The US-EU trade deal lifts uncertainty but imposes high tariffs, weighing on the EUR and supporting our long USD positioning. The agreement includes a 15% tariff on all EU exports to the US, including cars and potentially,…

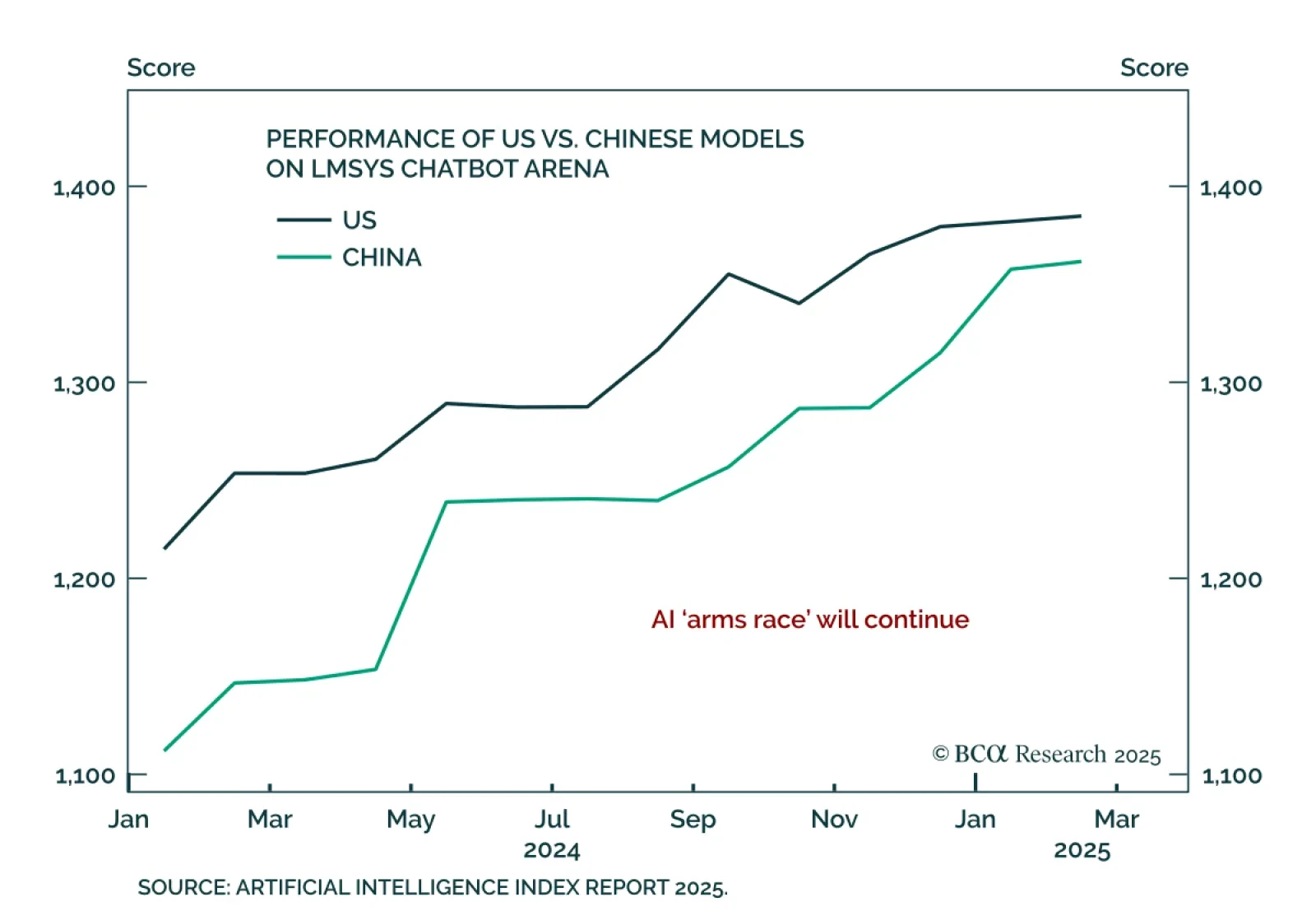

BCA’s Geopolitical strategists argue that artificial intelligence will destabilize both domestic politics and international security, prompting more aggressive fiscal responses. President Trump’s July 23 executive orders to…

The Japan-US trade deal removes short-term uncertainty but leaves in place high tariffs. The deal imposes a 15% tariff on most Japanese exports, lower than the previously threatened 25% on autos, and includes Japanese commitments to…

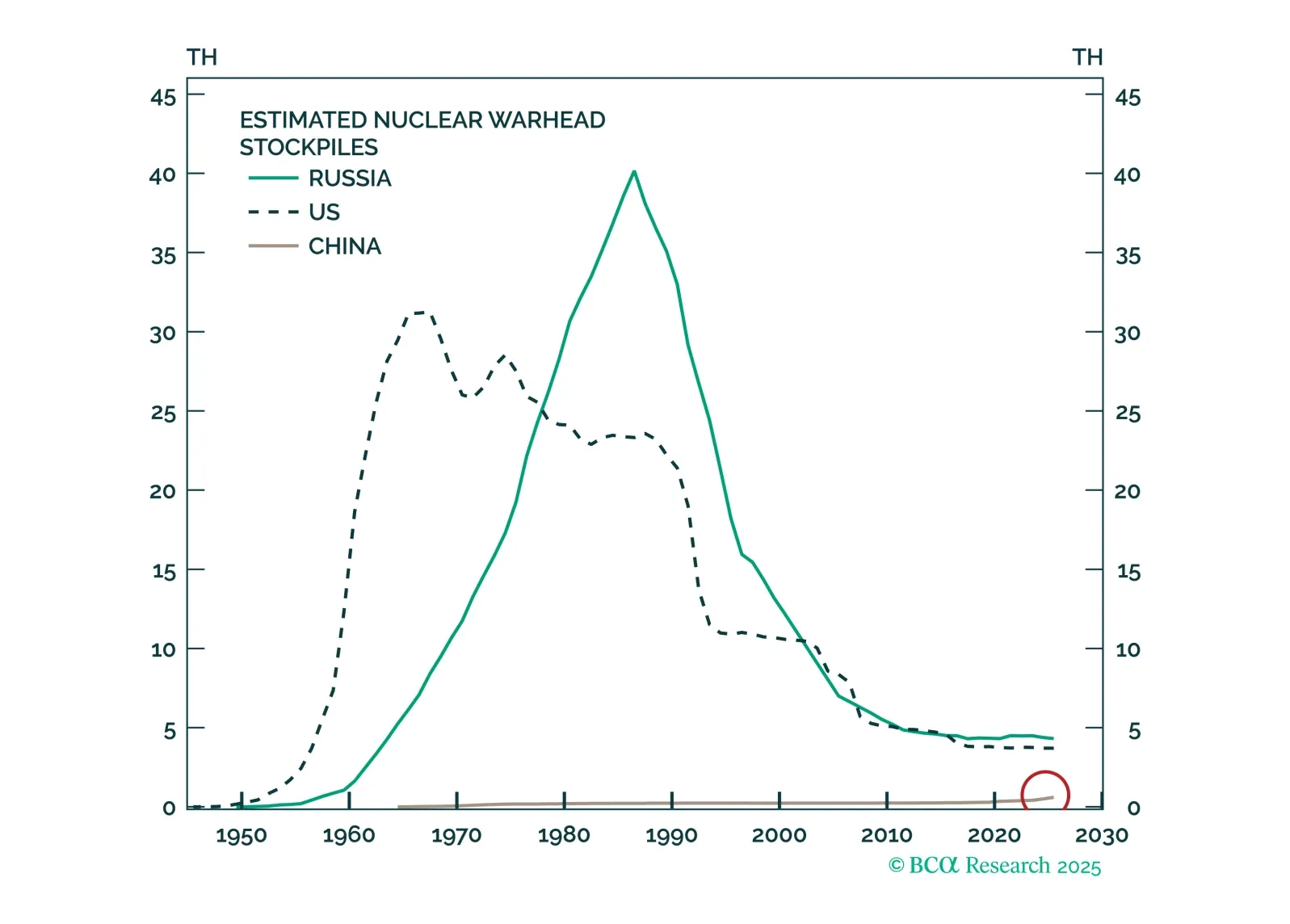

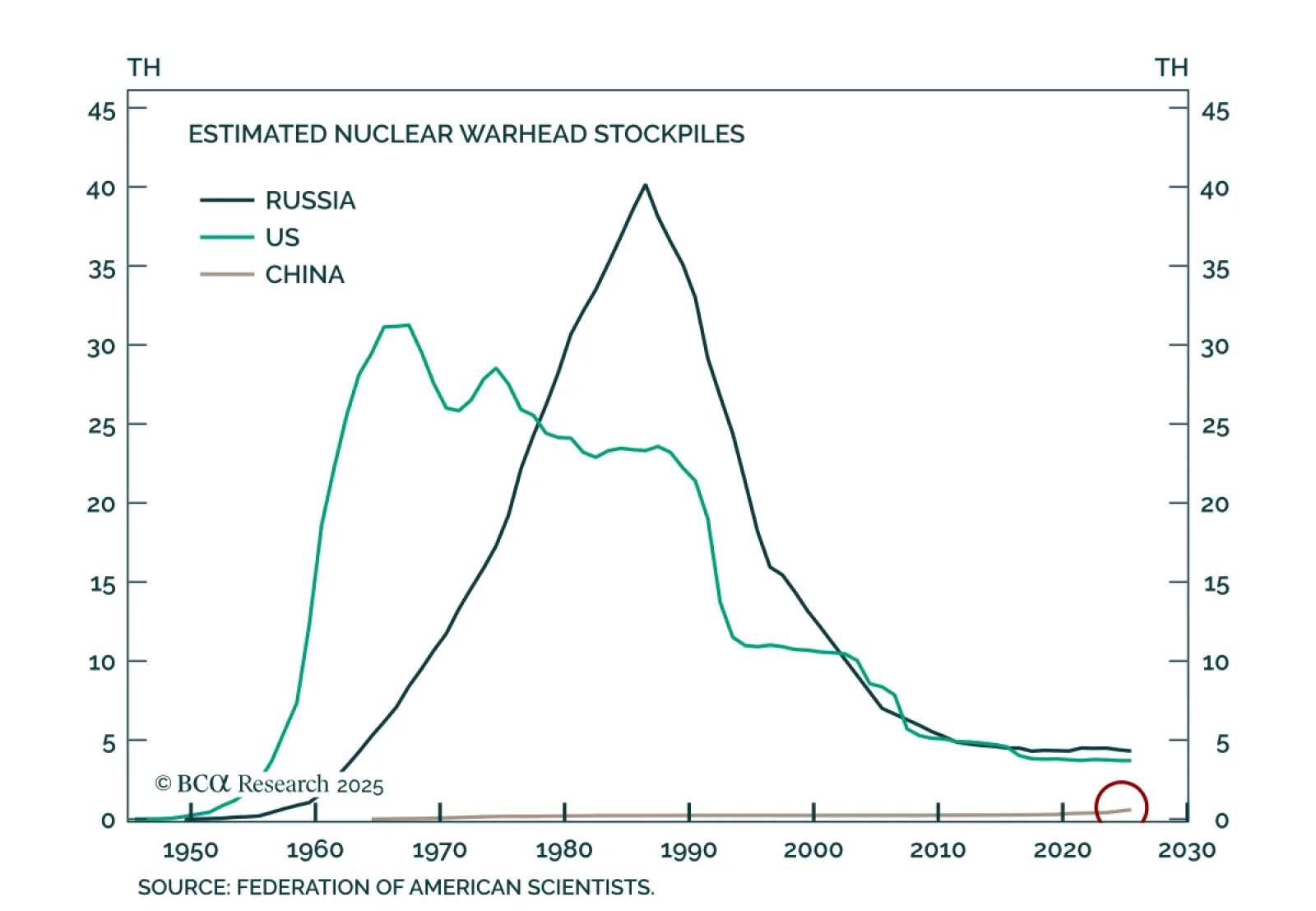

BCA’s Geopolitical strategists advise investors to remain open to the possibility that a new Cold War dynamic is forming in global trade. While the US-China rivalry does not map perfectly onto the original Cold War, the analogy…

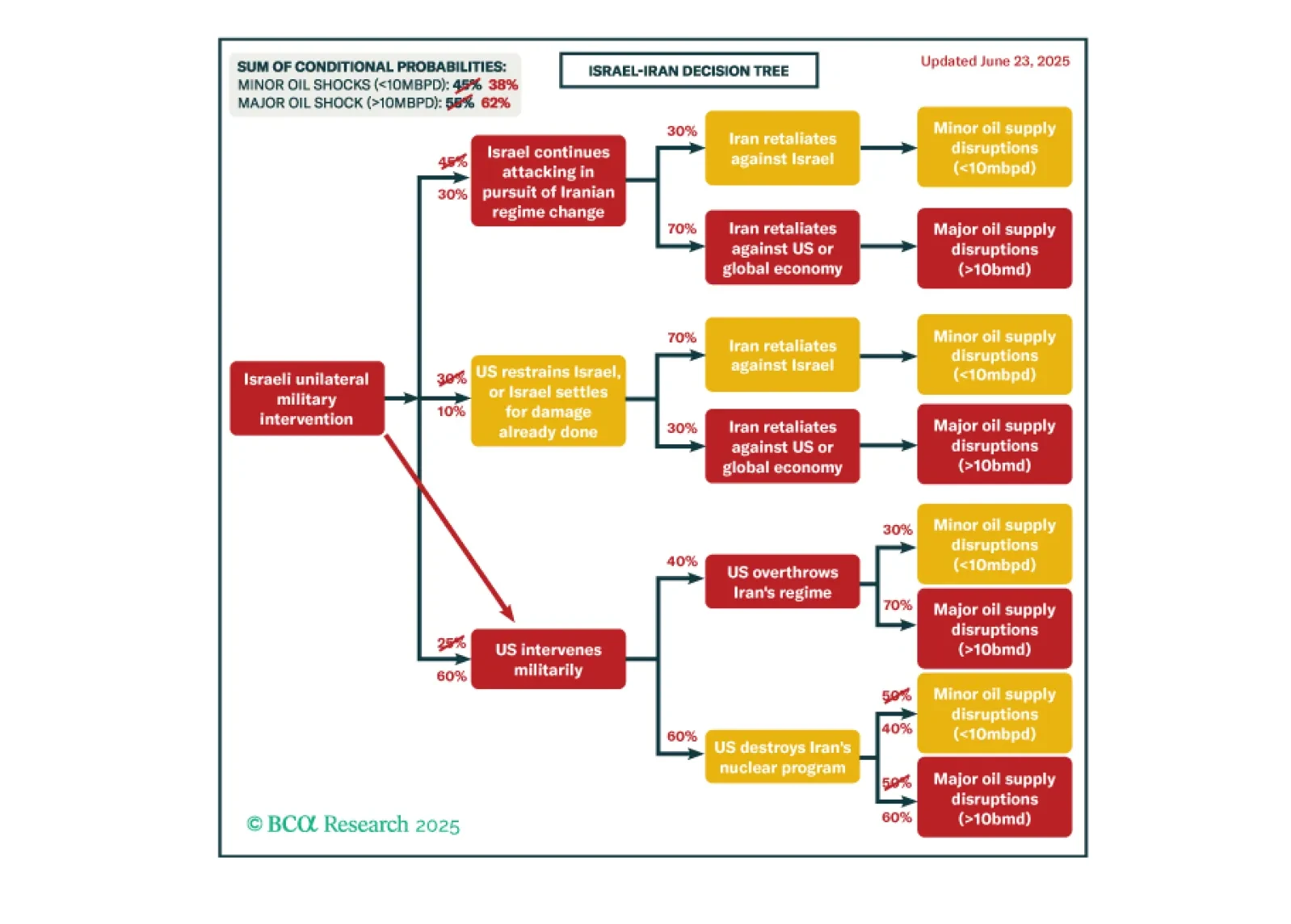

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

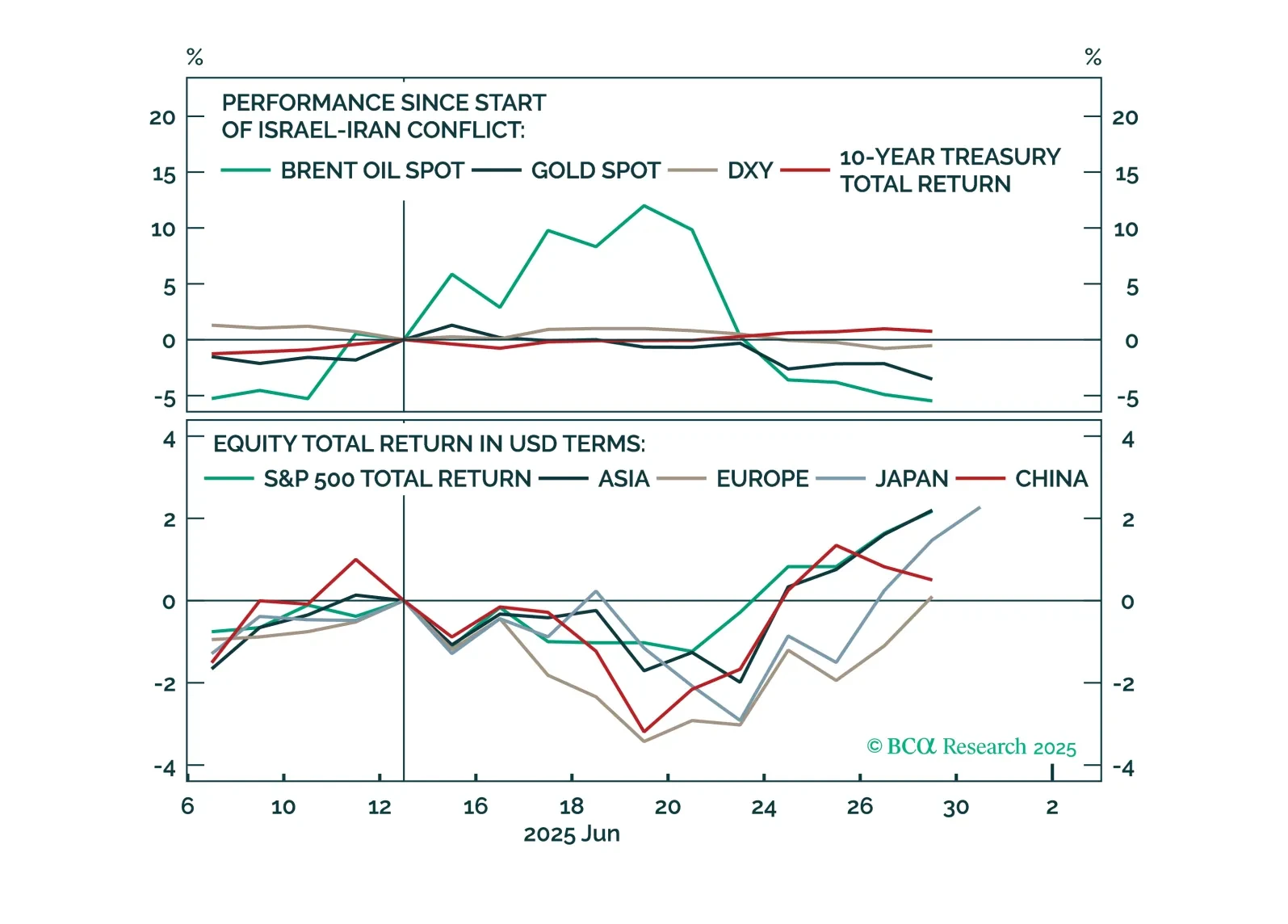

There is a thin line between geopolitical risk and Enlightenment, just ask Europe in the seventeenth century. The Middle East is exhibiting both. Investors are over-indexing on the negative – which has not impacted the investible…

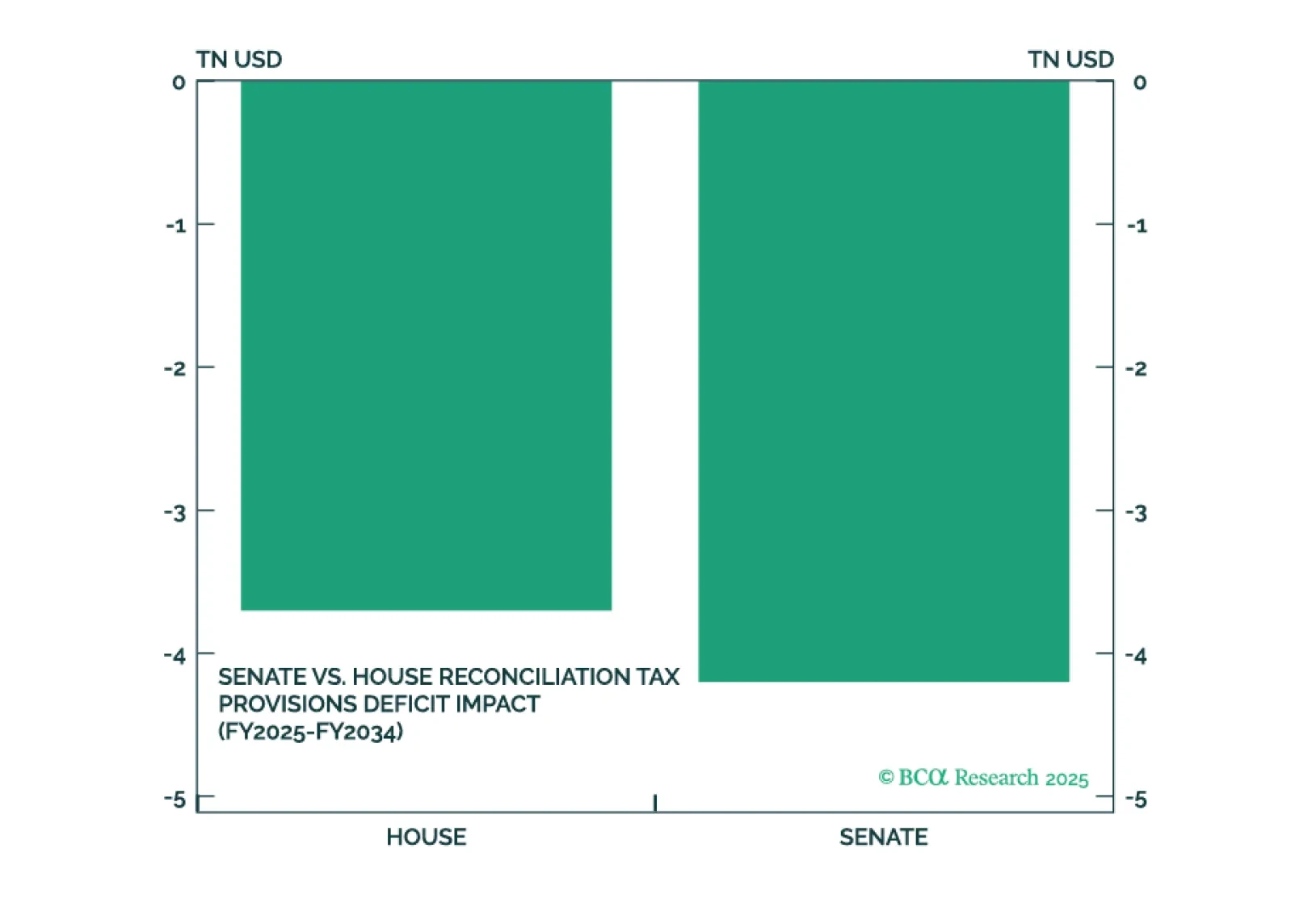

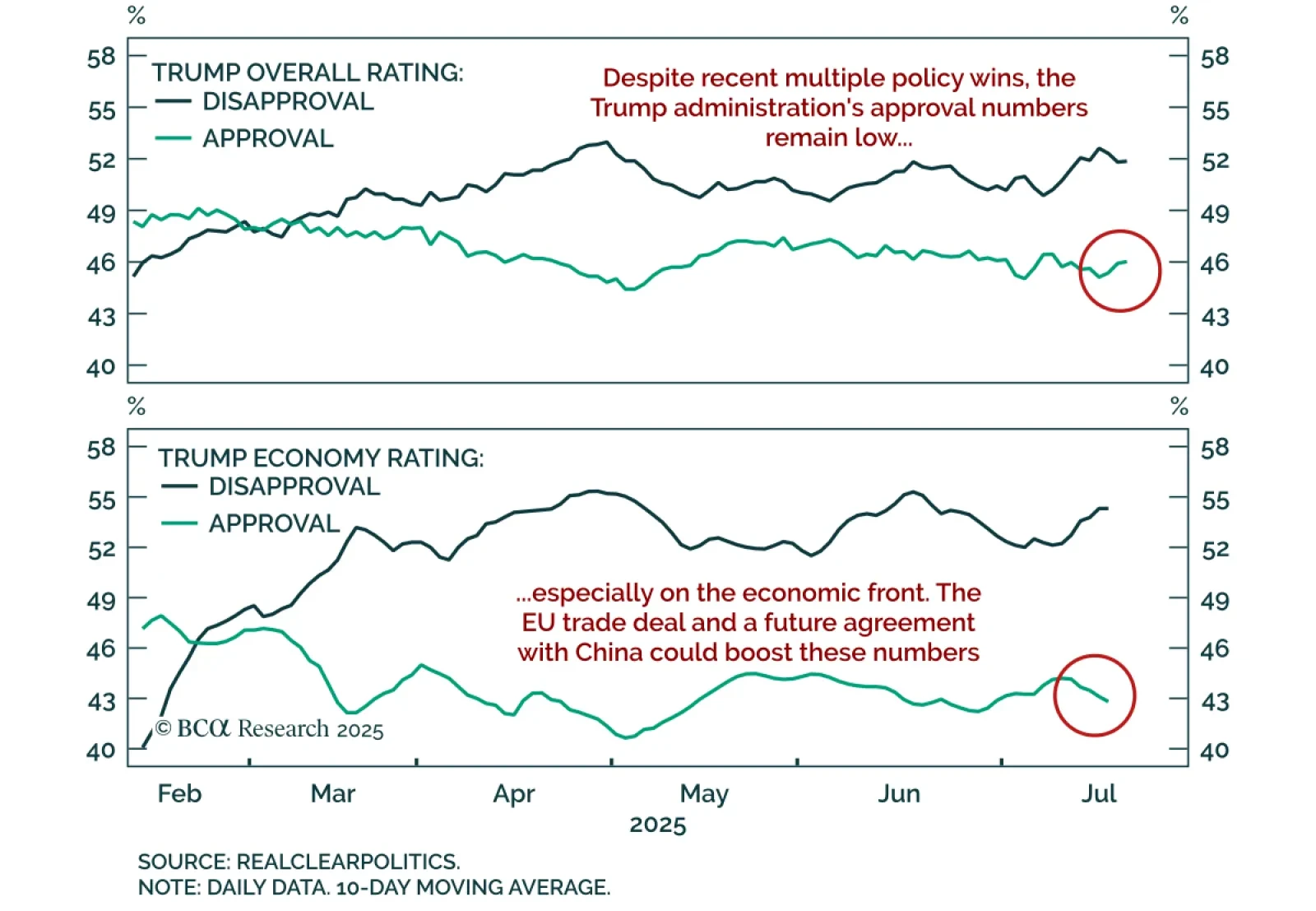

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…