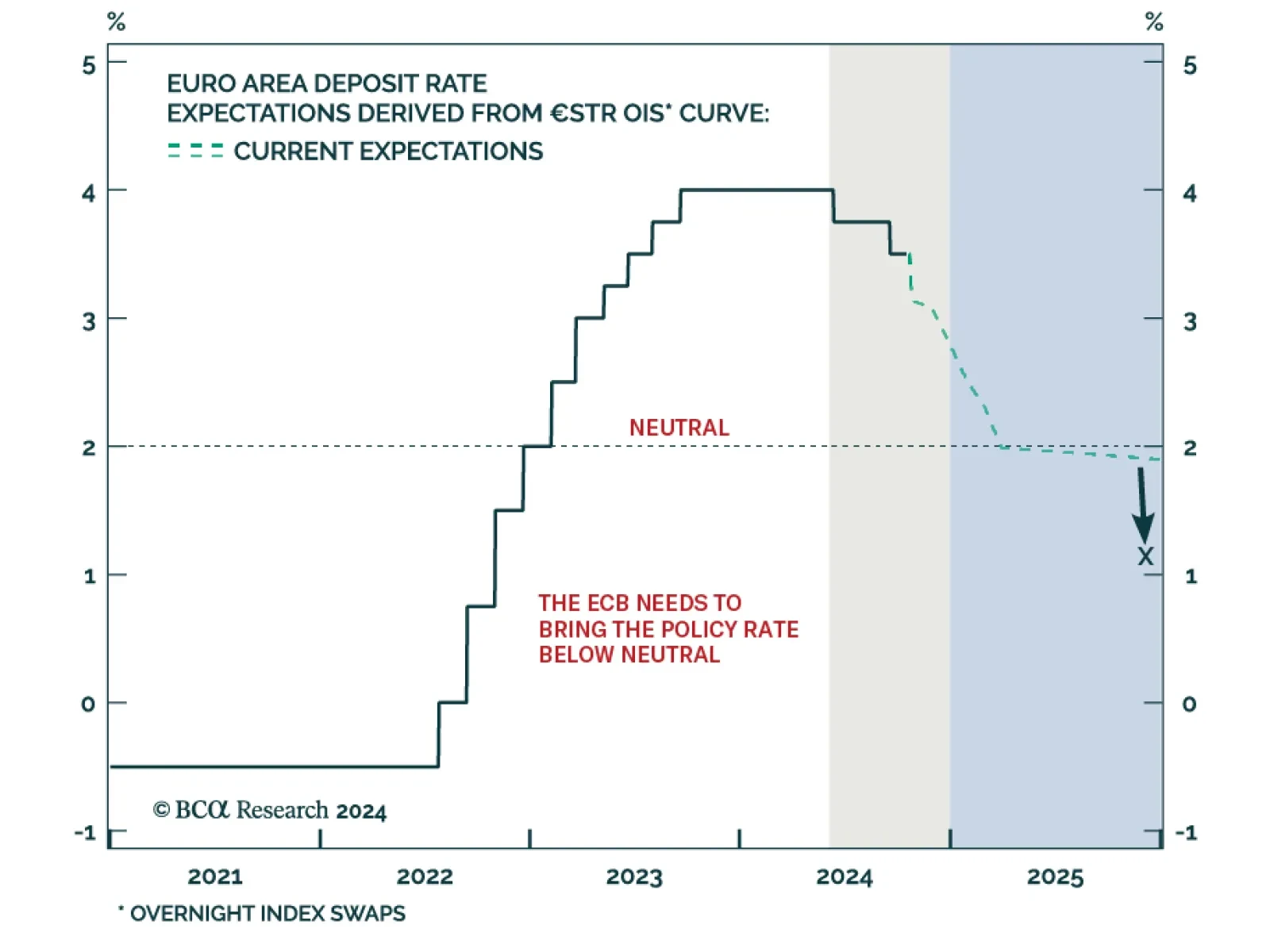

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

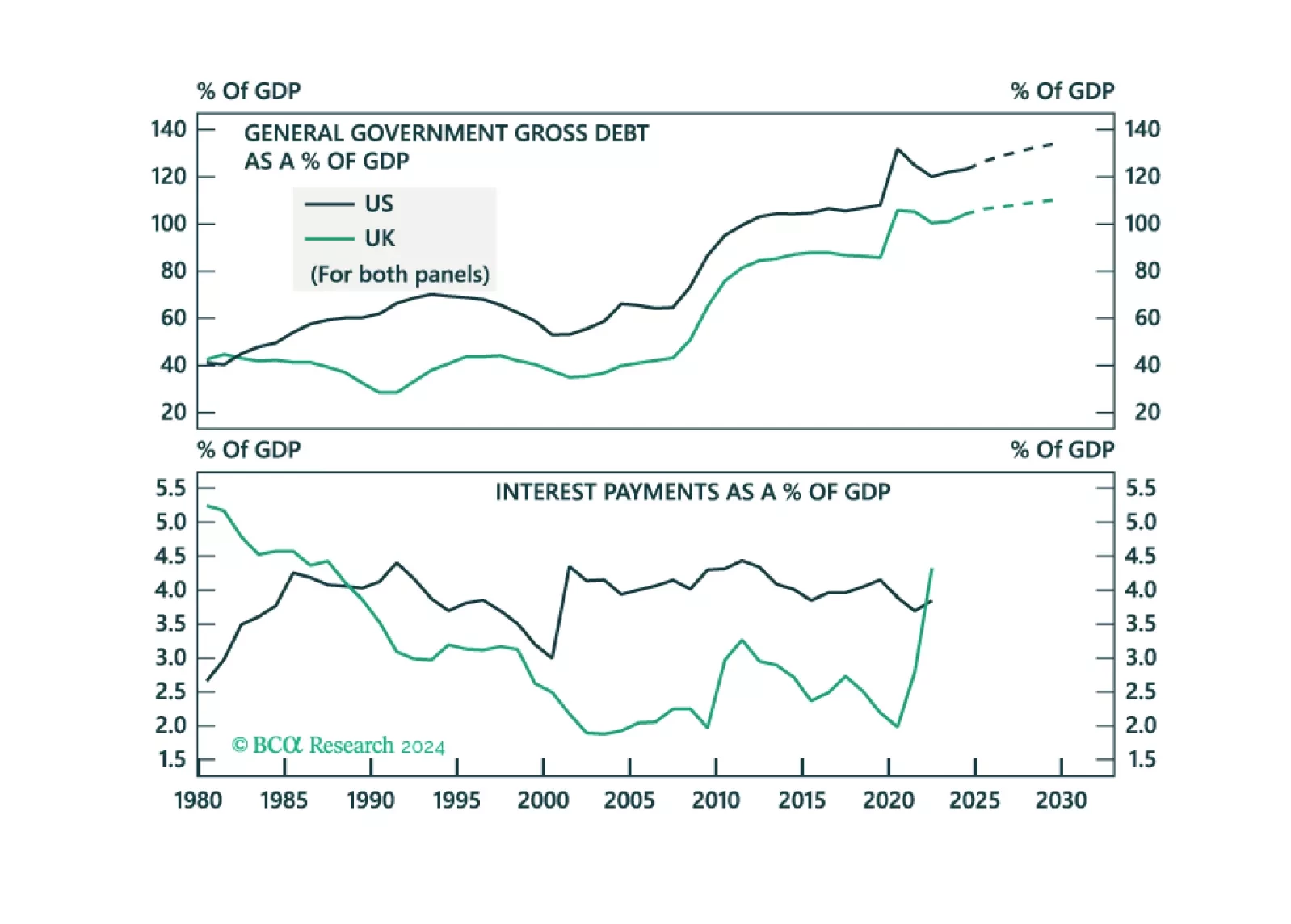

Recent positive US economic surprises drove cross-asset pricing, pushing both equities and Treasury yields higher. What do these yield levels mean for the Treasury market, and what path can we expect looking forward? Our US…

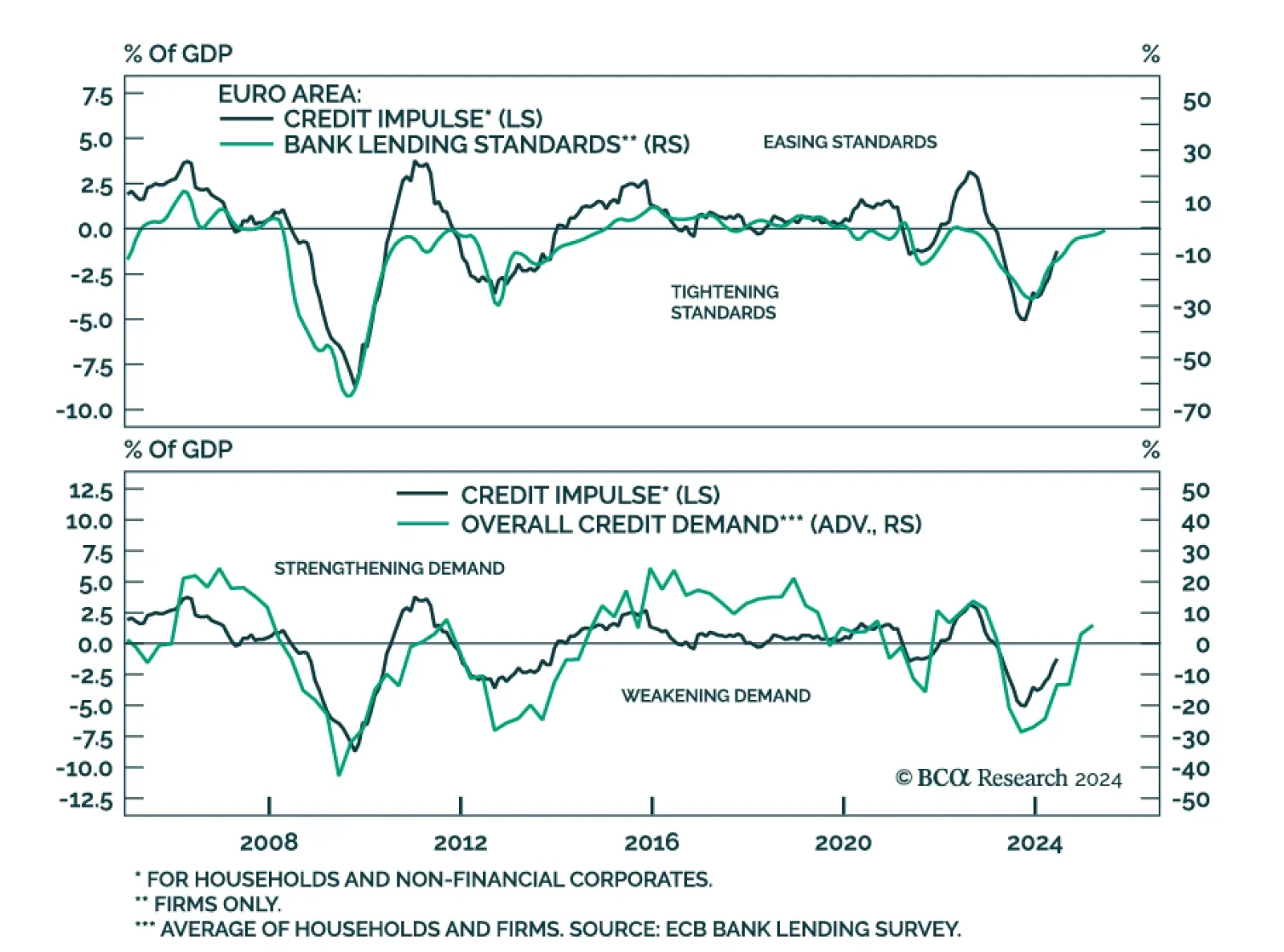

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

The UK August employment report was in line with recent data showing an economy humming at a decent pace. The unemployment rate decreased 0.1pp to 4% after peaking at 4.4% before the summer. The BoE will look kindly to the…

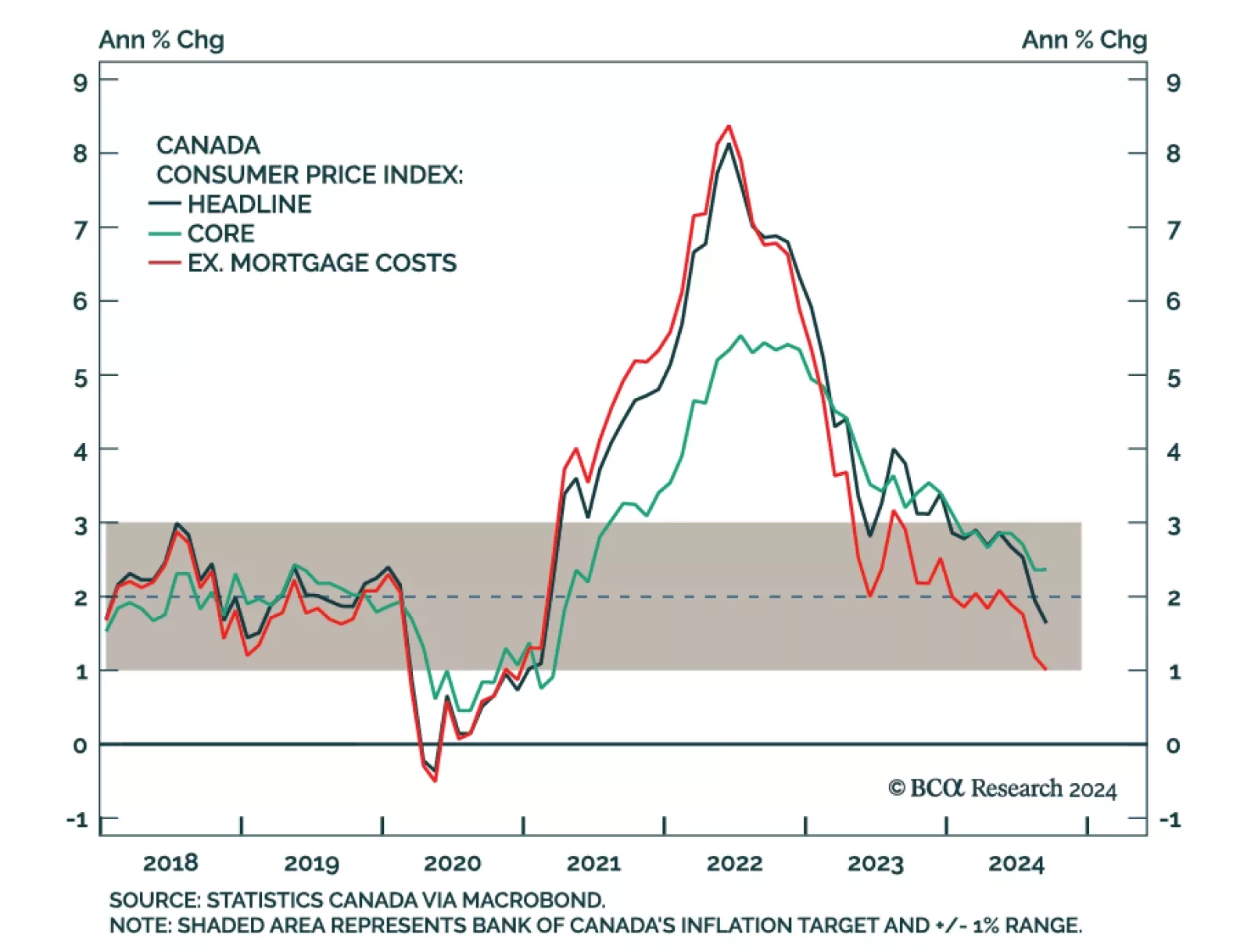

Canadian headline inflation rose 1.6% year-over-year in September, lower than the expected 1.8% and down from 2.0% in August. This was also its slowest pace since February 2021. The decrease was mainly driven by gasoline prices,…

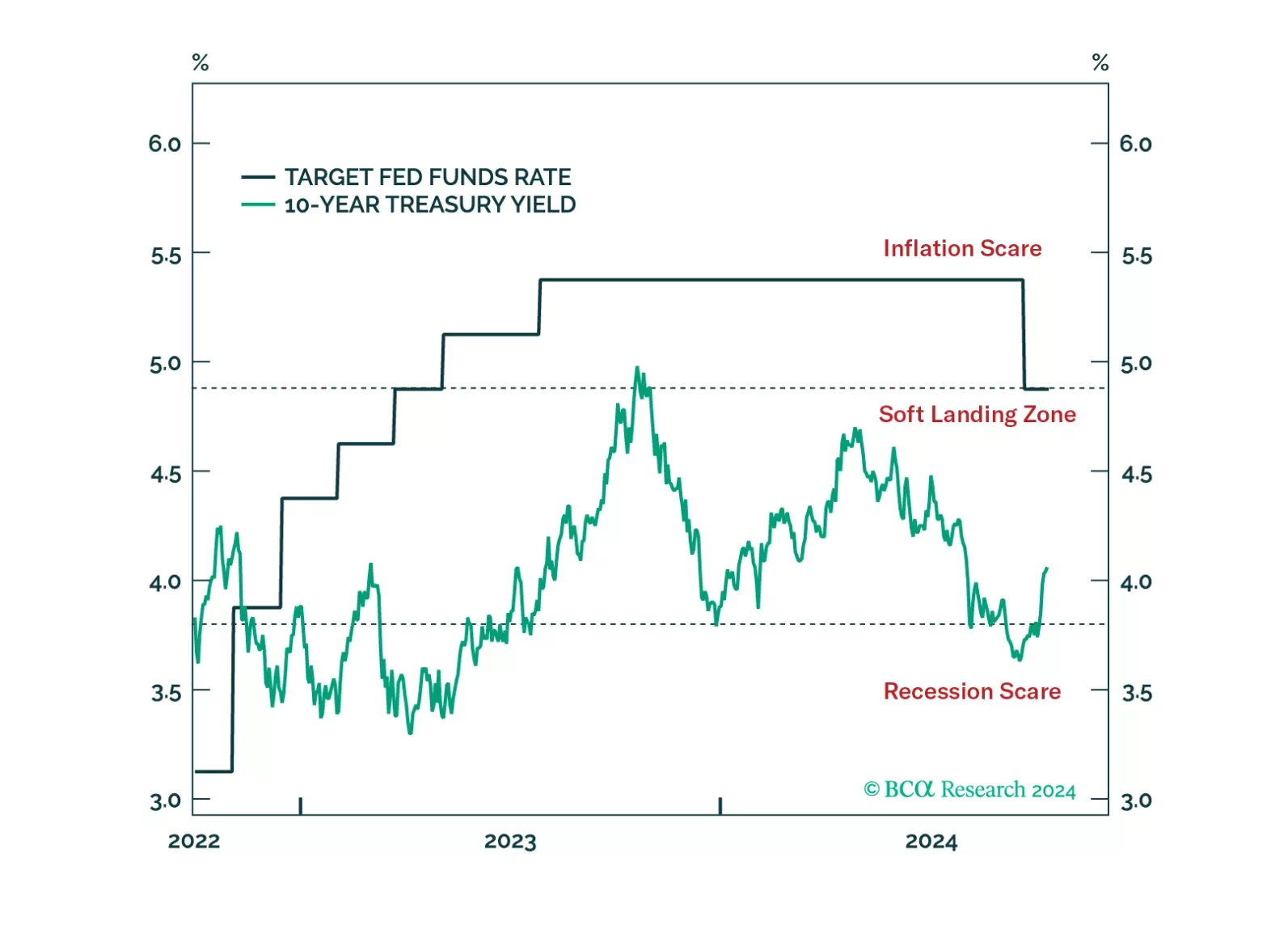

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

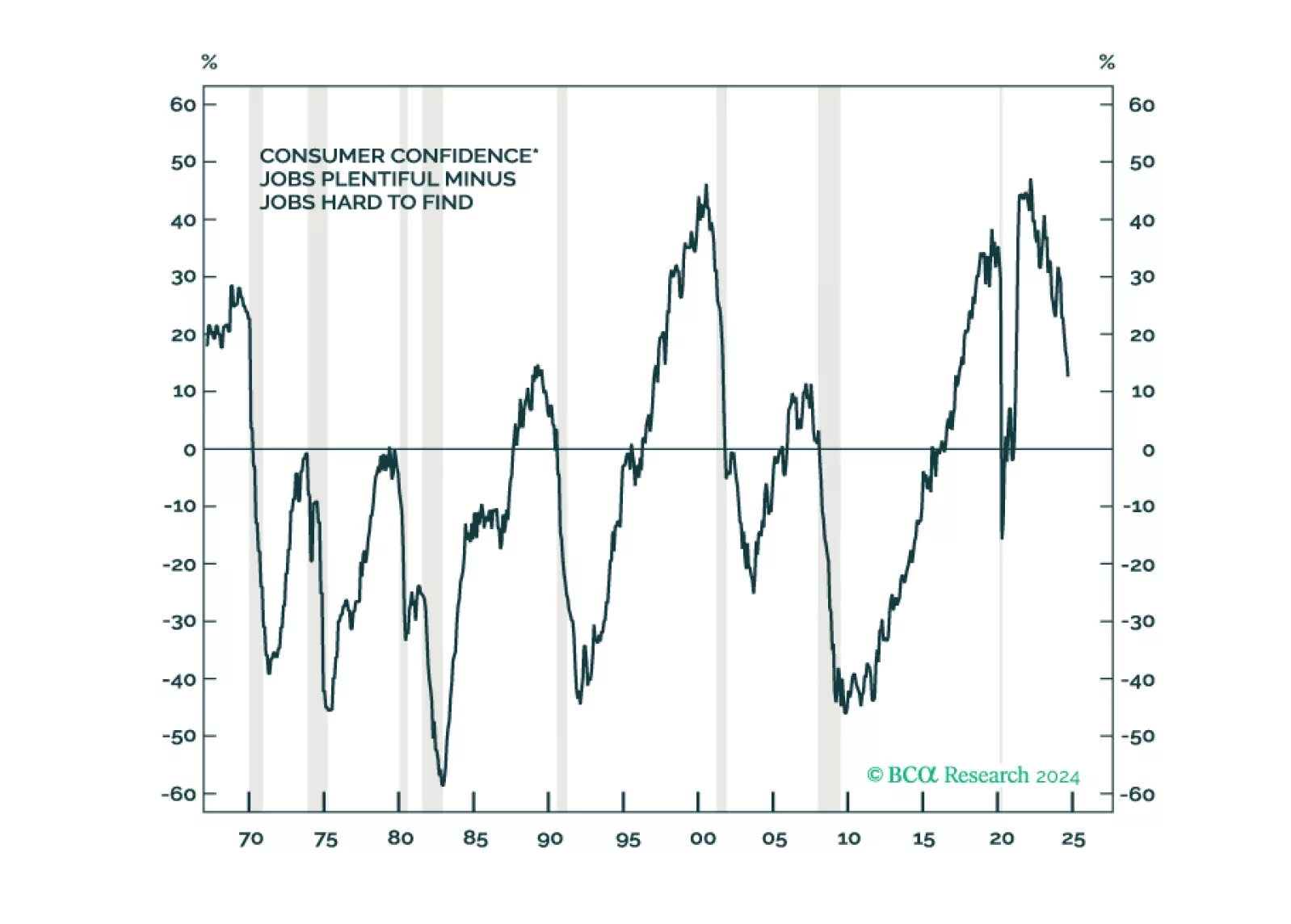

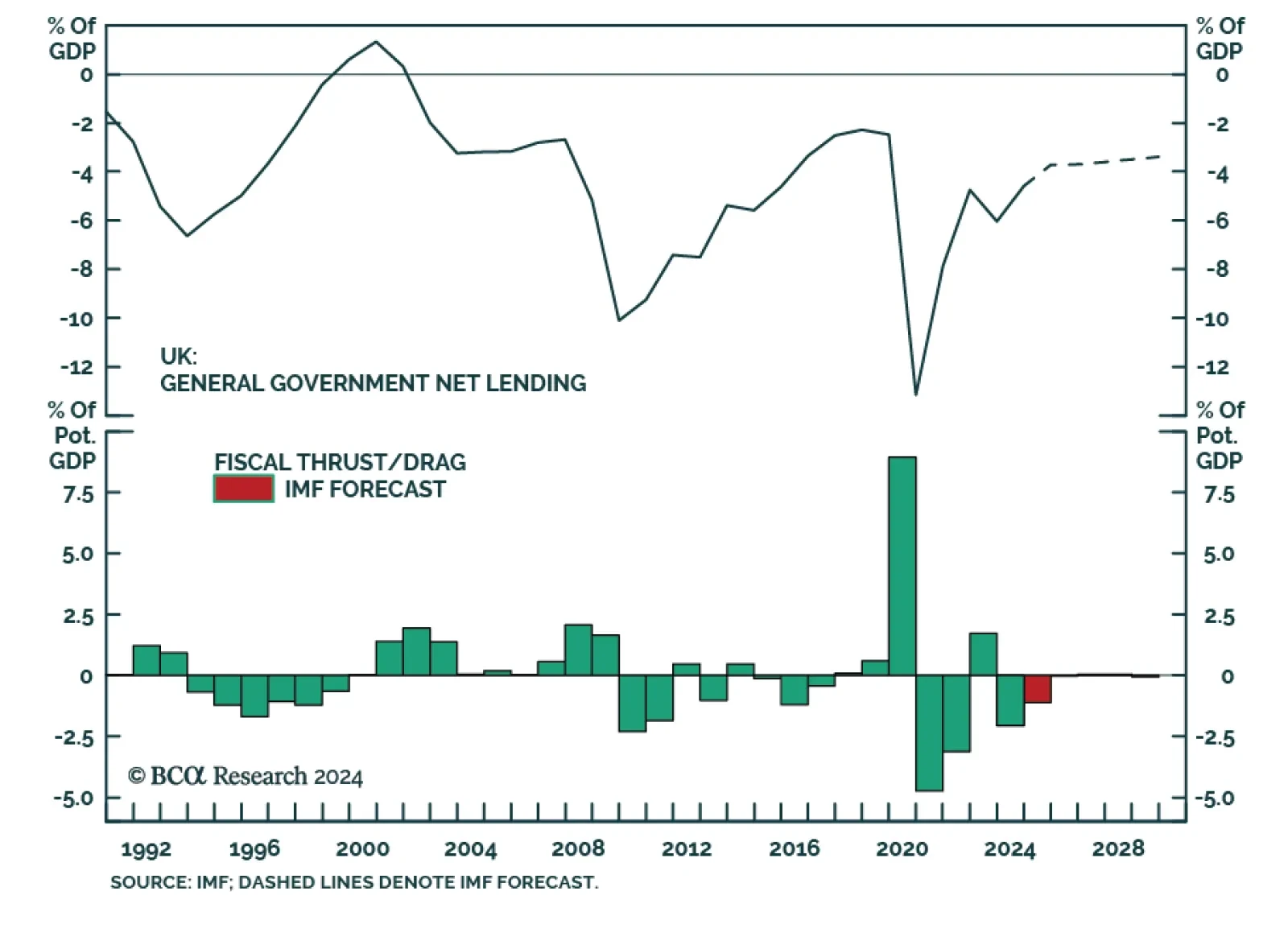

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.

We give our thoughts on this morning’s CPI release and (lack of) market reaction. We also close our short position in January 2025 fed funds futures.

Our Q3 portfolio was defensive, which we believe will be the appropriate stance in the next six-to-twelve months. Data coming out of the US has remained robust which could cause US bond yields to temporarily overshoot. An overshoot…