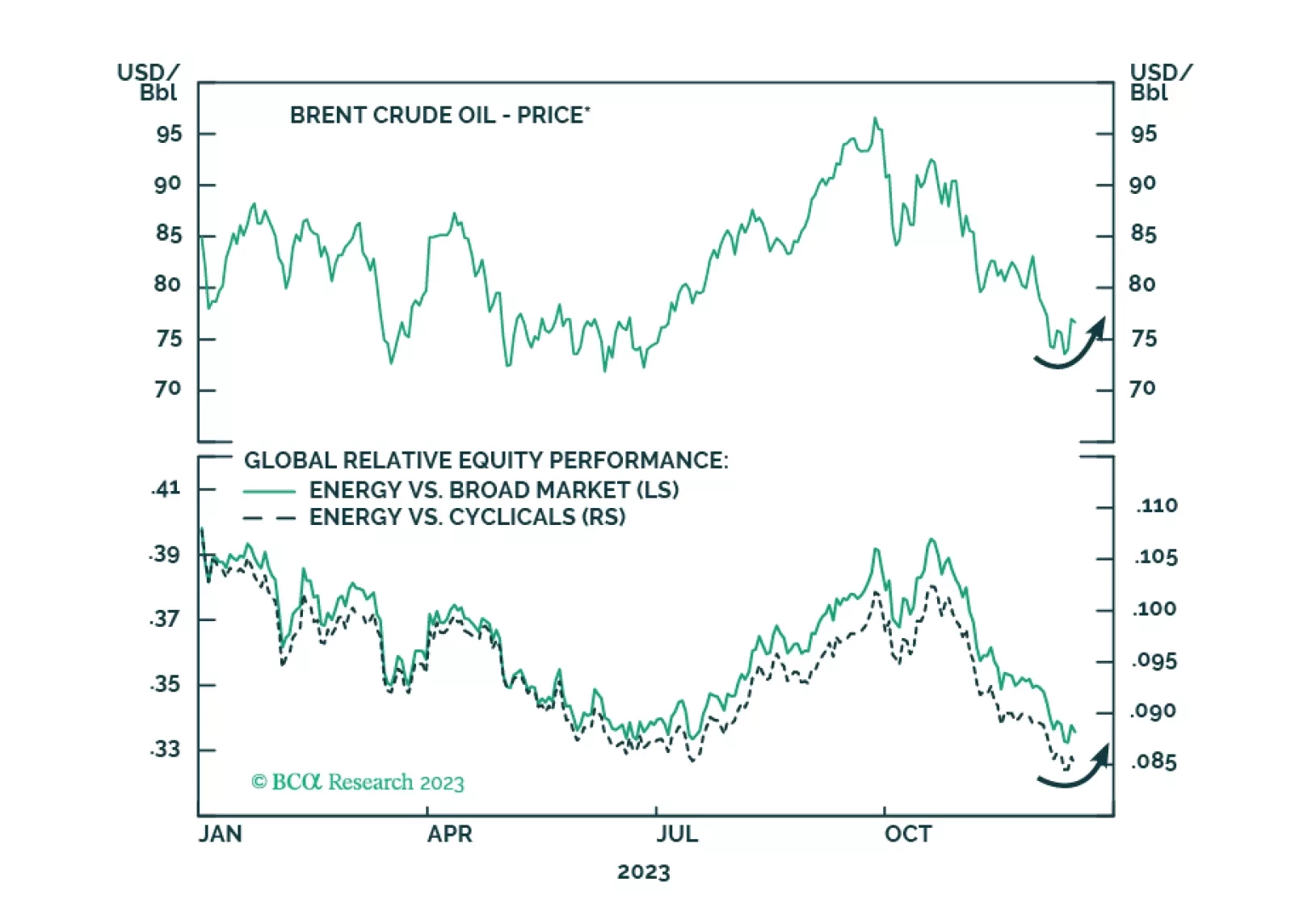

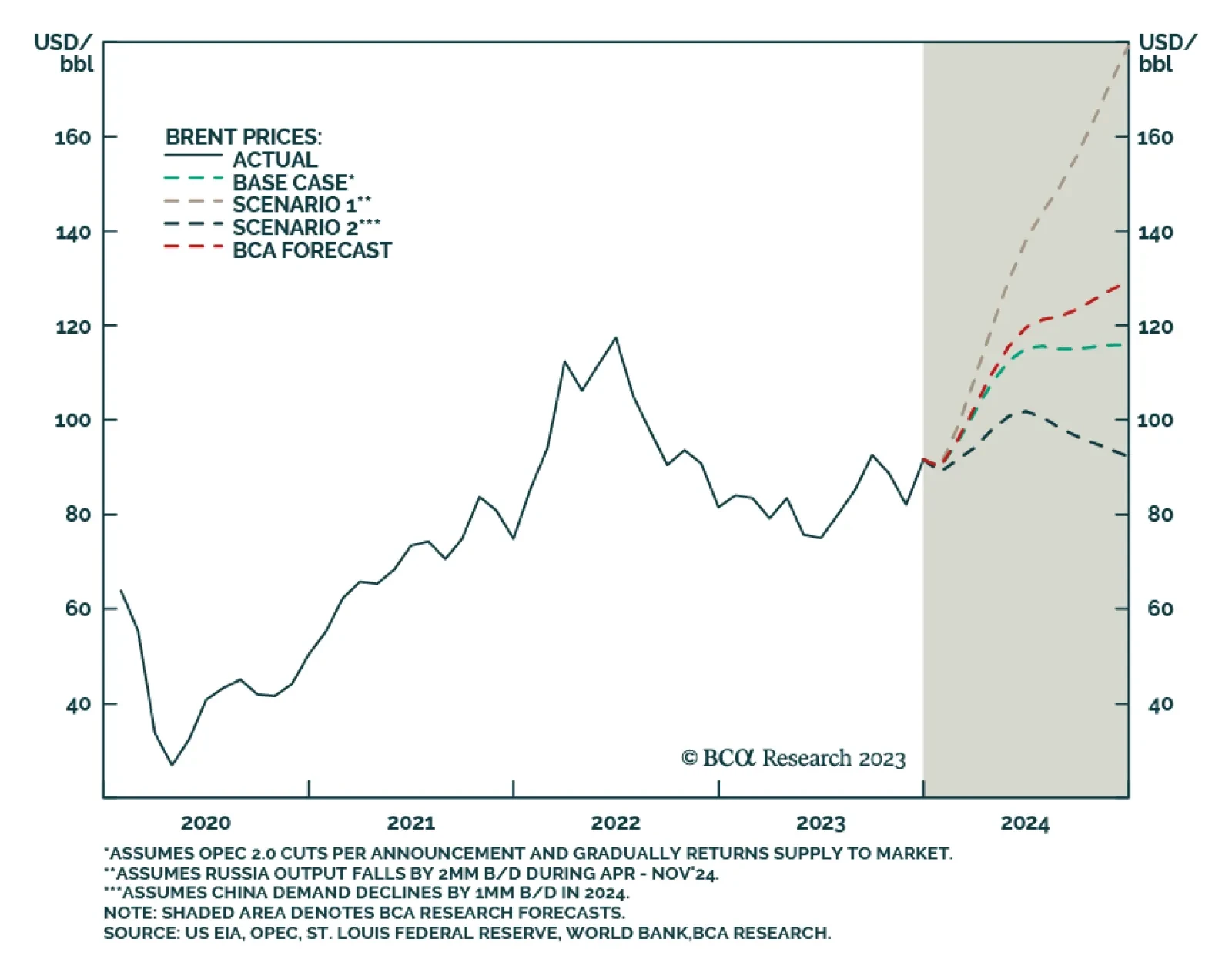

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

The short answer, according to our colleagues at BCA’s Commodity & Energy Strategy (CES) is straightforward, but not simple: Political economy – i.e., how states organize and operate their economies to support…

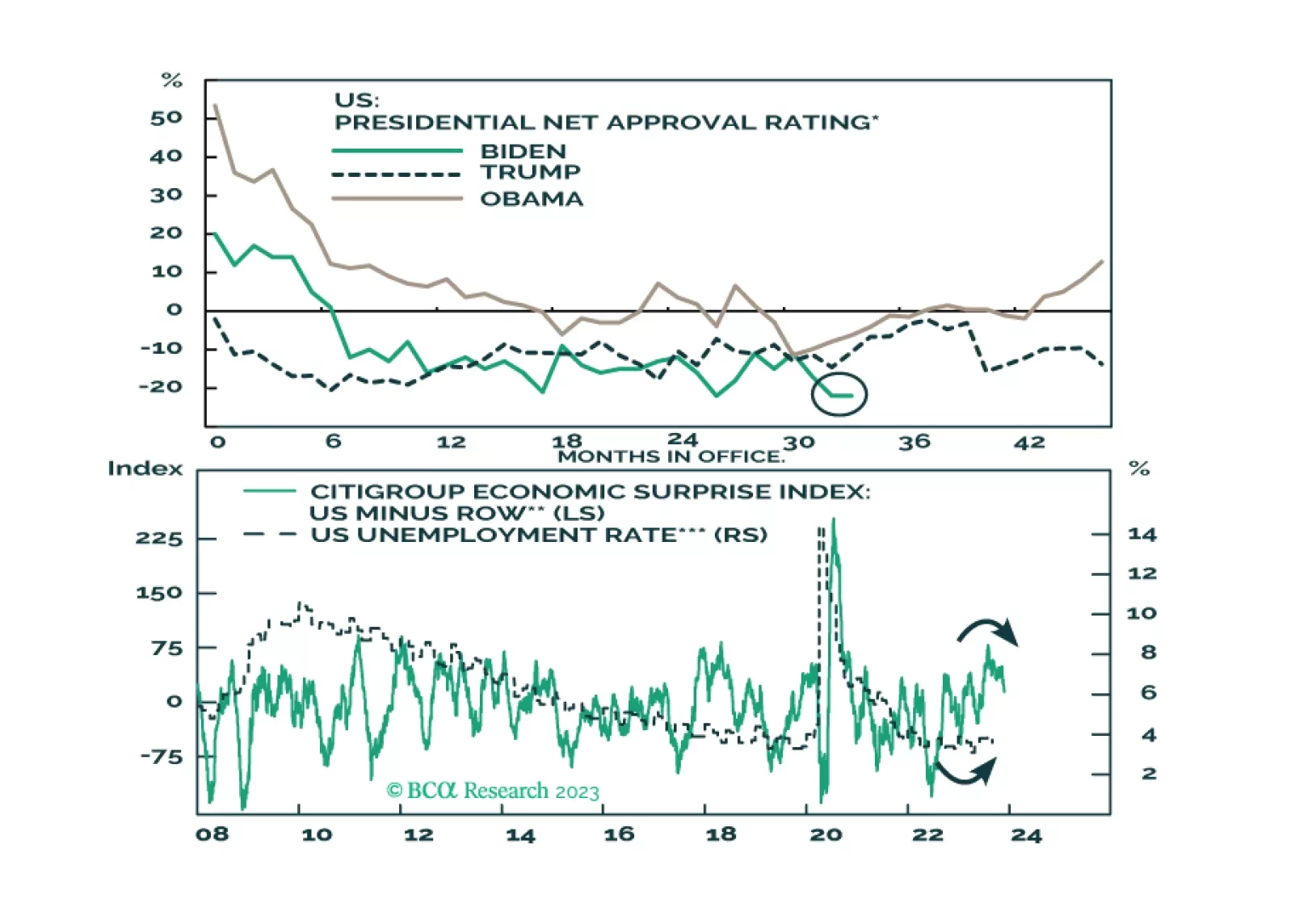

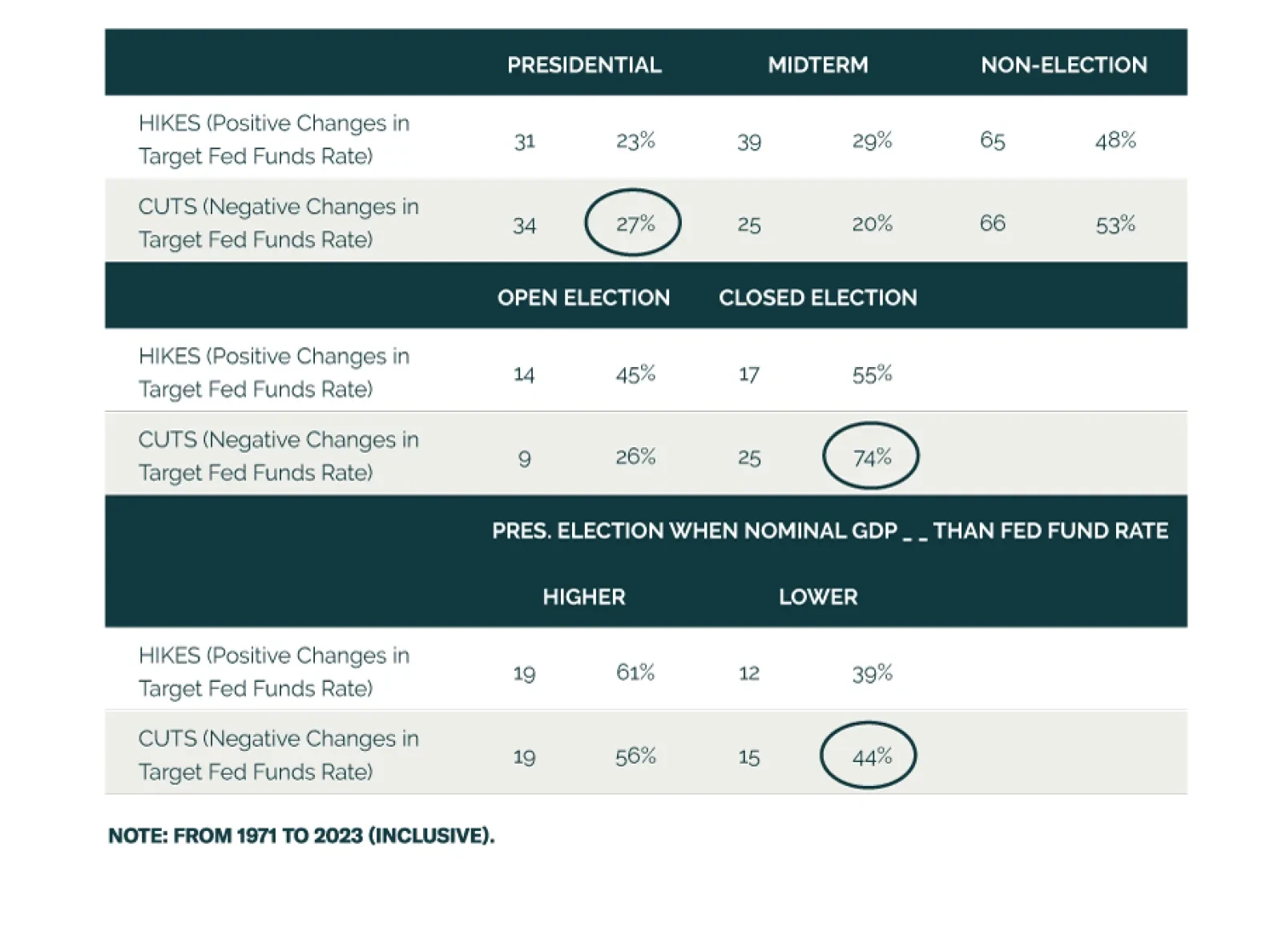

According to BCA Research’s US Political Strategy service, the Fed will be surprisingly dovish in 2024 but it has a poor track record of avoiding recessions once monetary policy is restrictive. The independence of the…

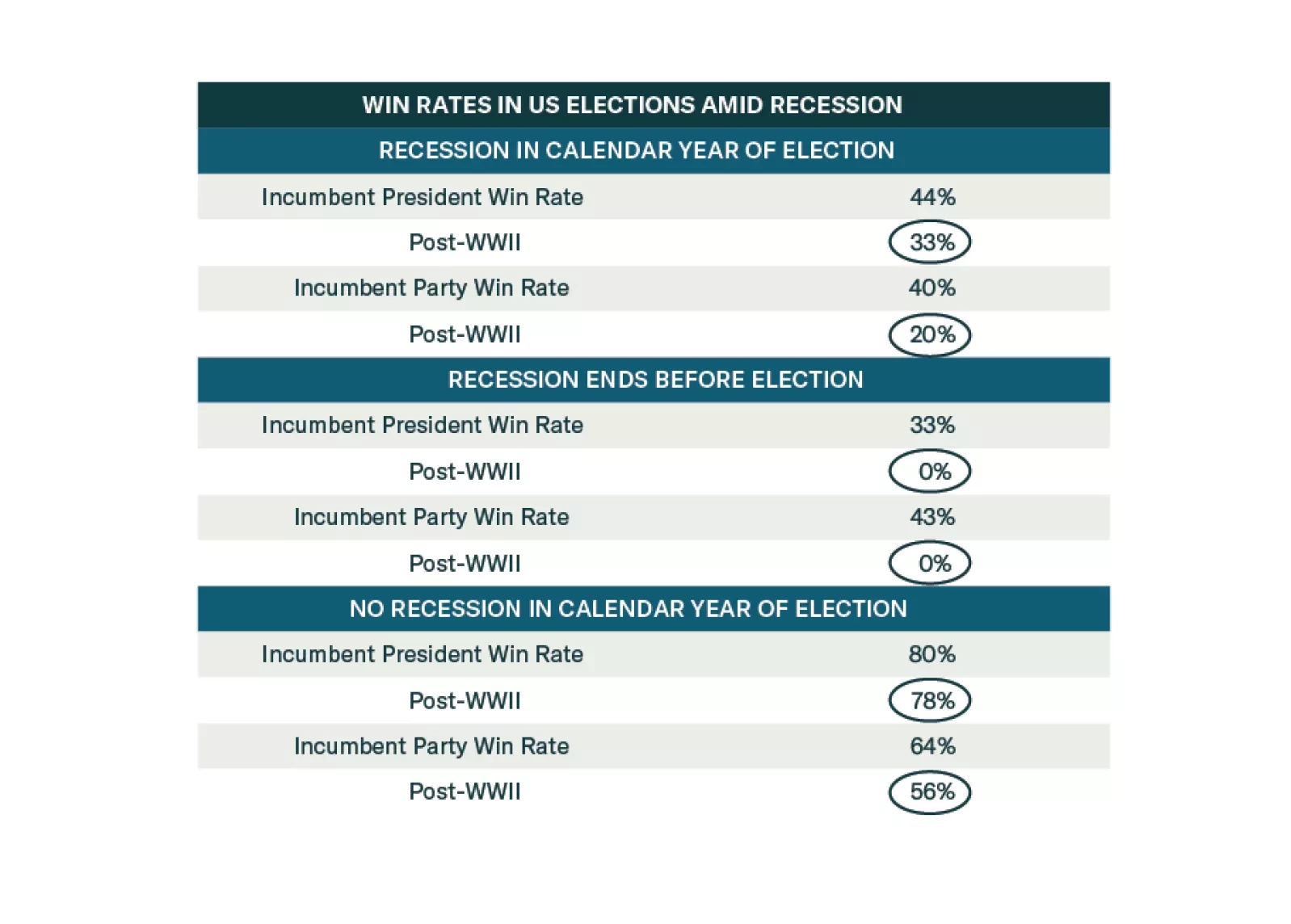

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

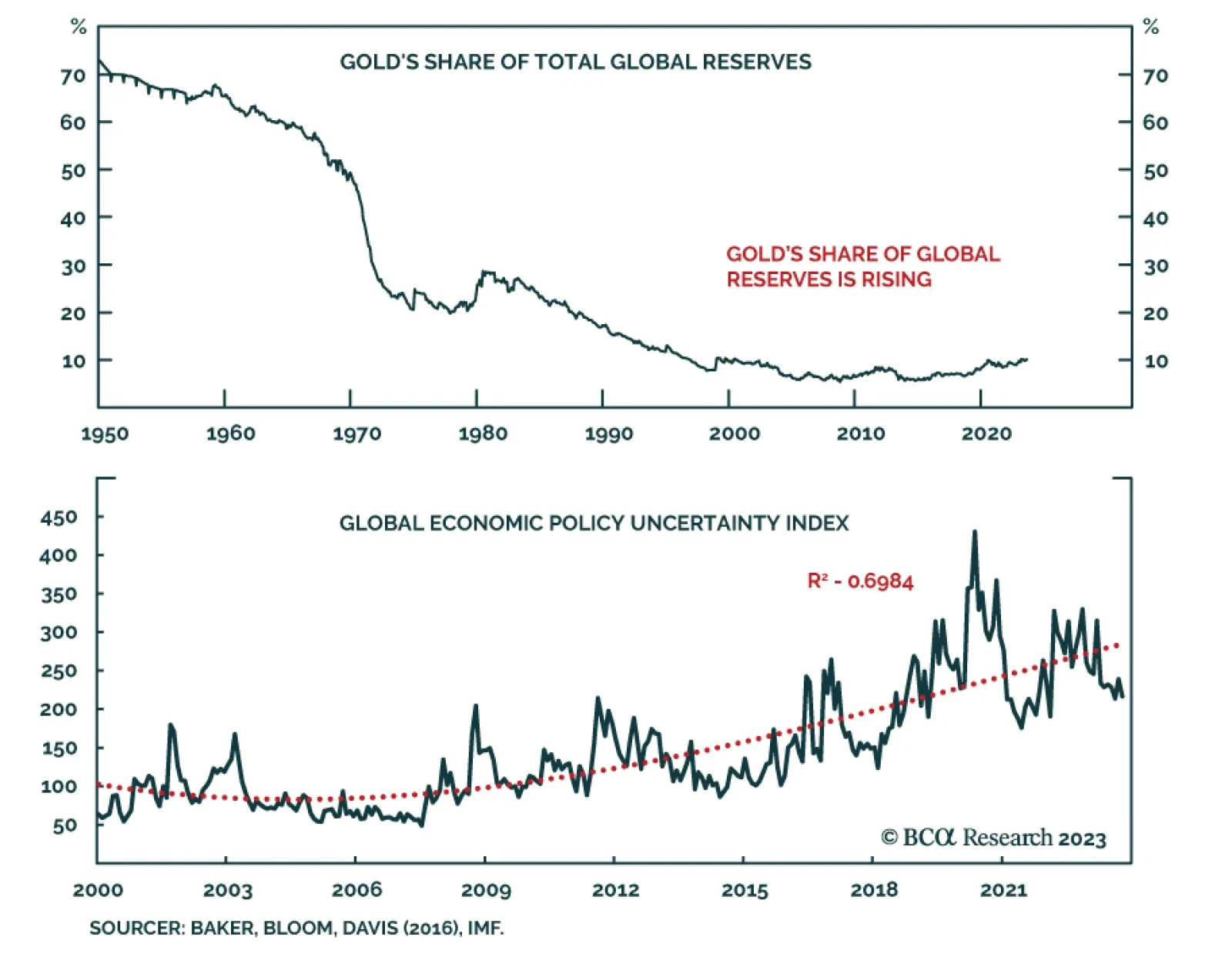

According to BCA Research’s Commodity & Energy Strategy service, as the world splits into East-West trading blocs, the continuing trend of trade fragmentation will challenge the need for a USD-centric monetary system,…

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…