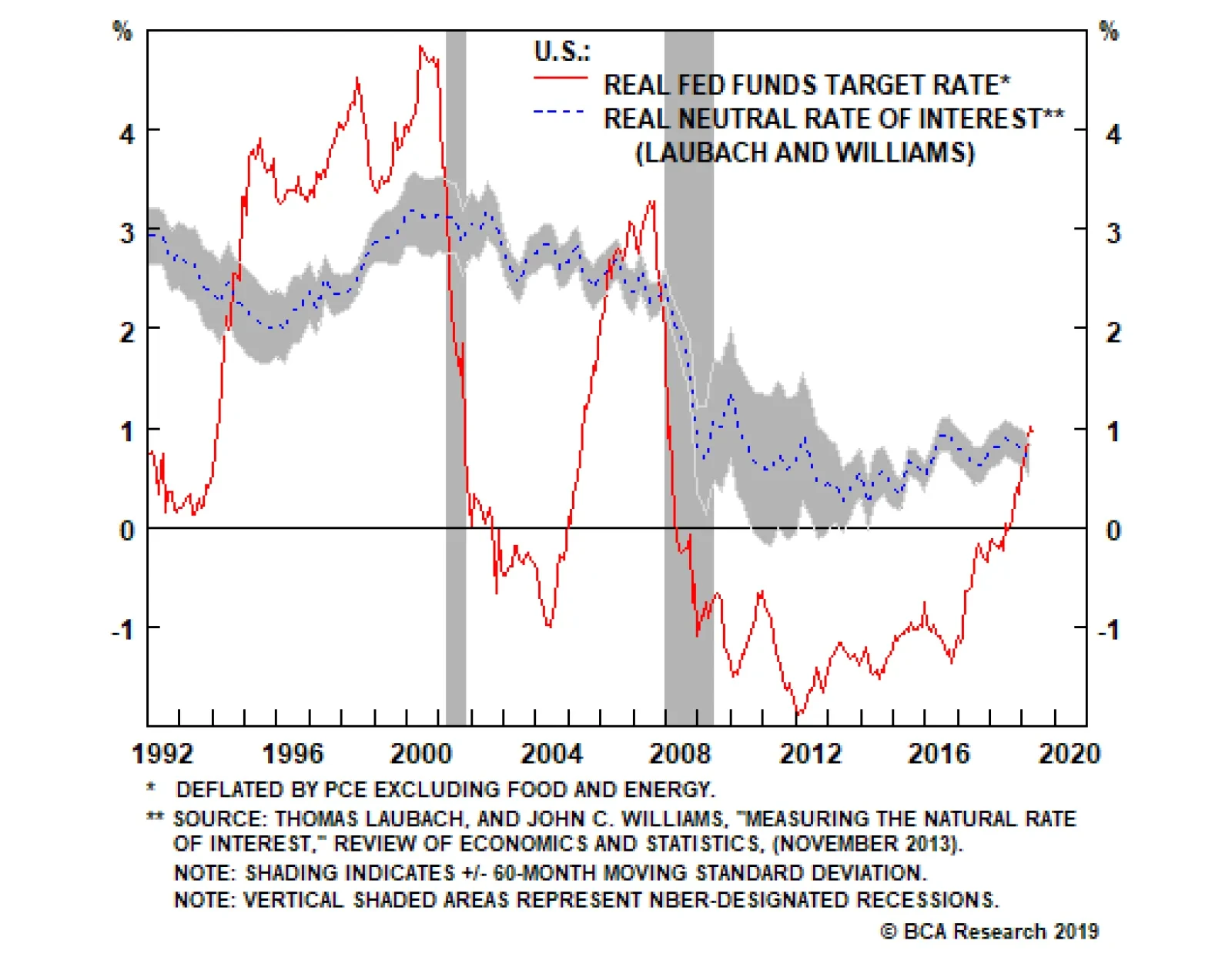

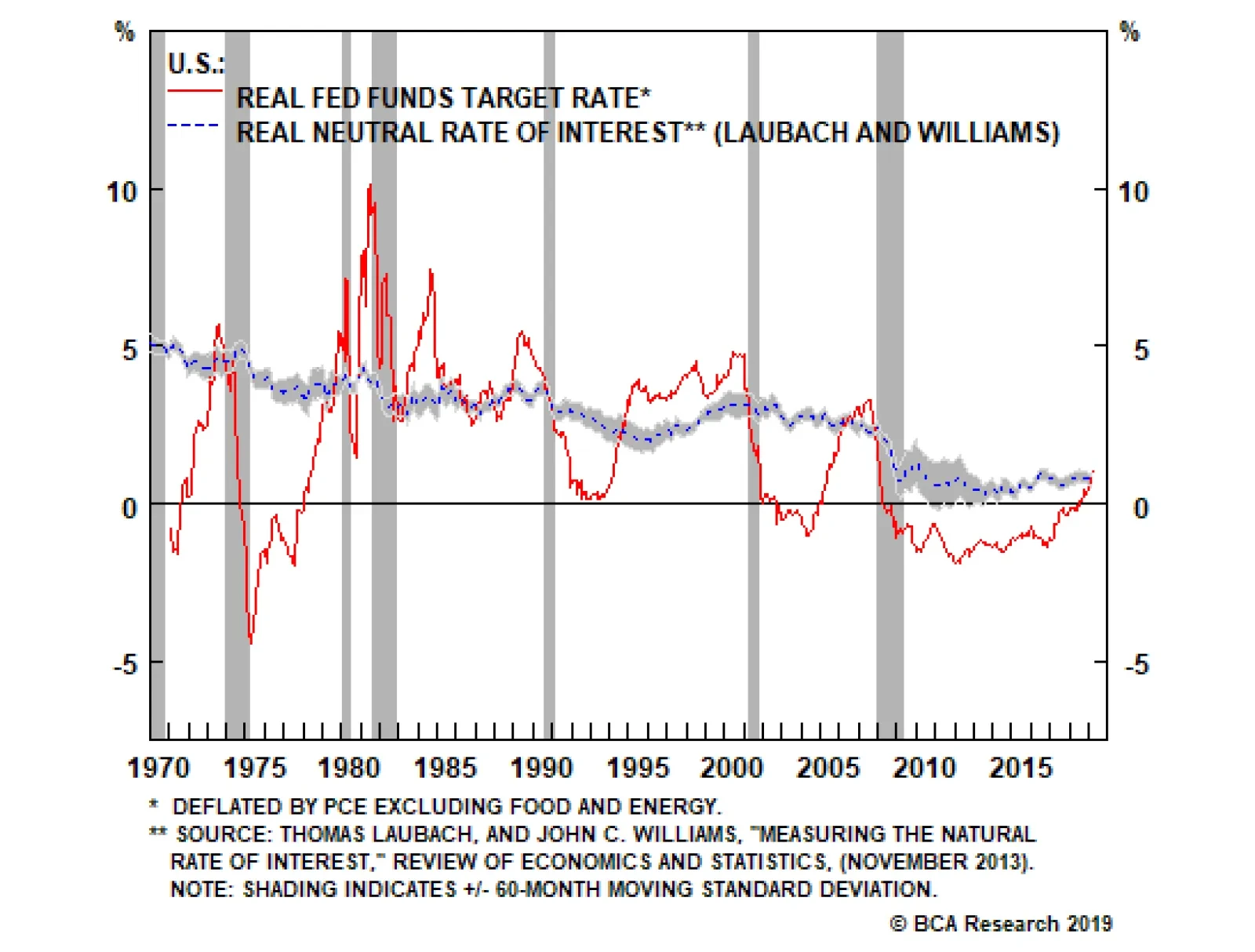

Our U.S. Investment Strategy team took the Fed’s focus to mean that it was wary of entering the next recession with one arm tied behind its back, given our personal view that it is reluctant to embark on subsequent rounds…

The U.S. economy remains near full employment. Investors therefore concluded that the “insurance cut” telegraphed by the Fed ahead of next month’s FOMC meeting stands a very good chance of finally goosing…

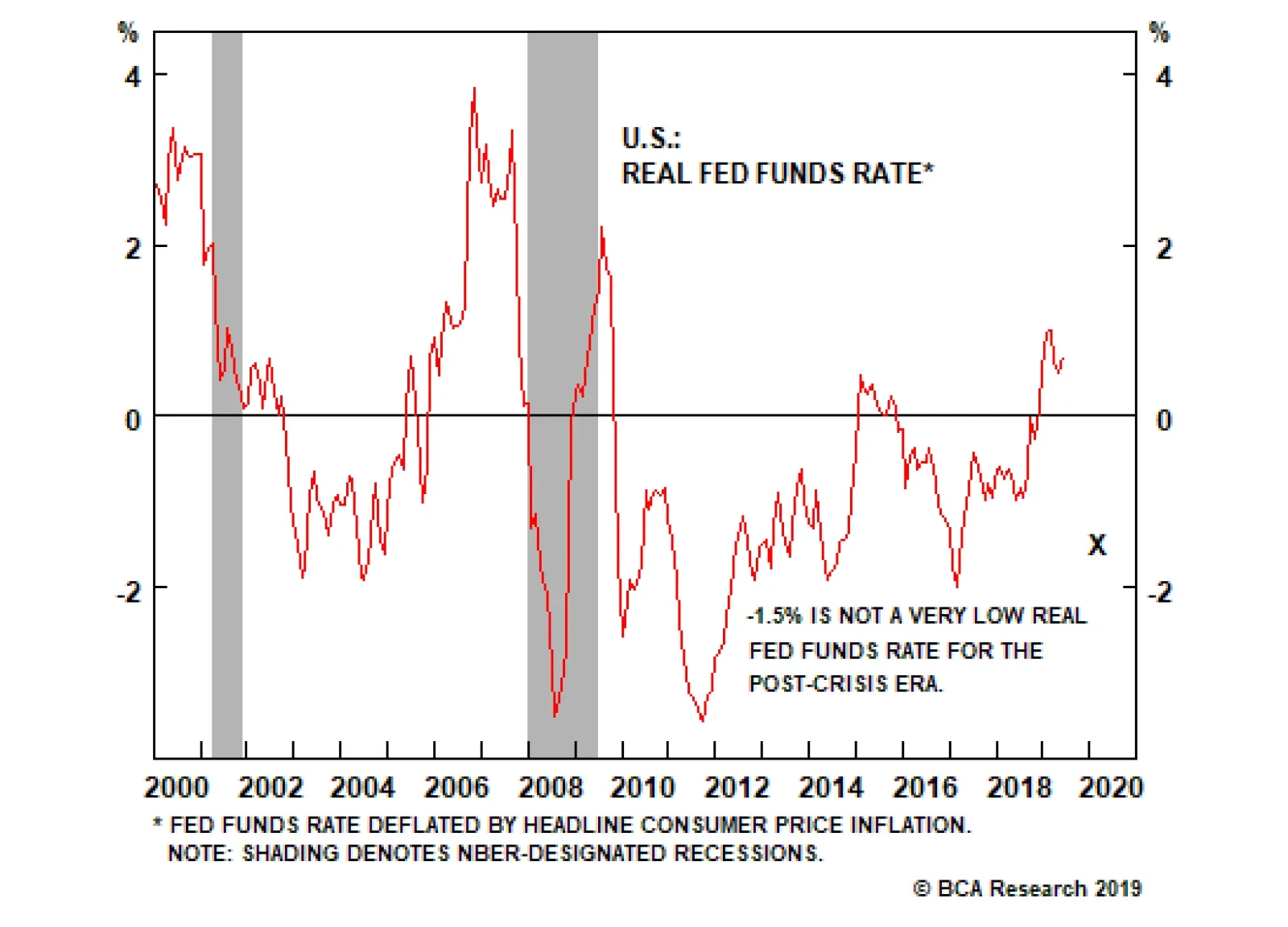

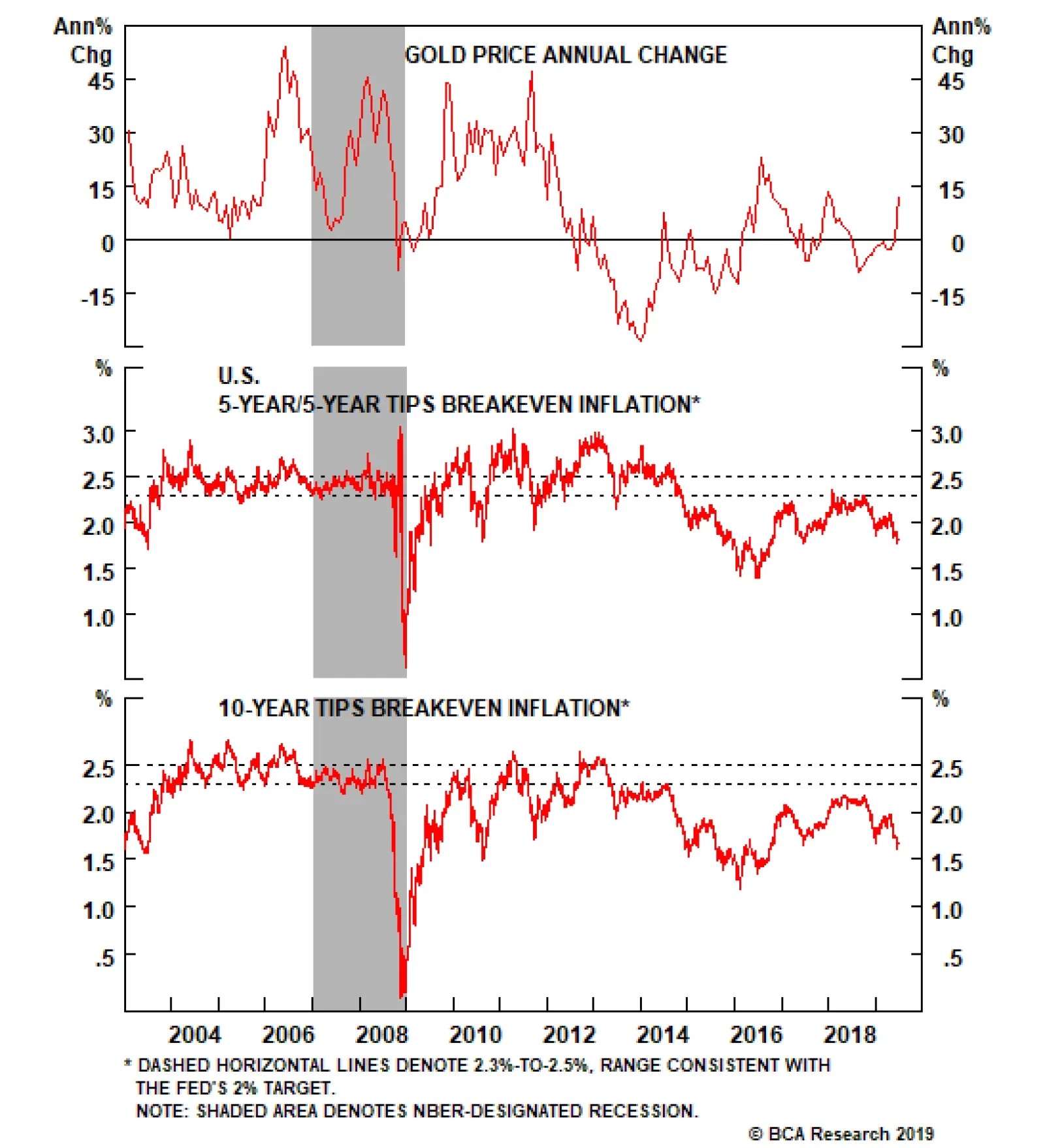

The zero bound constraint remains a formidable threat. It does make sense to try to raise inflation expectations in order to allow real rates to fall deeper into negative territory in the event that a recession occurs. The sharp…

Analysis on Thailand is available below. Feature Last week we were on the road meeting with some of our U.S. clients. This week’s report presents some of the key topics of our discussions in a Q&A format. Question: You have…

Right now, the Fed has the luxury of time on its side. Even though some measures of core inflation such as the trimmed mean calculation have reached the Fed’s 2% target, this follows a prolonged period of below-target…

Highlights A resurfacing of trade tensions could weigh on risk sentiment in the near term. A somewhat less dovish tone from the FOMC this month could further rattle risk assets. While we would not exclude the possibility of an…

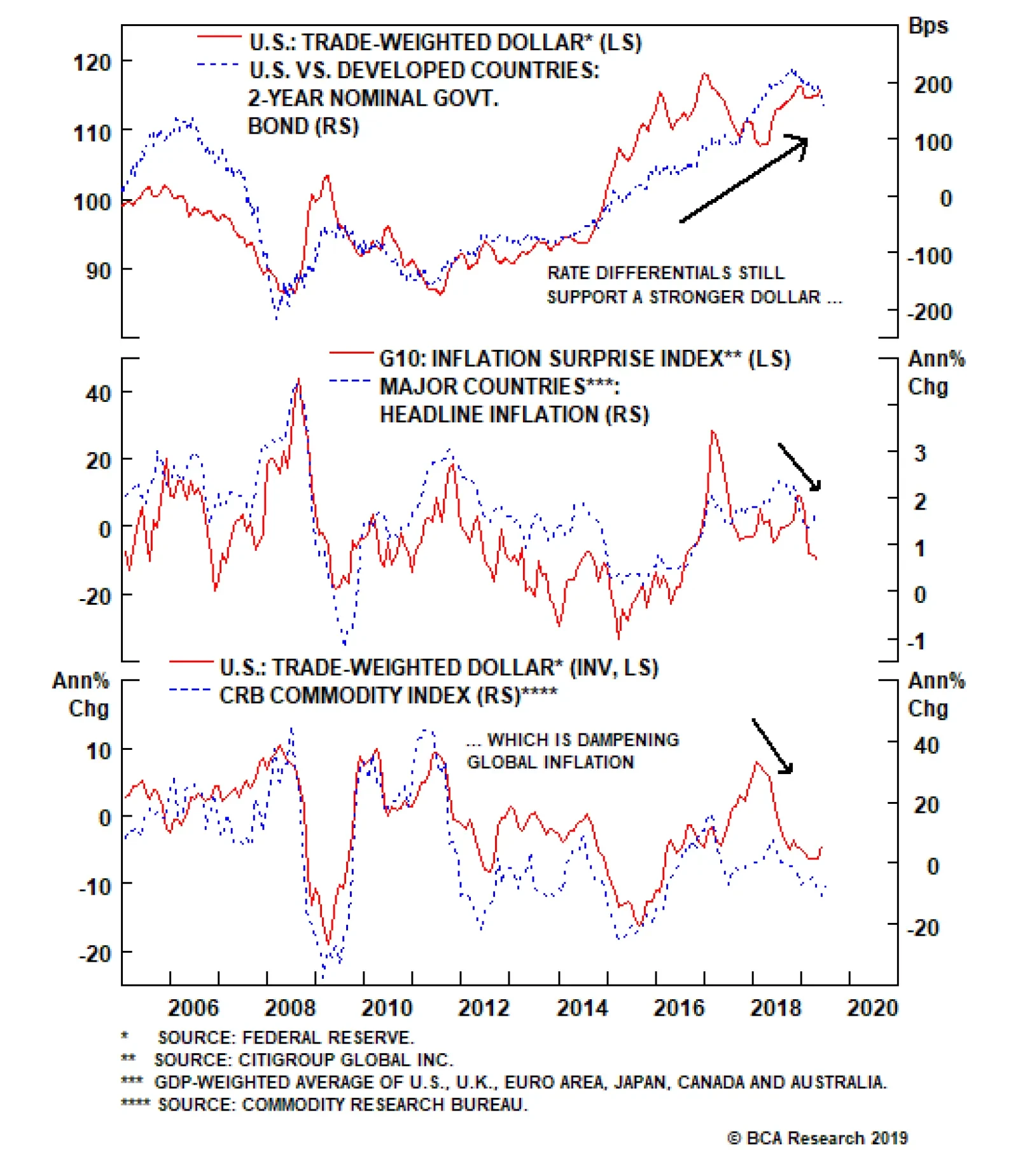

The coordinated nature of the global bond rally has left the Fed facing a combination of rapidly falling Treasury yields alongside a strong U.S. dollar. With interest rate differentials continuing to favor the greenback, the…

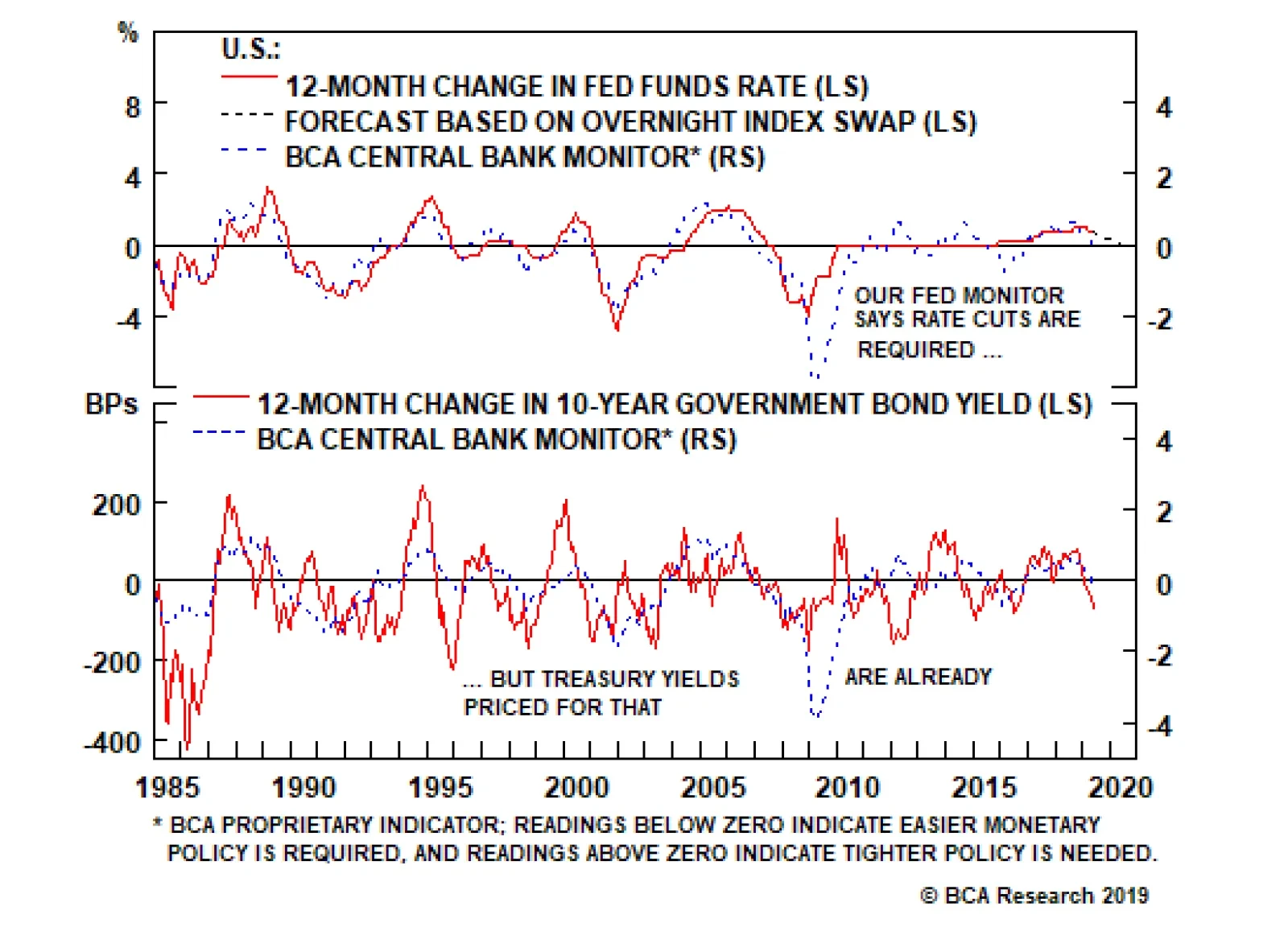

Our Fed Monitor is now signaling the need for easier U.S. monetary policy, but that is already discounted in the 75bps of rate cuts (over the next twelve months) priced at the front-end of the yield curve, and reflected by the…

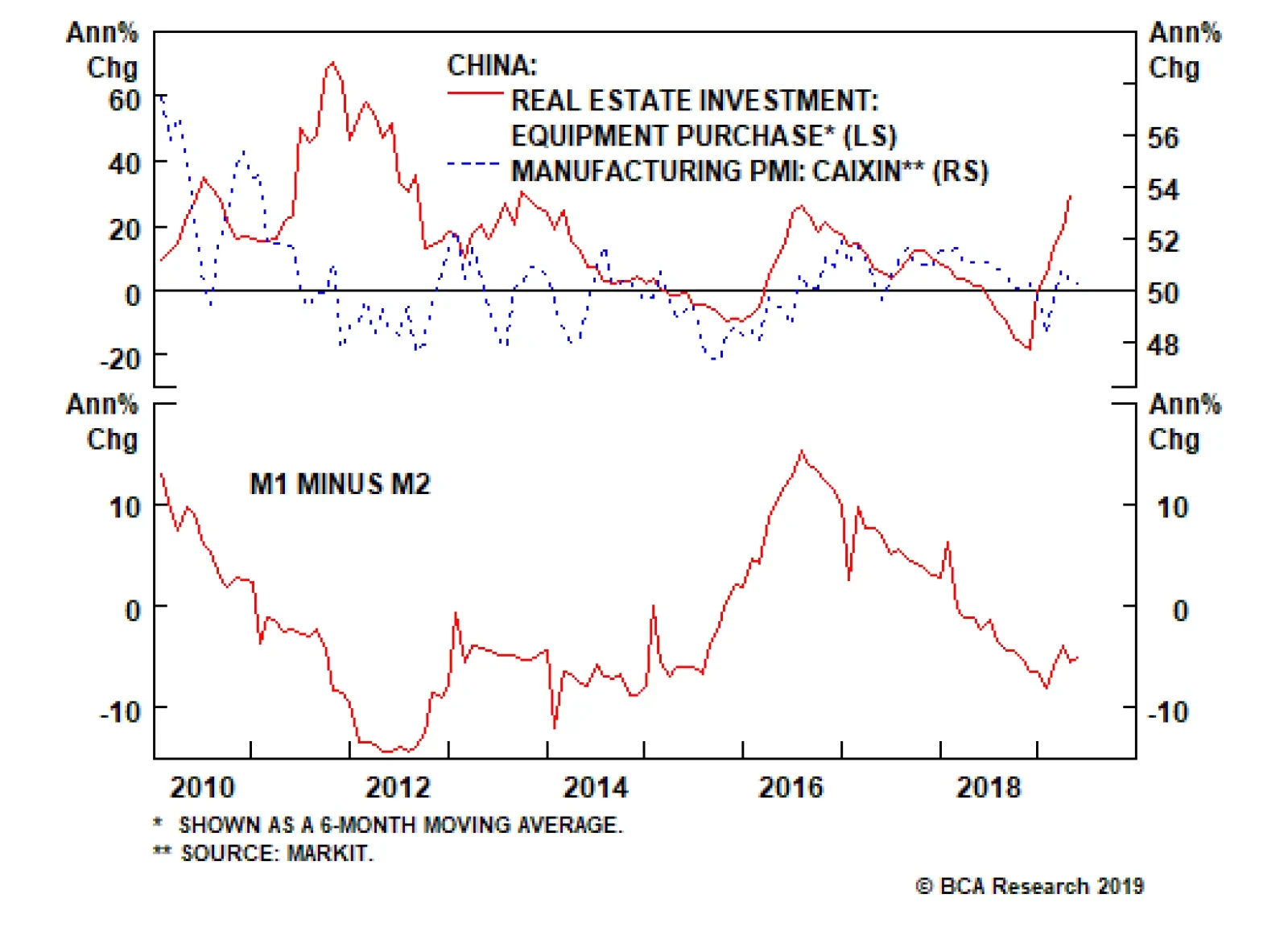

Chinese total social financing numbers for May increased to CNY1400 billion from CNY1360 billion. New loans rose to CNY1180 from CNY 1020 billion. M2 money supply was stable at 8.5% abut M1 increased to 3.4% from 2.9%. While…

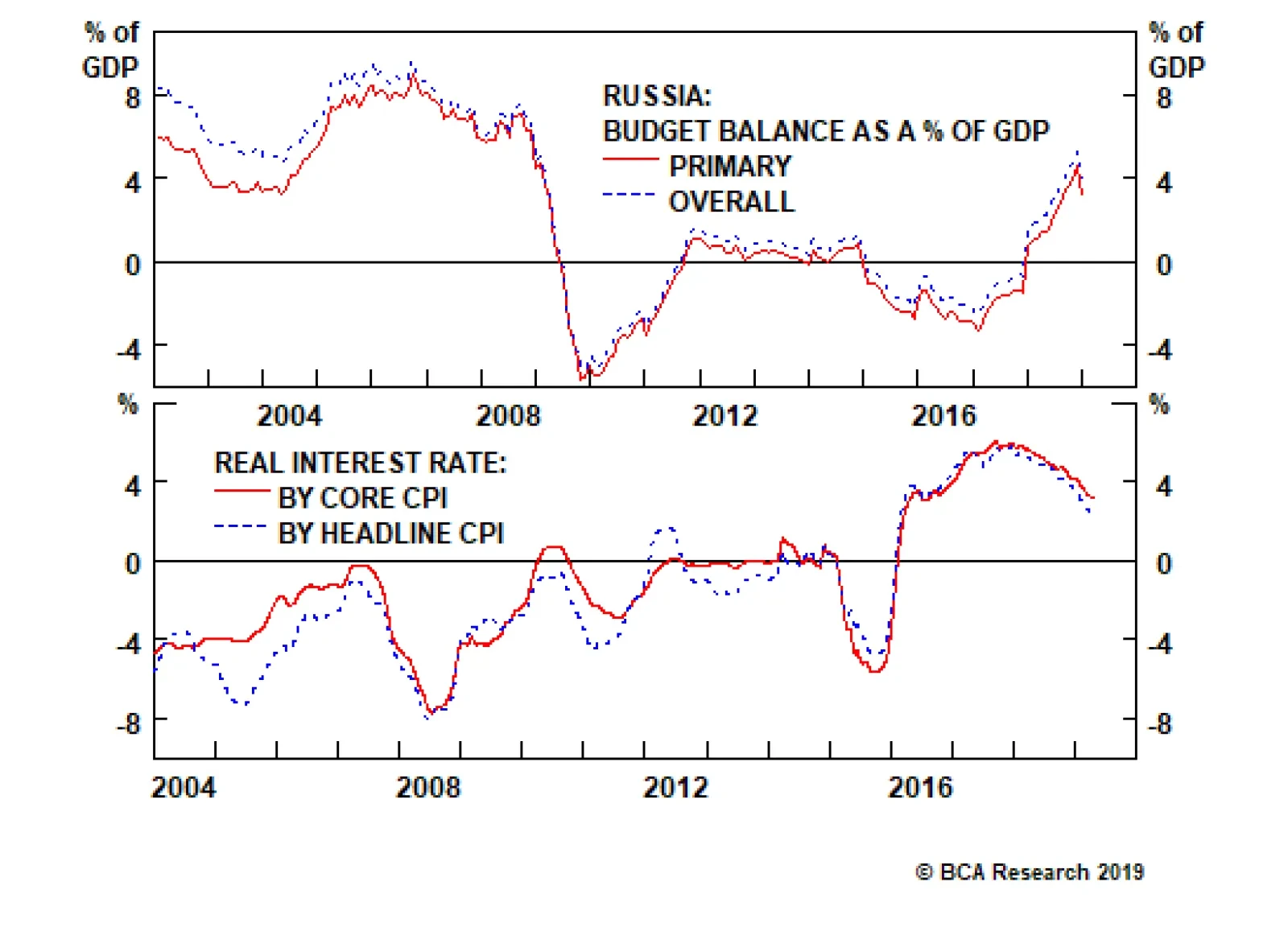

A combination of ultra-conservative fiscal and monetary policies over the past four years will help Russian equities, local bonds as well as sovereign and corporate credit to continue outperforming their respective EM benchmarks…