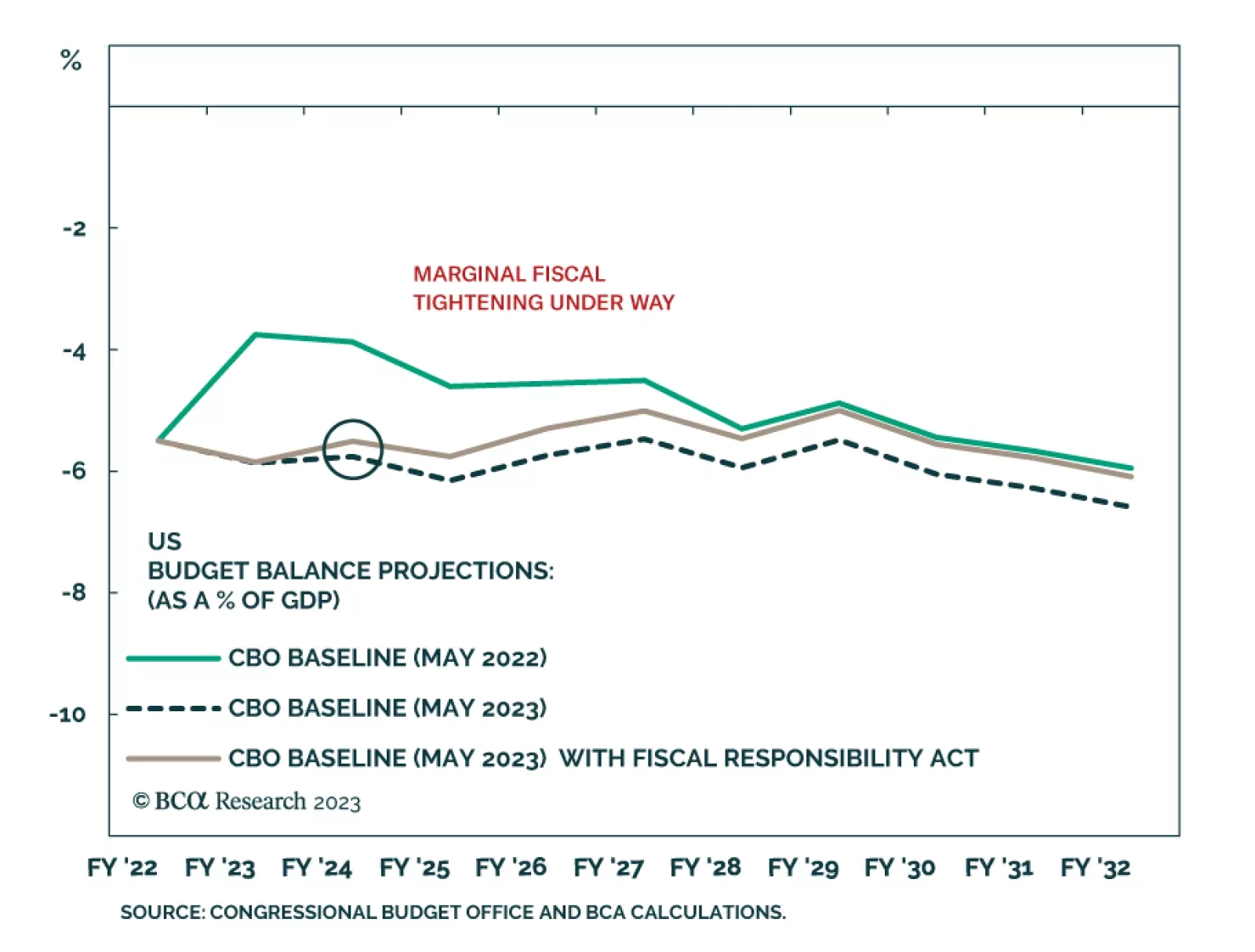

According to BCA Research’s US Political Strategy service, US fiscal policy is marginally negative for the economy and marginally increases the odds of recession in 2023-24. It is not a positive catalyst for equities in the…

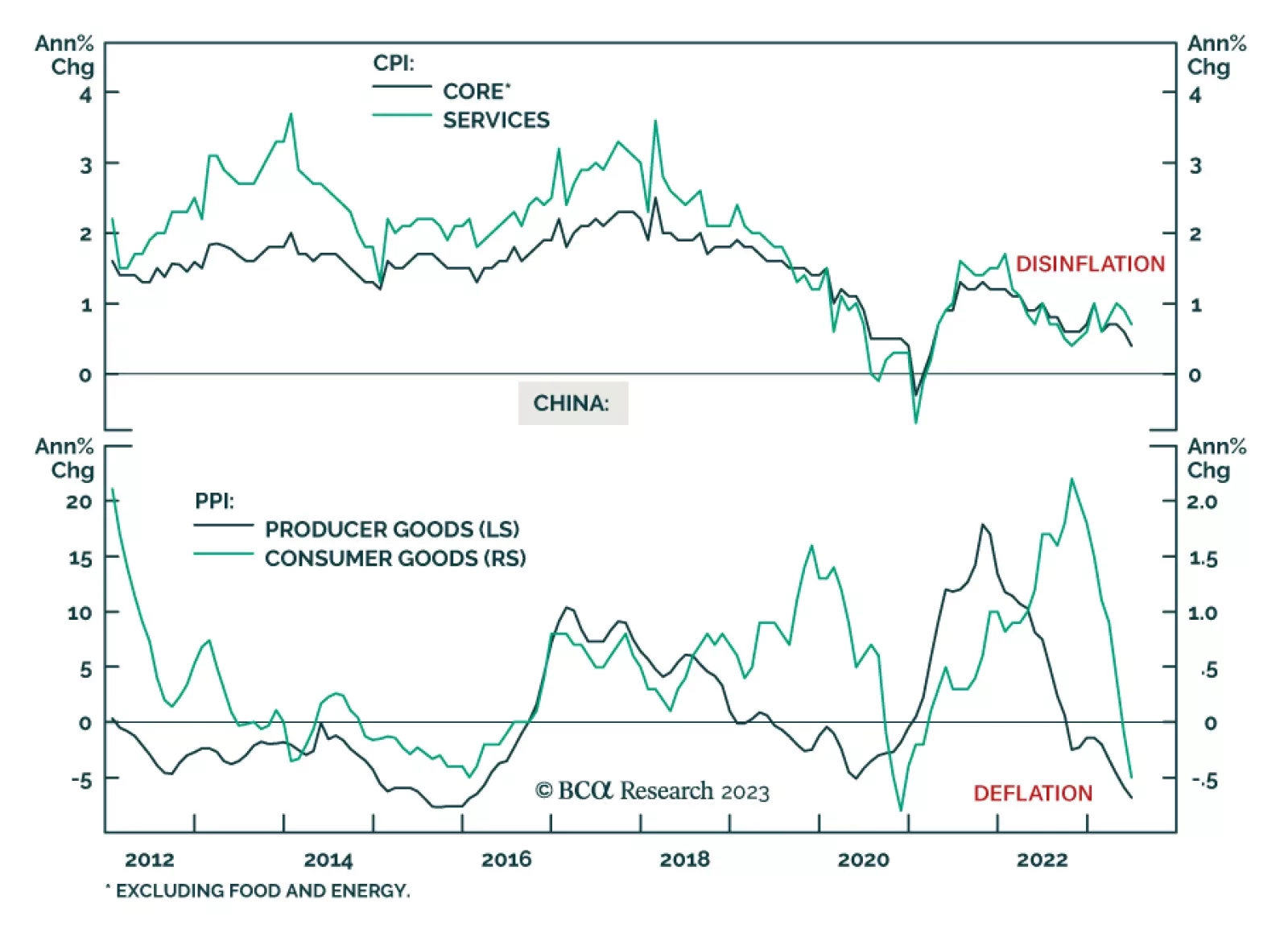

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

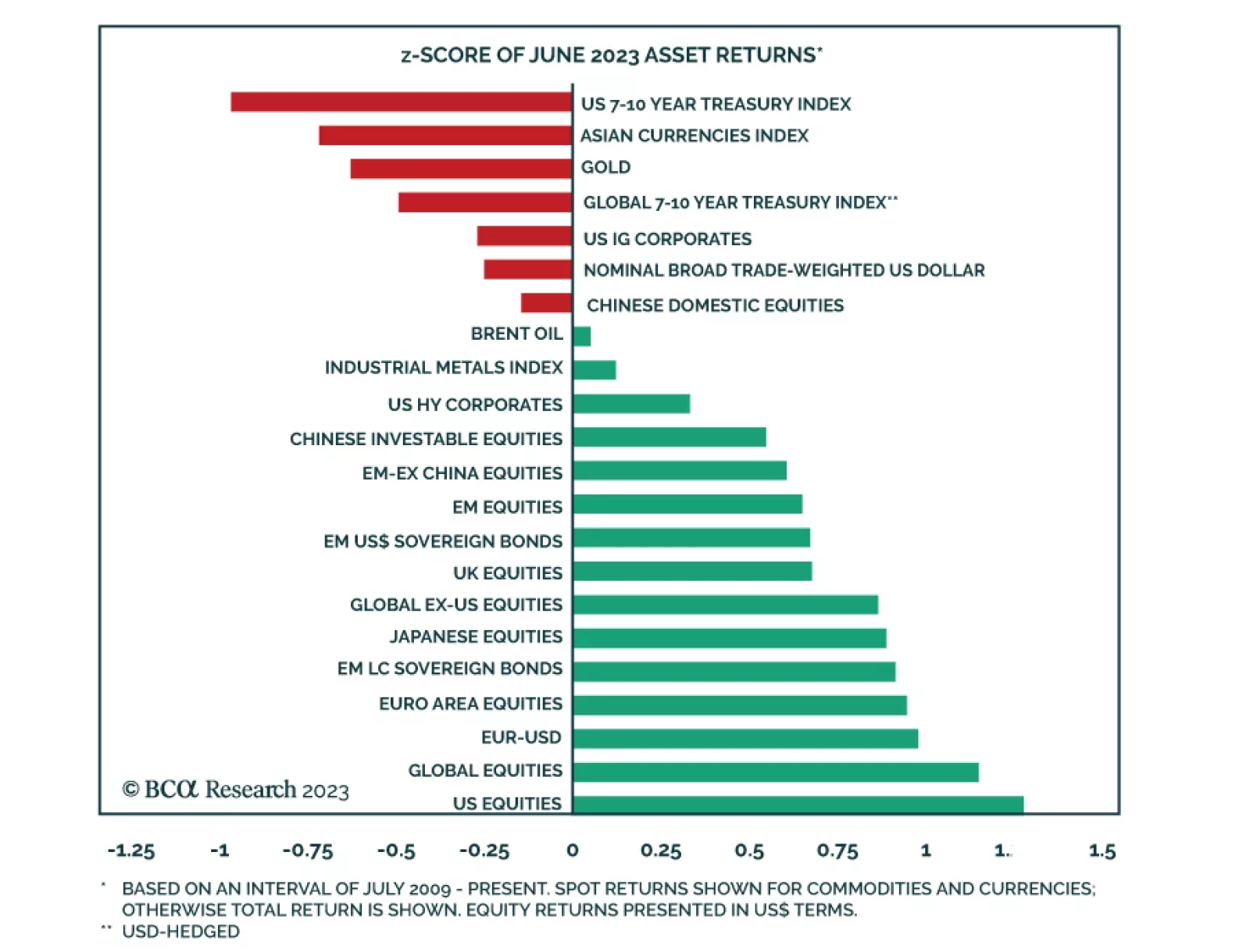

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

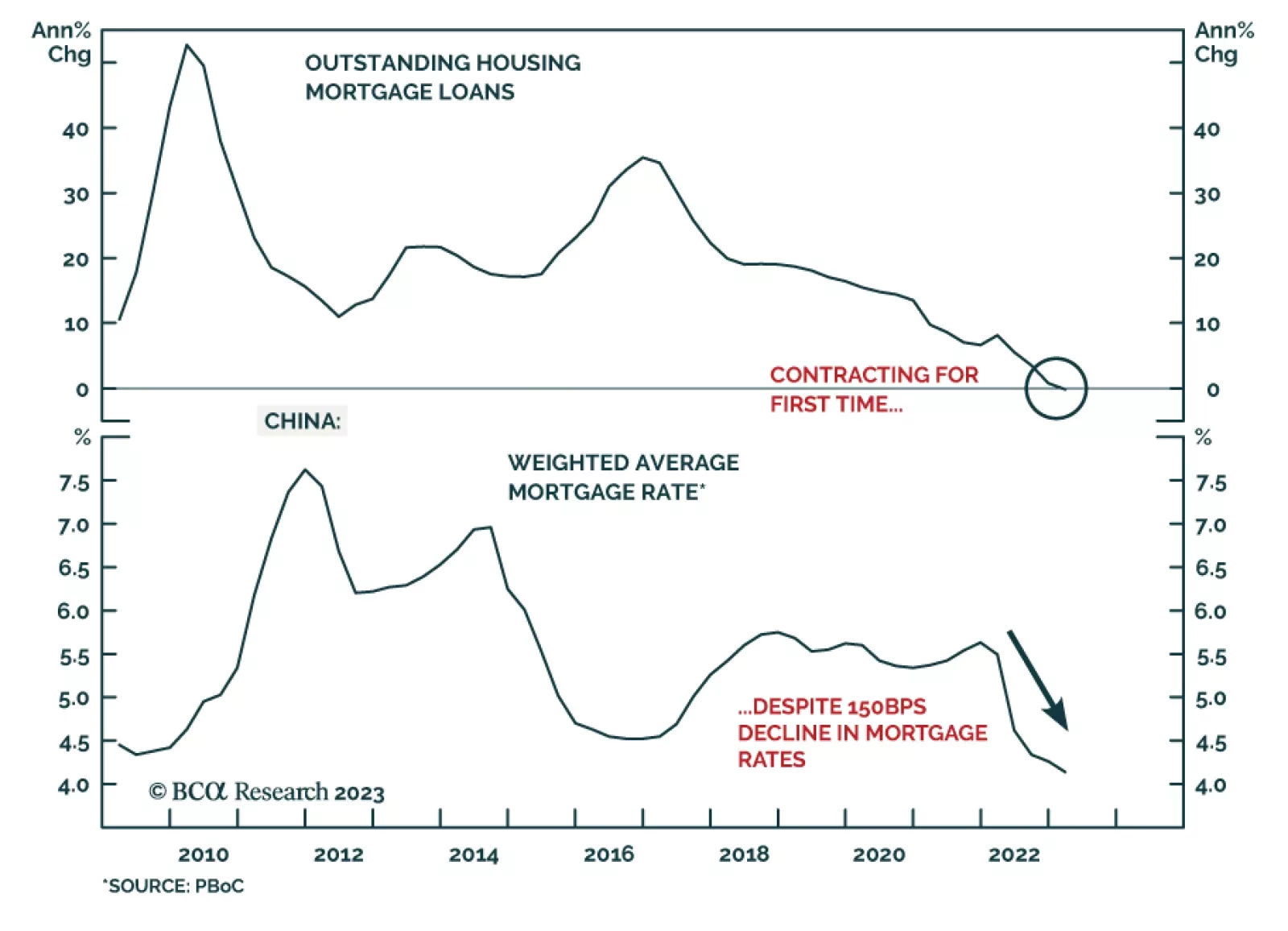

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…

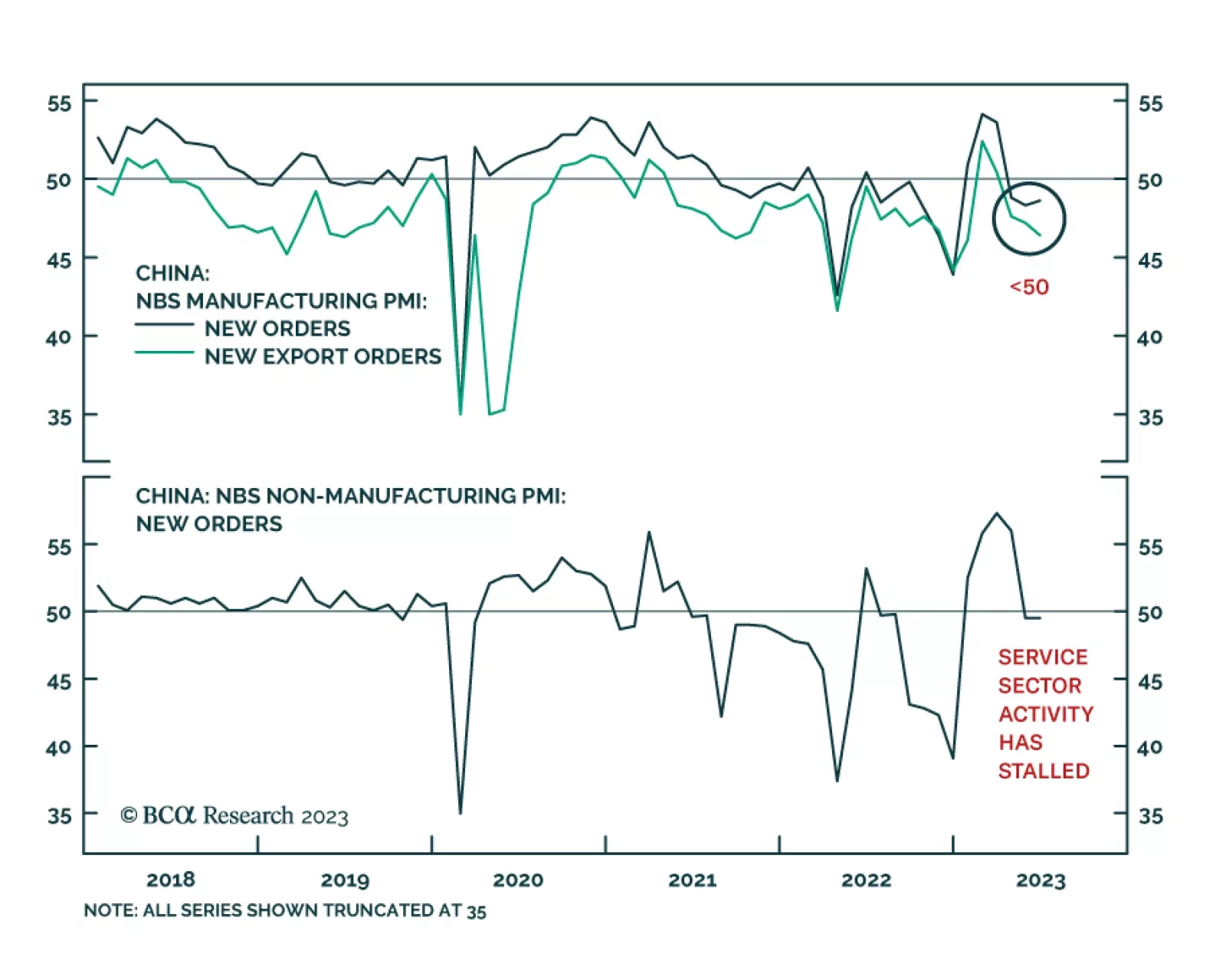

The June NBS PMI data revealed that growth conditions have deteriorated on the margin. The new orders and exports for overall manufacturing as well as for services have not improved and remain below 50. In addition, the import…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

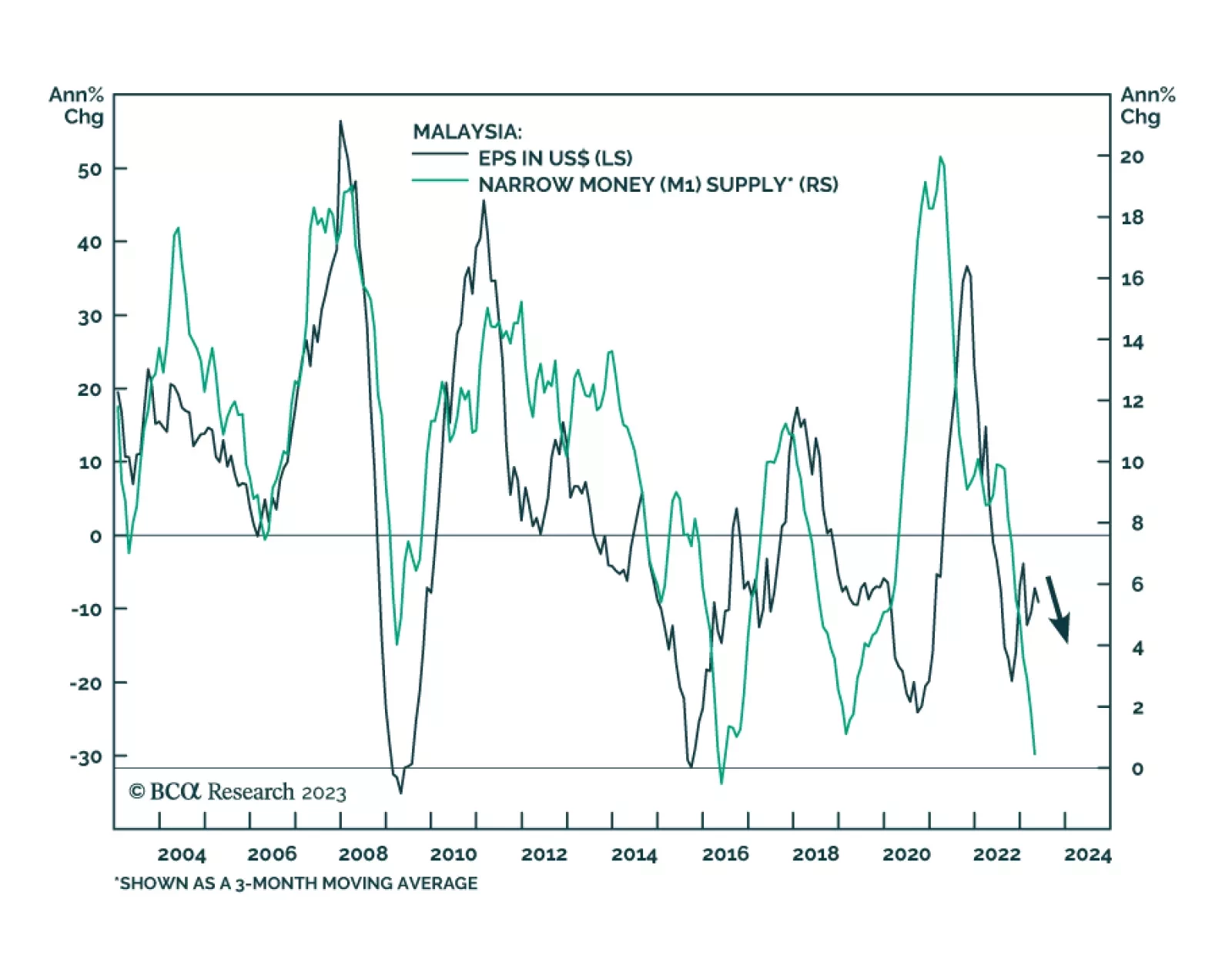

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?