Regular readers are familiar with our expectations for a global recession over the cyclical investment timeframe. A global downturn is overwhelmingly bearish for oil demand. The supply side, on the other hand, is…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

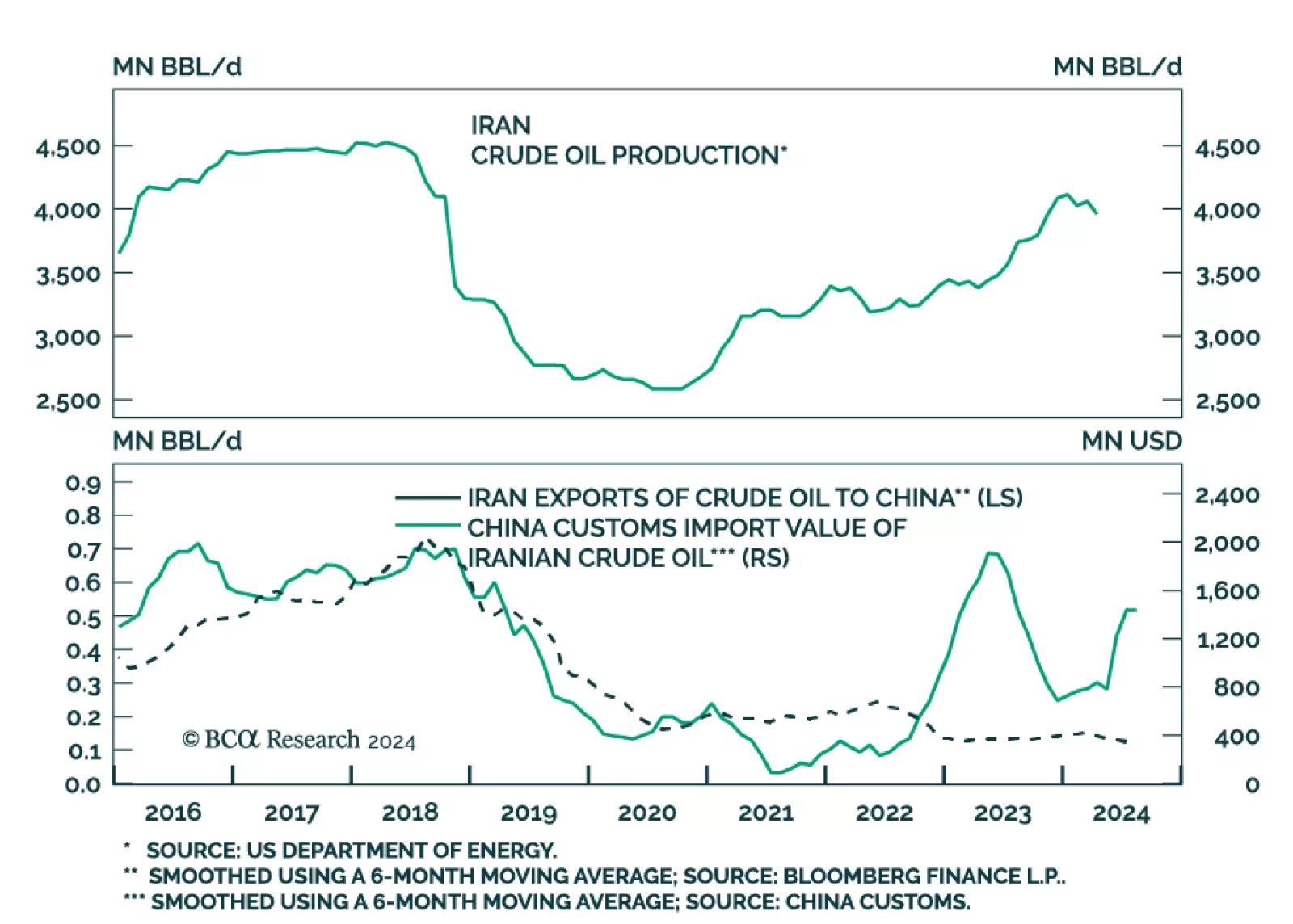

According to BCA Research’s Geopolitical Strategy service, the Biden administration’s outreach to Iran will fail. The war in the Middle East has expanded as our colleagues predicted: Israel attacked Lebanon. Now…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

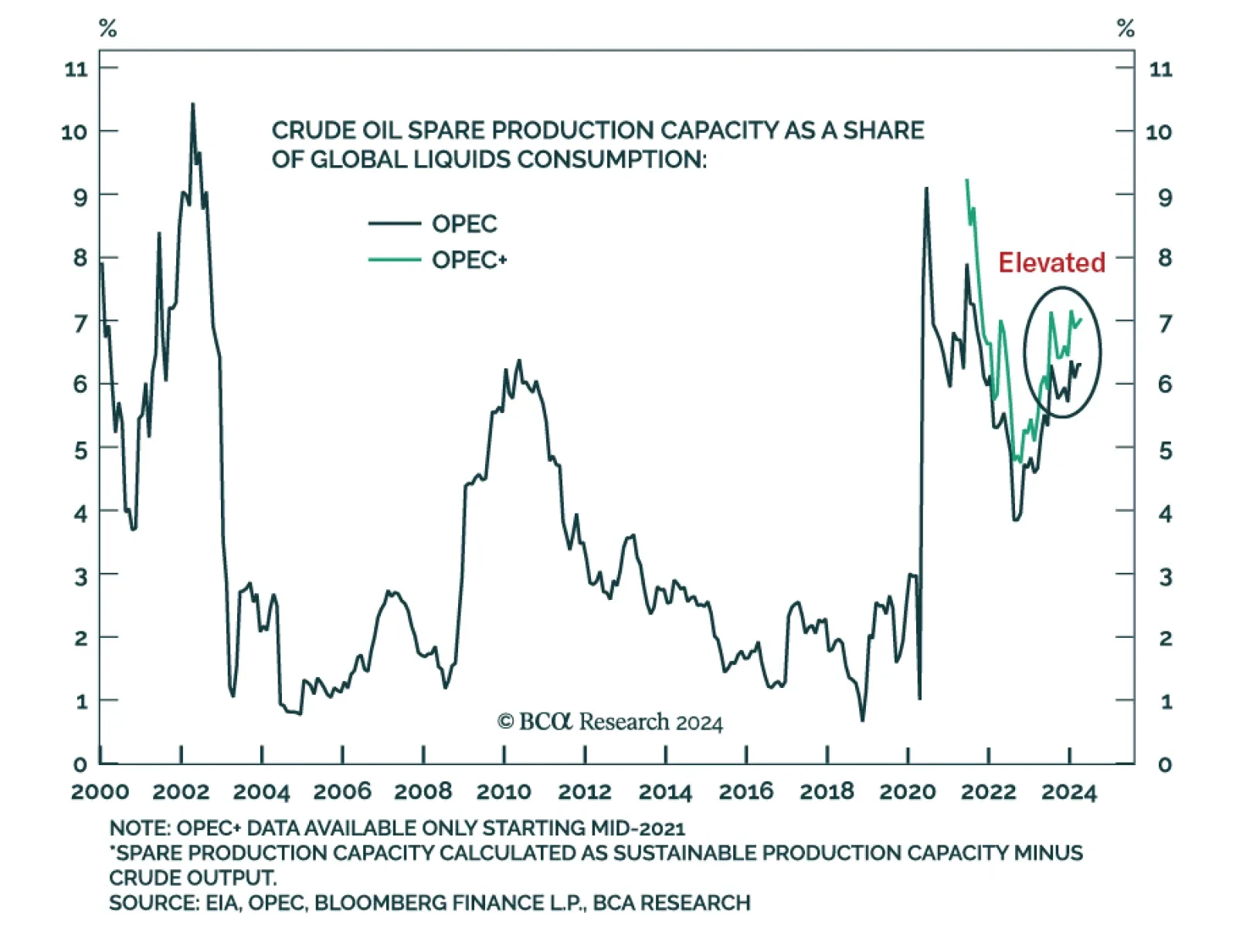

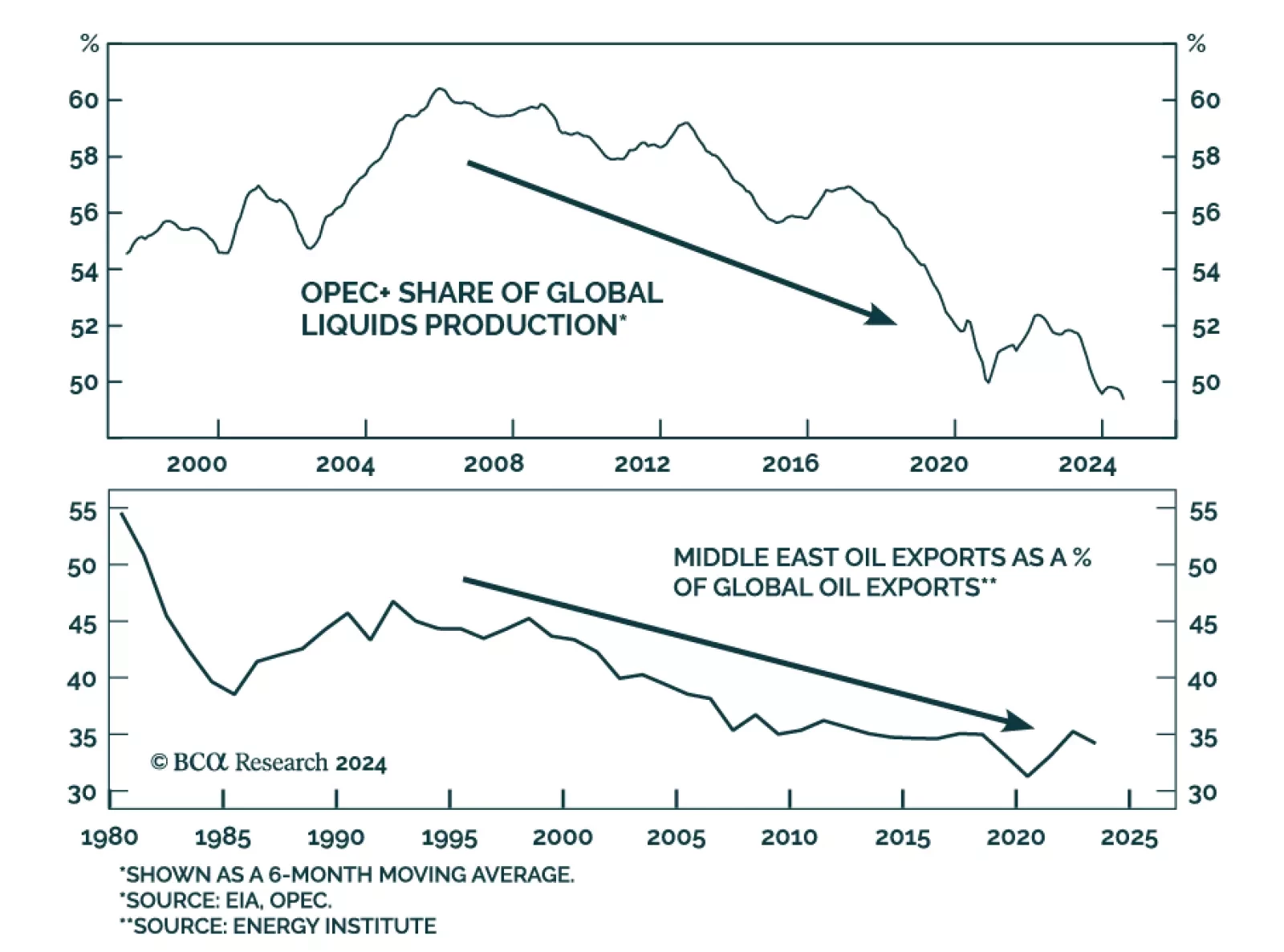

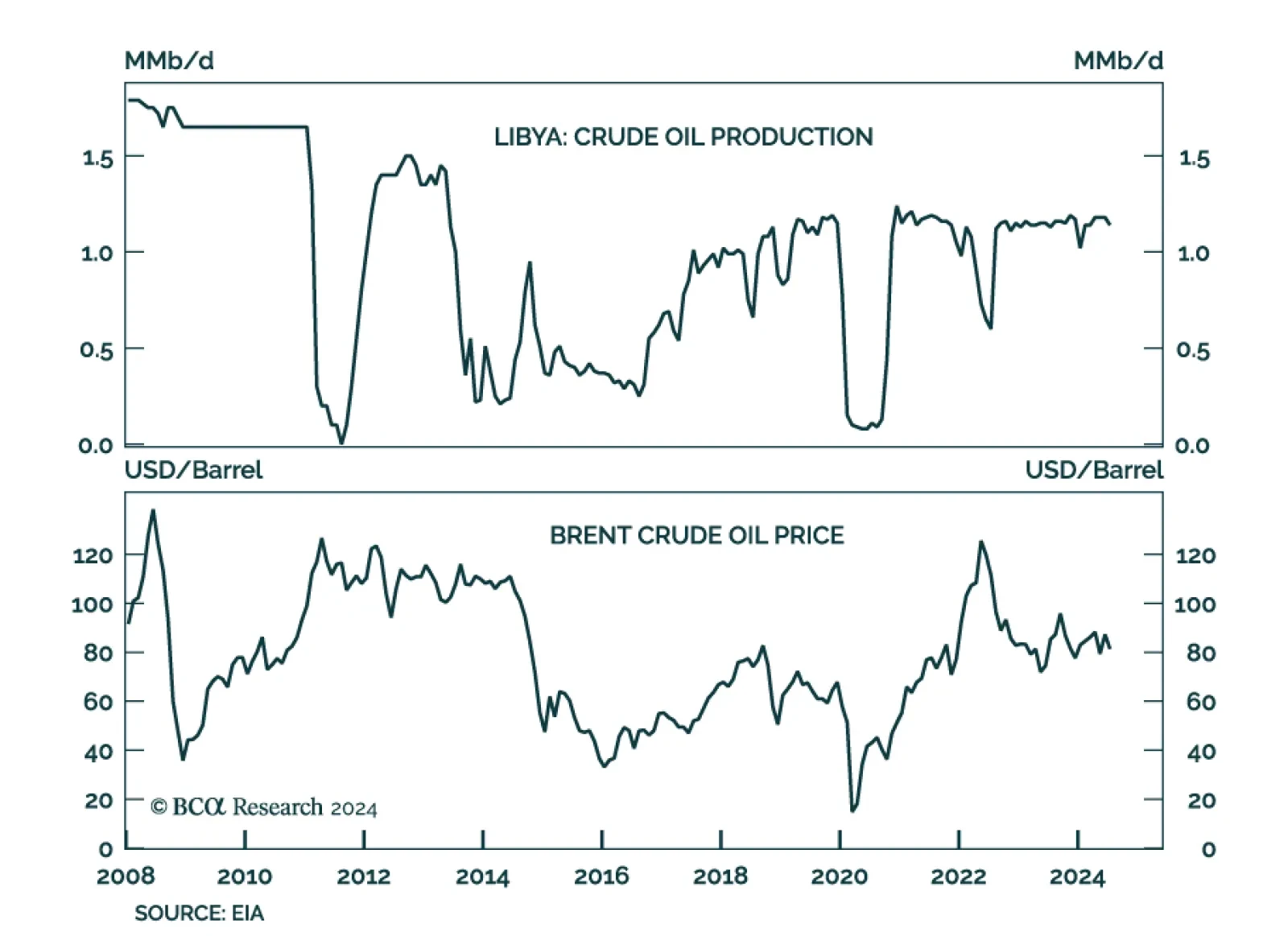

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

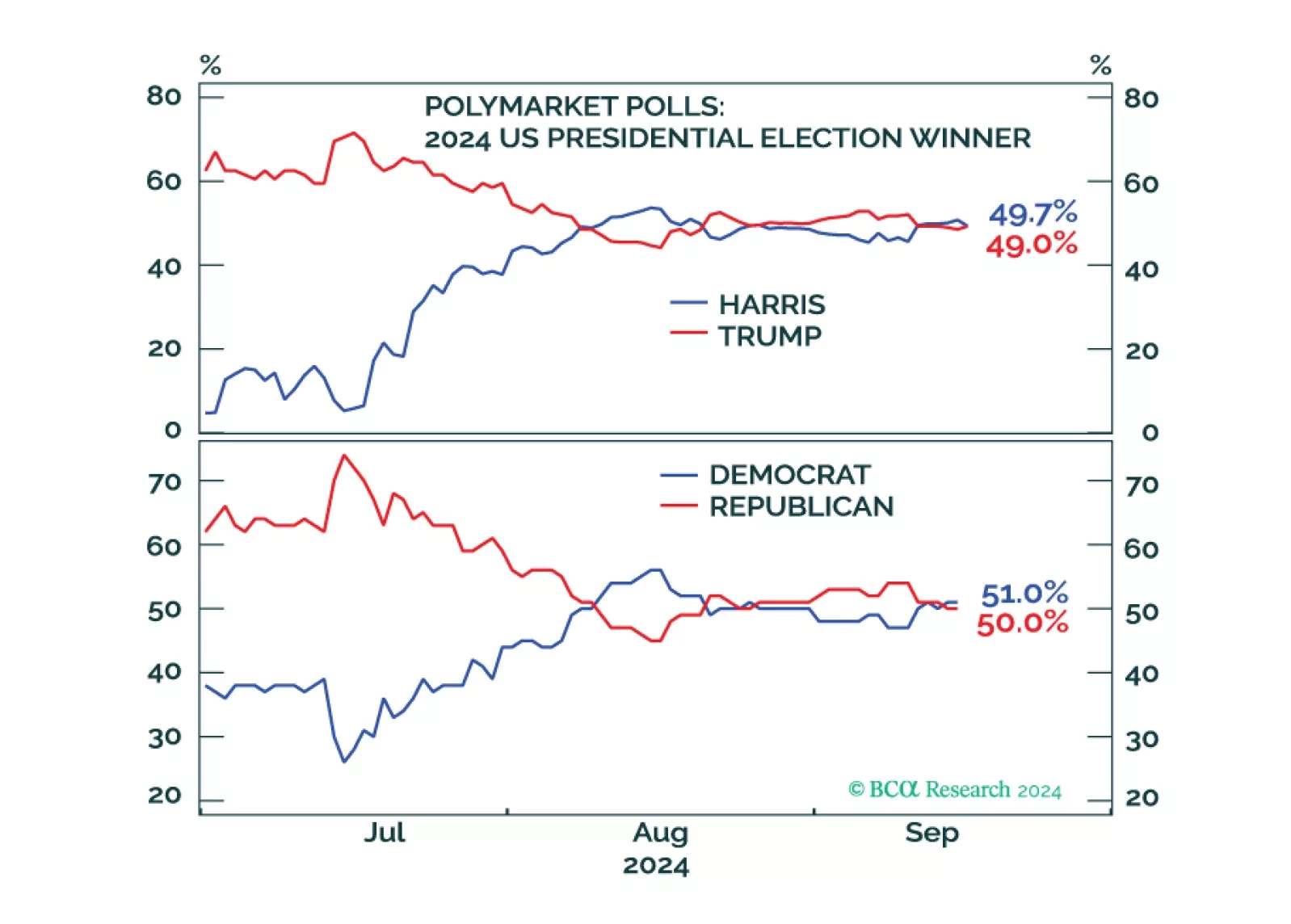

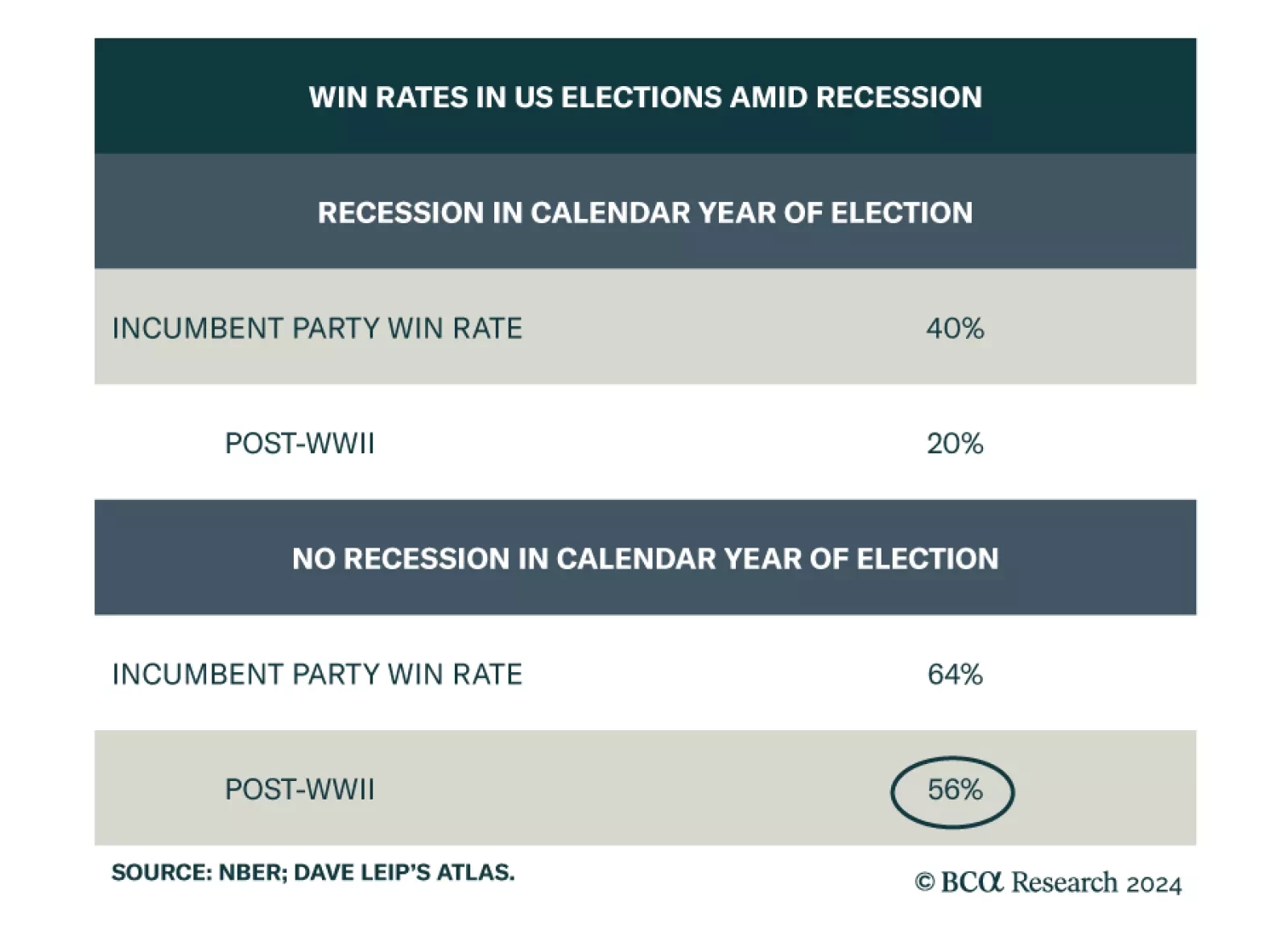

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

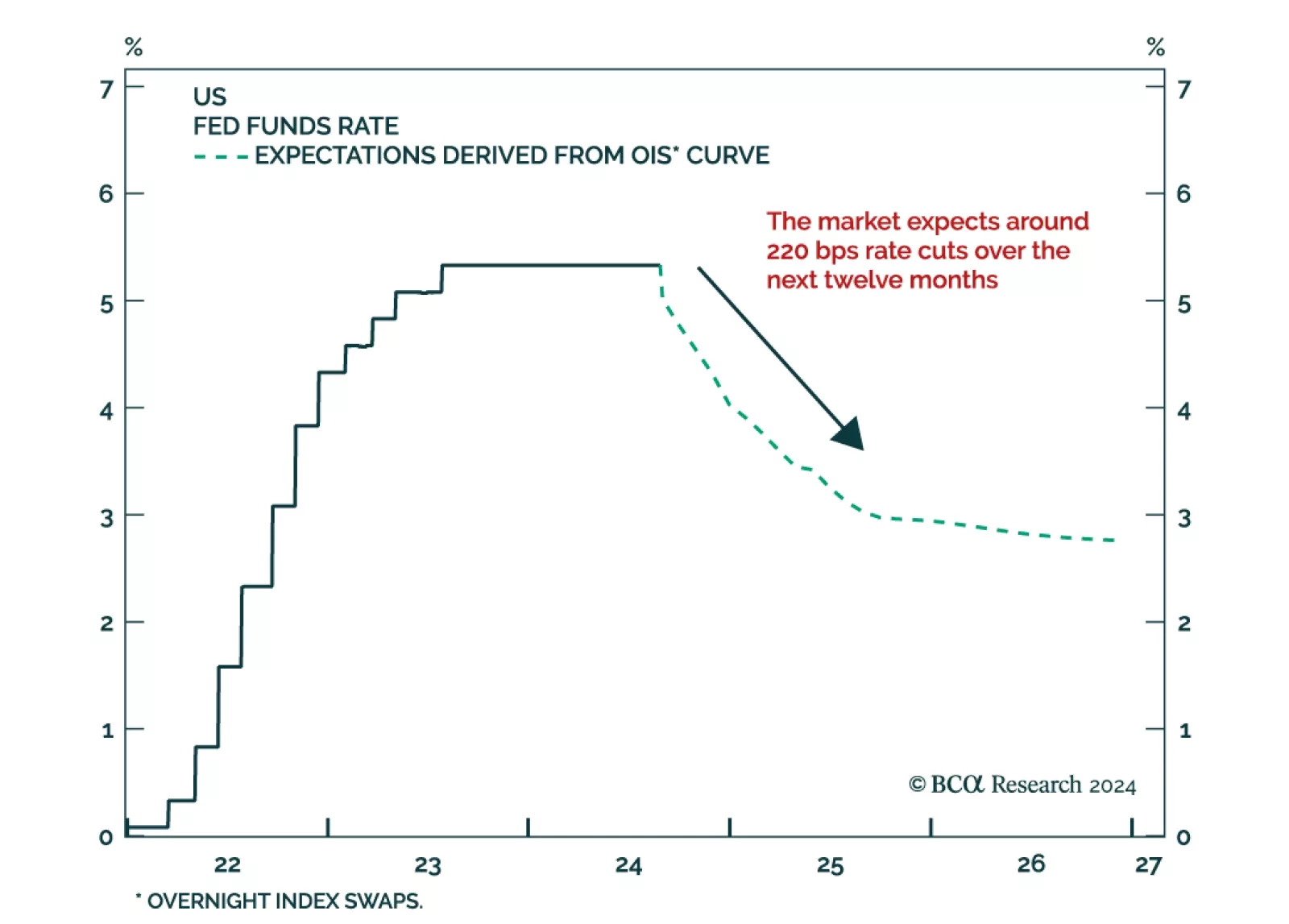

The market is currently expecting the Fed to cut rates by 100 bps over the course of 2024 and by another 120 bps throughout the first eight months of 2025. However, our Global Investment strategists expect the extent of 2024…

According to BCA Research’s Commodity & Energy Strategy service, oil markets are caught in a tug-of-war that has kept oil prices in a trading range since H2 2023. Bearish demand concerns are enforcing an upper limit on…

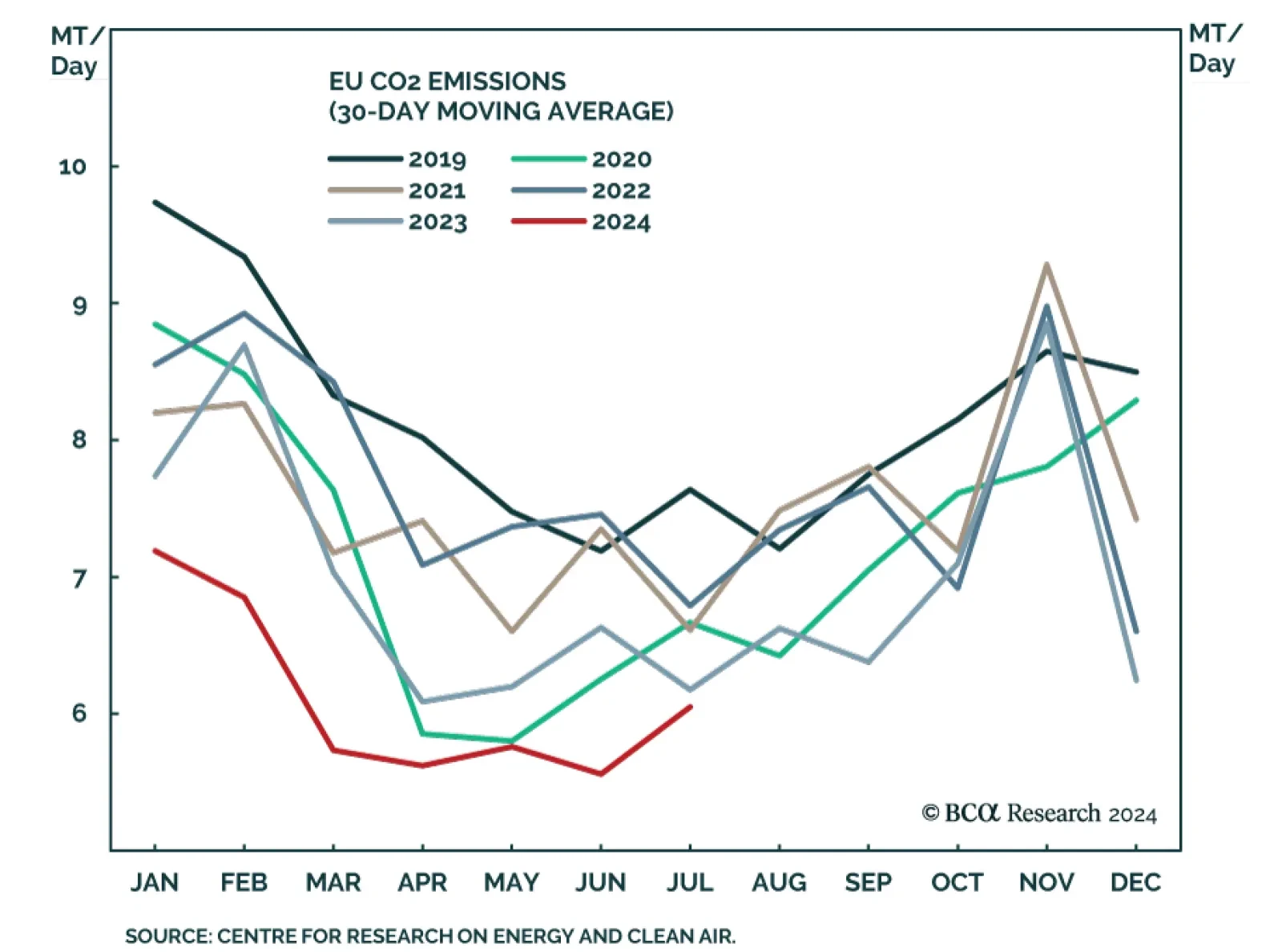

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…