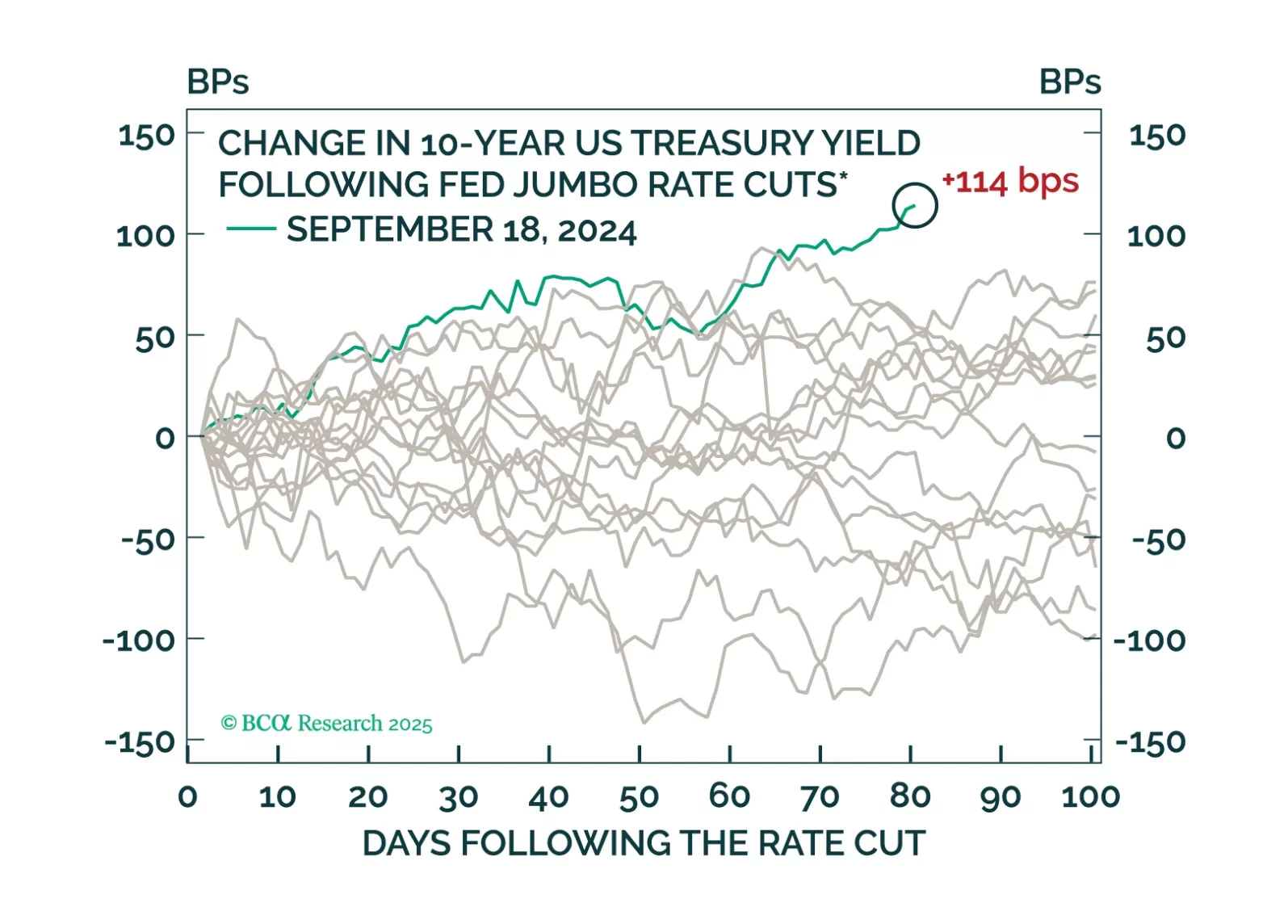

Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

This month, our Here, There, And Everywhere chartpack reiterates our main thesis for 2025: the three main narratives driving markets today – fiscal profligacy, trade war, and geopolitical conflict – will peak at some point in 2025.…

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

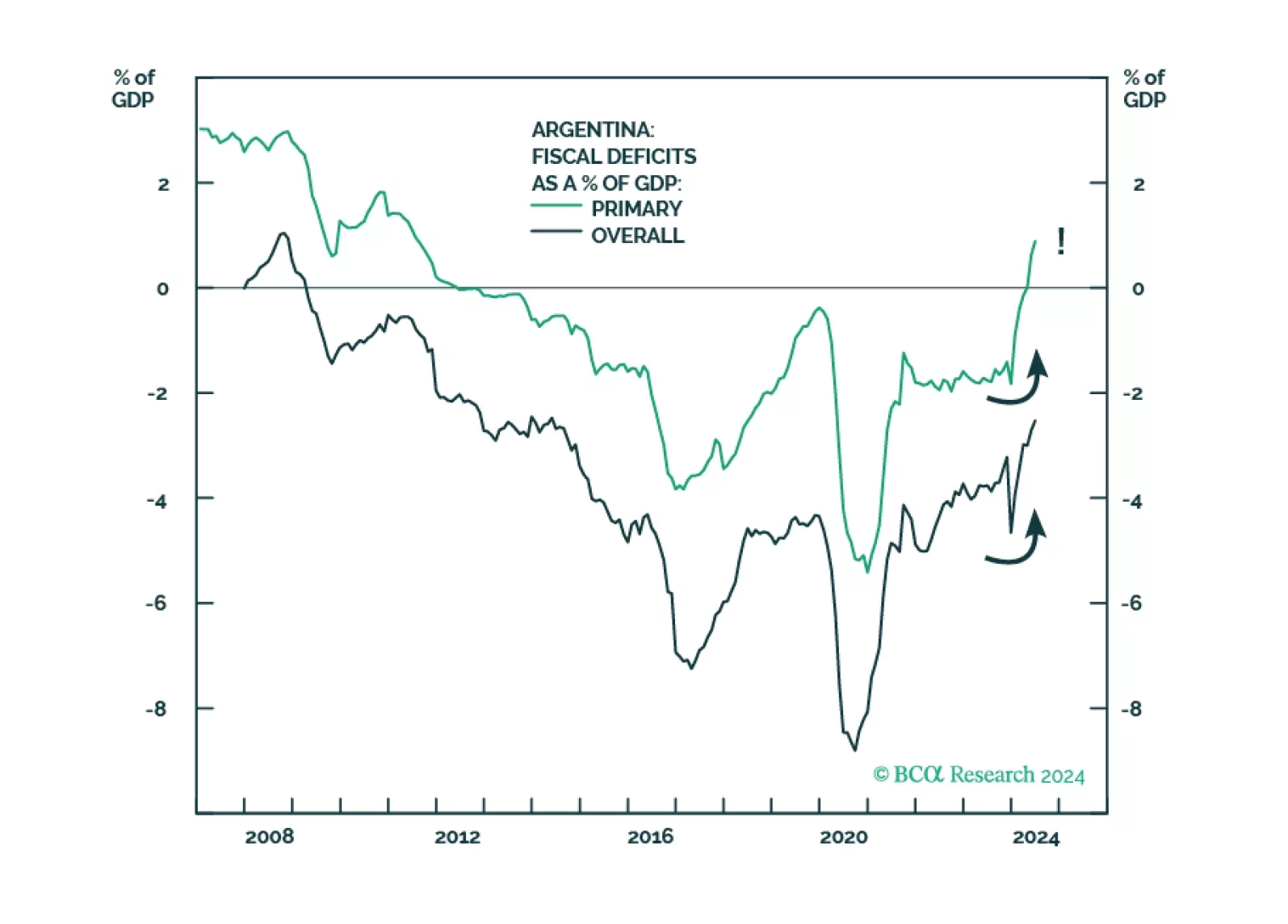

GeoMacro team partners with BCA’s Emerging Markets Strategy to examine political reforms in Argentina. Our colleague Juan Egaña argues that the time is not right to go long Argentinian assets and that Buenos Aires must avoid the…

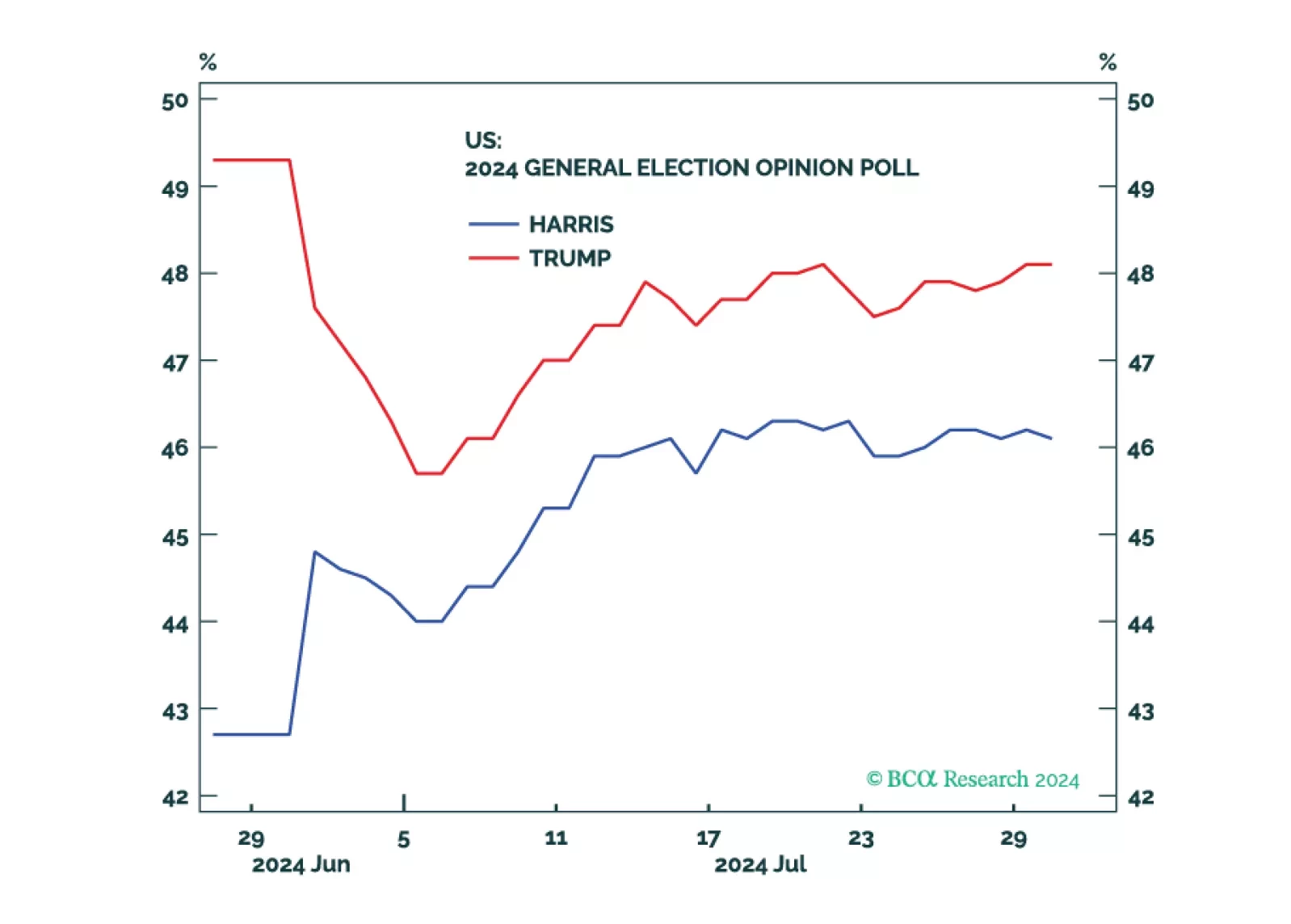

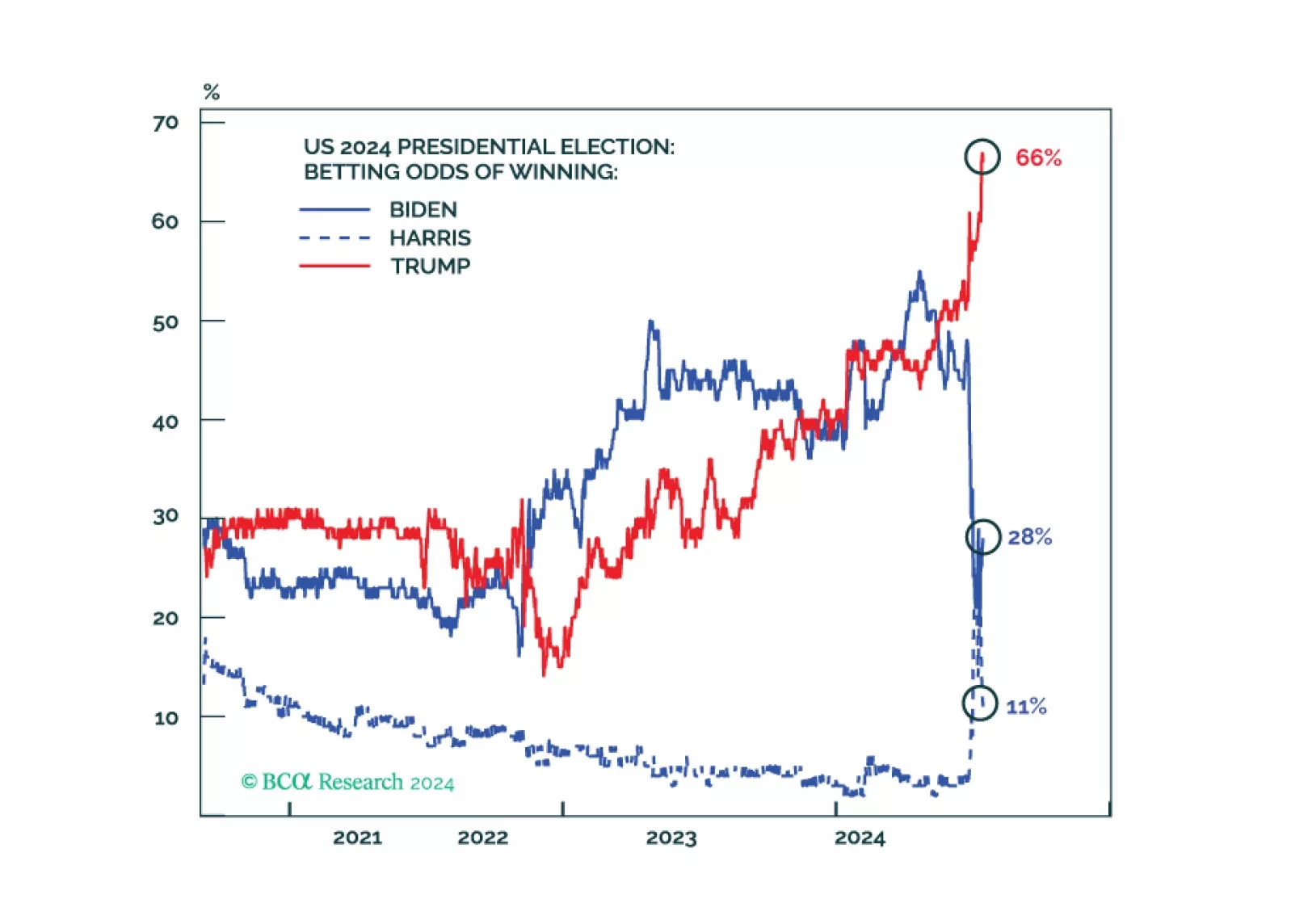

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

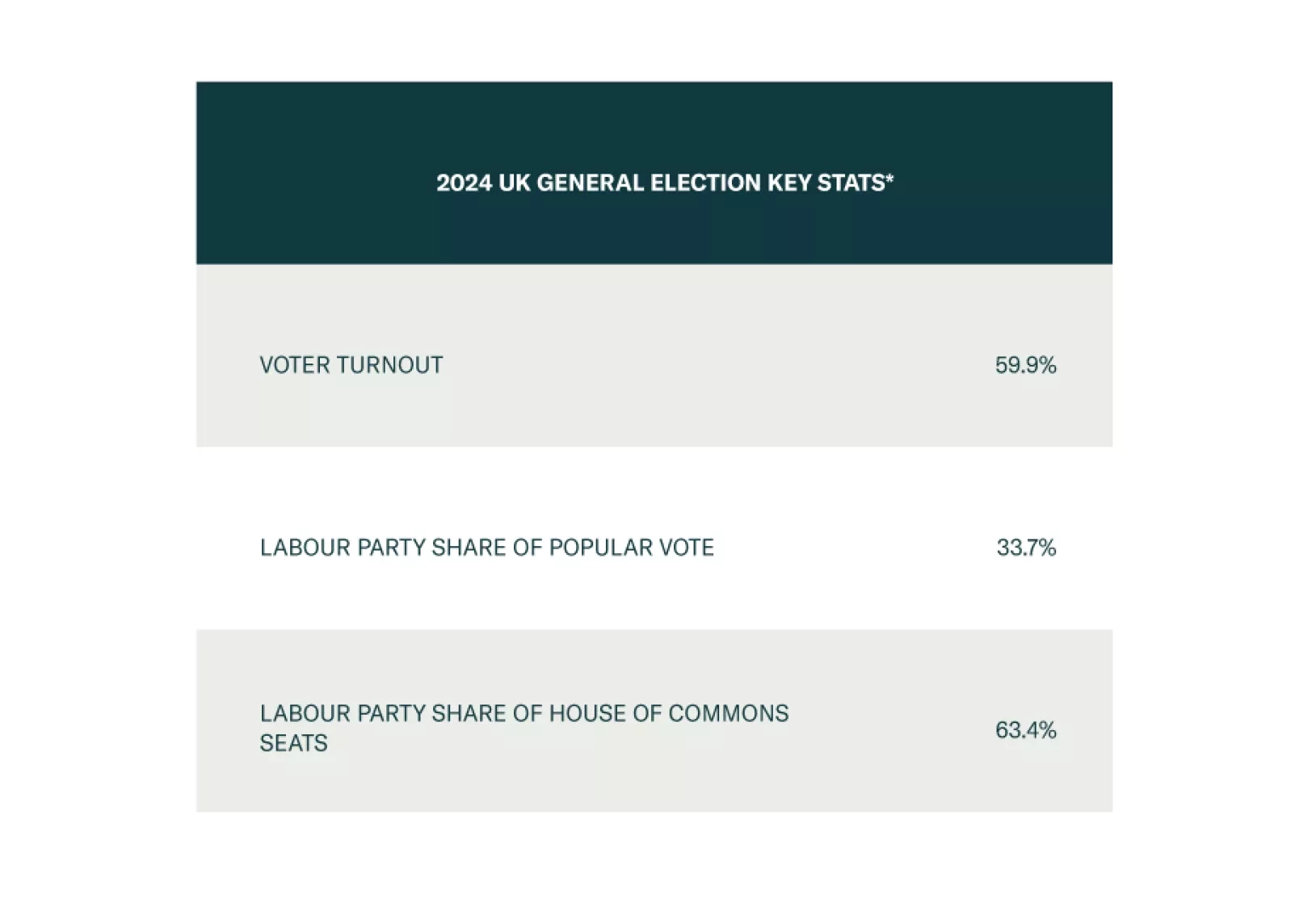

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…