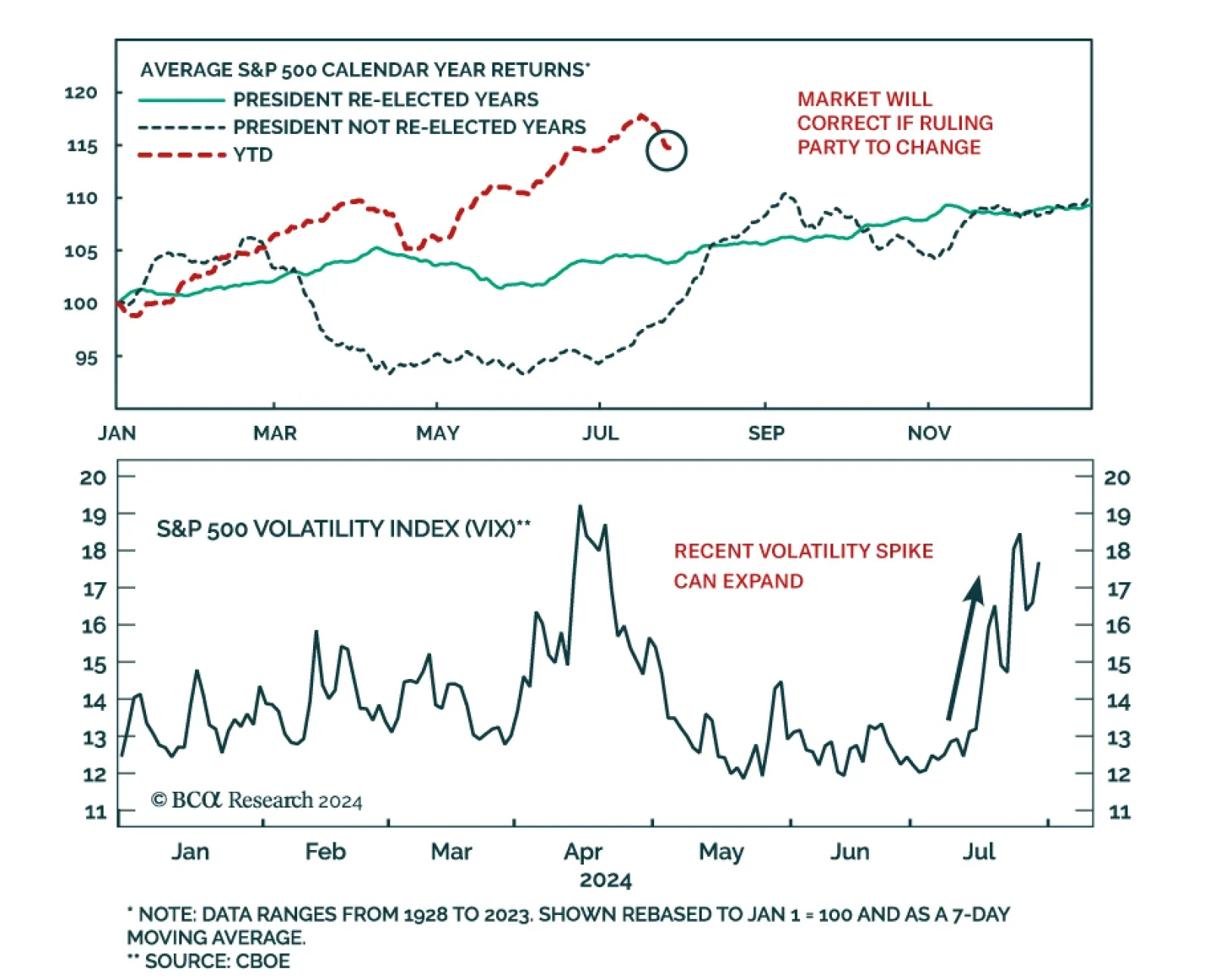

According to BCA Research’s US Equity Strategy service, the stock market outperformance in 2024 thus far is an unusual pattern in election years. The historical data imply that the market will suffer a spill if investors…

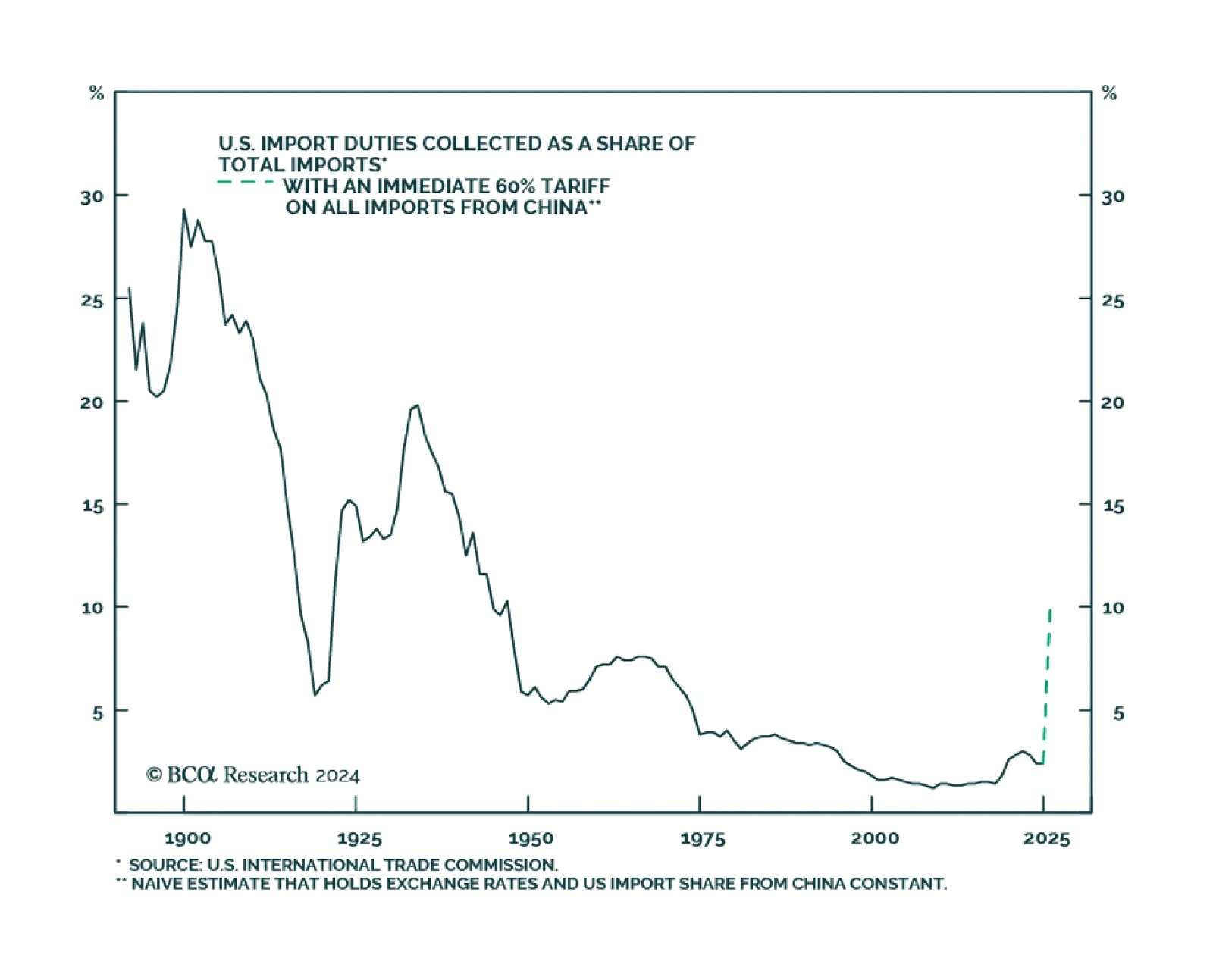

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors. A key question for investors is whether tariffs are…

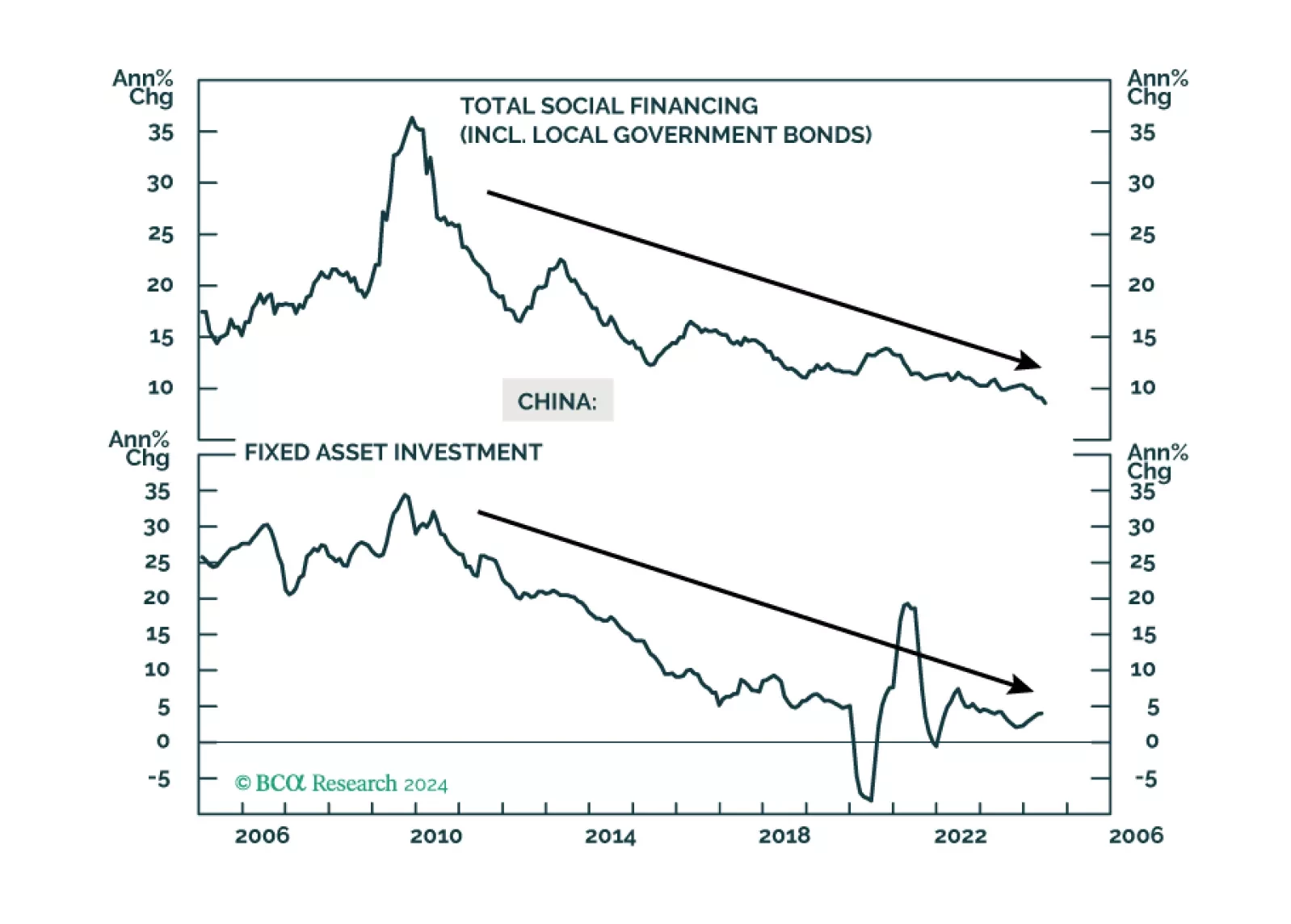

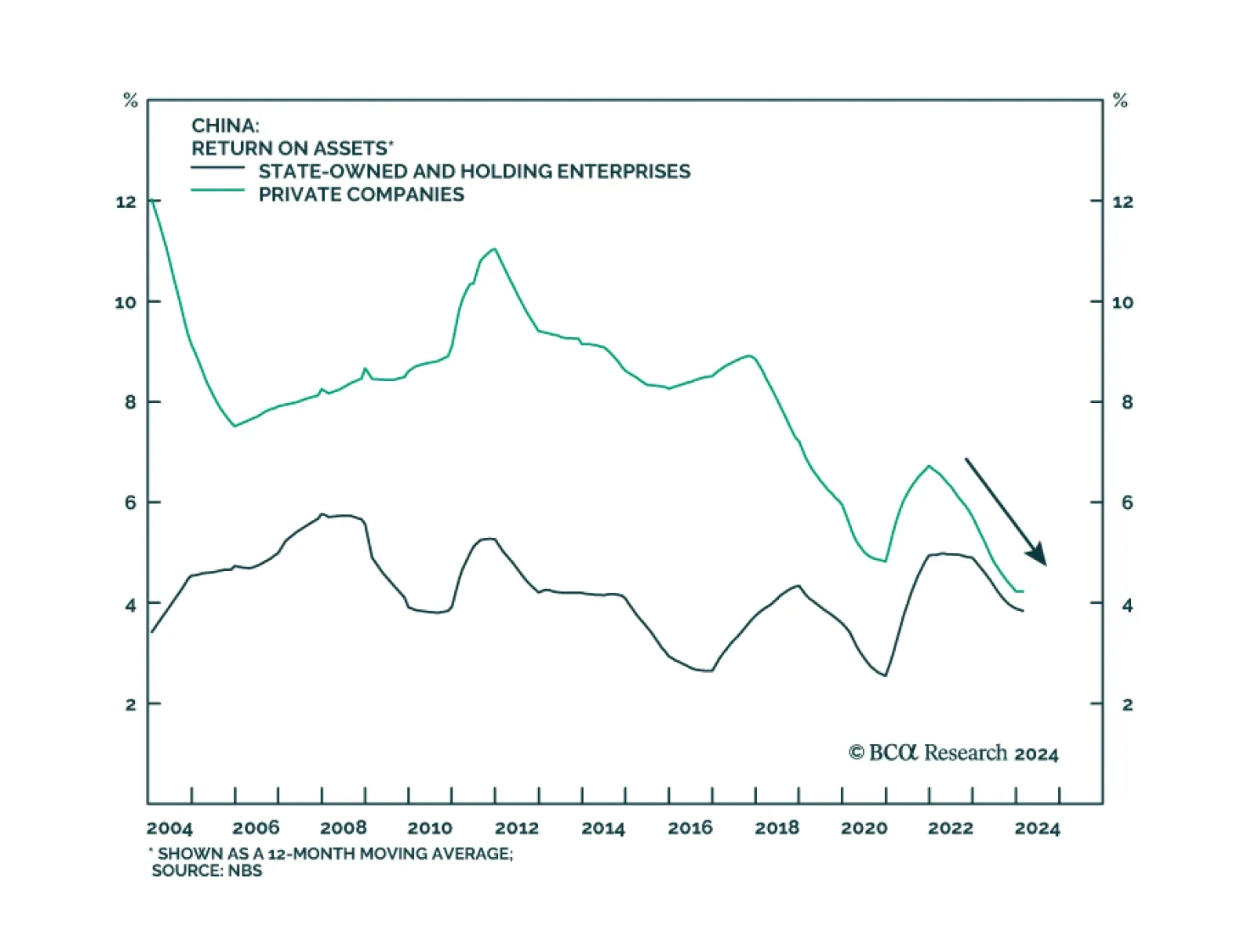

This report provides our framework for interpreting the messages from last week’s Third Plenum, and the potential implications for the economy and investors.

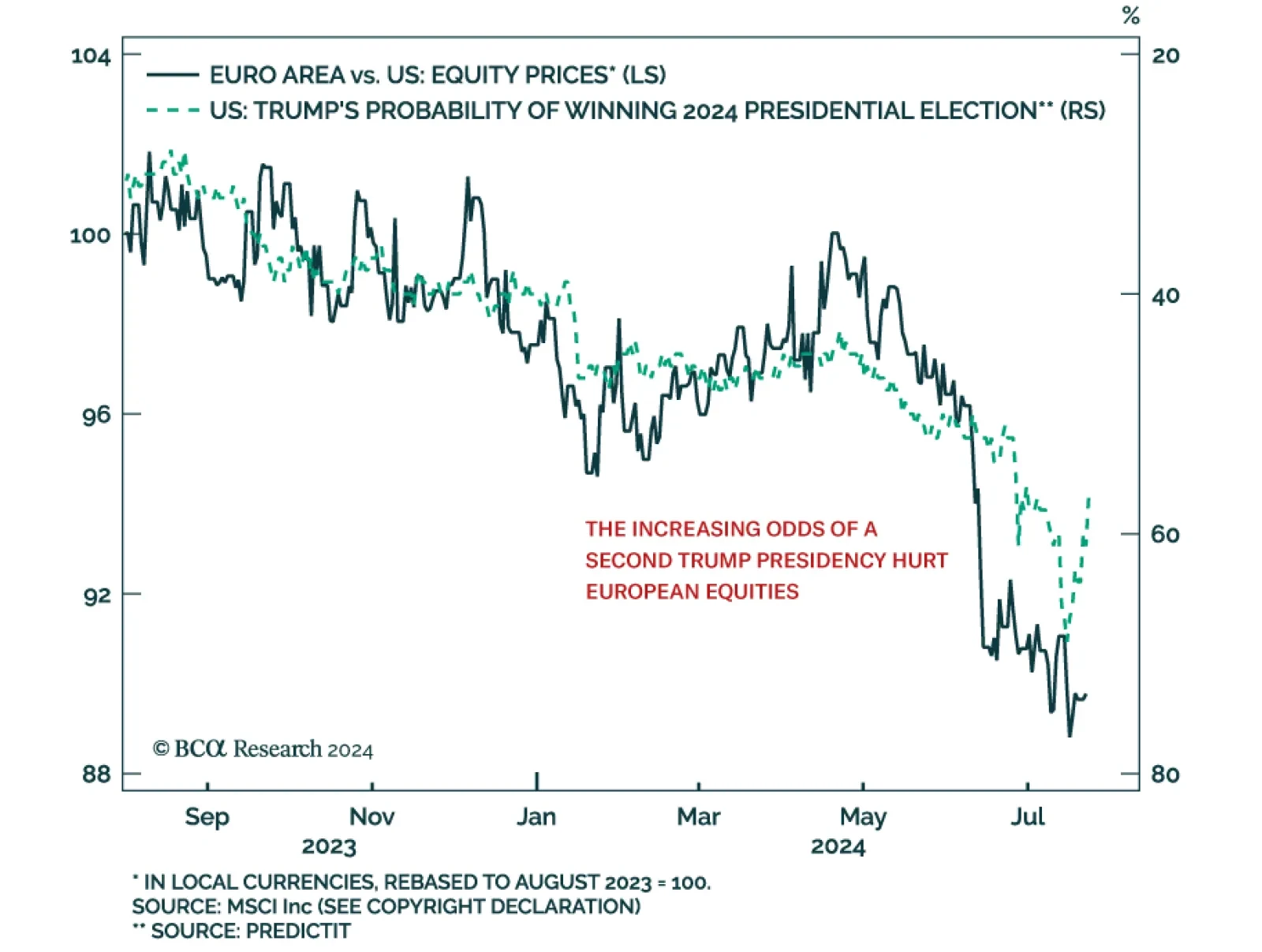

According to BCA Research’s European Investment Strategy service, the impact on global trade from another round of tariffs under a potential Trump administration is an emerging risk to Europe. The underperformance of…

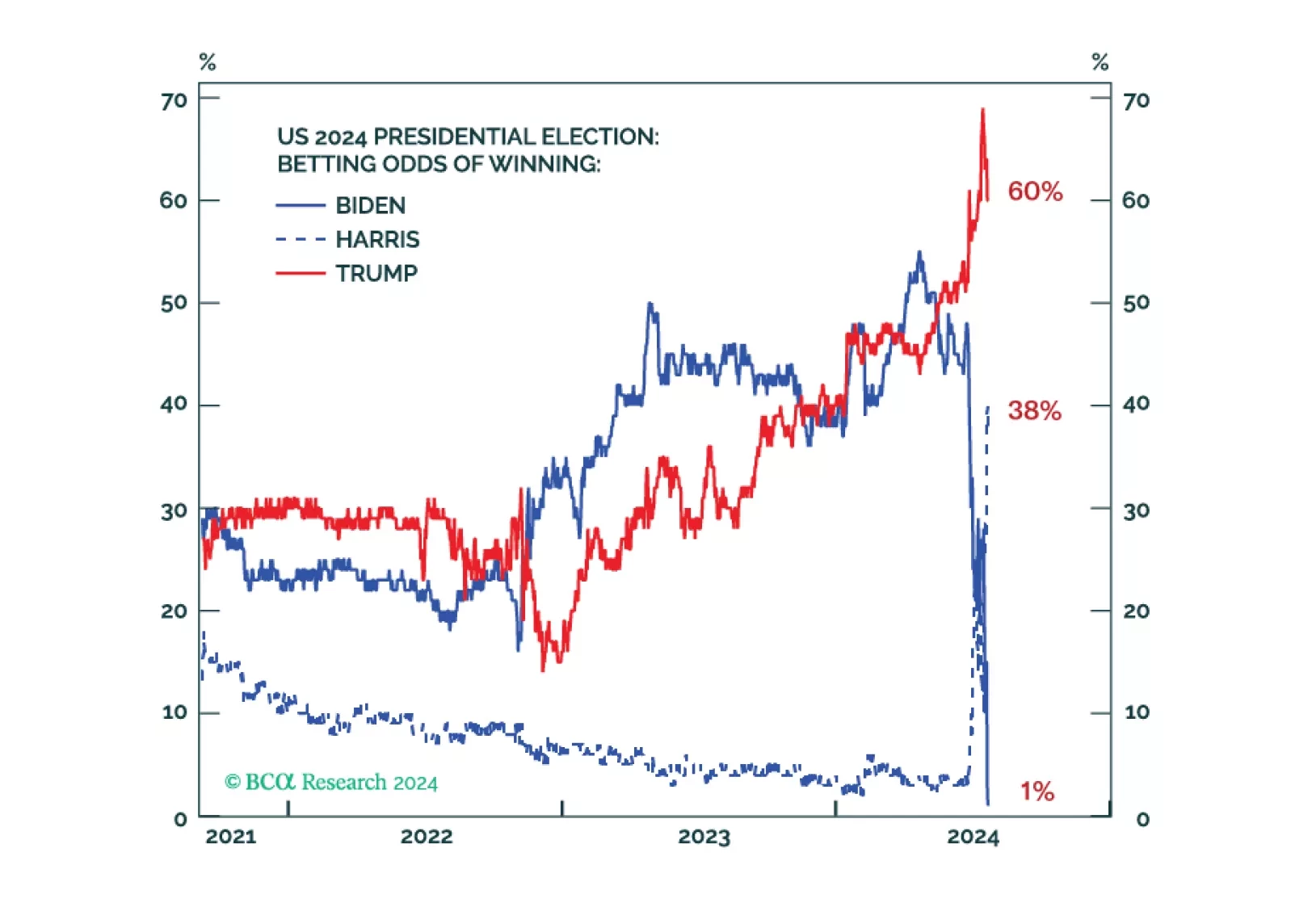

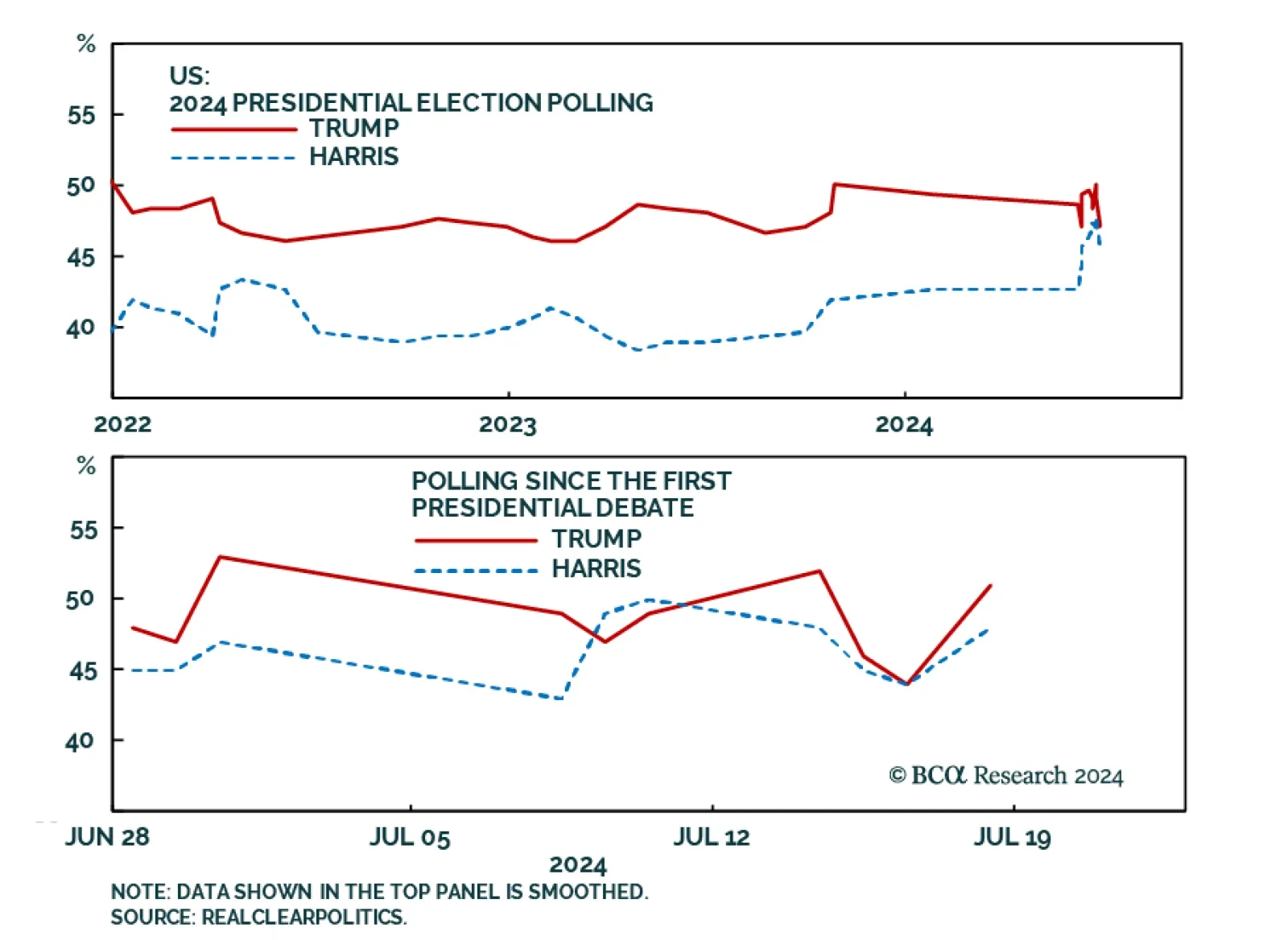

According to BCA Research’s US Political Strategy service, the biggest problem for Democrats is the economy. First, voters around the world have repeatedly voted against ruling parties since the 2022 inflation surge, in…

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

Though hope springs eternal among global investors for big-bang stimulus from Beijing, the closely watched Third Plenum adjourned without any specific prescriptions to reverse China’s economic slump. The communiqu…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.