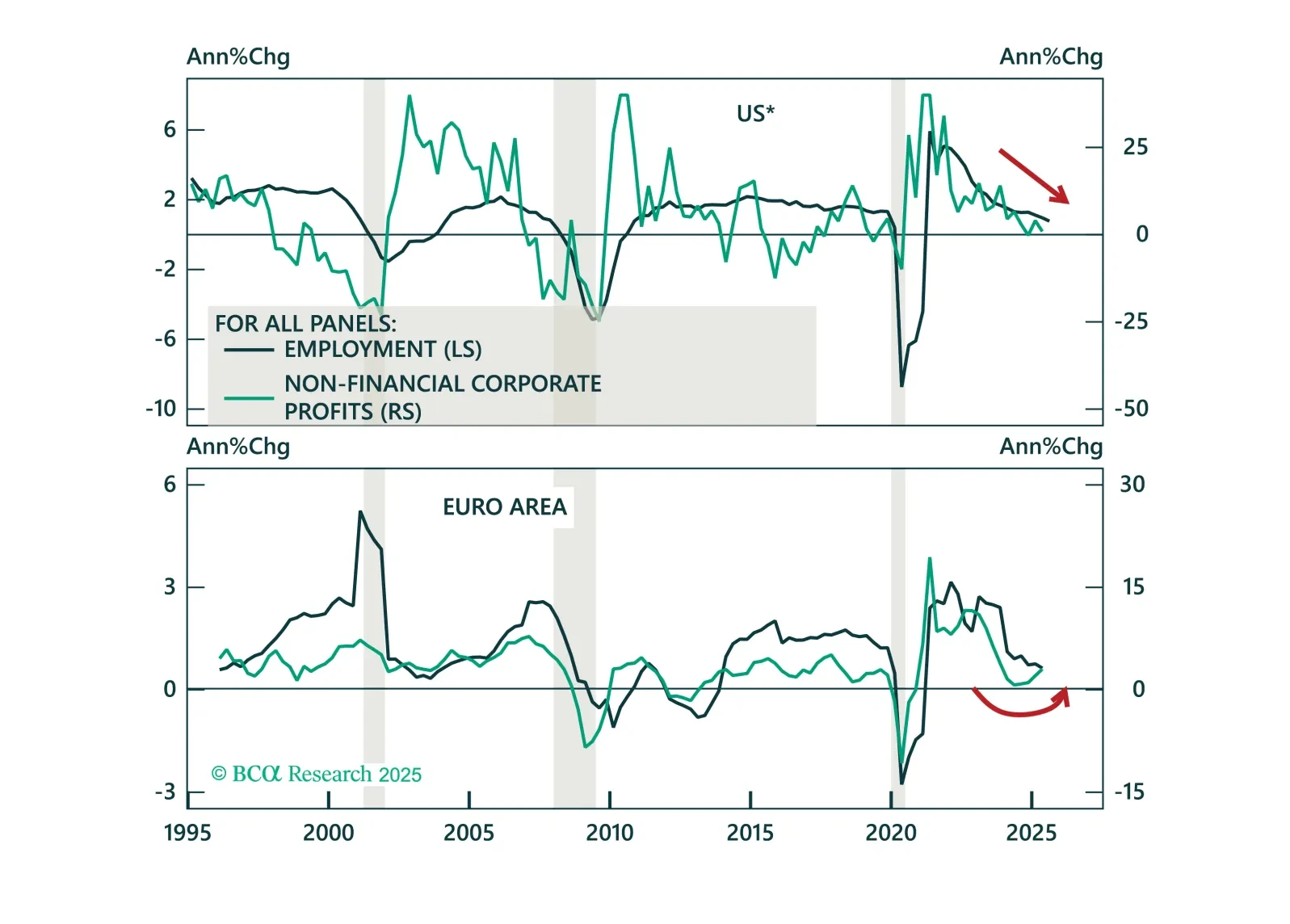

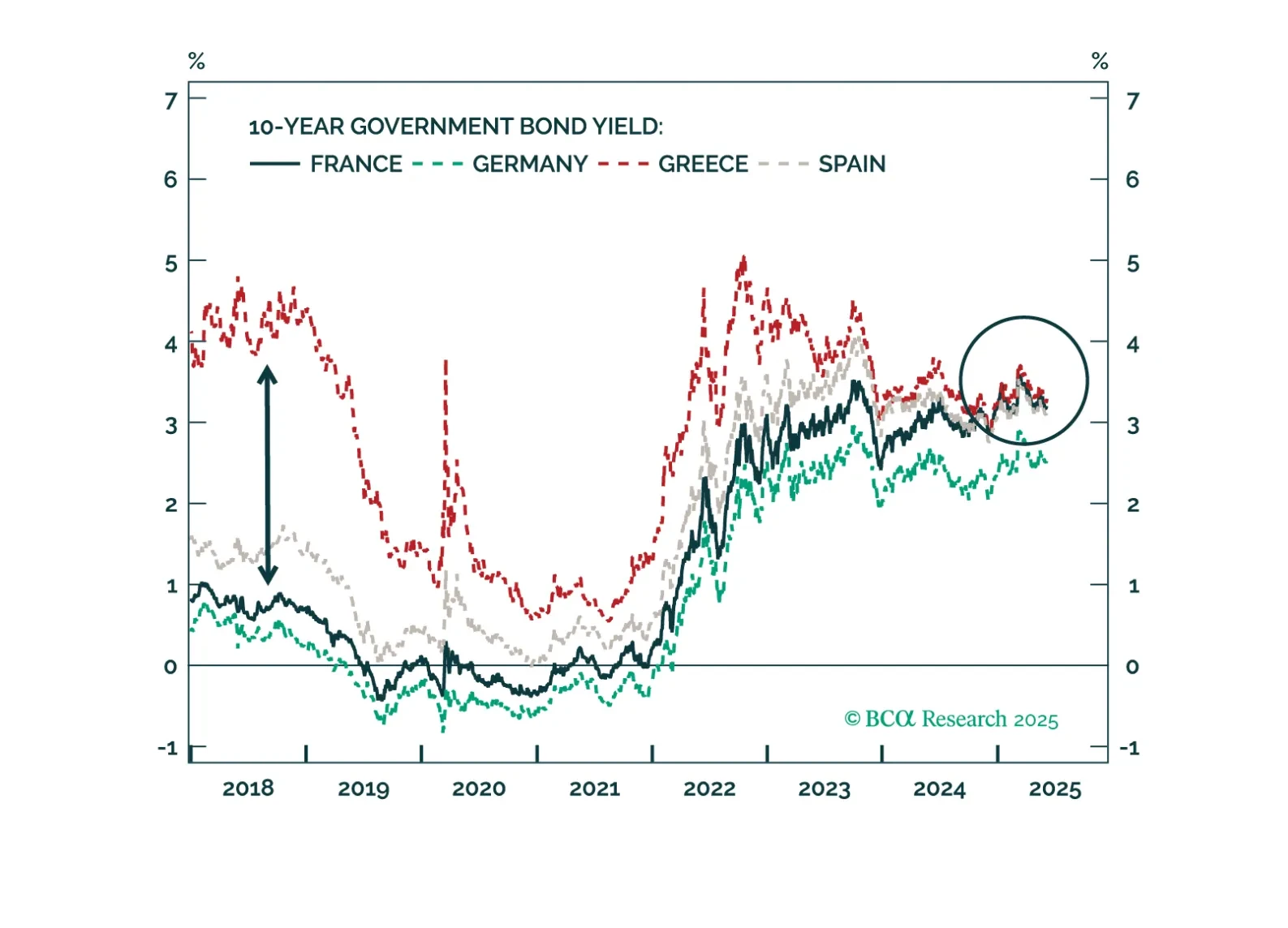

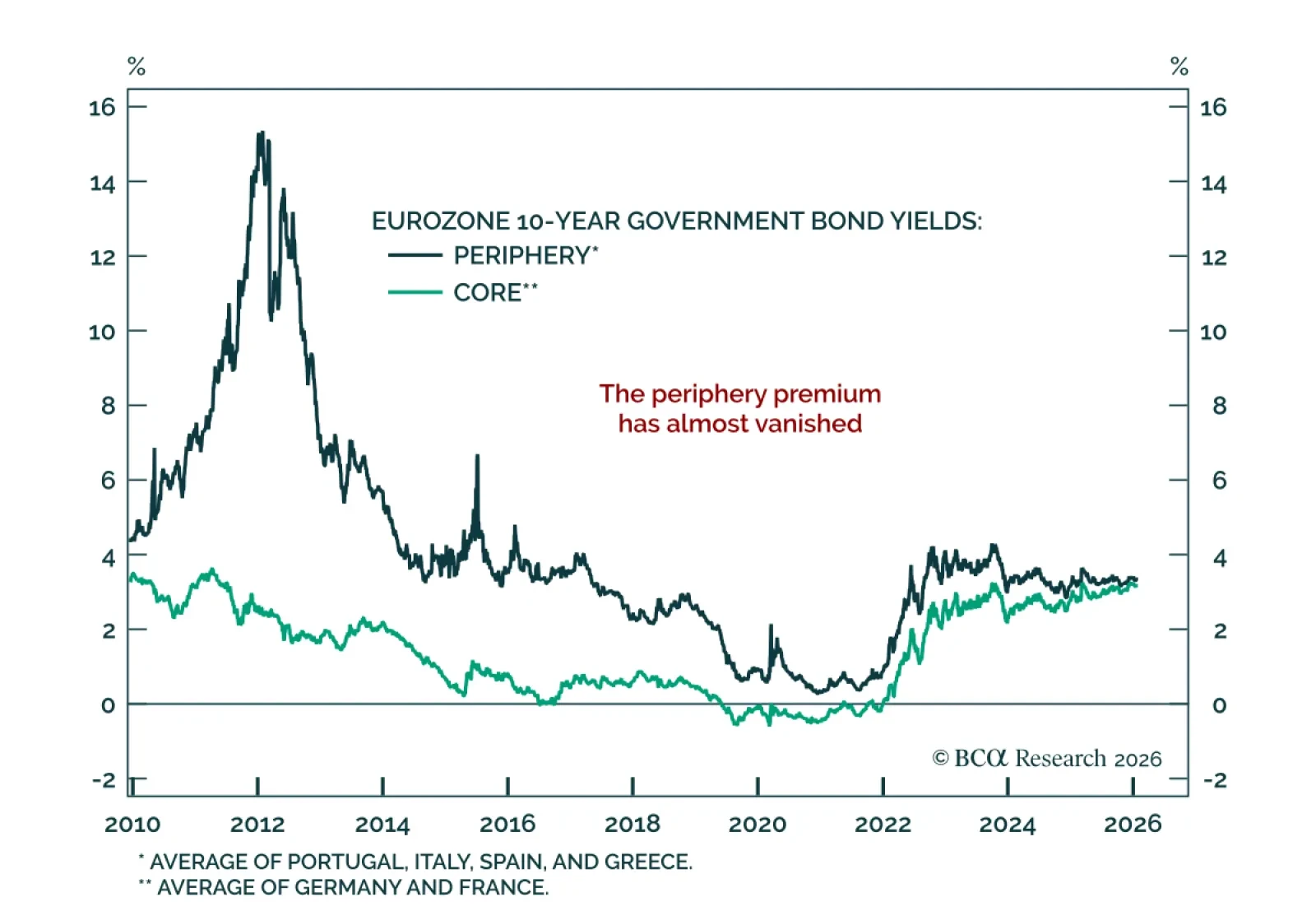

Peripheral Europe is driving the region’s resilience, and finally closing the gap with the core. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. The resilience of the European economy and strong…

A world of political churn favors safe havens — buy yen, stay overweight US stocks, and avoid chasing the fragile rally in China.

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

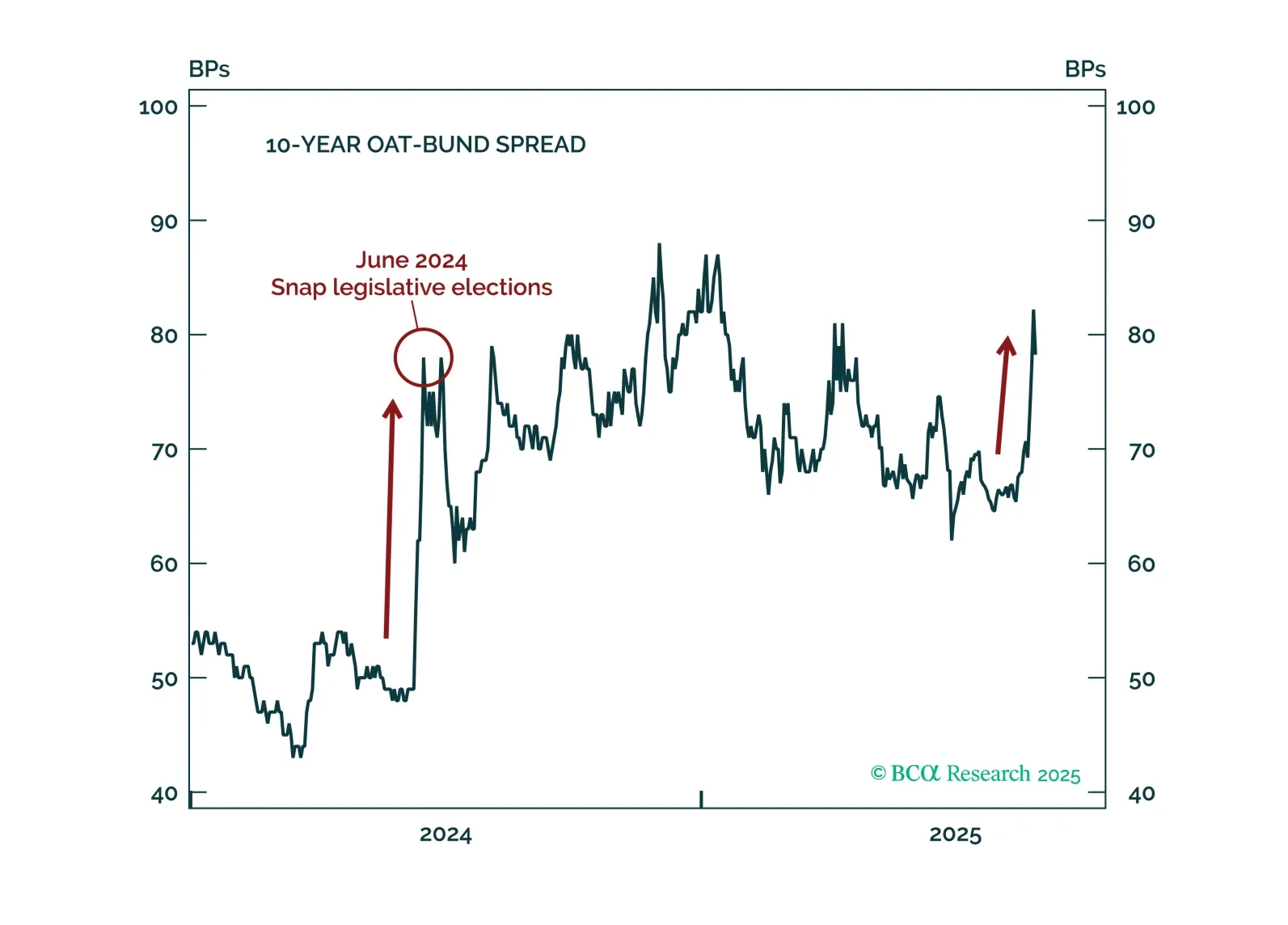

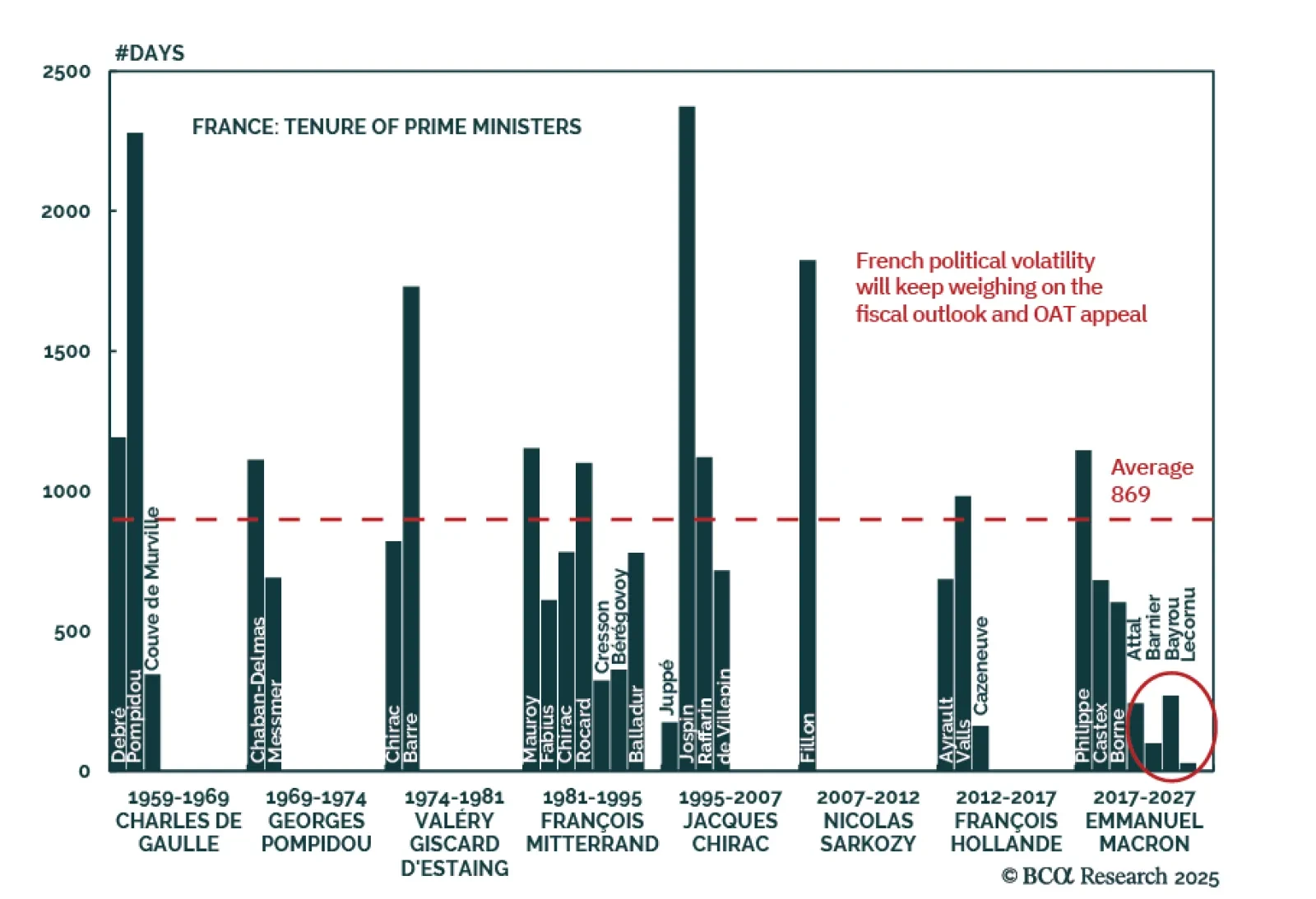

French markets woke up Monday to fresh political turmoil, with Prime Minister Sébastien Lecornu resigning just 27 days into office, marking the shortest tenure in modern French history. The CAC 40 dropped over 2%, the euro slid 0.7%…

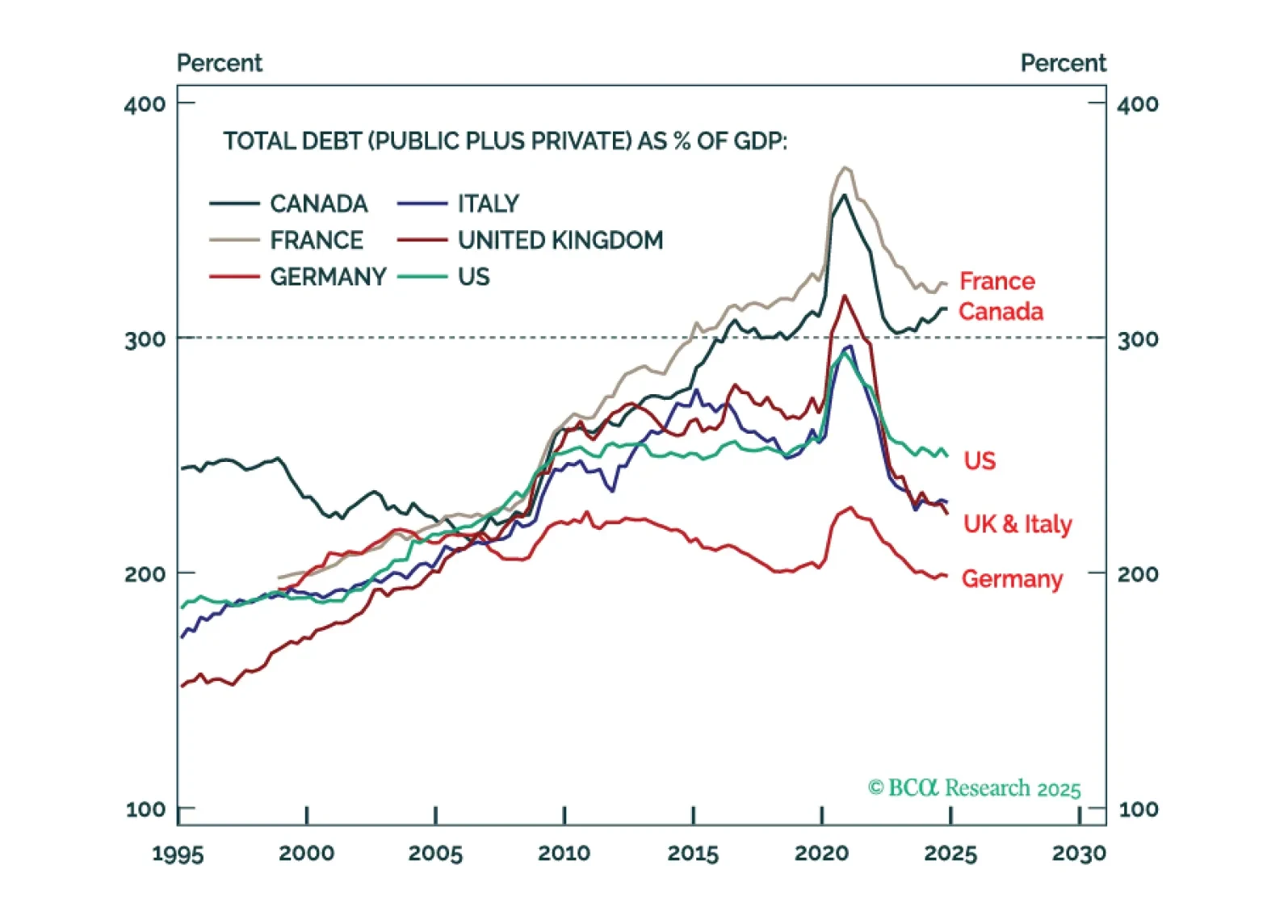

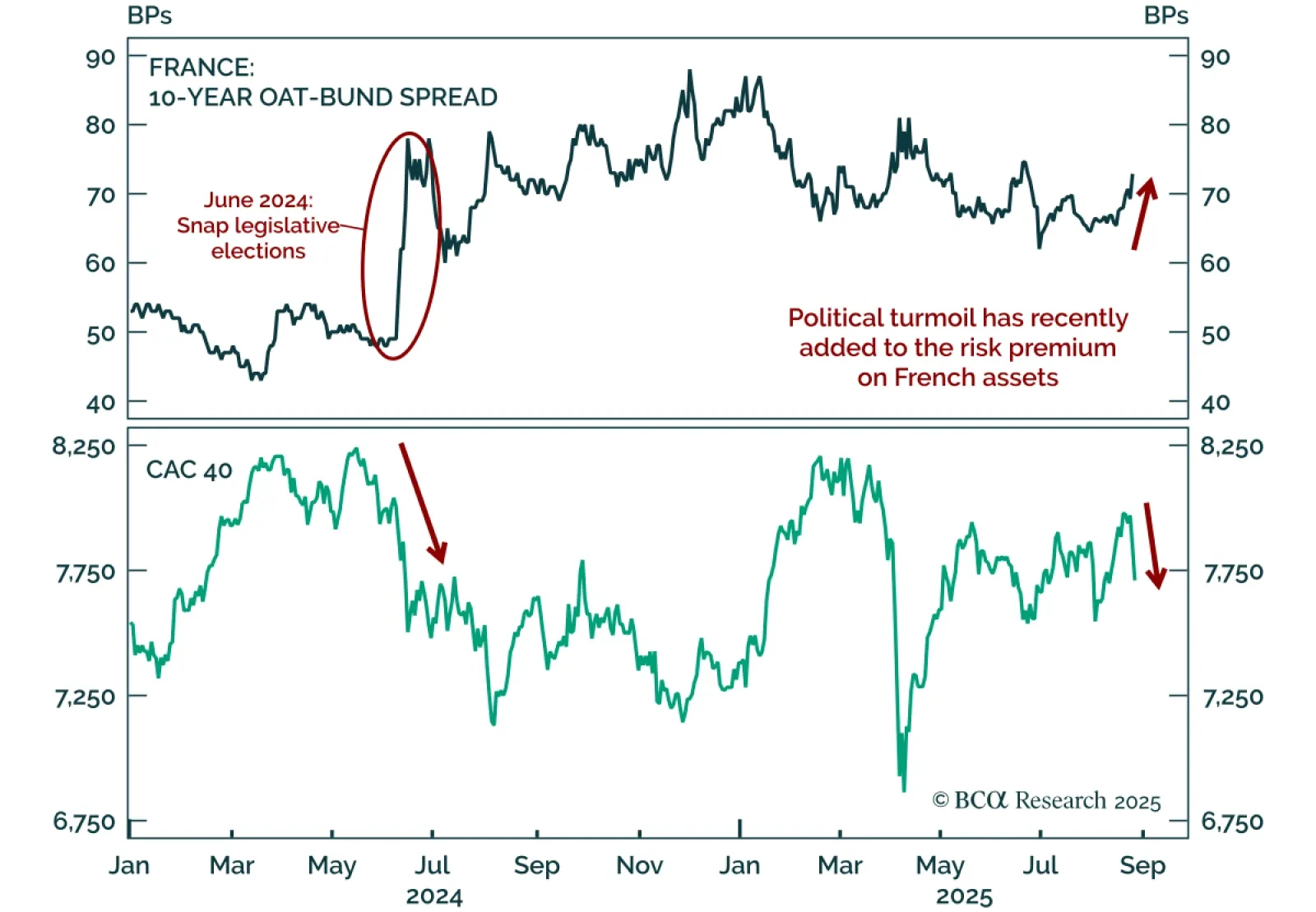

The bond vigilantes are circling over several targets right now: France, the UK, and Japan. But France is the most vulnerable because of a toxic combination: a total debt ratio well above 300 percent plus the worst primary deficit in…

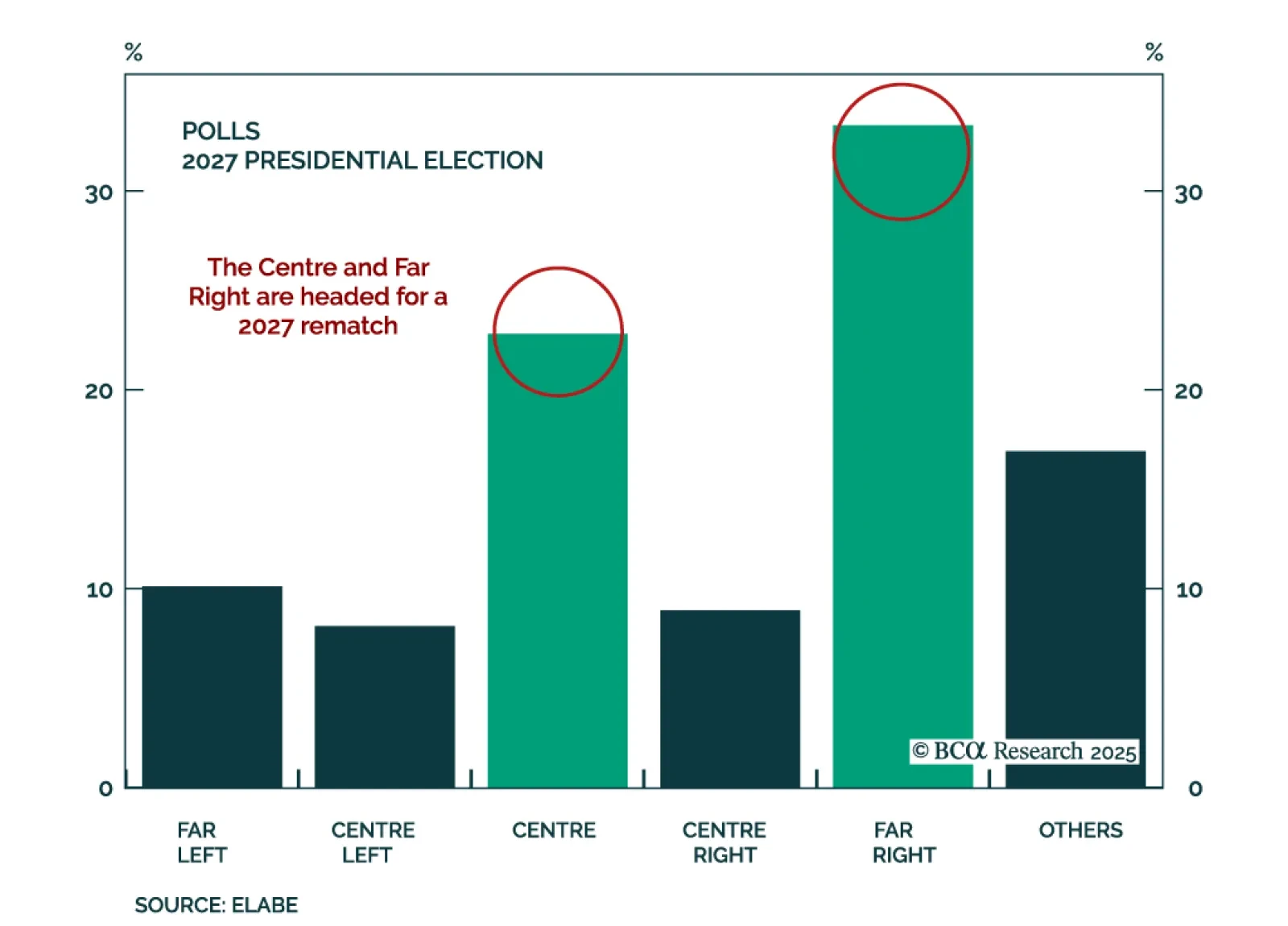

Political instability will persist in France as PM François Bayrou loses the confidence vote. The nomination of a new PM will not end the country’s political paralysis and will further fuel fiscal fears. Investors should remain…

France’s renewed political turmoil highlights fiscal risks for OATs, but creates opportunities to buy French equities on dips. PM Bayrou has called a September 8 confidence vote over his deficit-cutting budget proposals,…

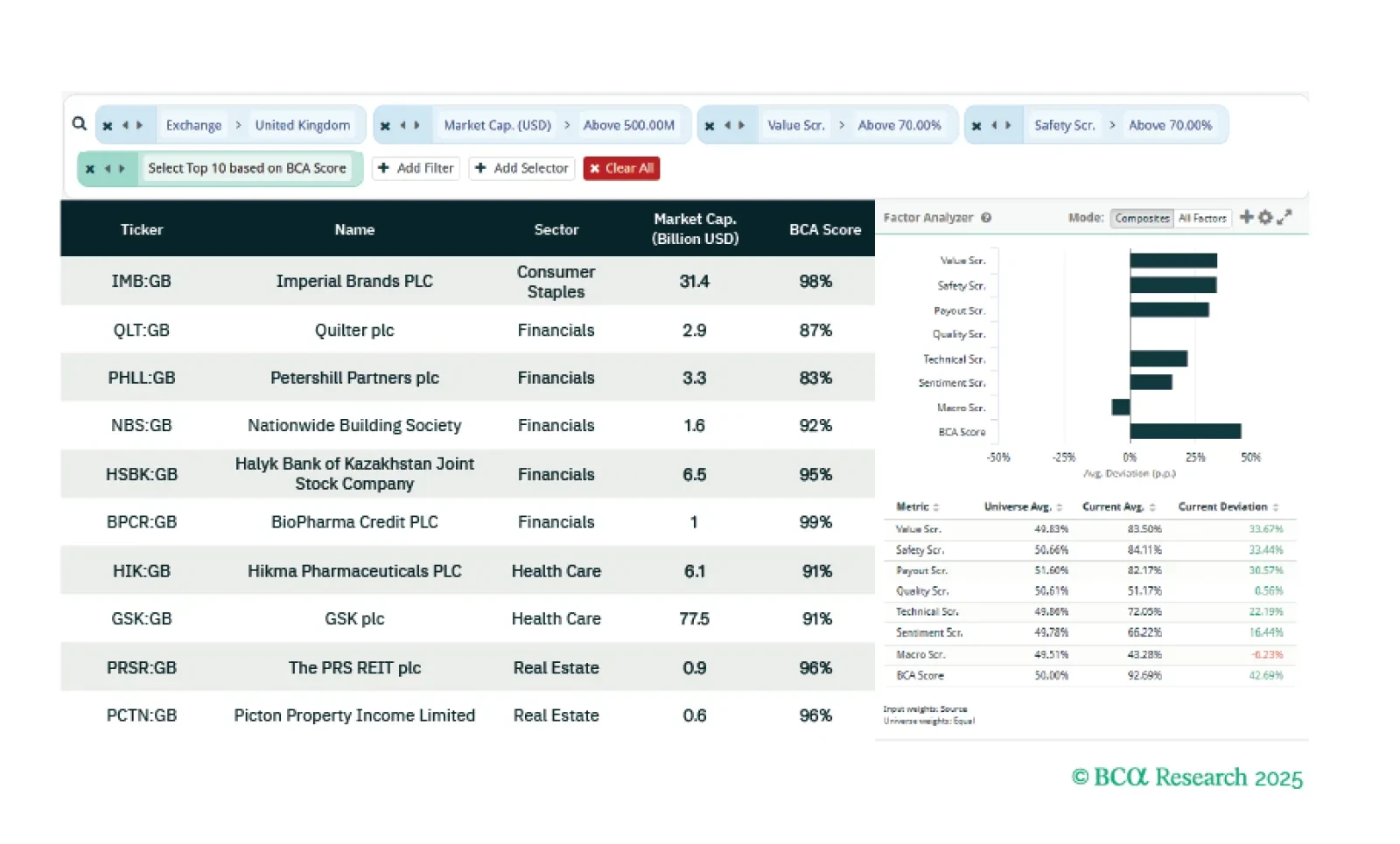

This week our three screeners explore: UK stocks that are cheap and offer a geopolitical hedge; French stocks that are sensitive to China; and US Value and dividend paying stocks.

BCA’s European Investment Strategist service warns that France’s political turmoil is far from over. The minority government is fragile, and the 2026 budget battle is set to trigger renewed social unrest and the threat of a no-…