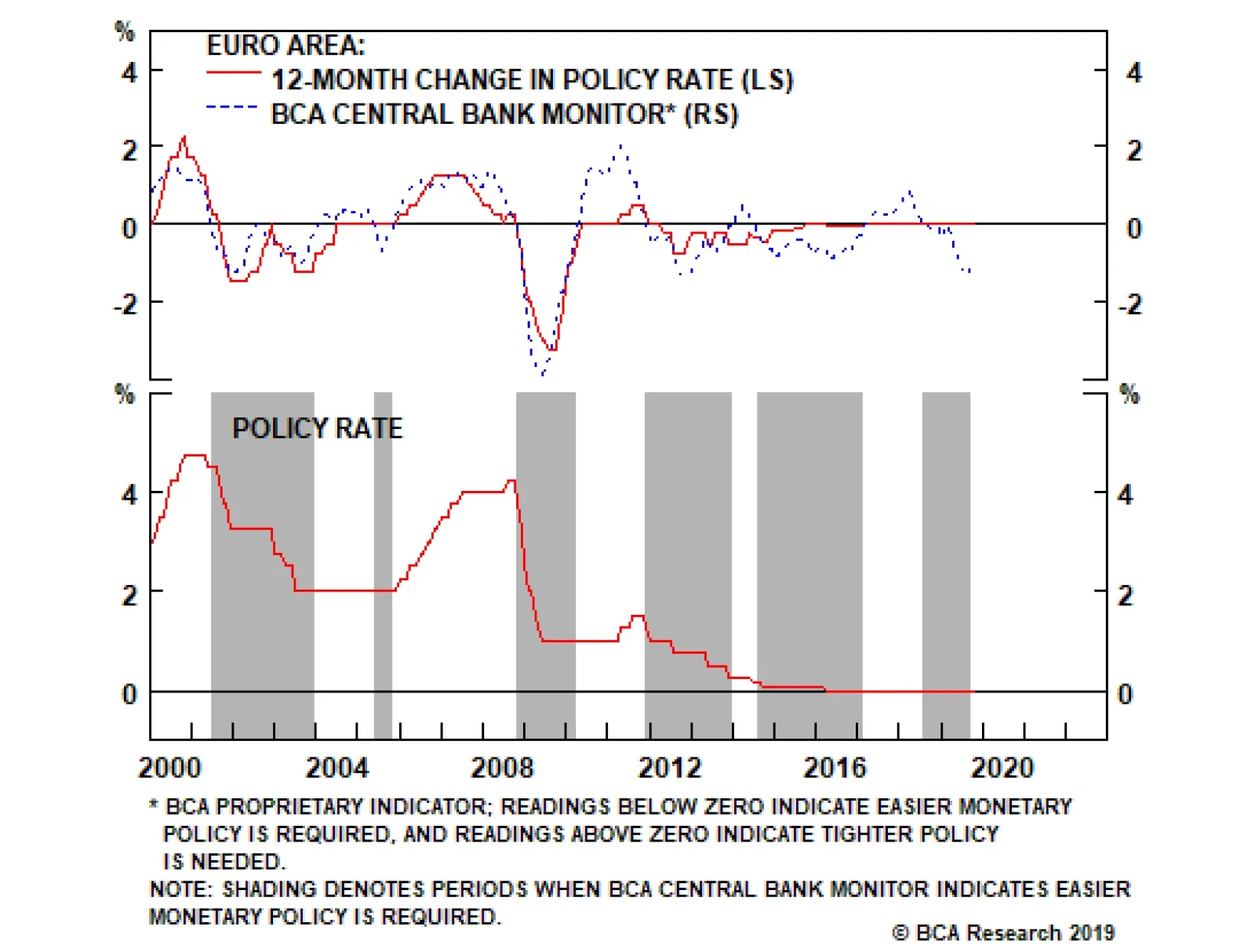

Our European Central Bank (ECB) Monitor is now well below the zero line, signaling a strong need for easier monetary policy. The global manufacturing downturn has hit the export-dependent economies of the euro area hard, with…

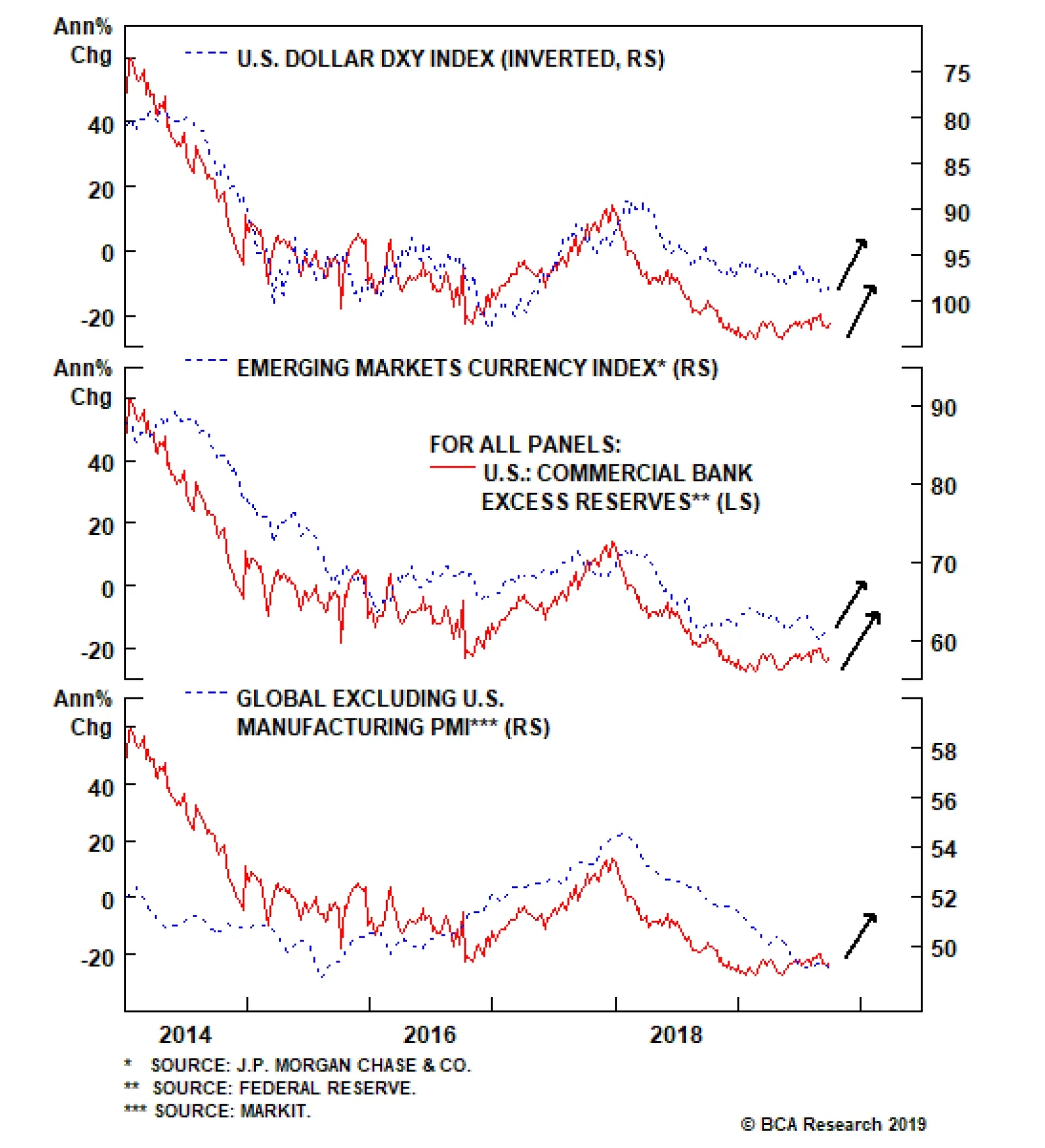

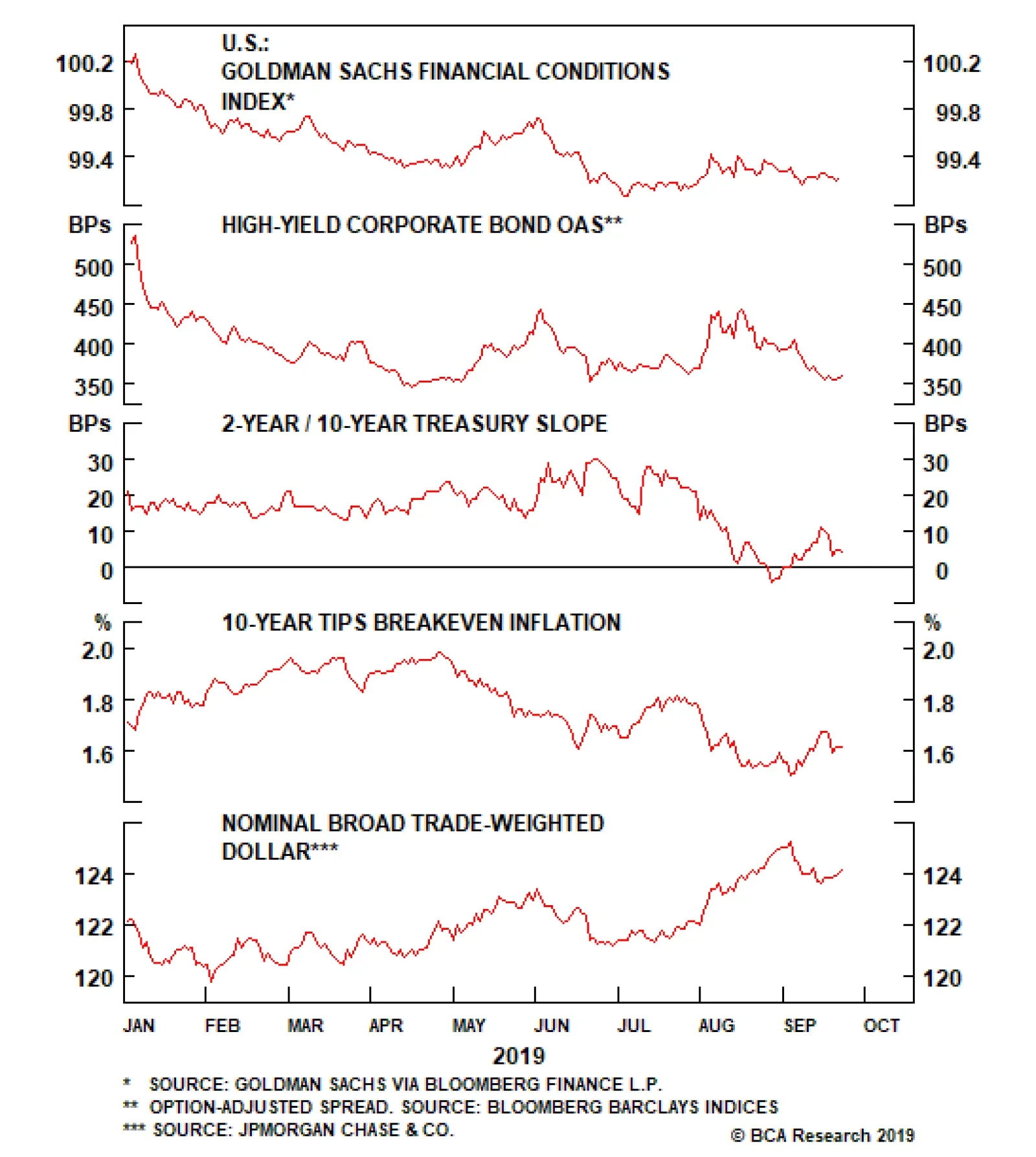

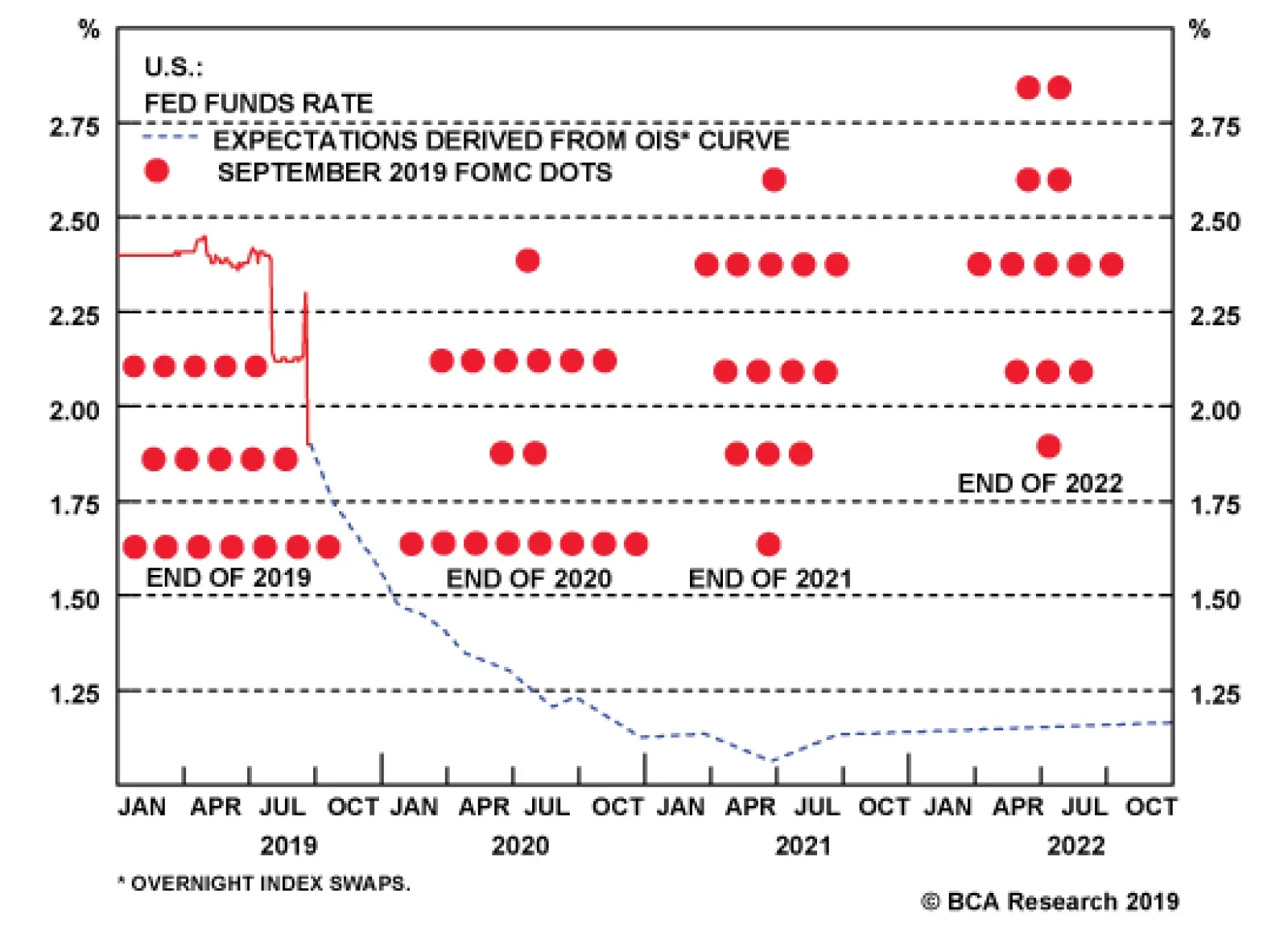

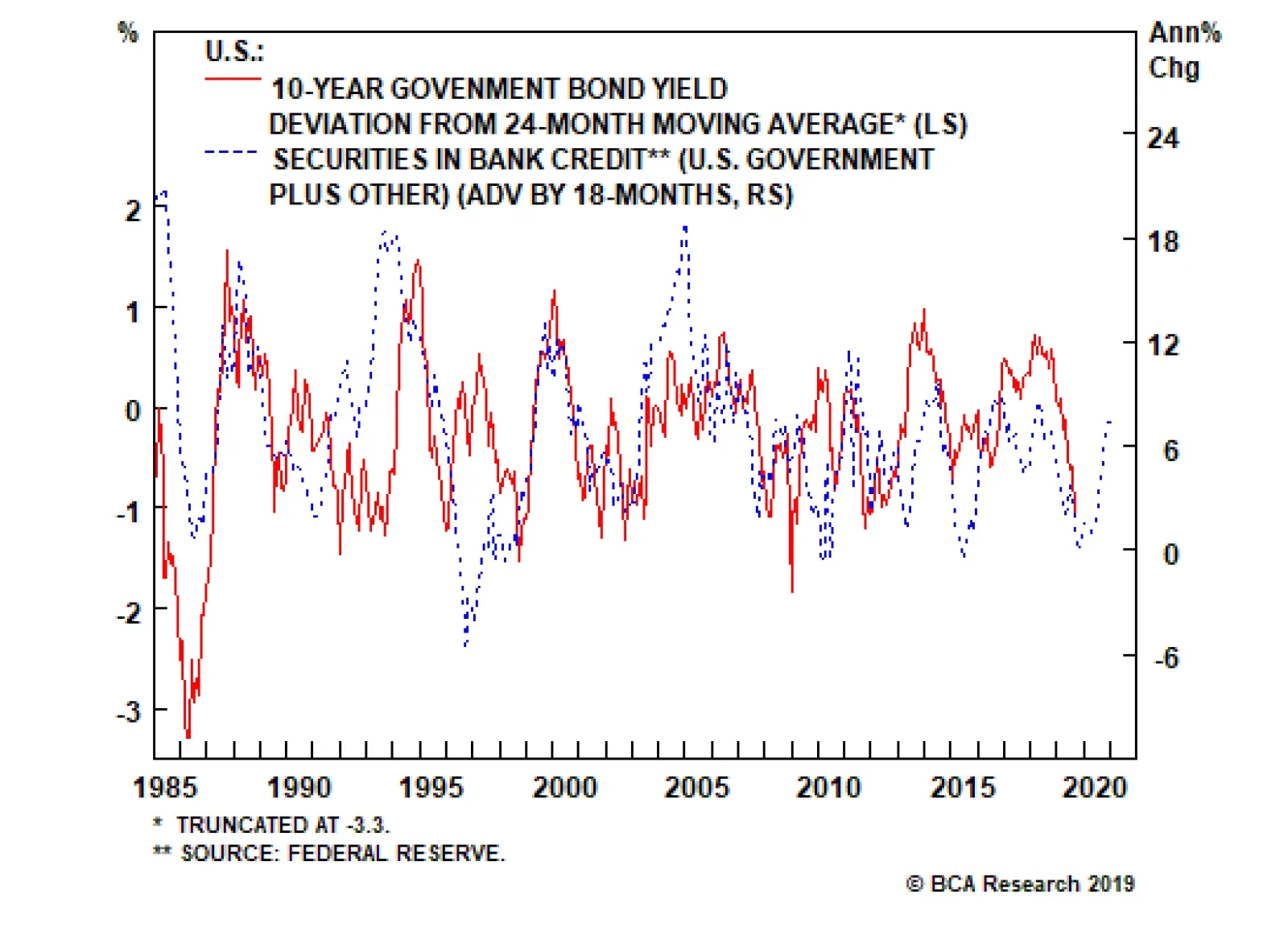

U.S. monetary conditions will continue to support asset prices and worldwide economic activity for the coming 18 months or so. The Fed will ease policy further and is a long way from tightening. We are still on track for three…

Fed Chairman Jerome Powell had his work cut out for him at last week’s FOMC press conference. First, he had to craft a coherent message about the Fed’s reaction function following a meeting where three voting members…

The market is priced for roughly one more 25 bps rate cut before the end of the year. More specifically, the fed funds futures market is split 50/50 on whether that rate cut occurs at the October or December FOMC meeting. The…

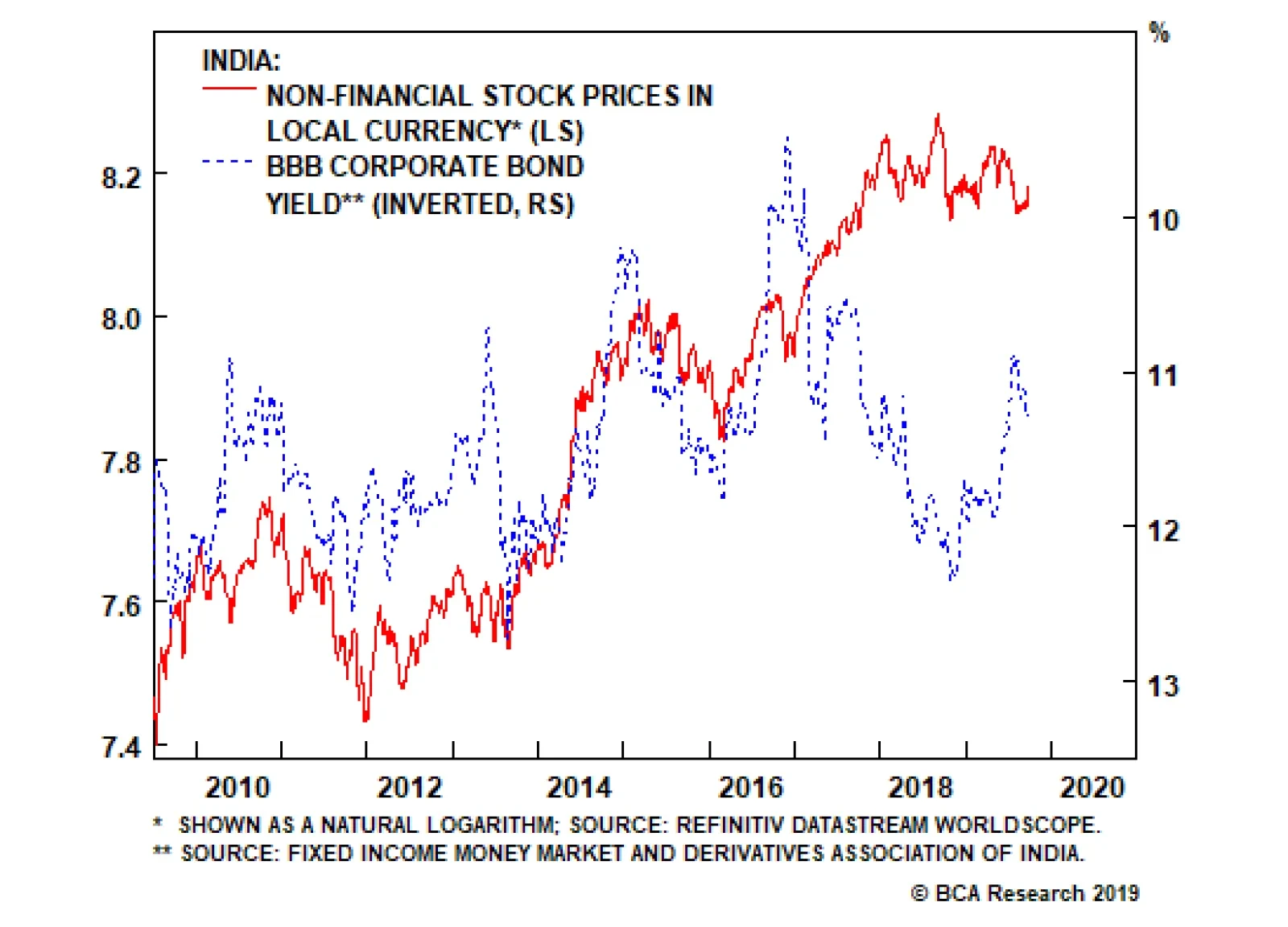

The Indian government resorted to an unexpected large corporate income tax cut last week. The government reduced the effective corporate tax rate from 35% to around 25%. If domestic bond yields rise materially in response to…

Highlights We are upgrading Indian stocks from underweight to neutral within an EM equity portfolio. Nevertheless, the outlook for the absolute performance of Indian share prices remains downbeat. Odds are that local bond yields will…

Dear Client, Owing to BCA’s 40th Annual Investment Conference at the Grand Hyatt in New York City next week, there will be no report on Wednesday, September 25. We will return to our regular publication schedule on Wednesday,…

Juxtaposed with news that China is once again buying U.S. soybeans, rumors that the U.S. could be willing to mollify its position are causing overbought and expensive bonds to rebound. However, we have been here before. Good news…