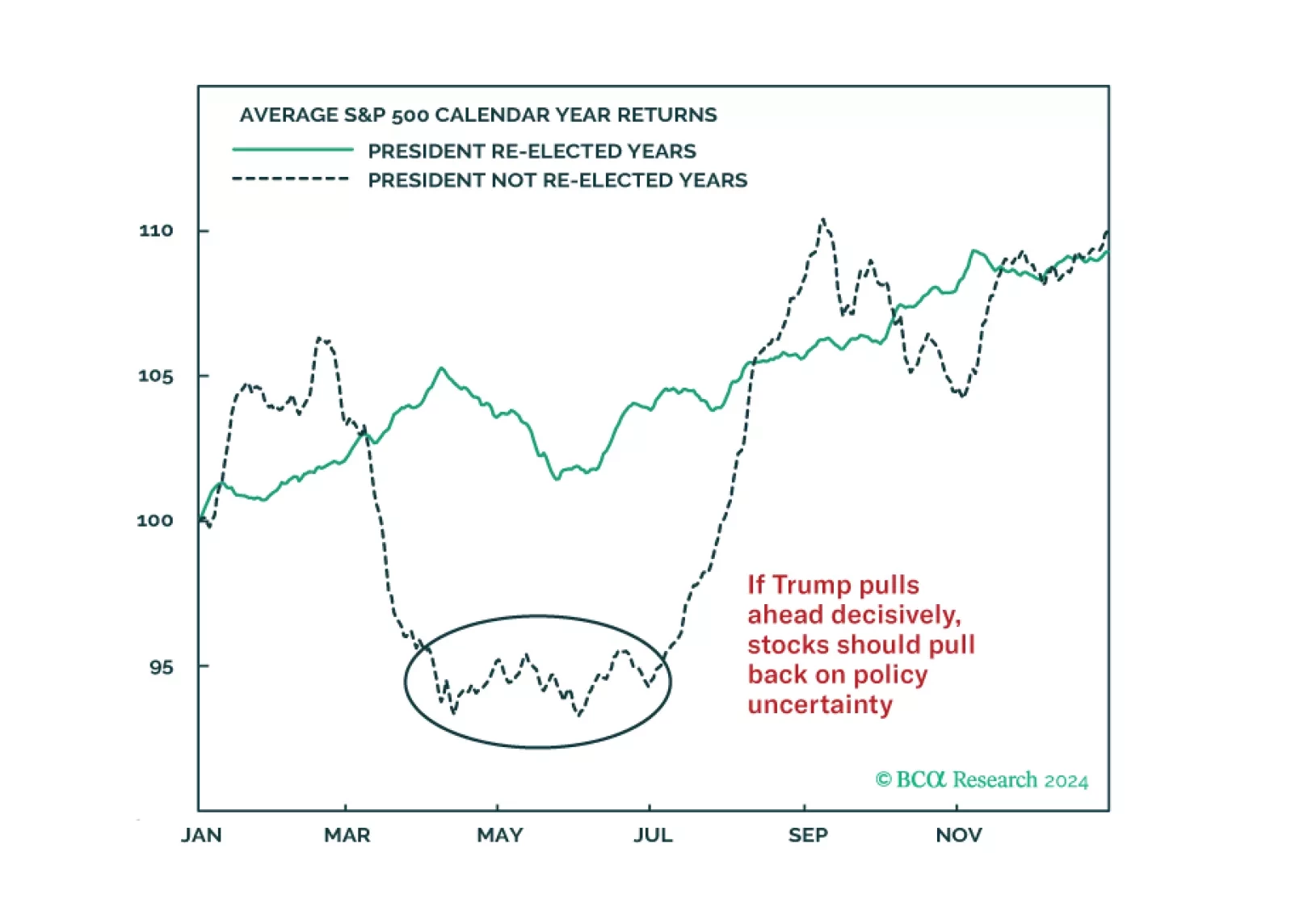

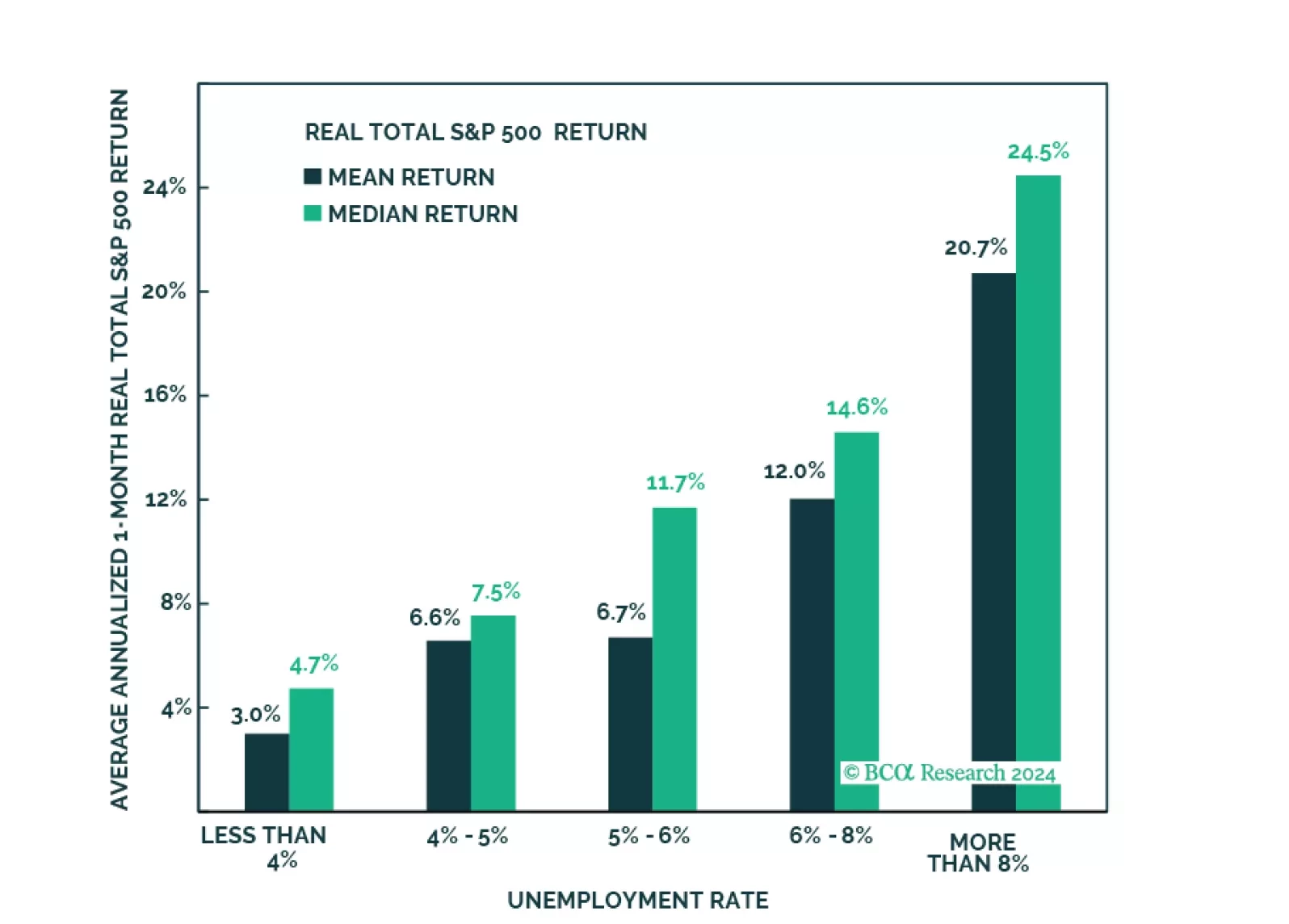

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

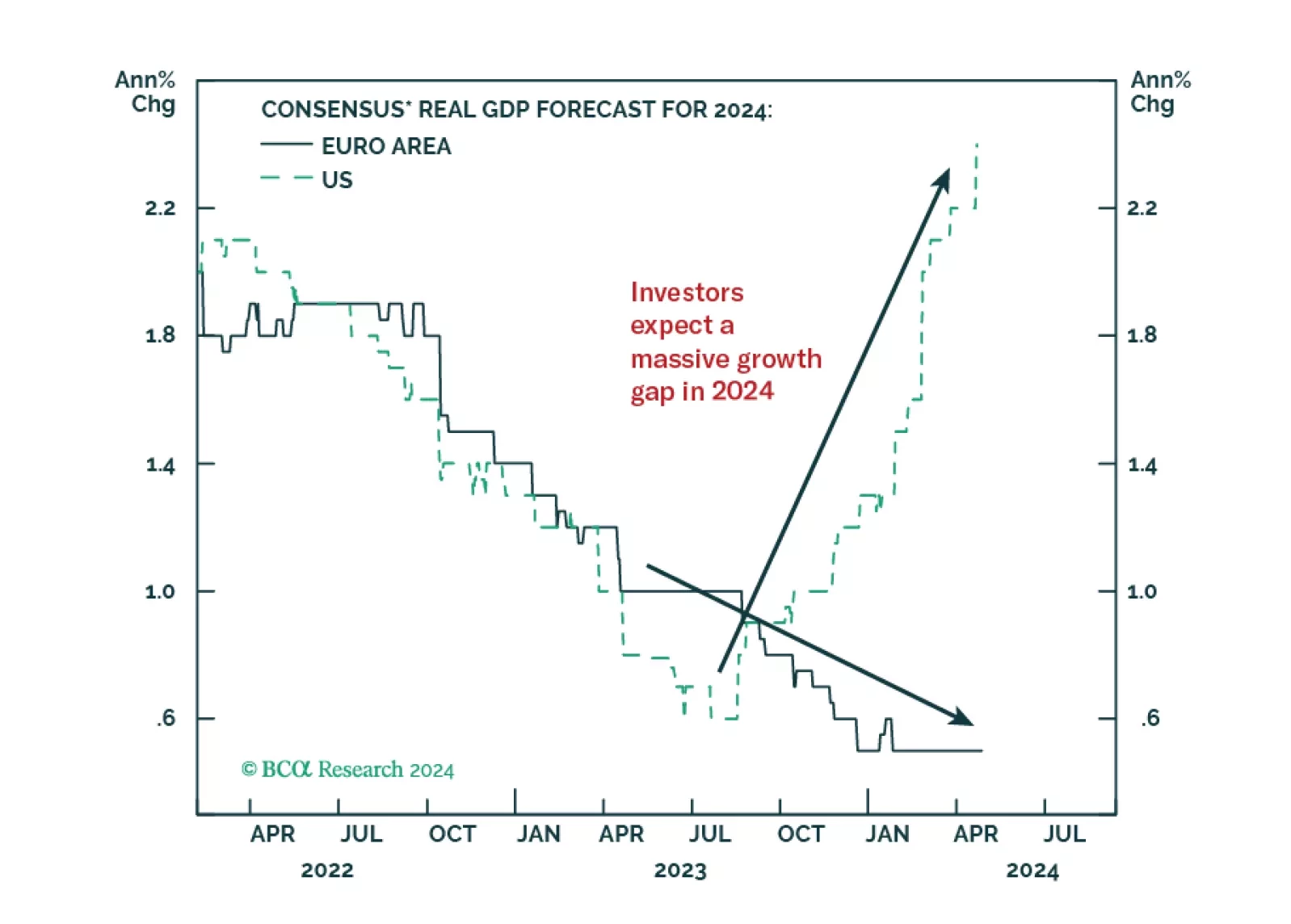

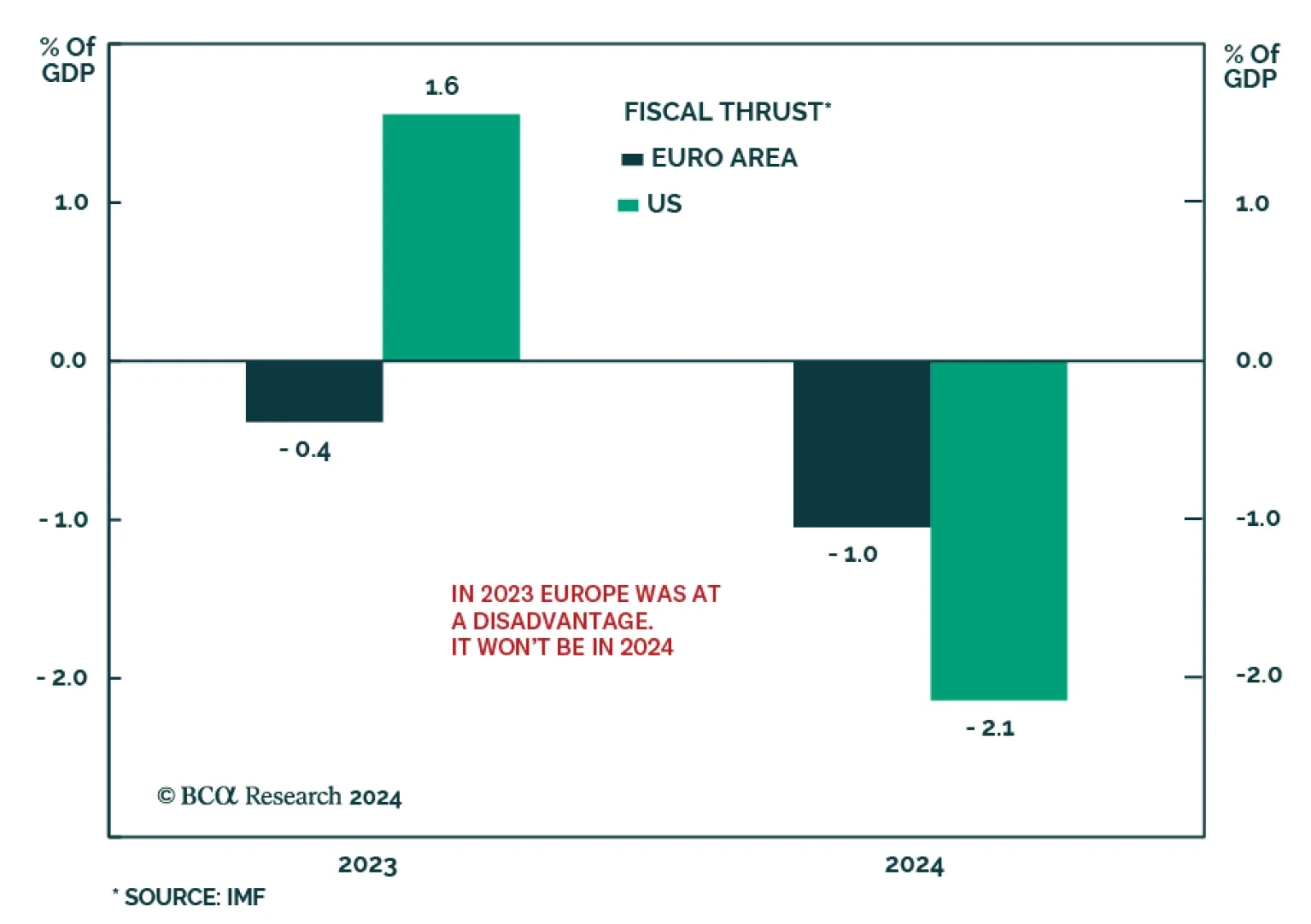

According to BCA Research’s European Investment Strategy service, US and Euro Area growth will likely converge in the next 12 months. Fiscal policy differences were the most visible headwind to Eurozone growth last…

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?

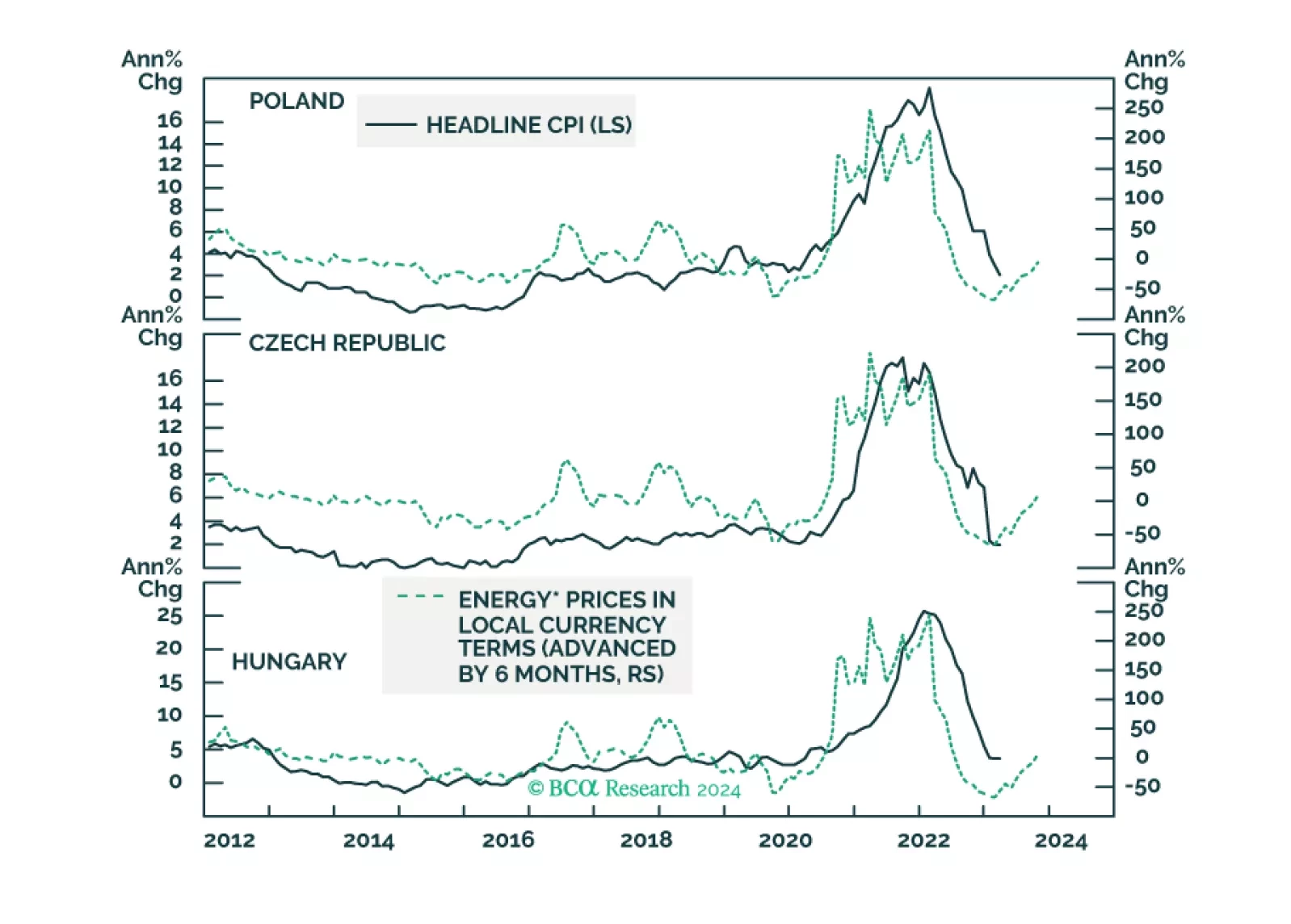

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…

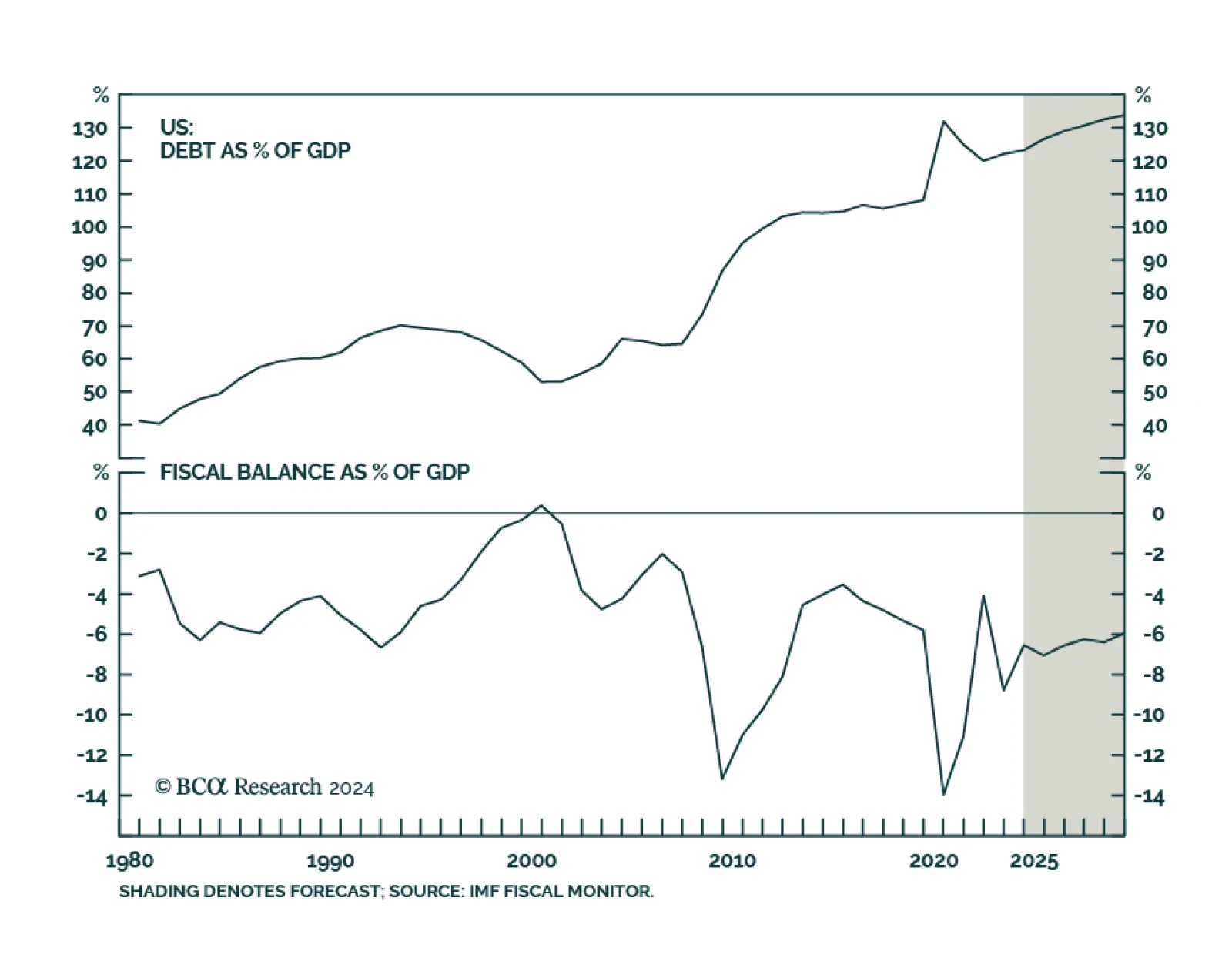

The IMF’s latest fiscal monitor report highlighted the dangers that rising sovereign debt alongside rising deficits pose to advanced economies. The United States, in particular, is at risk. The IMF projects that fiscal…

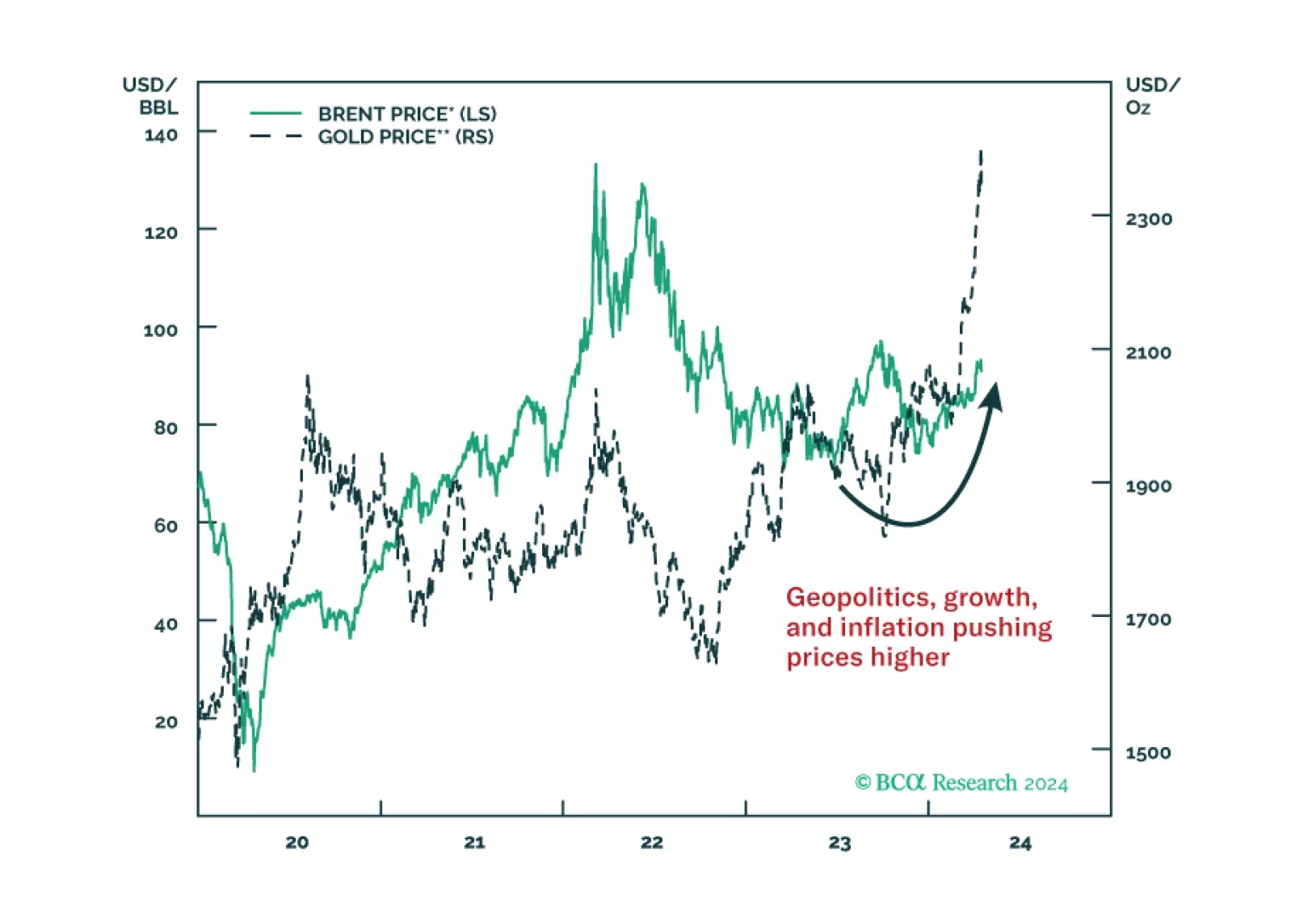

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

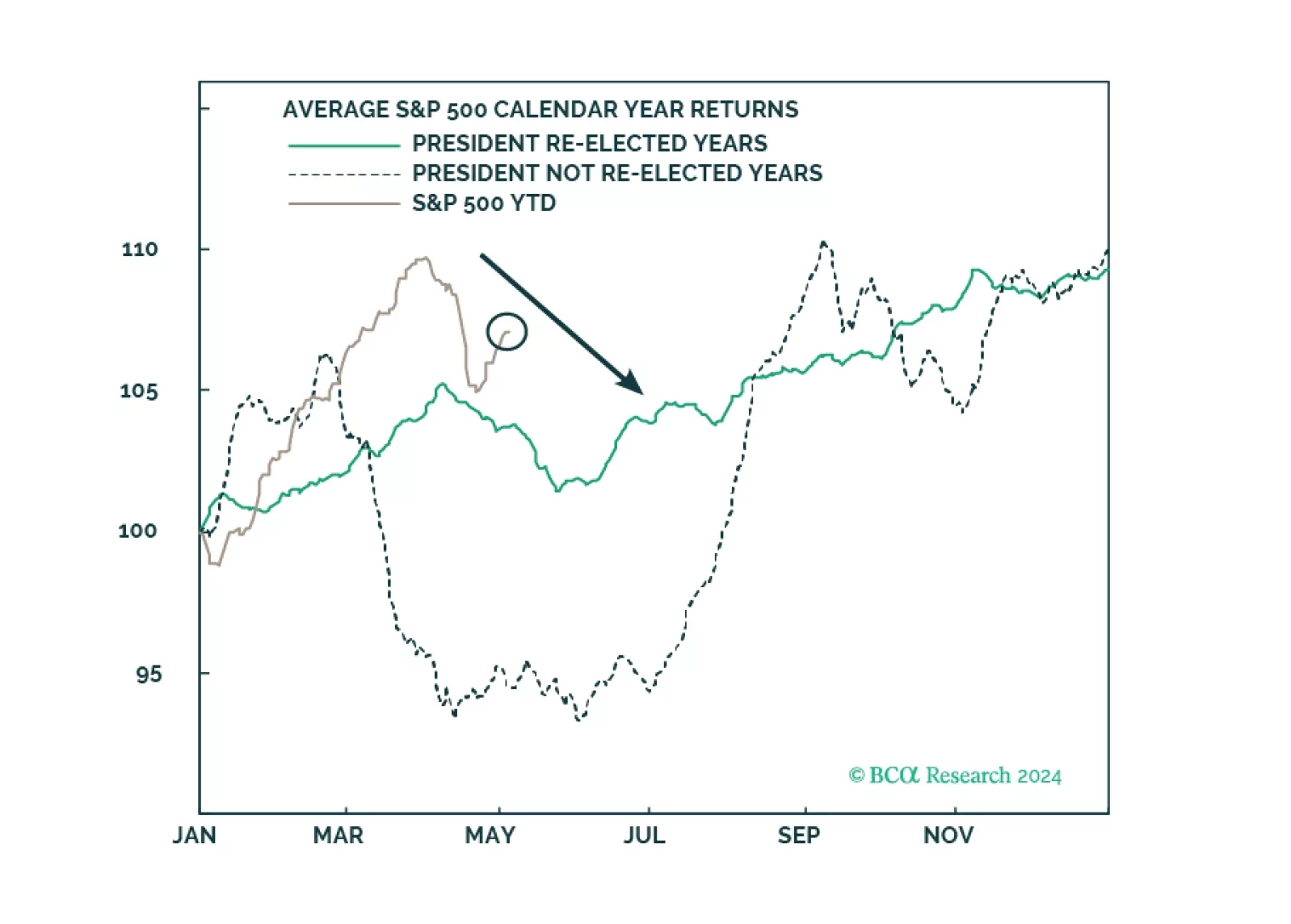

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

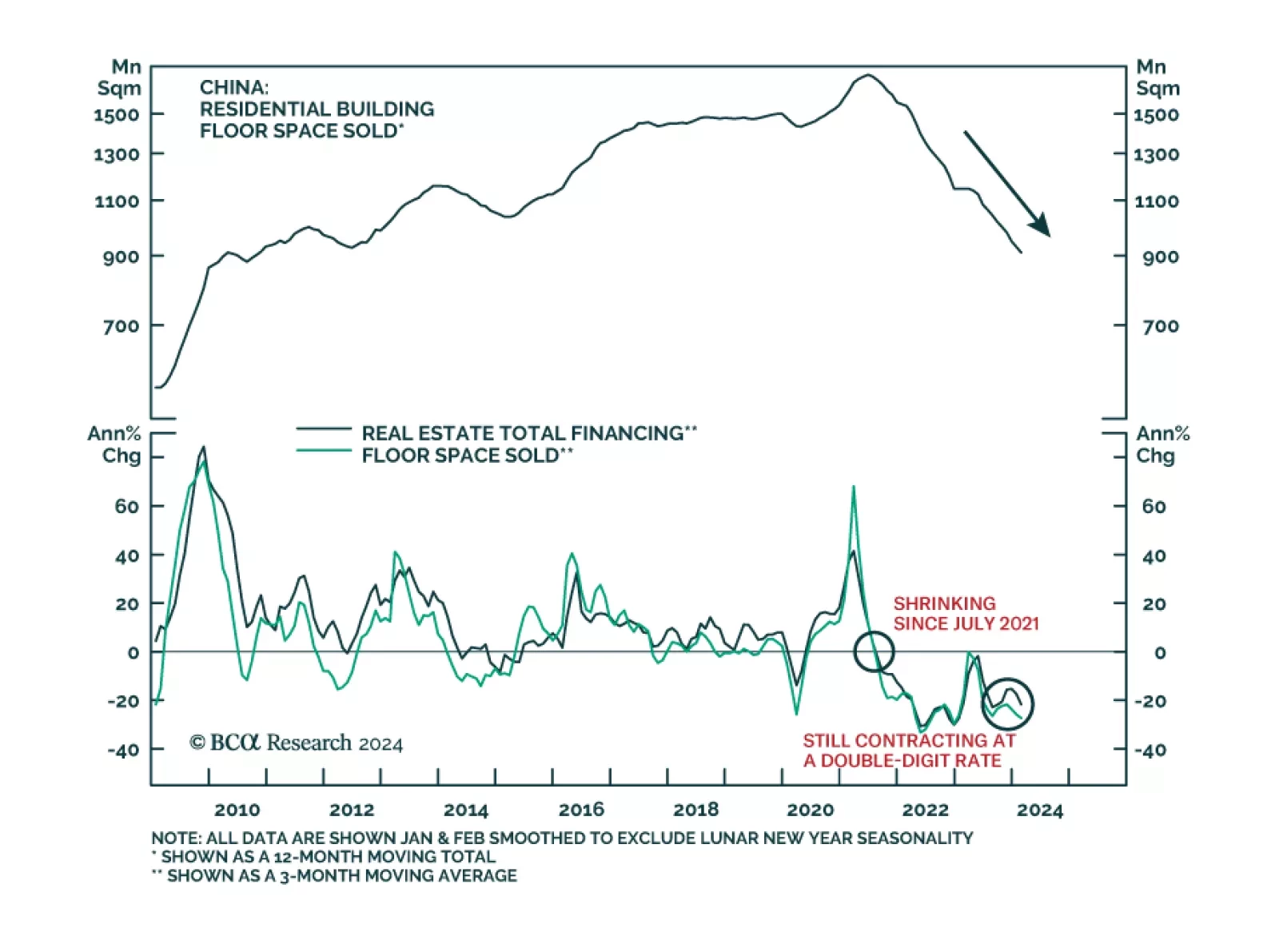

According to BCA Research’s China Investment Strategy service, the adjustment in China’s real estate sector is not over. Odds are that the property market will contract for the fourth year in a row. The property…