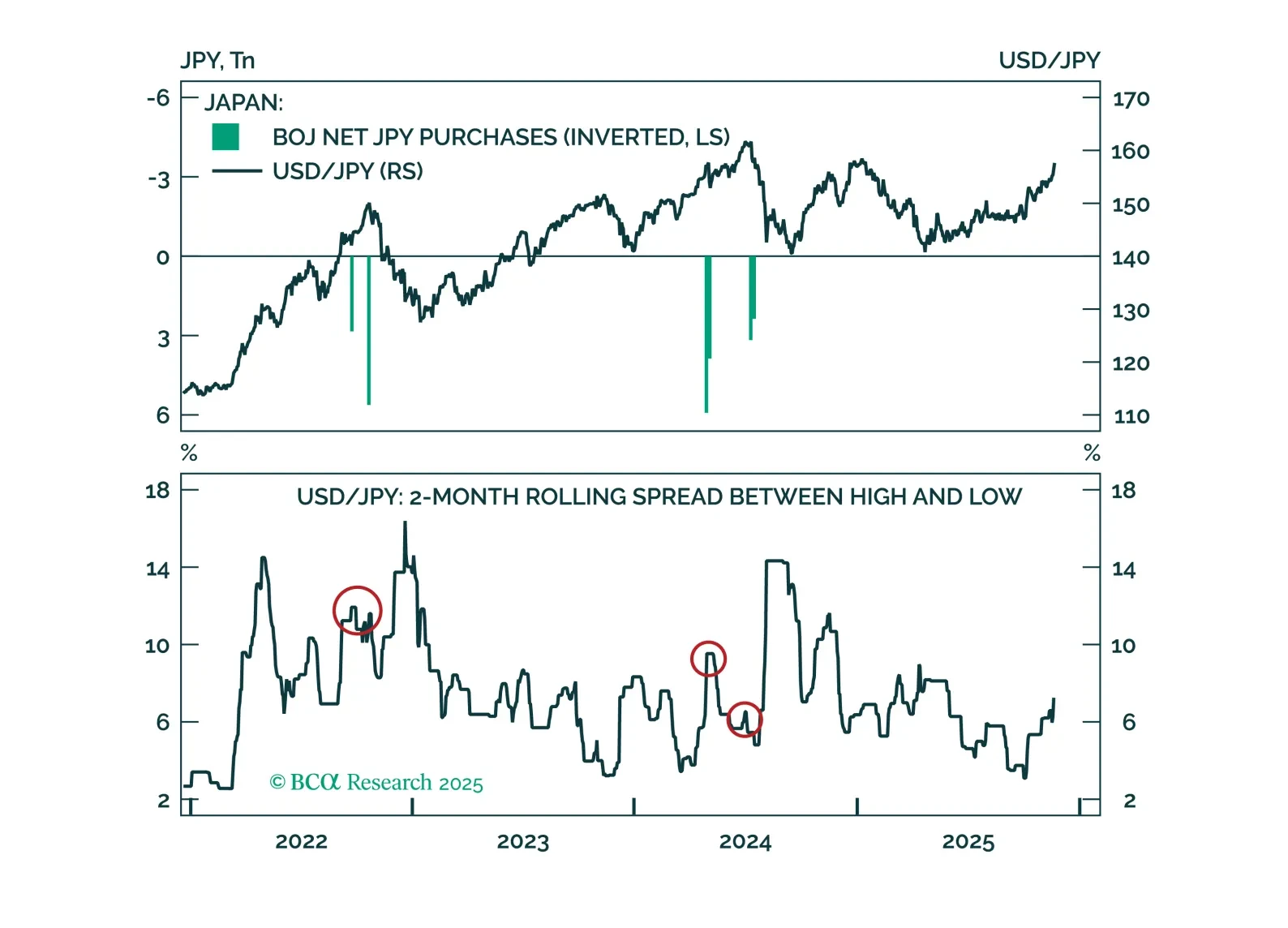

Markets are misreading Japan’s fiscal headlines. Our latest Insight examines what will shape BoJ policy next, when intervention might come, and the timing of a yen reversal.

Détente between China and the US is a big deal. Economic data continues to give the Fed reasons to cut. What is there to be worried about? Very little. But we chew on some bearish thoughts as we start thinking about 2026.

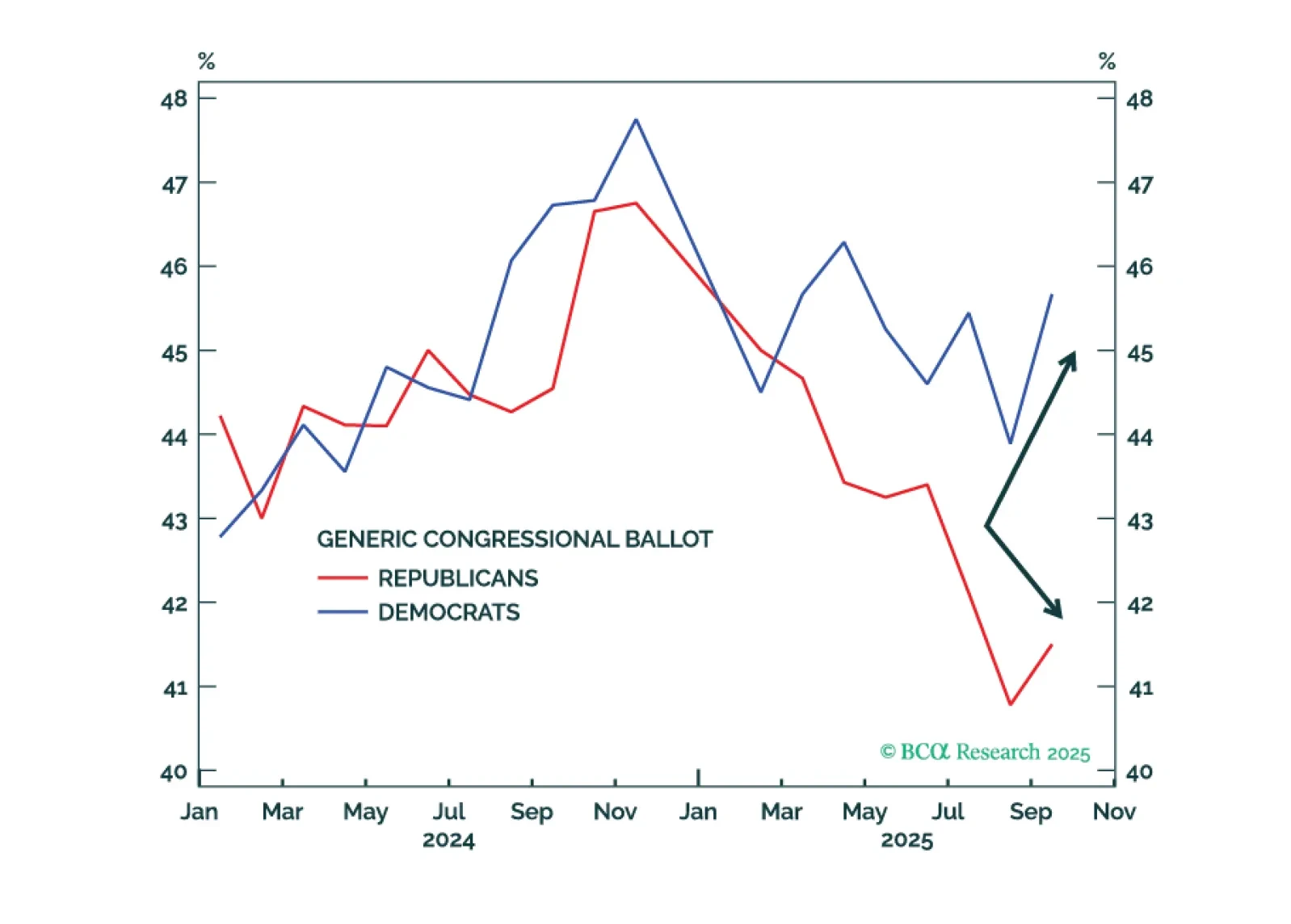

We give a one-third probability of a federal government shutdown. It probably will not happen before November. At worst, government shutdowns only cause temporary market volatility.

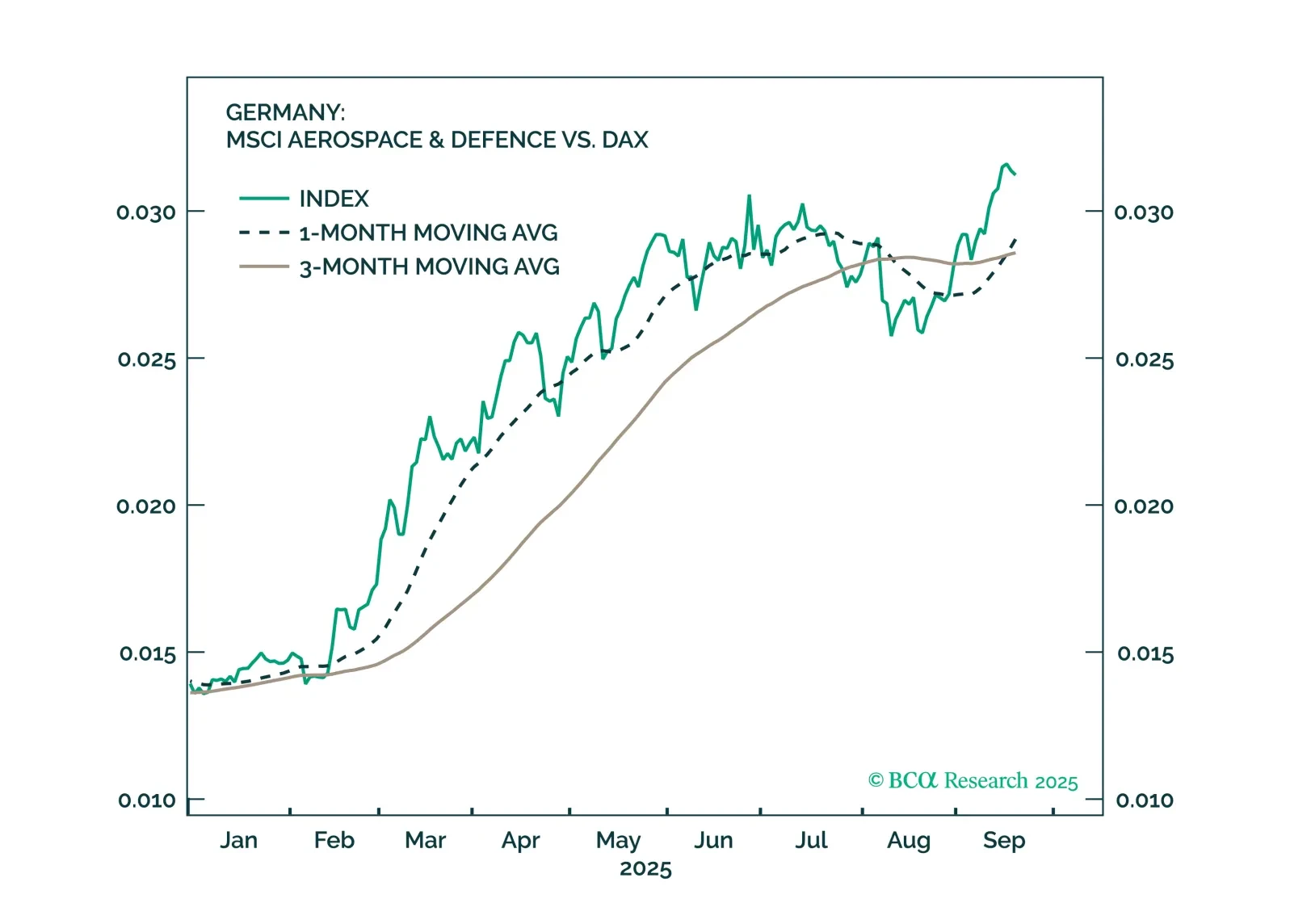

Germany is moving forward with implementing the large fiscal and defence spending announced earlier this year. Fiscal reforms are also positive, though they will fall short of expectations.

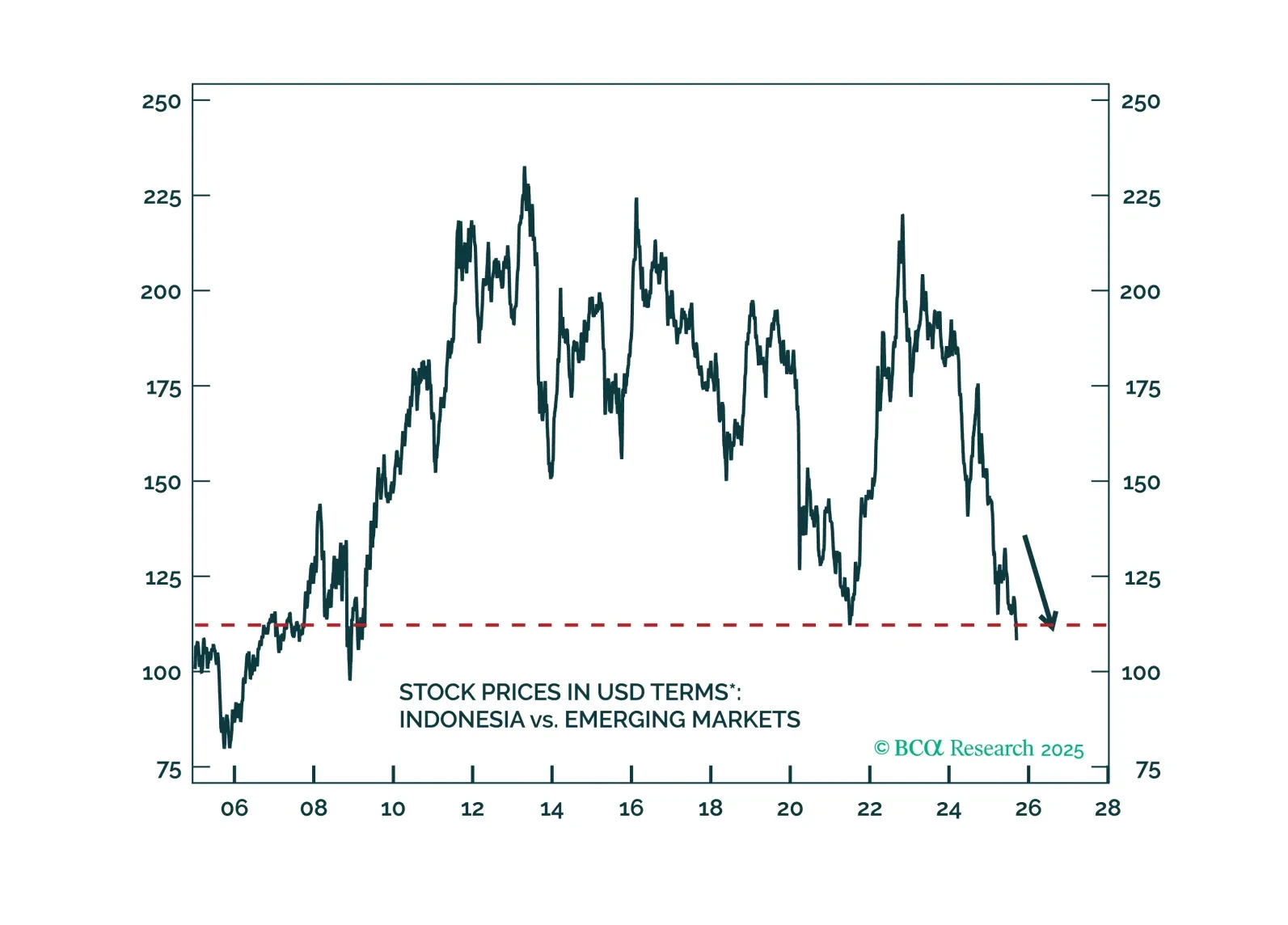

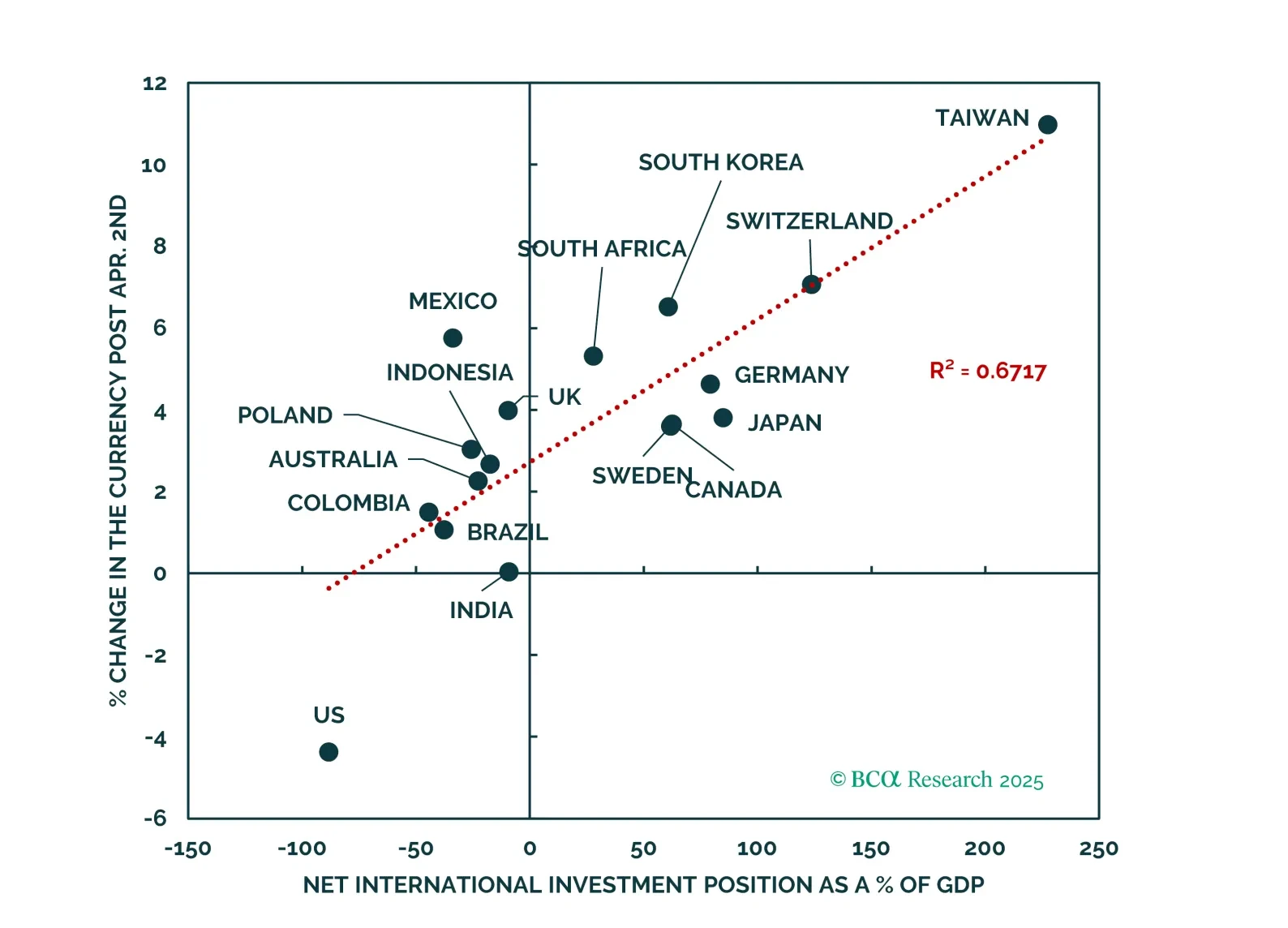

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…

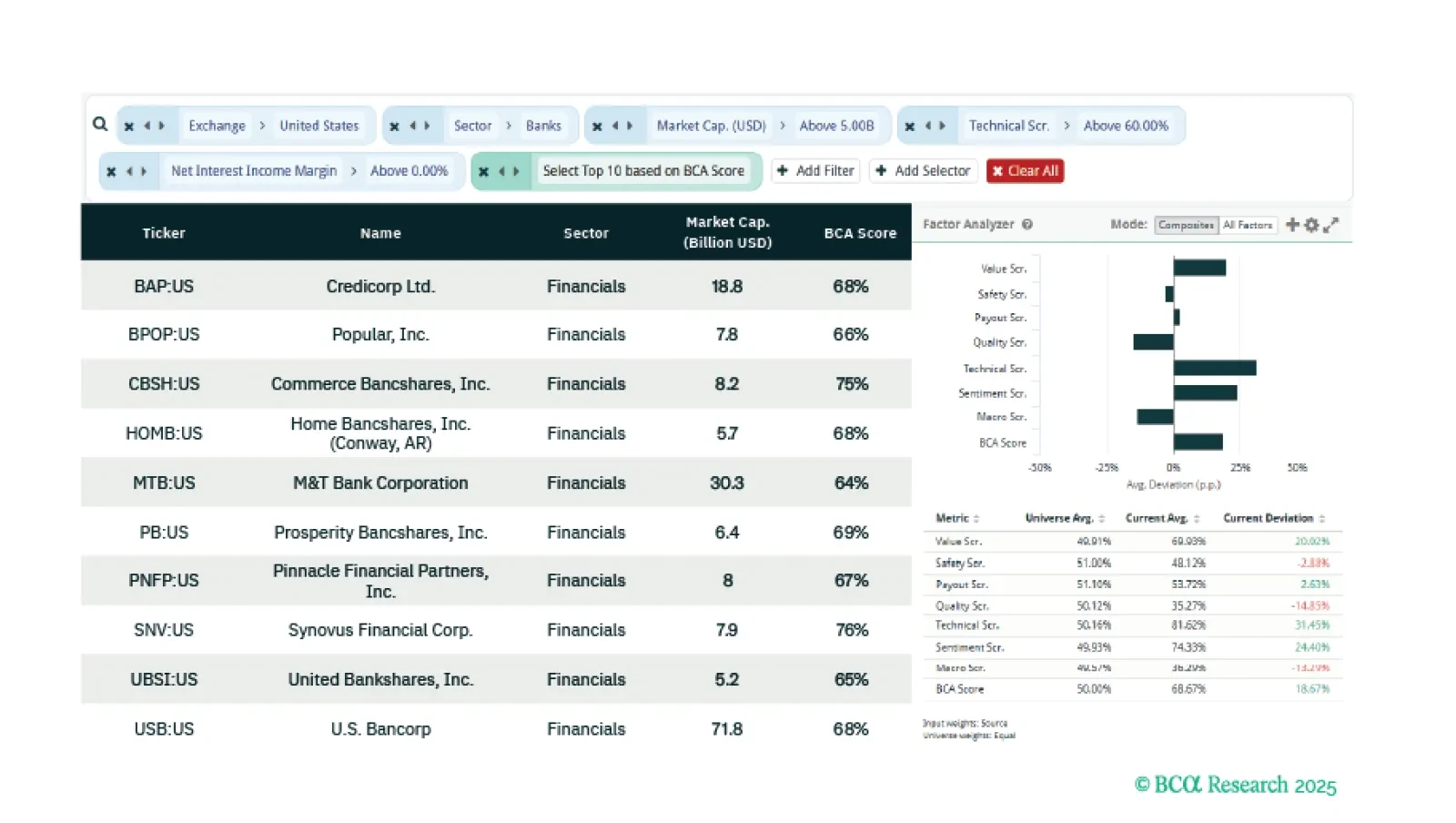

This week our three screeners identify: Equity plays on US banks, stocks that benefit from heightened US fiscal uncertainty, and a global Value and Technical basket of stocks.

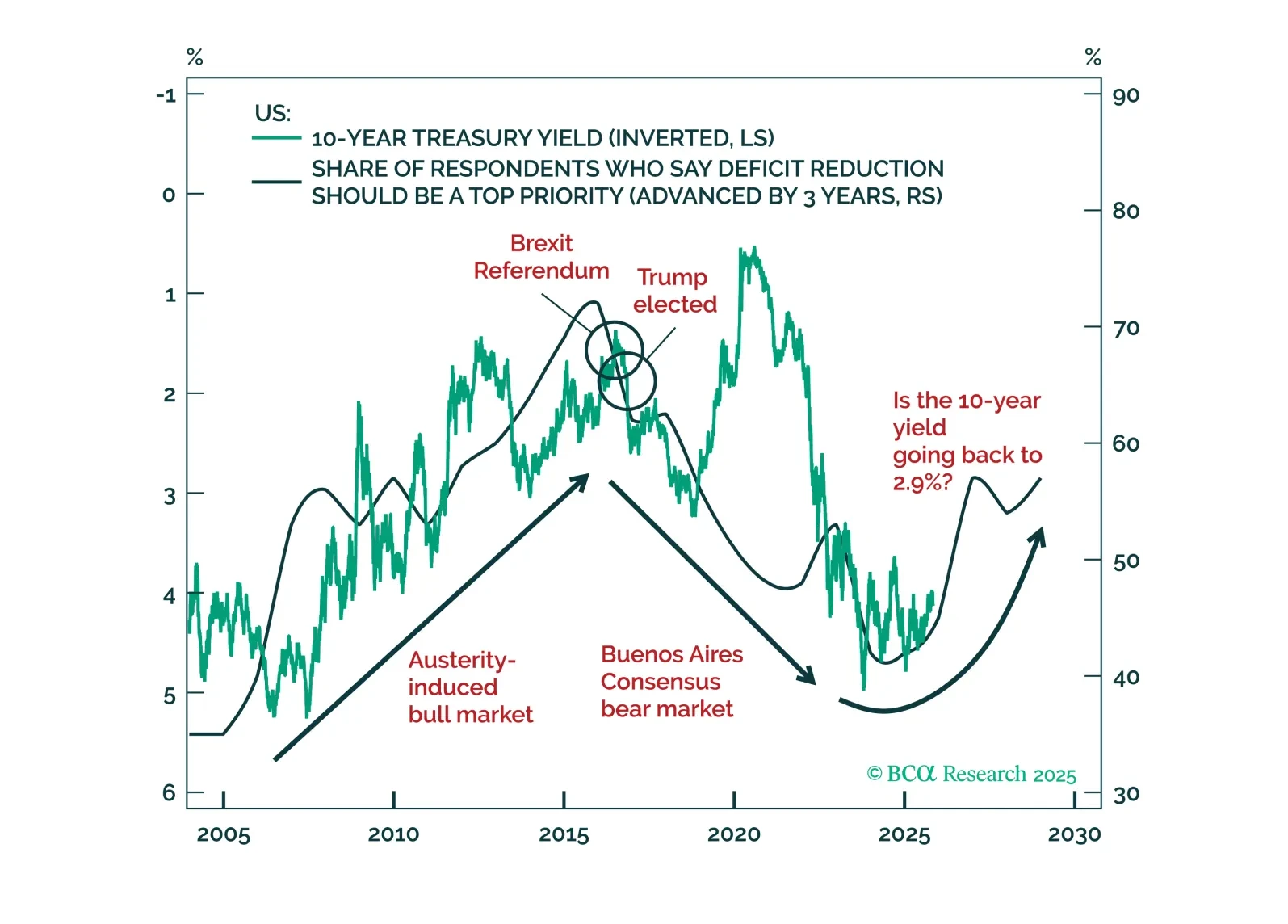

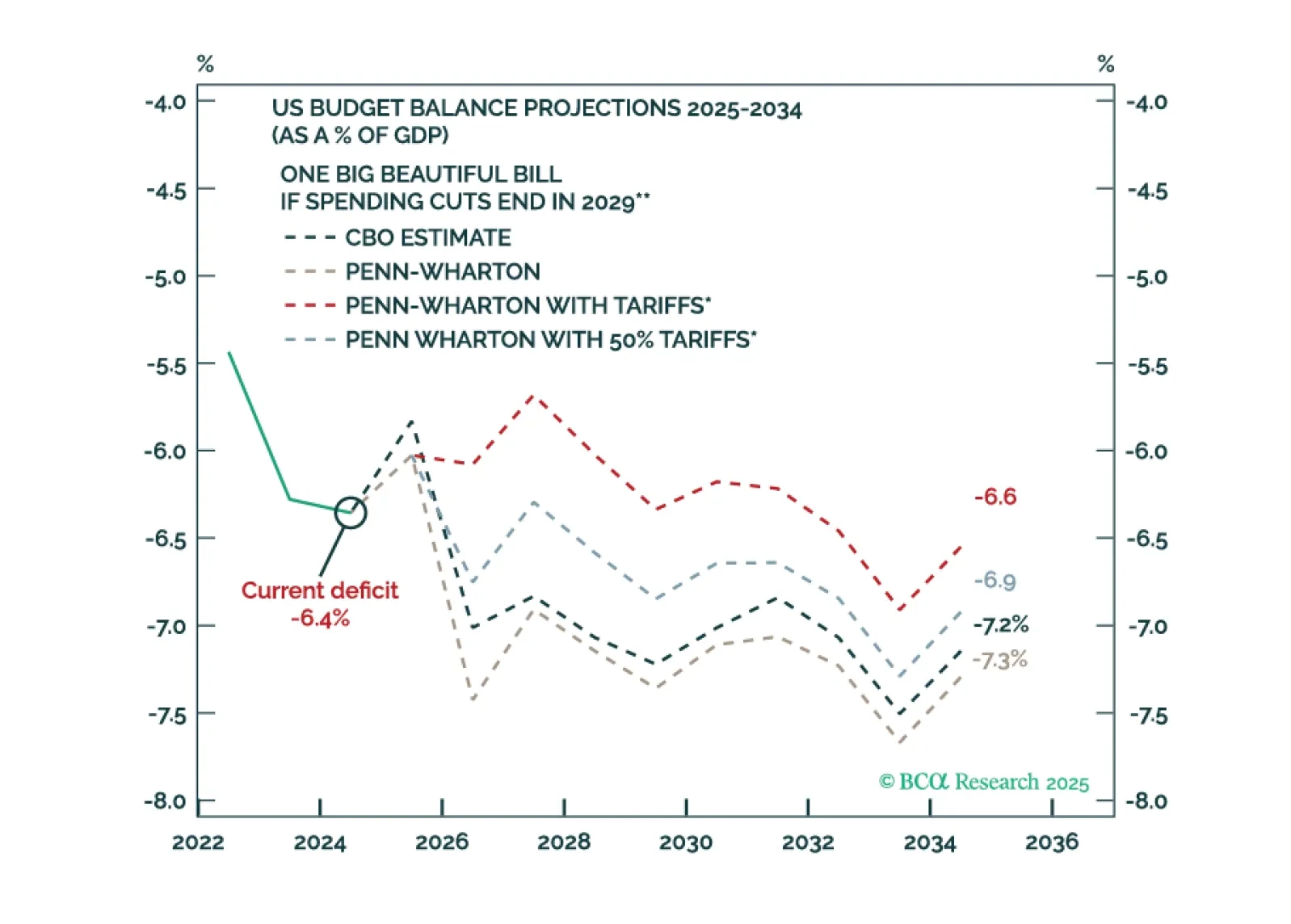

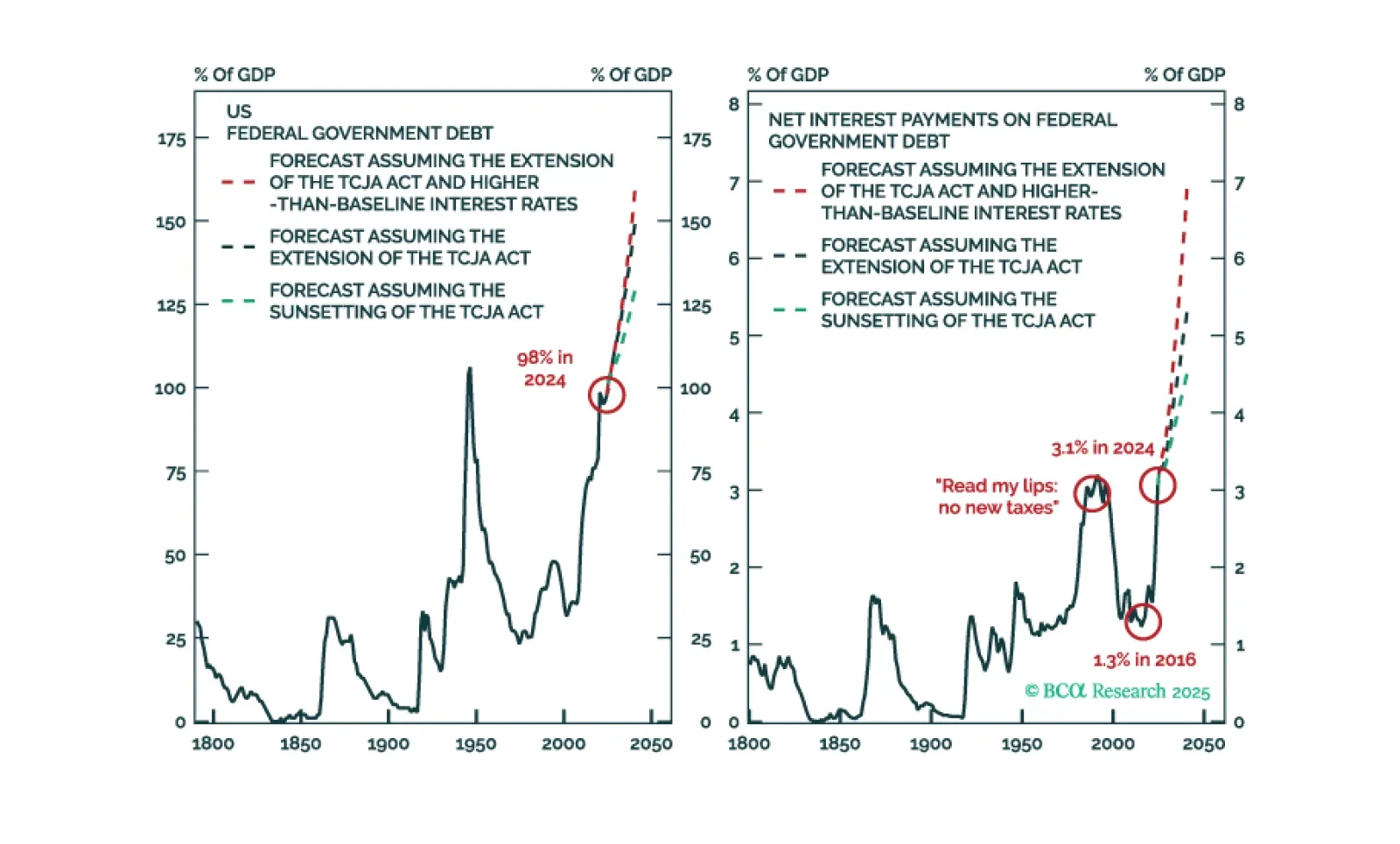

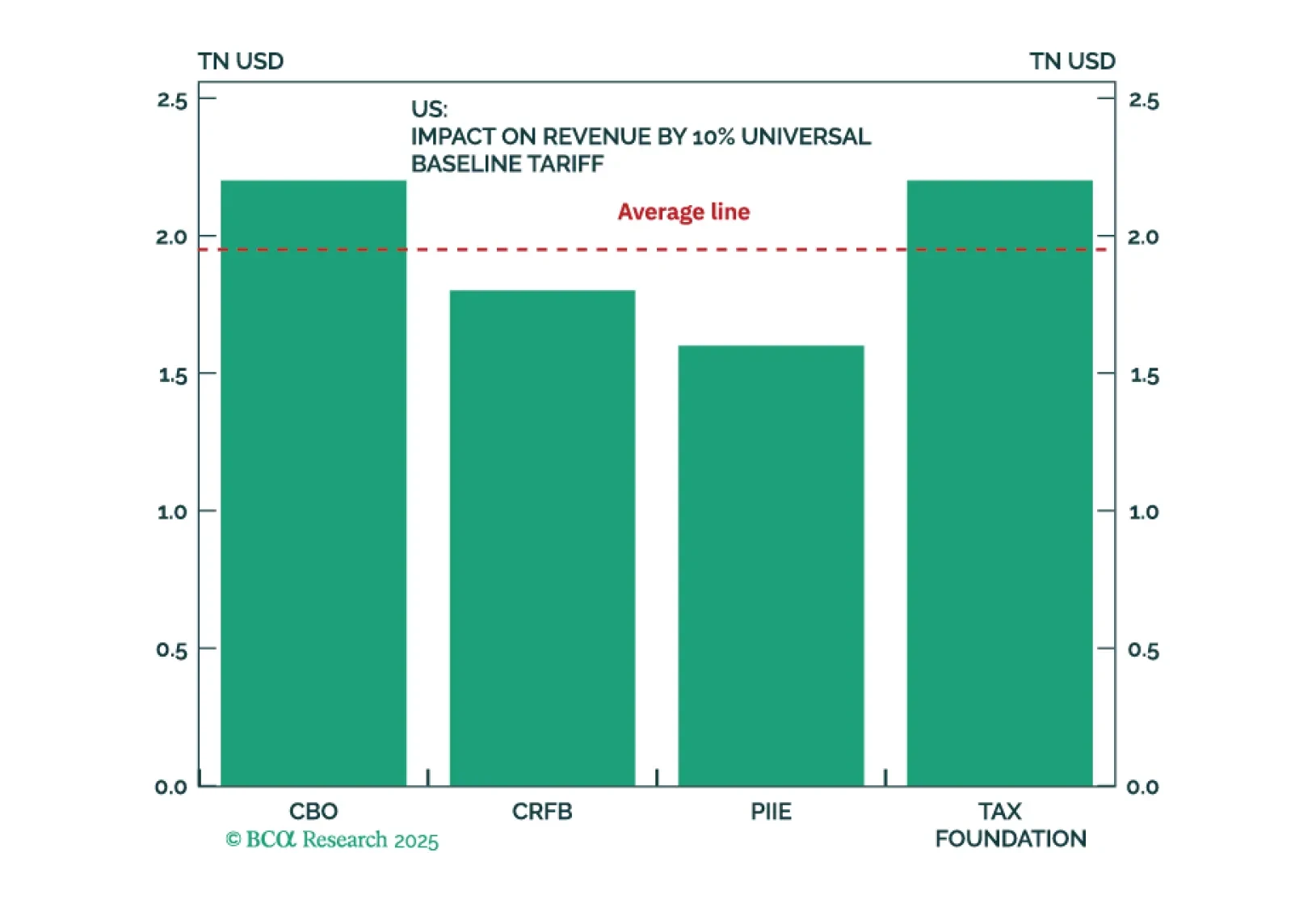

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

Fiscal policy, not tariffs, is now driving markets as Congress advances the One Big Beautiful Bill. The Senate cannot afford to remove the spending cuts in the bill, as they risk sparking a bond market riot. Even with this more…

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.