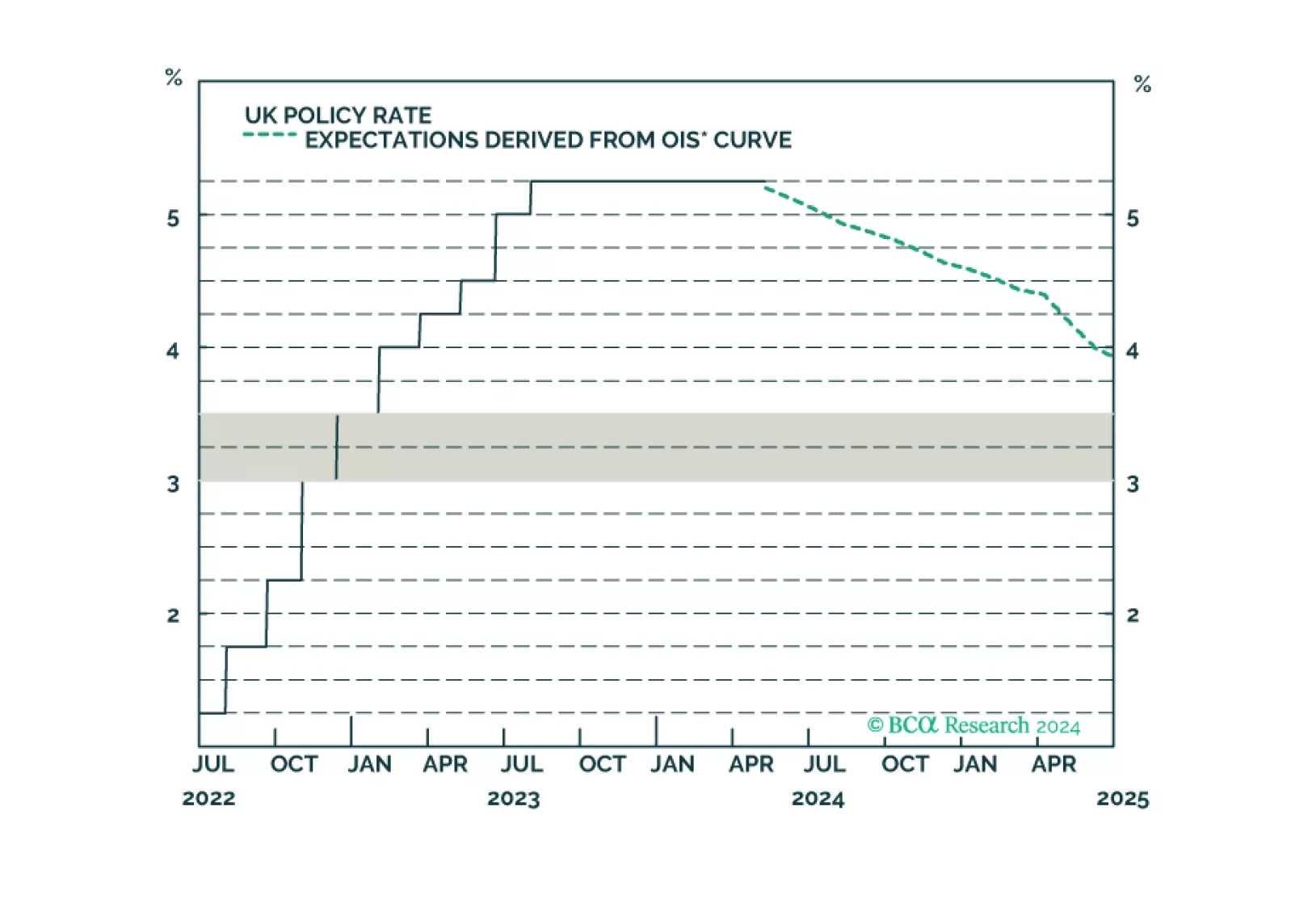

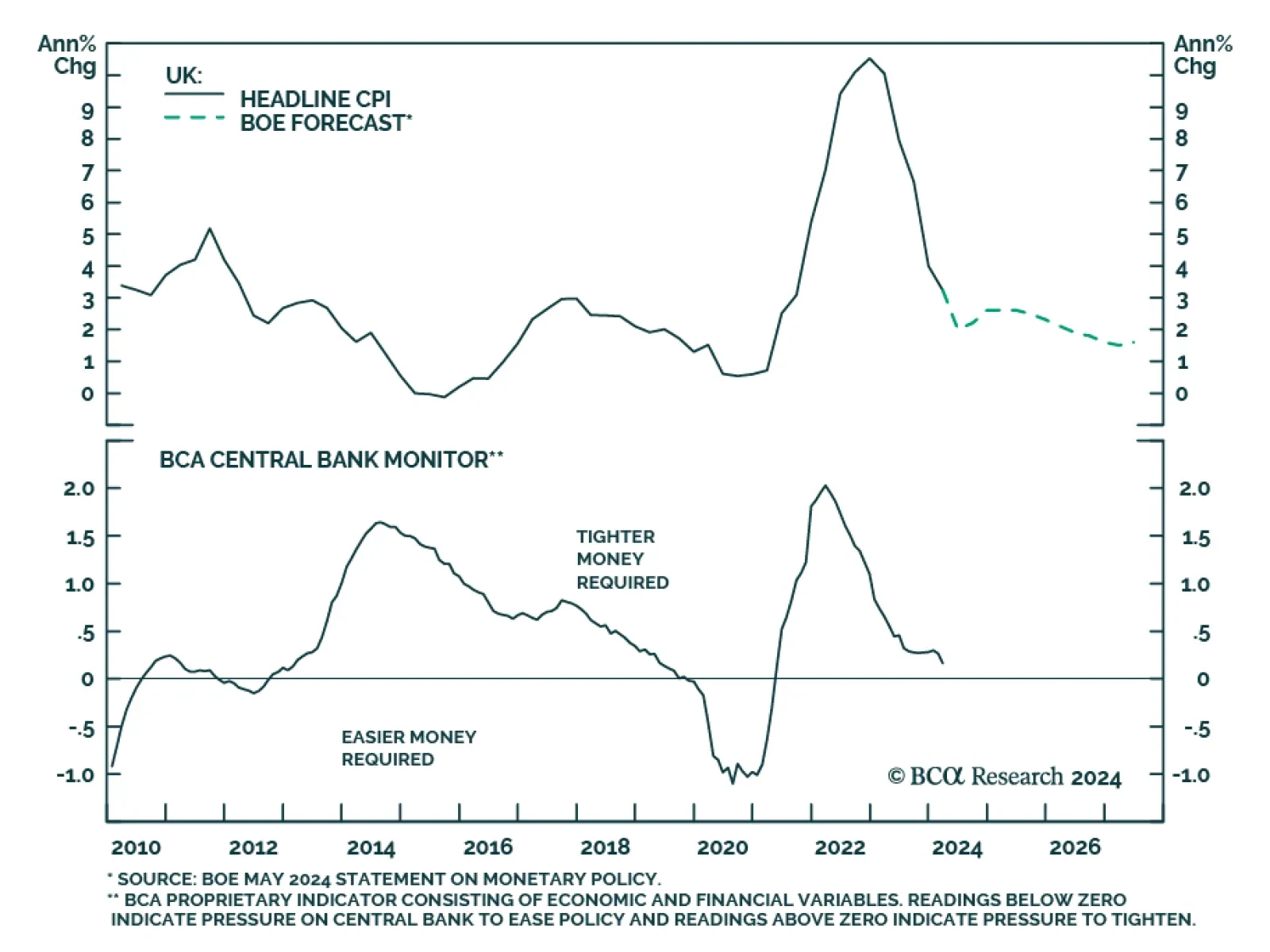

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…

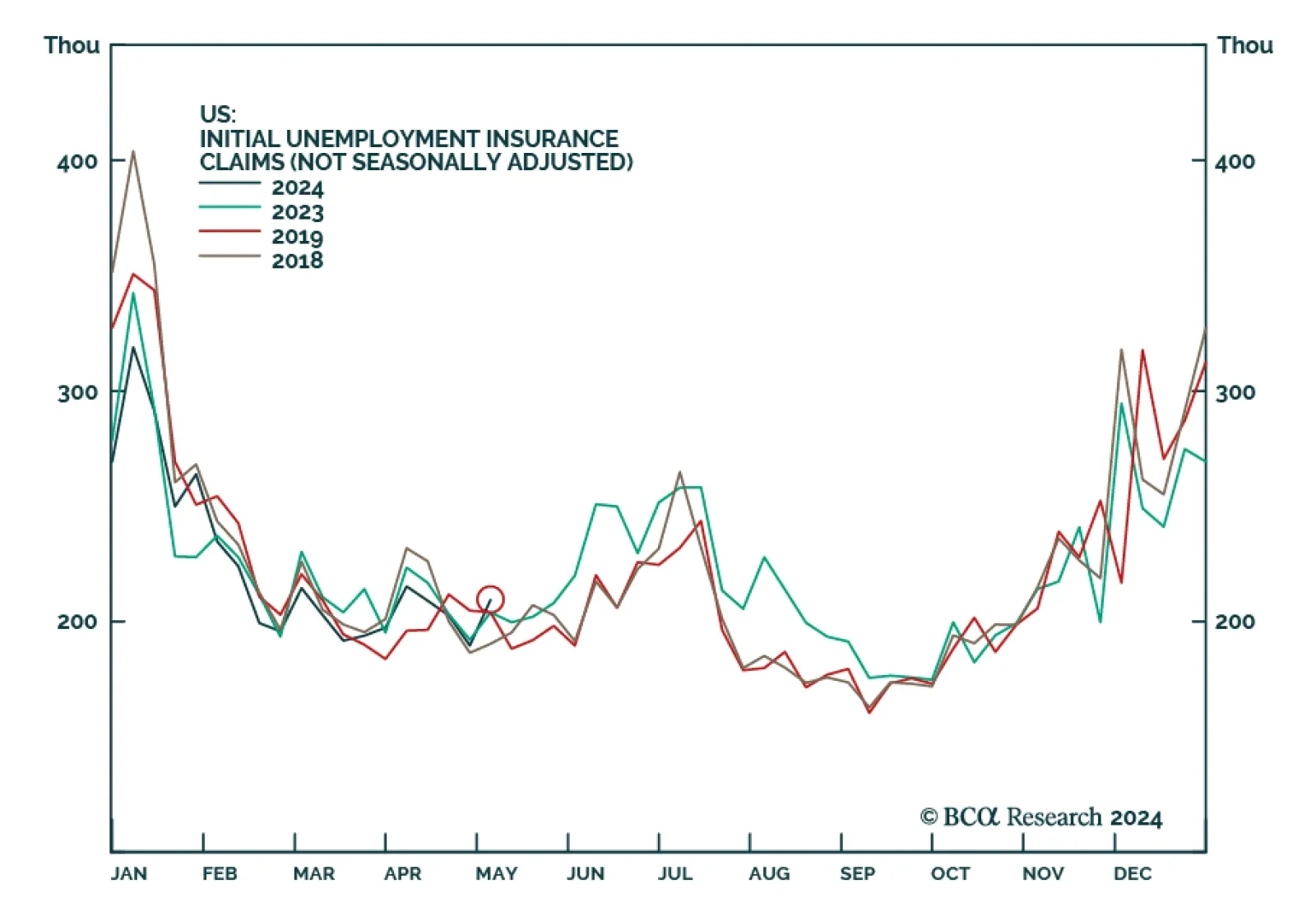

US initial jobless claims increased from 209 thousand last week to 231 thousand, surpassing expectations of 212 thousand. Moreover, continuing claims also surprised to the upside, increasing from 1.768 million to 1.785 million…

An update to our views on UK rates and currency following today’s Bank of England meeting.

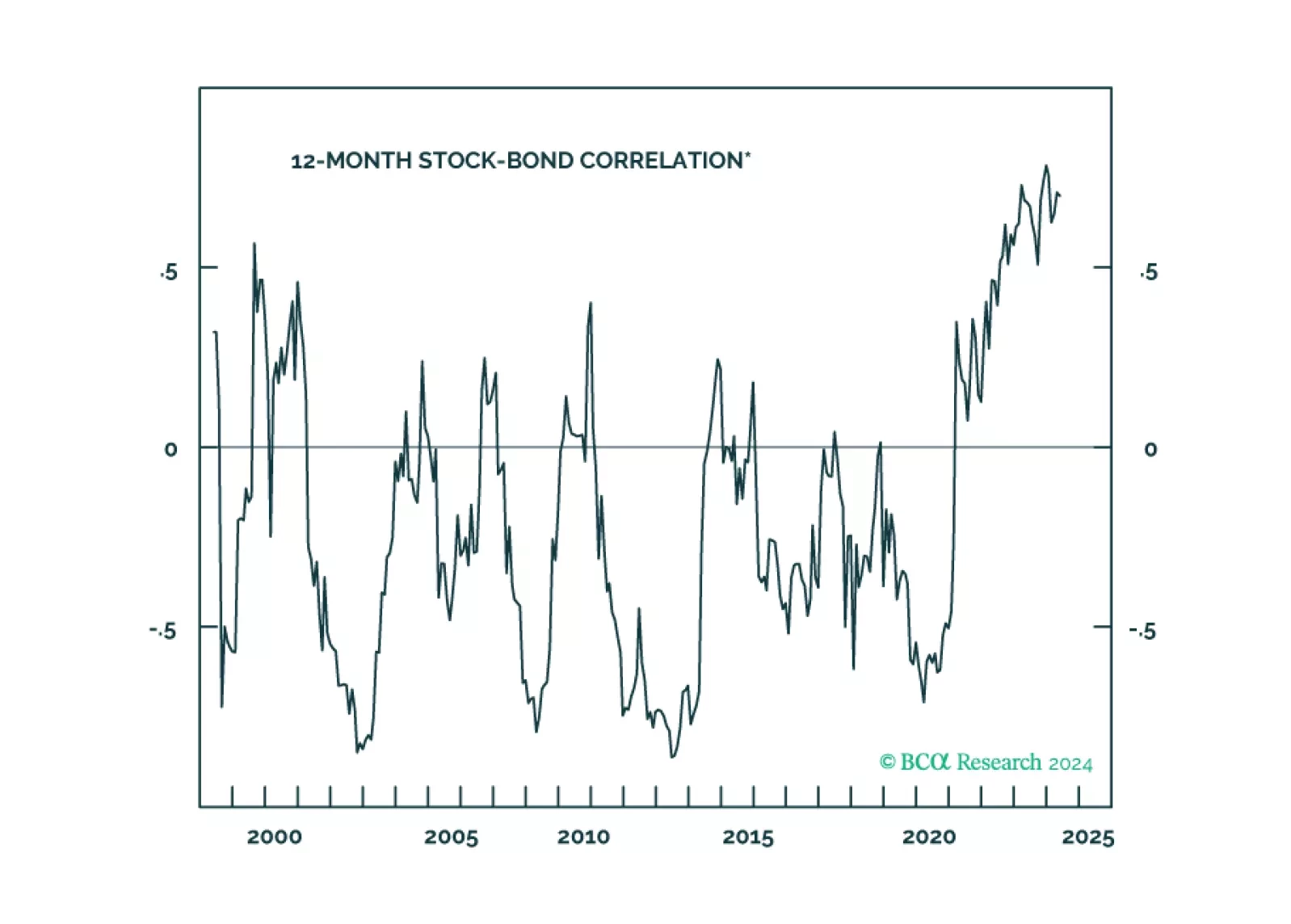

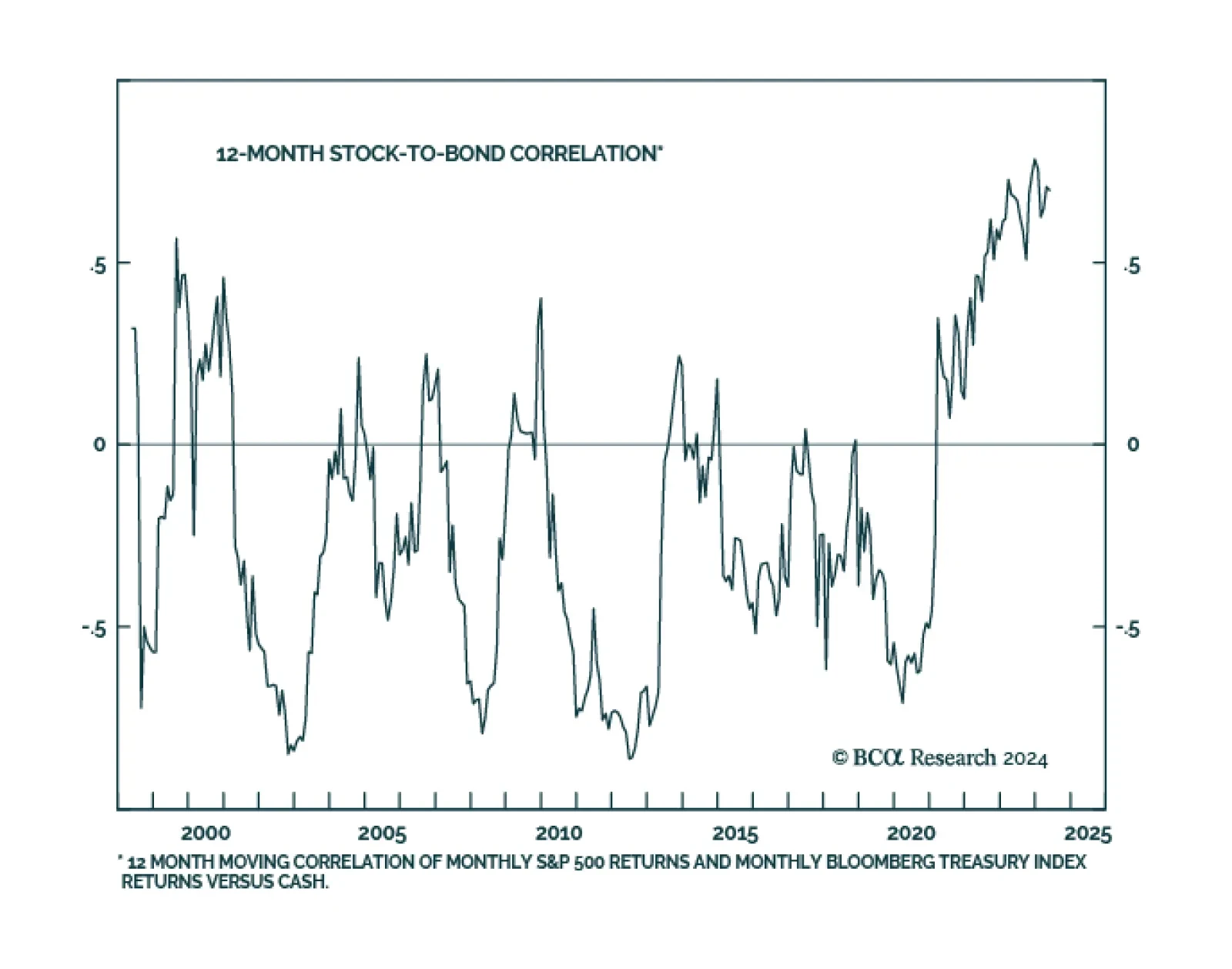

According to BCA Research’s US Bond Strategy service, investors should look to the stock-to-bond ratio to time the breakout in yields. The strong positive correlation between stock and bond returns has been a consistent…

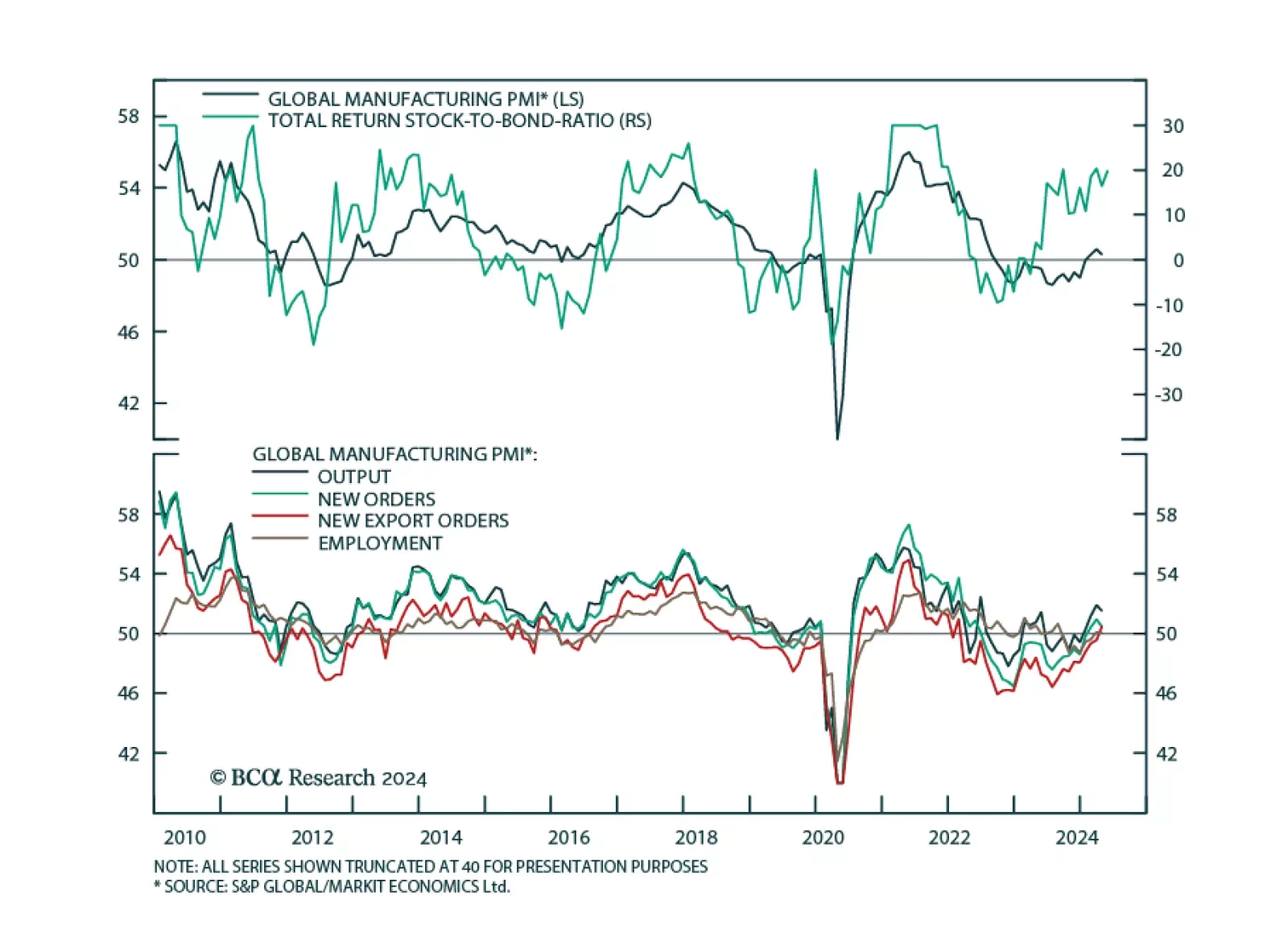

The revival in global growth momentum continued in April. The JPM Global Manufacturing PMI came in at 50.3, marking its third consecutive month of expansion. Details underscored solid demand conditions. Output and new orders…

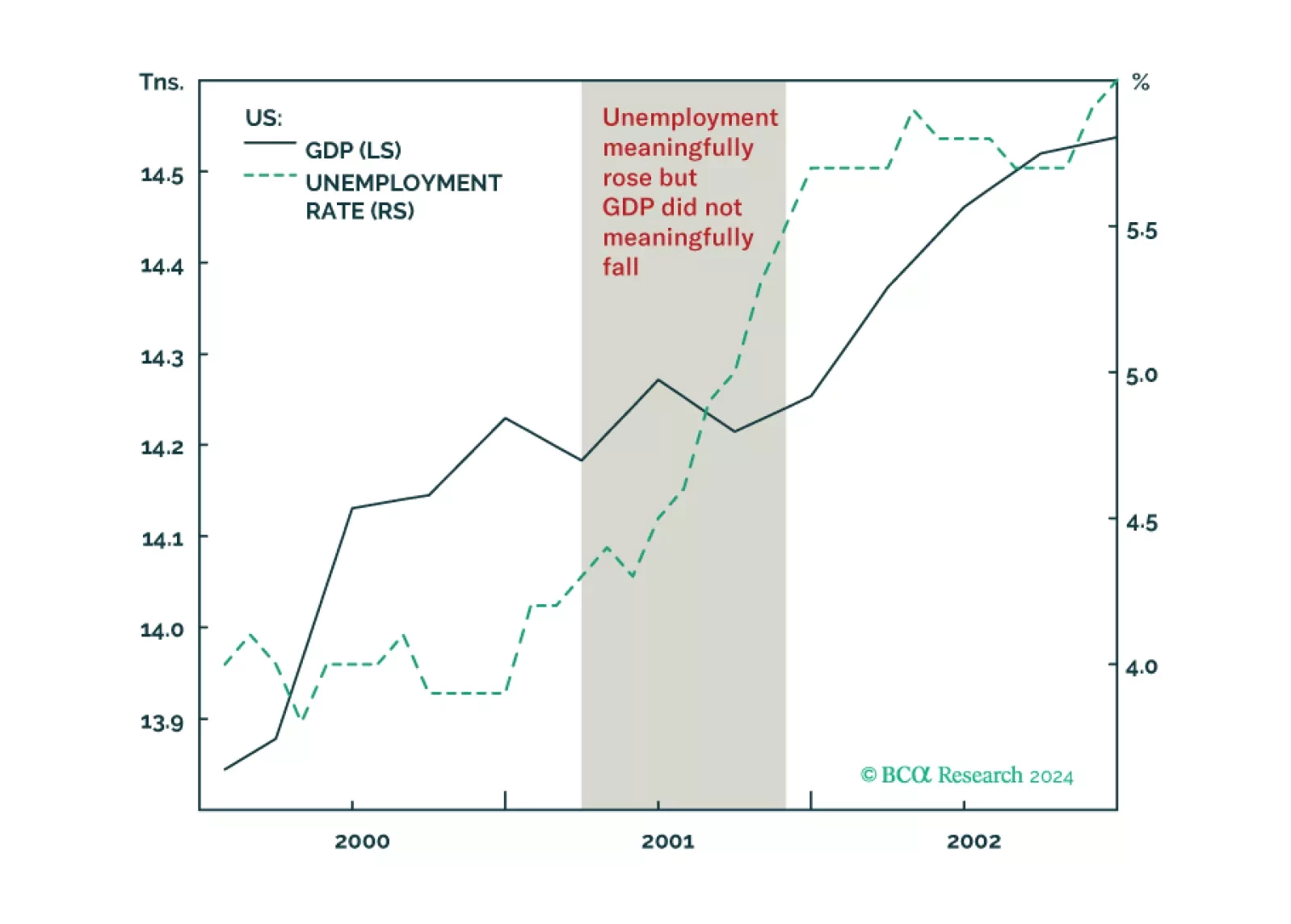

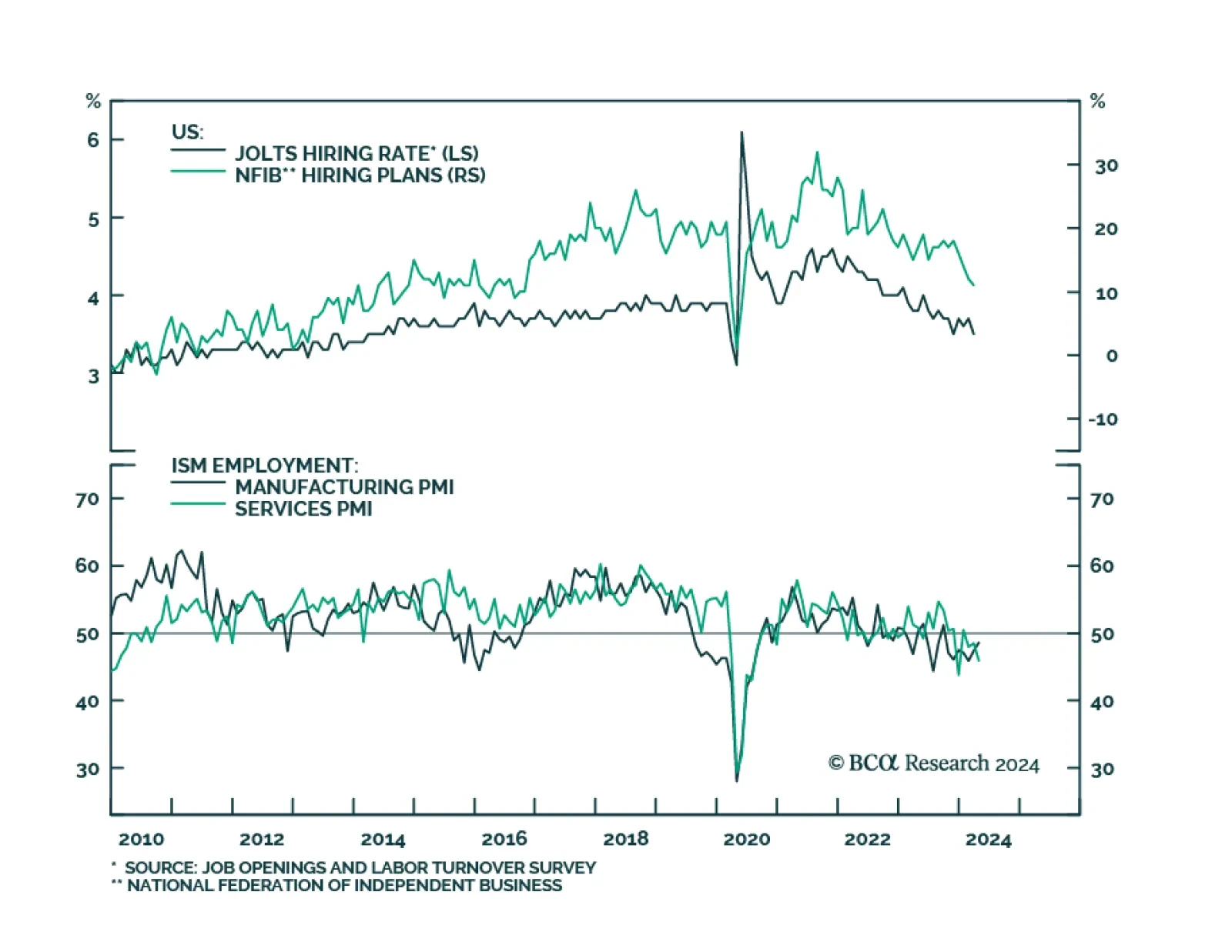

Why the US could get a jobs recession without a GDP recession, as happened in 2001, and what it means for stocks and bonds. Plus, an update on the Joshi rule.

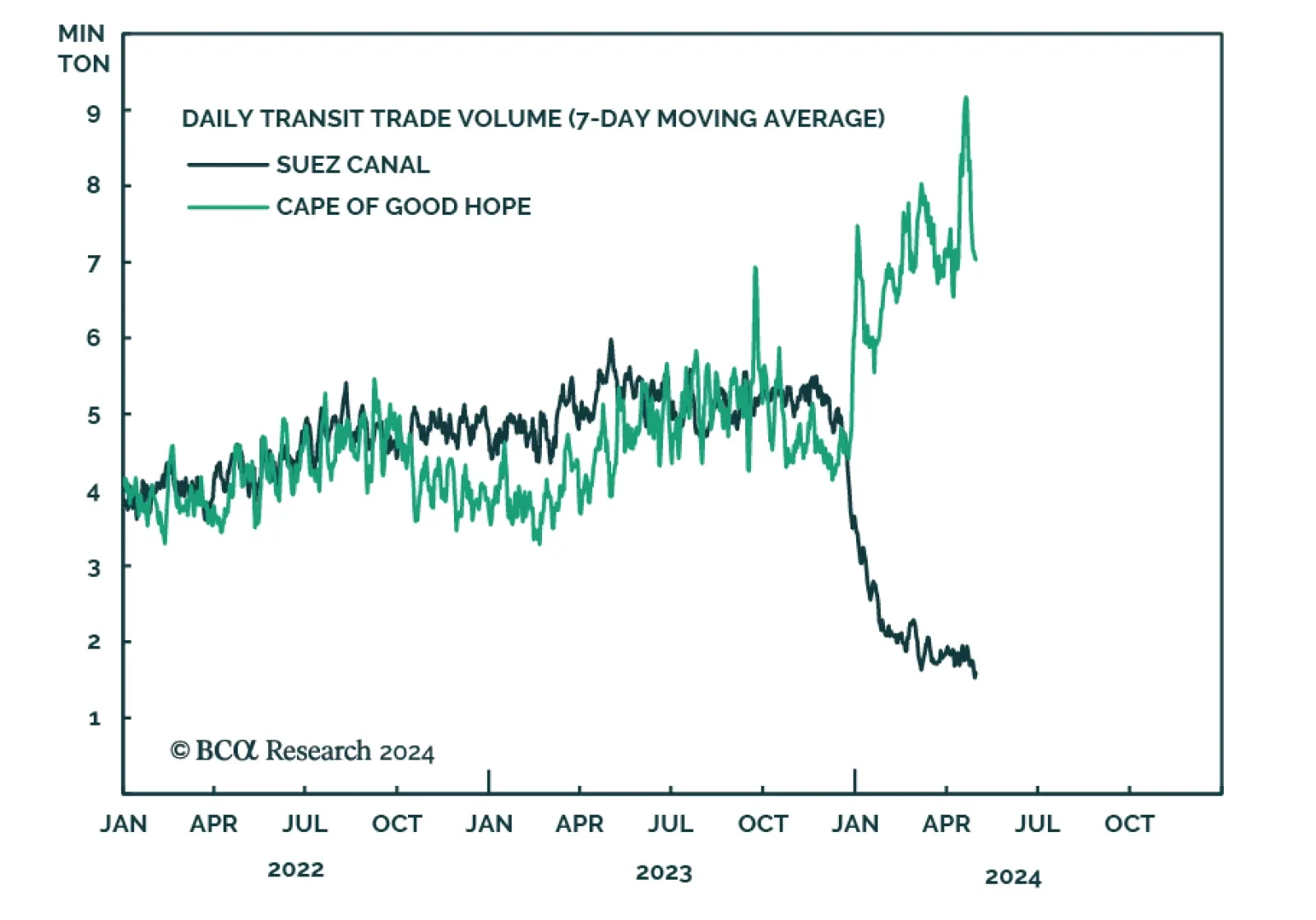

Transit through the Suez Canal has hit a new low. The 7-day moving average of daily ship transit calls is currently at 30, less than half of what it was at the end of 2023. The decline in volume has been even more severe, with…

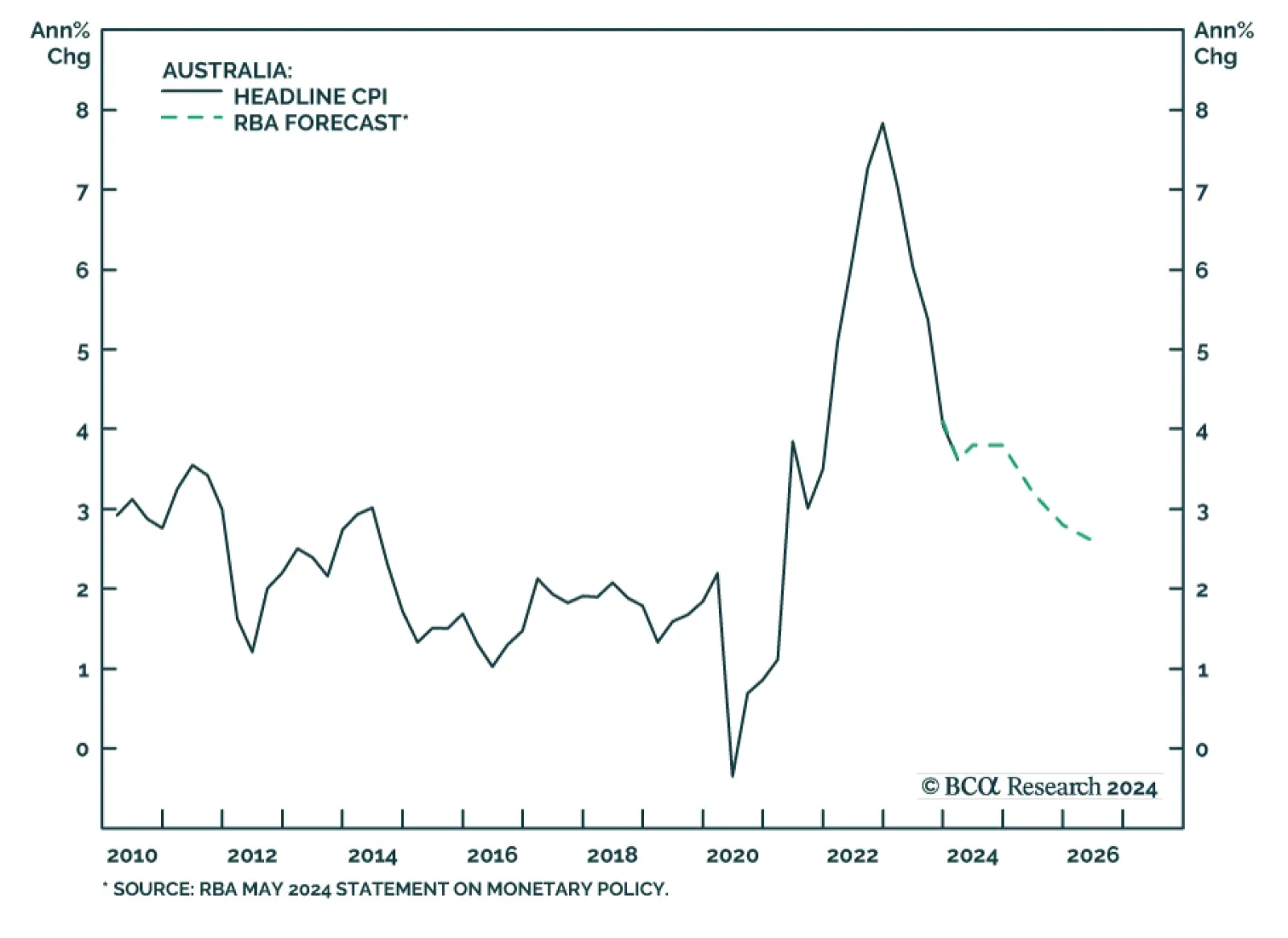

The Reserve Bank of Australia (RBA) left its policy rate unchanged at 4.35% at its May meeting, in line with expectations. The statement highlighted that inflation continues to moderate, though at a slower-than-expected pace.…

Our Portfolio Allocation Summary for May 2024.

According to BCA Research’s US Bond Strategy service, while US economic data clearly show that labor demand has slowed from its peak two years ago, it isn’t yet clear whether this slowing represents a re-normalization…