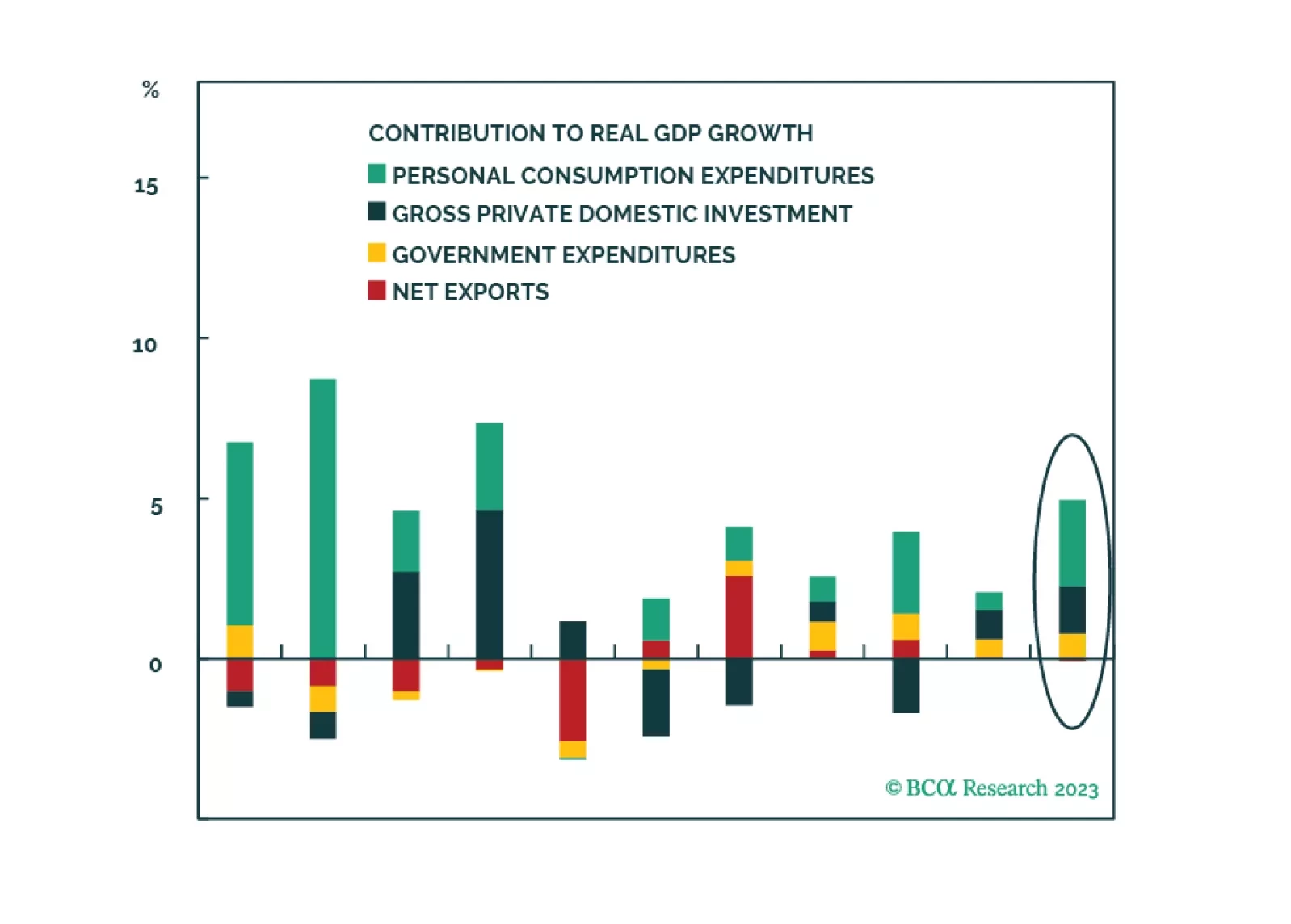

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

The bear market in US bonds will likely end with a bang rather than a whimper. Even during the secular US bond bull market of 1982-2021, cyclical bond bear markets ended only after an eruption of financial turmoil. It would be…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

The CCP’s fiscal measures and property-market support are important steps to deal with China’s liquidity trap. The fiscal measures are the first such direct aid to households and small firms seen since 2020, which included tax relief…

Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…