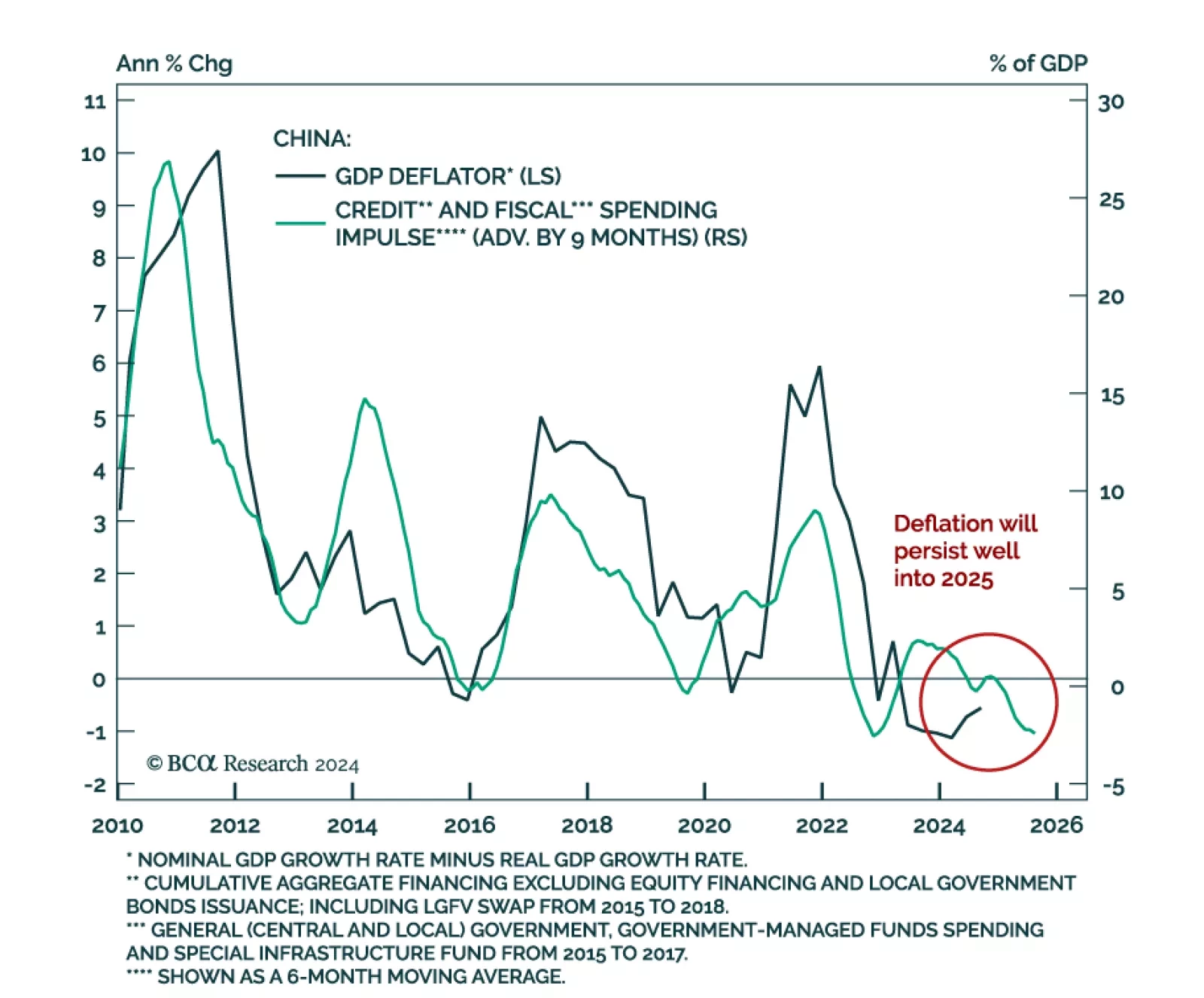

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

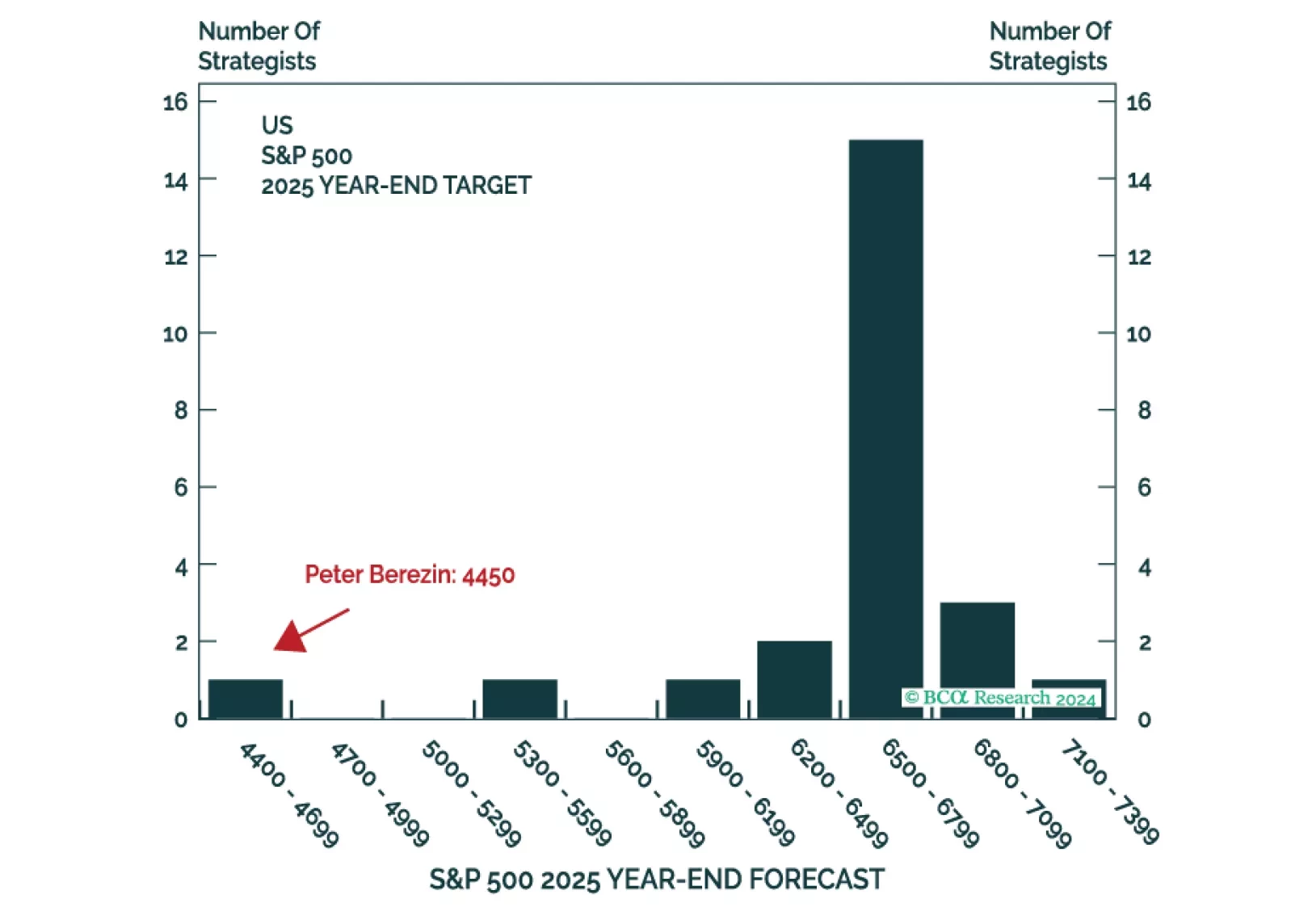

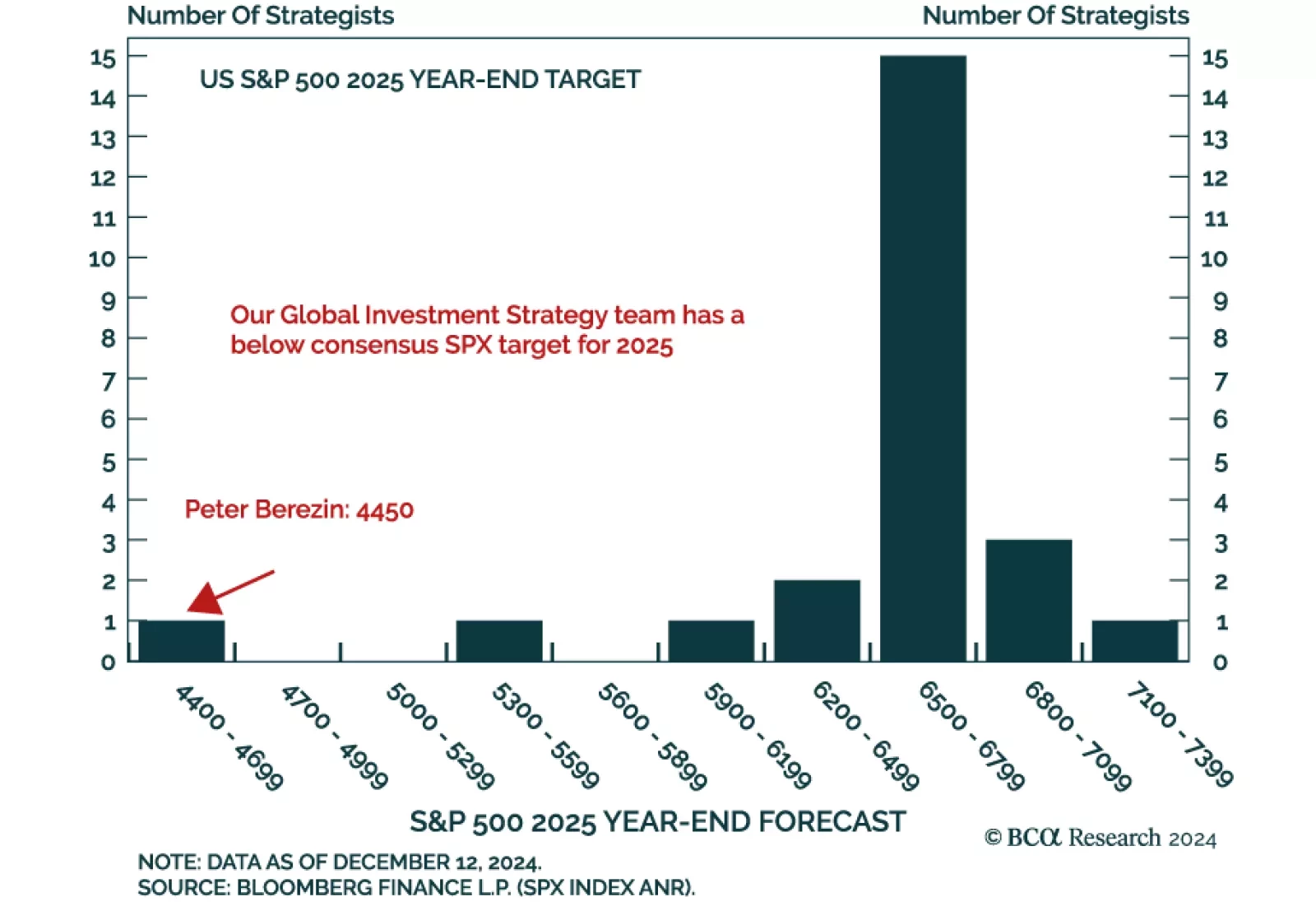

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

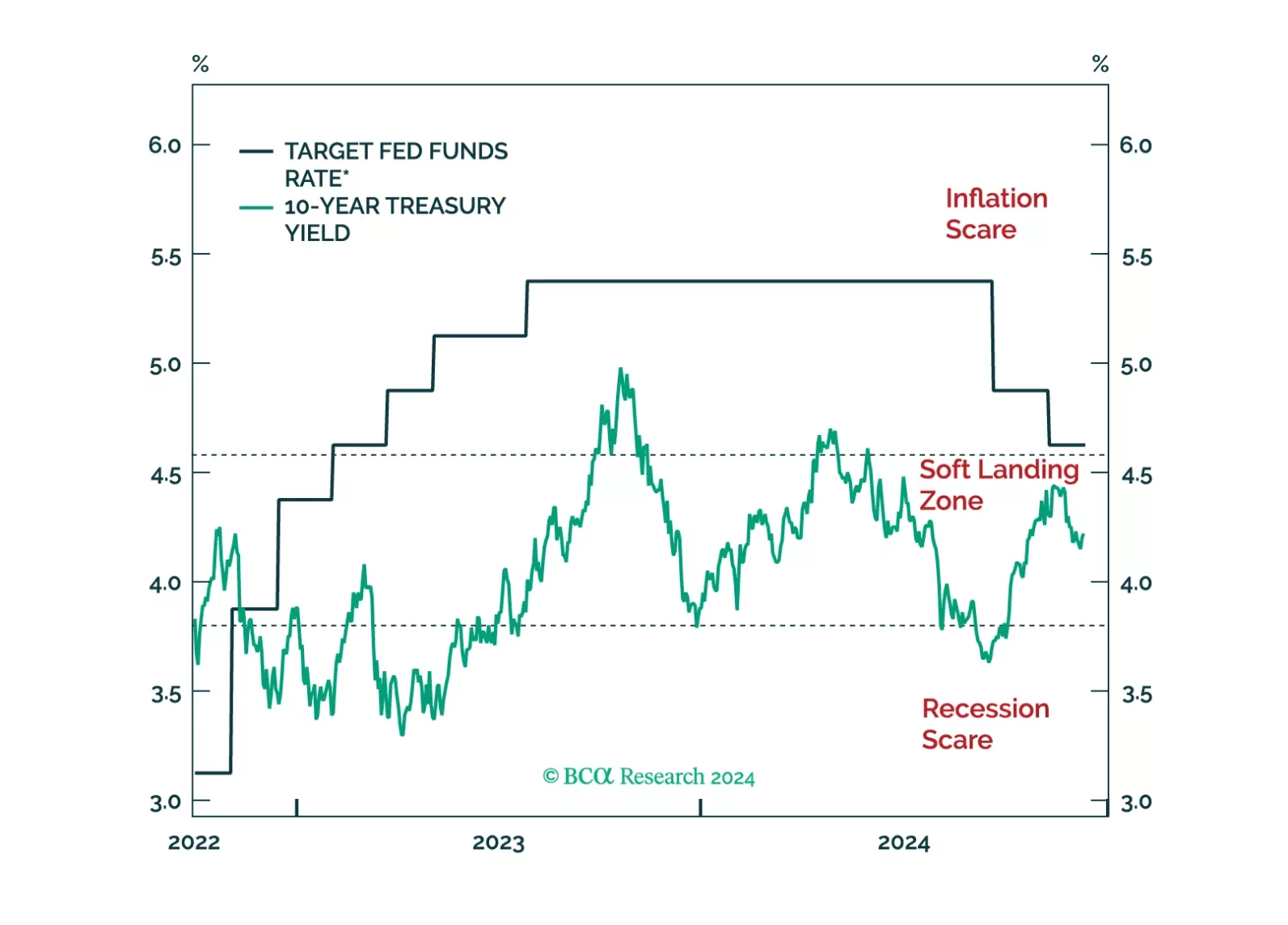

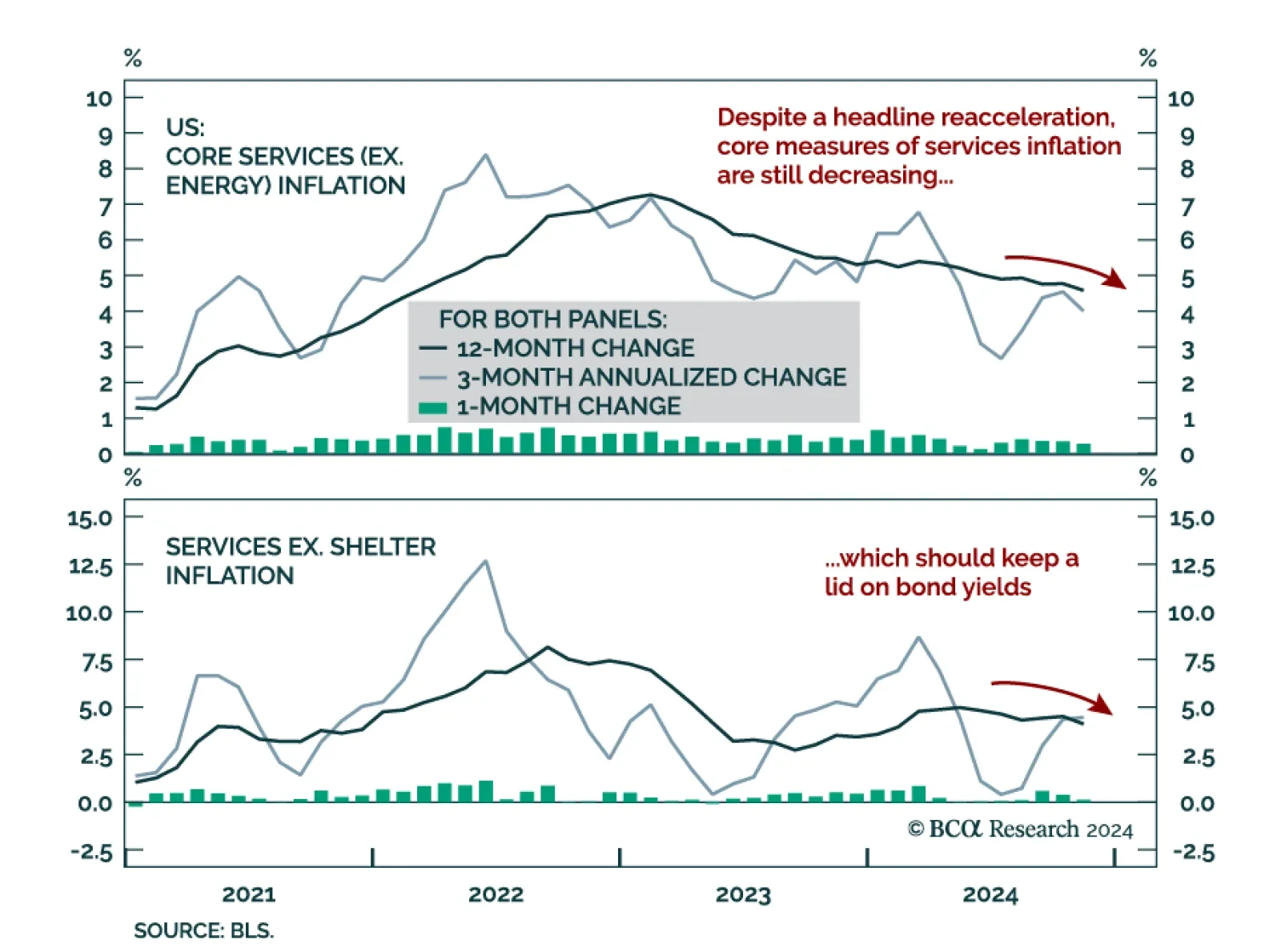

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

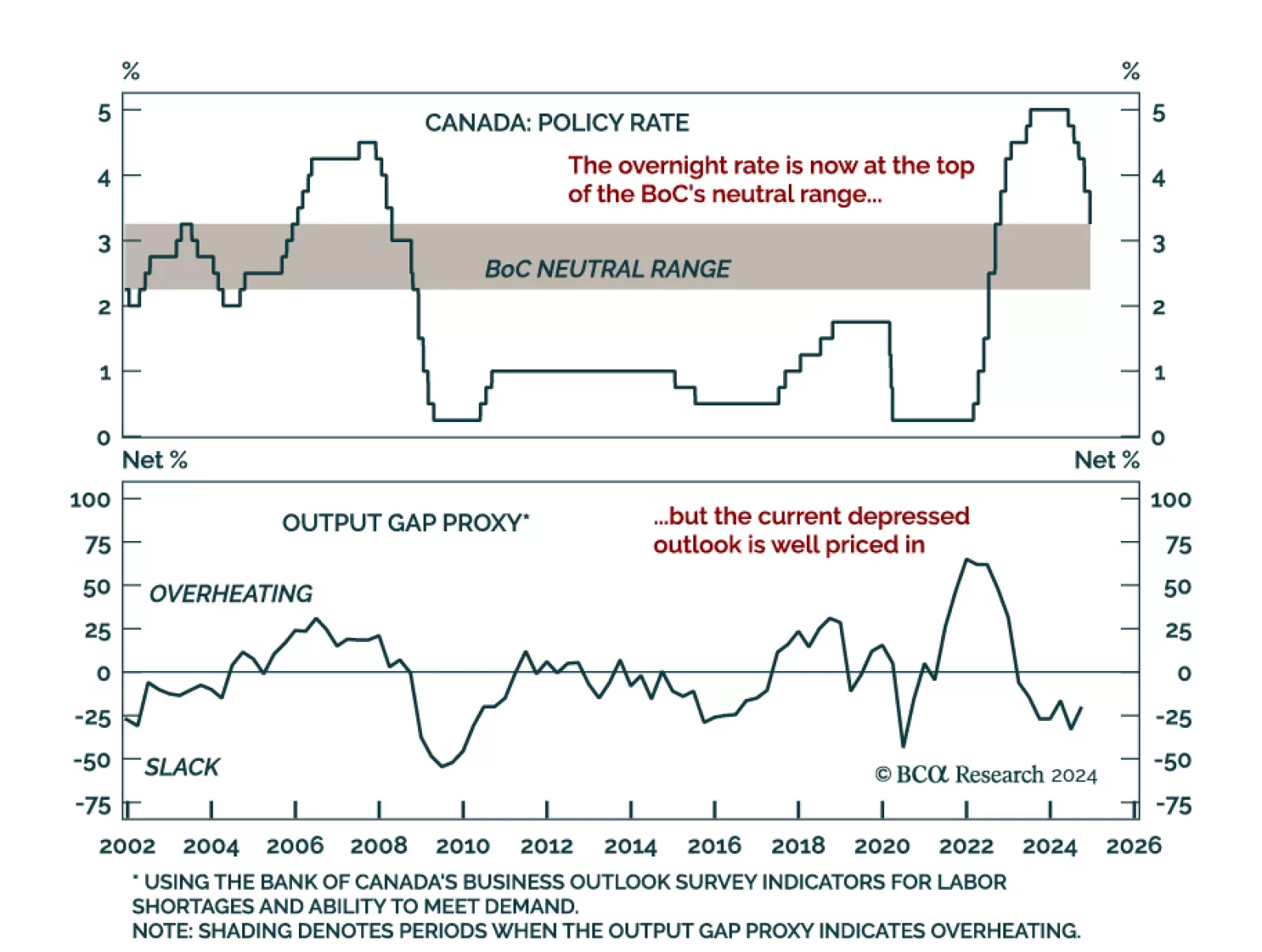

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…

China’s November trade balance increased to CNY 692.8 bln on the back of slowing-but-still-growing exports (down to 5.8% y/y from 11.2% in October), and a worsening imports contraction (-4.7% y/y vs. -3.7% in October). In…

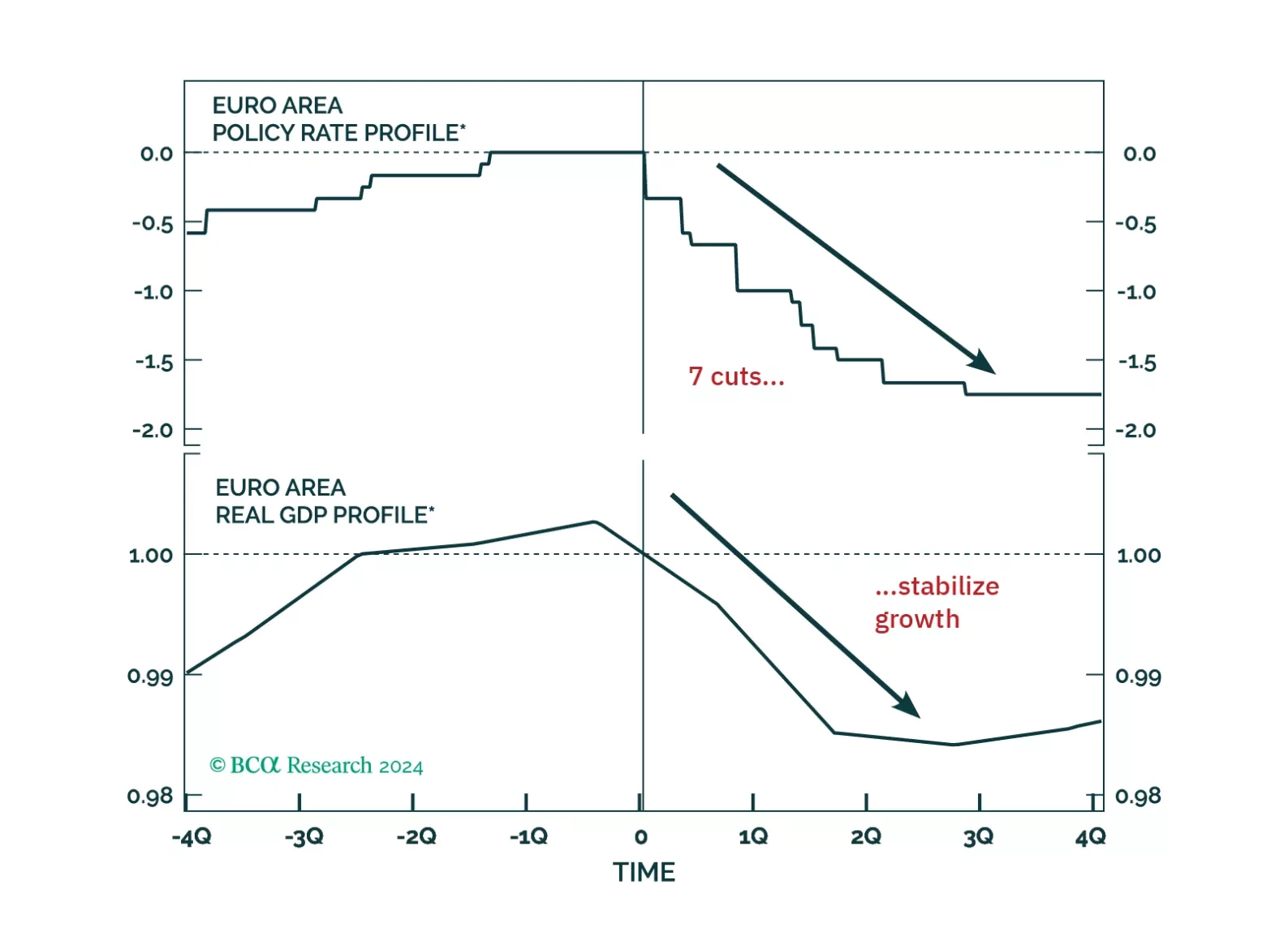

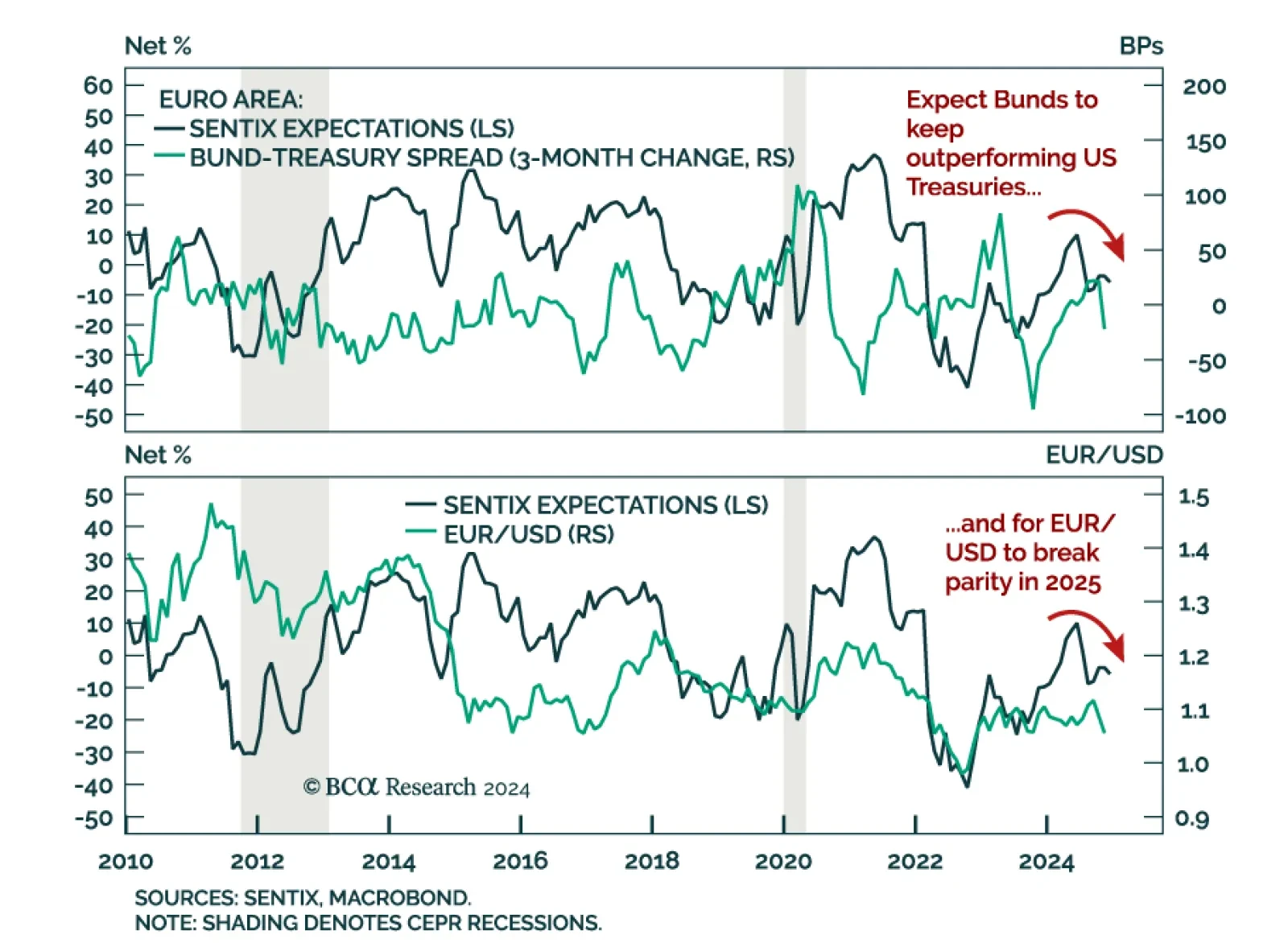

The December Sentix Economic Index for the Euro Area missed expectations, declining to -17.5 vs. -12.8 in November. Both the current situation and expectations components declined. As the first sentiment indicator for…

The US Treasury yield curve recently bull flattened, with the 2-year/10-year segment almost completely flat. Meanwhile, the breakeven inflation curve has re-inverted, with 2-year breakeven inflation rate now above the 10-year…