Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

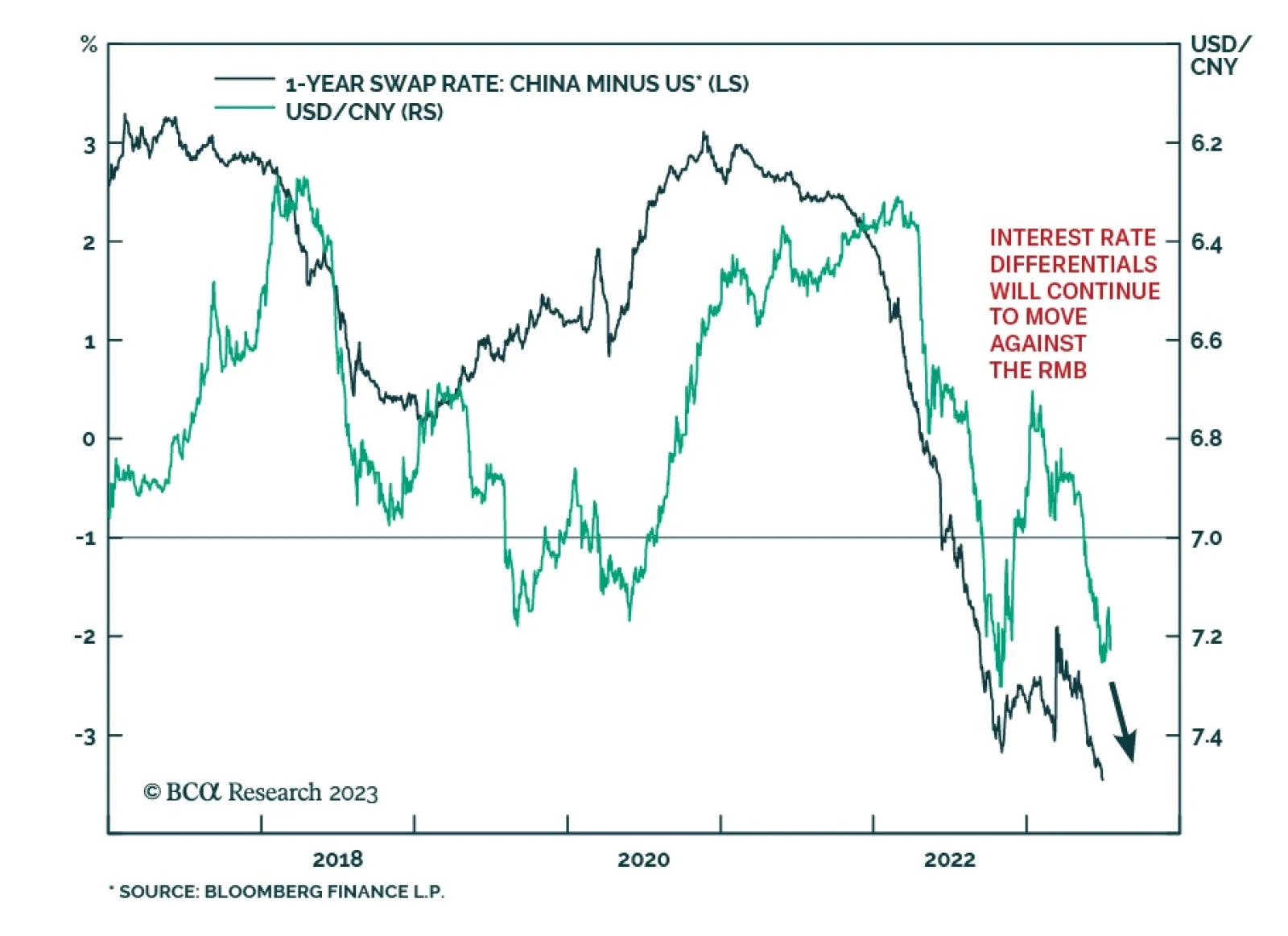

The Chinese yuan was among the best performing currencies on Thursday after authorities implemented measures to support the yuan. Specifically, the People’s Bank of China (PBoC) set its daily fixing at a stronger-than-…

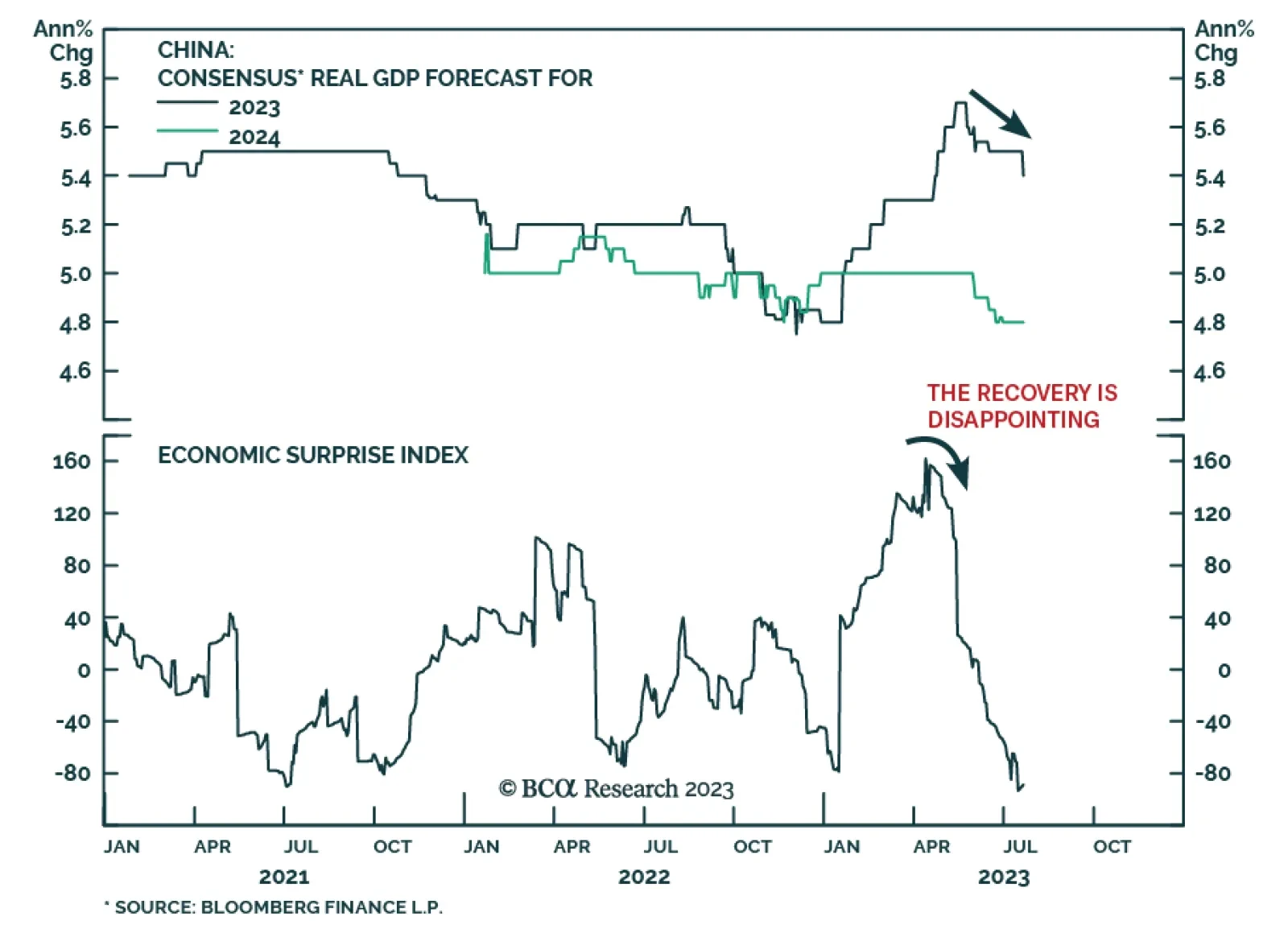

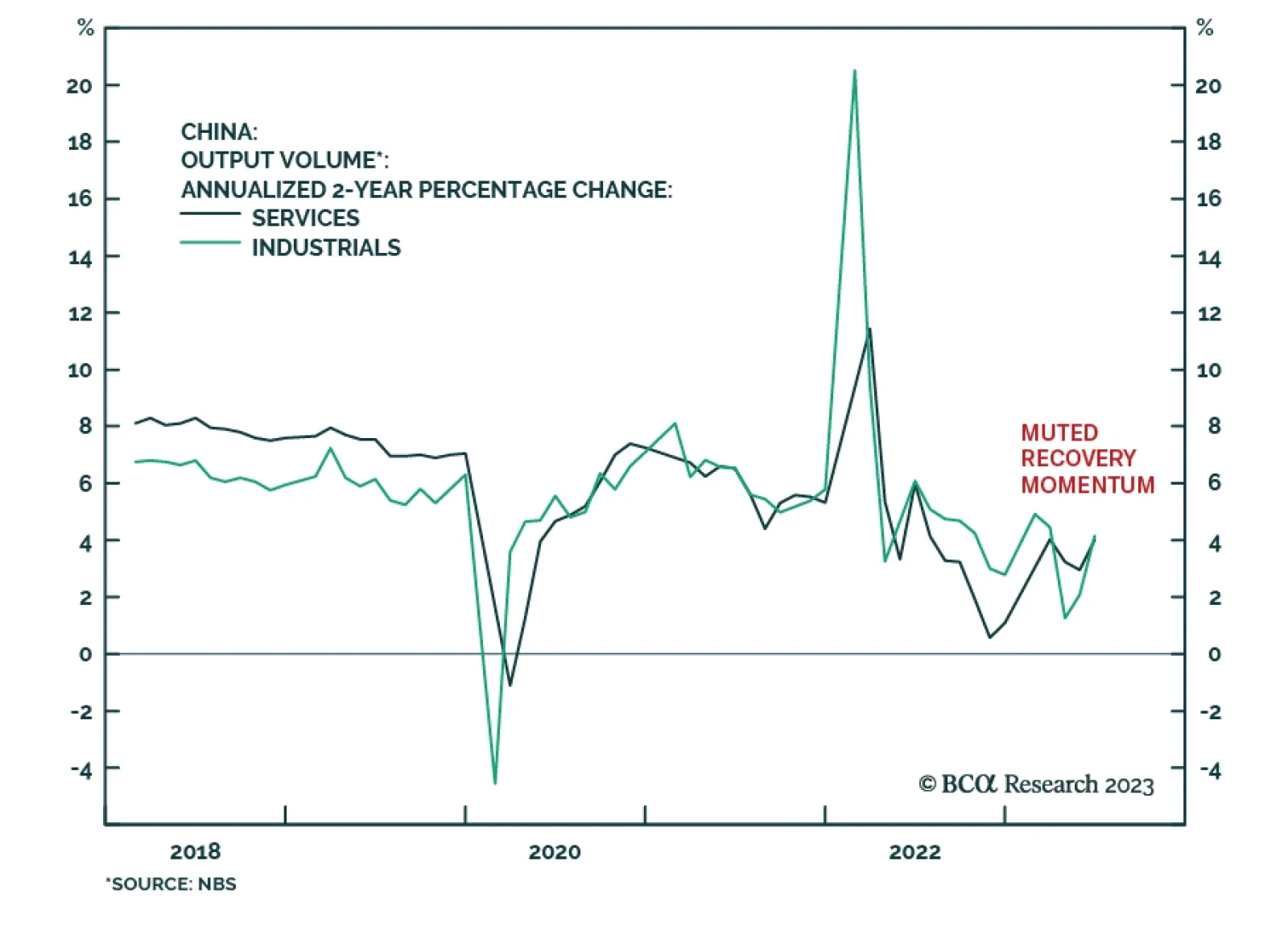

On the surface, the latest batch of Chinese economic data released on Monday shows a deterioration in consumer spending with retail sales growth slowing sharply from 12.7% y/y to 3.1% y/y in June – slightly below consensus…

In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

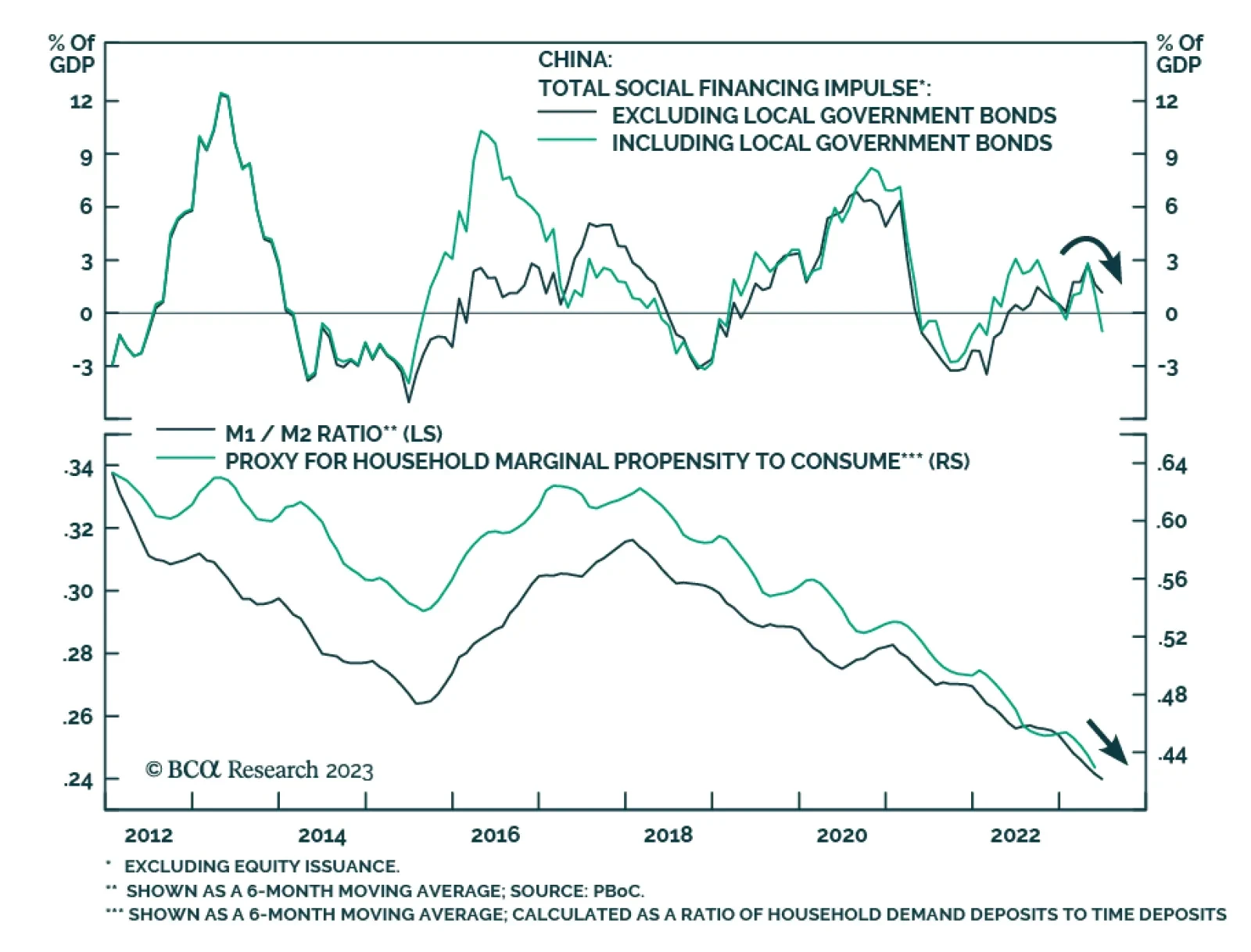

According to BCA Research’s China Investment Strategy team, China’s fiscal support will be limited due to political and economic factors. China has heavily relied on government expenditure support to sustain its…

The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…

China’s credit expansion surprised to the upside in June. Aggregate social financing totaled CNY 4.22 trillion – above expectations of CNY 3.10 trillion and exceeding CNY 1.56 trillion in the prior month. Similarly,…