The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

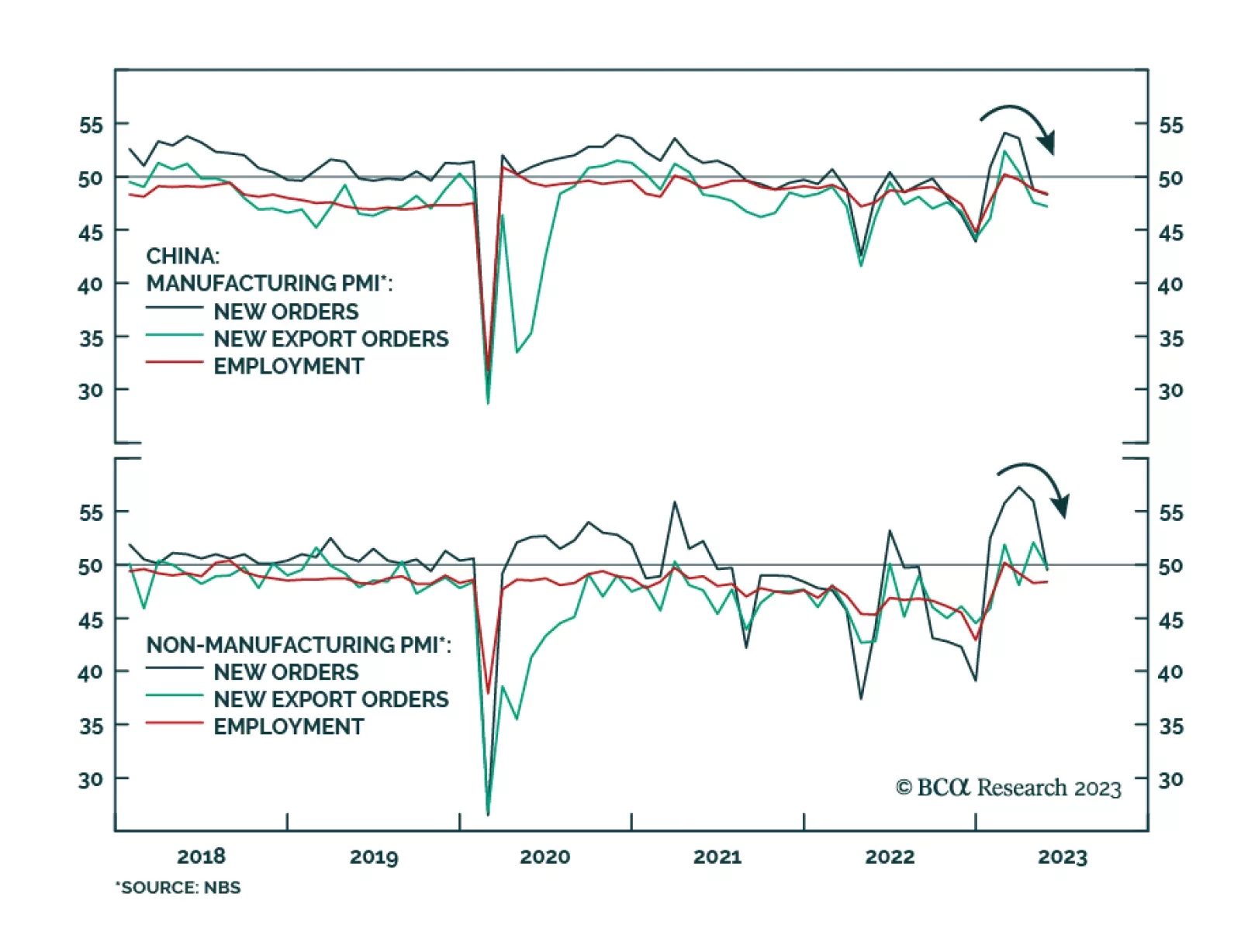

Chinese economic data releases continue to disappoint. Wednesday’s NBS PMI release showed the composite PMI dropped from 54.4 to 52.9 in May – the lowest since January. Importantly, the Manufacturing PMI unexpectedly…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

In Section I, we discuss why the rally in stock prices over the past month reflects the soft-landing view, and why that is not a likely economic outcome. US inflation is slowing, but target inflation remains elusive. Meanwhile,…

We are increasing our gold price target to $2,200/oz, given the increasing risk of fiscal dominance in the US, rising geopolitical risk, the return of trading blocs and currency debasement risk. These risks also will increase…