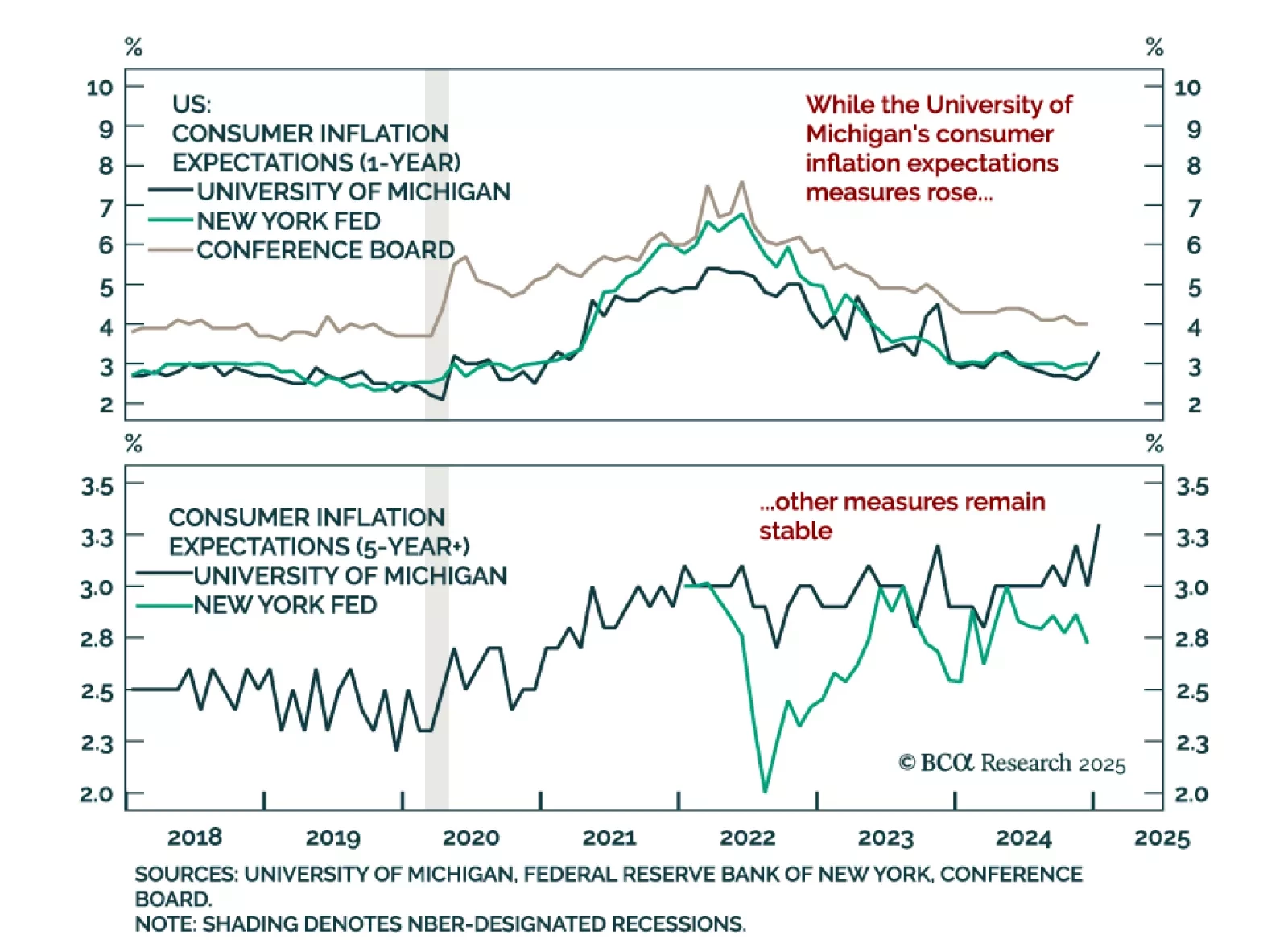

The preliminary January University of Michigan Consumer Sentiment Index missed estimates on Friday, driven by a cooling of consumer expectations. Worryingly, both the 1-year and 5-to-10 year inflation expectations ticked up to 3.3%…

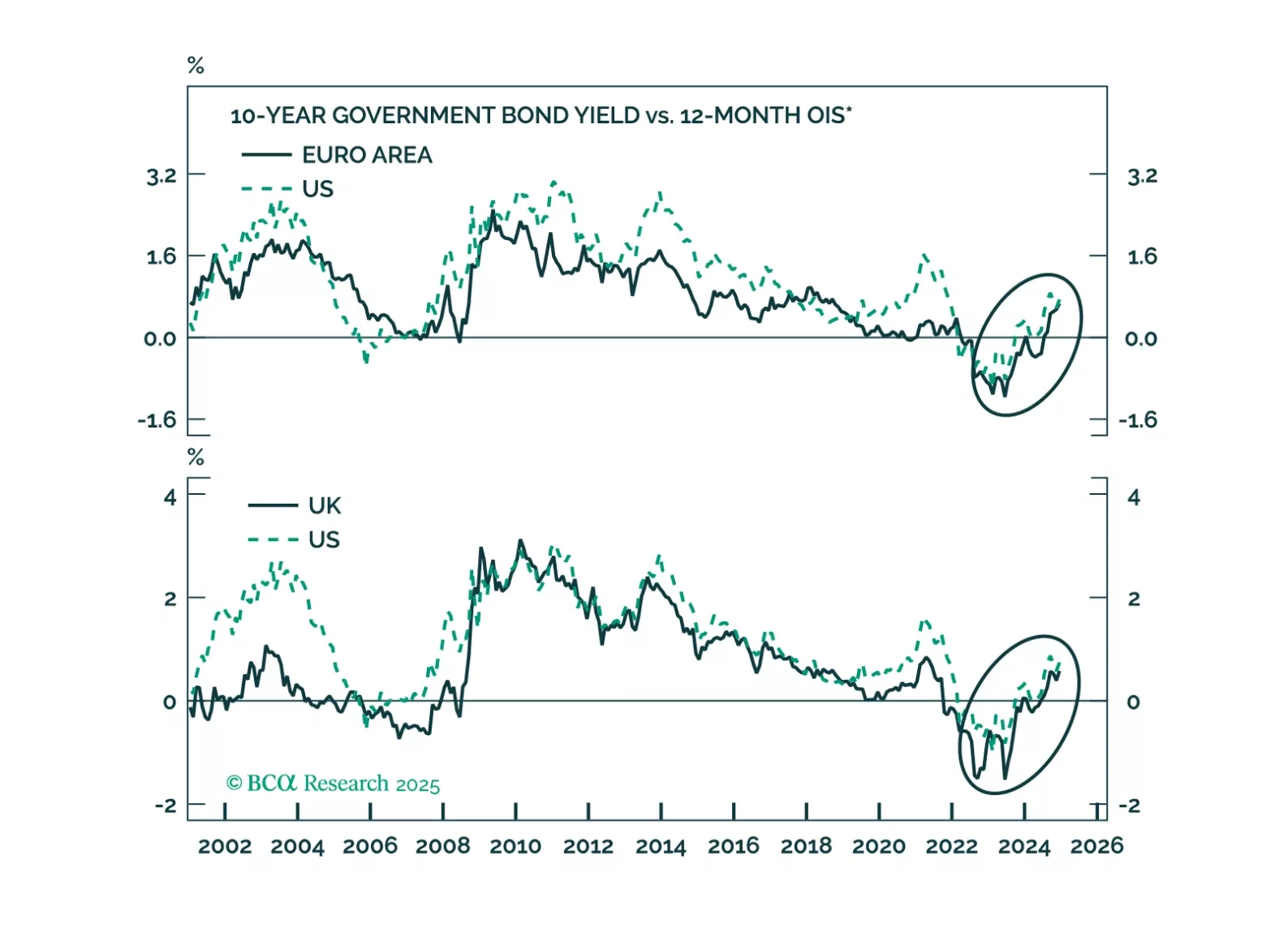

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

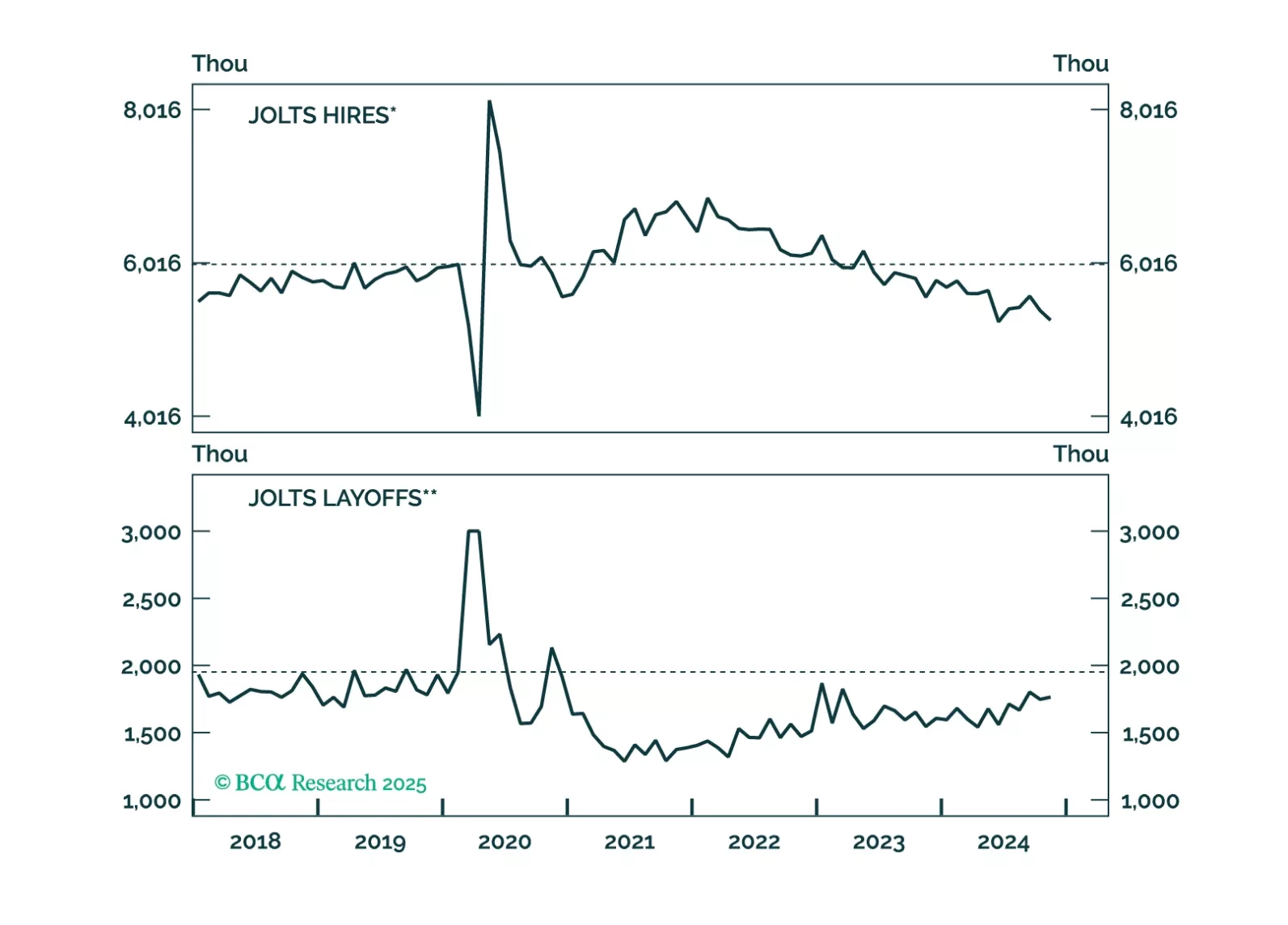

Thoughts on the increase in bond yields and this morning’s employment data.

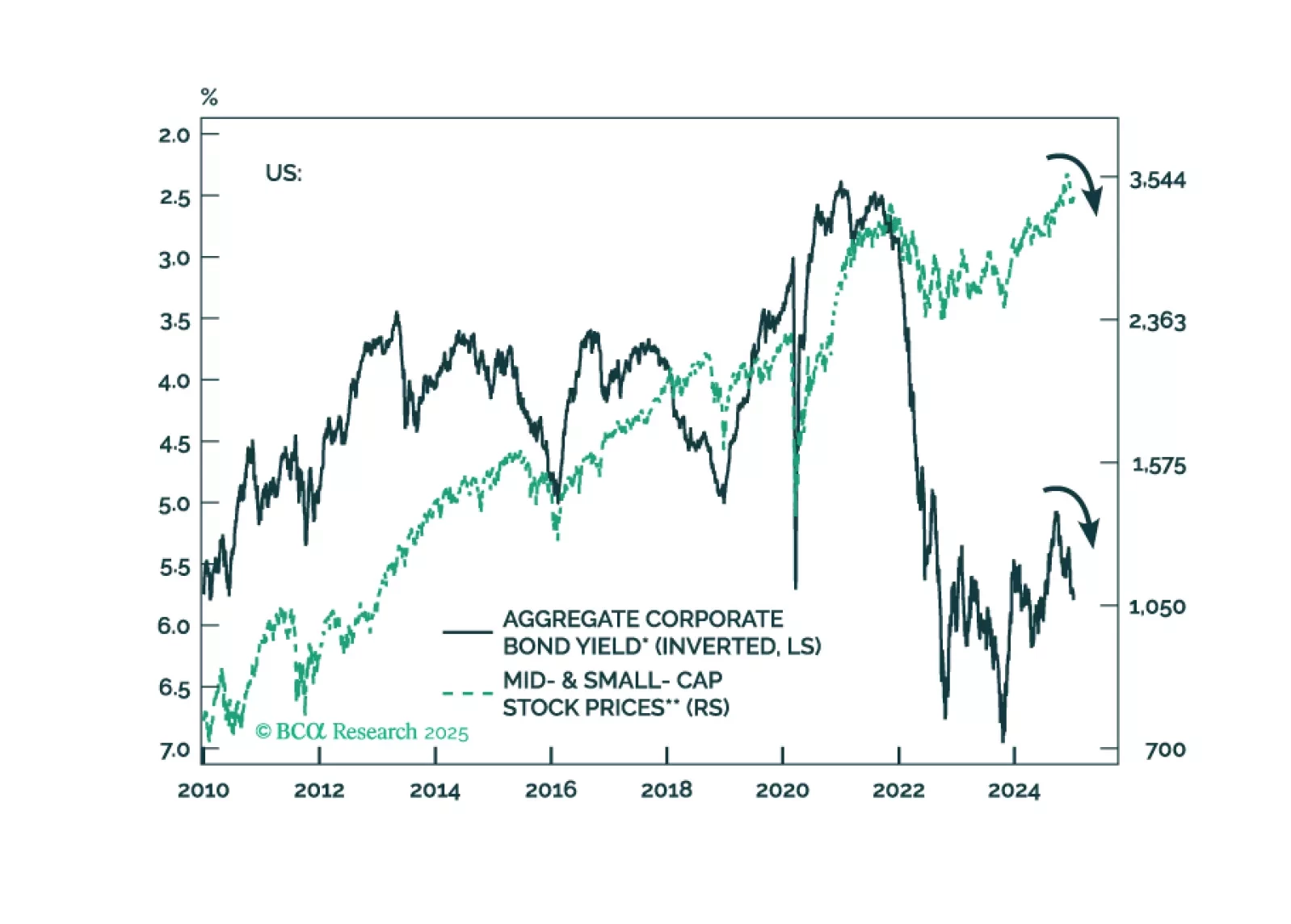

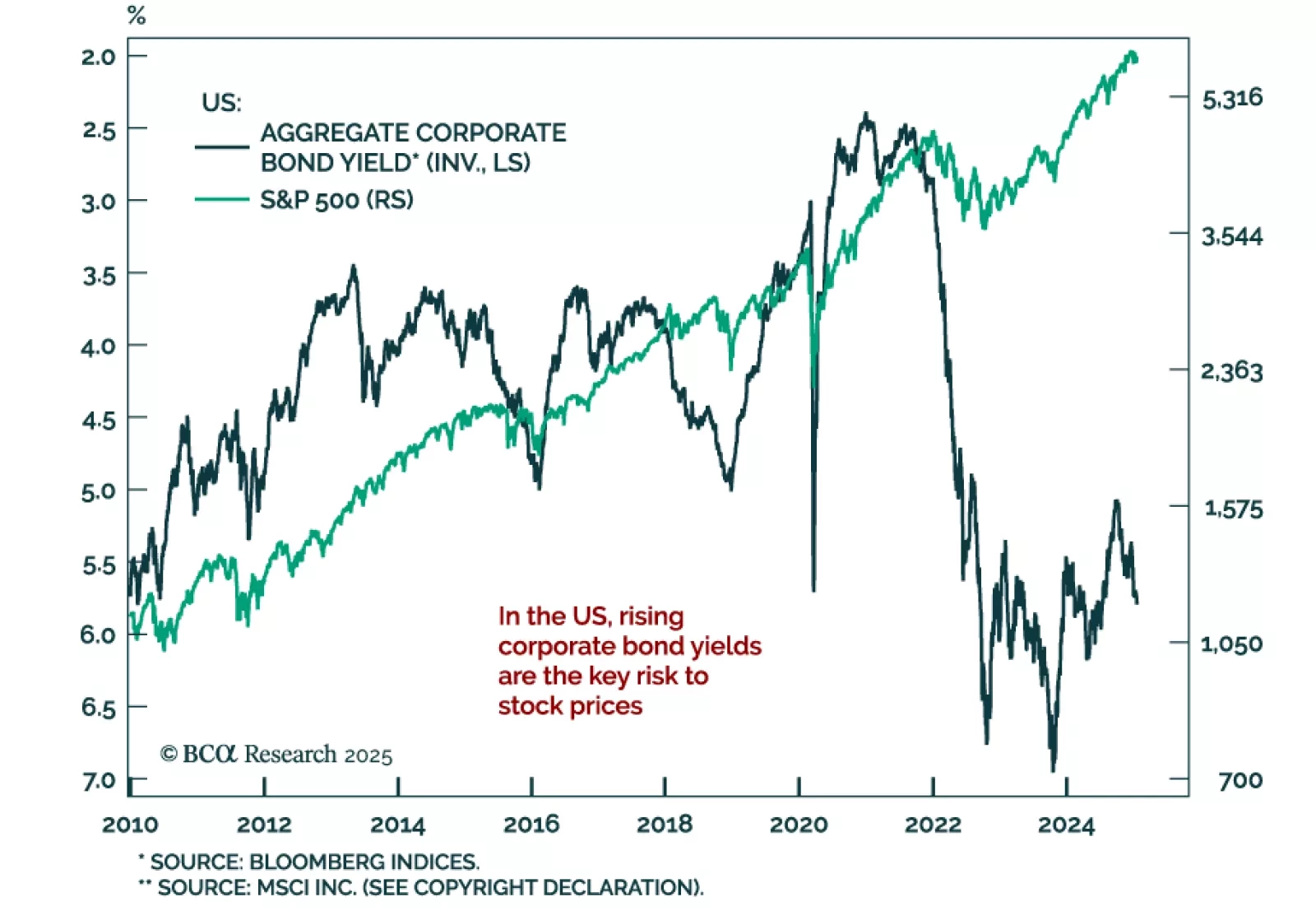

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

Chinese December CPI and PPI releases show deflationary pressures are not abating. CPI slowed to a 0.1% y/y pace from 0.2% in November, while producer prices fell 2.3%. The Chinese economy has not meaningfully changed course…

US bond yields will move higher, unleashing a storm in global financial markets. In the US, rising corporate bond yields will produce a selloff in share prices. In Mainstream EM, rising domestic and USD bond yields will weigh on…

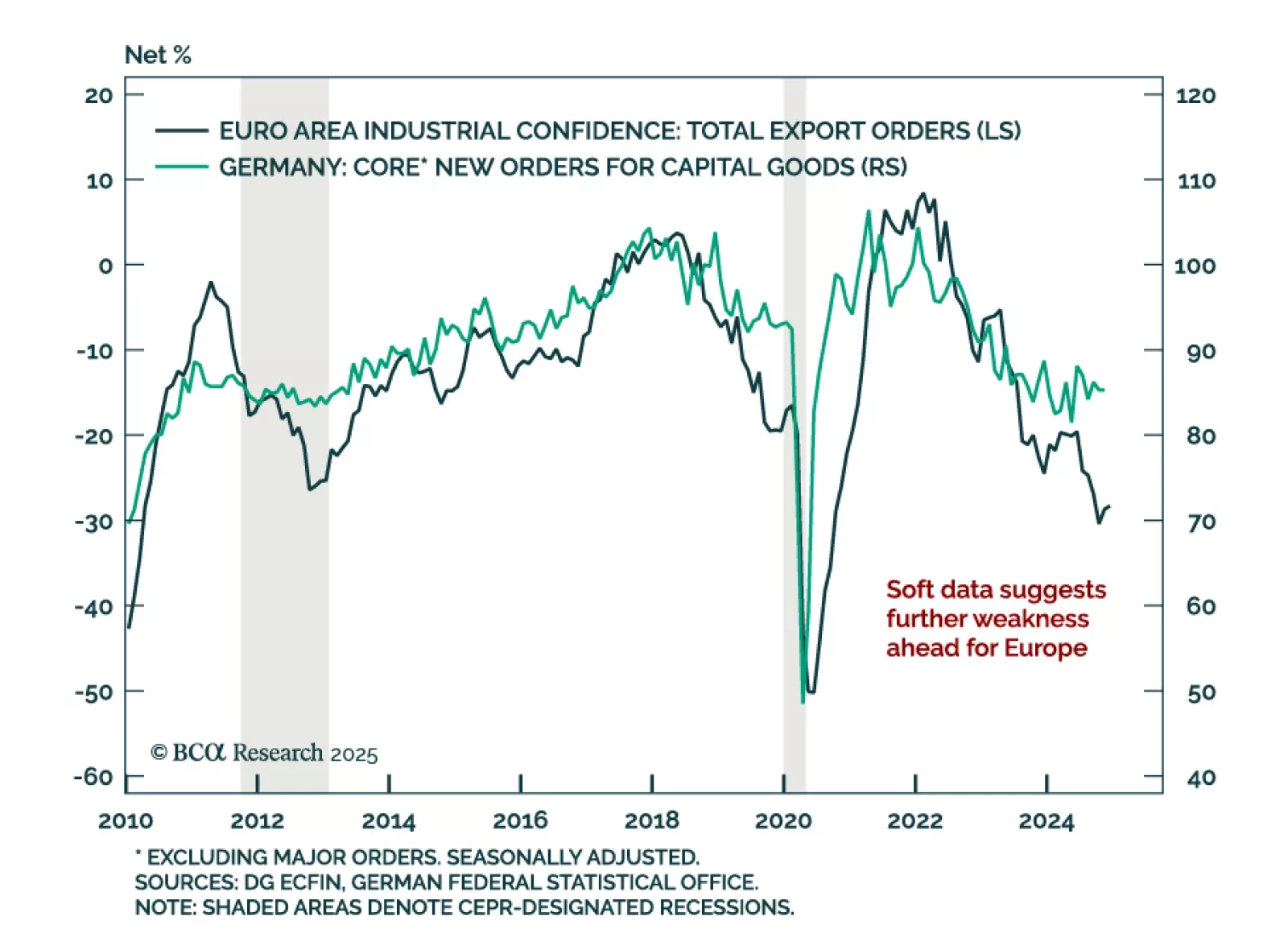

November factory orders in Germany widely missed estimates, falling by 5.4% m/m, worsening the 1.5% October decline. Excluding major orders, which often distort the overall picture, core new orders fell 1.7% y/y after growing 5.7% in…

Our Portfolio Allocation Summary for January 2025.

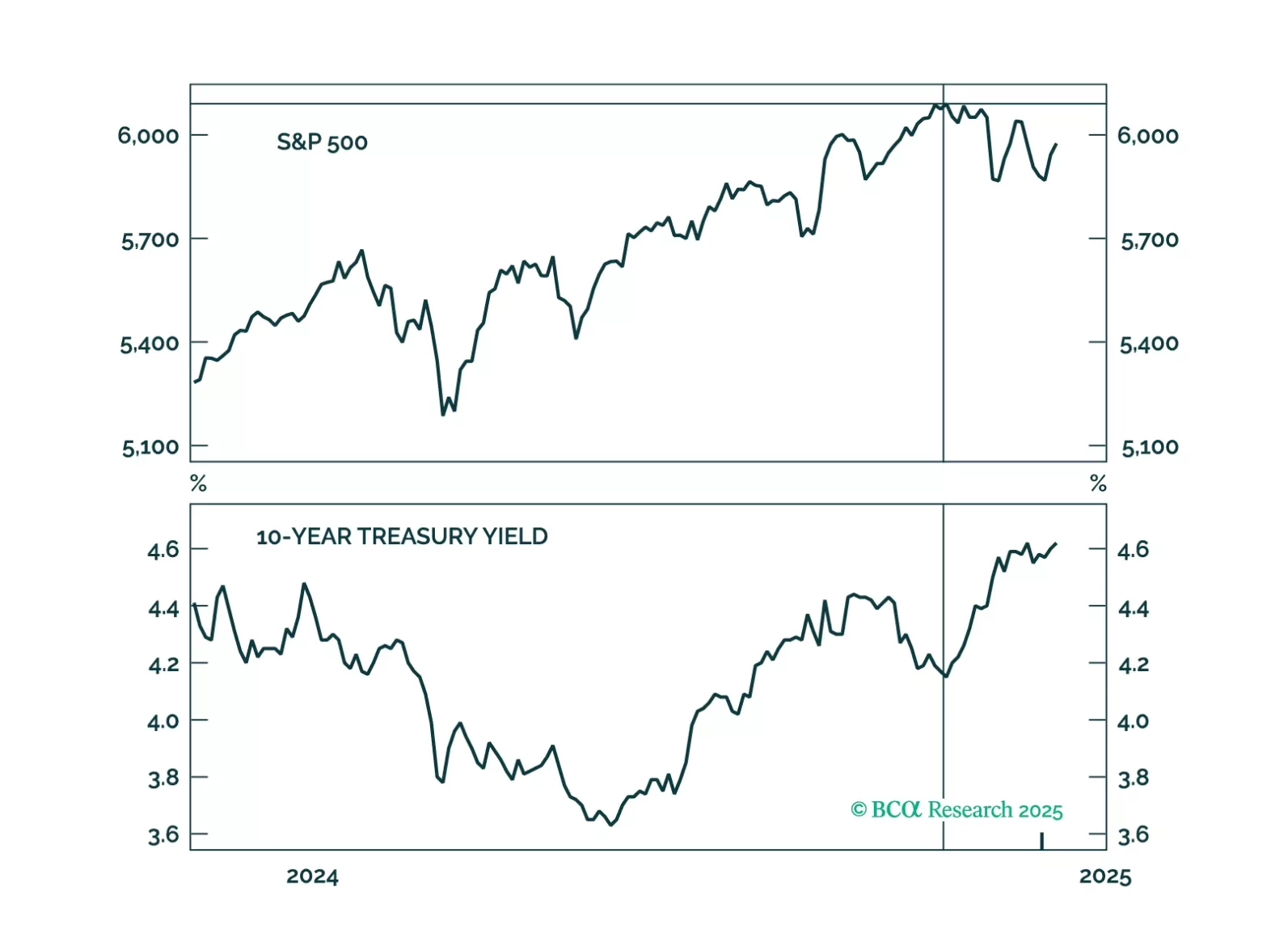

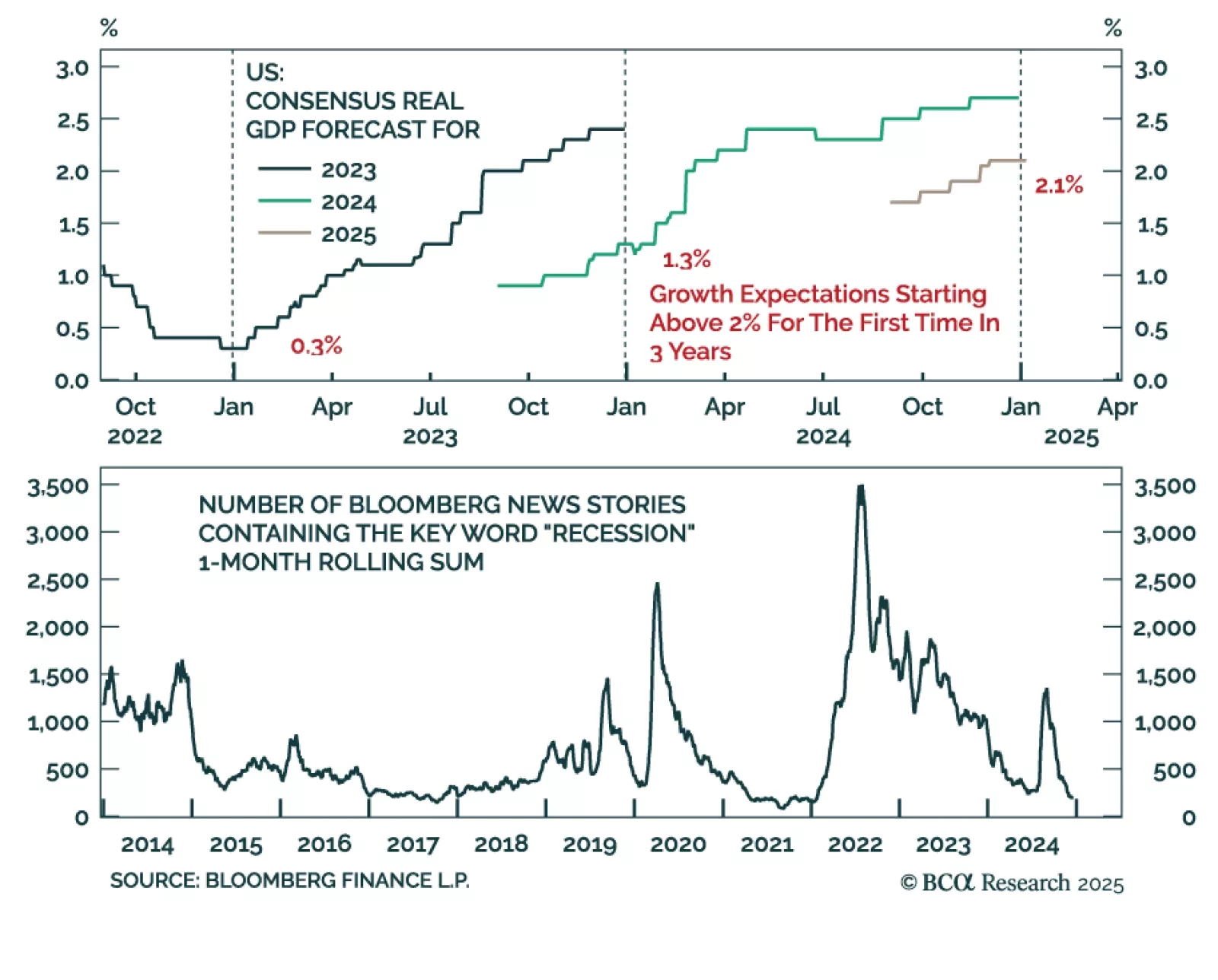

Our Global Asset Allocation strategists published their monthly tactical asset allocation report, where they illustrate booming expectations in the US will be self-limiting. For the first time since 2022, US GDP growth is…

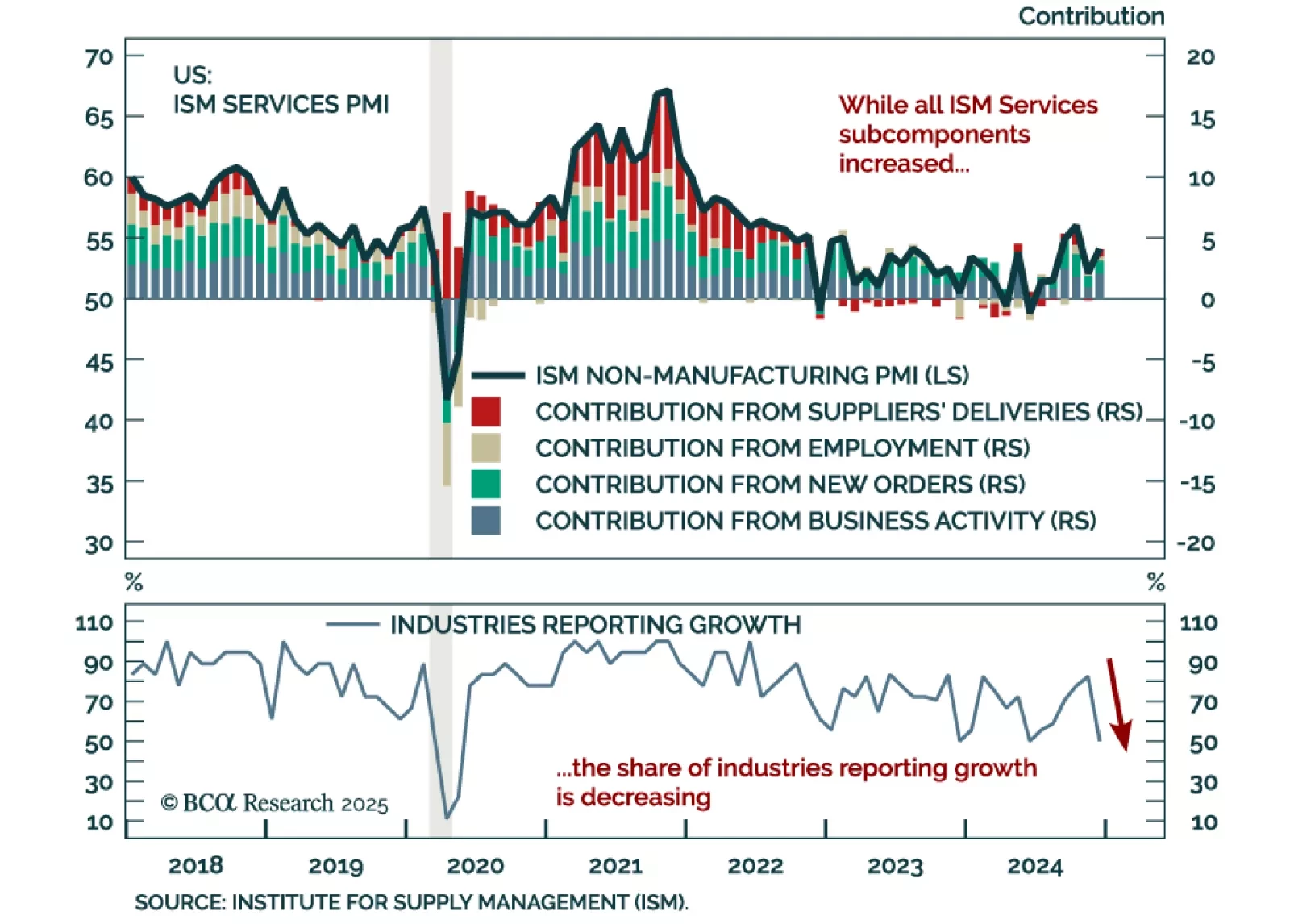

The December ISM Services PMI beat estimates, increasing to 54.1 from 52.1 in November. All subcomponents increased except for employment, which nonetheless remains in expansion. The prices paid component was especially strong,…