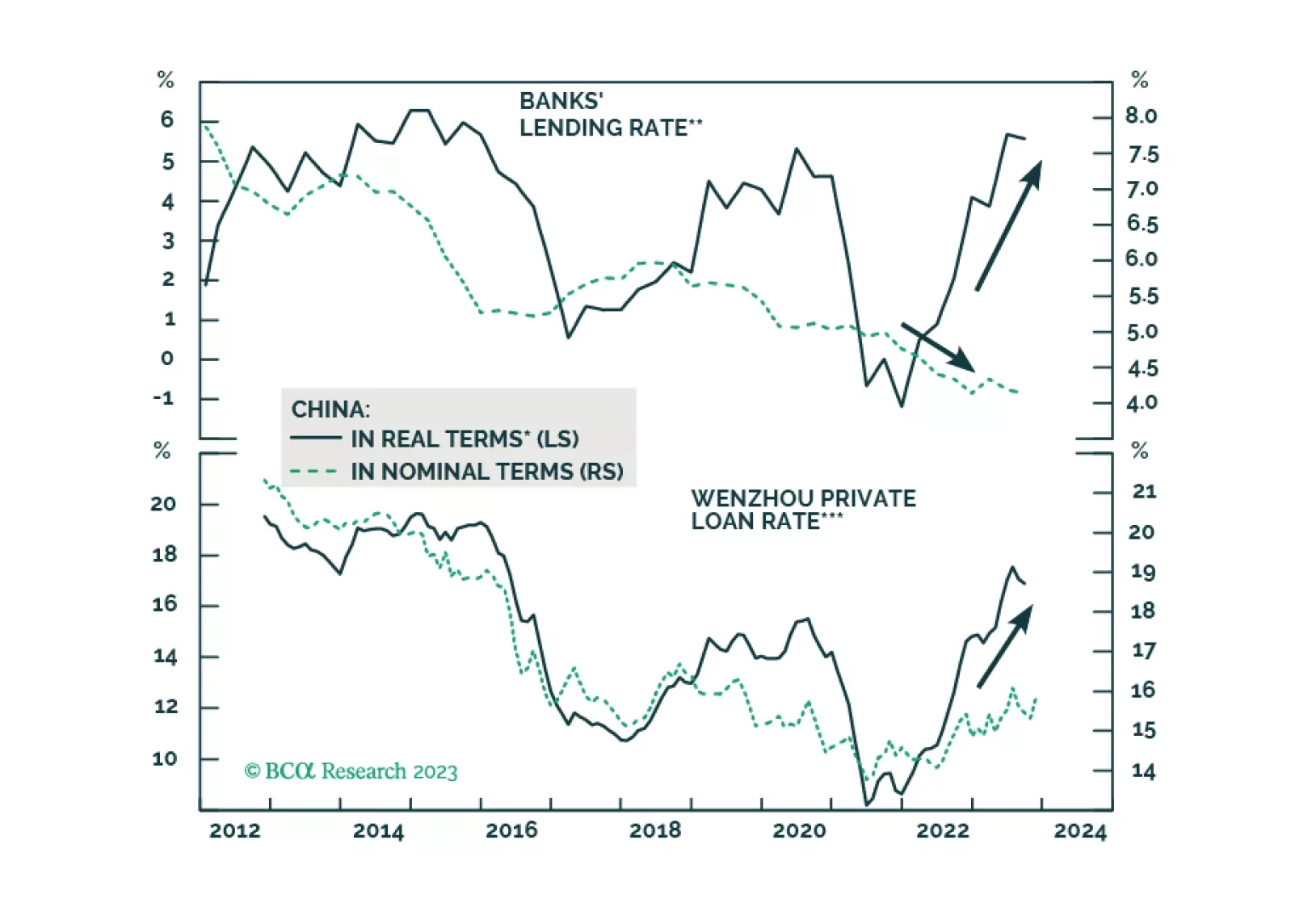

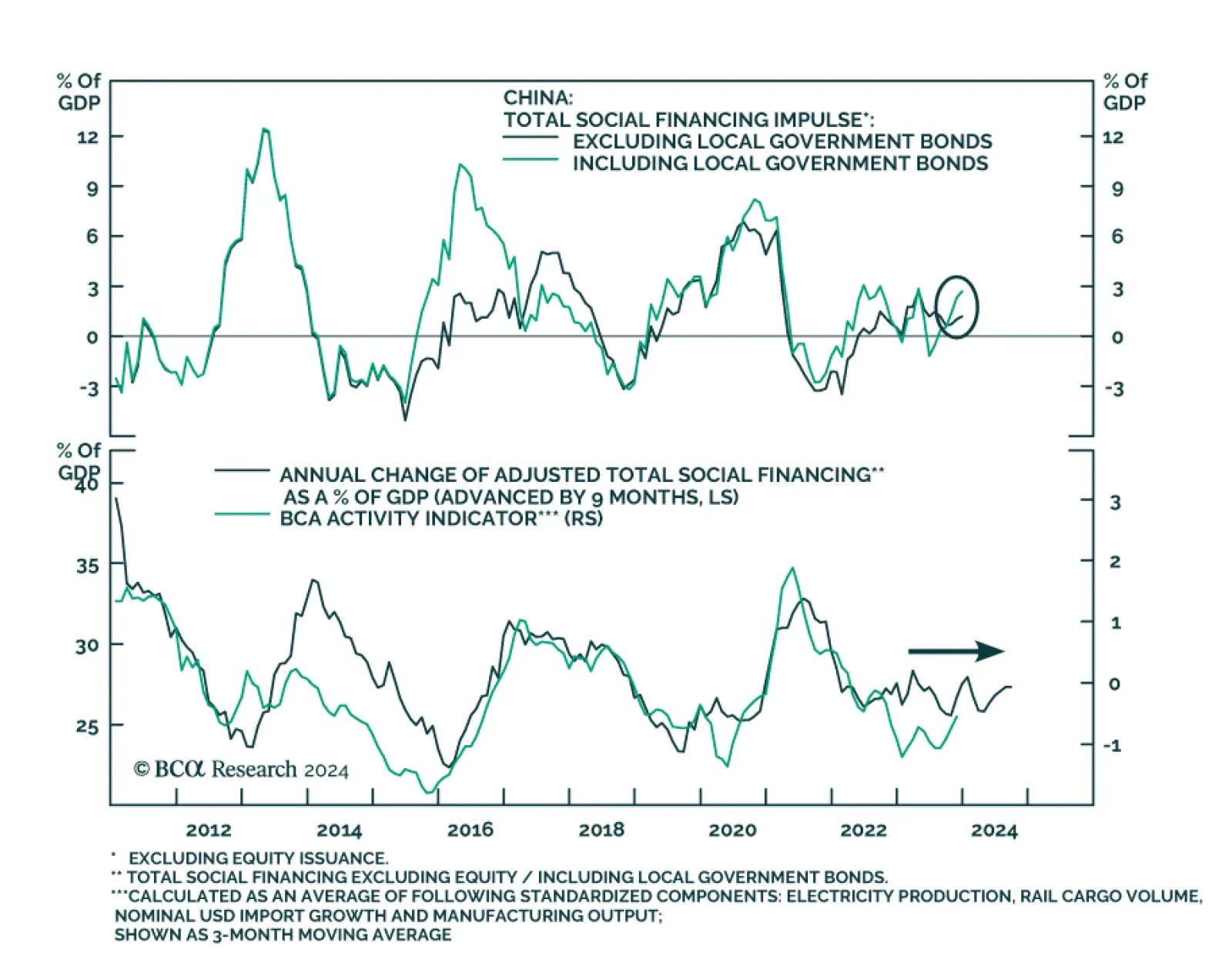

Chinese credit dynamics remain muted with the expansion in total social financing easing from 2.45 trillion yuan to 1.94 trillion yuan in December, below expectations of a tamer slowdown to 2.16 trillion yuan. Loan growth also…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

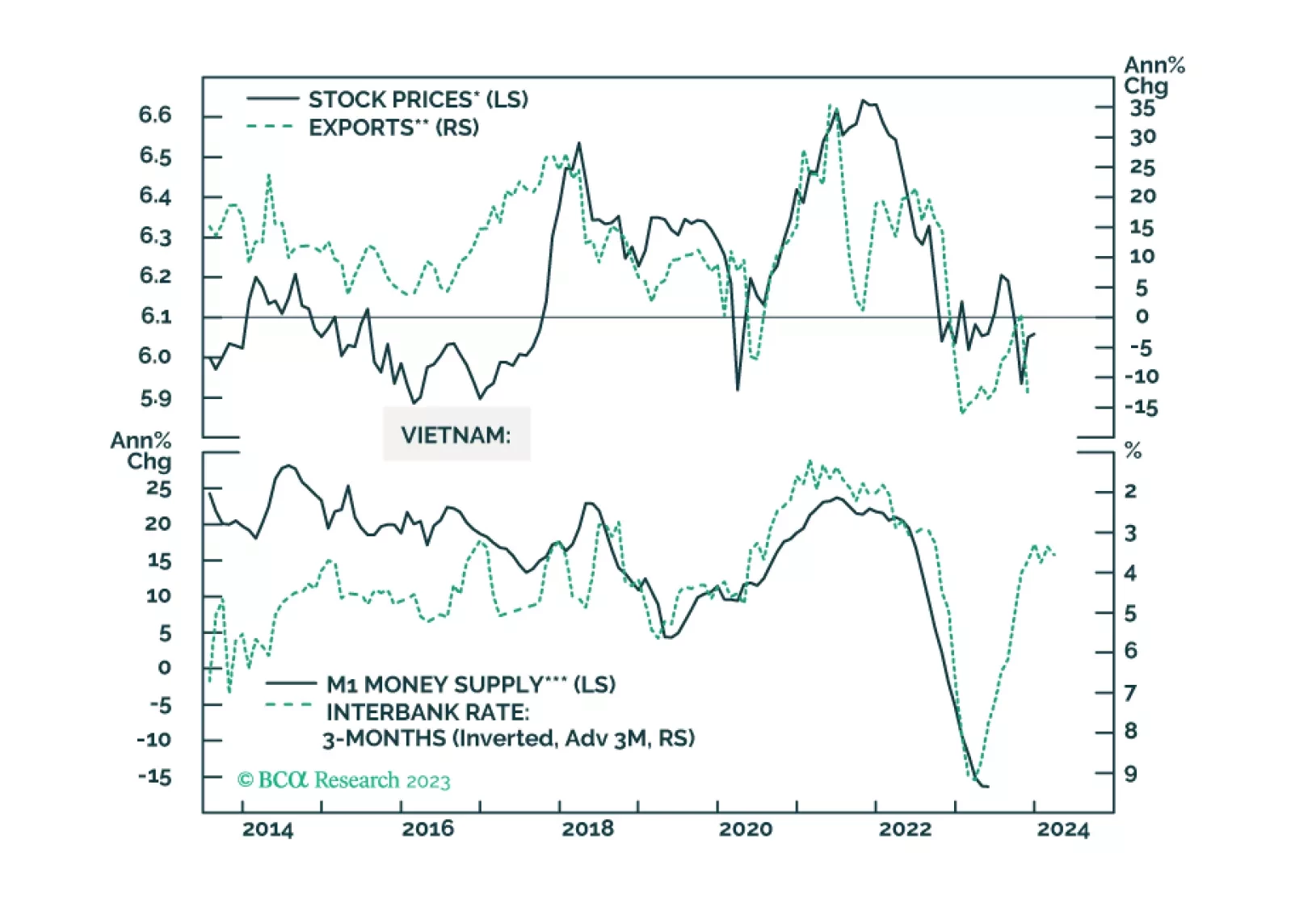

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

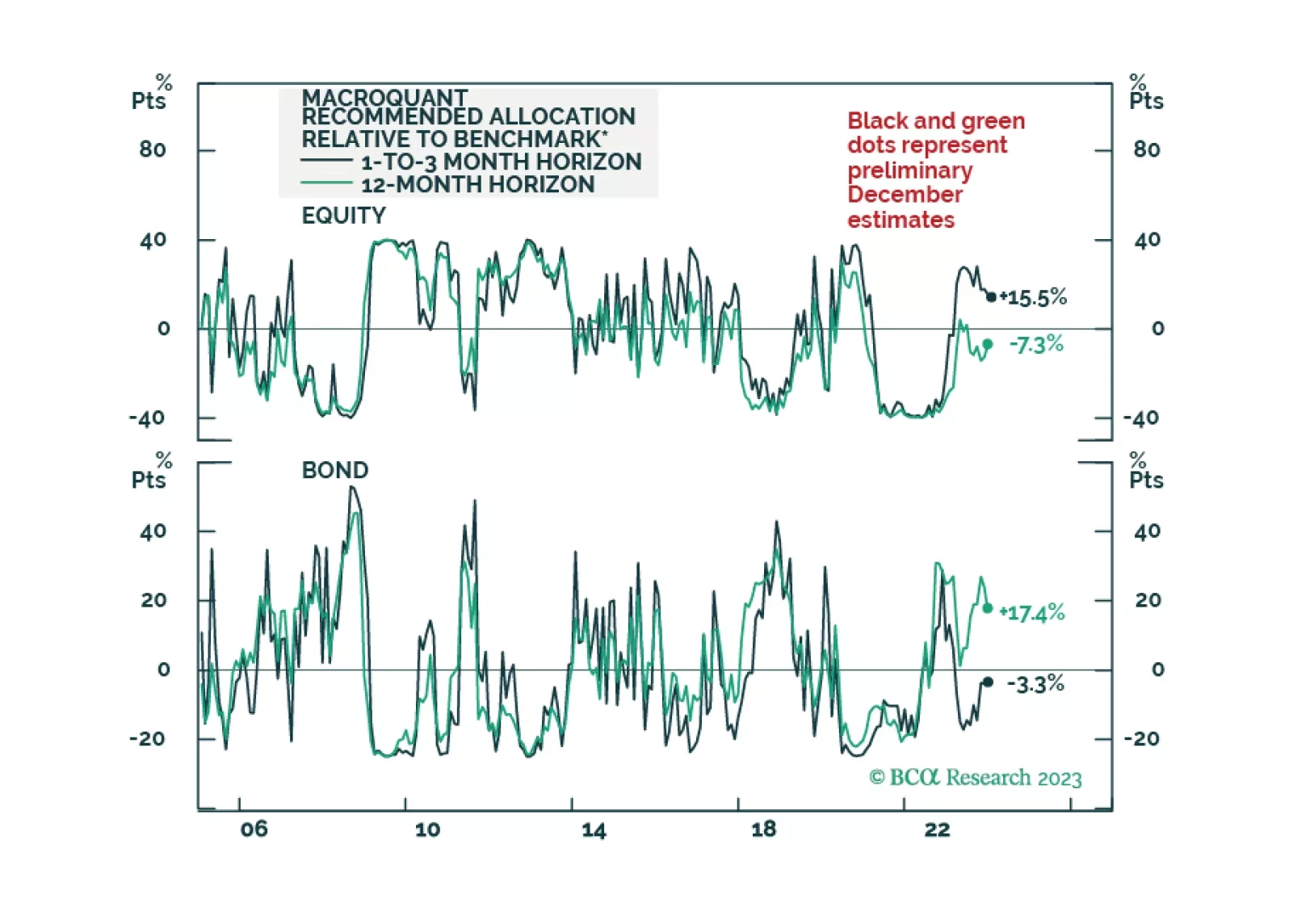

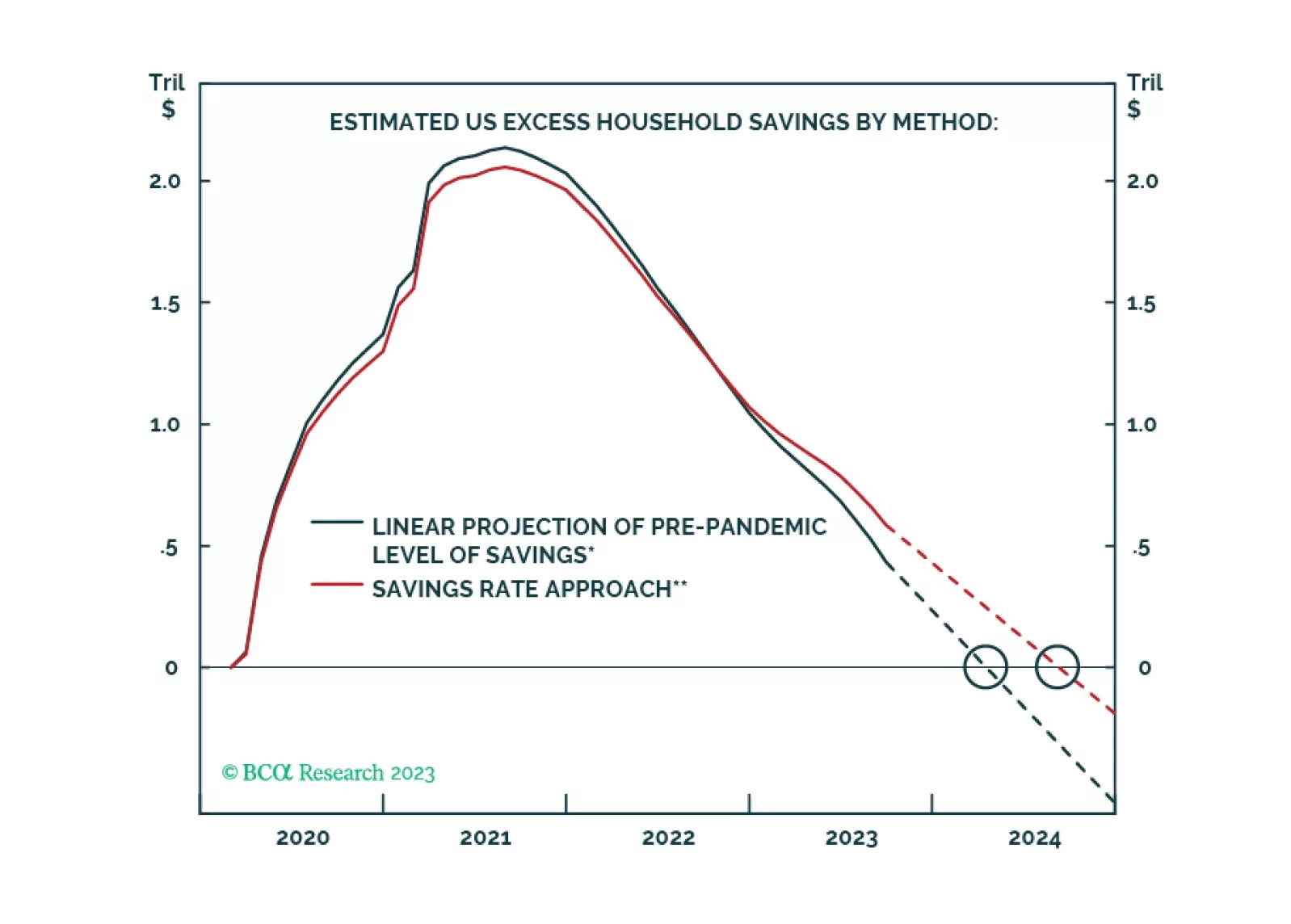

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

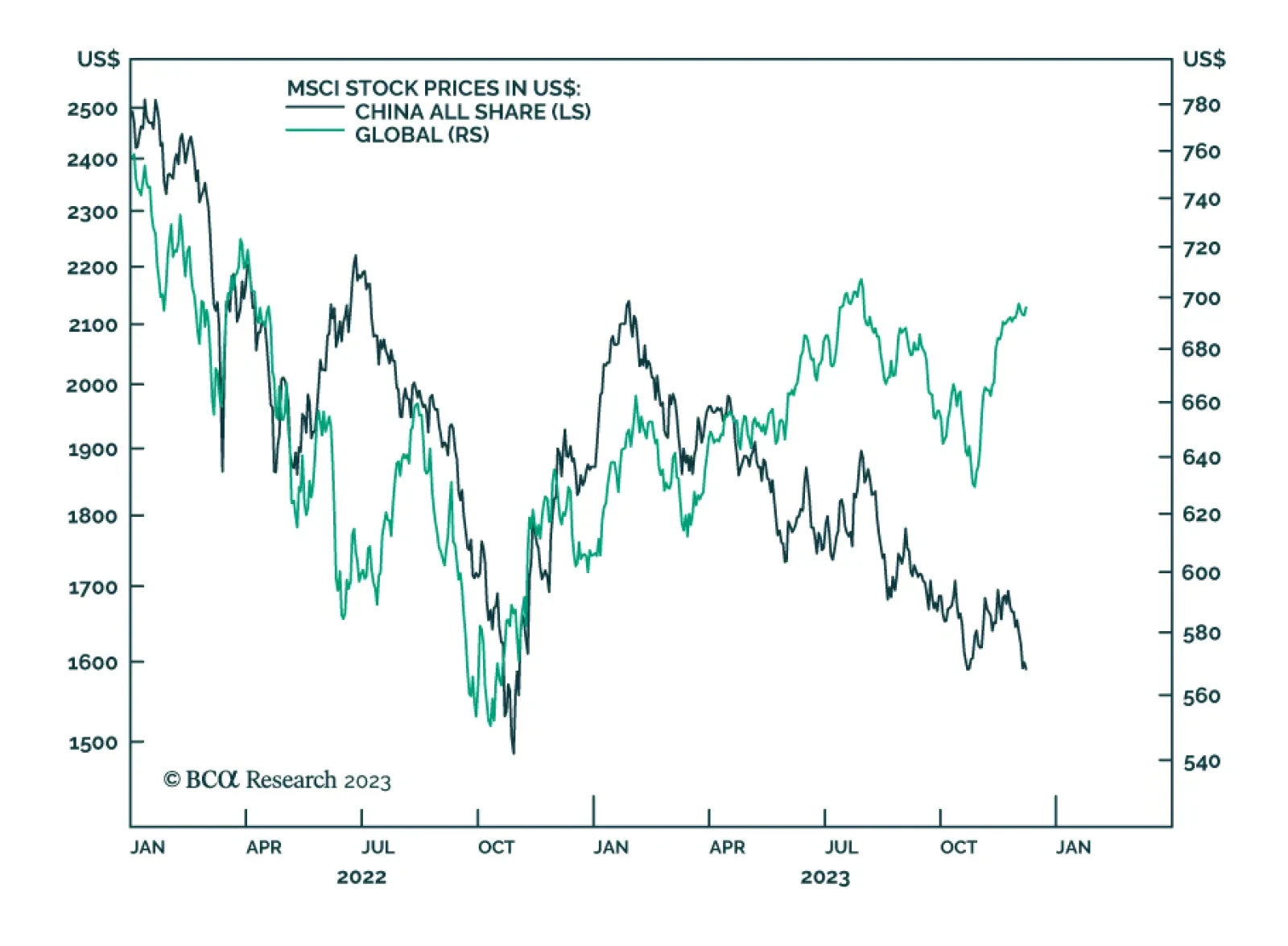

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…

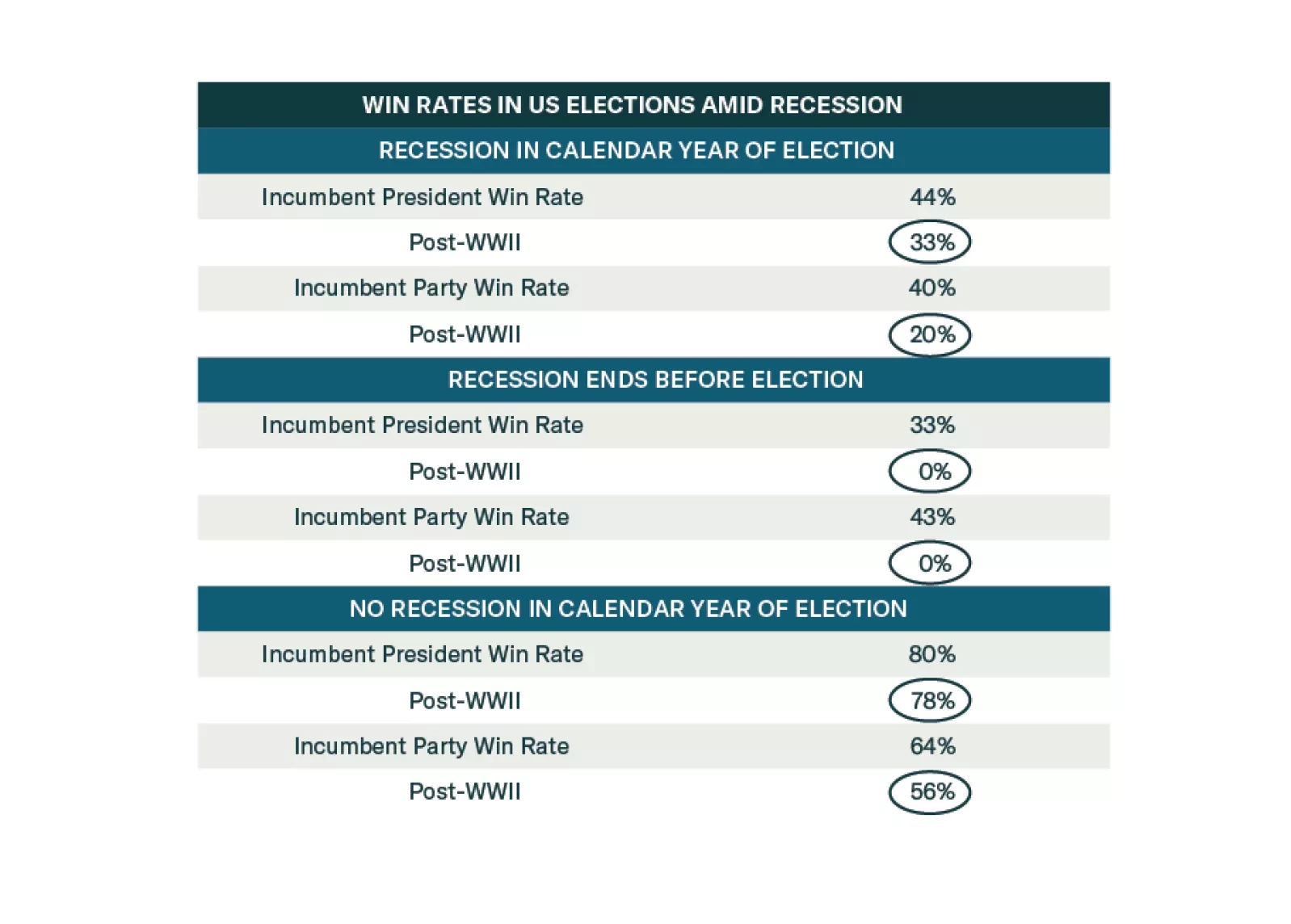

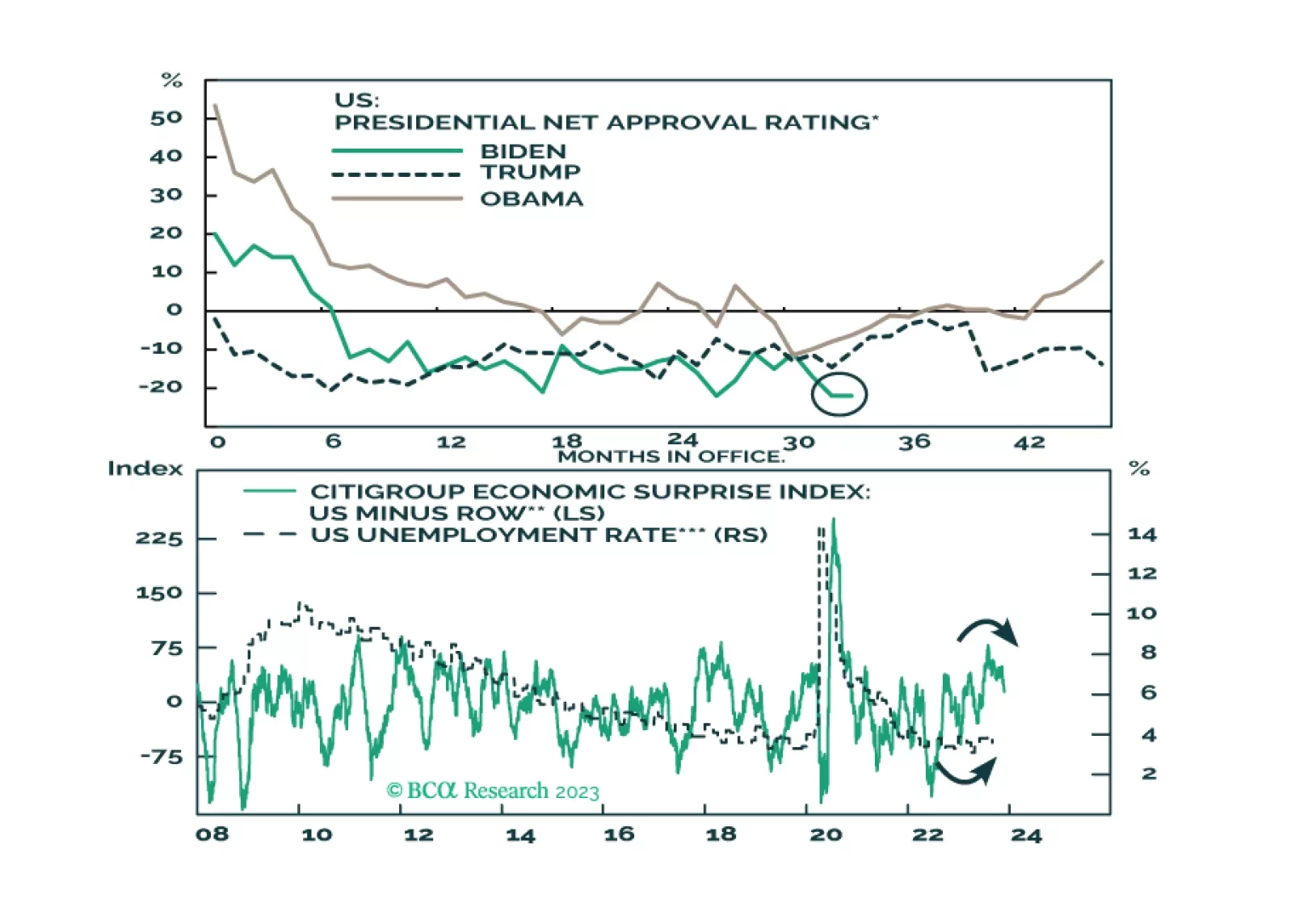

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…