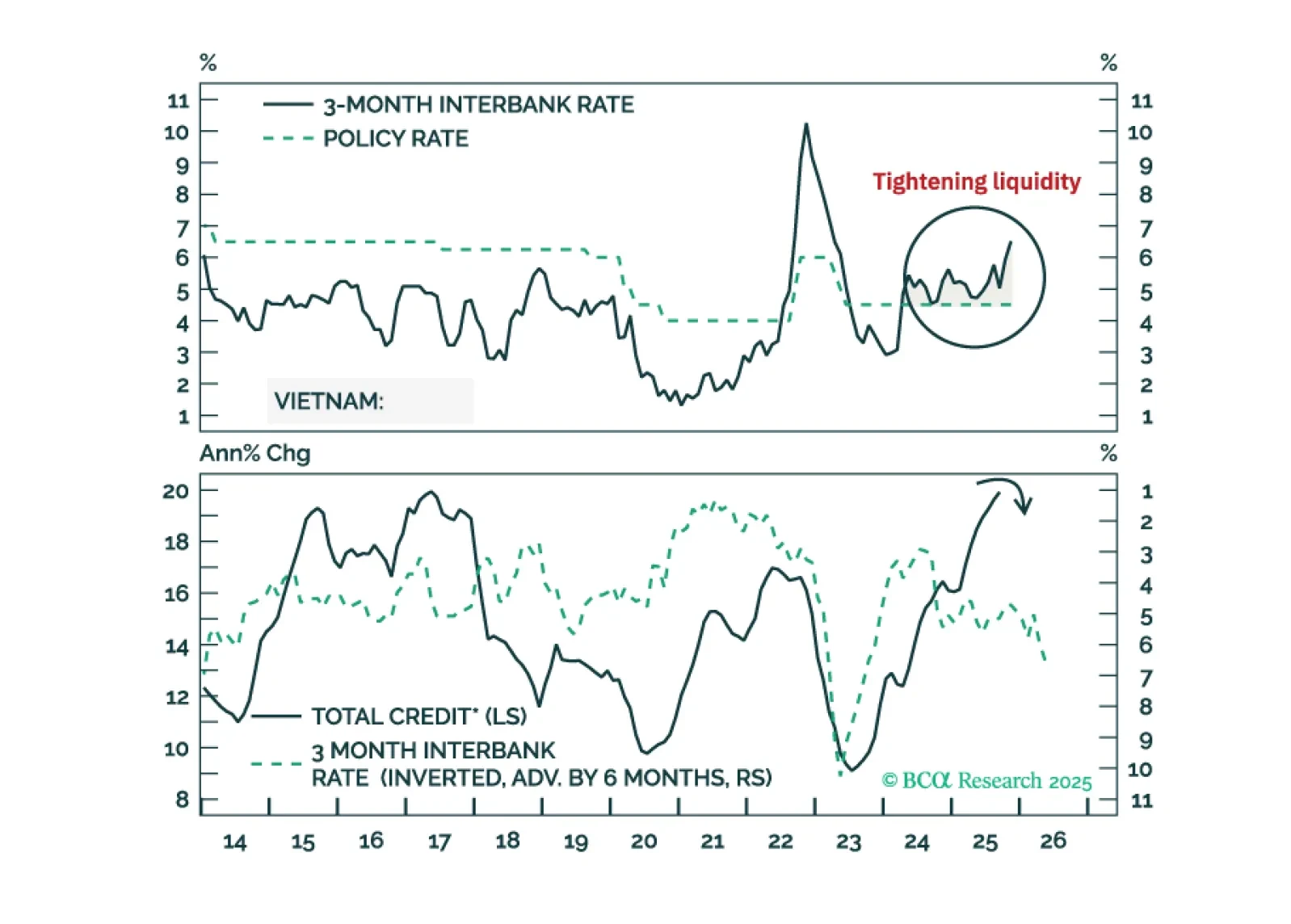

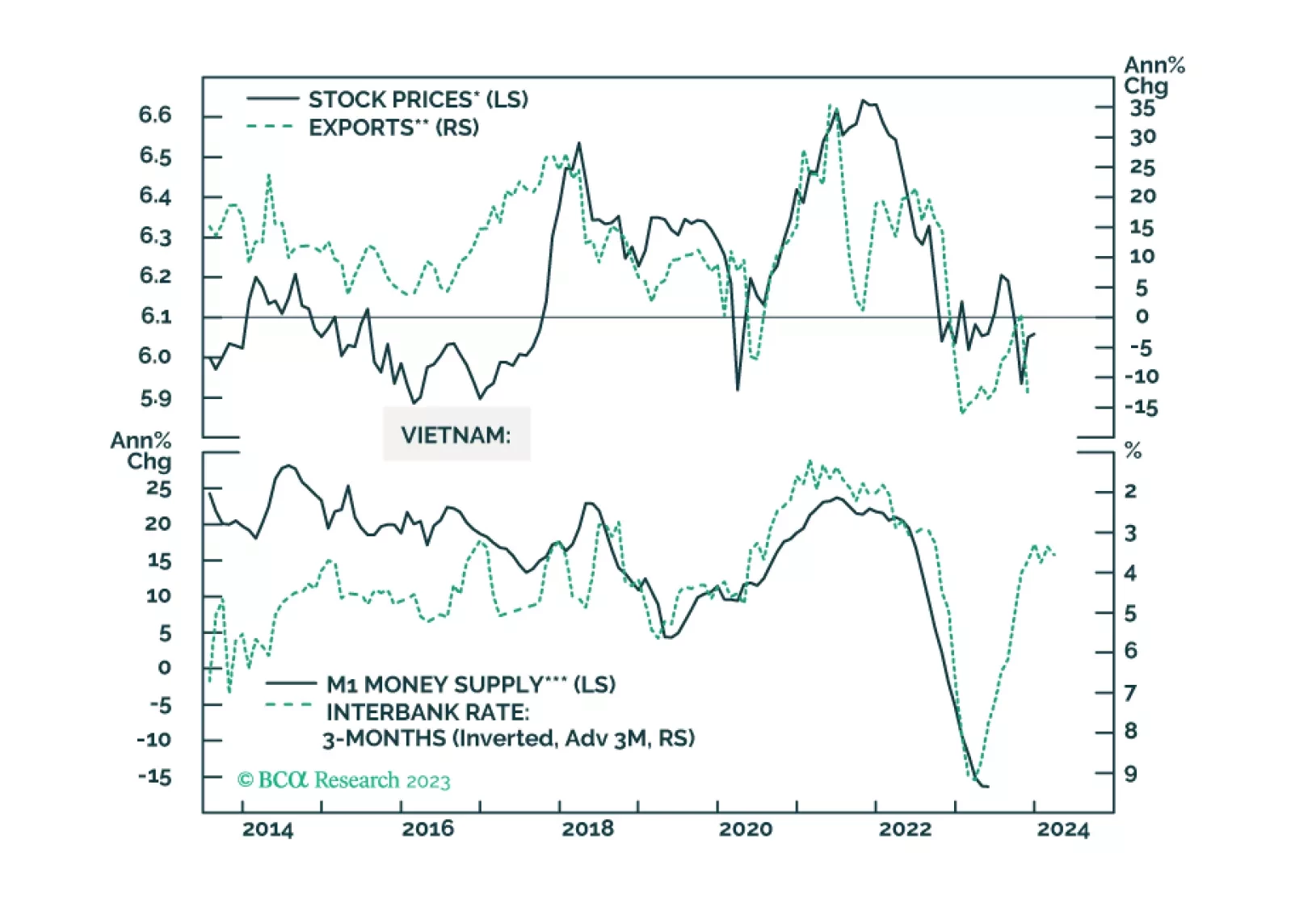

We remain bullish on the alpha-generating potential of Vietnamese stocks over the medium and long term. But our negative outlook on global/EM beta makes us bearish on this bourse in absolute terms over the medium term.

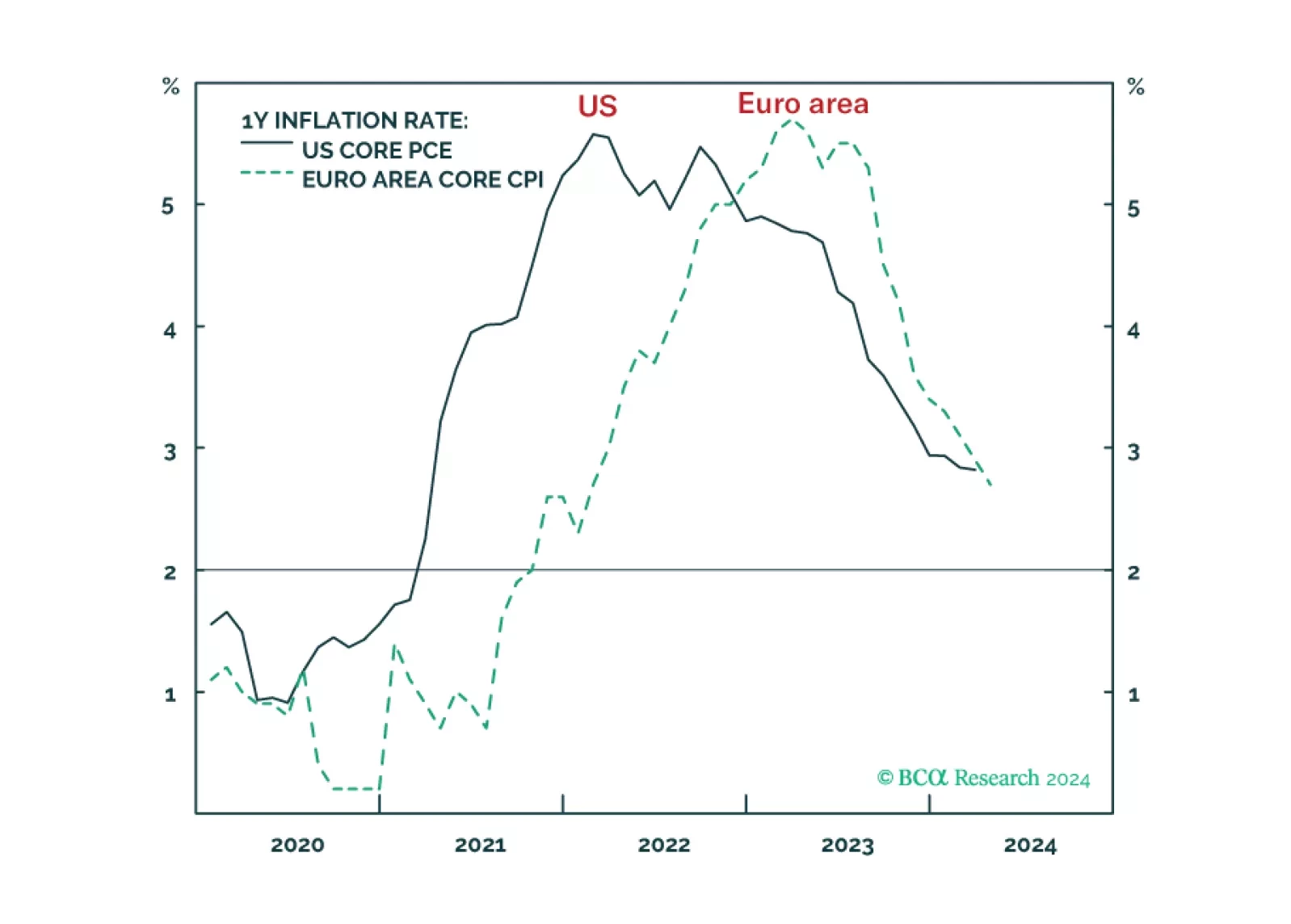

Wild hopes for US rate cuts got shattered, exactly as we predicted. But given the different incentives that the Fed and ECB now face, the relative pricing between the Fed and the ECB could widen further in the coming months. We…

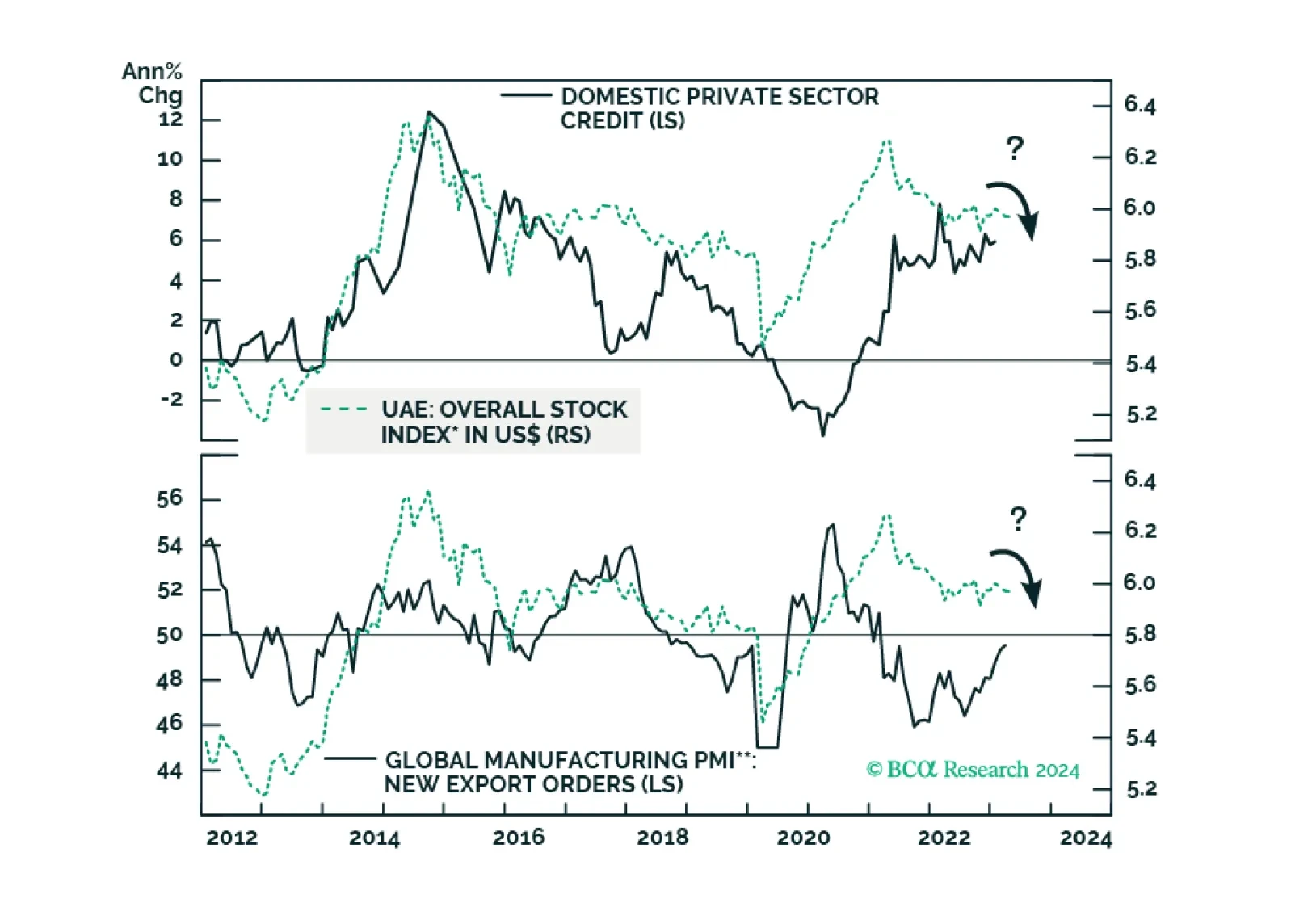

Subdued credit growth and weak global trade will remain headwinds for Emirati stocks. Surging property prices, which have led to a boom in real estate stocks, will also peak soon. Stay neutral on this bourse. Sovereign credit…

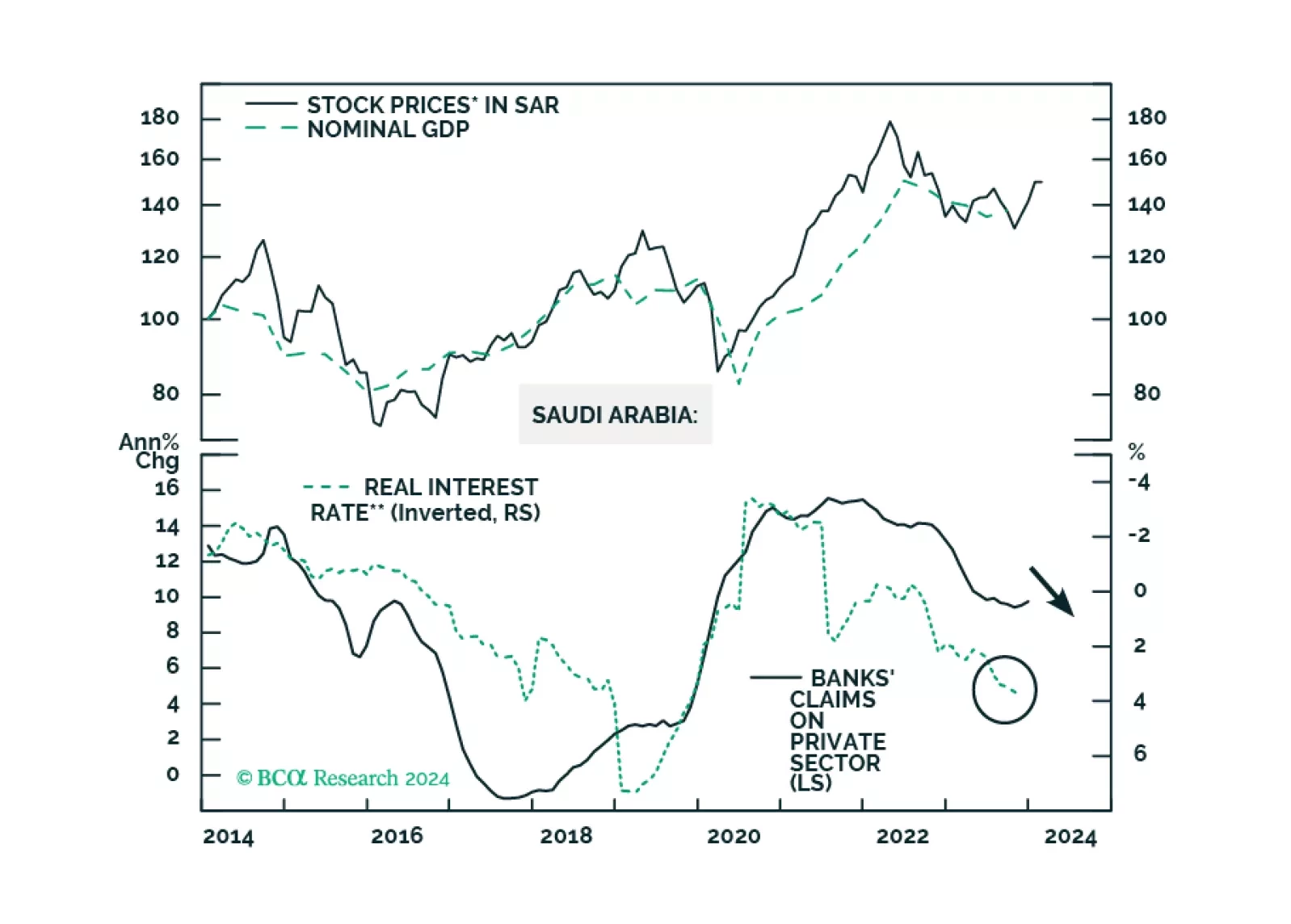

The Saudi economy is facing internal and external headwinds. The geopolitical conflict is also escalating in the Middle East. EM equity portfolios should stay neutral on Saudi stocks. EM sovereign credit portfolios should upgrade…

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

Vietnamese stocks can remain shaky for a few more months. But they have cheapened considerably, and equity portfolios with longer terms investment horizon should overweight them in EM, Emerging Asia and Frontier Market portfolios.

UAE markets are a simultaneous play on interest rates, crude prices, and global trade. None of them is presently favorable, with rising interest rates being the main threat to the UAE economy and stock market.

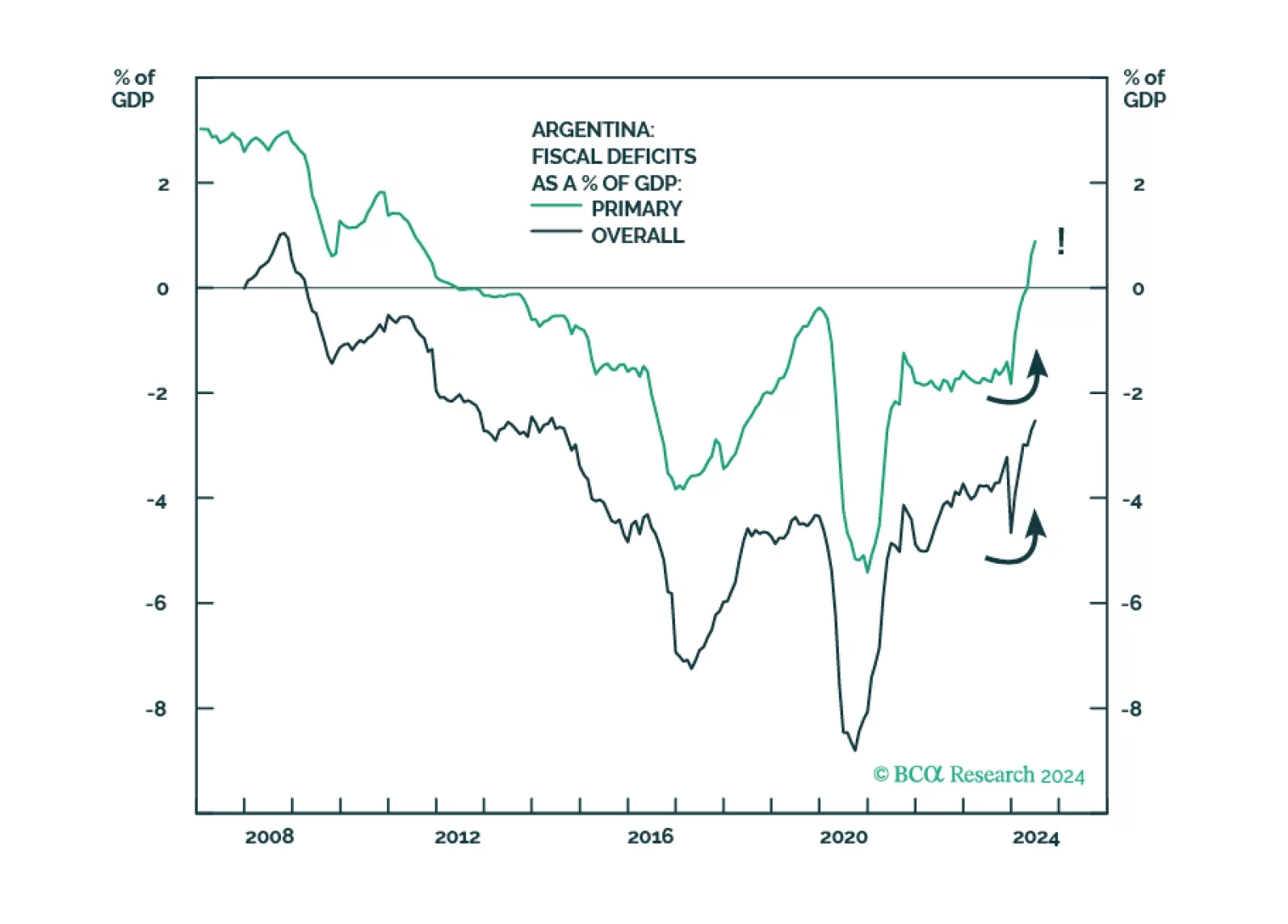

Unlike in the past, Saudi Arabia is currently pursuing a counter-cyclical policy. This is the right policy and could lead to a re-rating of this bourse in the long run. In the short term however, rising interest rates, tight fiscal…