The central bank tweaked some of its lending facilities to further loosen financial conditions. It also “clarified” its forward guidance by promising to keep both short- and long-term interest rates extremely low…

Highlights We continue to recommend overweighting Mexican local fixed-income markets, the peso and sovereign credit relative to their respective EM benchmarks. A new trade: Sell Mexican CDS / buy Brazilian and South African CDS.…

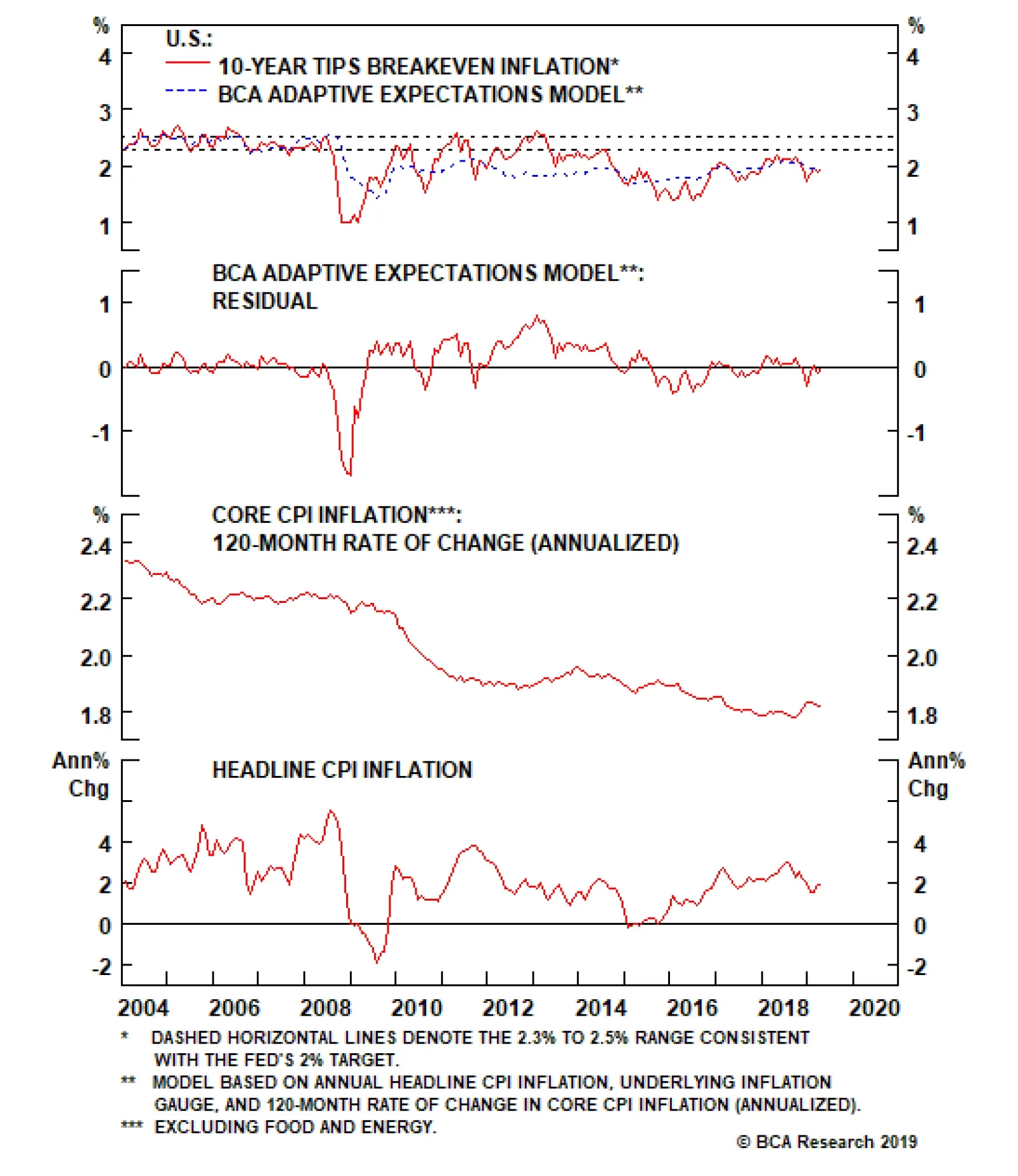

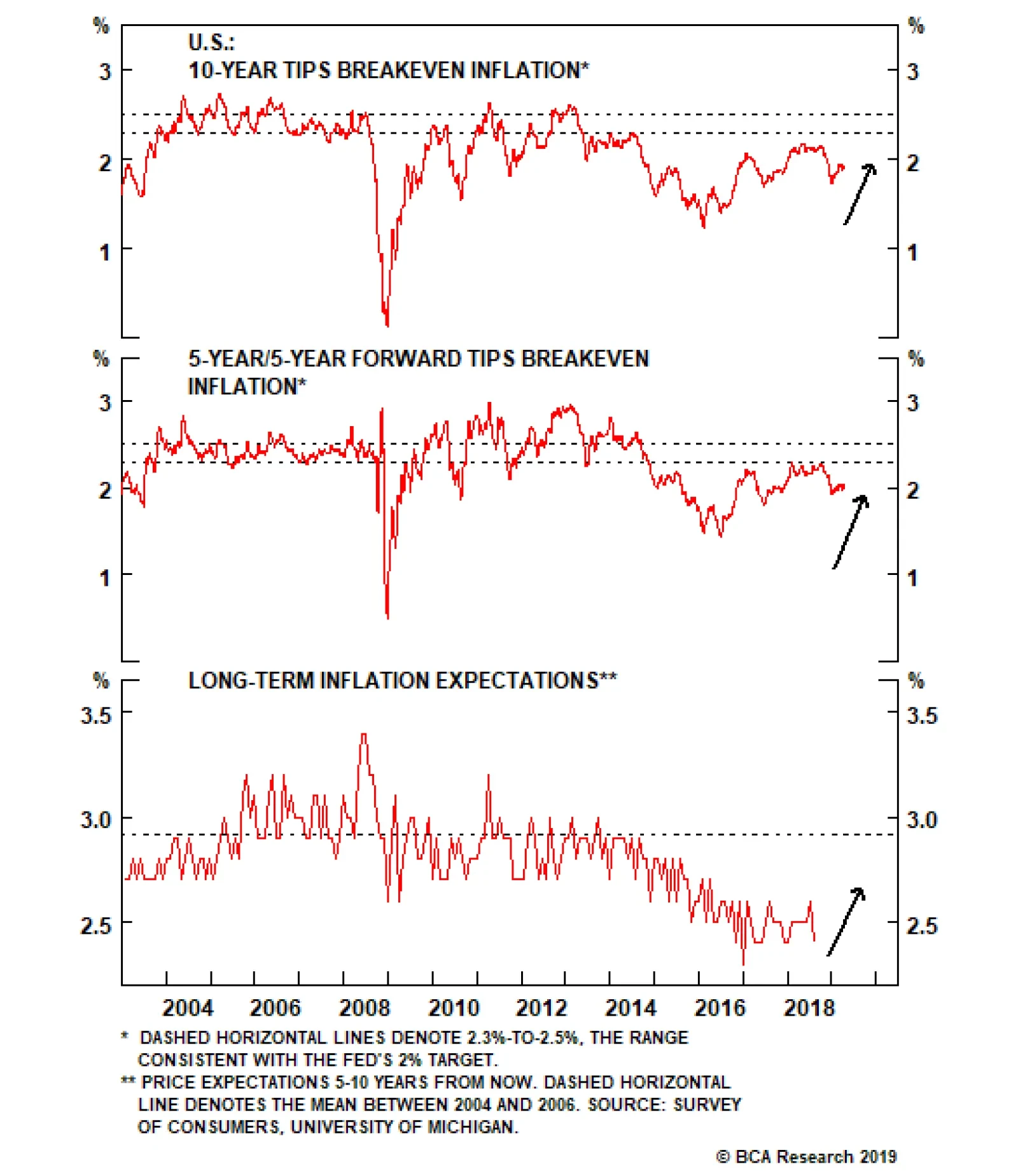

In the Fed’s thinking, it must ensure that policy is accommodative enough to re-anchor inflation expectations. Otherwise, a Japanese-style scenario of permanent deflation could unfold. From the minutes: “Several…

In fact, looking through the minutes our U.S. Bond Strategy team could only locate the following relevant passage: “A few participants observed that the appropriate path for policy, insofar as it implied lower interest…

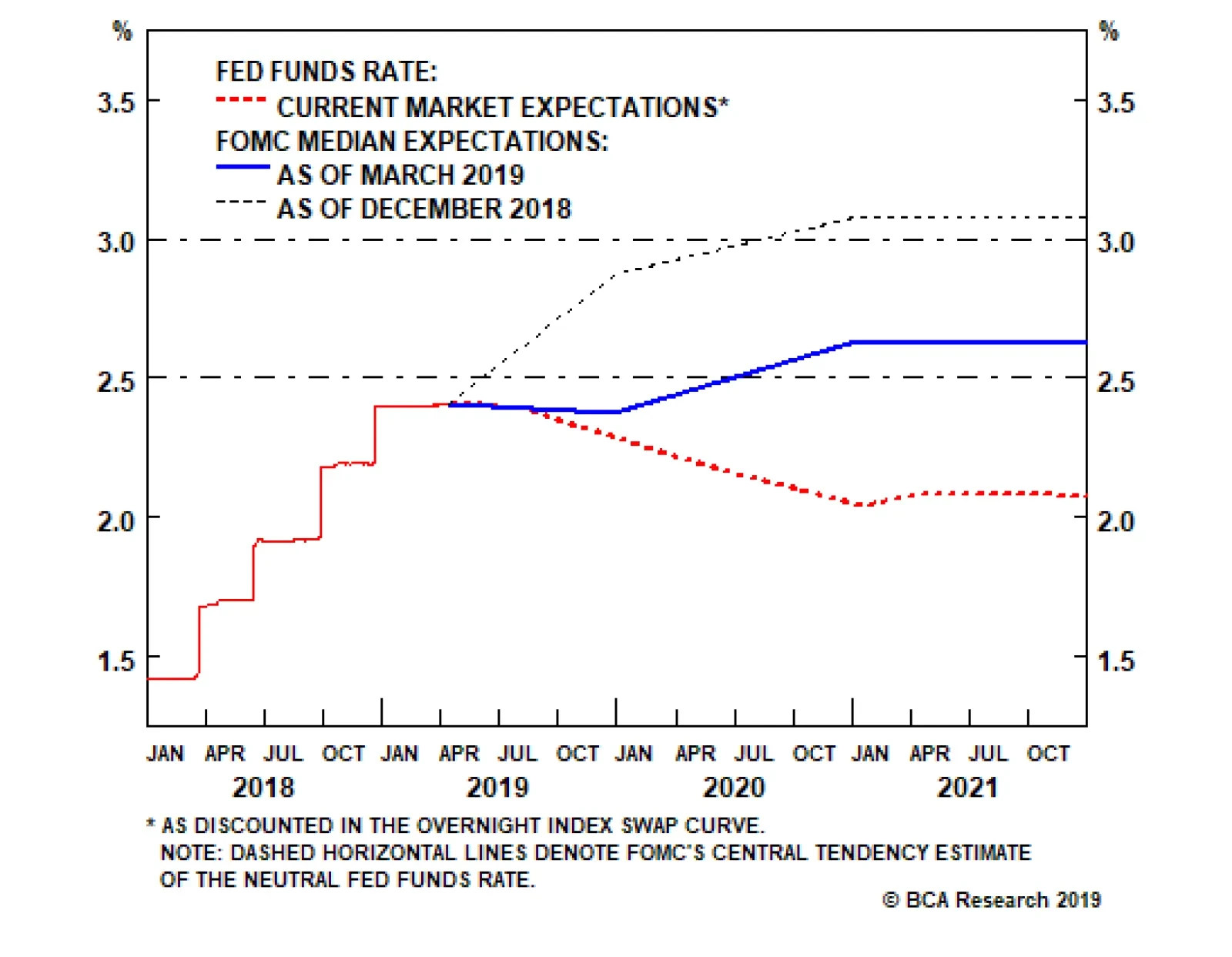

From a data perspective, it seems the Fed is mostly holding off to see how the outlook for the rest of the world evolves. The minutes of the March meeting, released last week, suggested that there may be more nuance to the Fed…

While most FOMC participants do not expect growth weaknesses to last beyond the first quarter of 2019, a majority do not anticipate interest rates to rise in 2019. The key to this seeming paradox lies in the participants’…

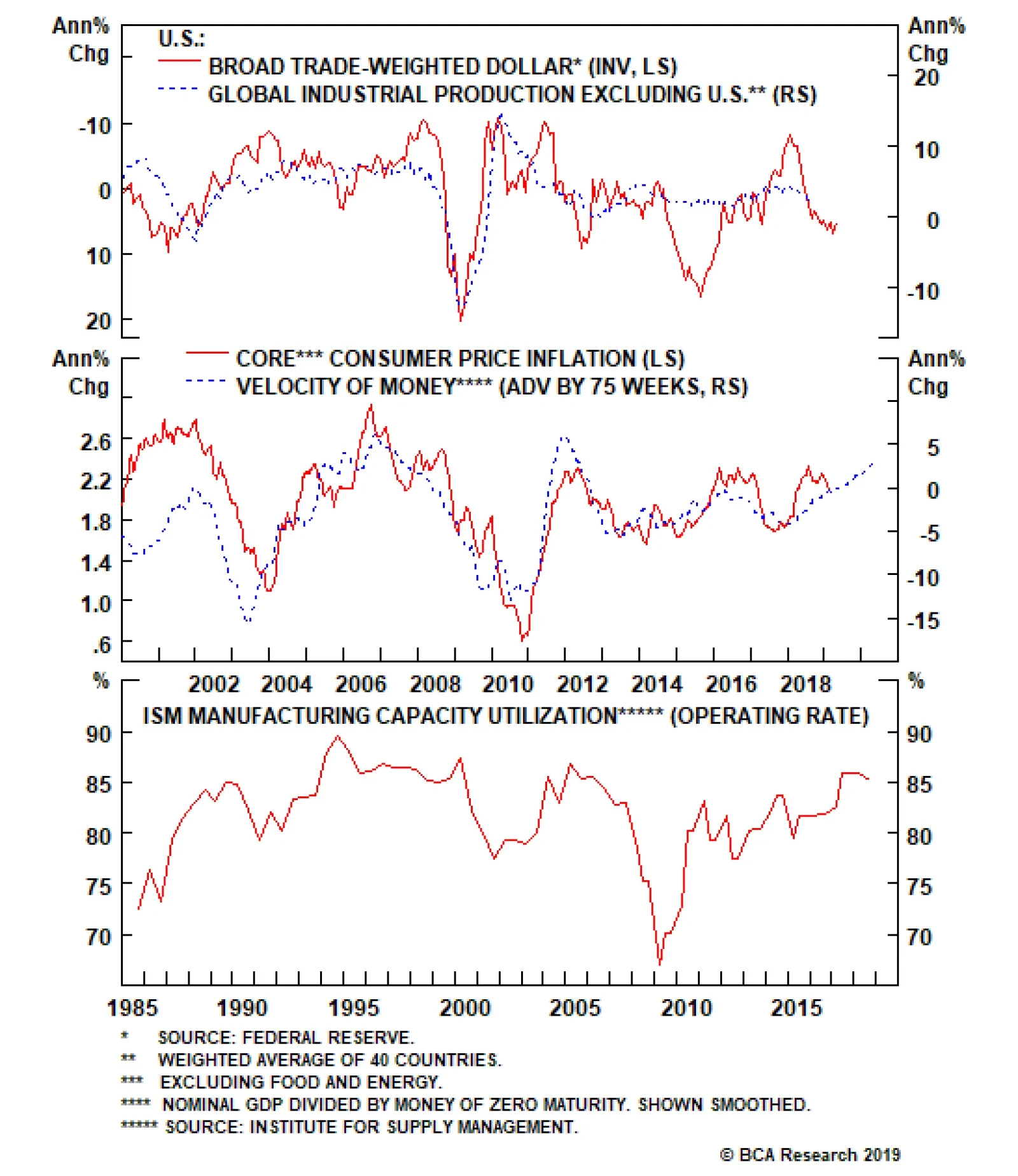

First, rebounding global growth is normally associated with a weakening dollar. This time will not be different, especially as U.S. equity valuations relative to global stocks suggest that investors are particularly pessimistic…

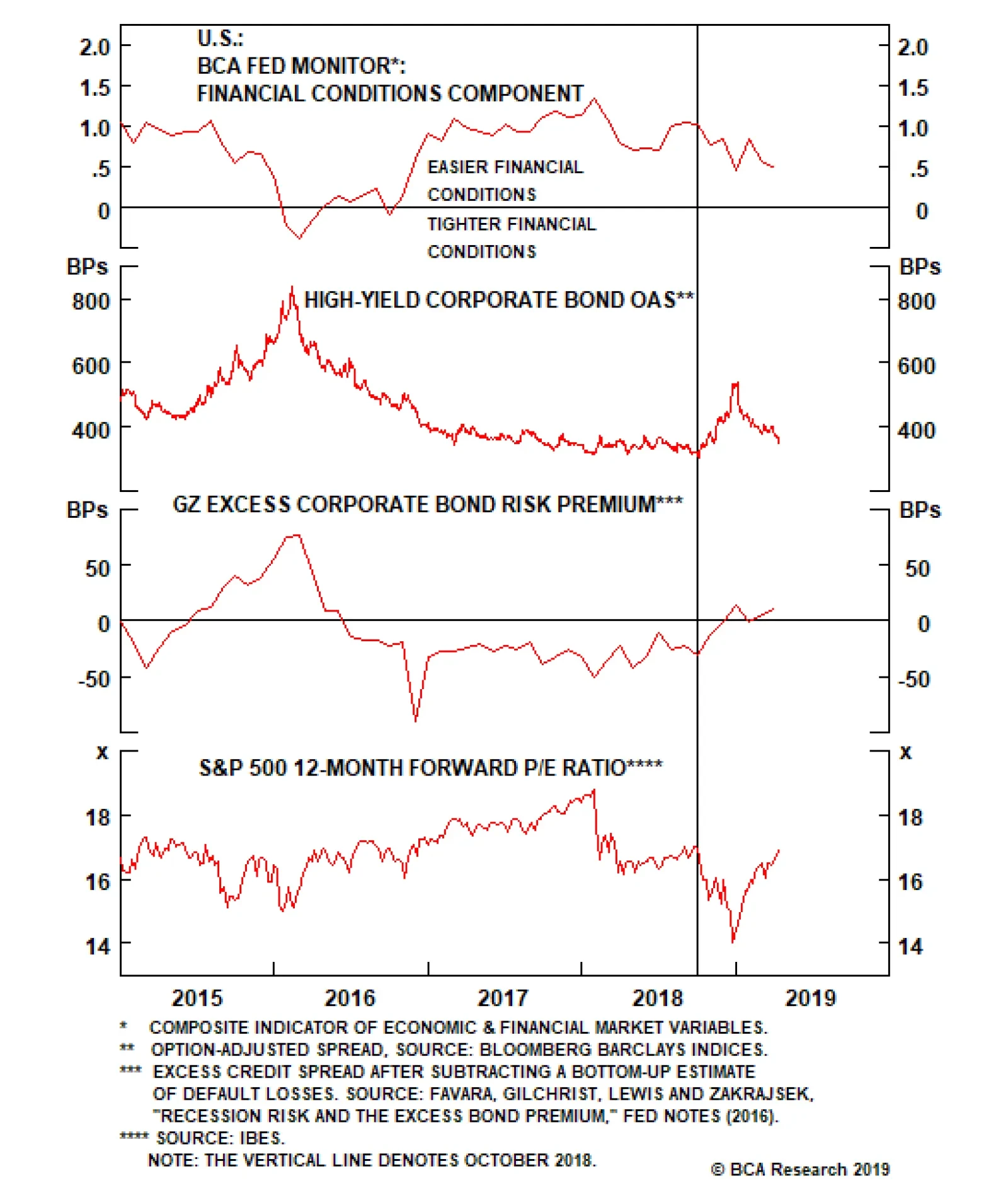

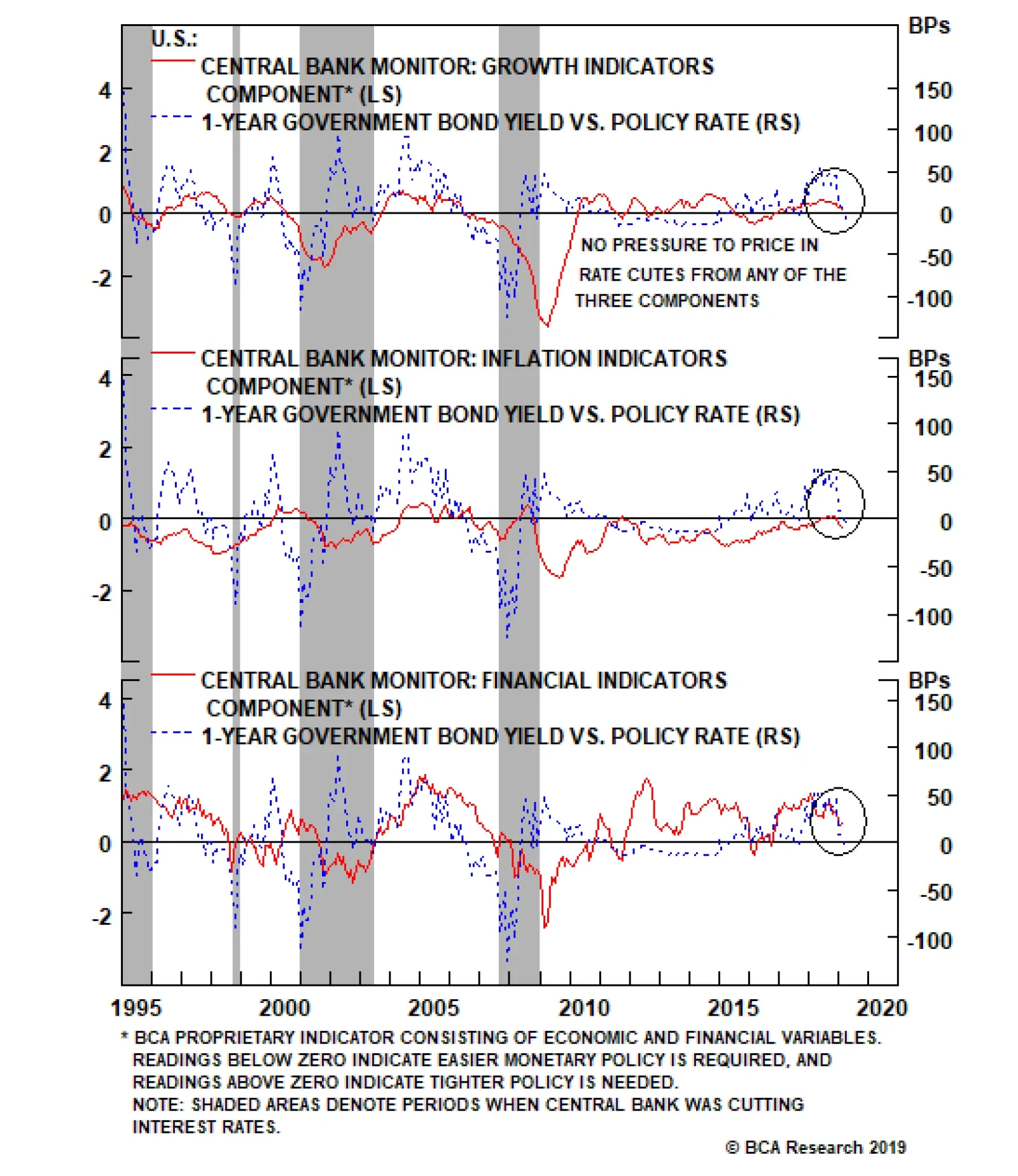

Our Global Fixed Income Strategy team’s Fed Monitor has drifted lower over the past several months and now sits just above the zero line. This indicates that there is no pressure to hike interest rates, which is consistent…

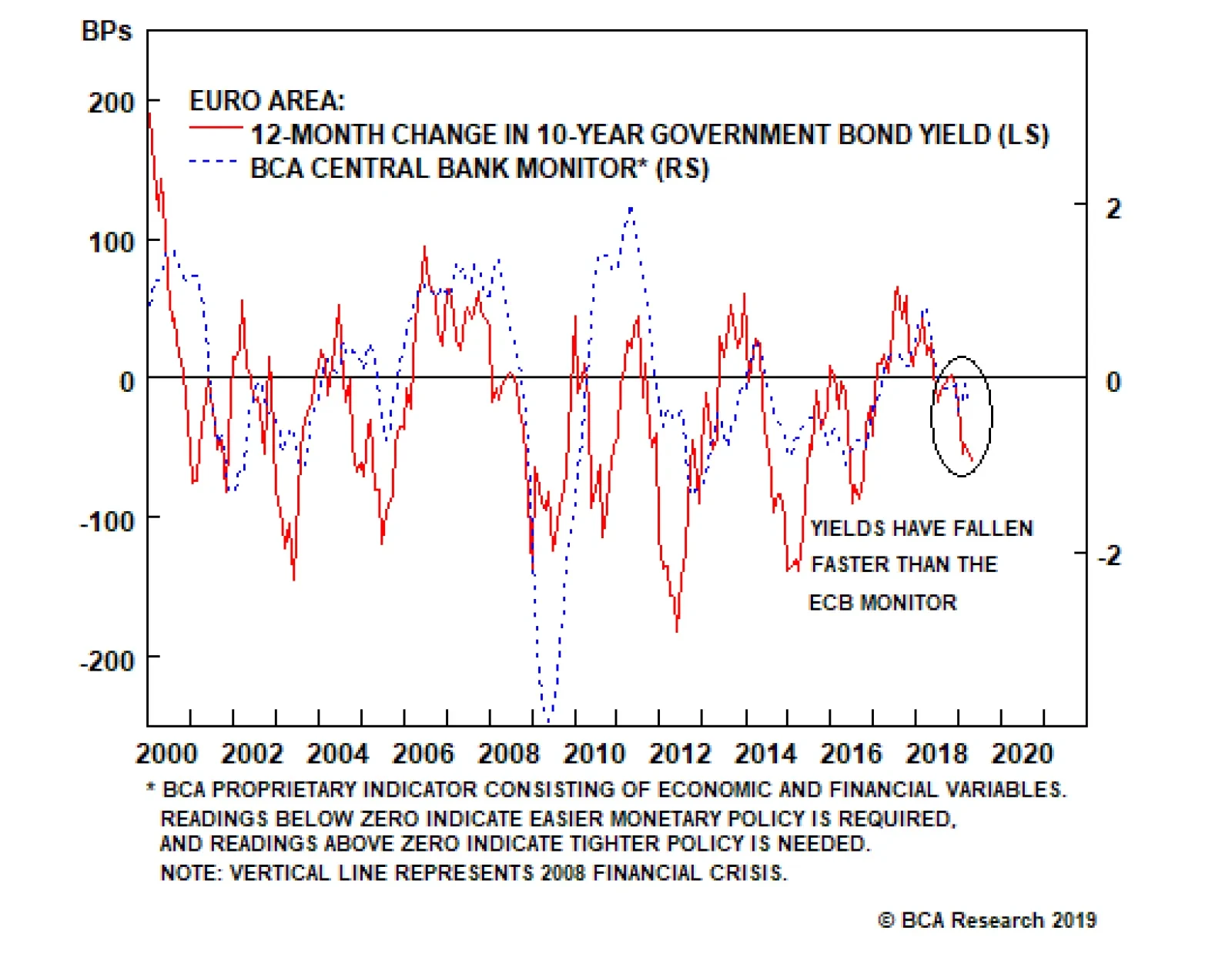

Our Global Fixed Income Strategy team’s European Central Bank (ECB) Monitor is slightly below the zero line, signaling no real need for any change to euro area monetary policy. The sharp slowing of economic growth last year…