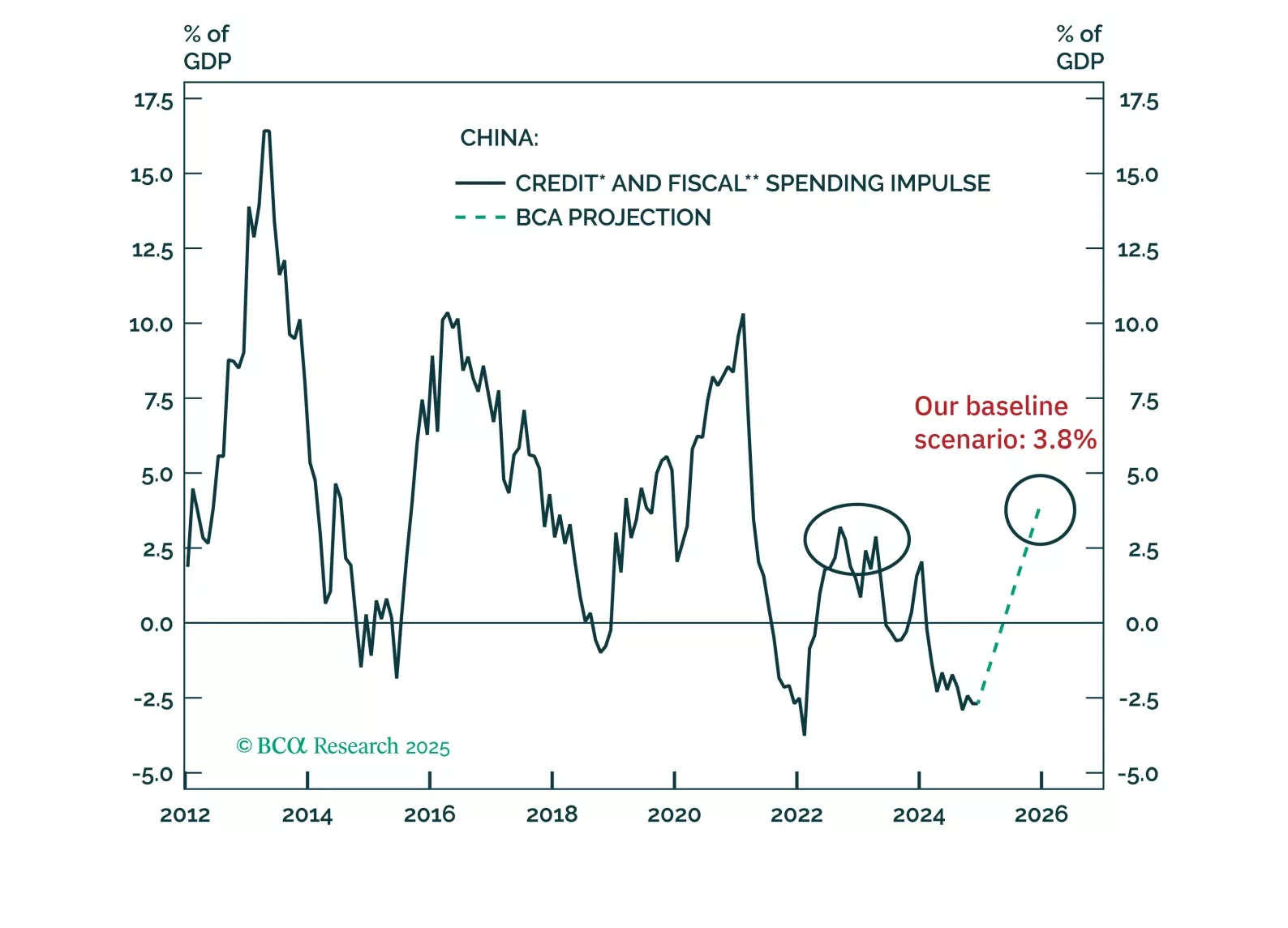

The fiscal stimulus announced at this year’s National People’s Congress is only slightly larger than last year’s. Notably, the details of the measures suggest that it will be challenging for fiscal stimulus to effectively…

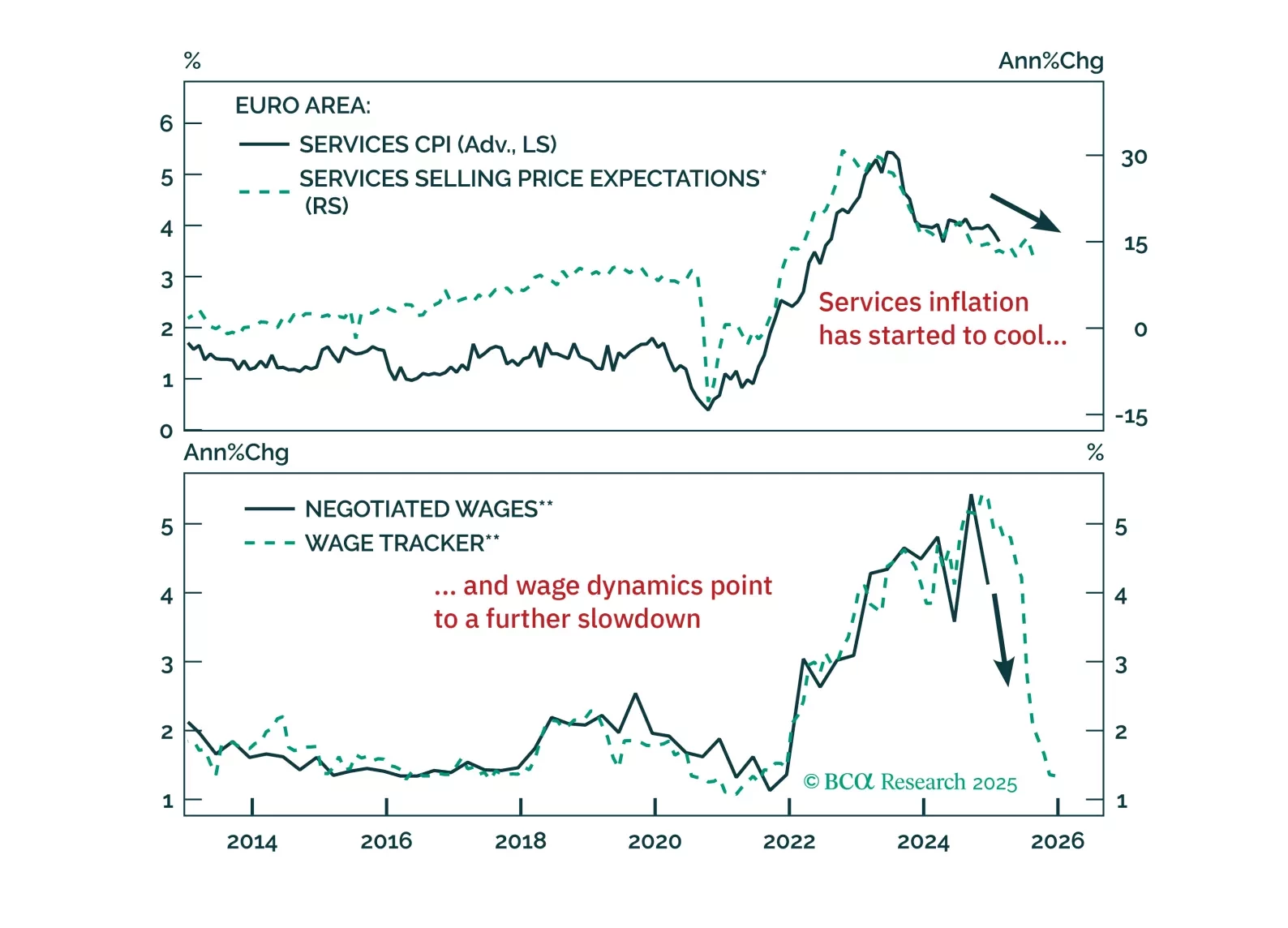

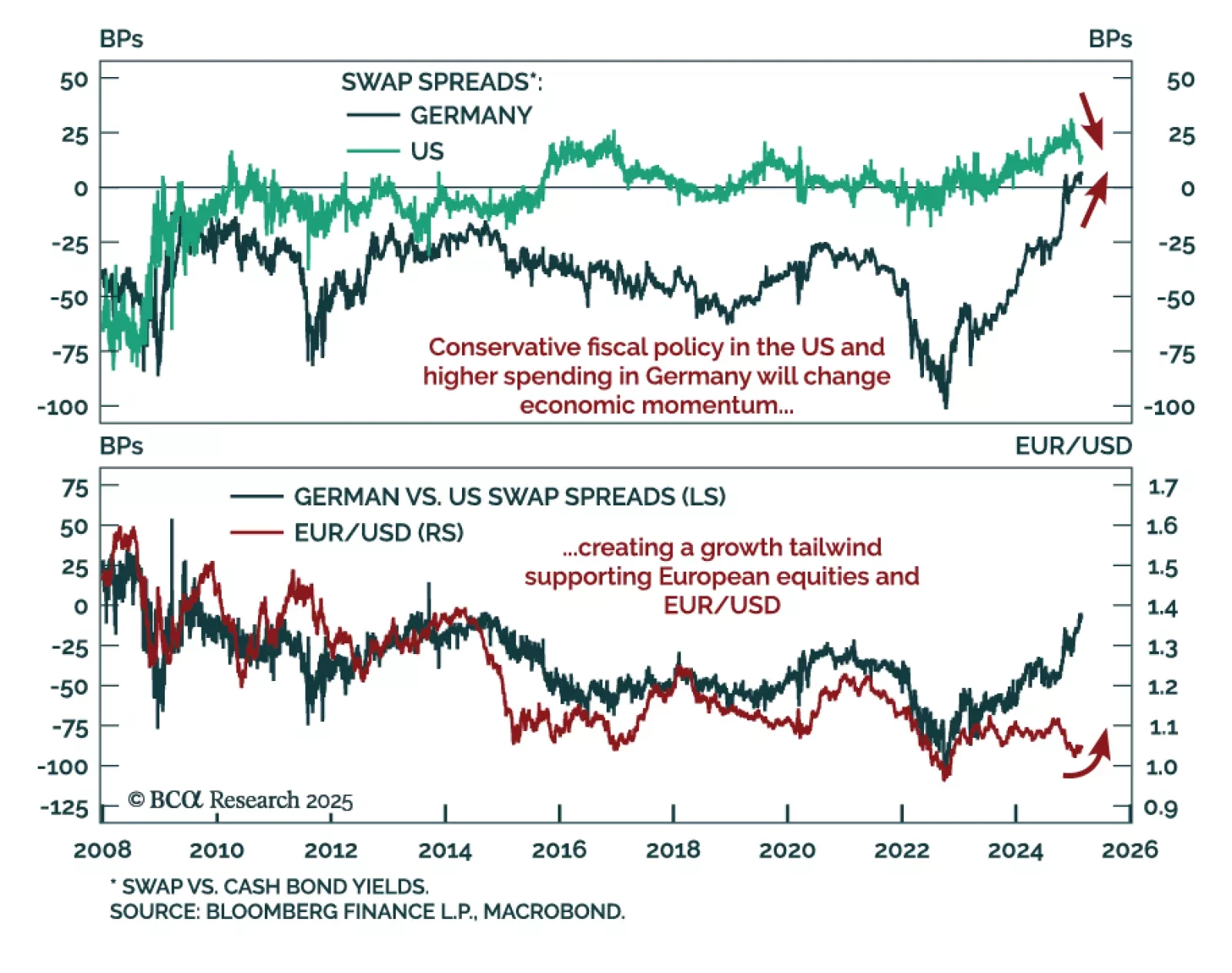

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

February flash inflation for the Eurozone was slightly hotter than expected but nonetheless declined, with both headline and core inflation falling 0.1% to 2.4% y/y and 2.6%, respectively. Services inflation also declined to 3.7%…

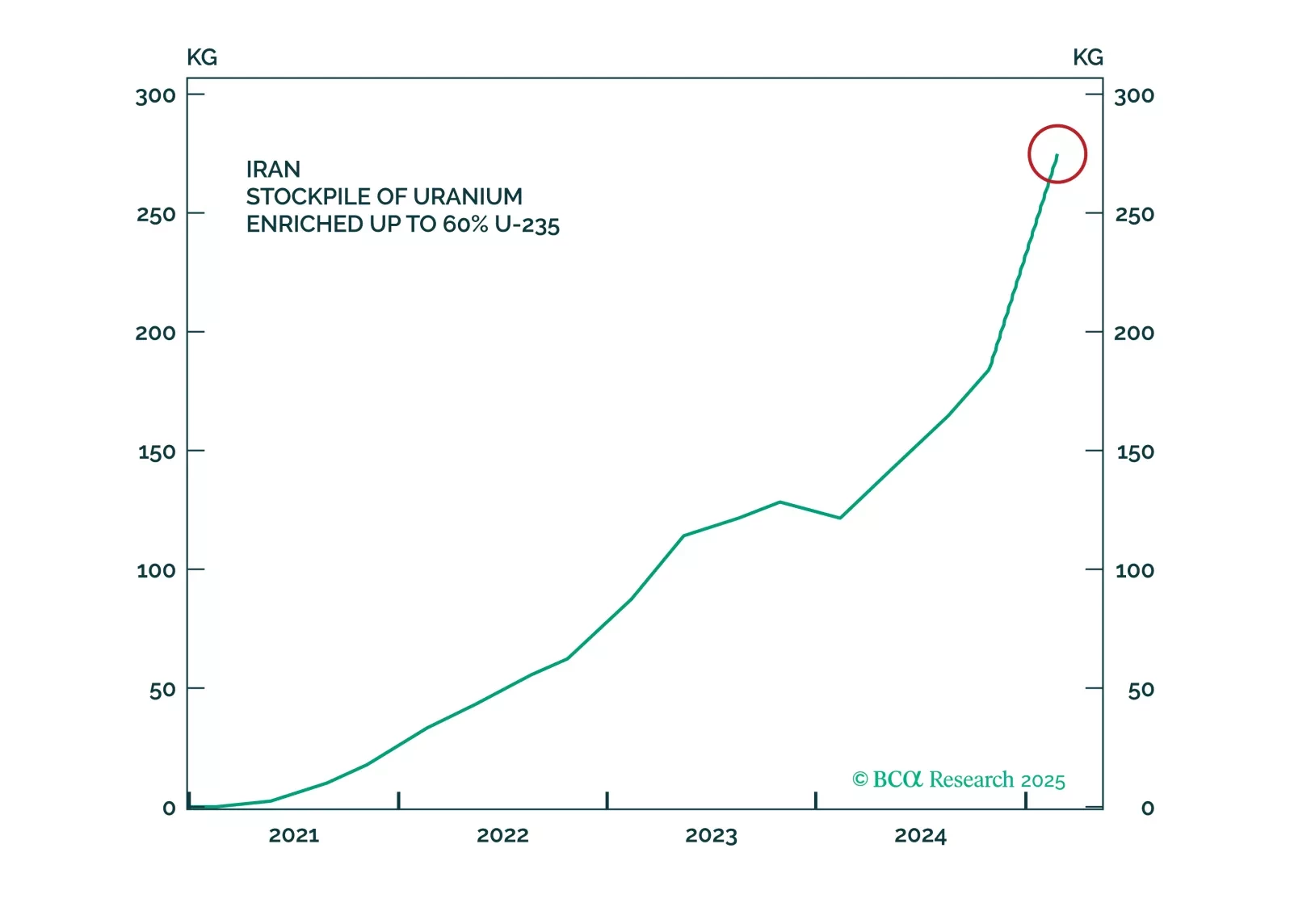

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

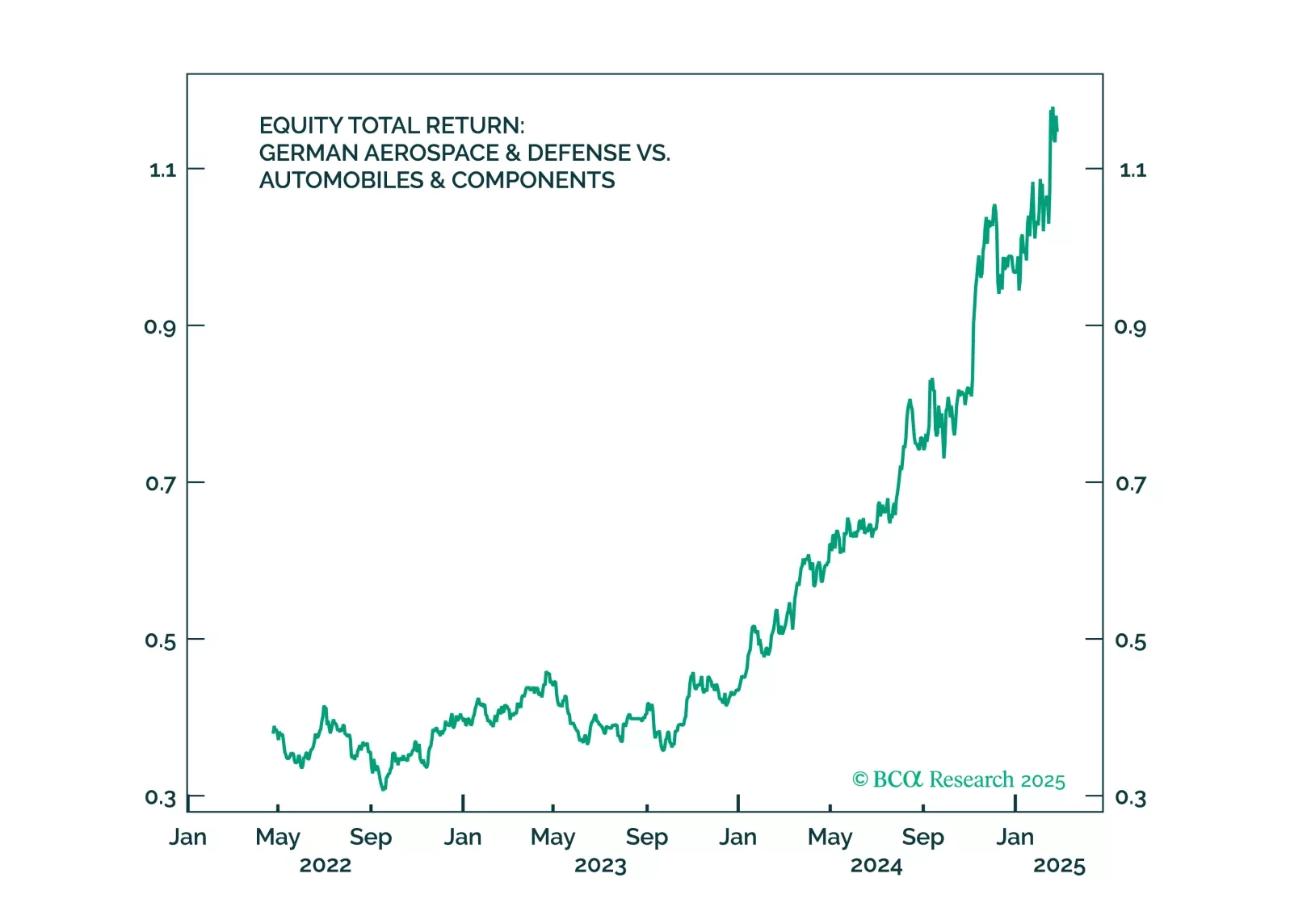

European equities have outperformed the US so far in 2025, especially after Euro Area economic surprises started outperforming as the US is starting to disappoint. The current leadership change between US and European assets reflects…

German election results were roughly as expected, but Europe’s biggest economy suddenly just got more interesting. While the details of the governing coalition have yet to be finalized, Chancellor Merz has floated options to ease the…

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

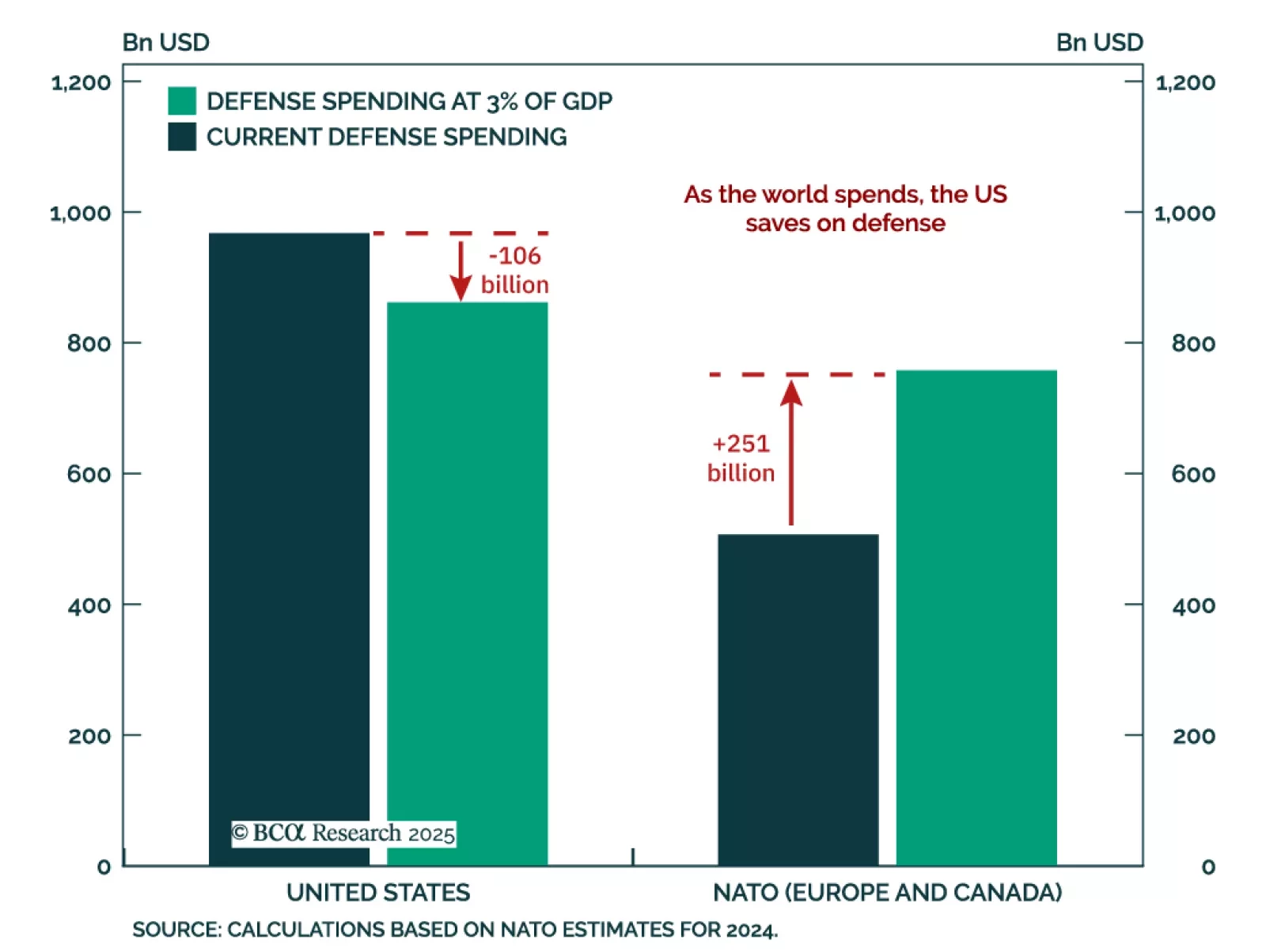

Our GeoMacro and Global Investment strategists crunched the numbers to determine what the world owes the US for its security commitments. The US administration views trade deficits and defense commitments as interconnected…

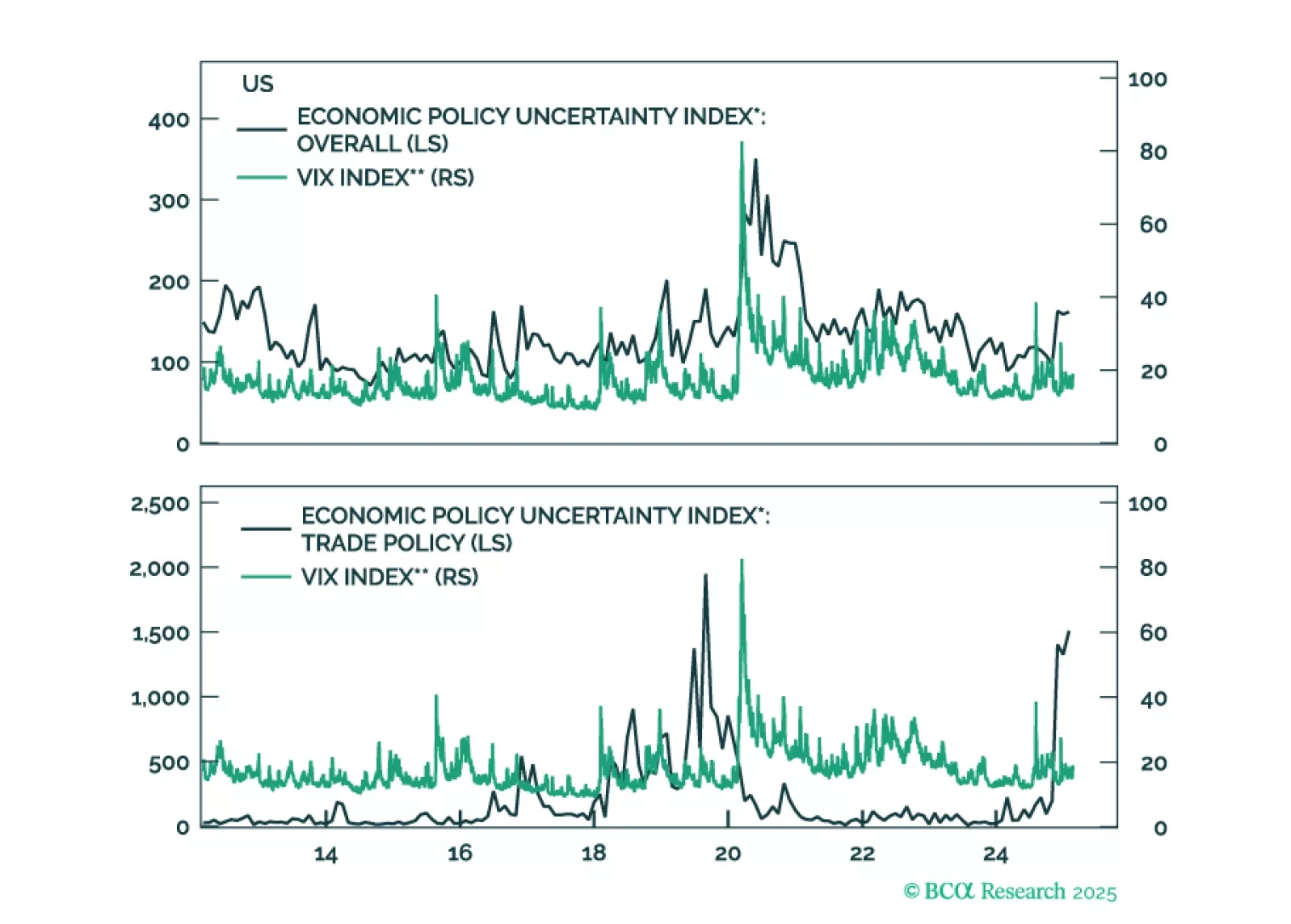

US growth has slowed in recent weeks. This can be seen in the weaker data on retail sales, consumer confidence, services PMIs, and a swath of housing releases (notably starts, existing home sales, homebuilder confidence, and stock…

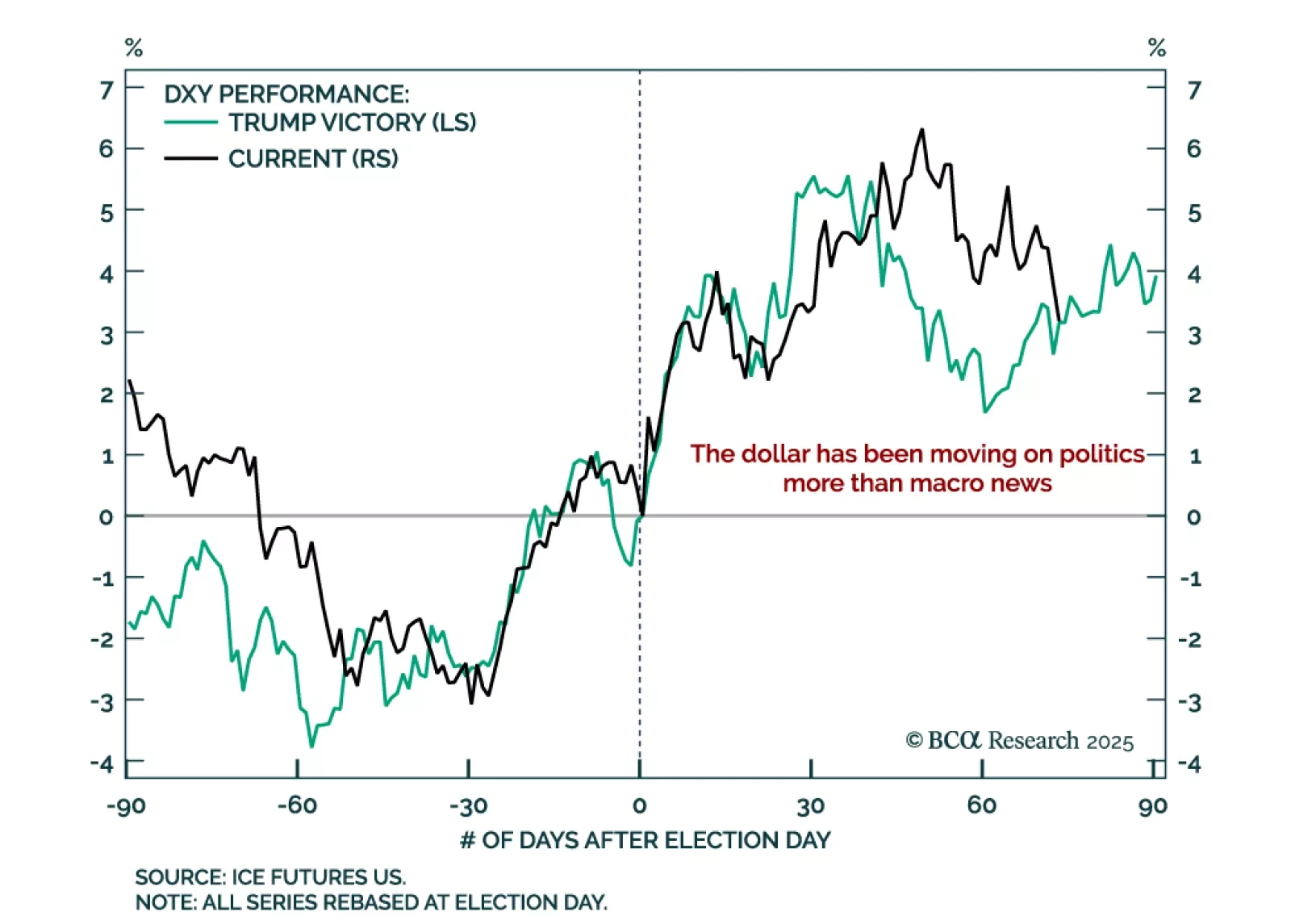

Our Foreign Exchange strategists reviewed the rationale to their short US dollar position as the DXY has been in a trading range with resistance near 110 and support around 100. The widening US budget deficit caps the dollar’s…