The central government has so far abstained from stimulating the property market due to already existing speculative excesses there. This is very different from the policy easing that took place in 2008-‘09, 2012 and 2015-…

Highlights Please note that country sections on Mexico and Colombia published below. The policy stimulus in China could produce a growth revival in the second half of 2019, but there are no signs of an imminent bottom in China’s…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…

Highlights So What? The Trump administration is focusing on re-election in 2020, which could push the recession call into 2021. Why? The midterms were investment-relevant, just not in the way most of our clients thought. We are…

As is tradition, during client visits in Europe last week, I had the pleasure of reconnecting with Ms. Mea, a long-term BCA client.1 It was our third encounter and, as always, Ms. Mea was eager to delve into our reasoning, challenge our…

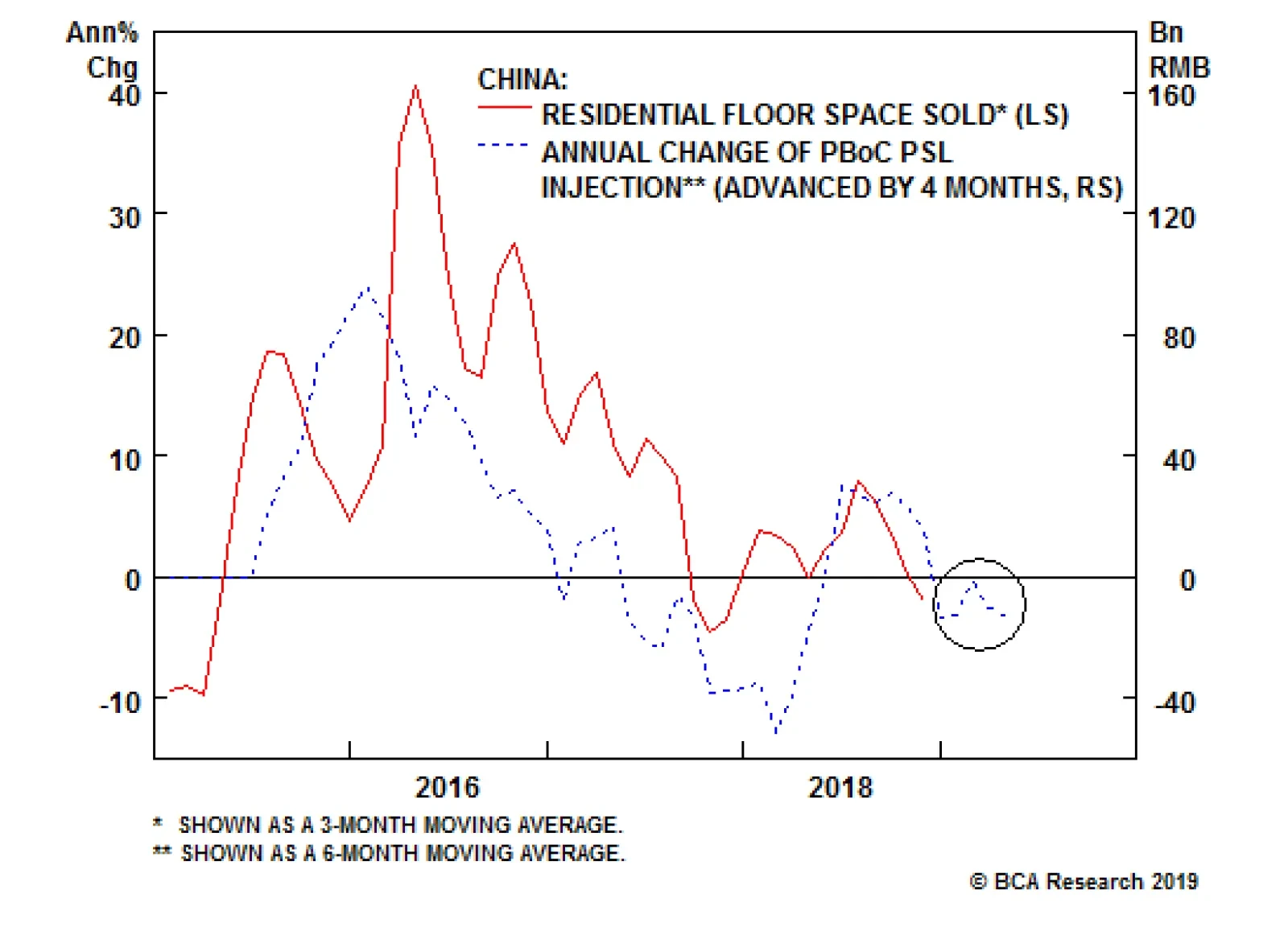

Highlights The correction in global equities is not yet over, but we would turn more constructive if stocks retreated about 6% from current levels. Among the many things bothering investors, the fate of the Chinese economy remains…