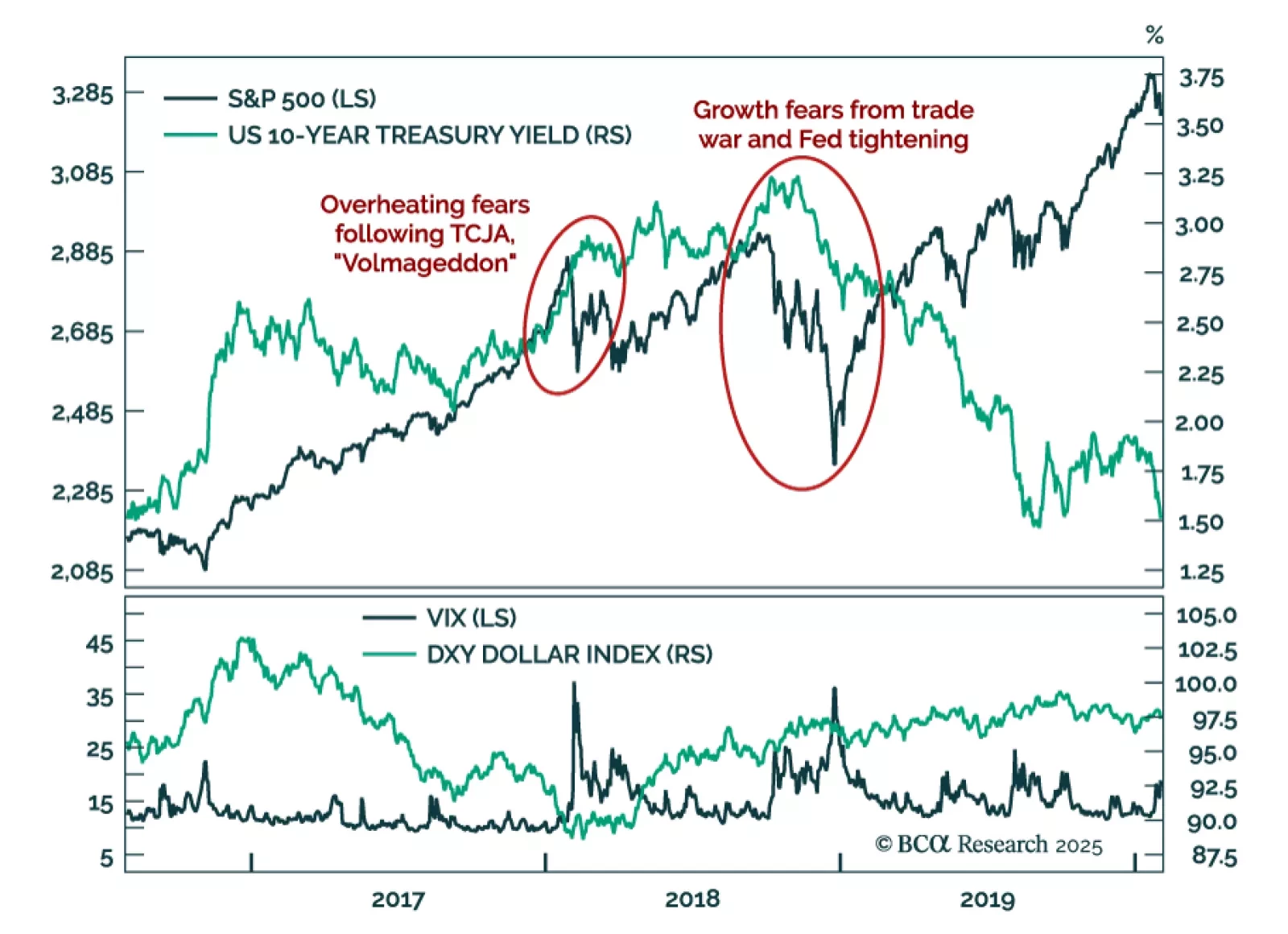

We look at President Trump’s first mandate for lessons on how markets would likely react to different policies. On the fiscal front, the 2017 Tax Cuts and Jobs Act (TCJA) was the first pro-cyclical stimulus in decades. Markets pushed…

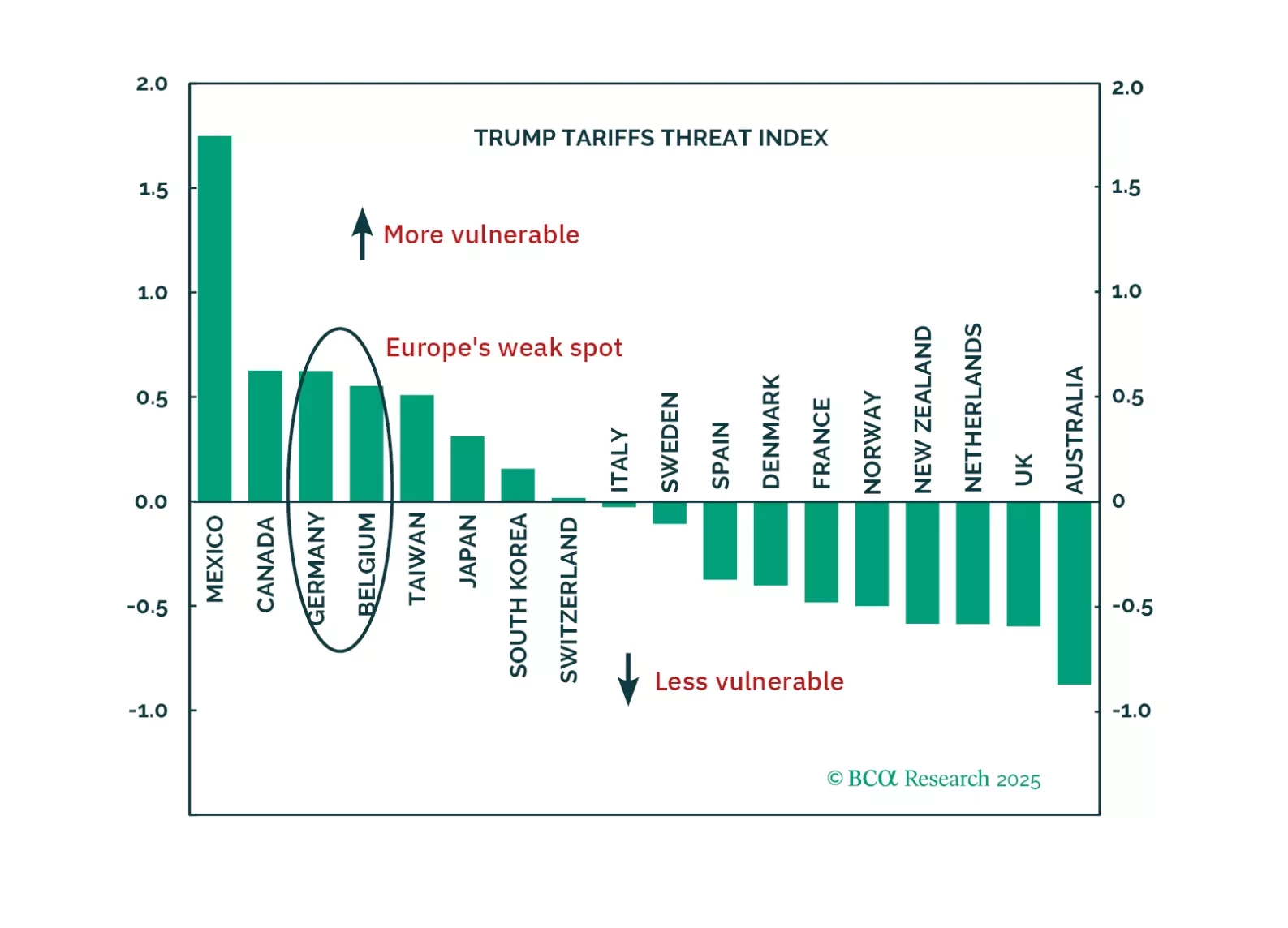

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

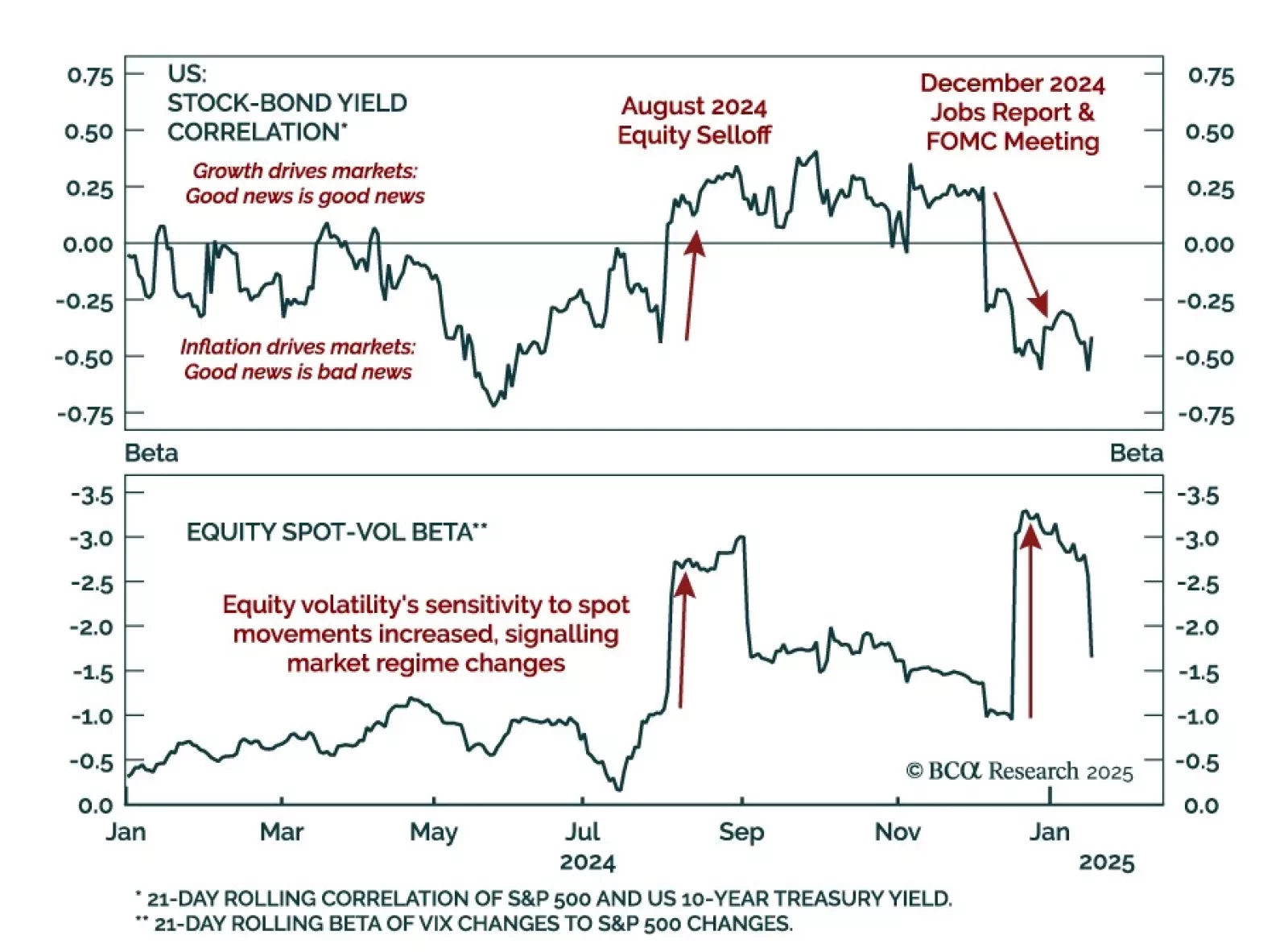

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

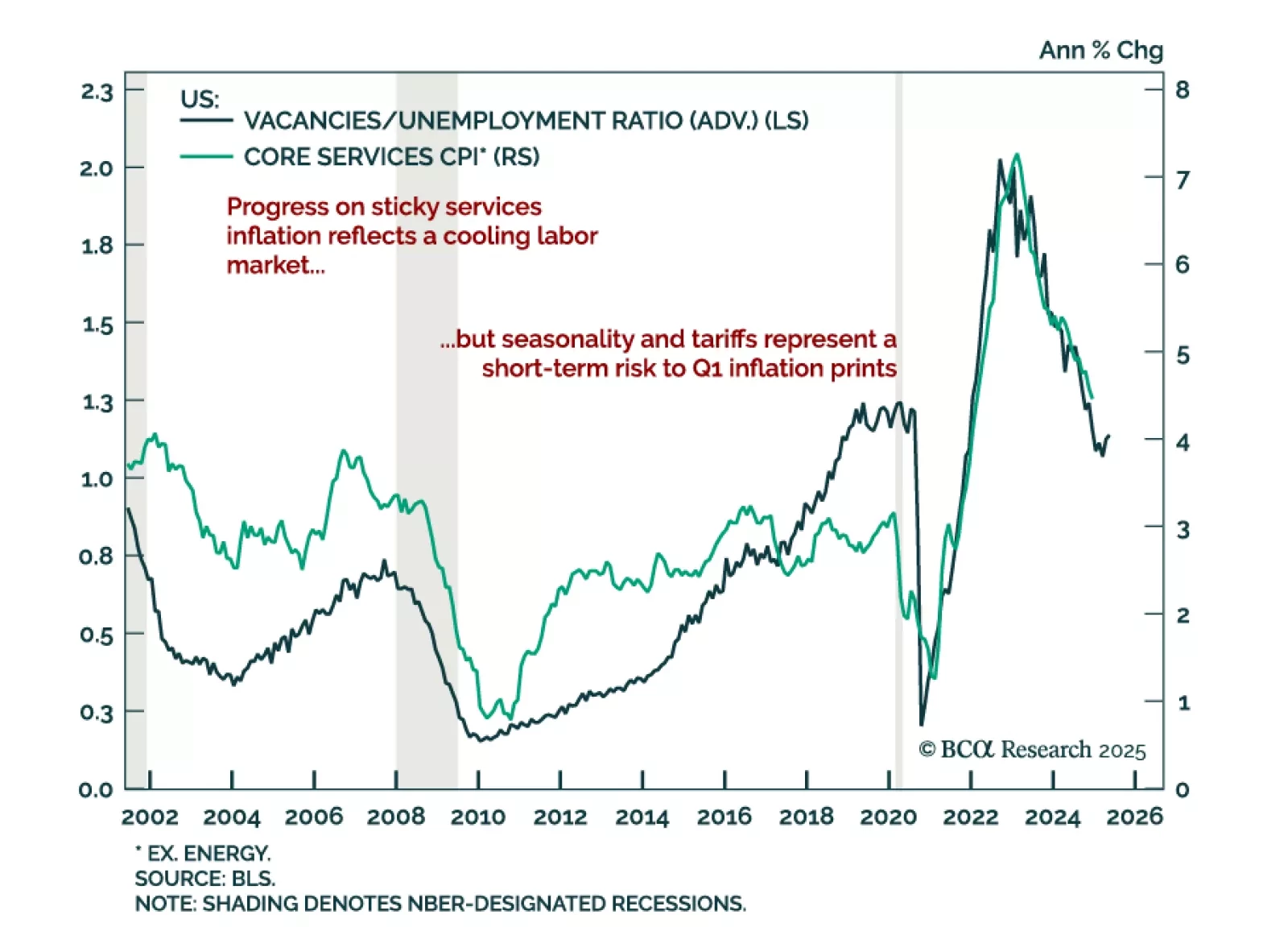

The December US CPI came in better than expected. While headline CPI met estimates of 0.4% m/m (2.9% y/y), core surprised to the downside at 0.2% m/m, decelerating to 3.2% y/y from 3.3%. Moderation in core annual inflation was driven…

Today, we publish our Quarterly Model Bond Portfolio report. We review the performance of the portfolio in 2024 and discuss how to best position a global fixed income portfolio following the sharp rise in yields during the last…

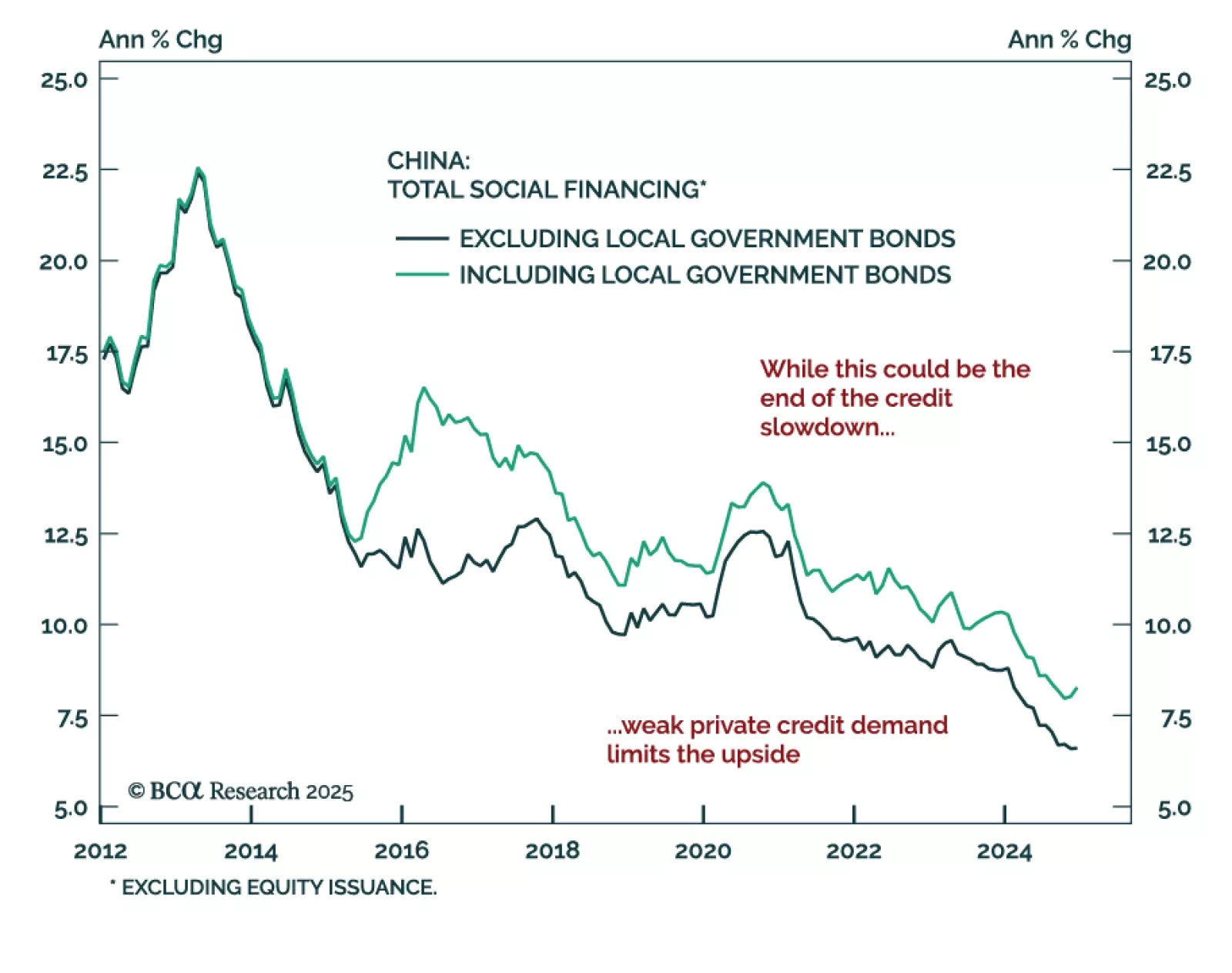

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

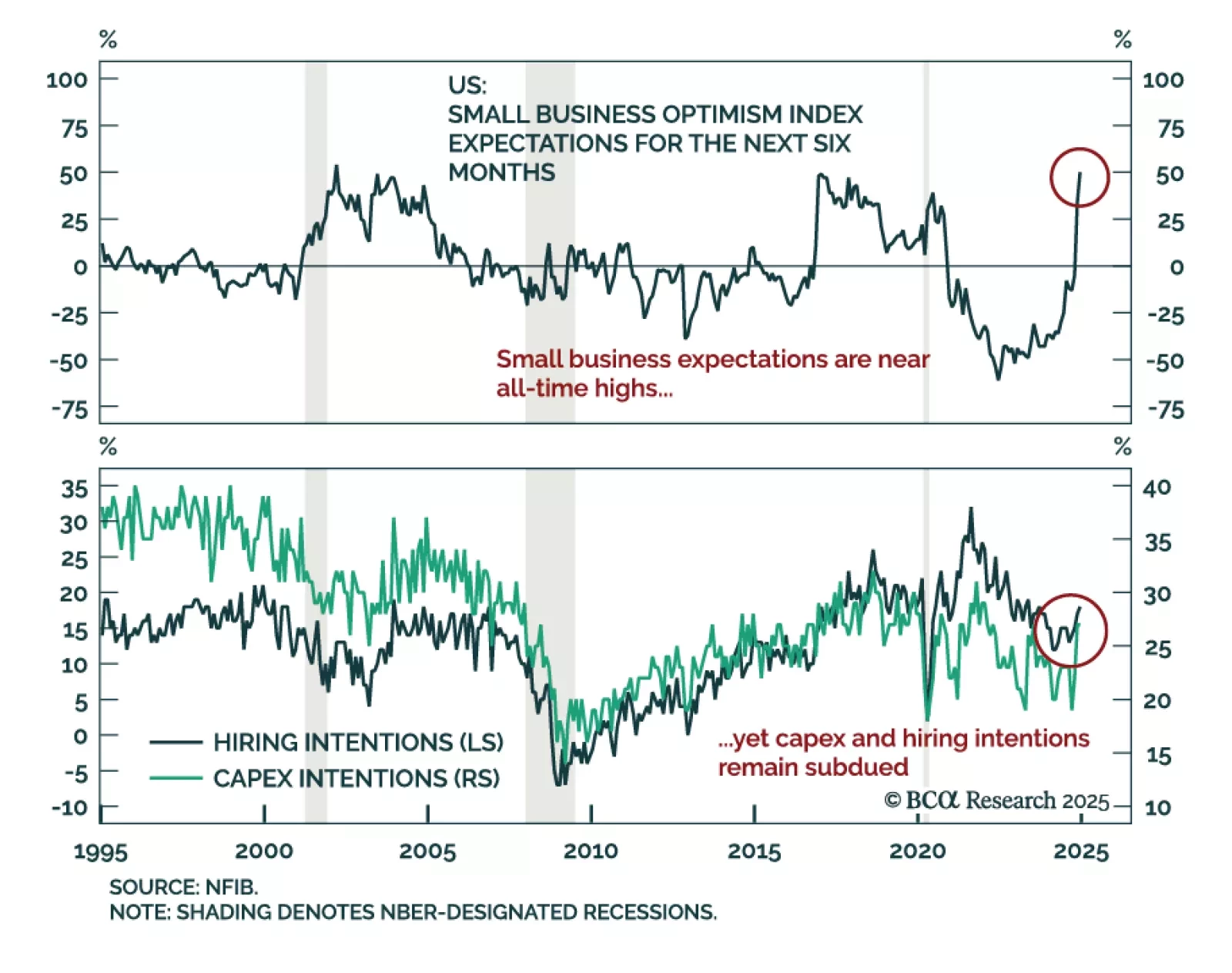

The December NFIB Small Business Optimism Index beat expectations, jumping to 105.1 from 101.7 in November. Most index subcomponents increased, led by measure of expectations, notably for the state of the economy and real sales.…

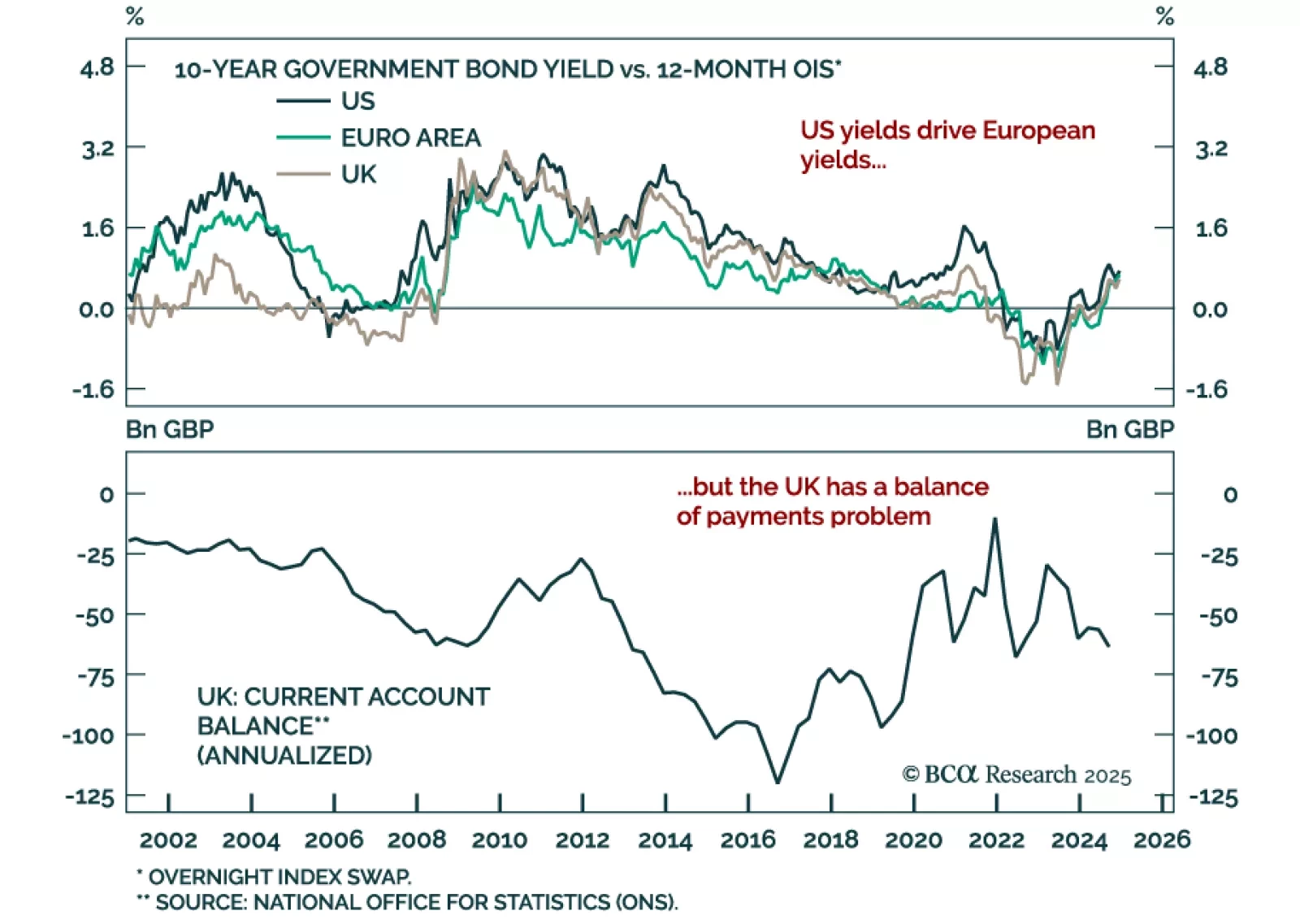

Our European Investment strategists looked at the developed markets bond selloff from a European perspective, focusing on Euro area and UK government bonds and currencies. The recent selloff in European bonds is driven primarily…

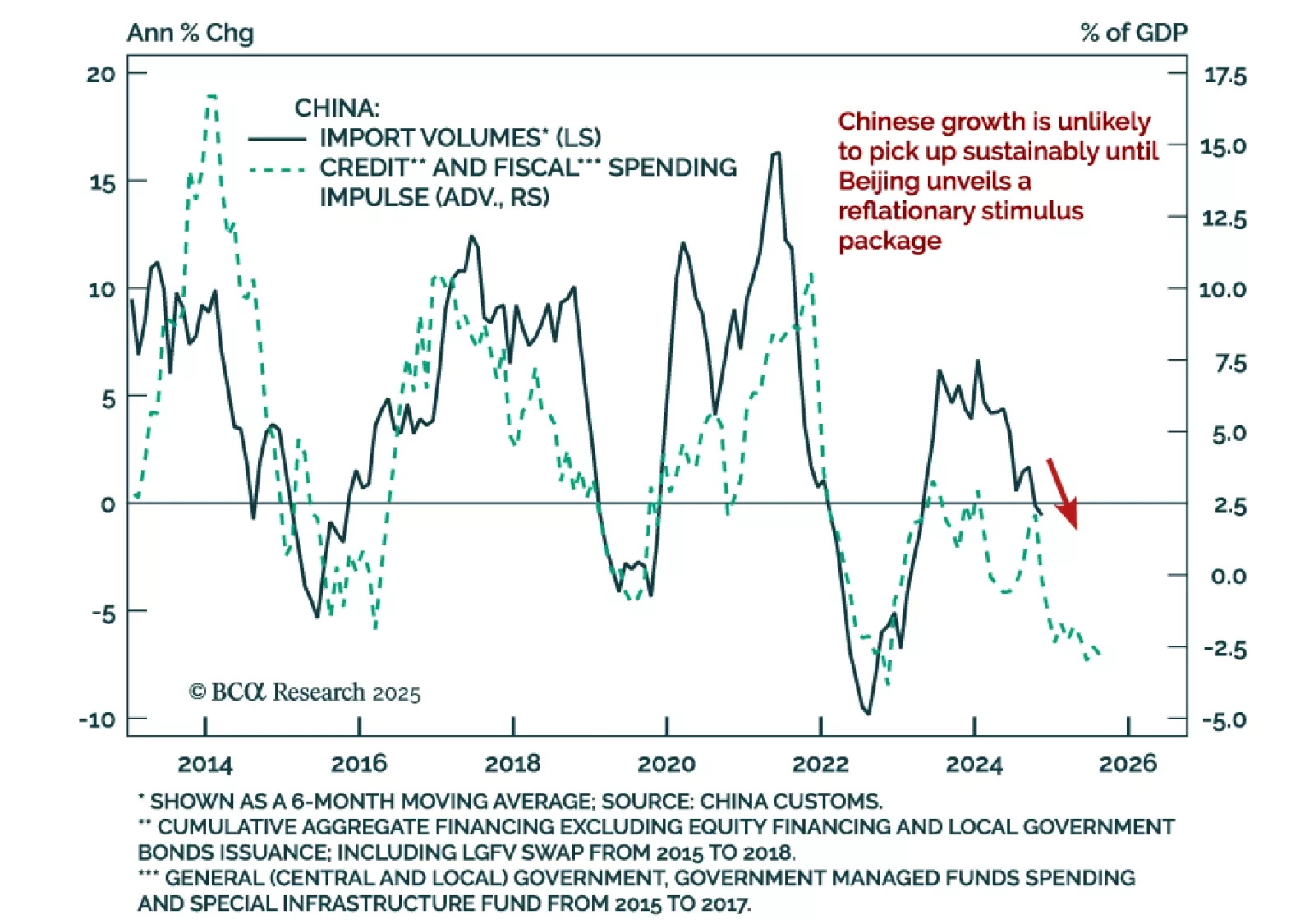

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…