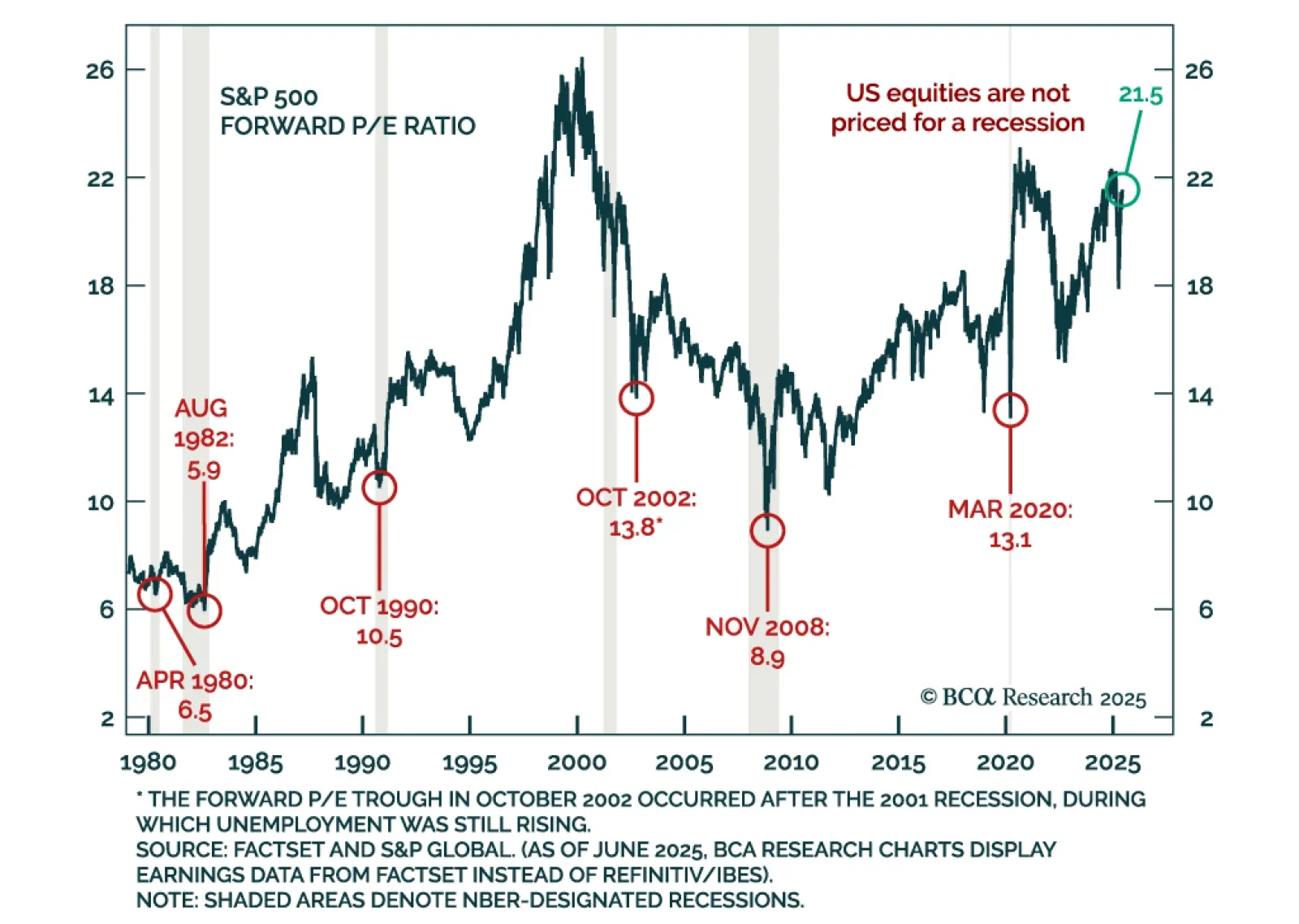

Geopolitical risks and fragile margins reinforce a defensive allocation stance, as oil shocks and high US equity valuations pose growing downside risks. At this month’s Views Meeting, our strategists discussed the potential fallout…

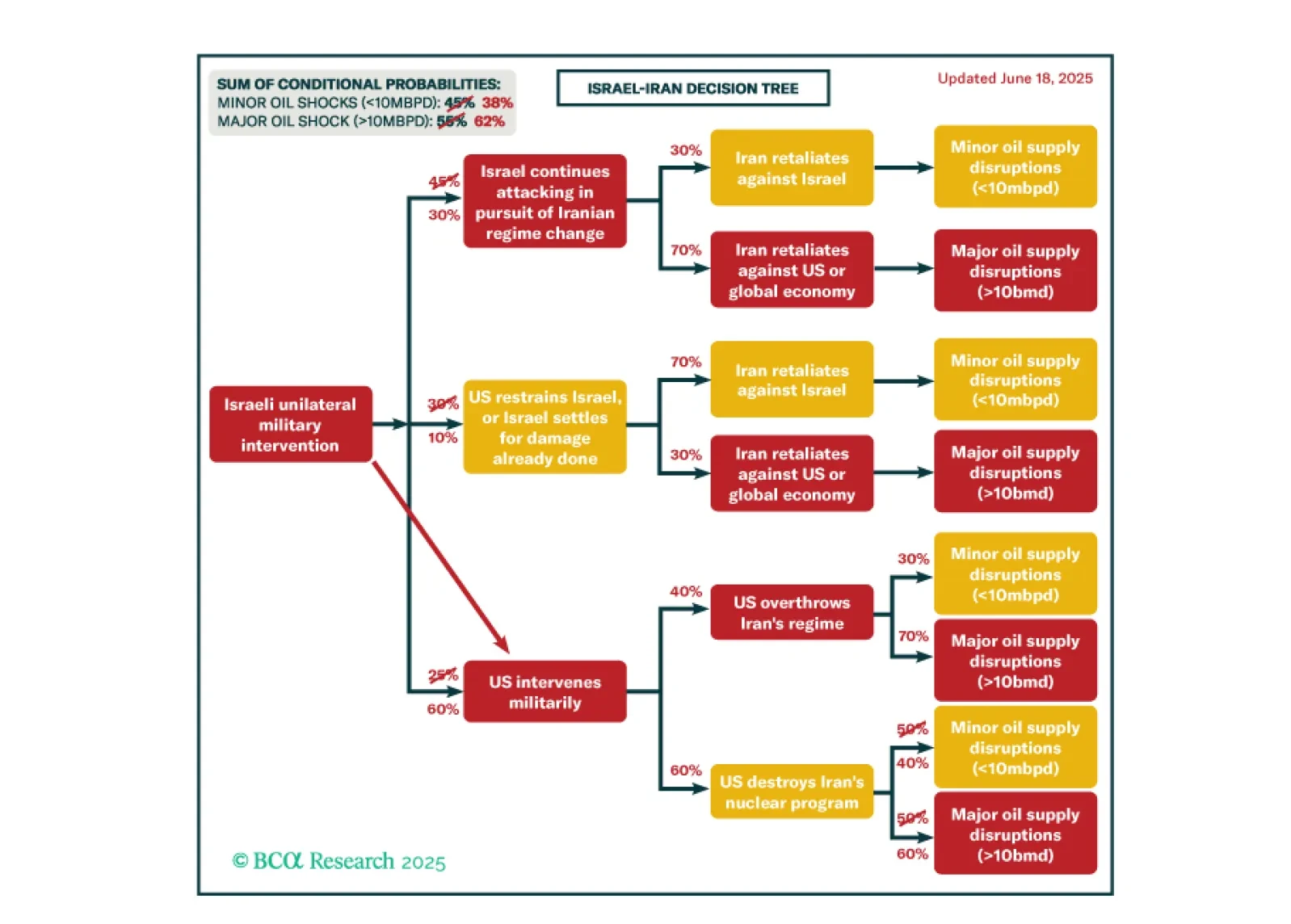

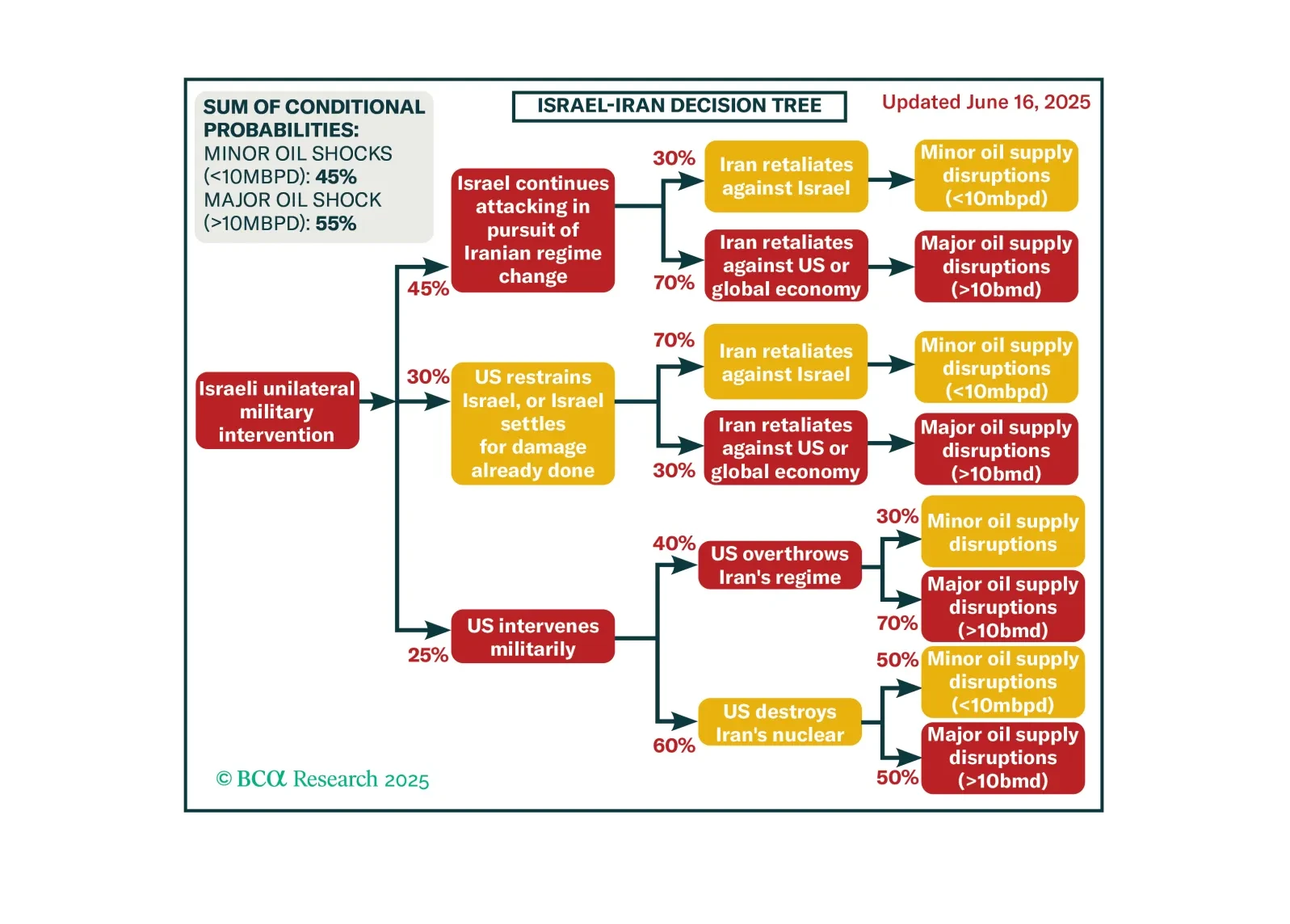

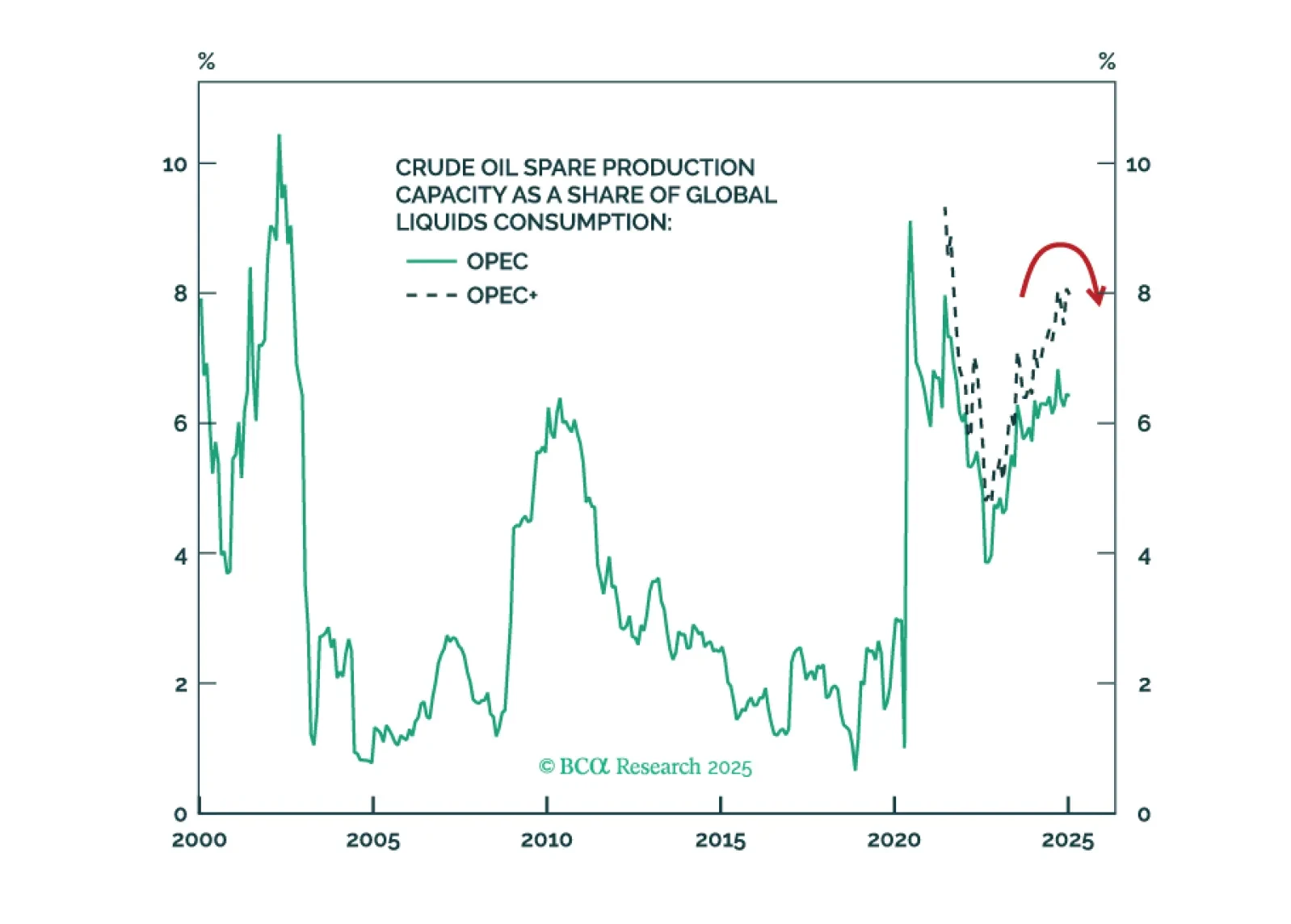

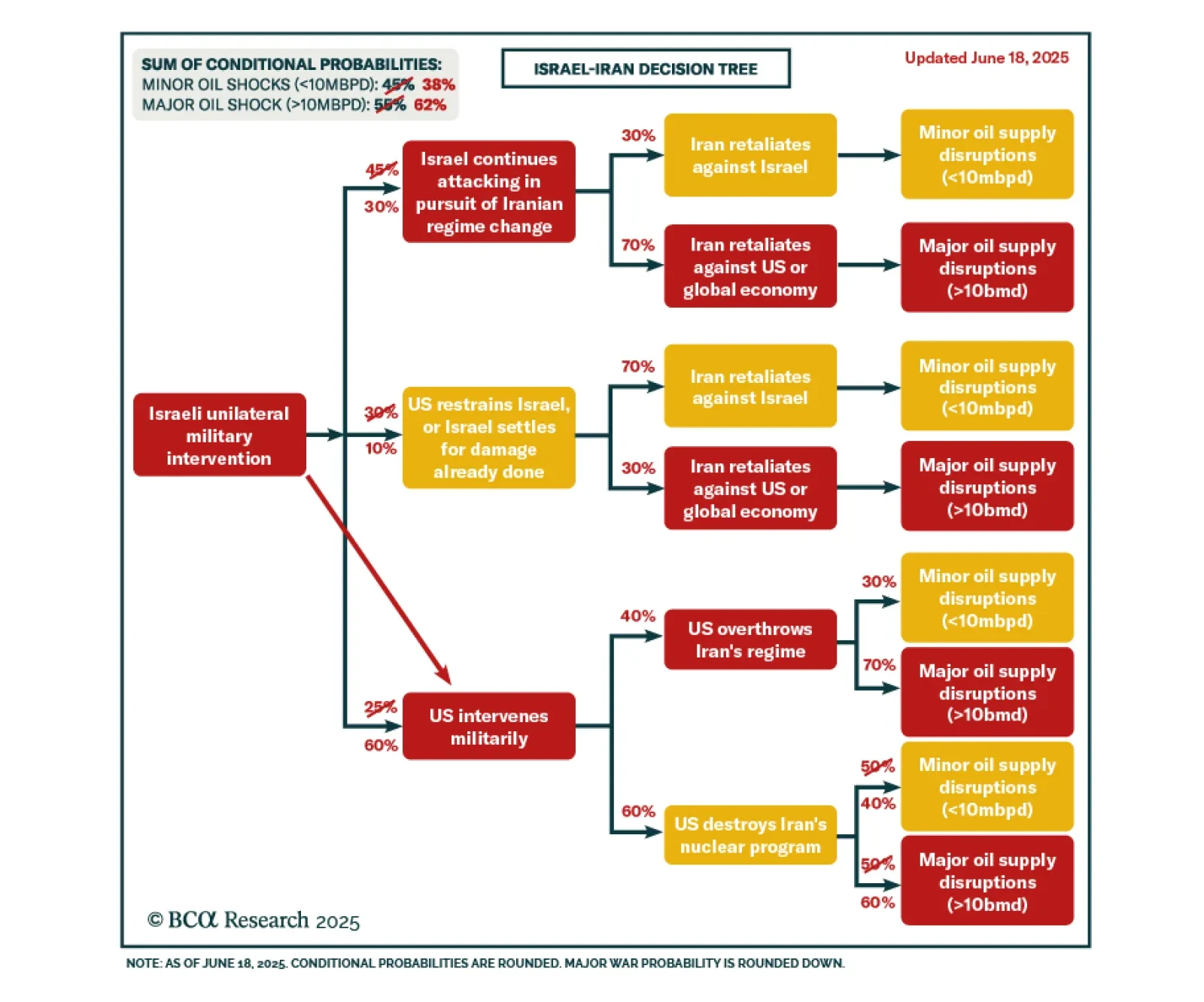

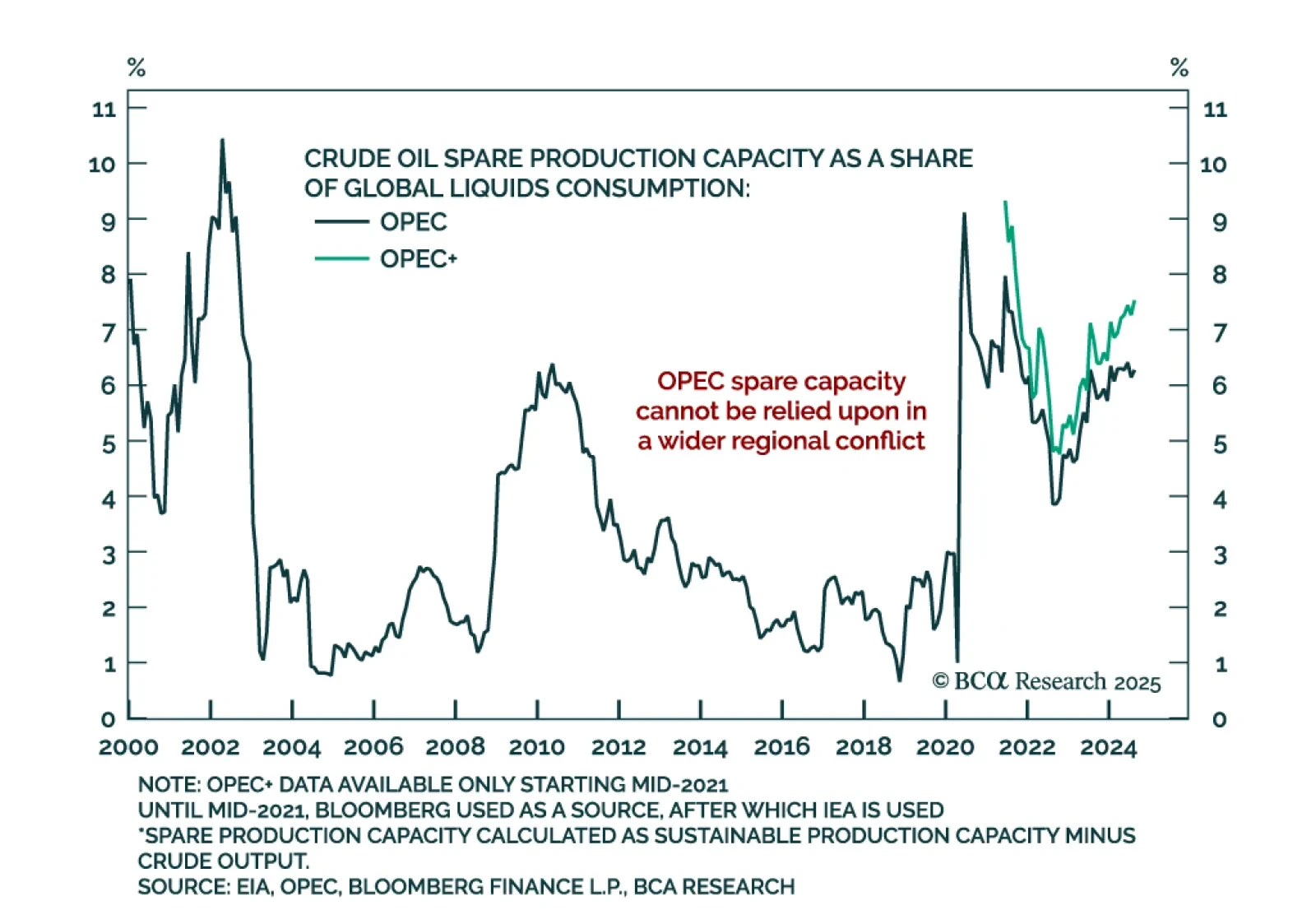

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

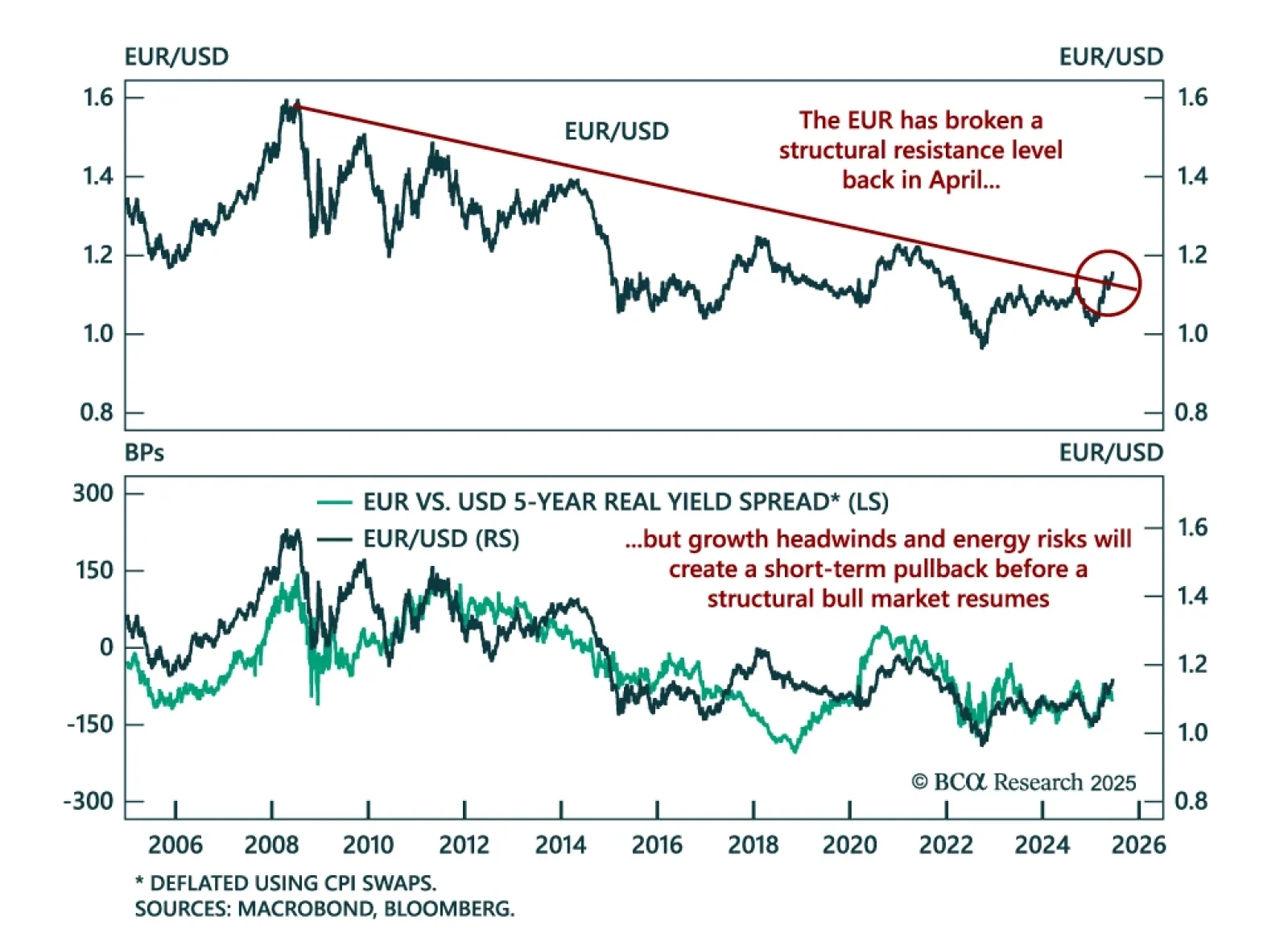

Short term euro upside is limited despite a structural bull case, as fragile growth, easing ECB policy, and geopolitical risks cap further gains. EUR/USD broke above structural resistance in April amid optimism over German stimulus…

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

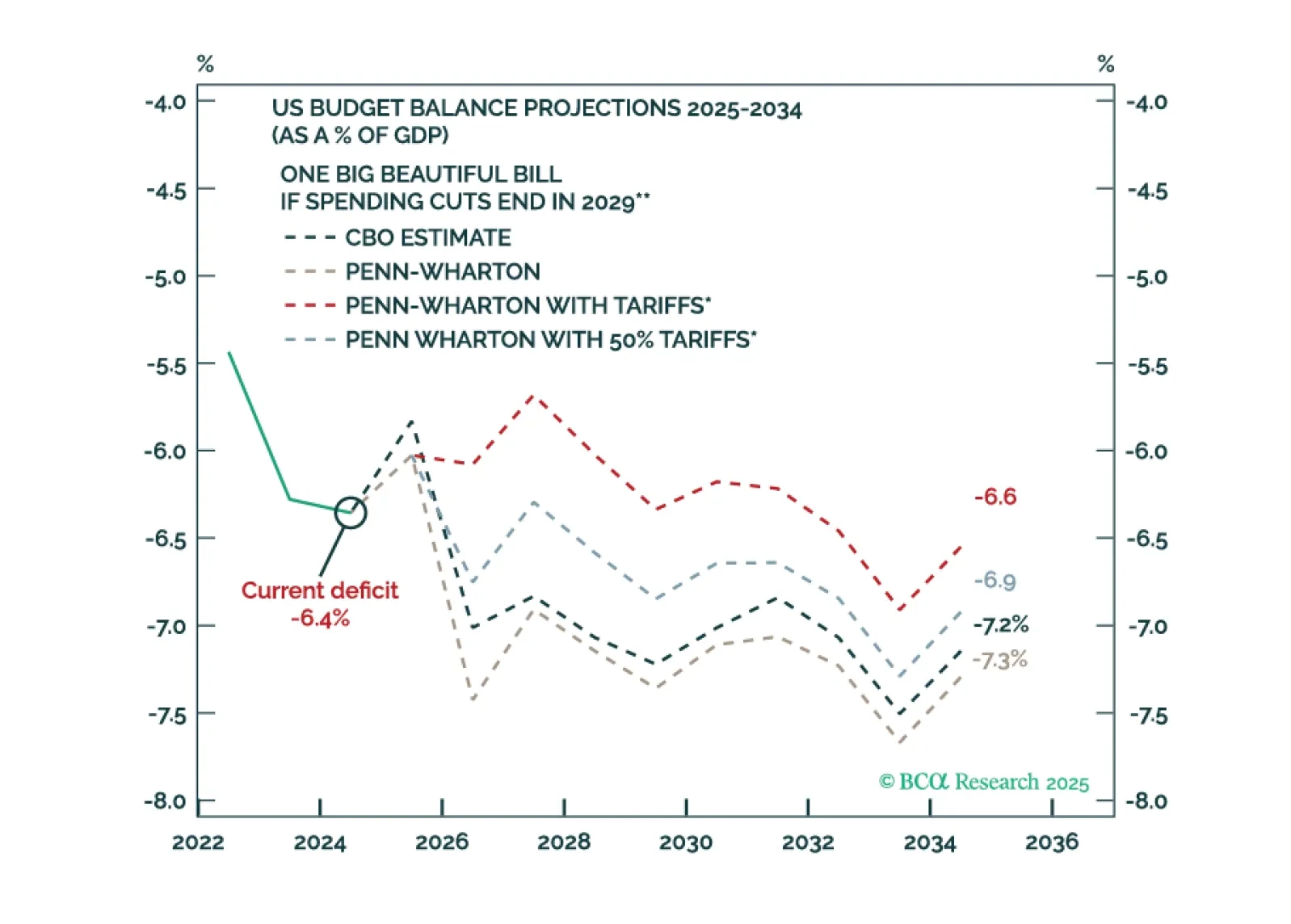

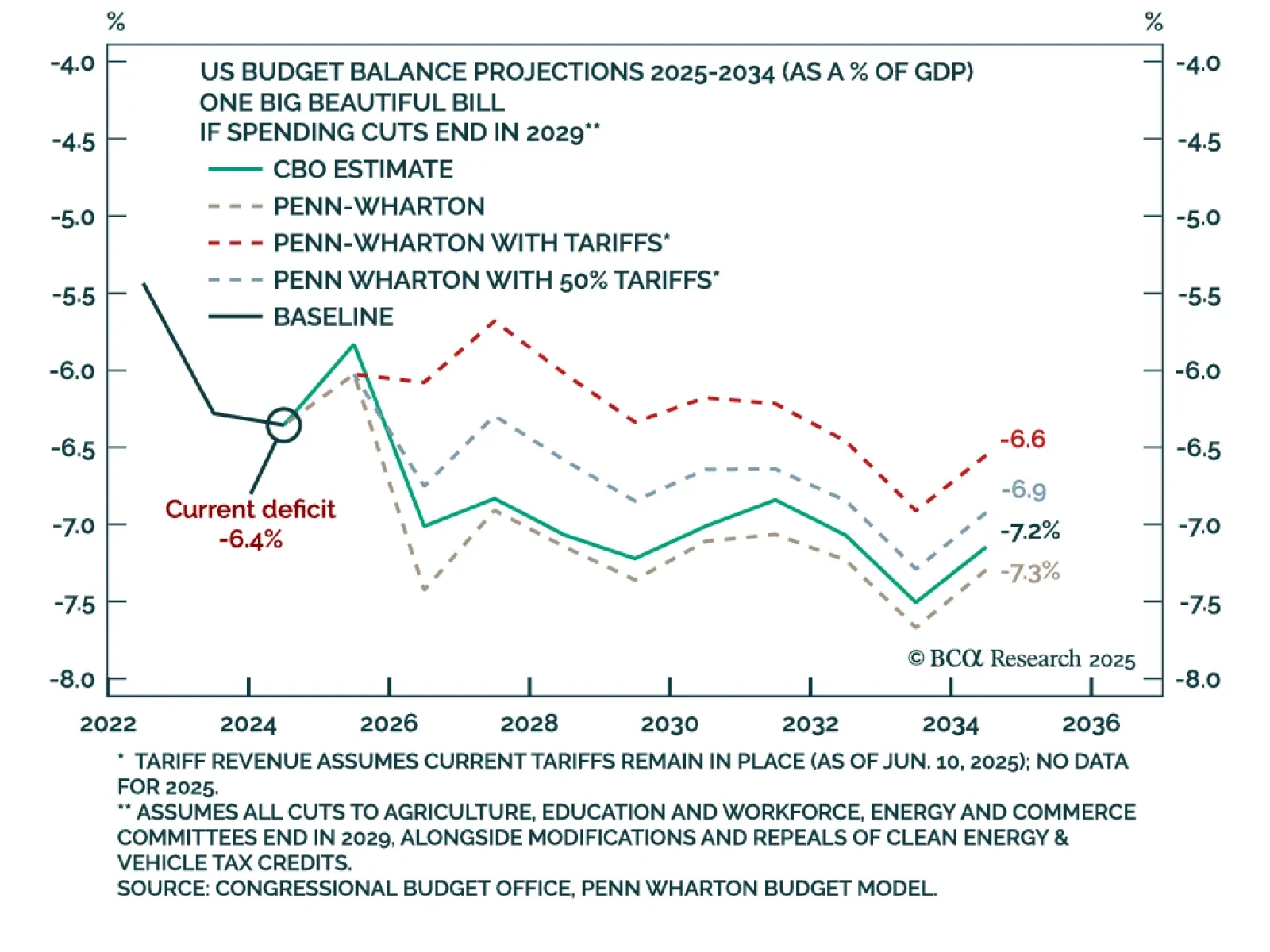

BCA’s Geopolitical strategists expect further bond market volatility as Congress advances the “One Big Beautiful Bill,” which will act as a new fiscal stimulus ahead of the midterms. They assign a 90% probability to the eventual…

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

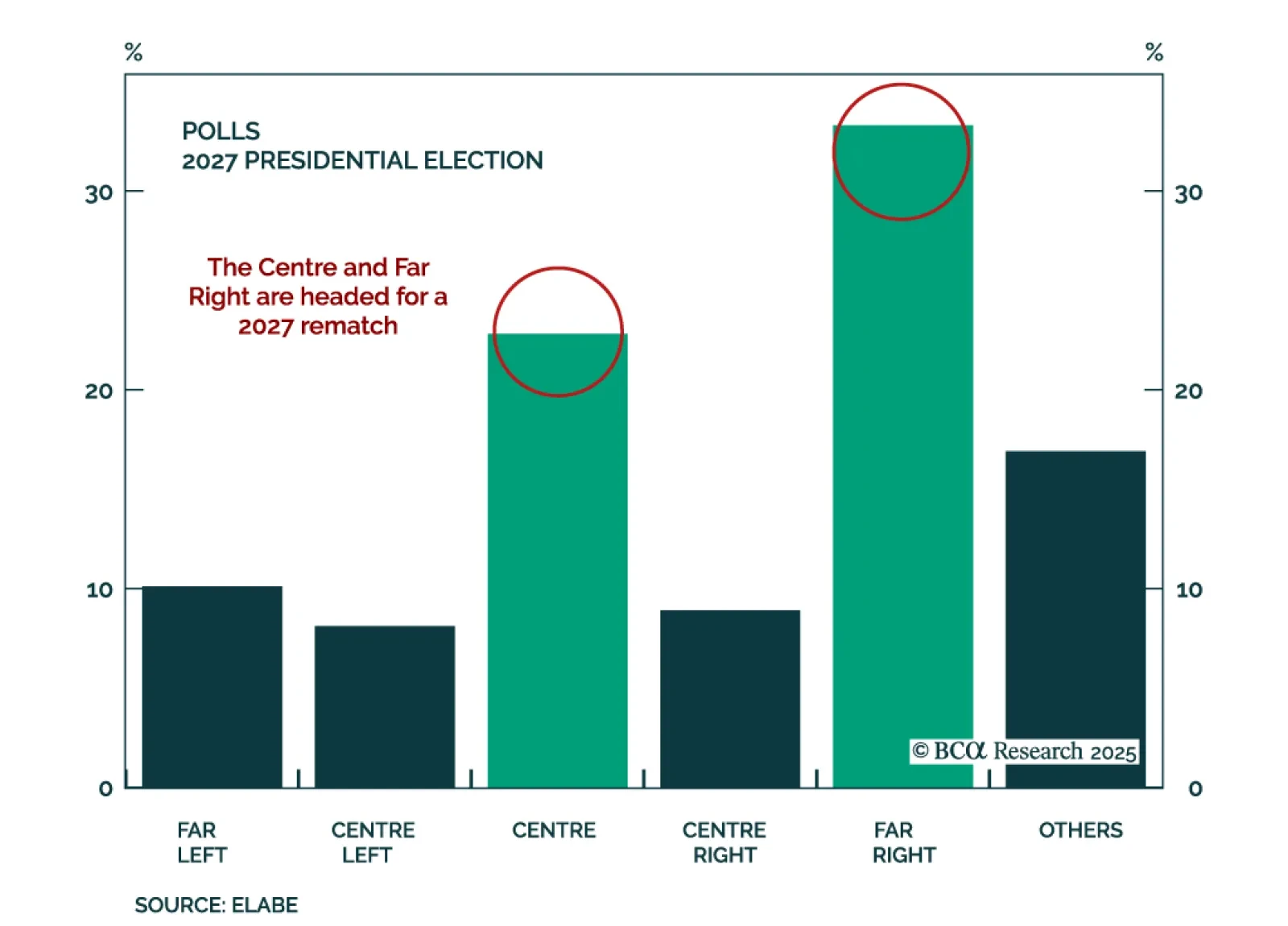

BCA’s European Investment Strategist service warns that France’s political turmoil is far from over. The minority government is fragile, and the 2026 budget battle is set to trigger renewed social unrest and the threat of a no-…