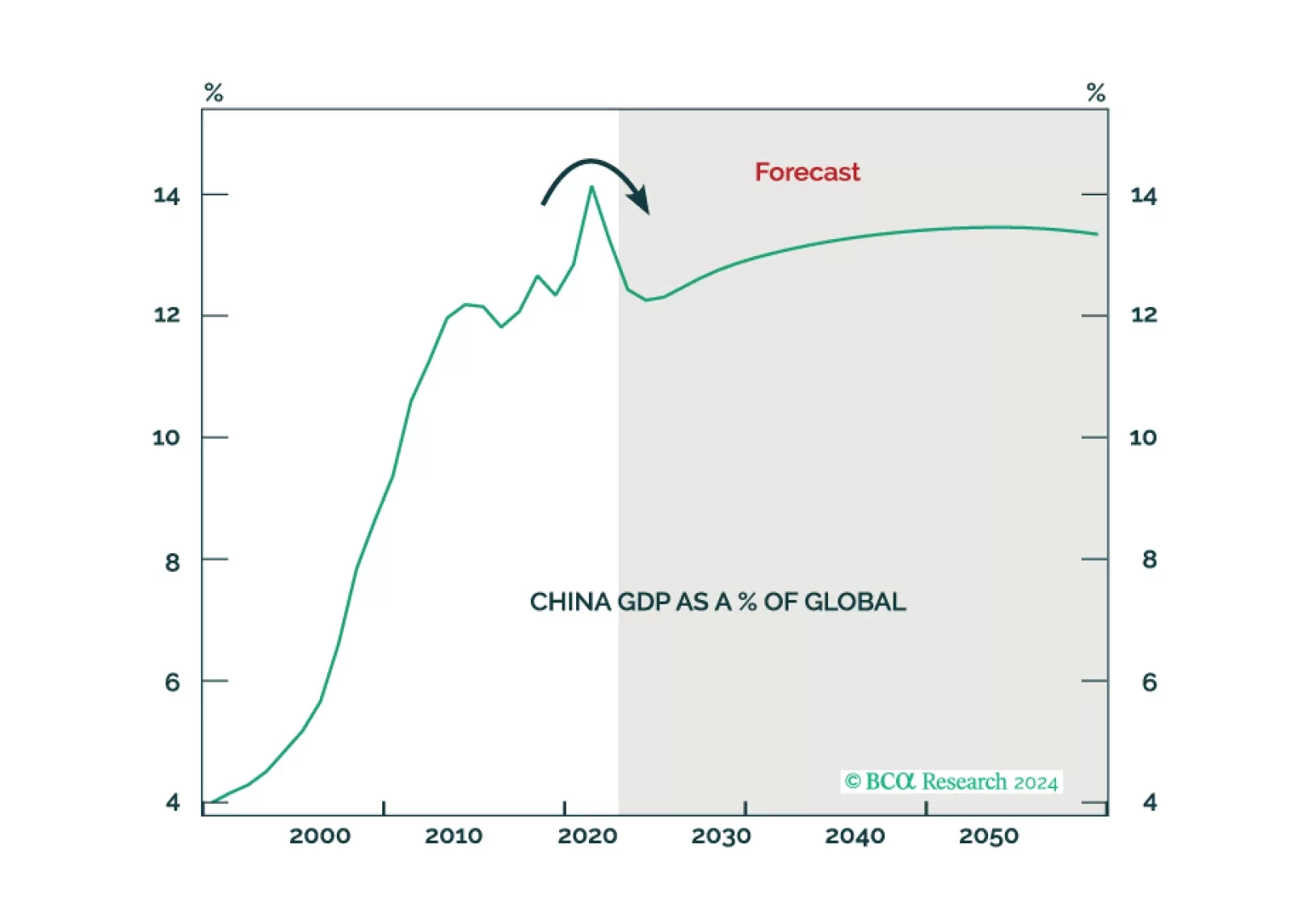

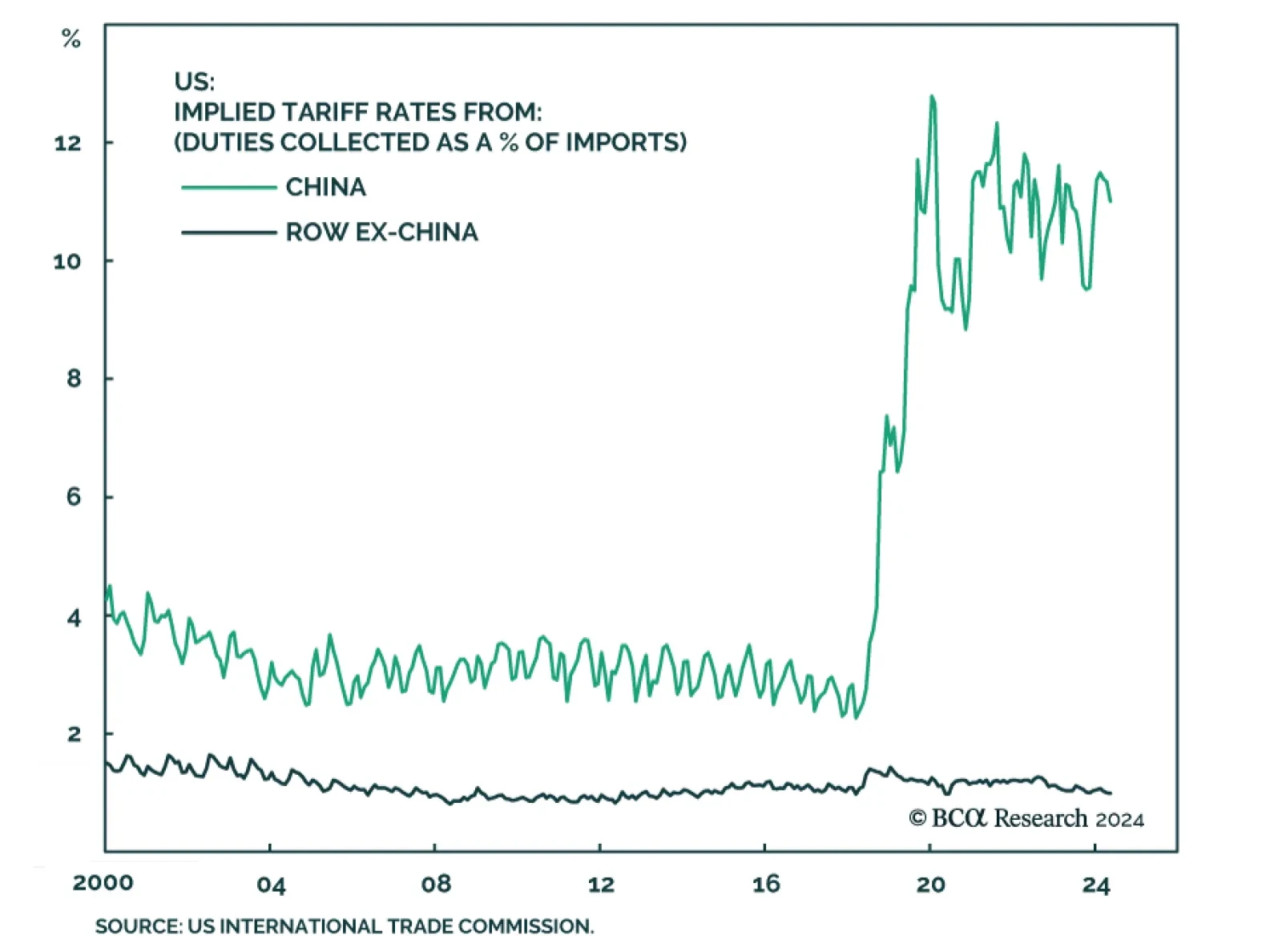

According to BCA Research’s Geopolitical Strategy service, Trump’s brand, legacy, and populist movement are based on the popular demand for a more hawkish US policy on trade and immigration. China has been the chief…

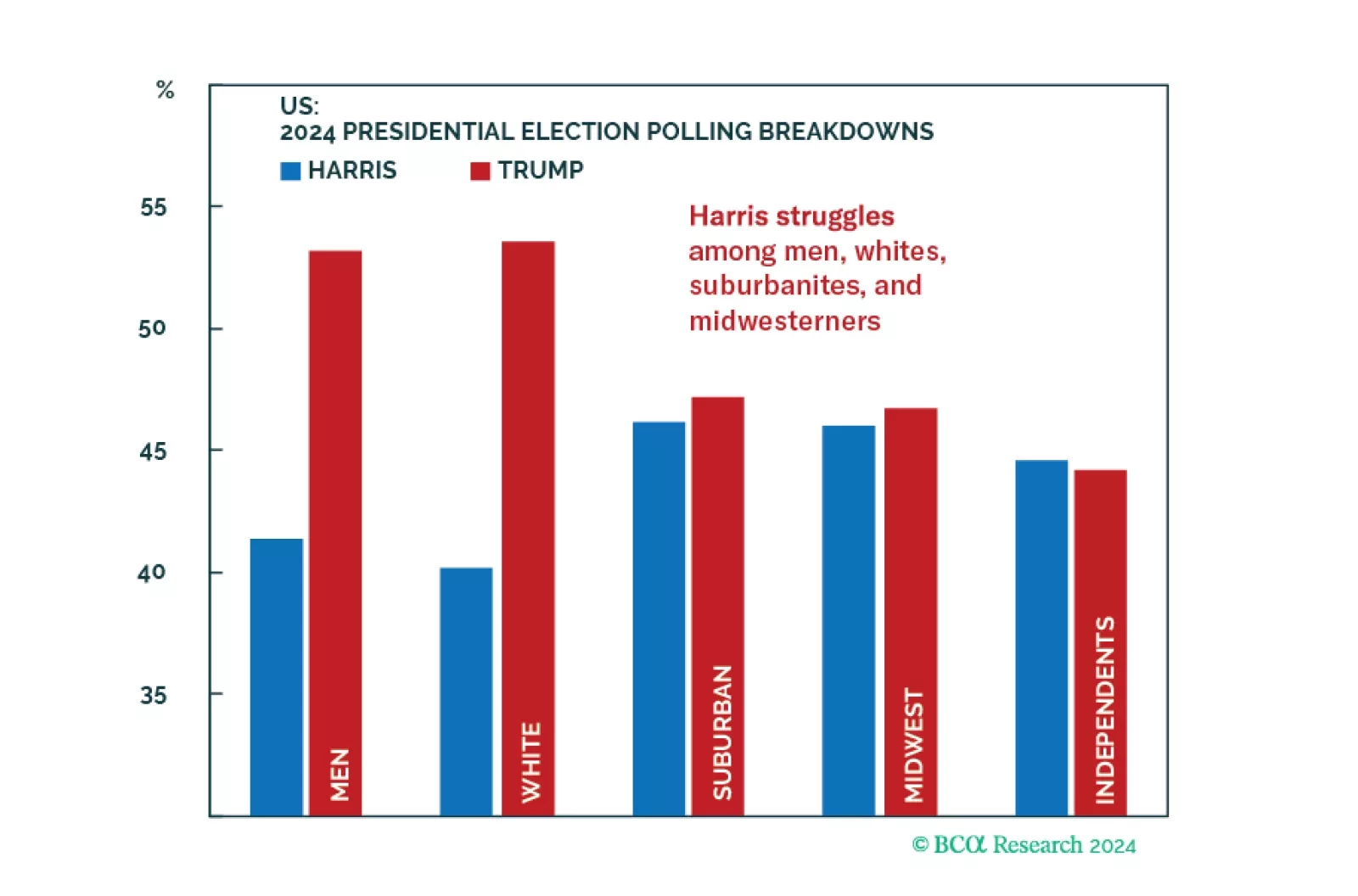

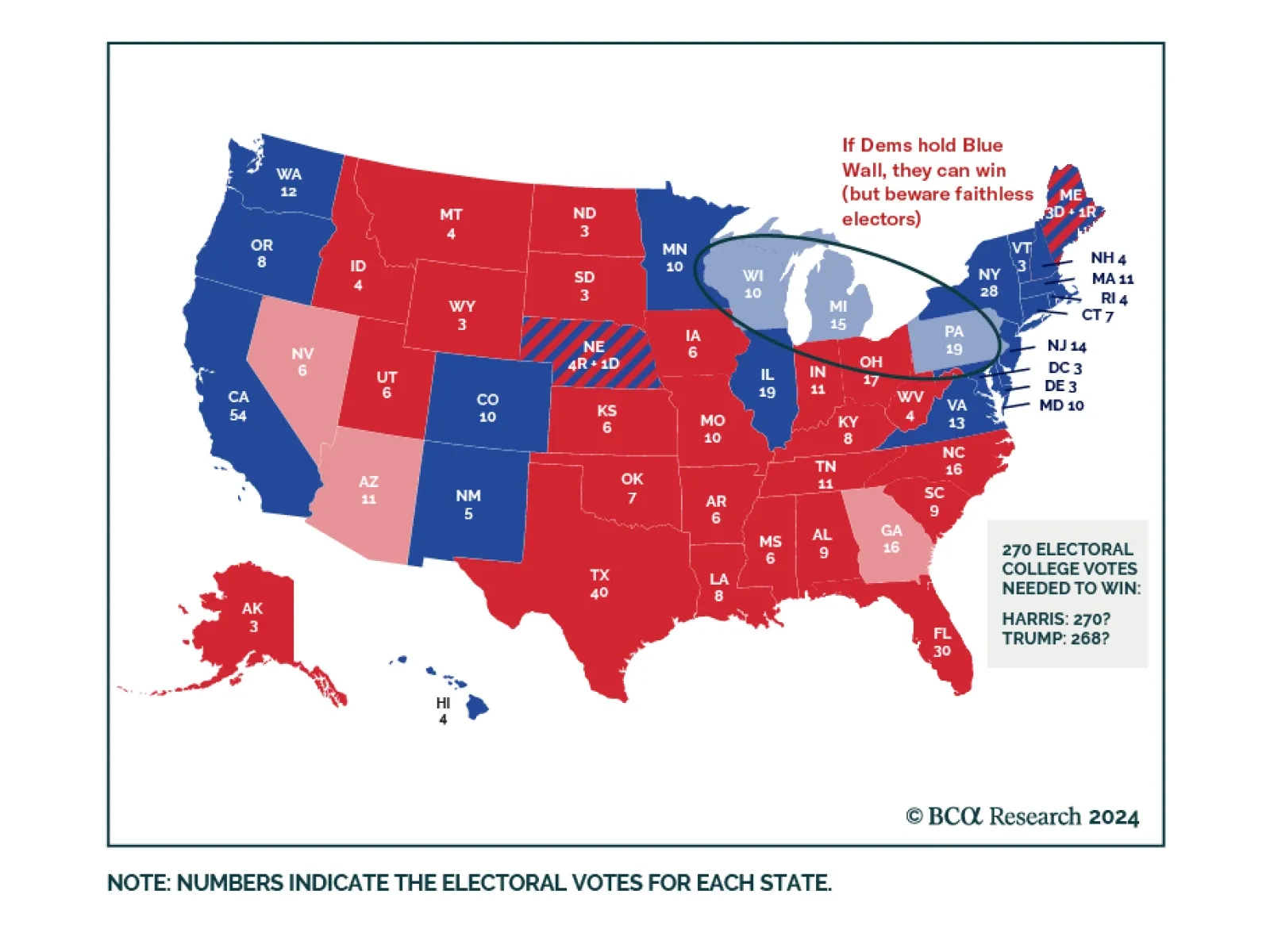

According to BCA Research’s US Political Strategy service, there is a strange quirk about Walz and the state of Nebraska that could have national consequences in the black swan scenario of an electoral college tie. Walz…

Harris picked Walz to patch up her weak side in the electorally vital Midwest. But the US election will continue to weigh on risk appetite, stocks, and high-beta assets because the odds of a single-party sweep are at least 50%,…

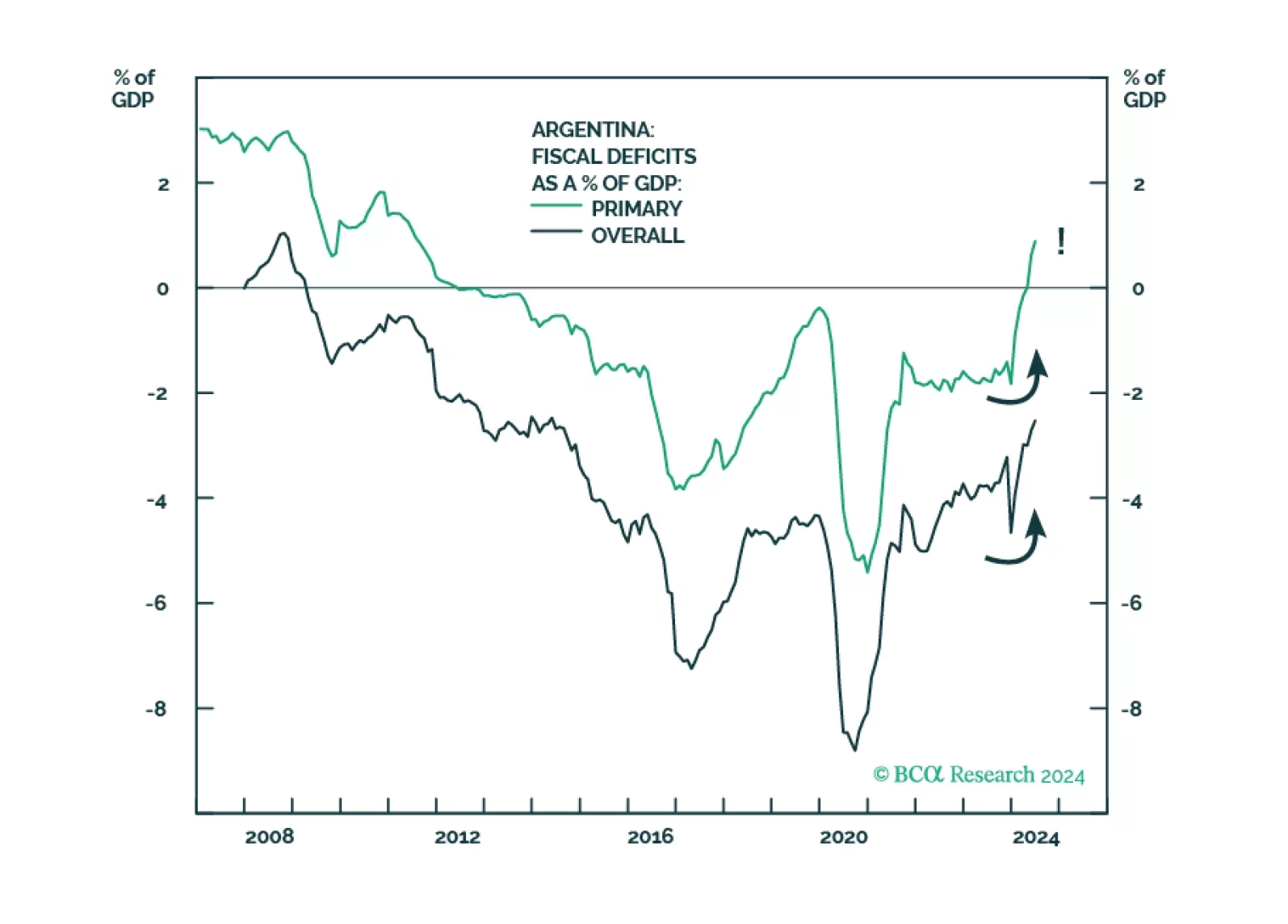

GeoMacro team partners with BCA’s Emerging Markets Strategy to examine political reforms in Argentina. Our colleague Juan Egaña argues that the time is not right to go long Argentinian assets and that Buenos Aires must avoid the…

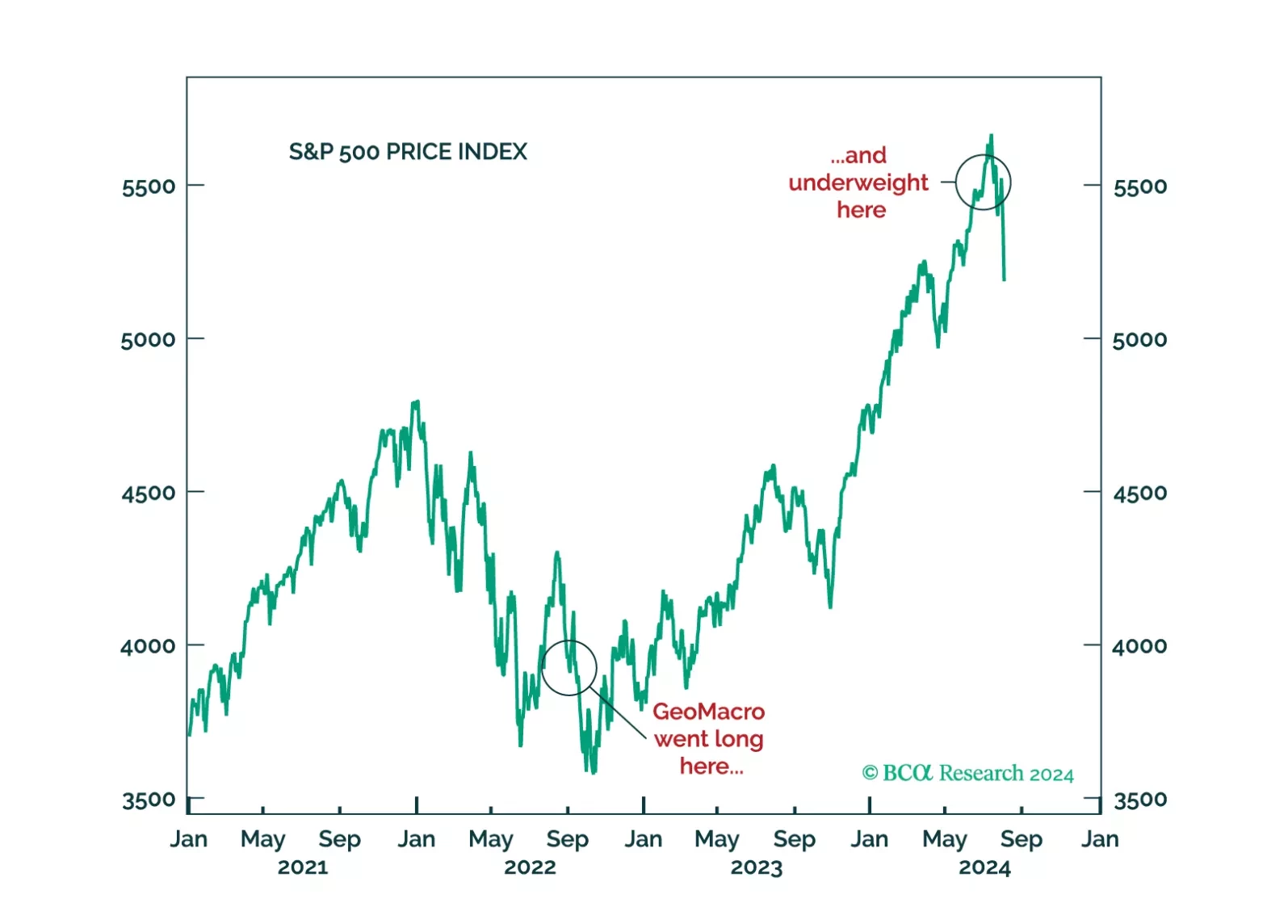

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…

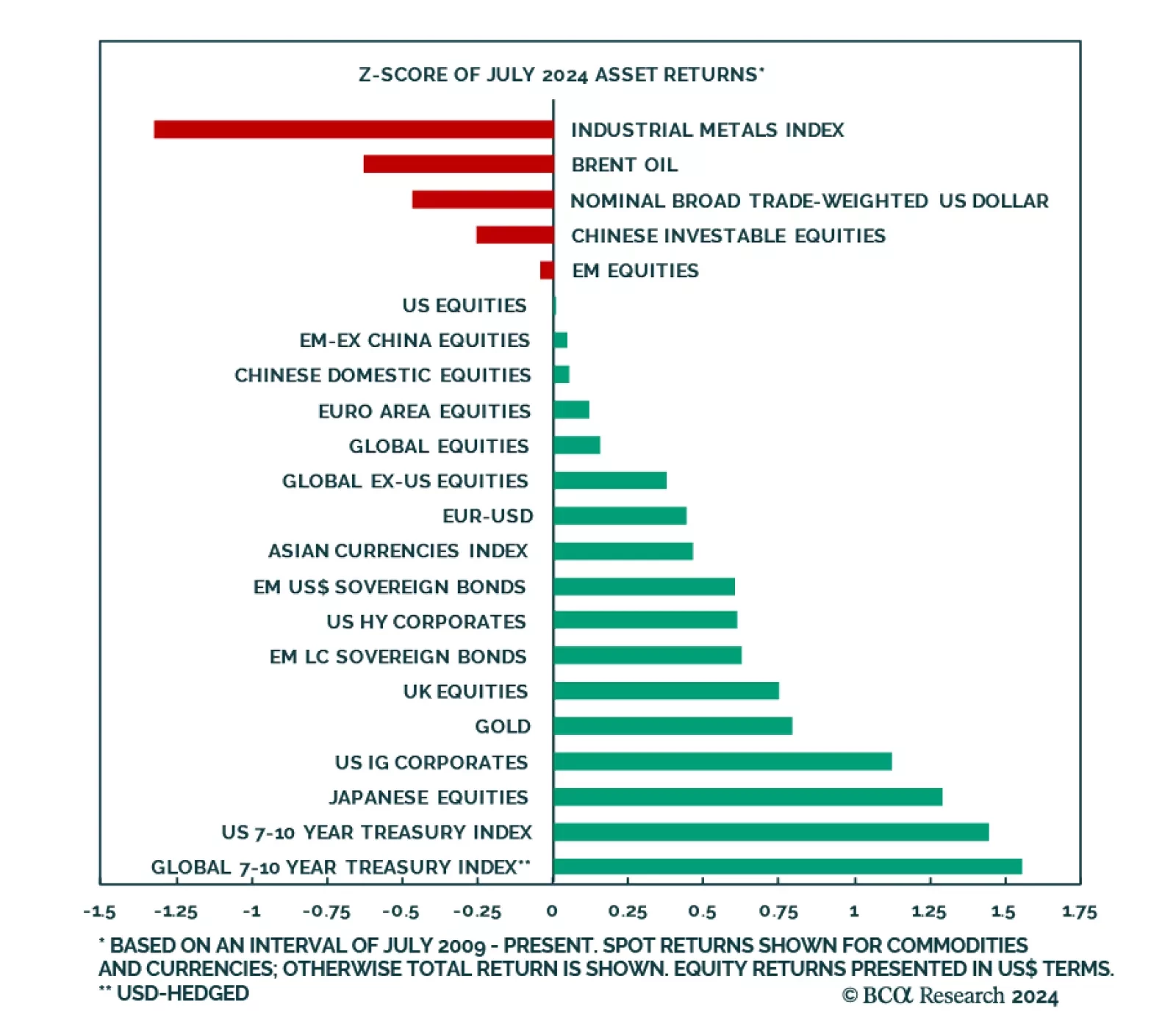

No clear risk-on/risk-off pattern emerged from July’s market performance data. On the one hand, consistent with a risk-off environment, US bonds ranked highest in the monthly return distribution, while pro-cyclical…

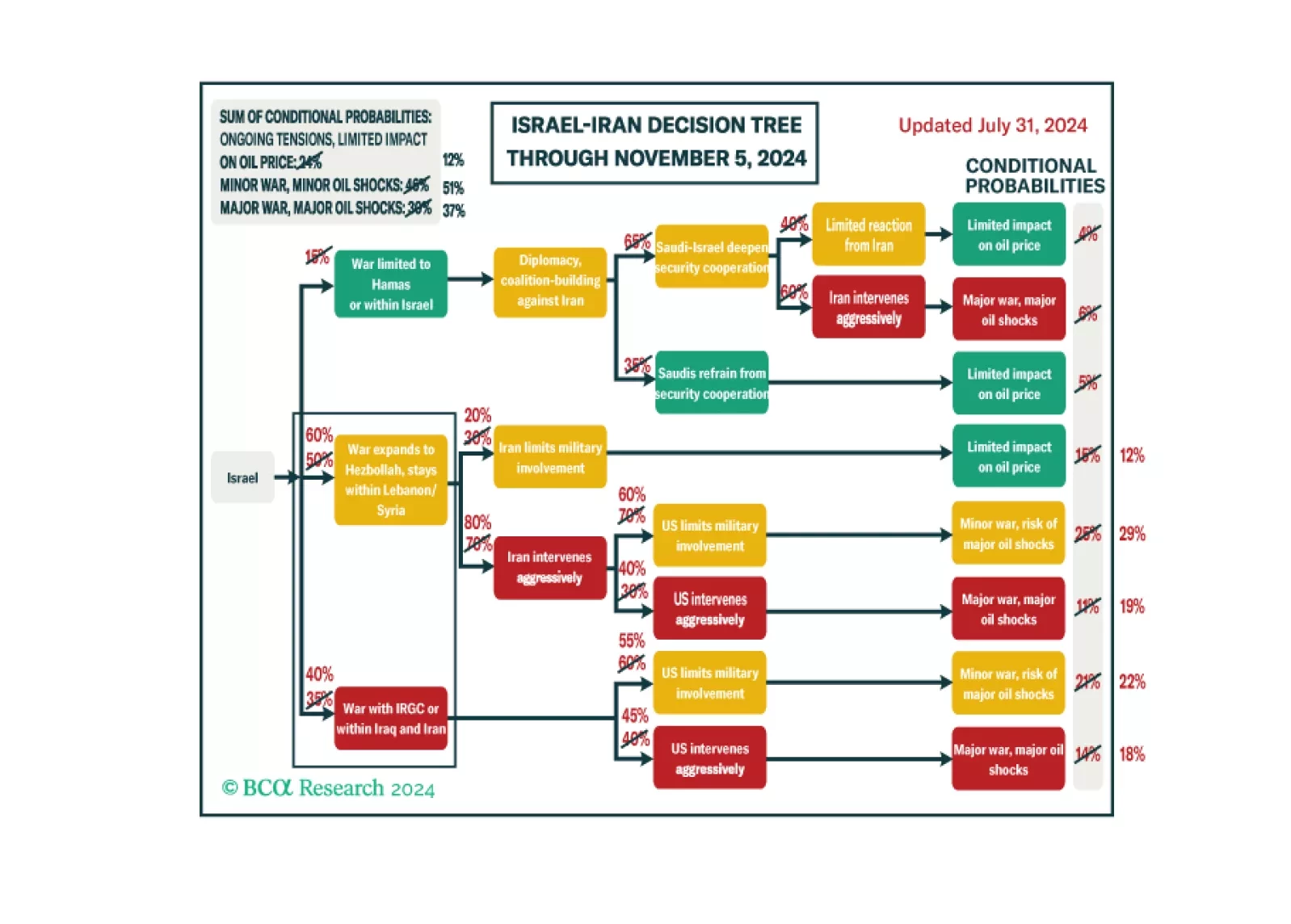

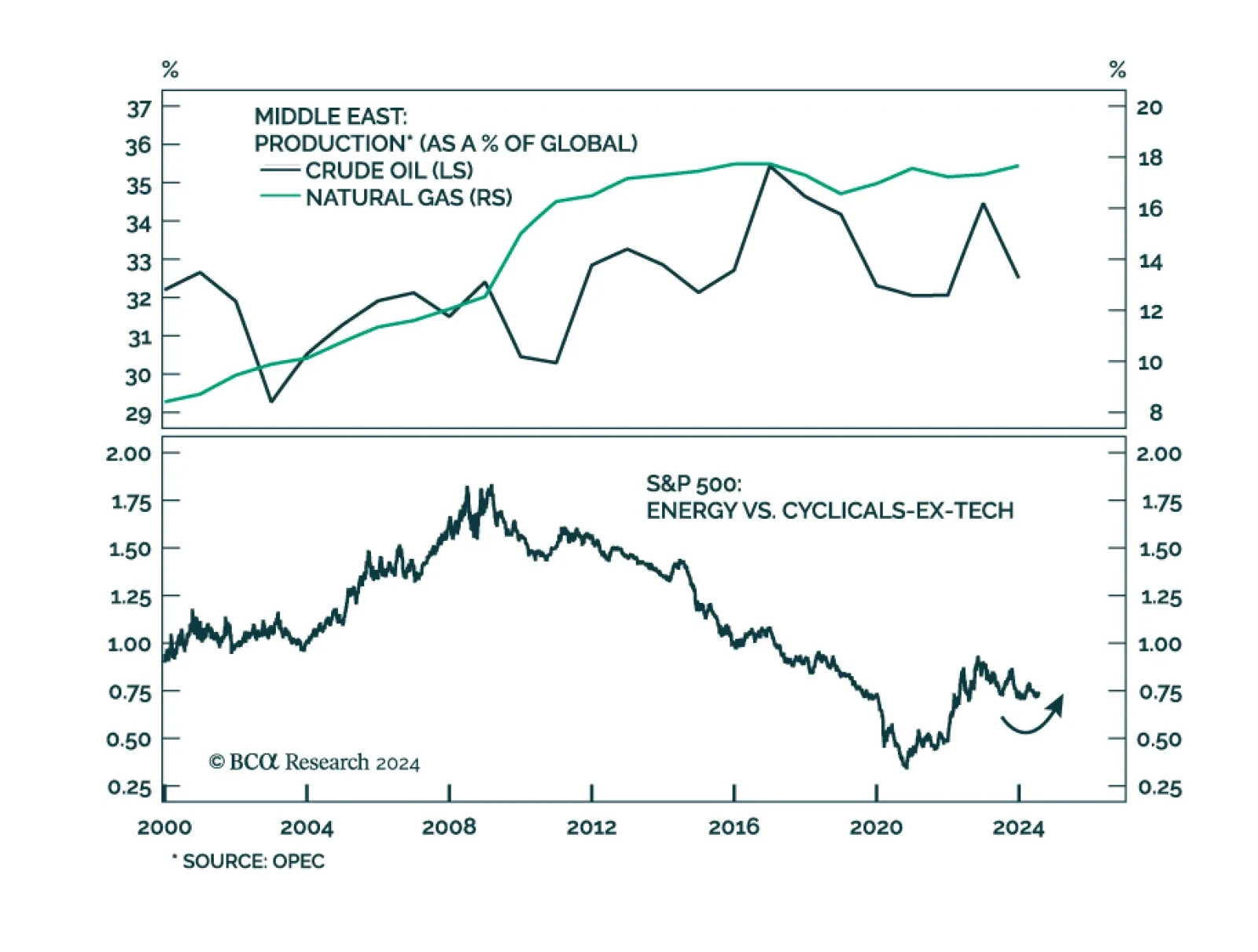

Following the recent escalation in the Middle East conflict, BCA Research’s Geopolitical Strategy service upgrades its subjective odds of a major oil supply shock to 37%. Volatility should spike again as investors…

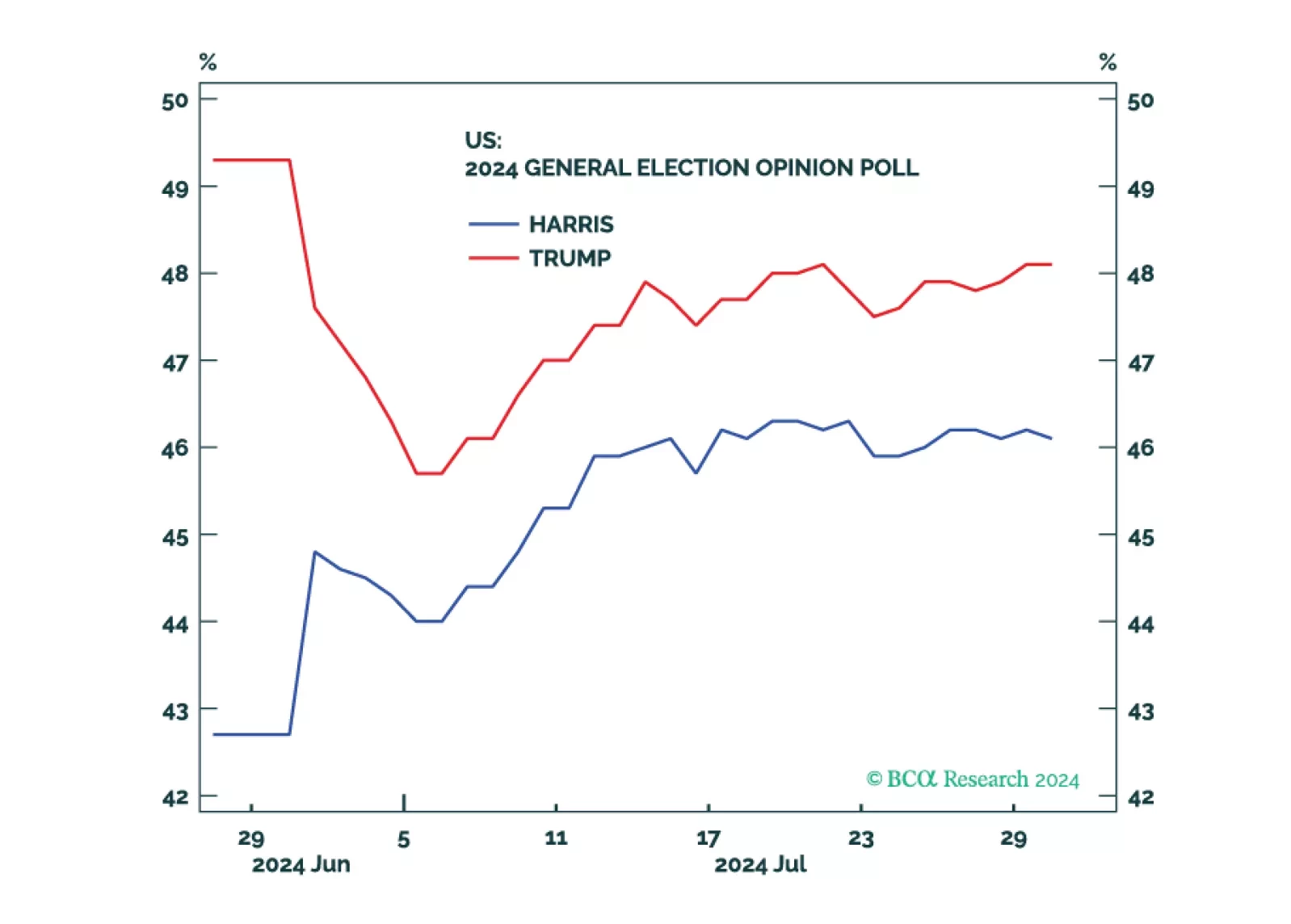

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.