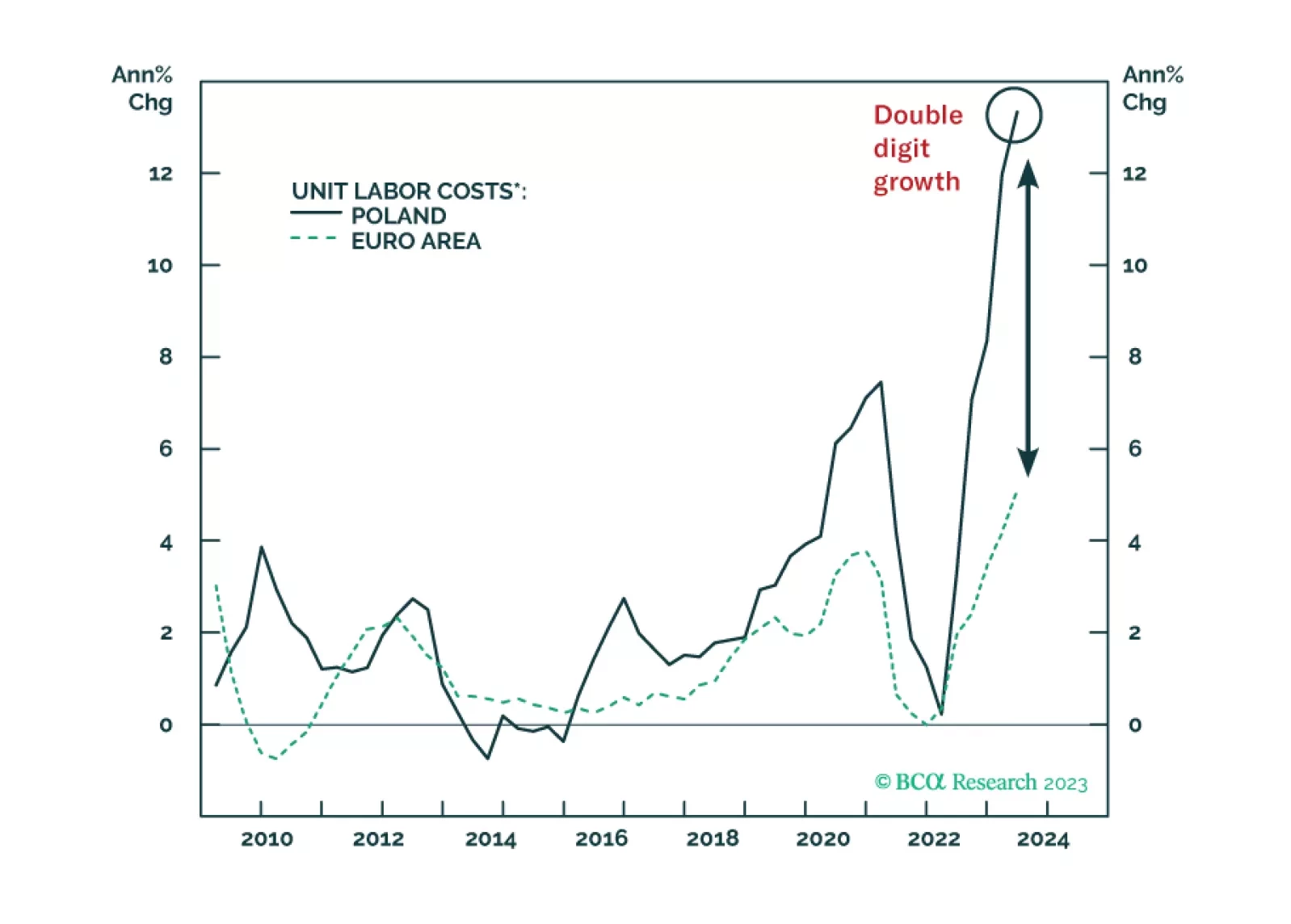

Poland’s inflation will stay elevated. And yet, its return to the European mainstream has improved its financial market outlook. Accordingly, we are recommending new trades on Polish equity, fixed income, and currency.

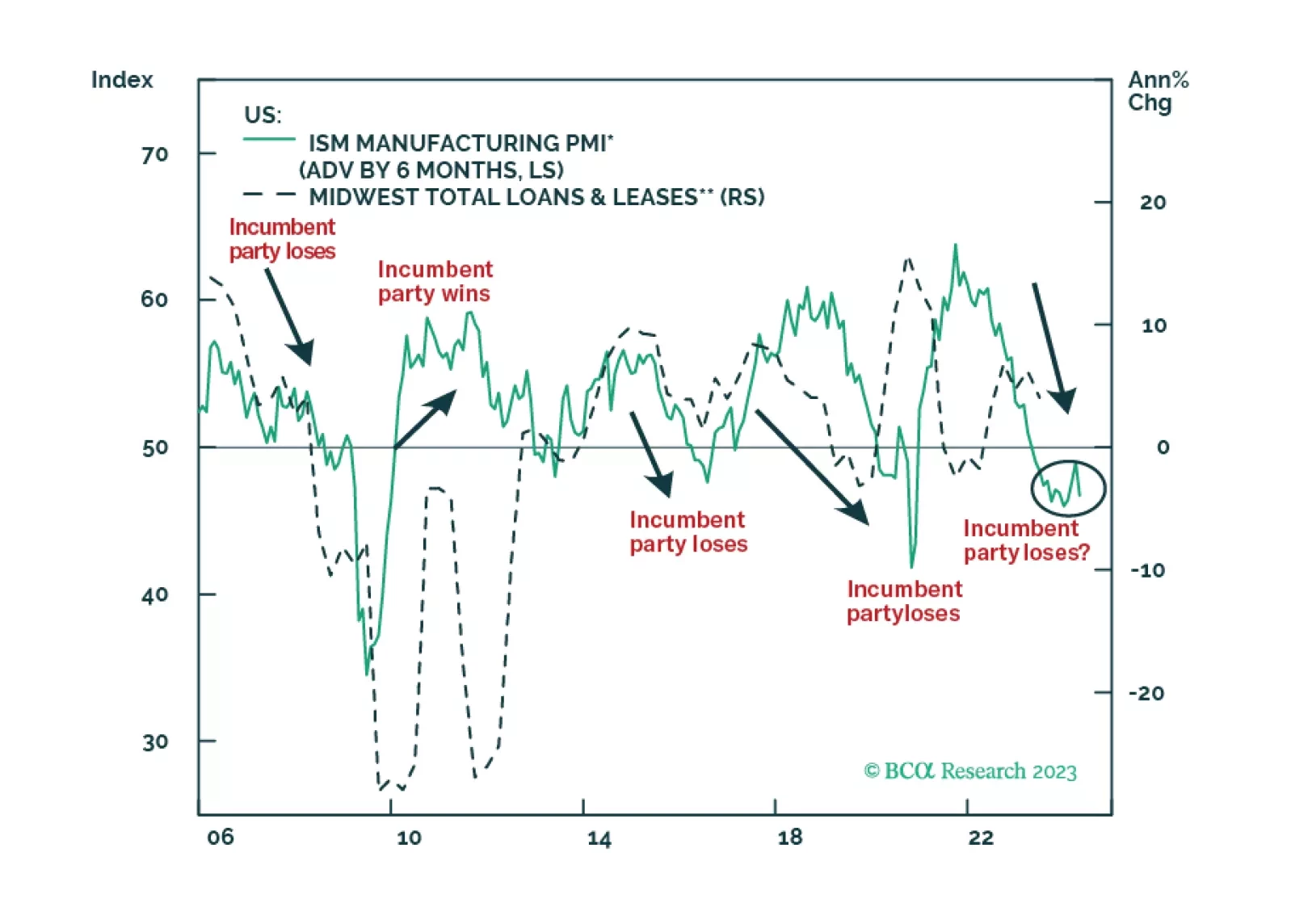

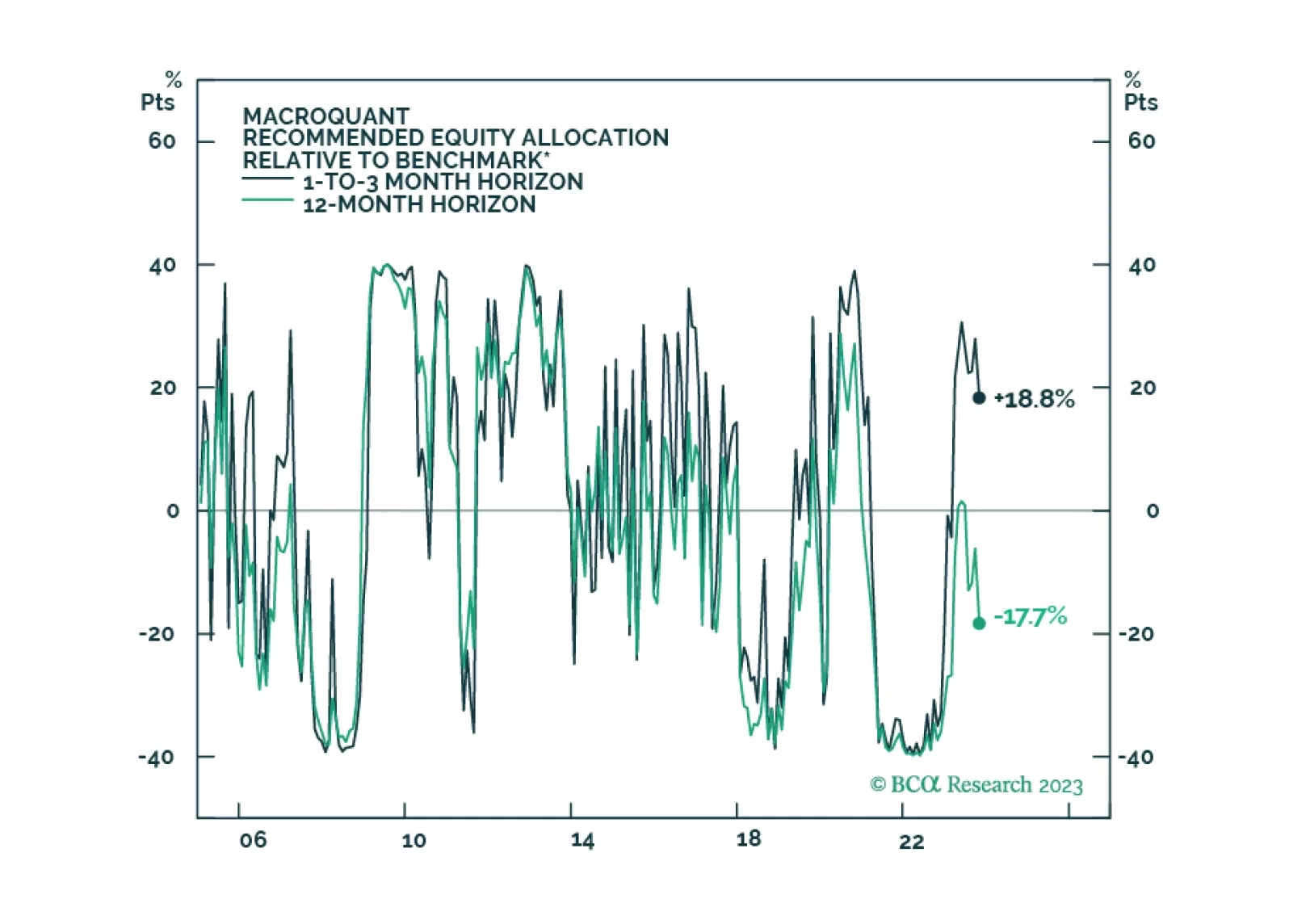

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.

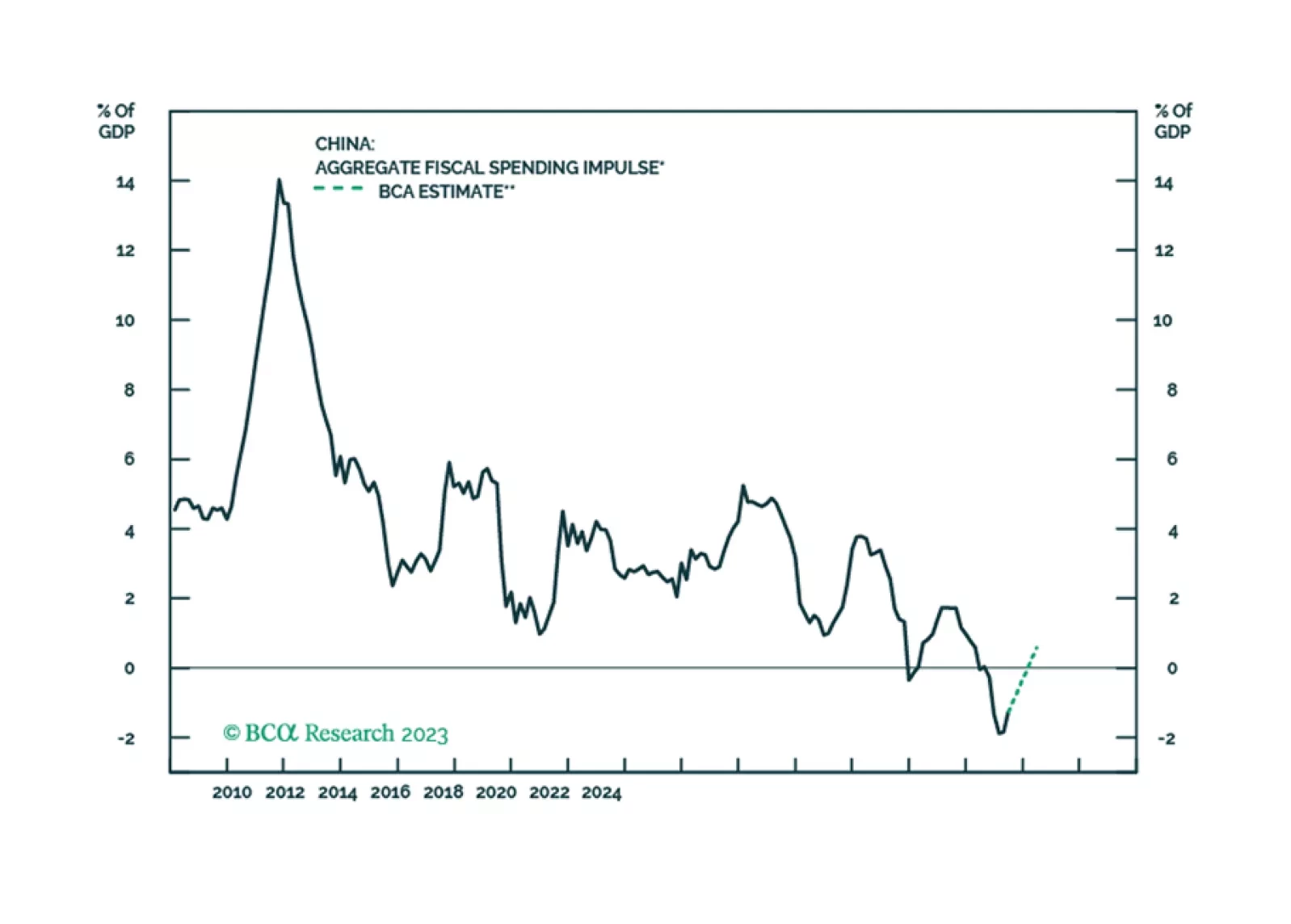

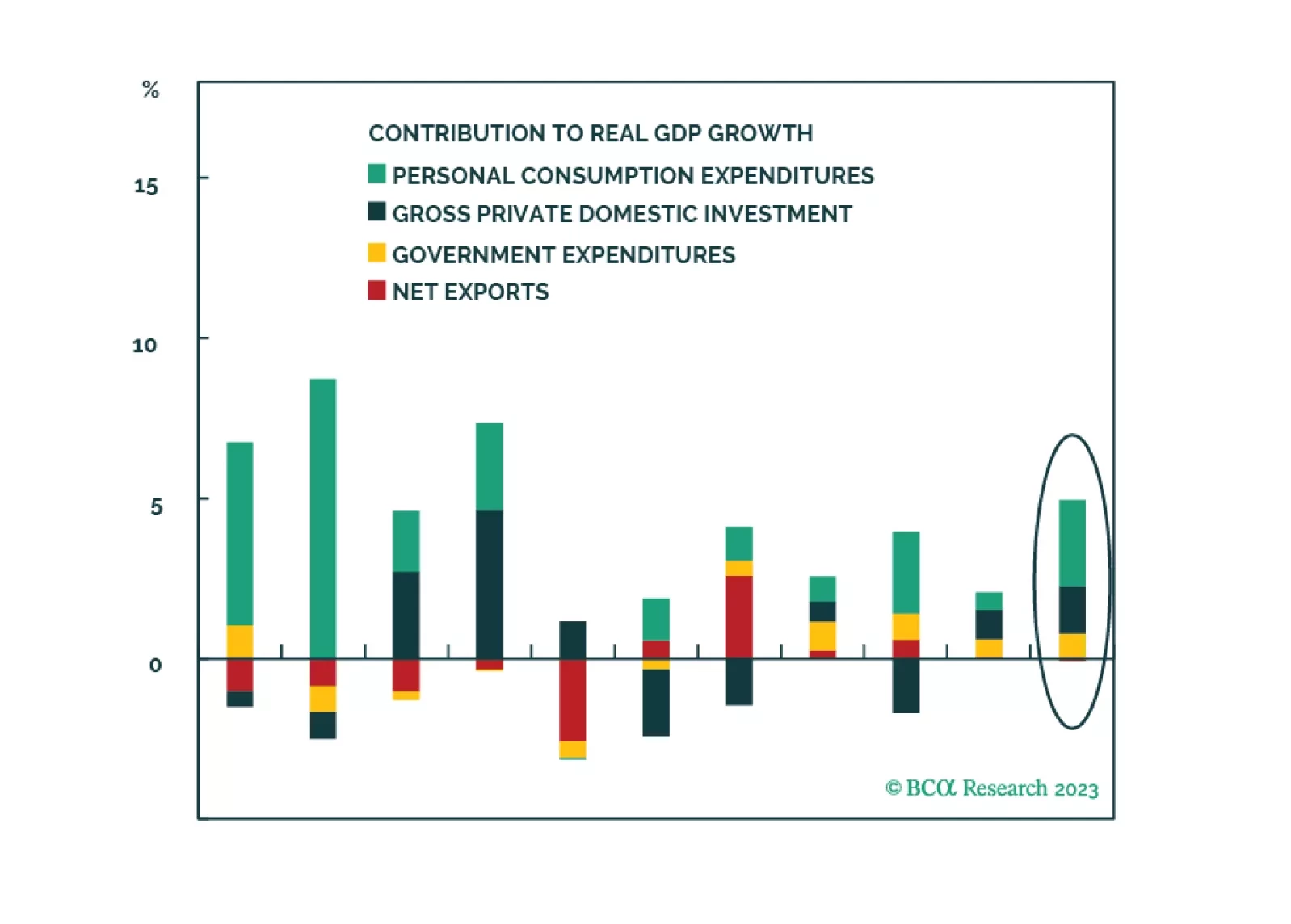

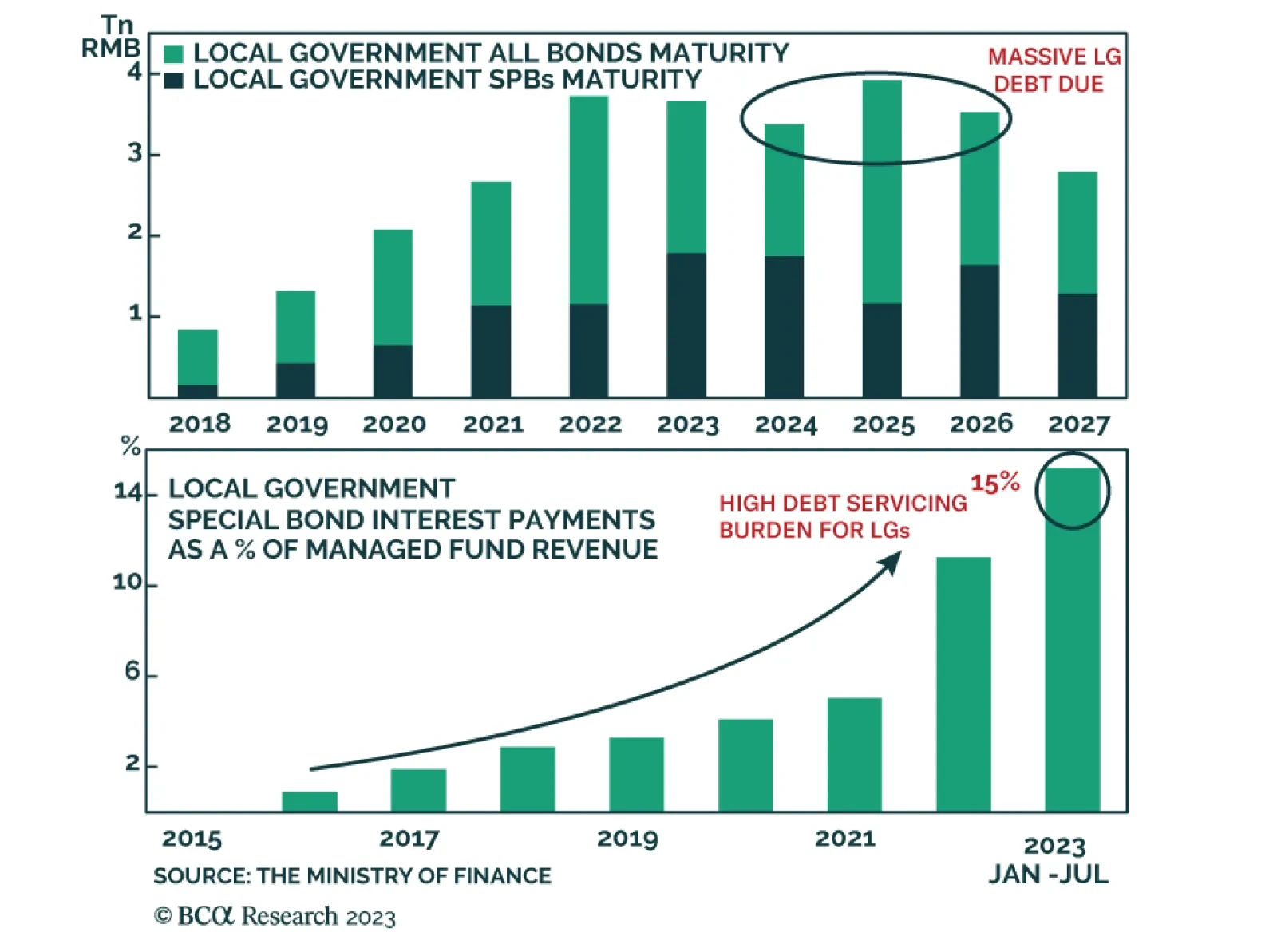

According to BCA Research’s China Investment Strategy service, China's recently introduced debt swap program will help prevent mushrooming defaults, but it will not lead to an acceleration in growth. In August, the…

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.