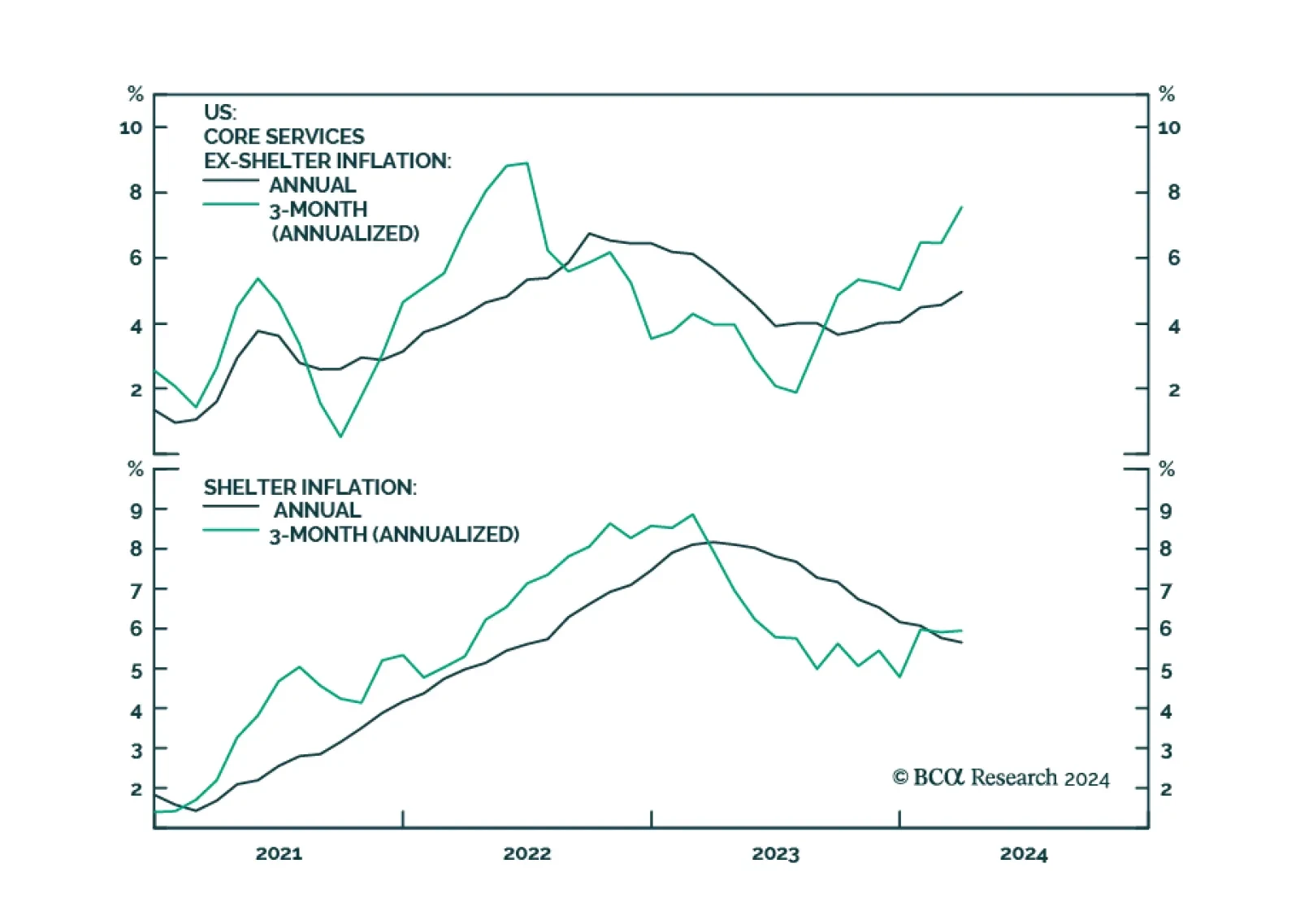

Headline inflation came in at 0.4% on a MoM basis and 3.5% on an annual basis, beating expectations of 0.3% and 3.4% respectively. Meanwhile core inflation came in at 0.4% on a MoM basis and 3.8% on an annual basis, beating…

Our reaction to this morning’s CPI report and bond market moves.

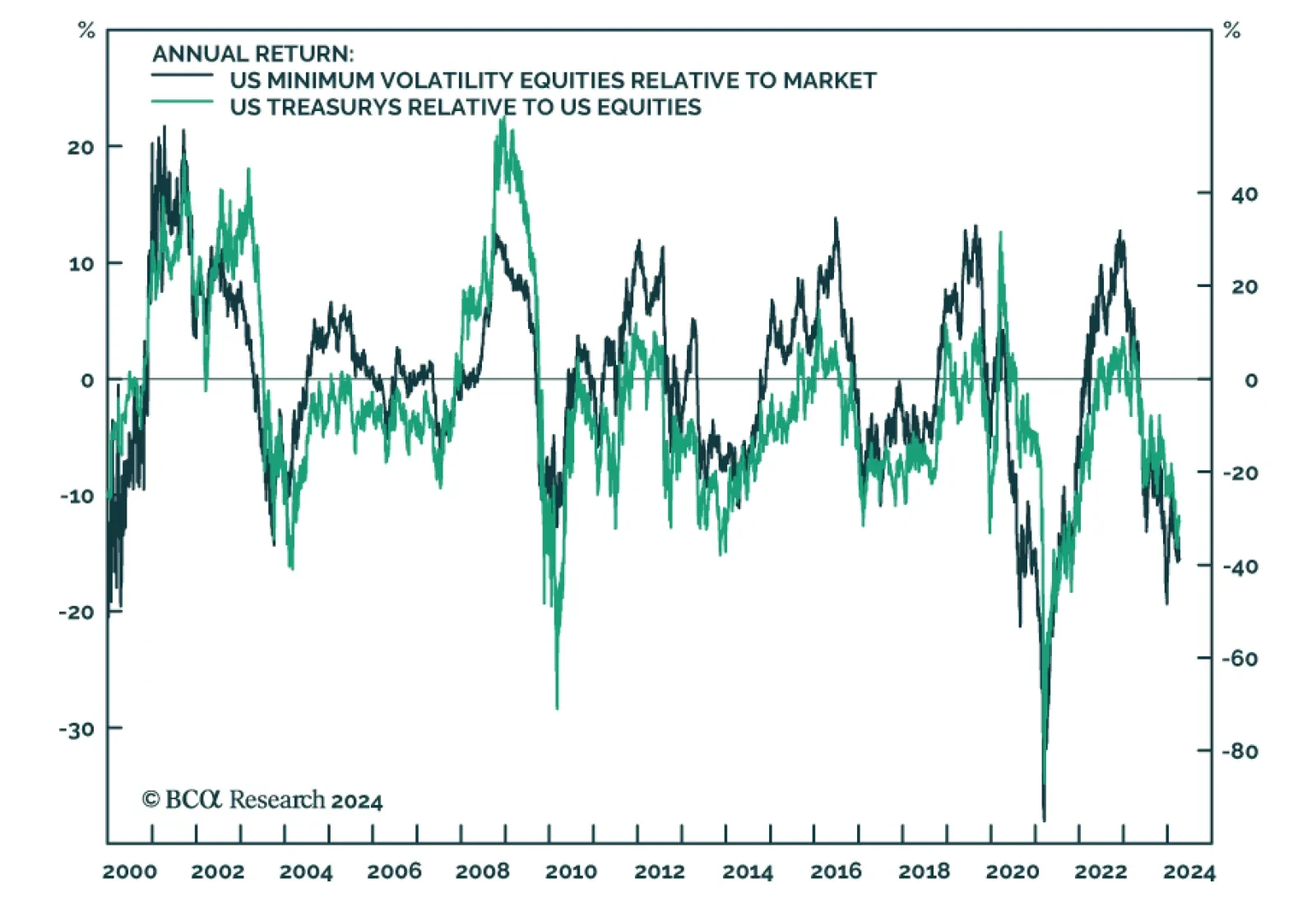

Investors typically associate high-flying tech stocks with high sensitivity to interest rates. The rationale is simple: Given that most of their cashflows are further into the future, their value will be more sensitive to changes…

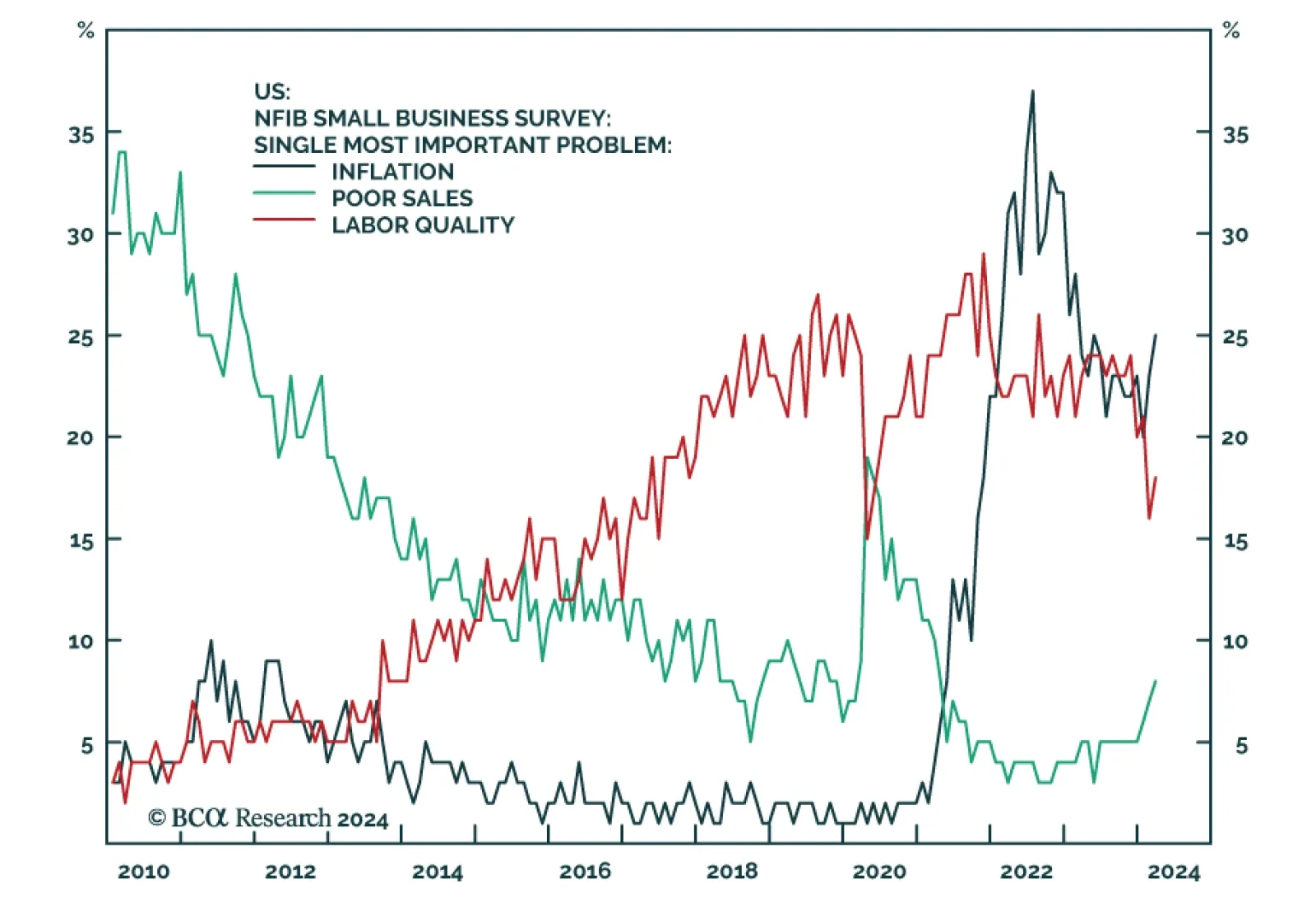

The NFIB’s small business optimism index decreased by 0.9 points to 88.5 in March, missing expectations of 89.9, and reaching its lowest level since 2012. A few things stood out from the report: Labor market…

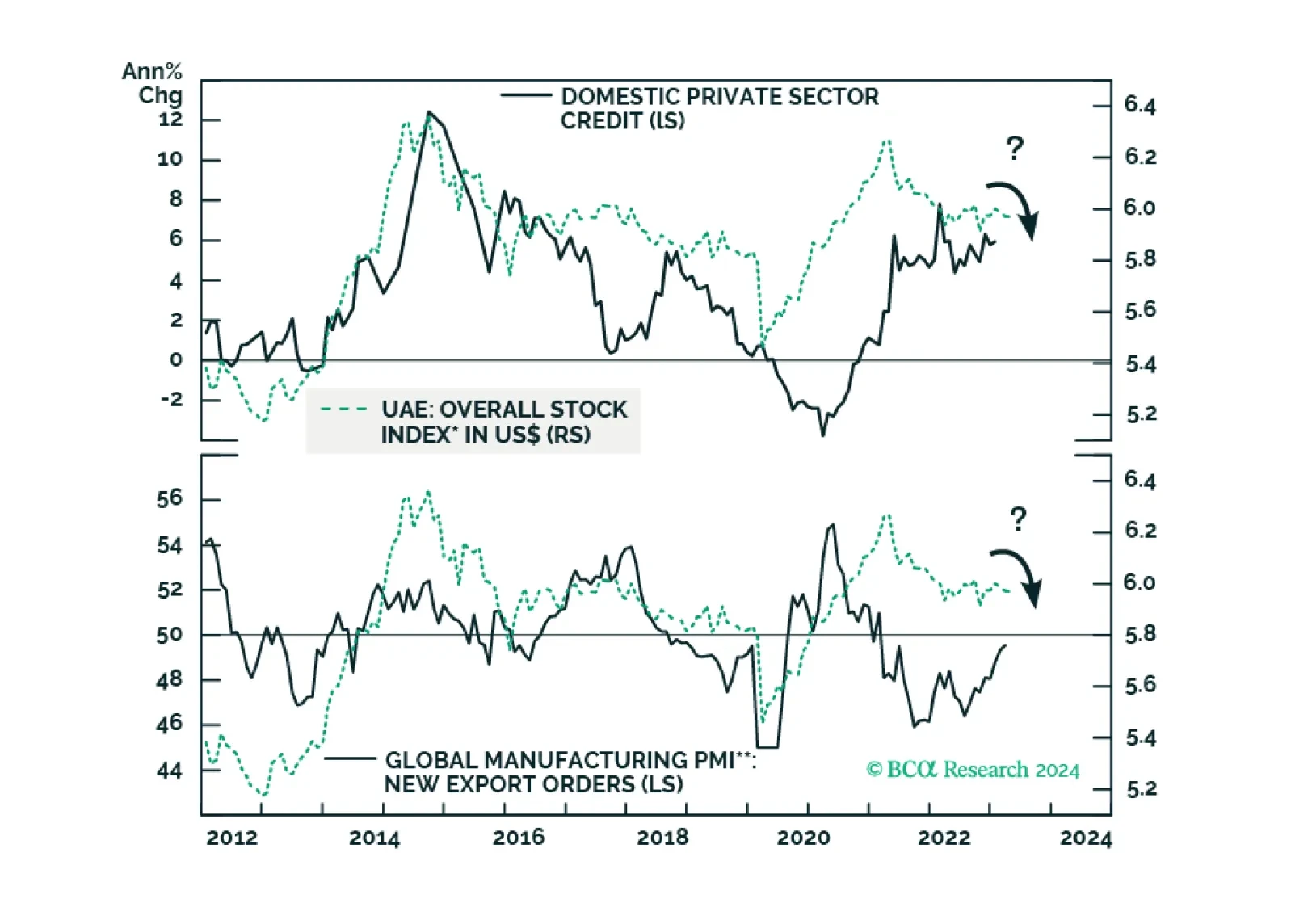

Subdued credit growth and weak global trade will remain headwinds for Emirati stocks. Surging property prices, which have led to a boom in real estate stocks, will also peak soon. Stay neutral on this bourse. Sovereign credit…

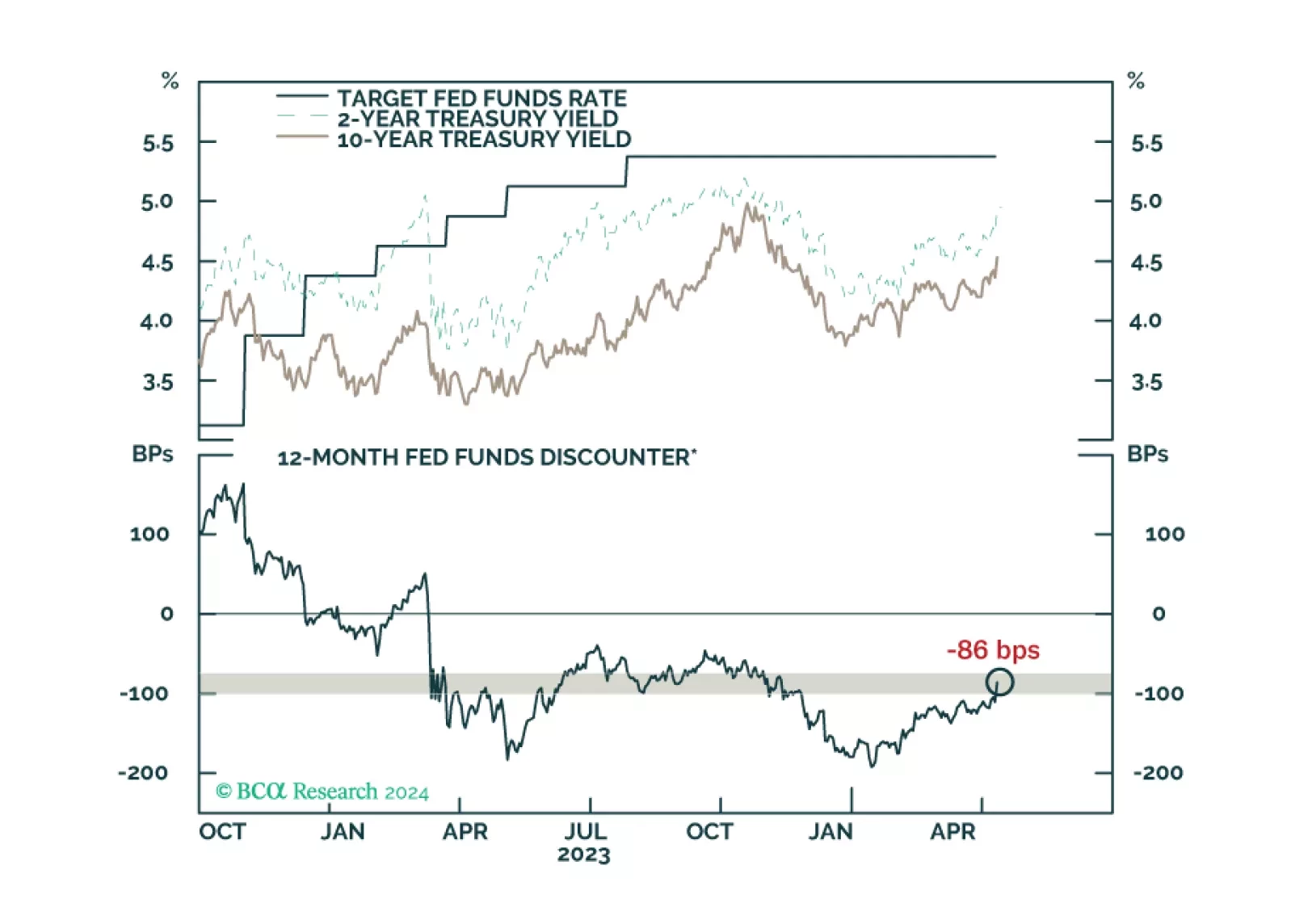

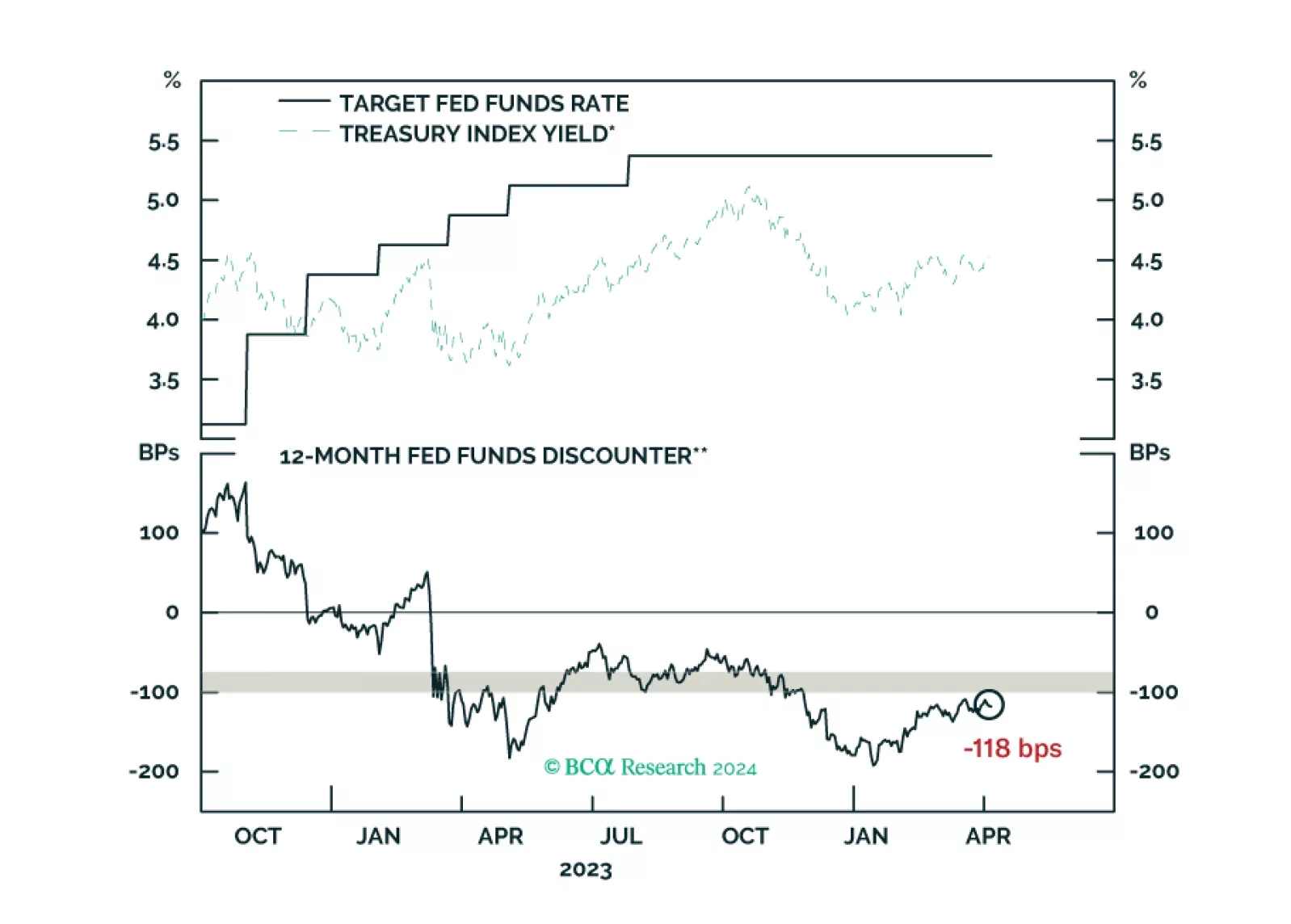

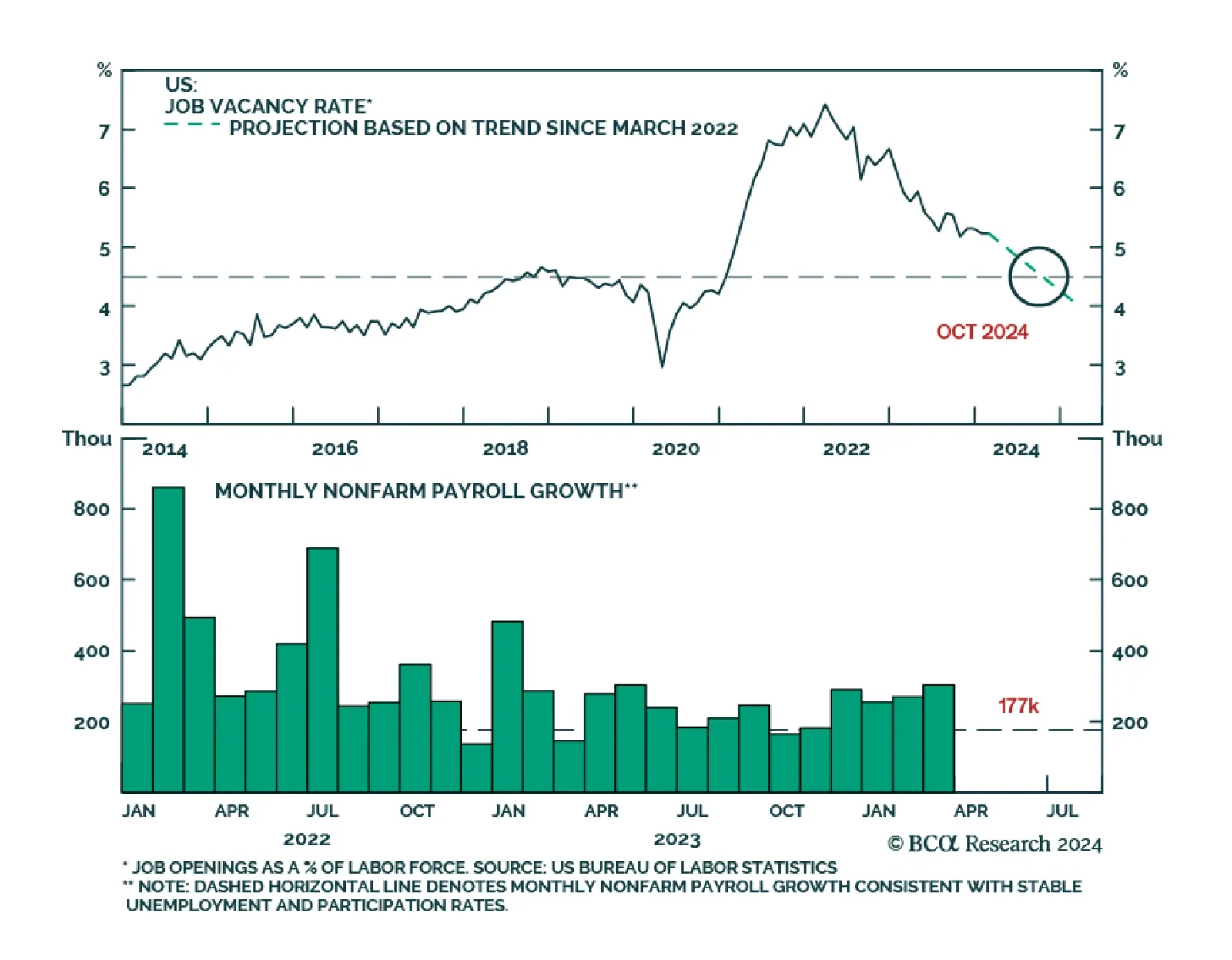

According to BCA Research’s US Bond Strategy service, until labor market cracks emerge, the path of least resistance for bond yields is probably higher, but the potential near-term upside in yields is limited. The team…

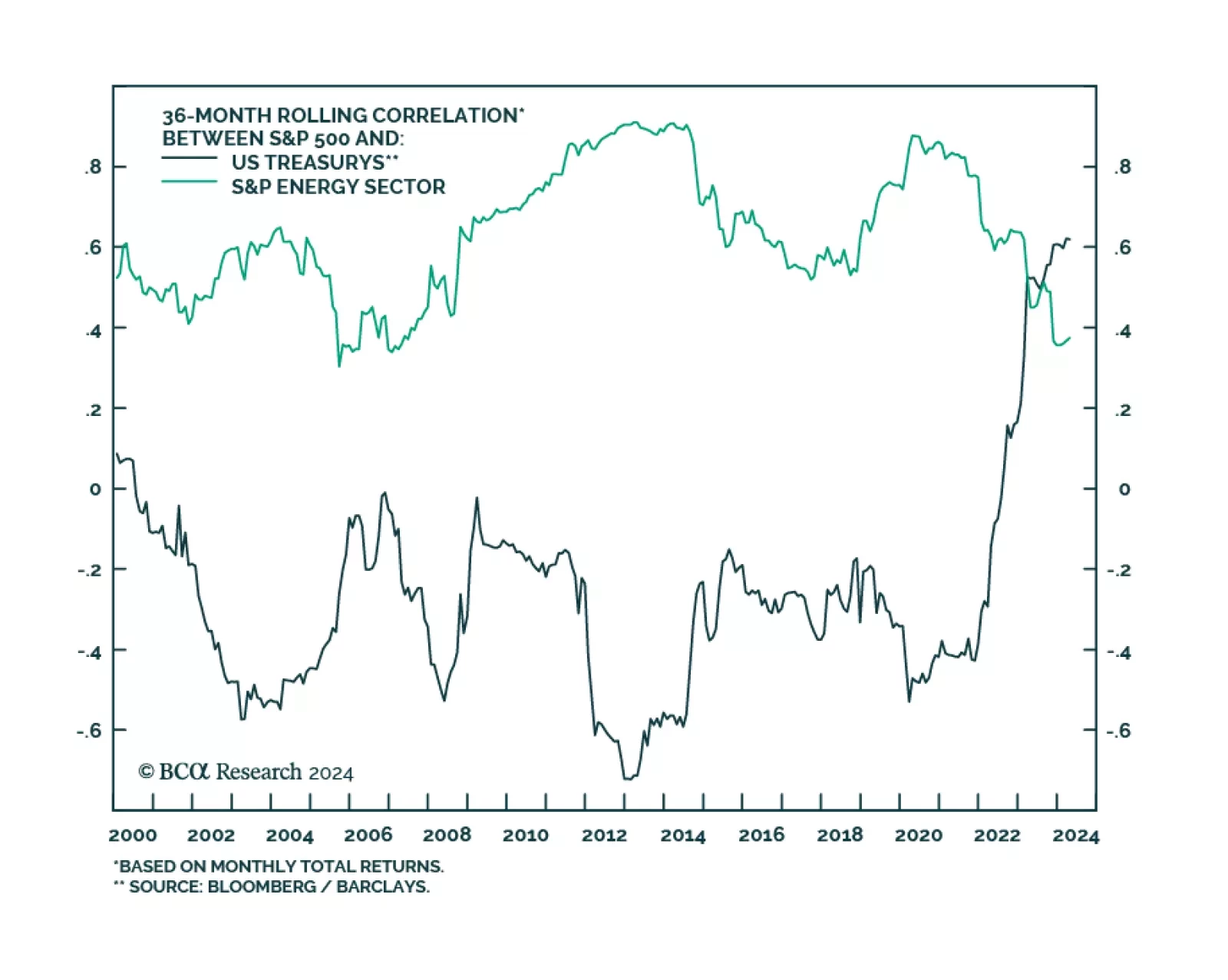

Traditionally, equity managers have thought of oil equities as cyclical. This is because, in the past, oil equities had a strong positive correlation to the overall market. But US oil equities have increasingly become more…

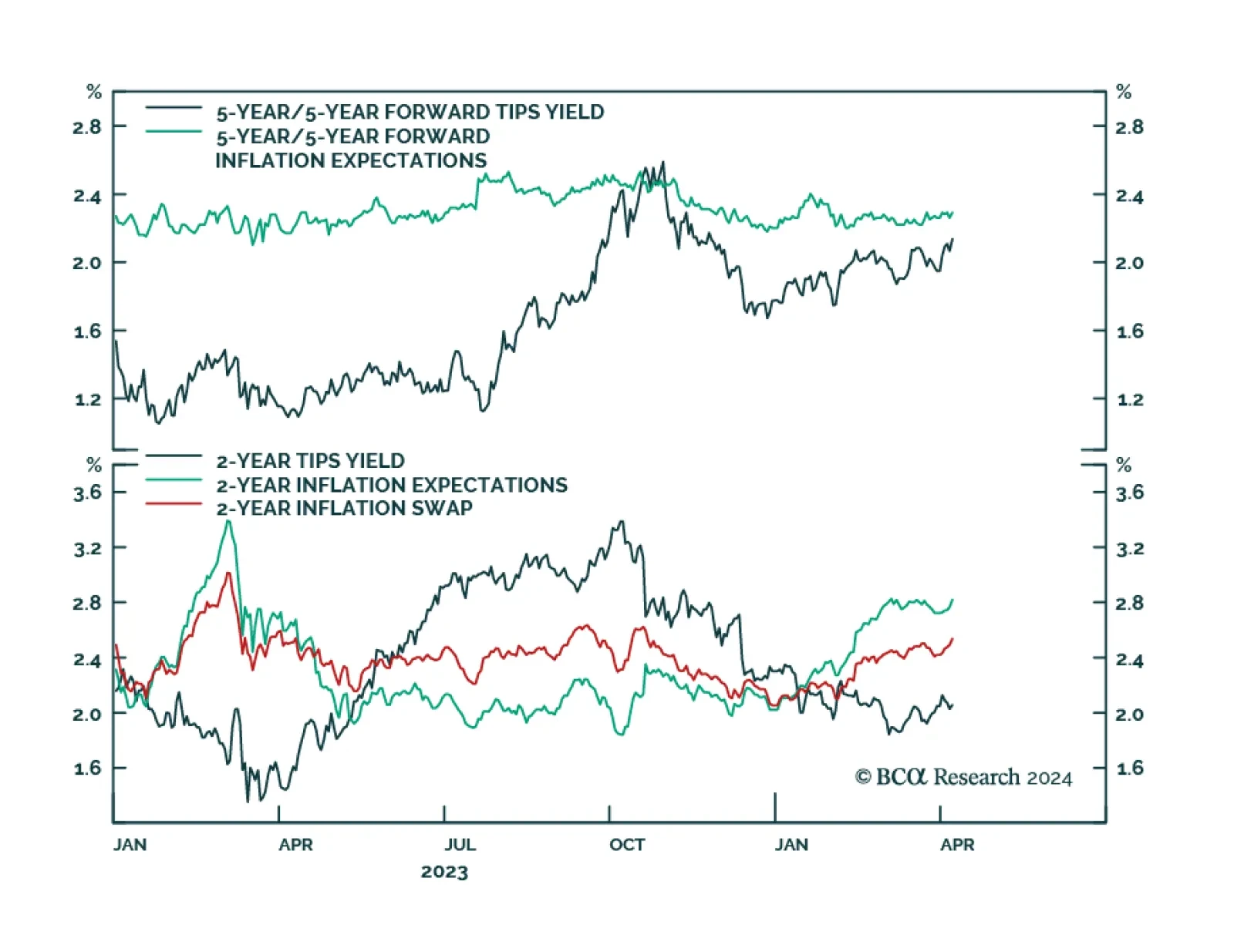

The recent rise in market-based inflation expectations has caught the attention of market participants. Some investors have begun to worry that the Federal Reserve might be losing control of its inflation mandate by cutting rates…

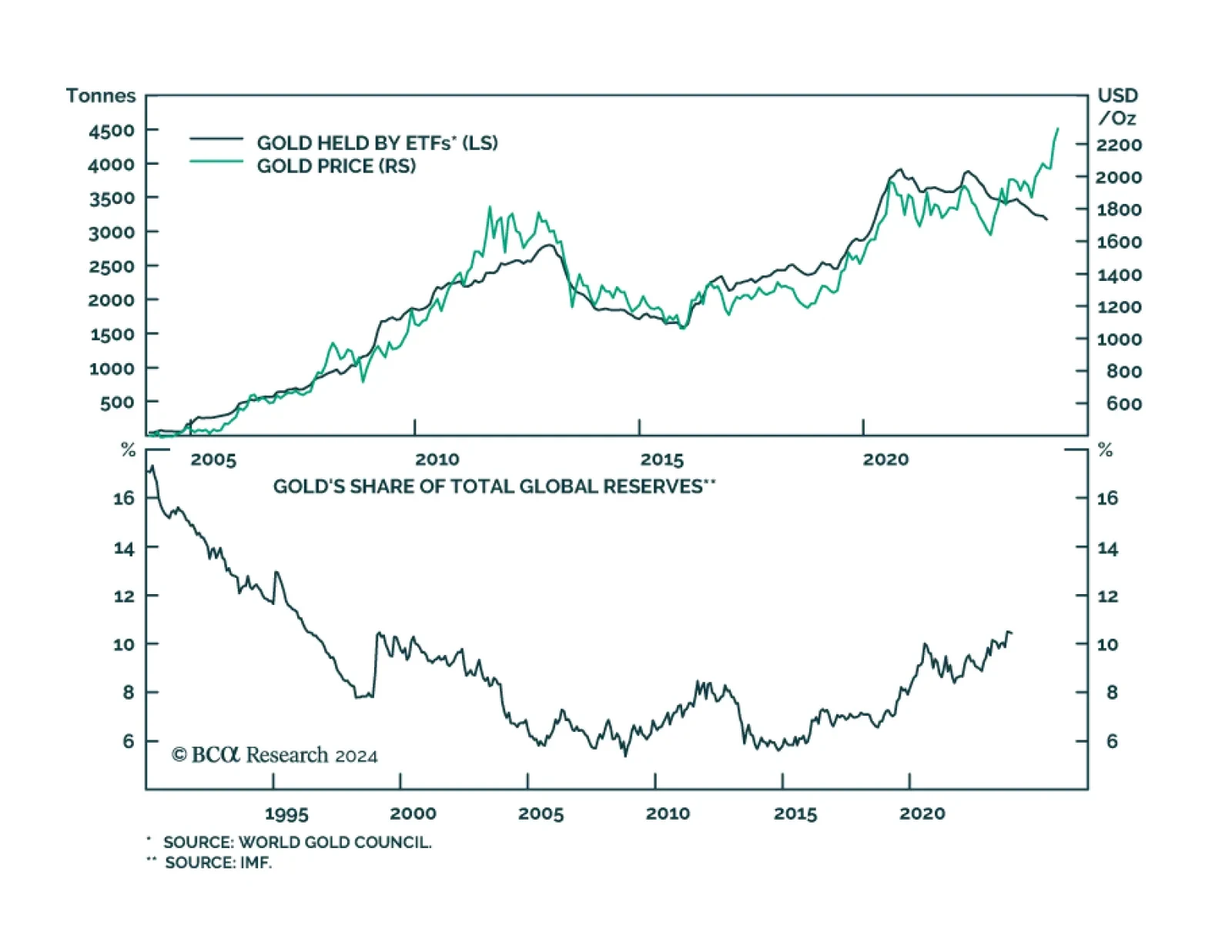

Gold prices reached $2300 per ounce for the first time on Wednesday. They have now rallied by more than 12% so far this year. To a degree the furious rally in gold has been puzzling. Who has been buying? It certainly has not…

Our reaction to this morning’s employment report and bond market moves.