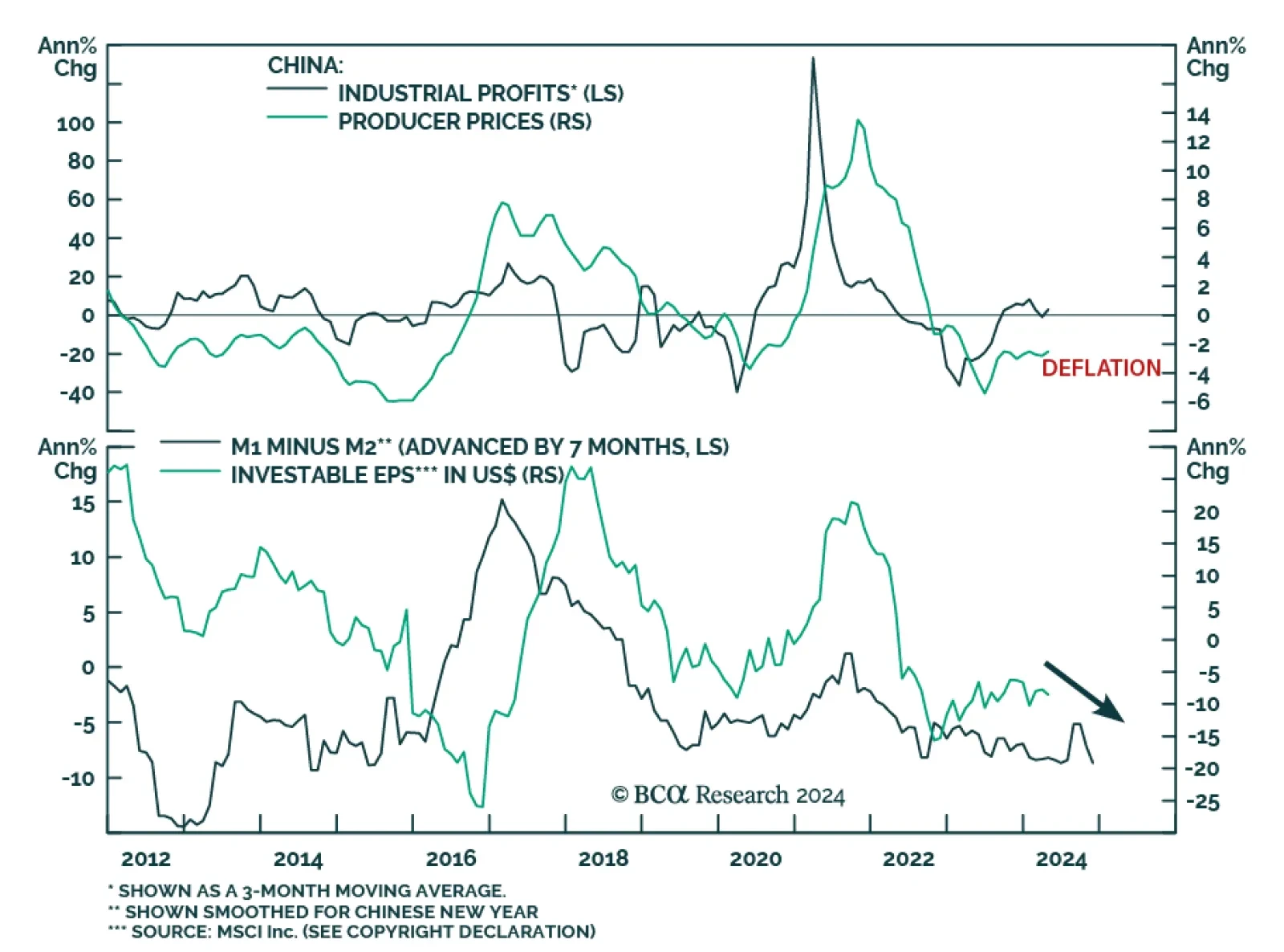

Chinese industrial profits rose by 4.0% y/y in April, from a 3.5% y/y contraction in March. They grew by 4.3% in the first four months of the year, compared to the same period in 2023. In March, the central government pledged…

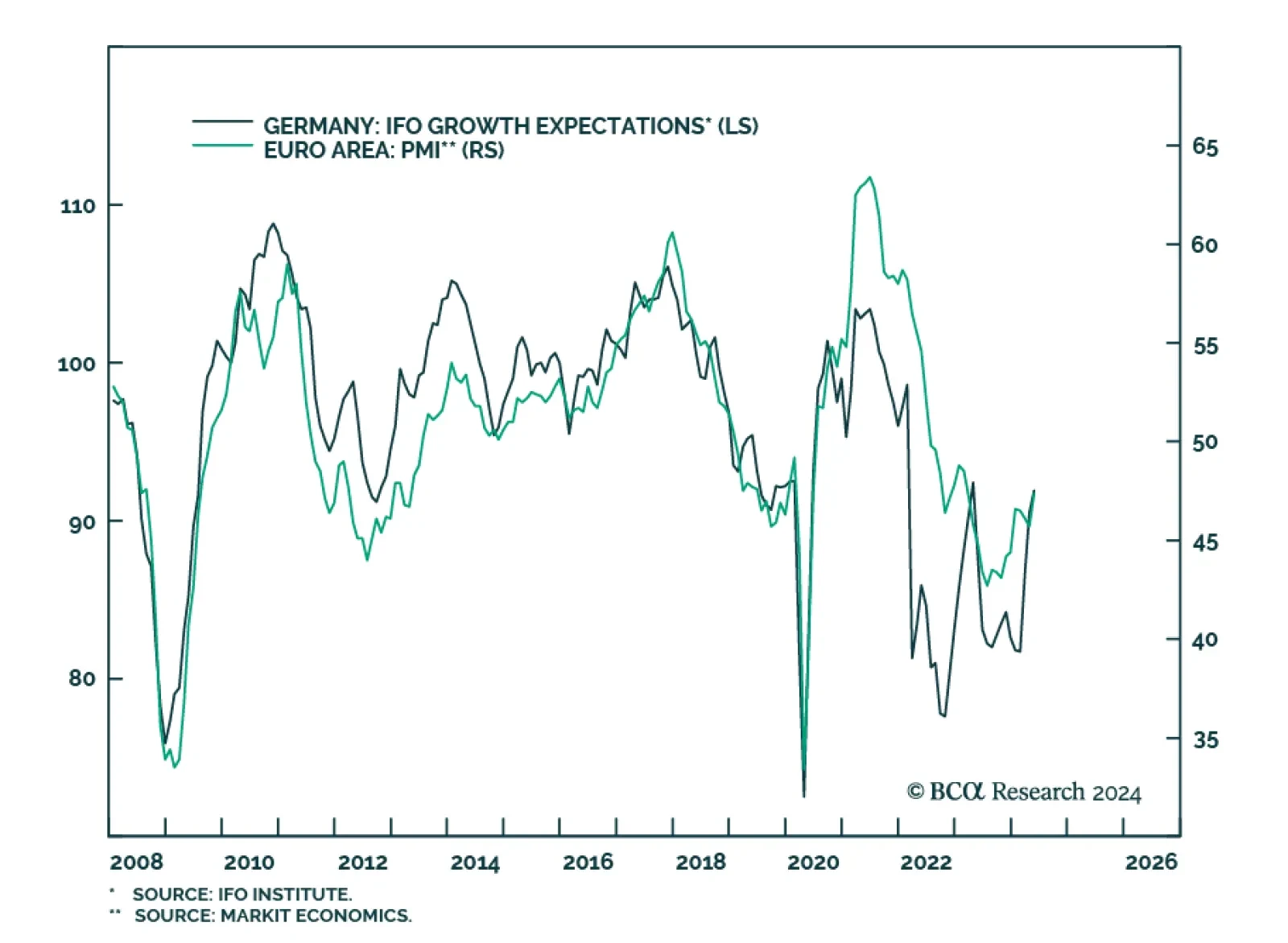

Sentiment among German companies stalled in May, after having firmed for 3 consecutive months. The IFO Business Climate came in at 89.3, unchanged from April, disappointing expectations of further strengthening to 90.4. Although…

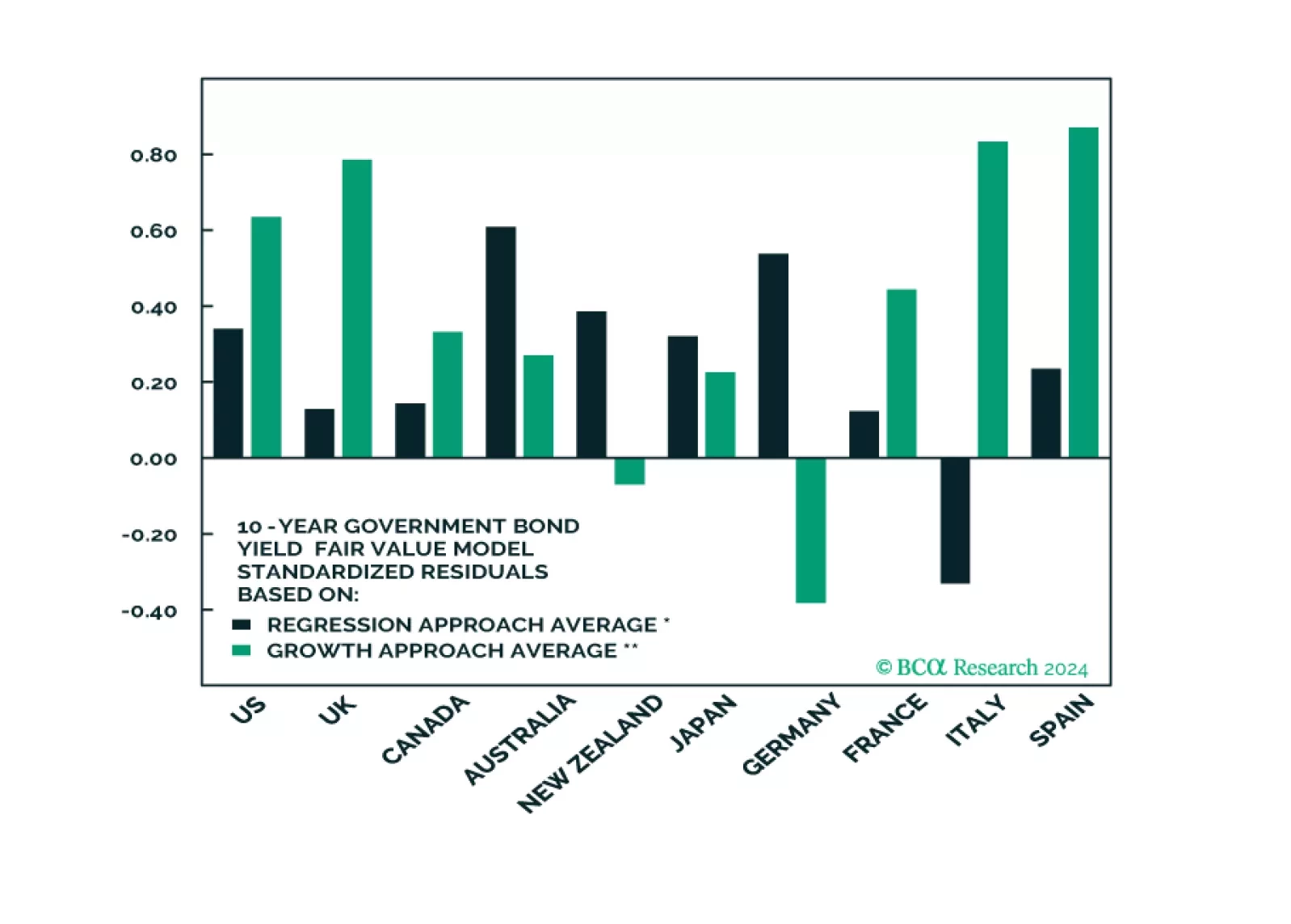

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

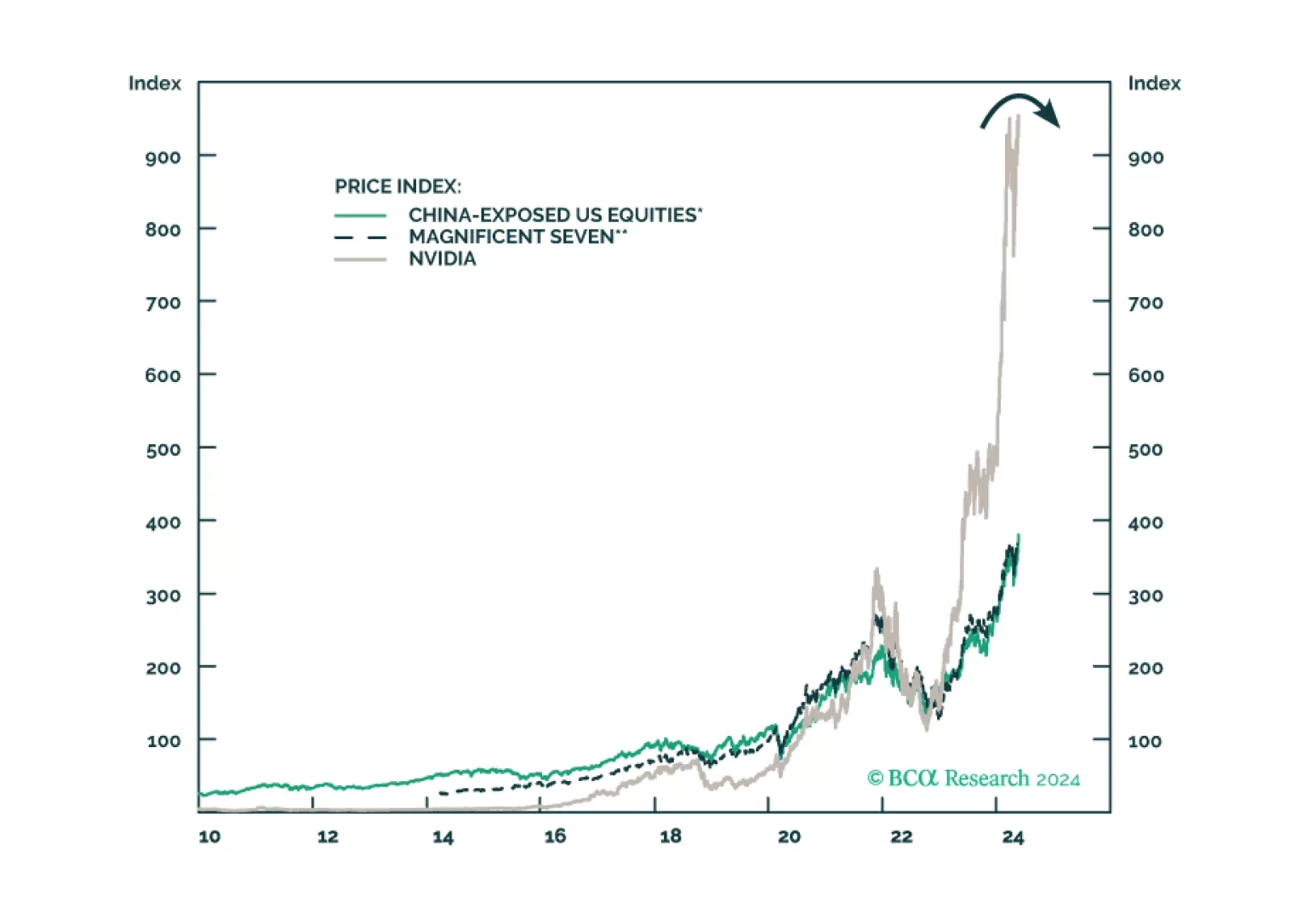

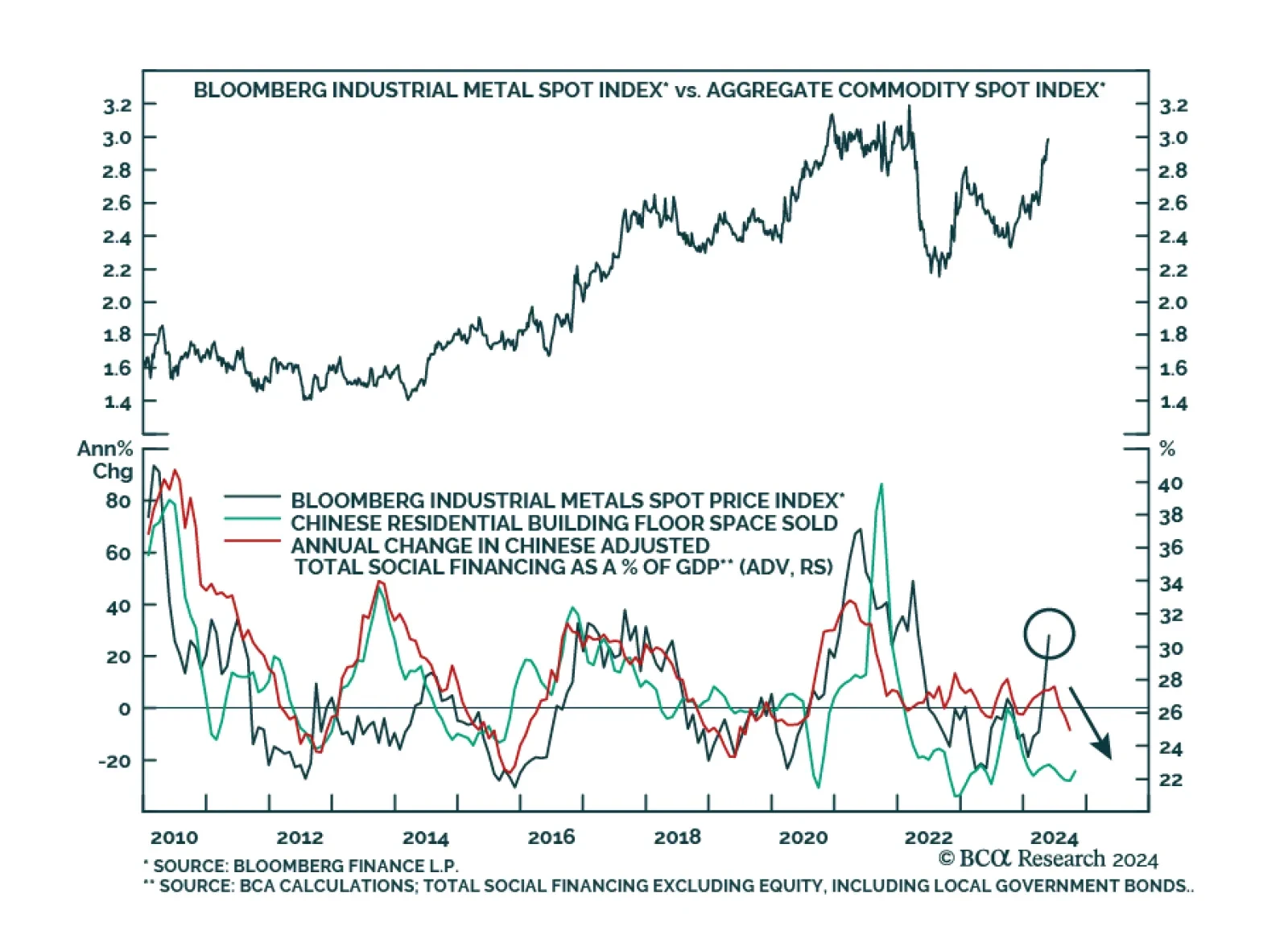

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

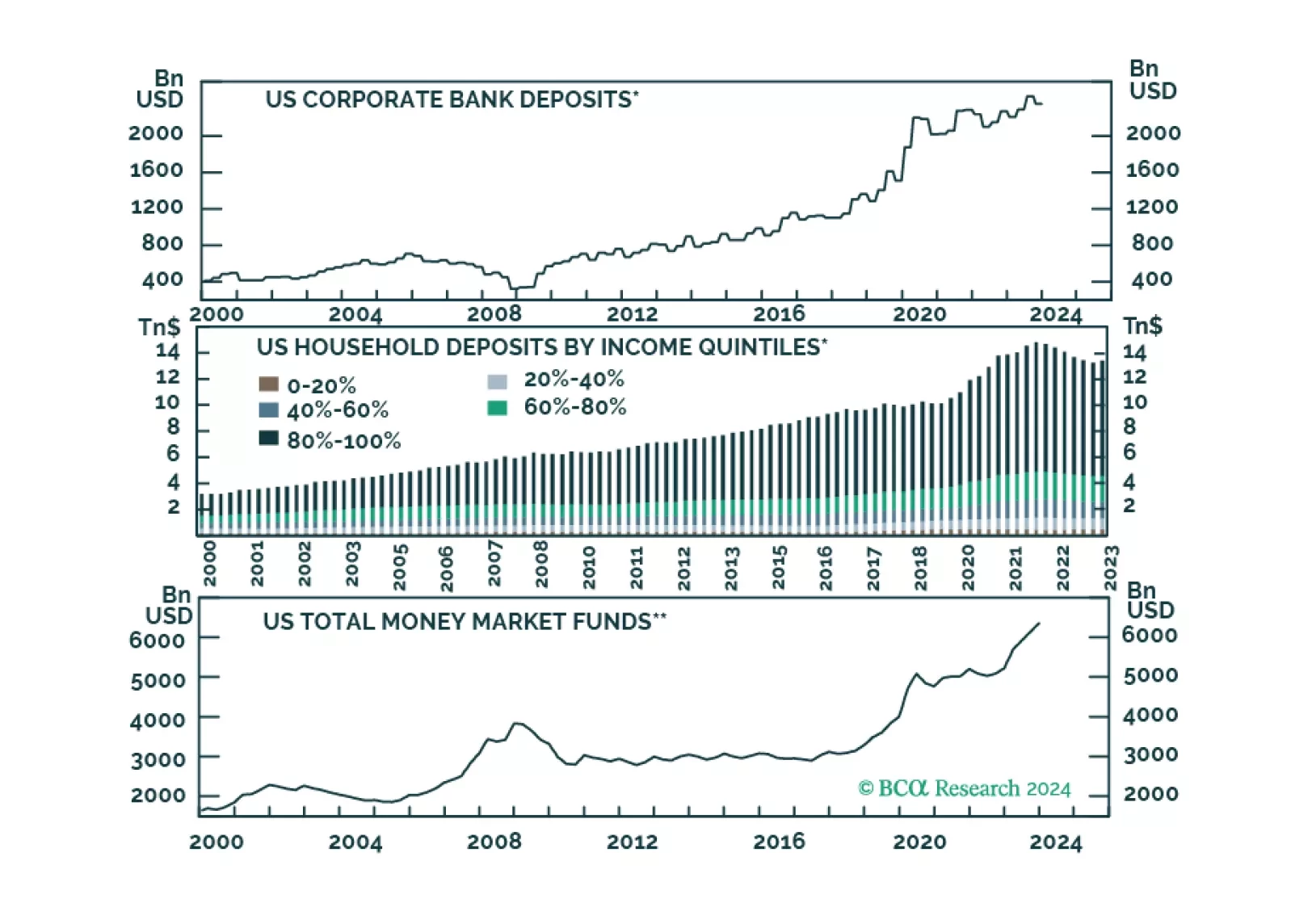

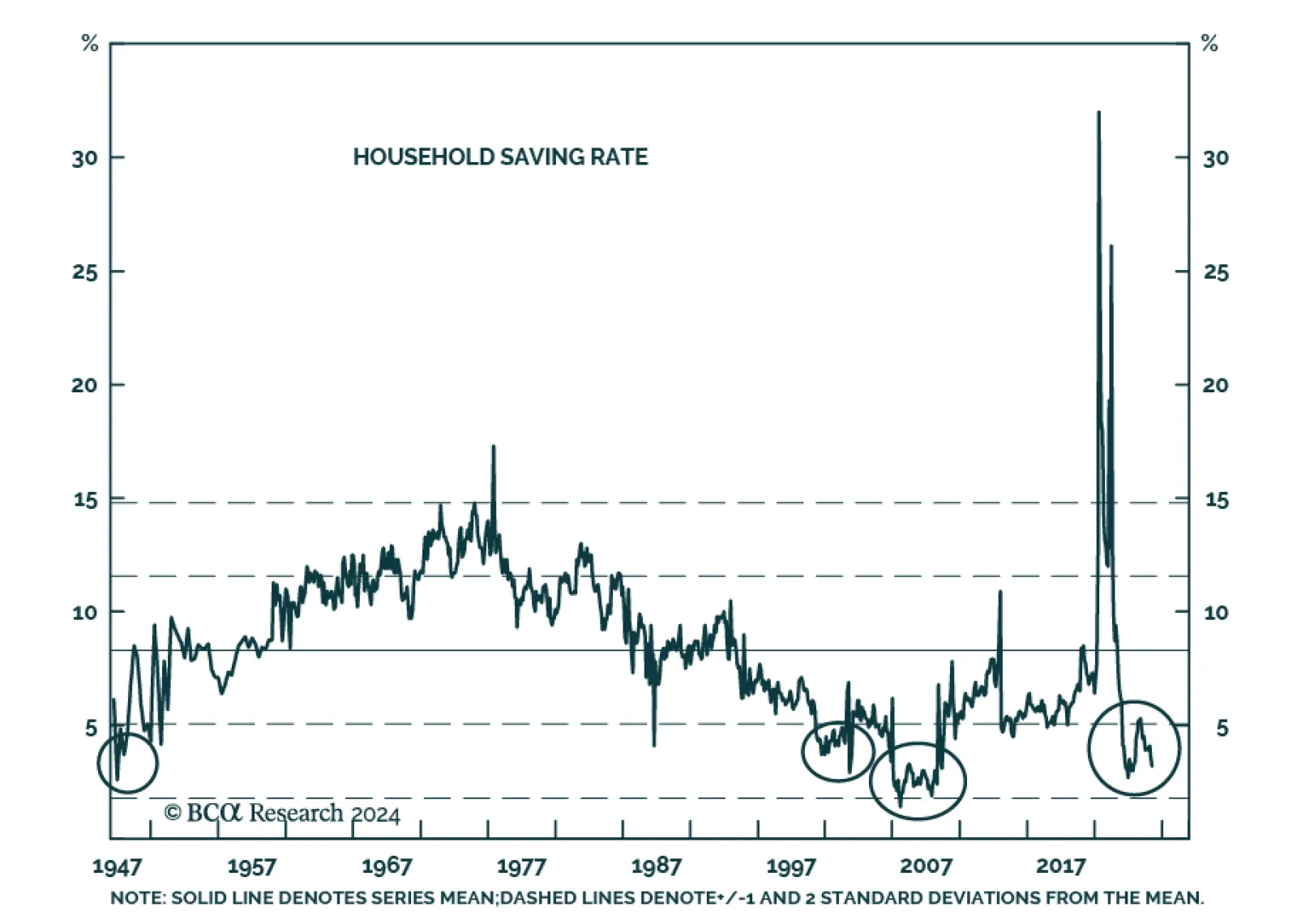

Our US Investment strategists have used the savings rate as a proxy for households’ willingness to spend. Its persistent decline suggests that consumers have been spending their pandemic-era excess savings and our…

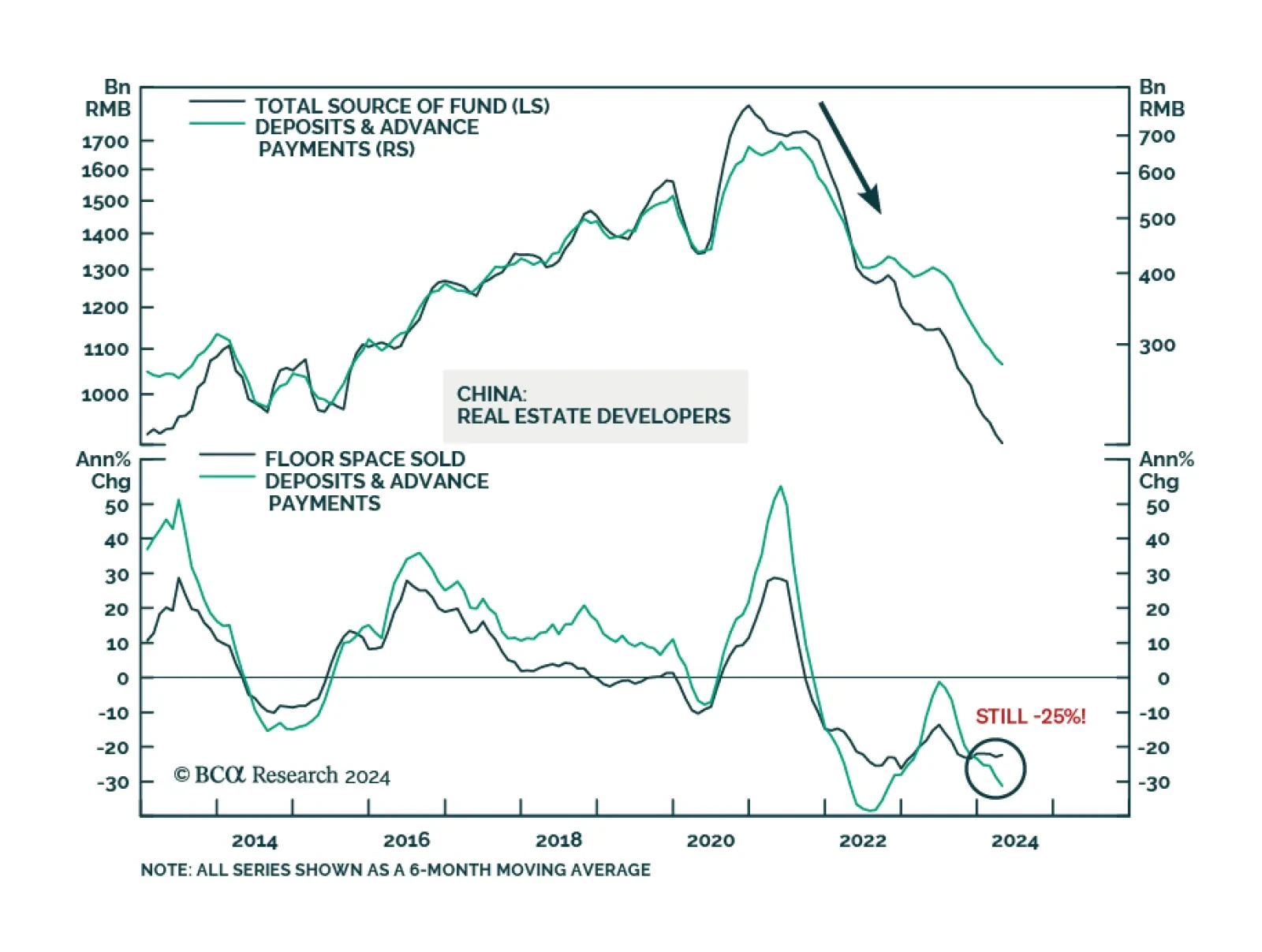

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

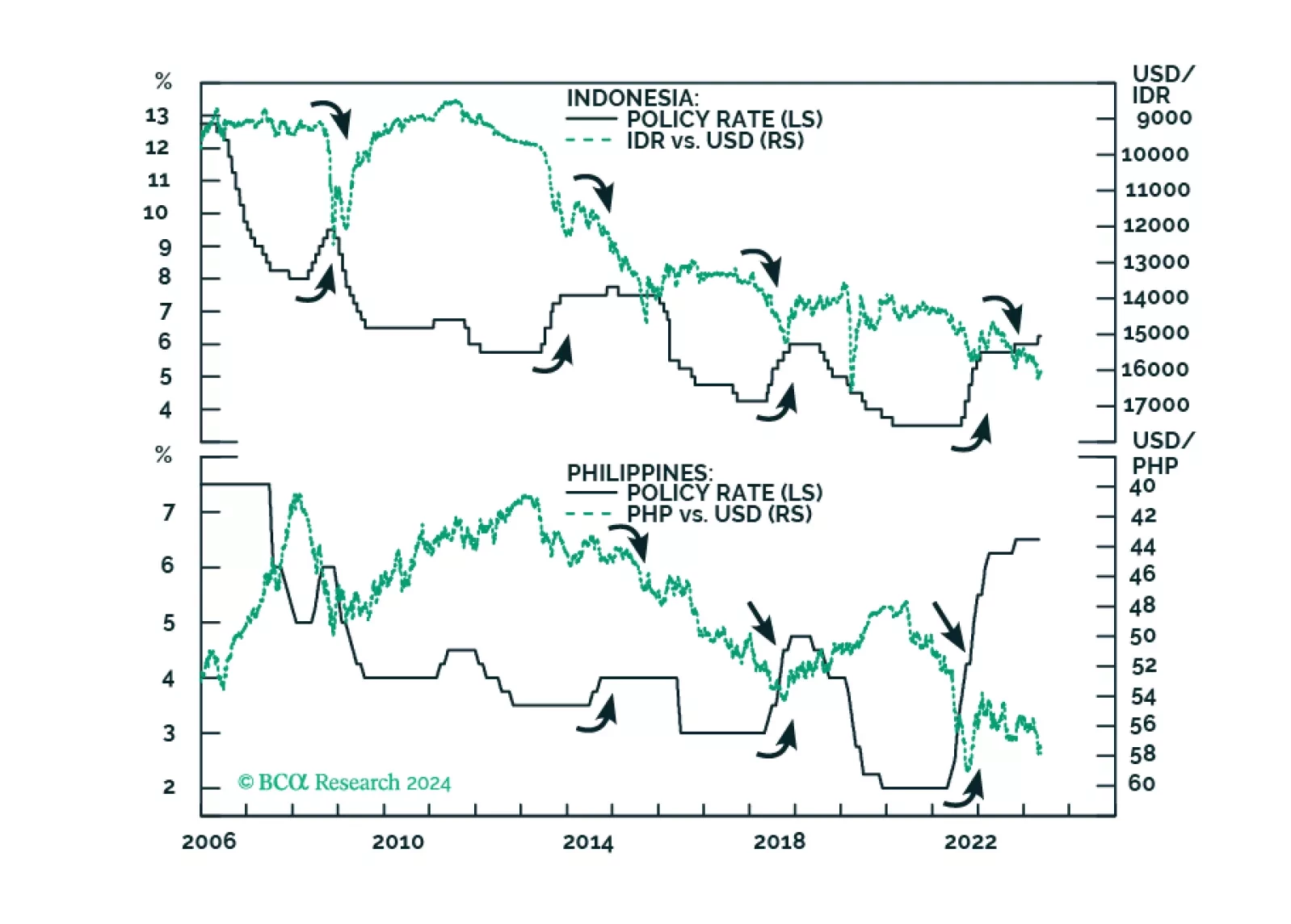

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

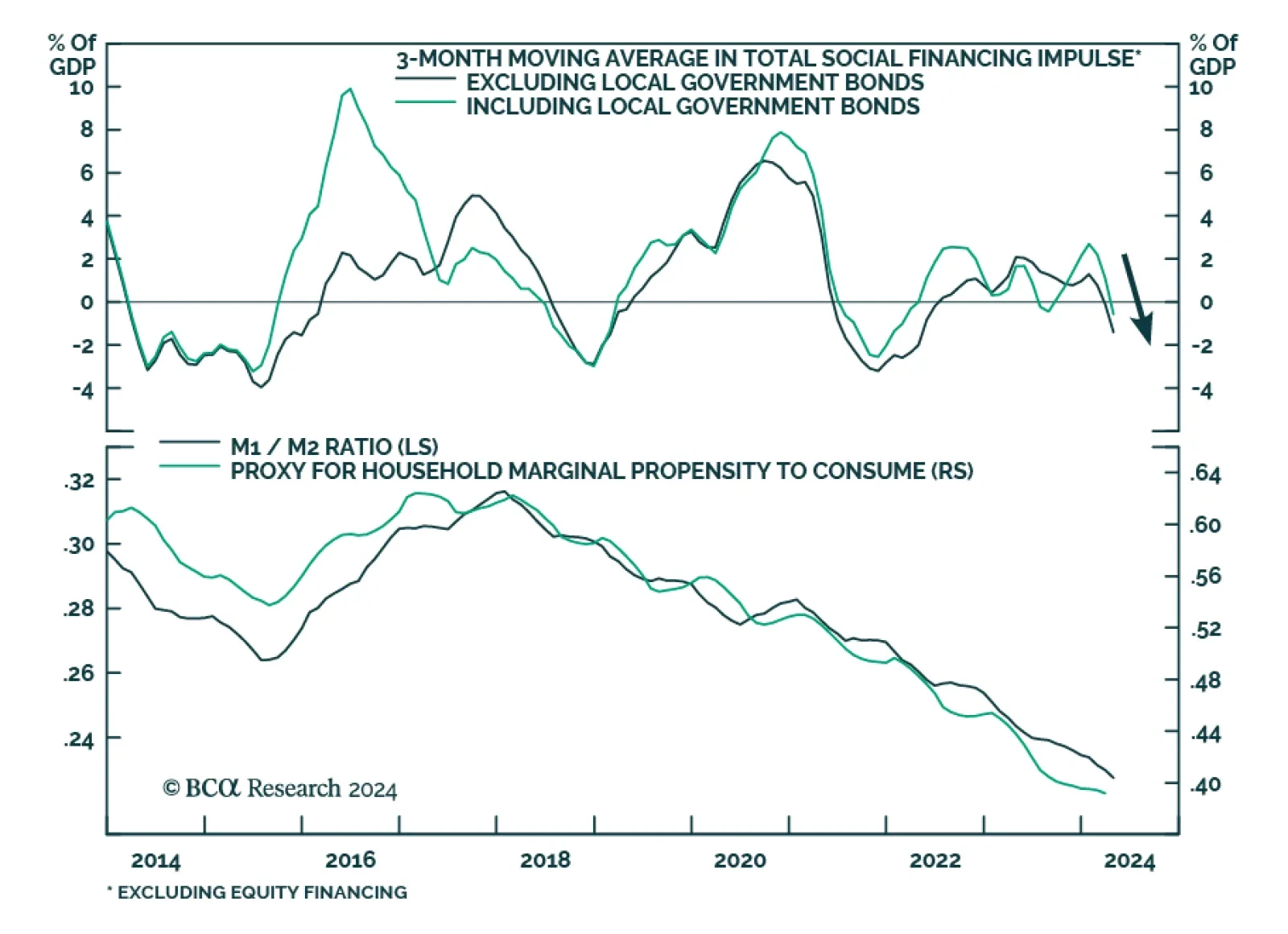

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…