The downgrade of the US credit rating highlights the risk of fiscal dominance overriding the Fed’s long-standing monetary dominance focused on its dual mandate. This threatens to push inflation and long-term interest rates higher. It…

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

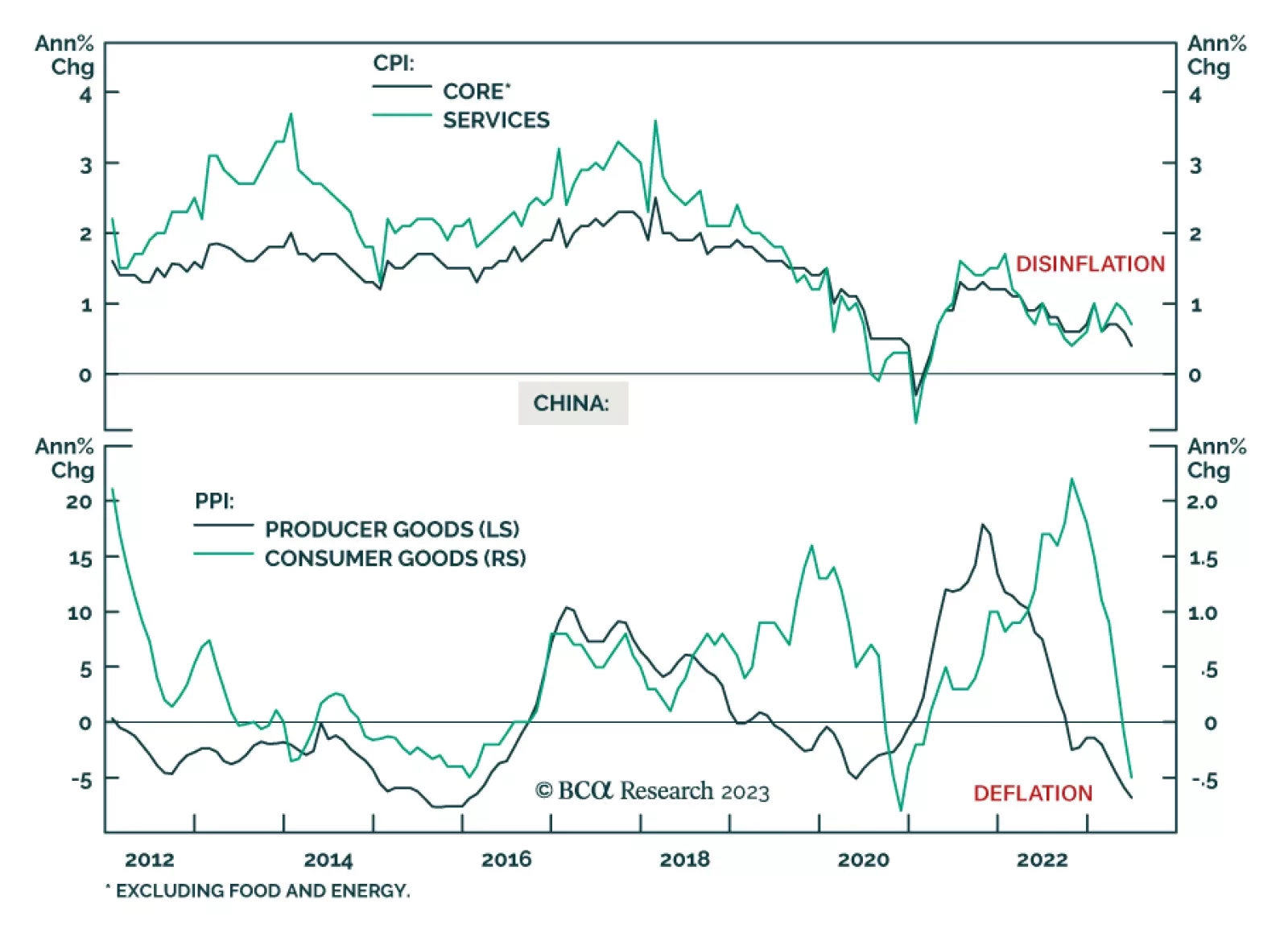

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

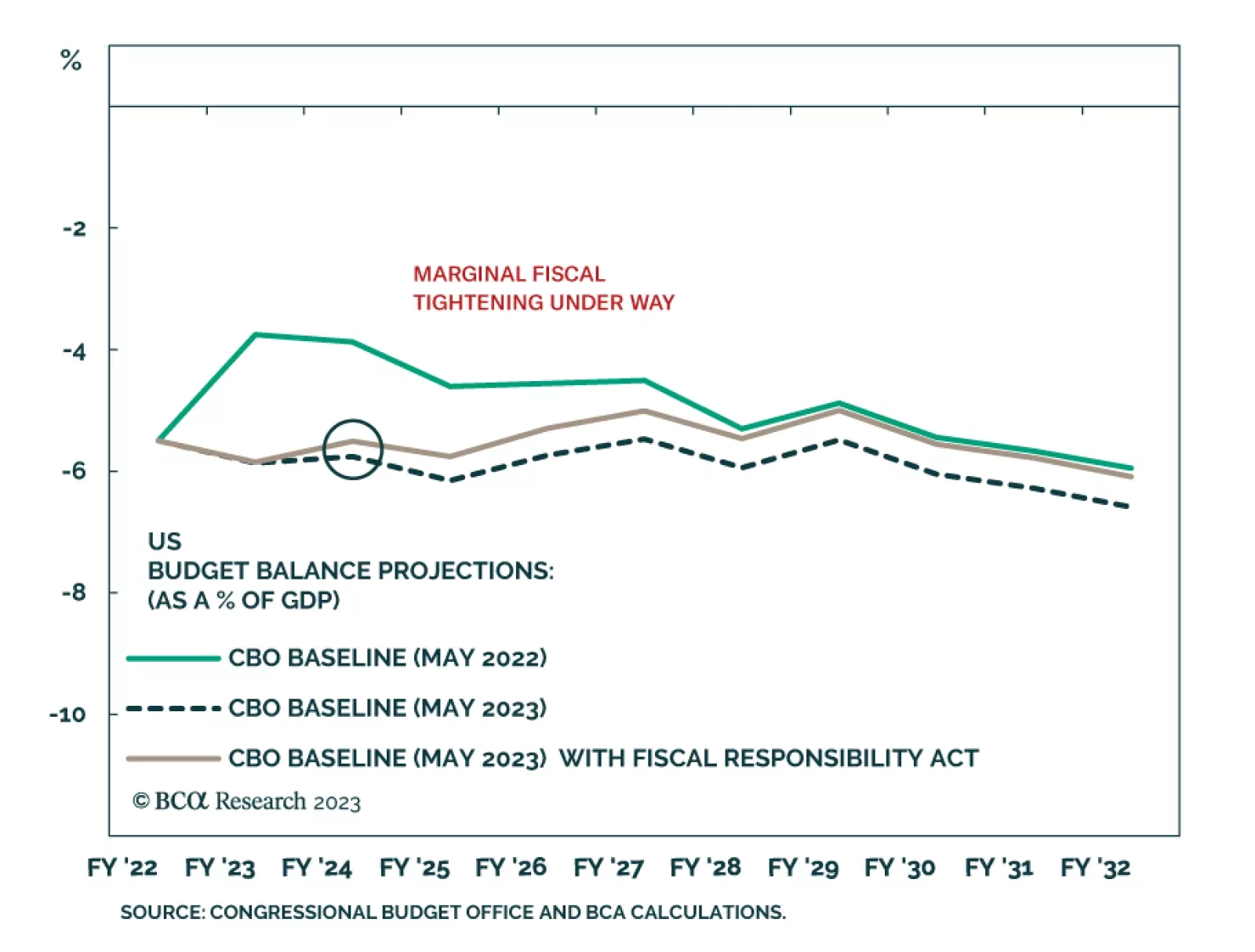

According to BCA Research’s US Political Strategy service, US fiscal policy is marginally negative for the economy and marginally increases the odds of recession in 2023-24. It is not a positive catalyst for equities in the…

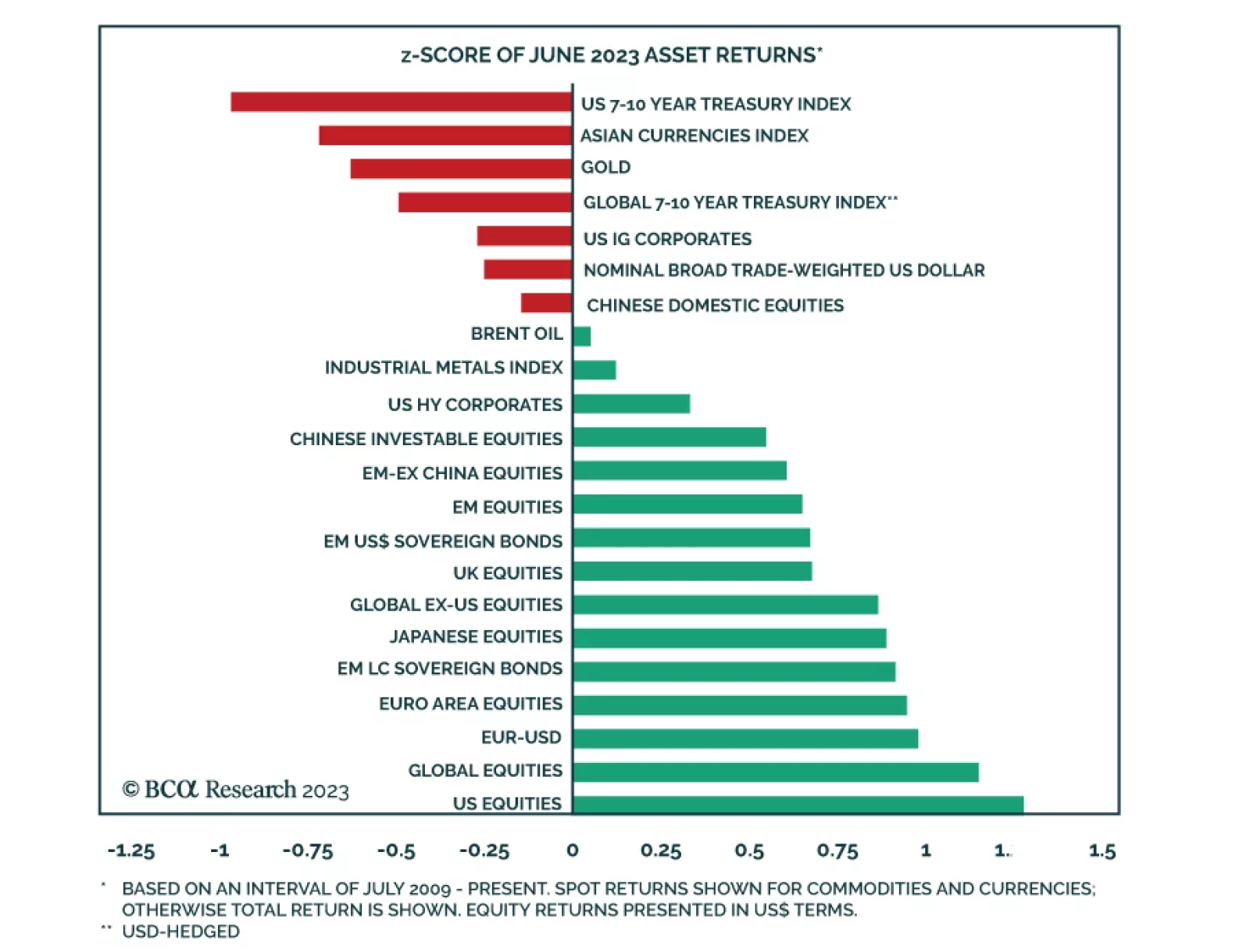

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

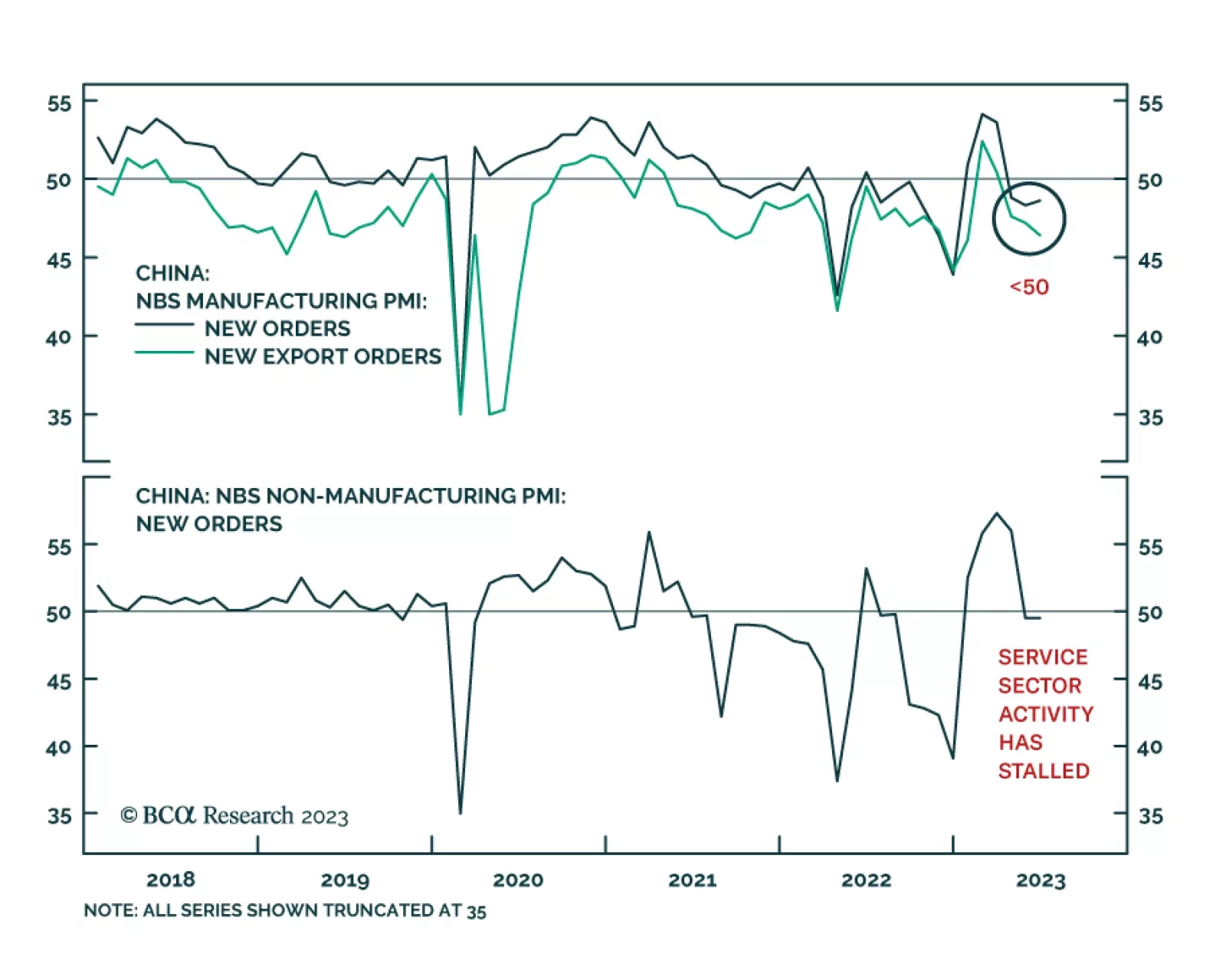

The June NBS PMI data revealed that growth conditions have deteriorated on the margin. The new orders and exports for overall manufacturing as well as for services have not improved and remain below 50. In addition, the import…

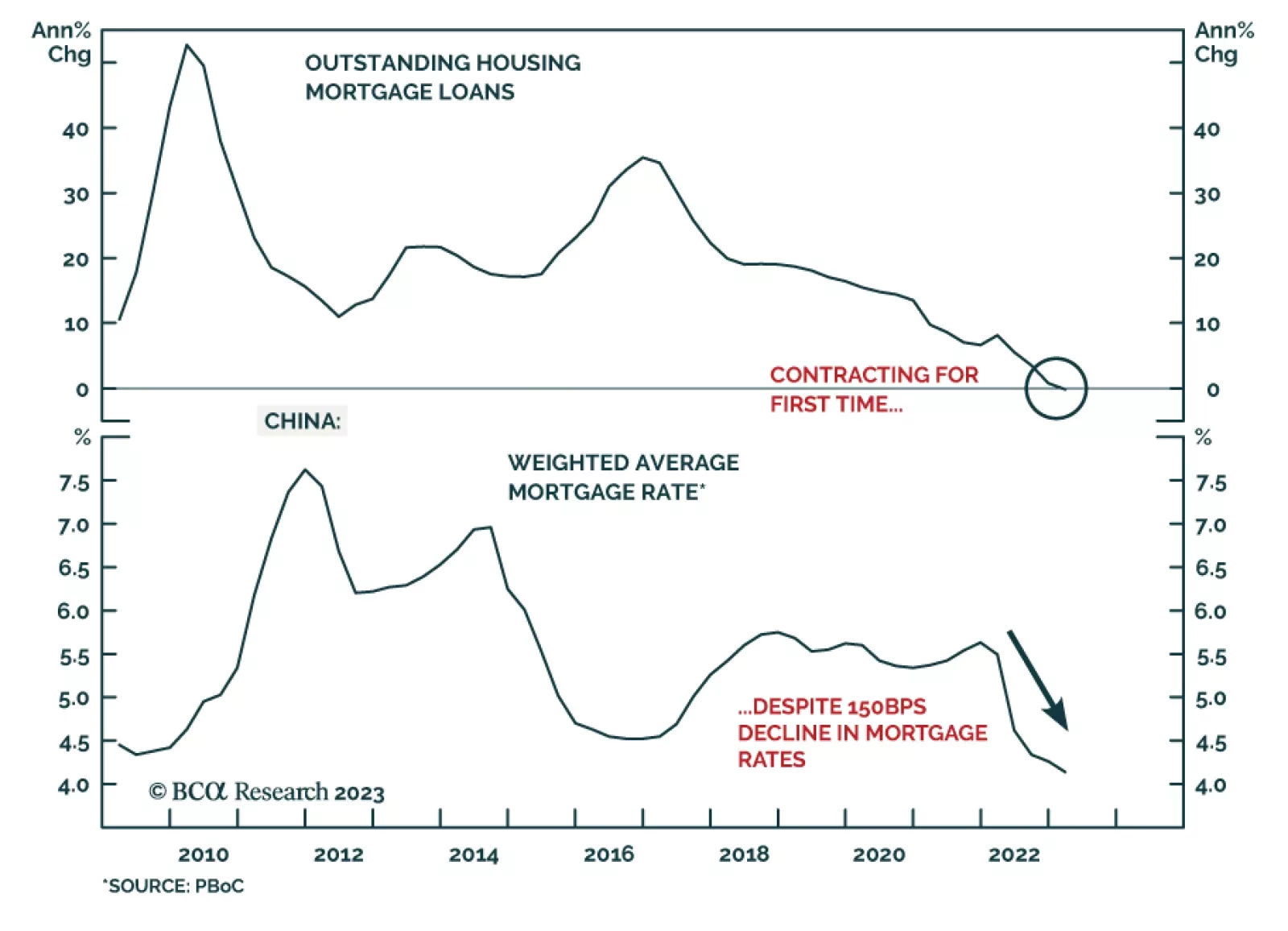

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…