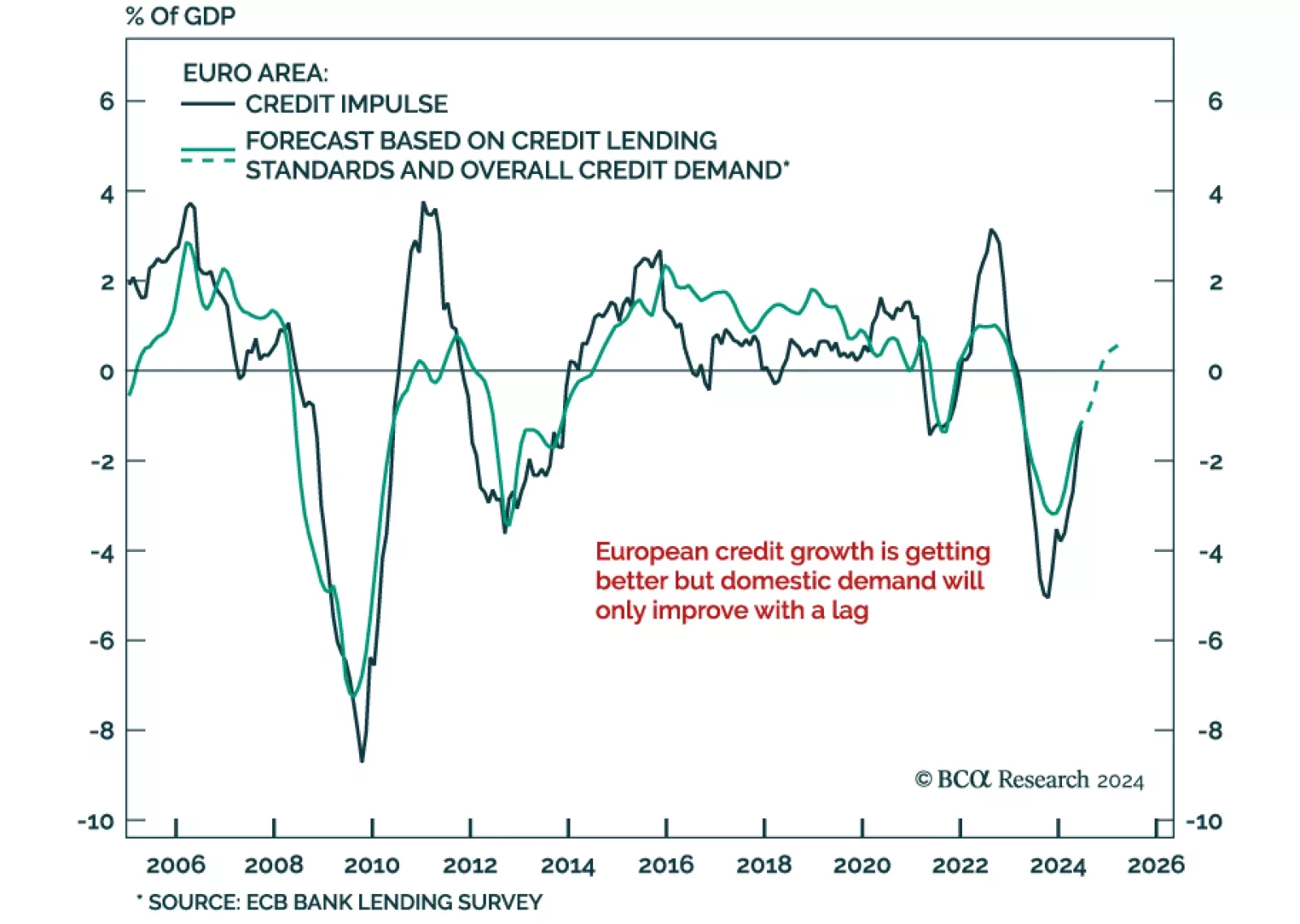

Eurozone money and credit data beat expectations, with M3 accelerating to 3.2% year-over-year in September from 2.9% a month prior. Household and corporate lending both drove the improvement. This development echoes the latest…

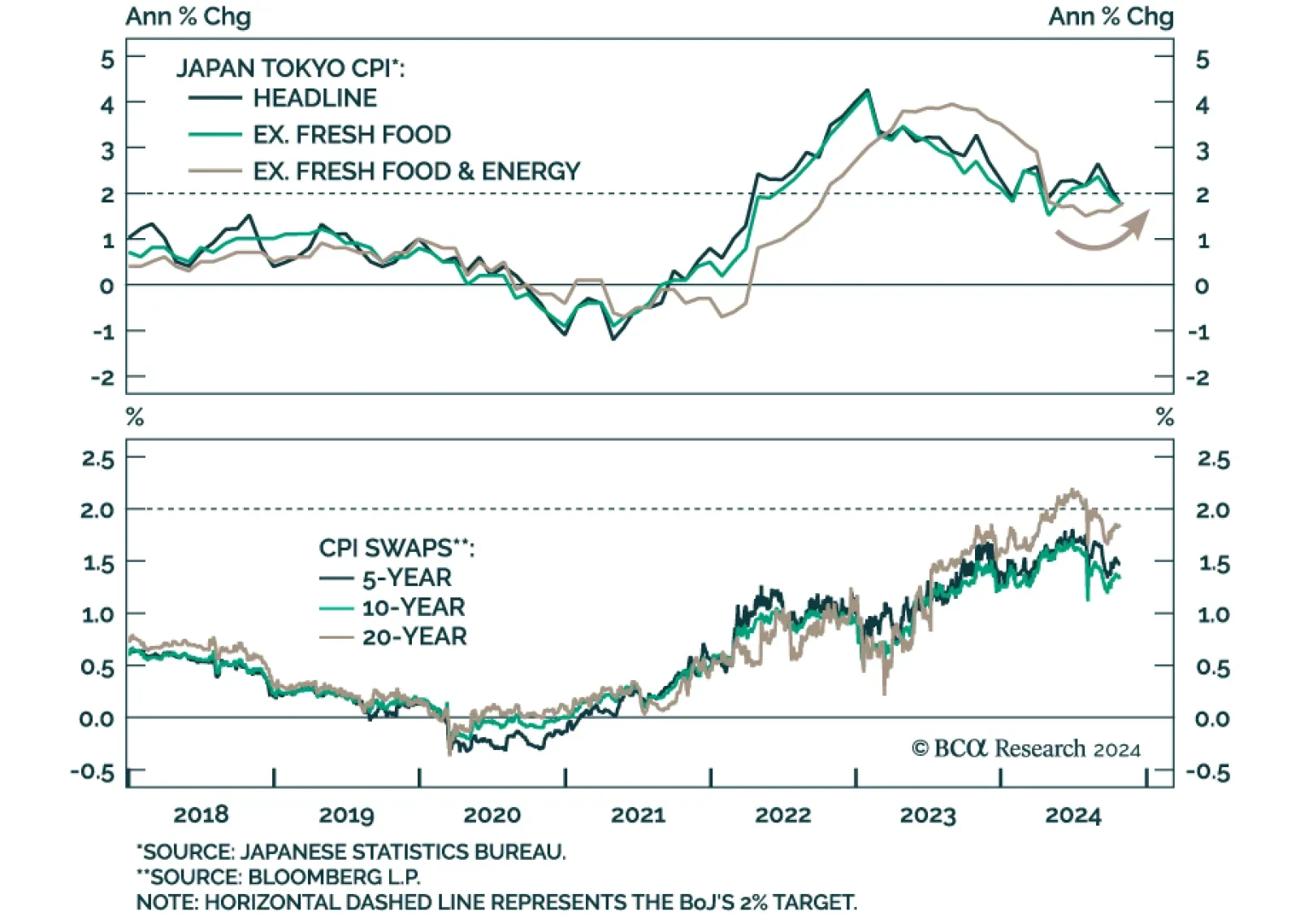

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

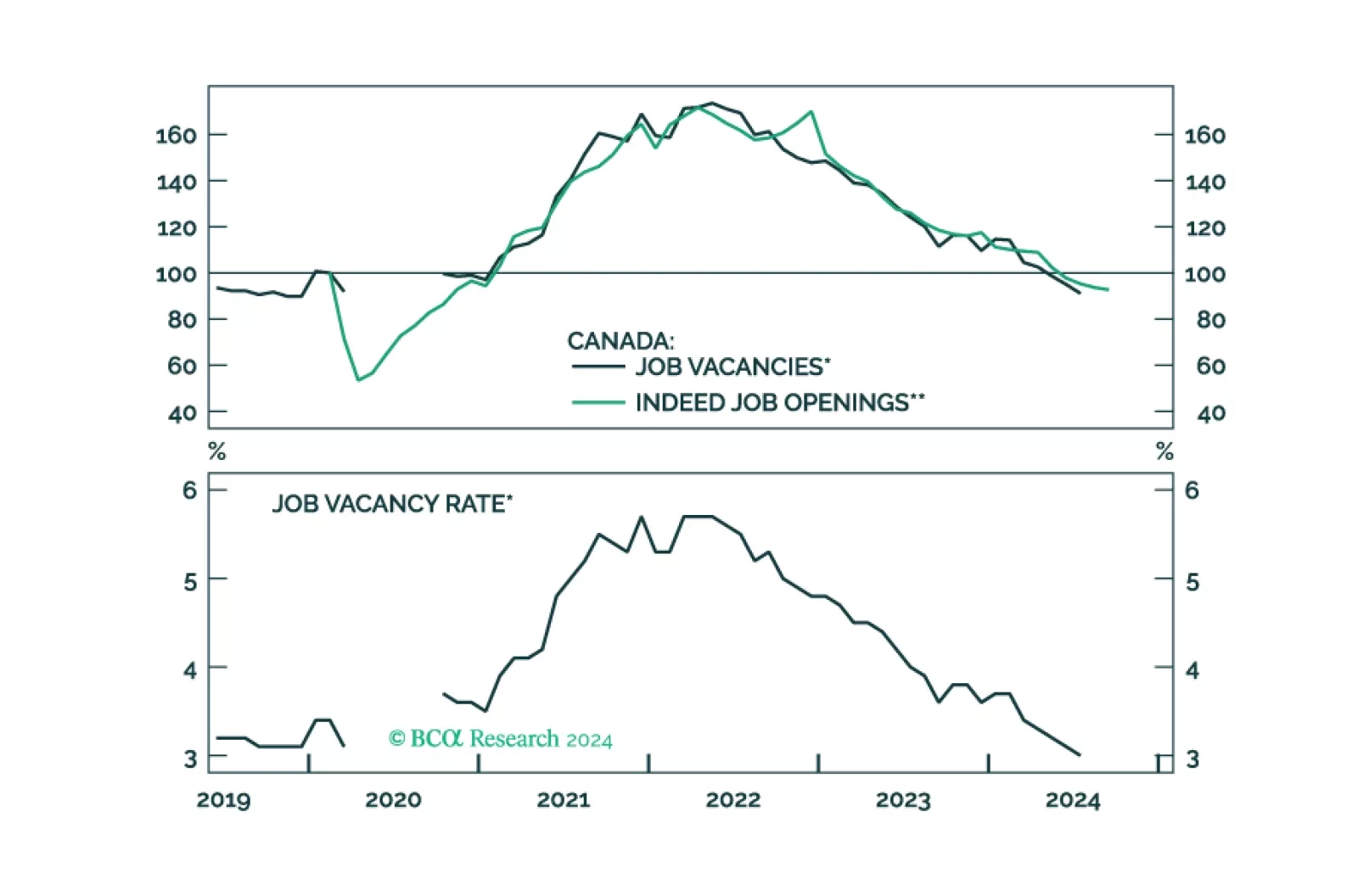

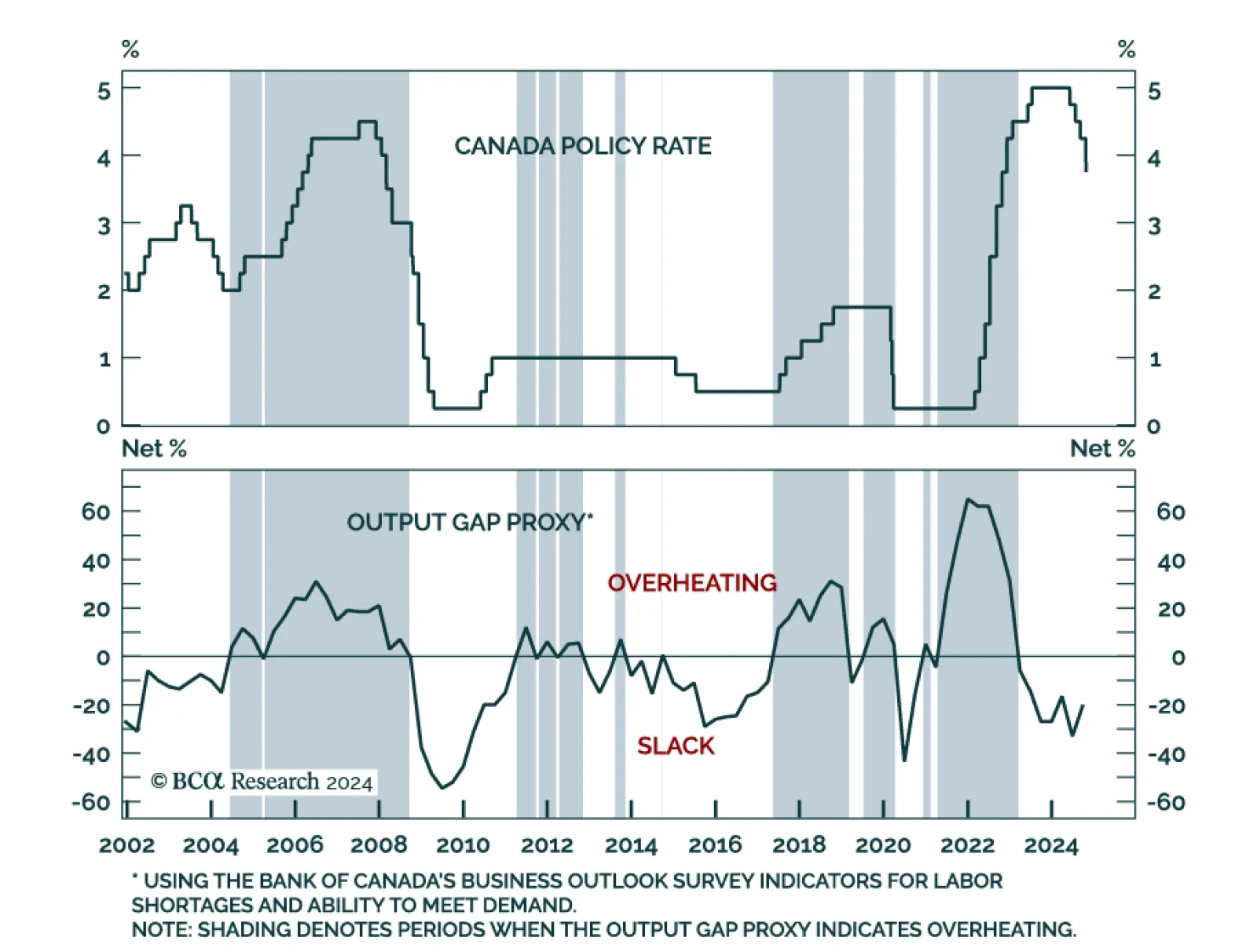

In this Insight, we evaluate if there is more juice in our macro bet of being long June 2025 CORRA versus SOFR futures, and correspondingly, being short the CAD, for investors with a 1-3 month horizon.

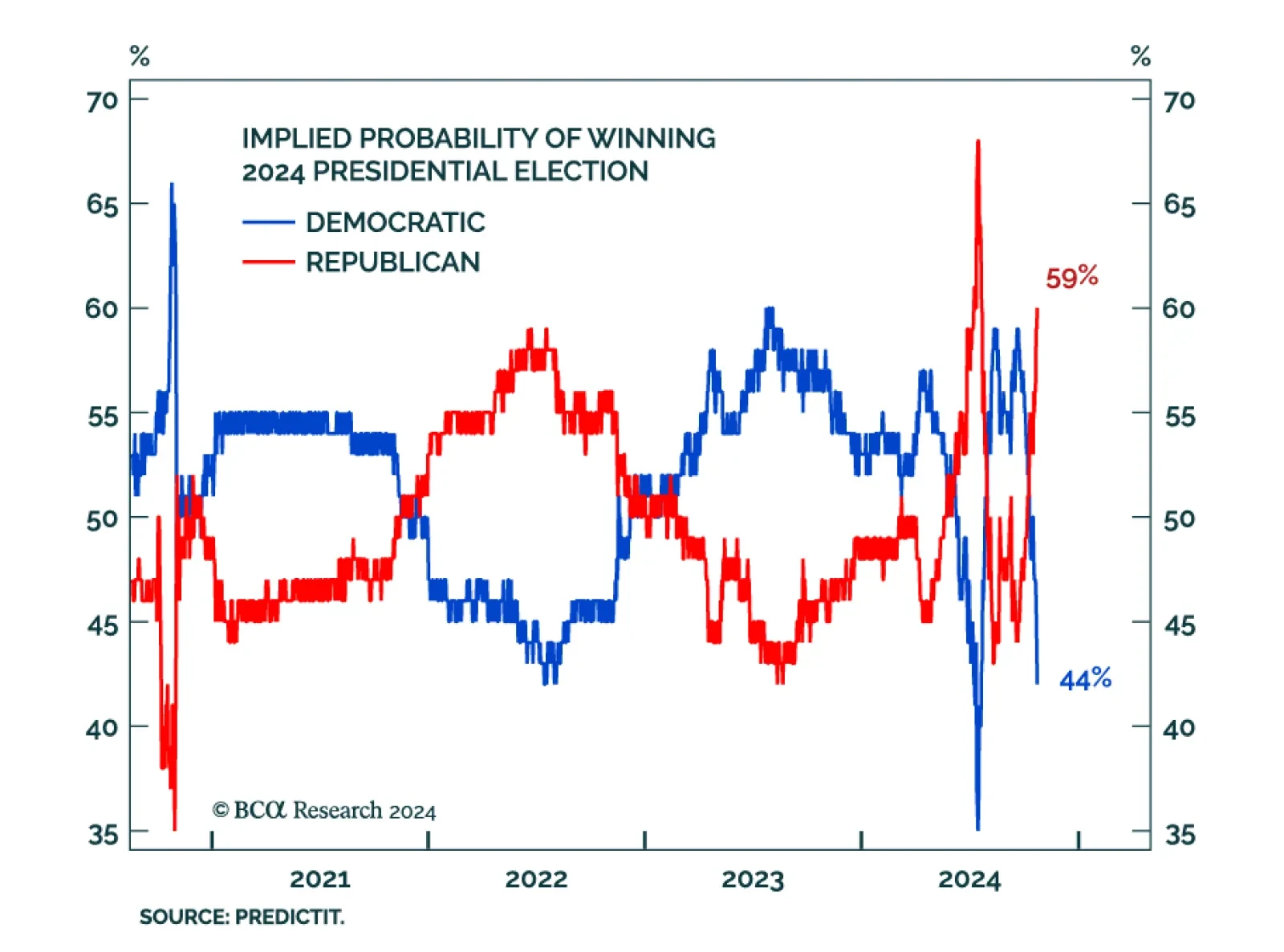

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…

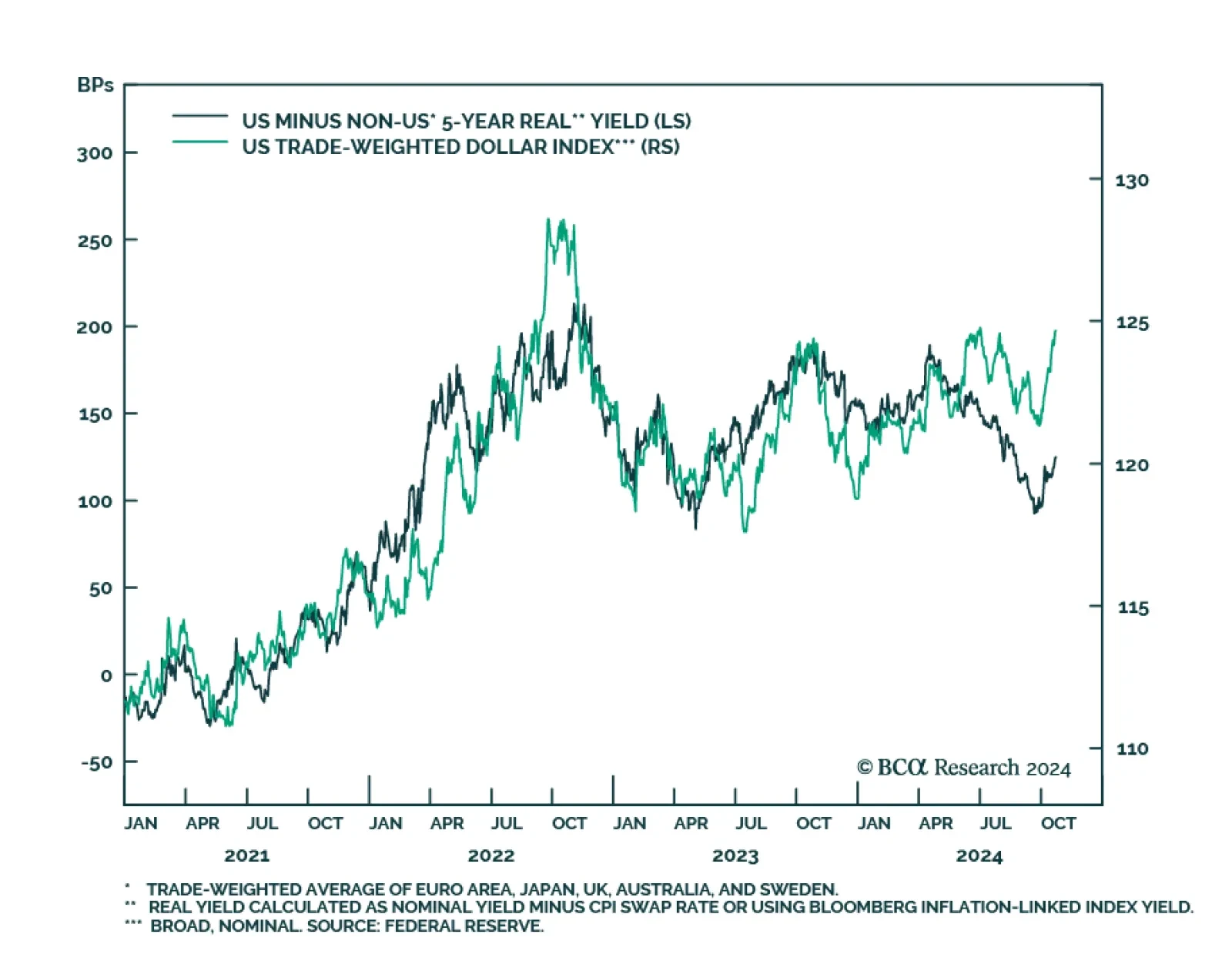

The US dollar had a strong October thus far, breaching its 20-,50- and 200-day moving averages with a 4% increase and only three trading days in the red. The DXY now sits above where it was before the August selloff in risk…

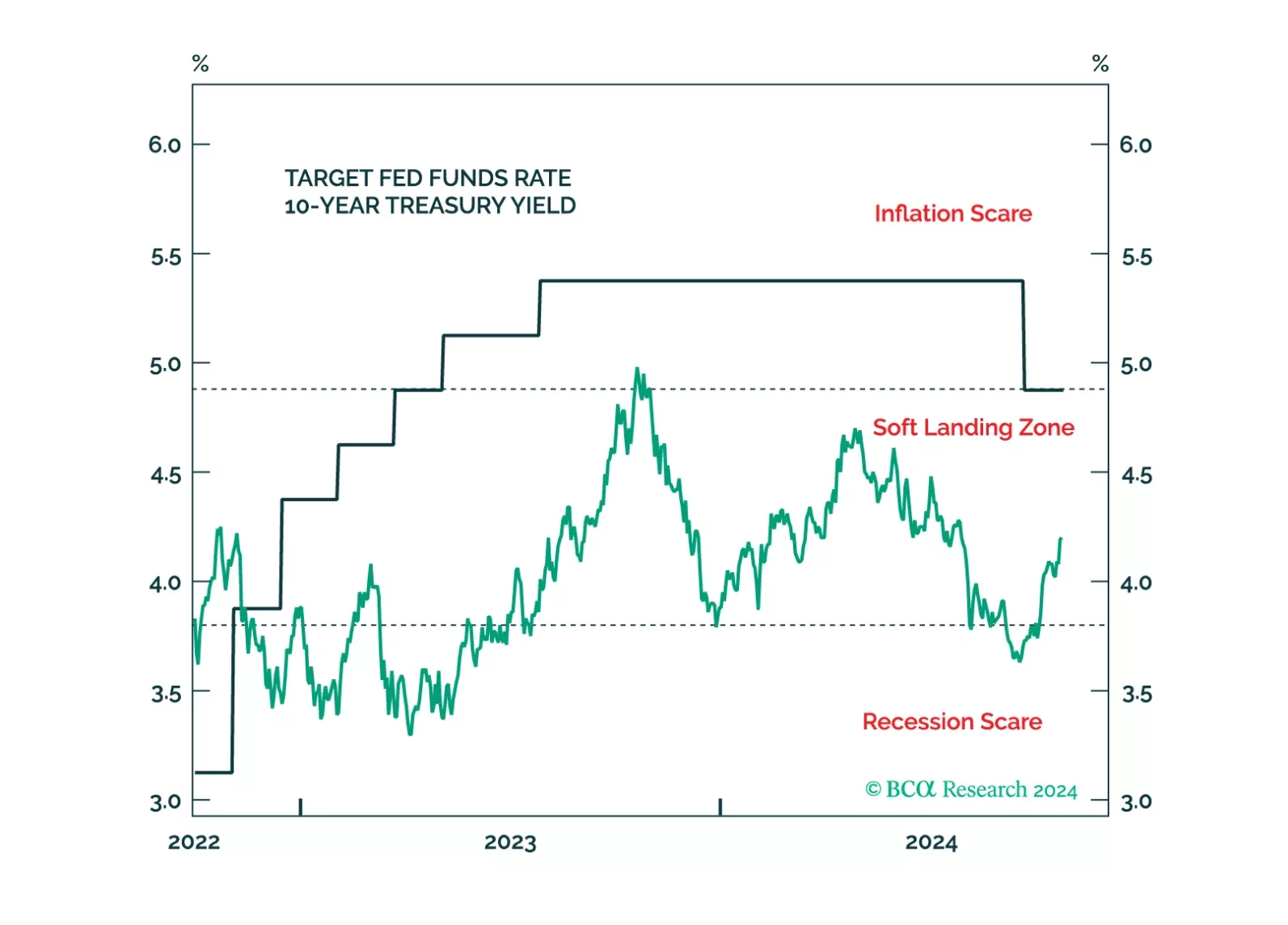

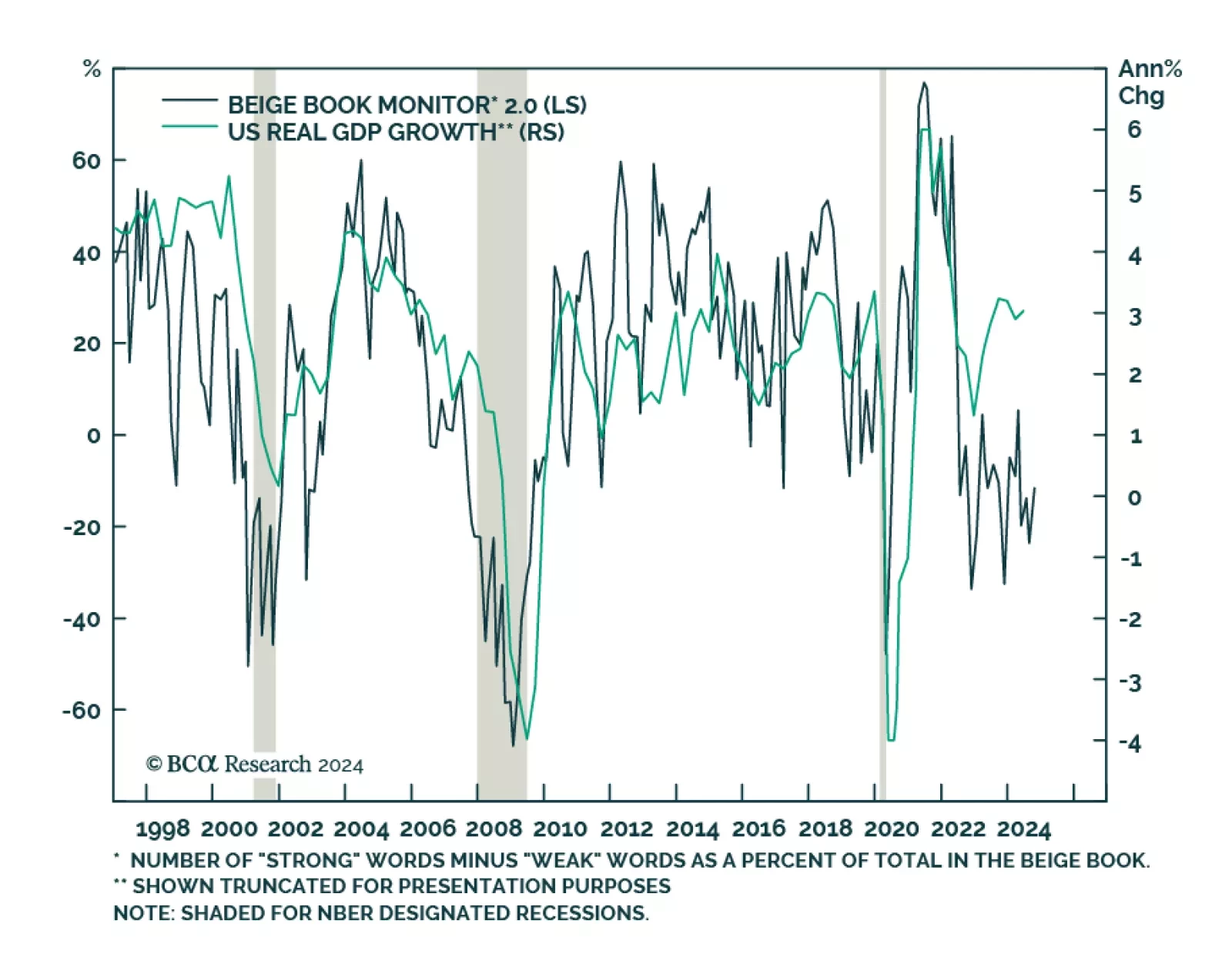

The Federal Reserve’s Beige Book, its survey of business contacts, shows an economy that has seen little growth since early September. The Fed’s contacts confirmed the manufacturing recession reflected in other…

After cutting three times already since June, the Bank of Canada fulfilled market expectations and cut the overnight rate by 50 bps to 3.75%. The BoC sees risks around inflation as roughly balanced over its projection horizon,…

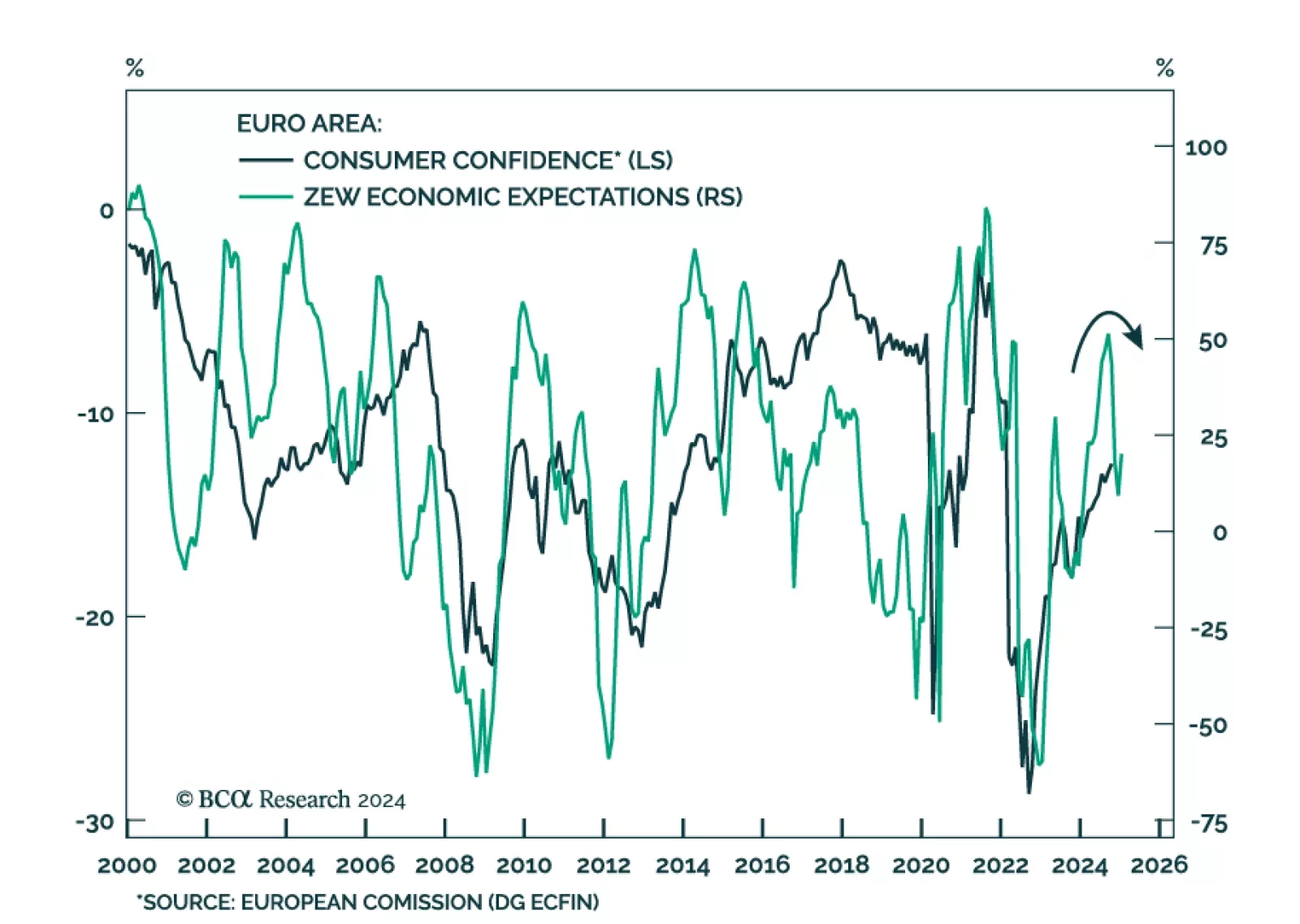

Flash estimates for European consumer confidence met expectations at -12.5 in October, rising from -12.9 in September. Despite this positive development, Euro Area sentiment remains poor. Consumer confidence remains below its…

A Donald Trump victory would send bond yields higher during the next few weeks, but yields will fall in 2025 no matter the election outcome.

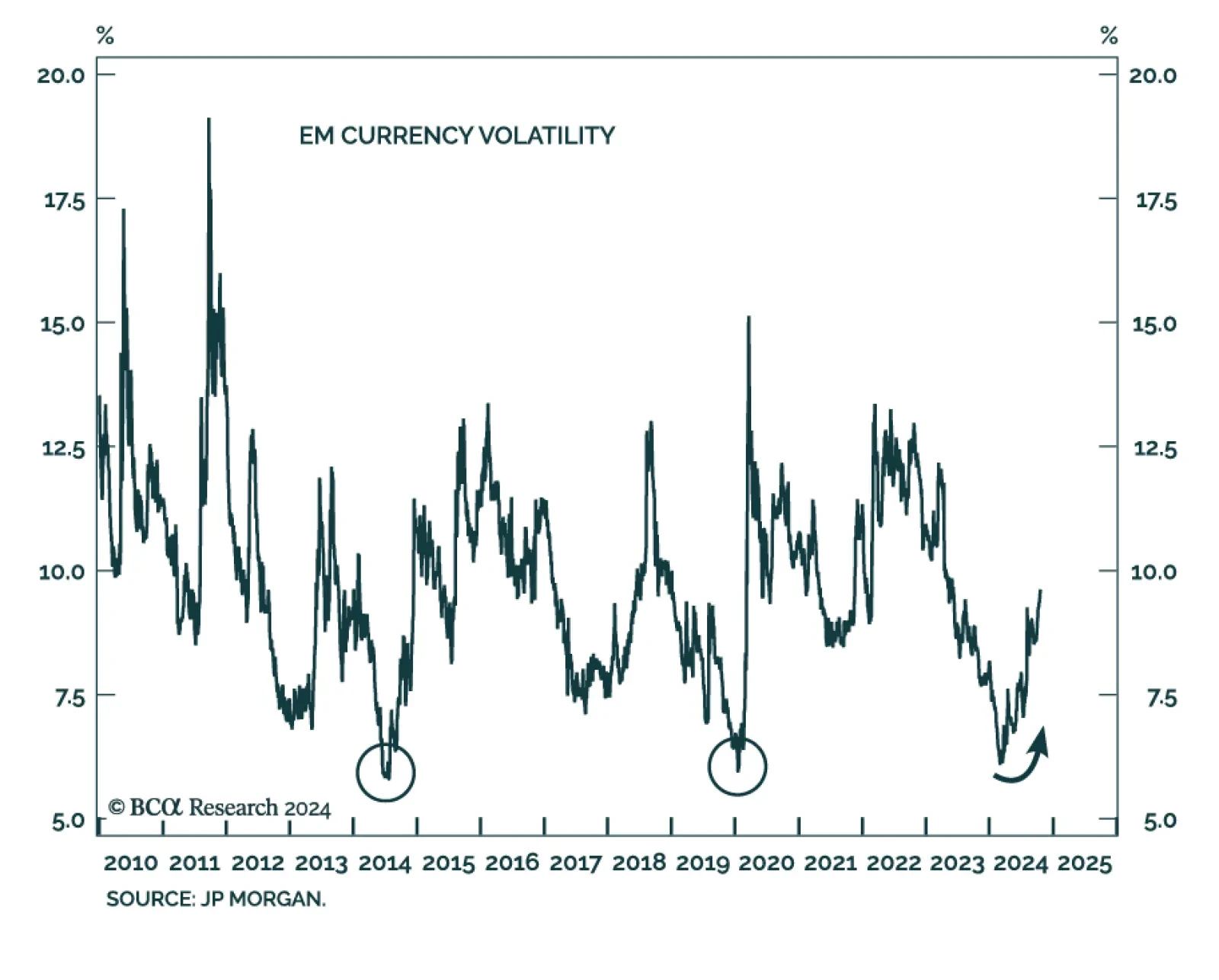

Our Emerging Markets Strategy team sees evidence of a “Trump trade” across markets, as the dollar strengthens, Treasury yields jump, and US small caps try to break out. However, the tactical and cyclical outcomes…