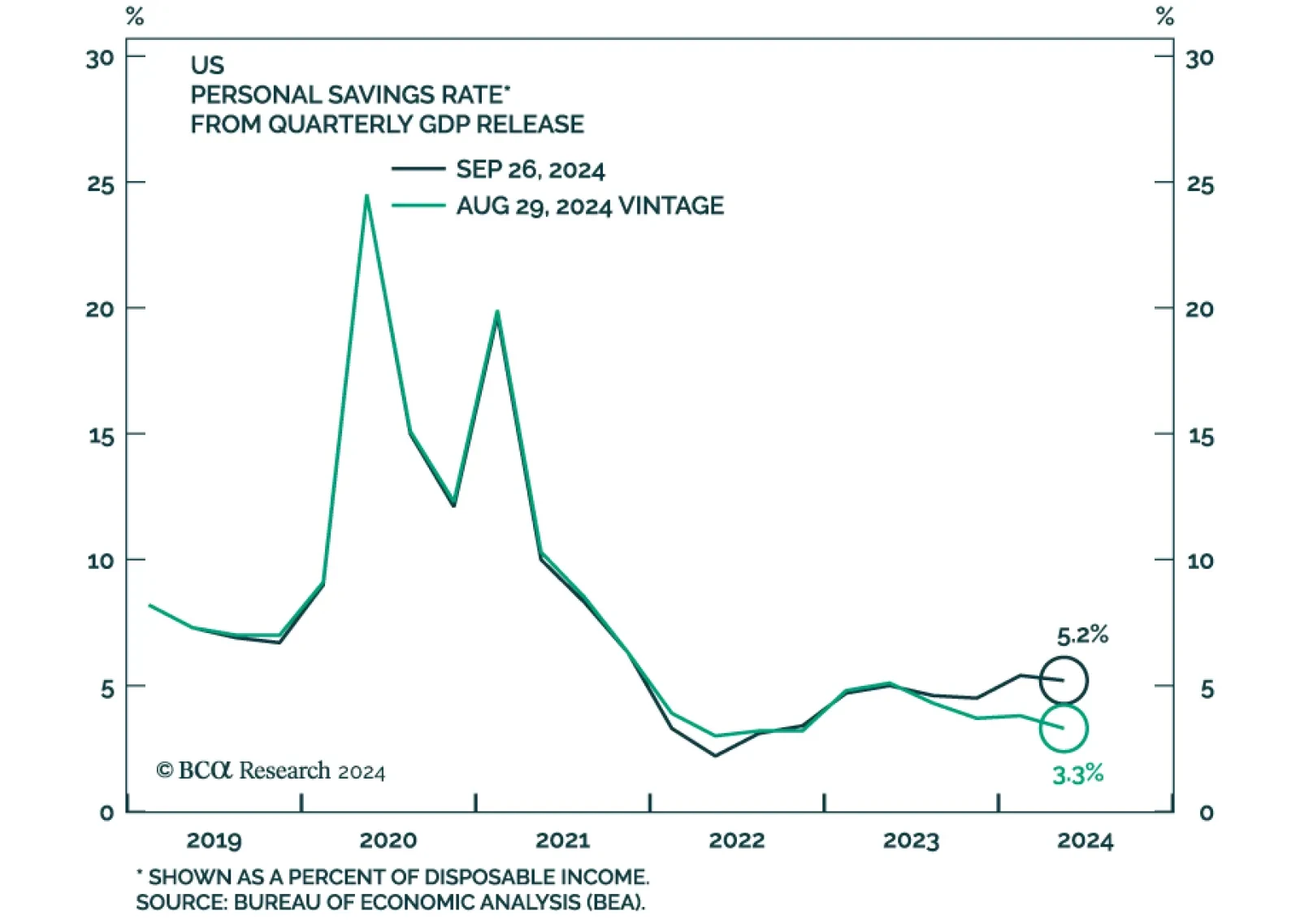

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

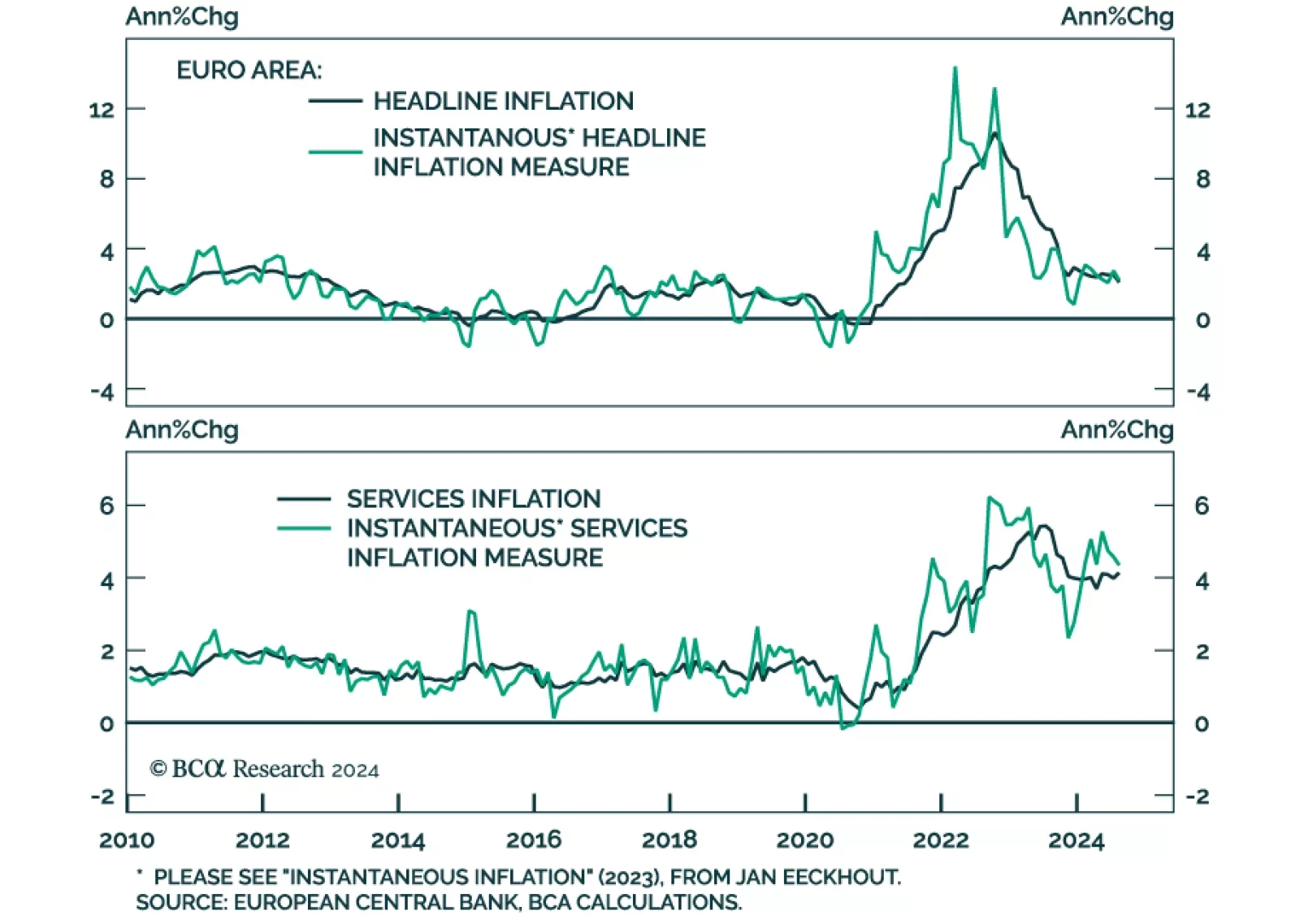

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

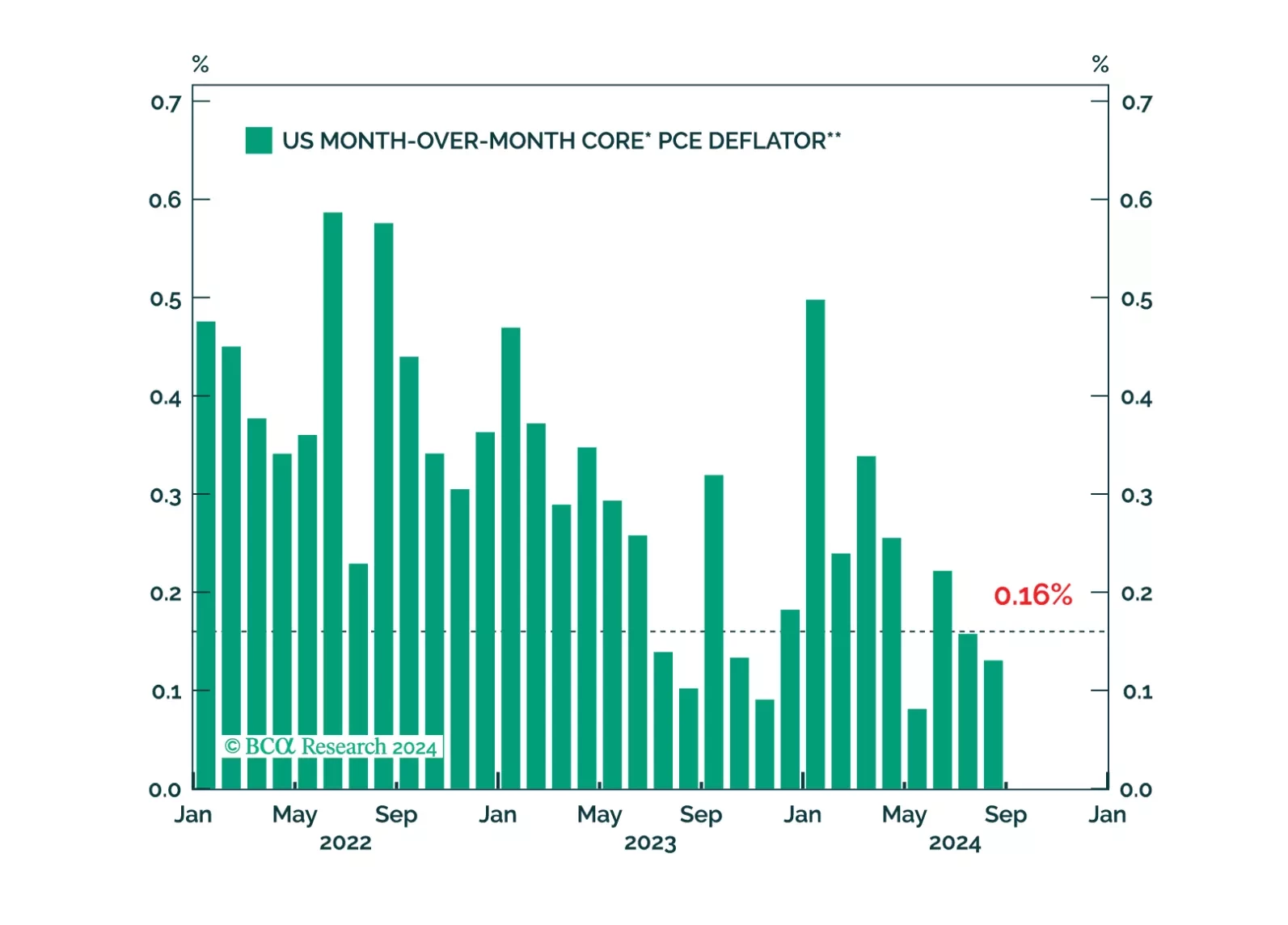

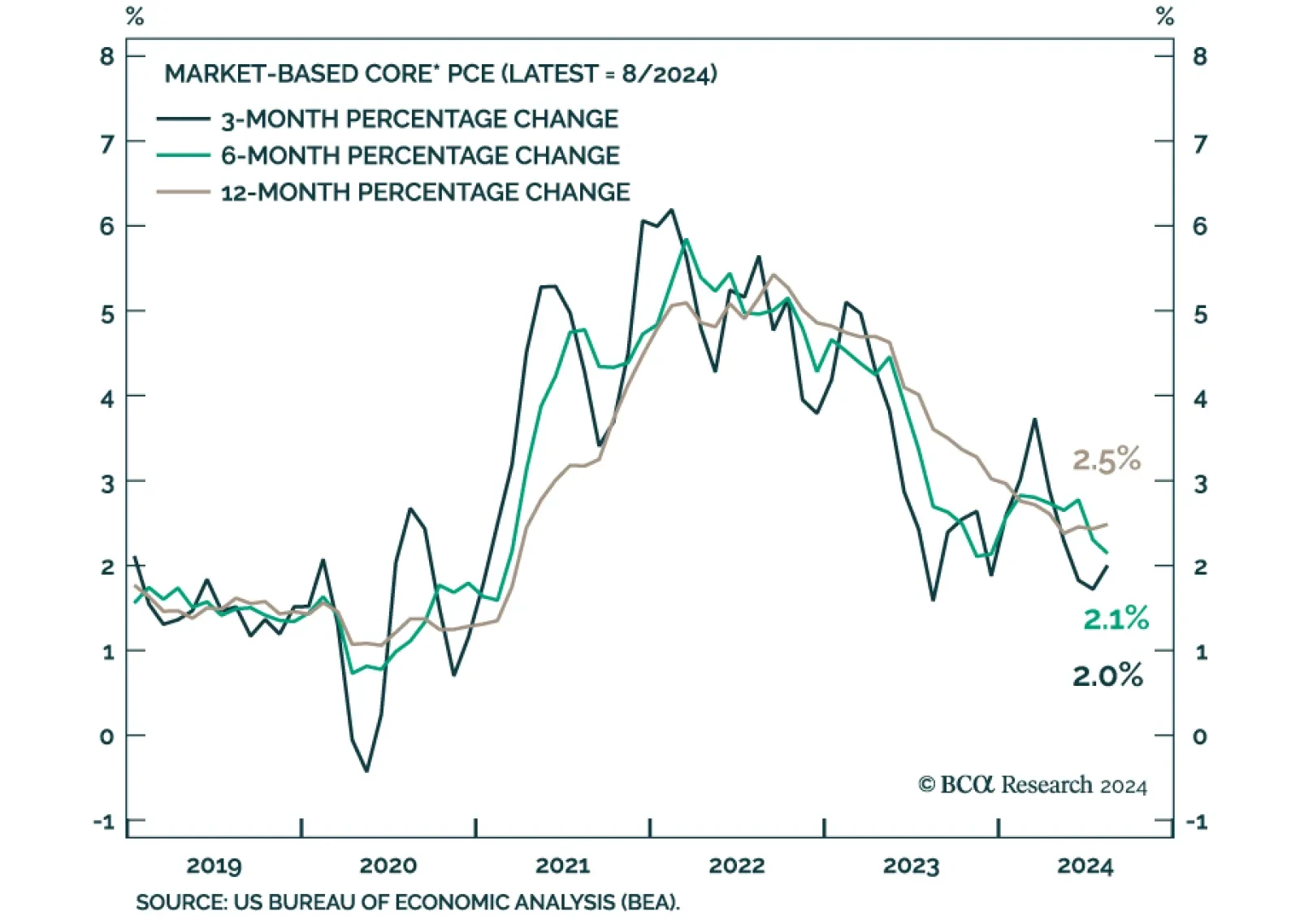

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

We consider the possibility that lower interest rates could lead to an increase in household borrowing, prolonging the economic recovery.

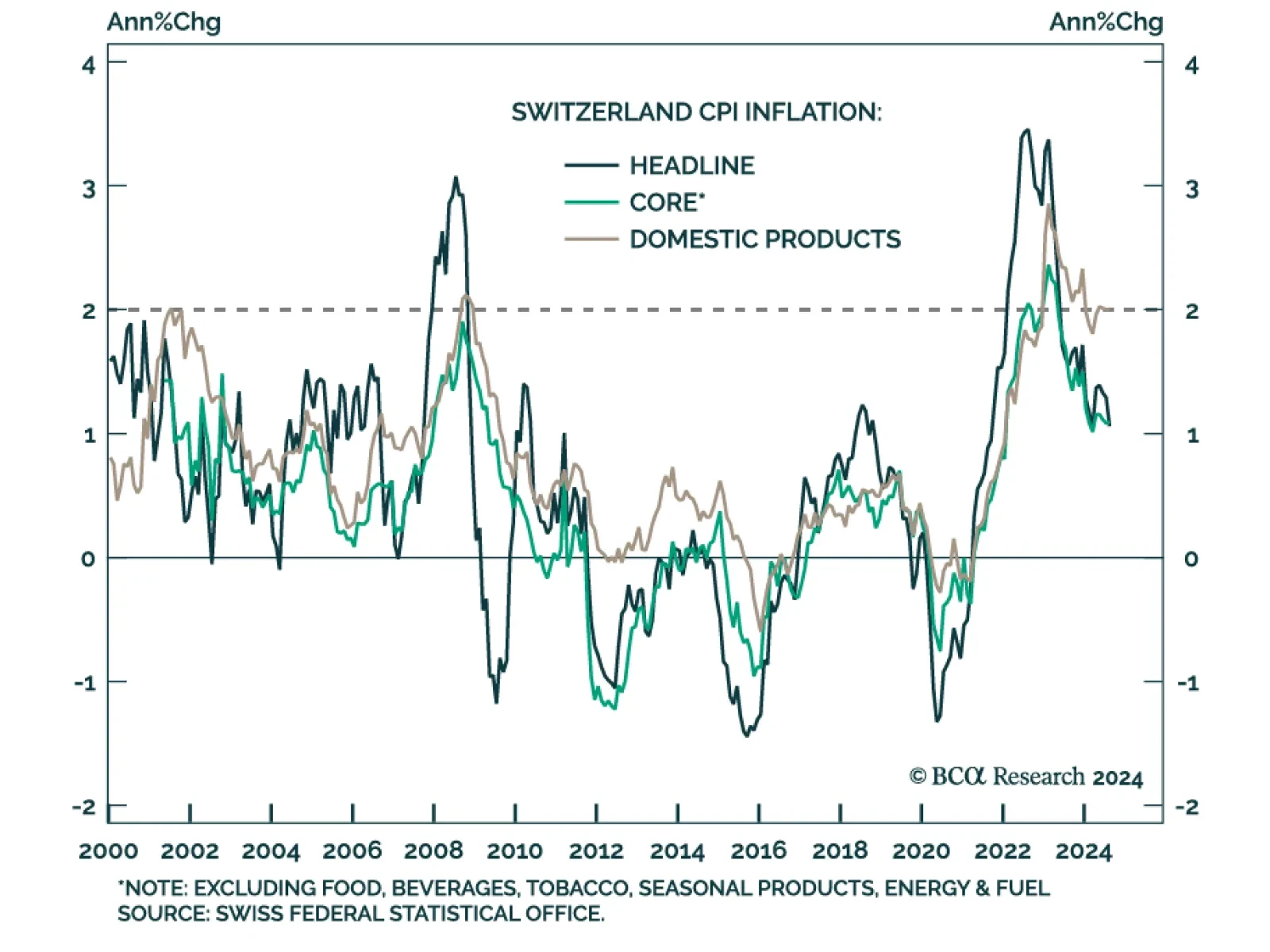

In a widely expected move, the Swiss National Bank (SNB) cut its policy rate for a third consecutive meeting on Thursday, from 1.25% to 1.00%. The move marked President Thomas Jordan’s final policy decision and his incoming…

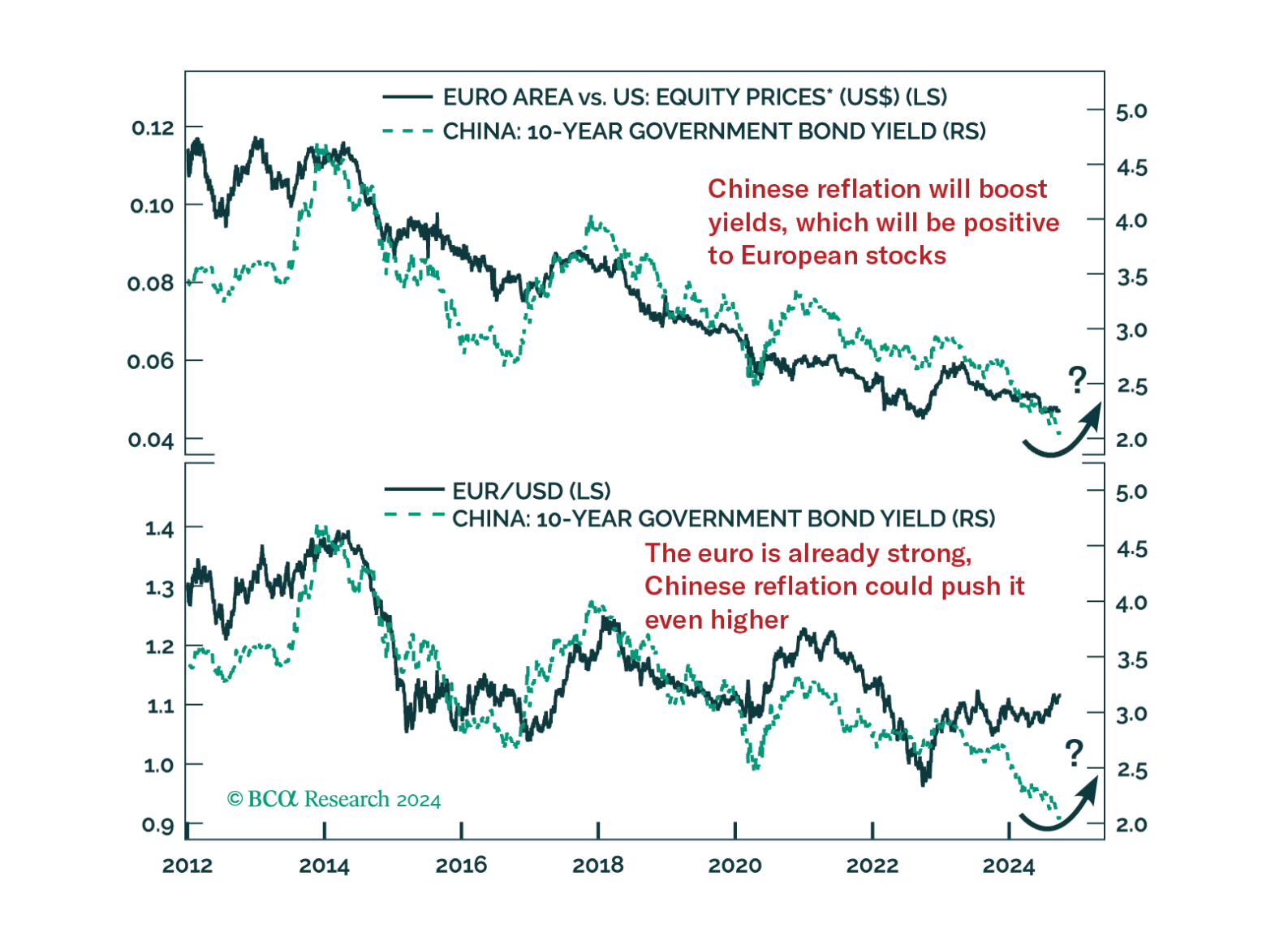

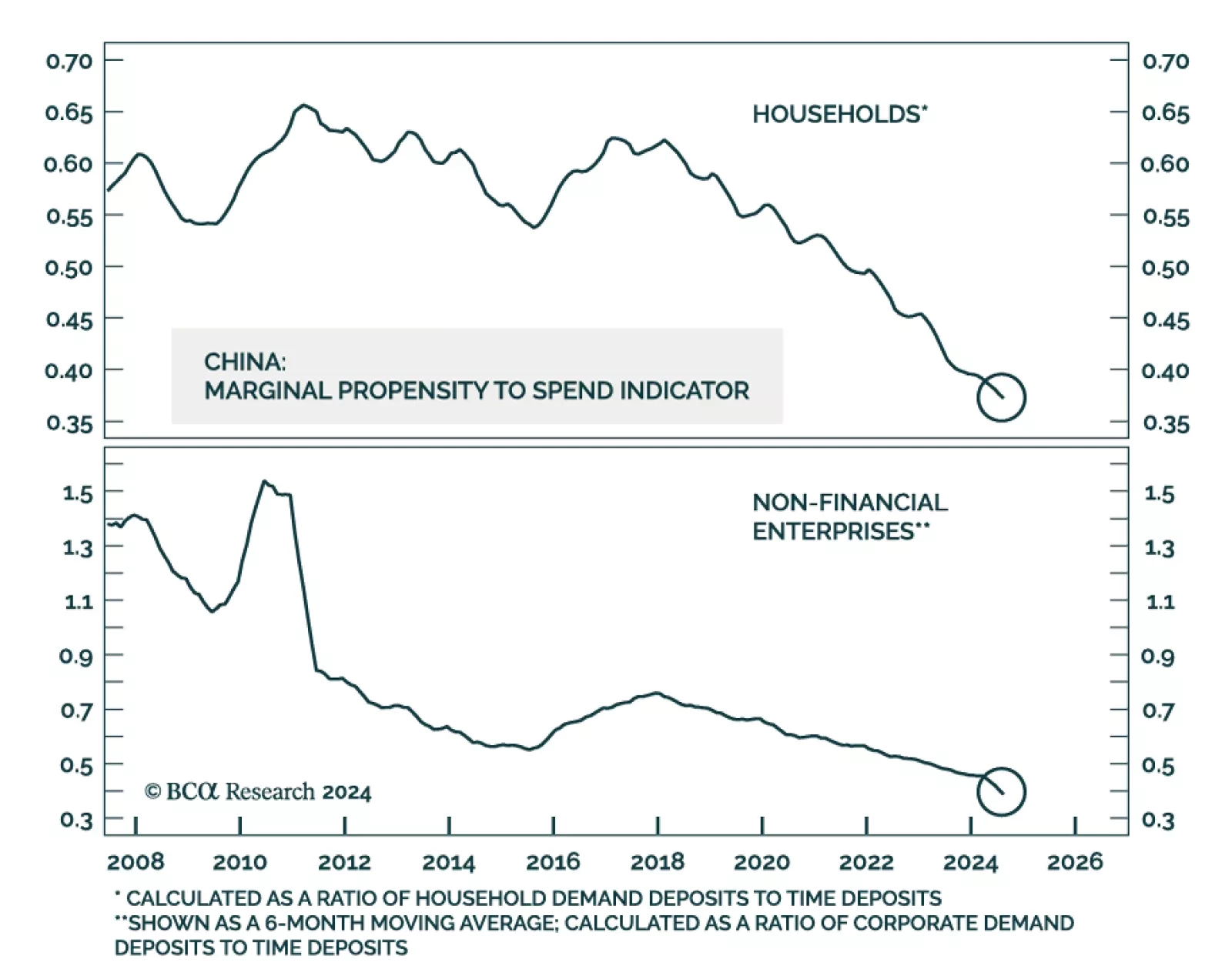

This week has not been short of developments on Chinese policy. After unleashing a monetary policy blitz, the authorities held an unscheduled Politburo meeting resulting in a pledge to take actions towards stabilizing the housing…

China’s Politburo announcement is likely to lead to a repricing of China’s growth in the near-term. Read how investors can hedge against this potent threat to our defensive investment stance.

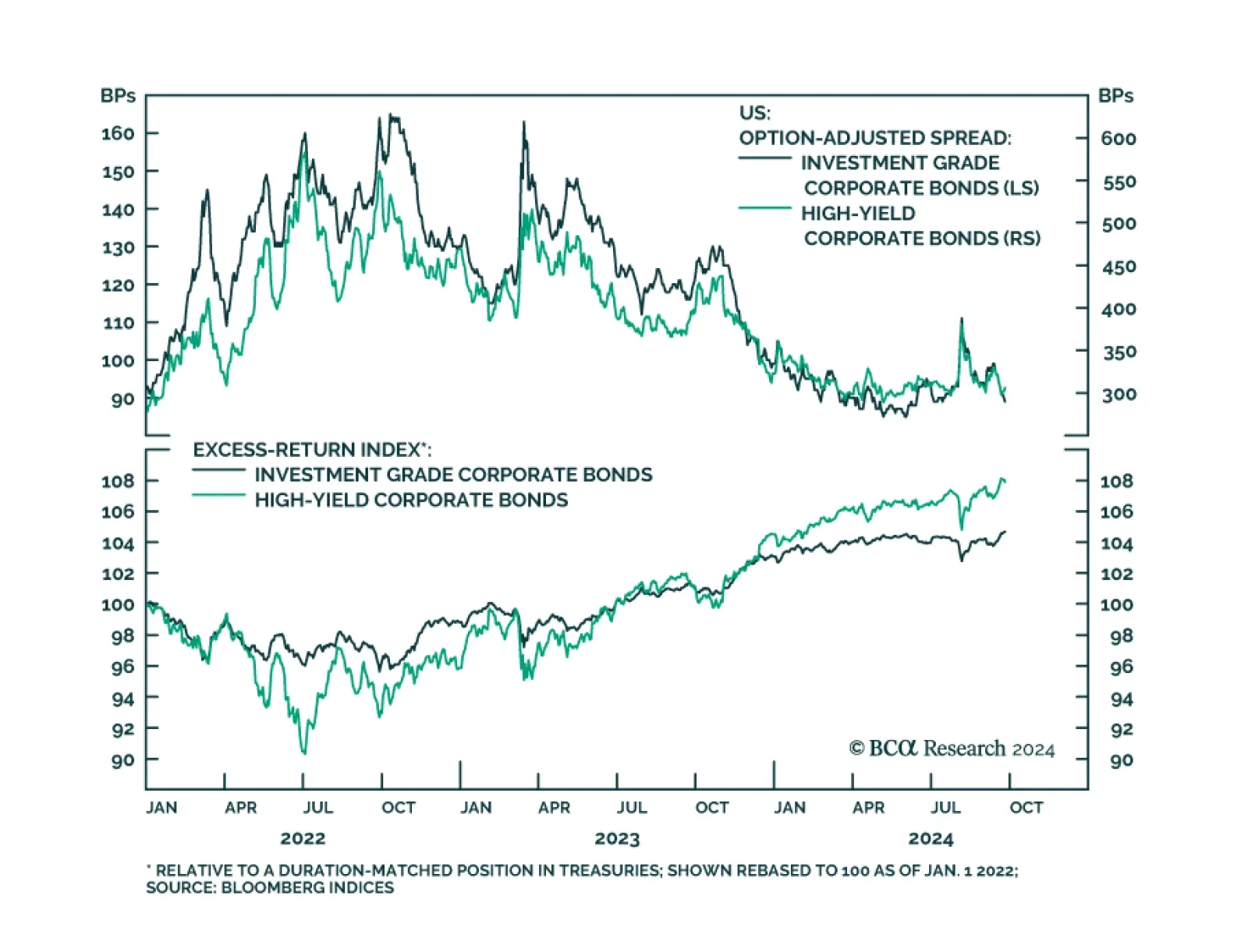

US investment grade and high yield spreads have tightened 22 and 75 bps since their August highs. Risk assets have cheered the outsized Fed rate cut as the narrative in markets aligns with the Fed’s conviction it can…

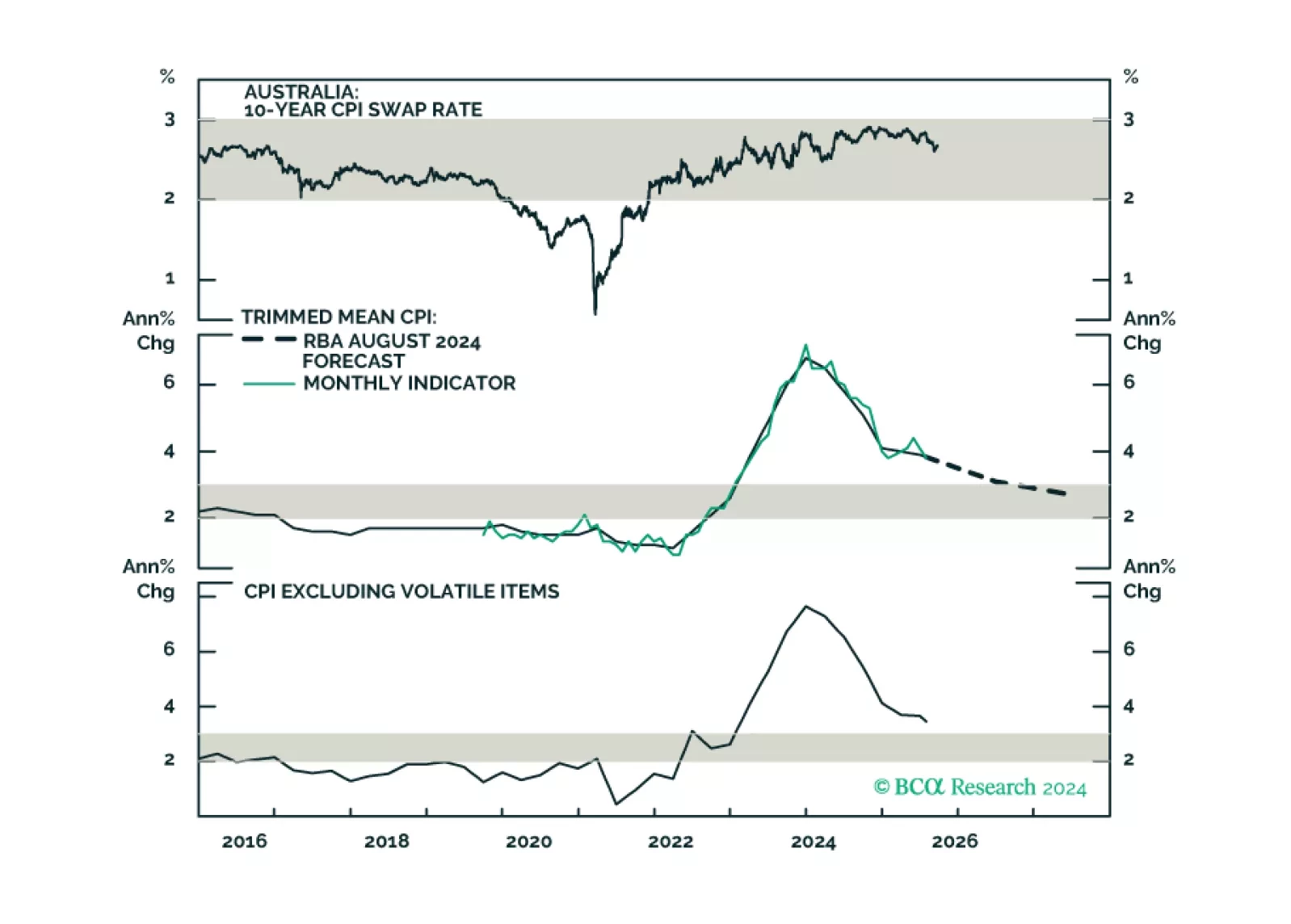

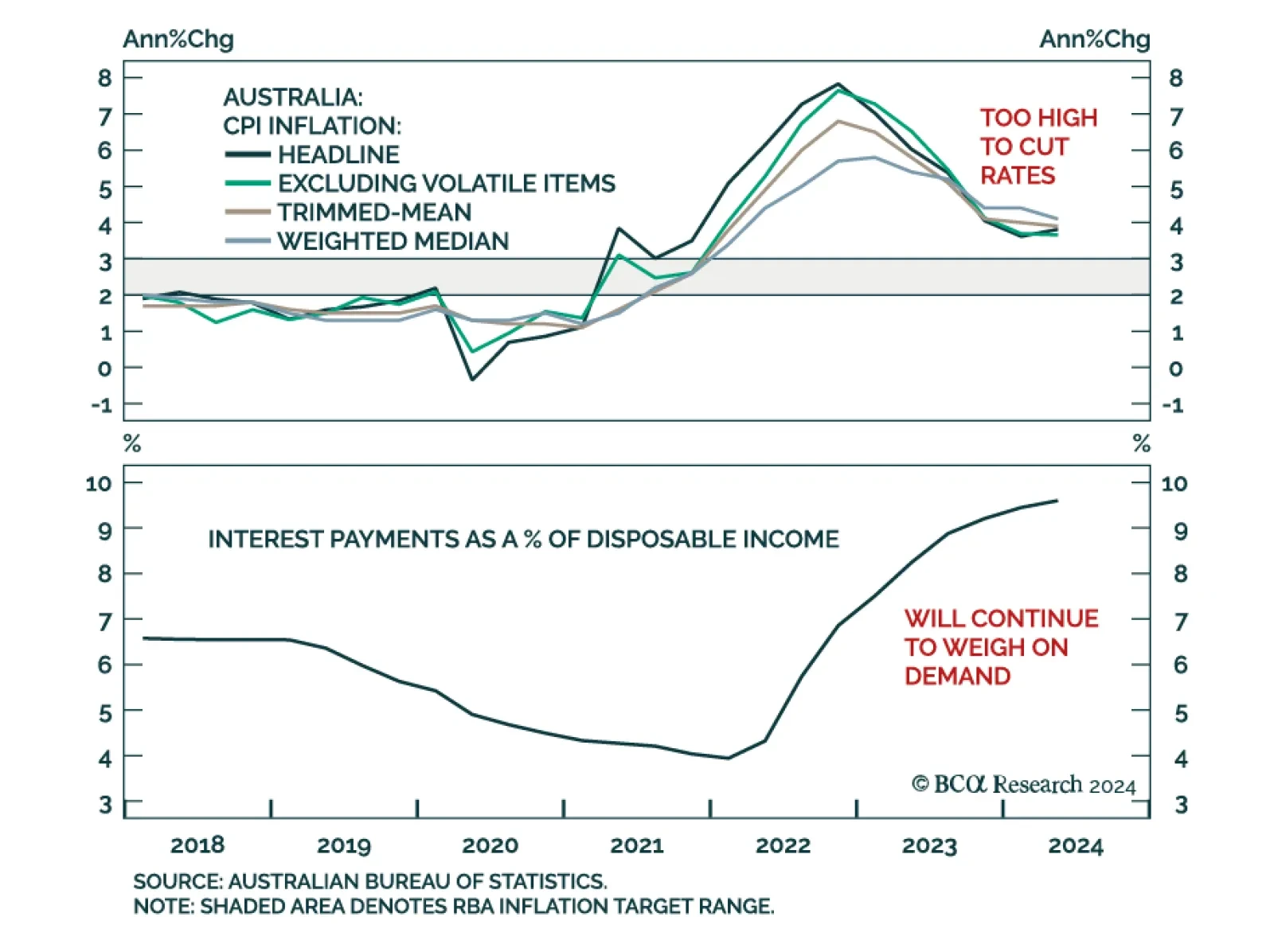

This insight parses through the RBA’s latest policy decision, and makes recommendations on whether to expect any rate cuts in 2024, and beyond.

In a widely expected move, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% in September. All measures of Australian CPI inflation remain well above the RBA target range. The Commonwealth Energy Bill Relief…