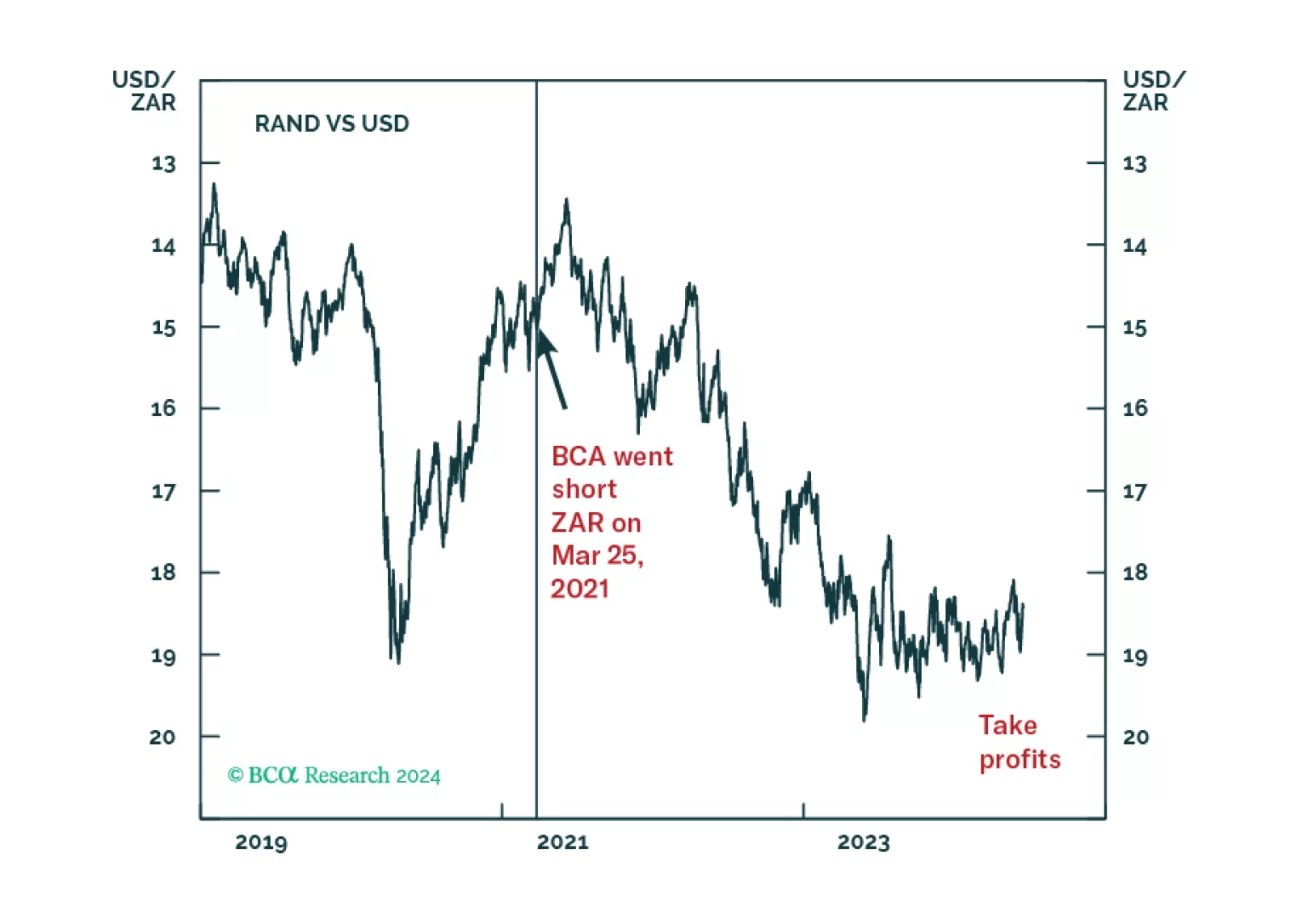

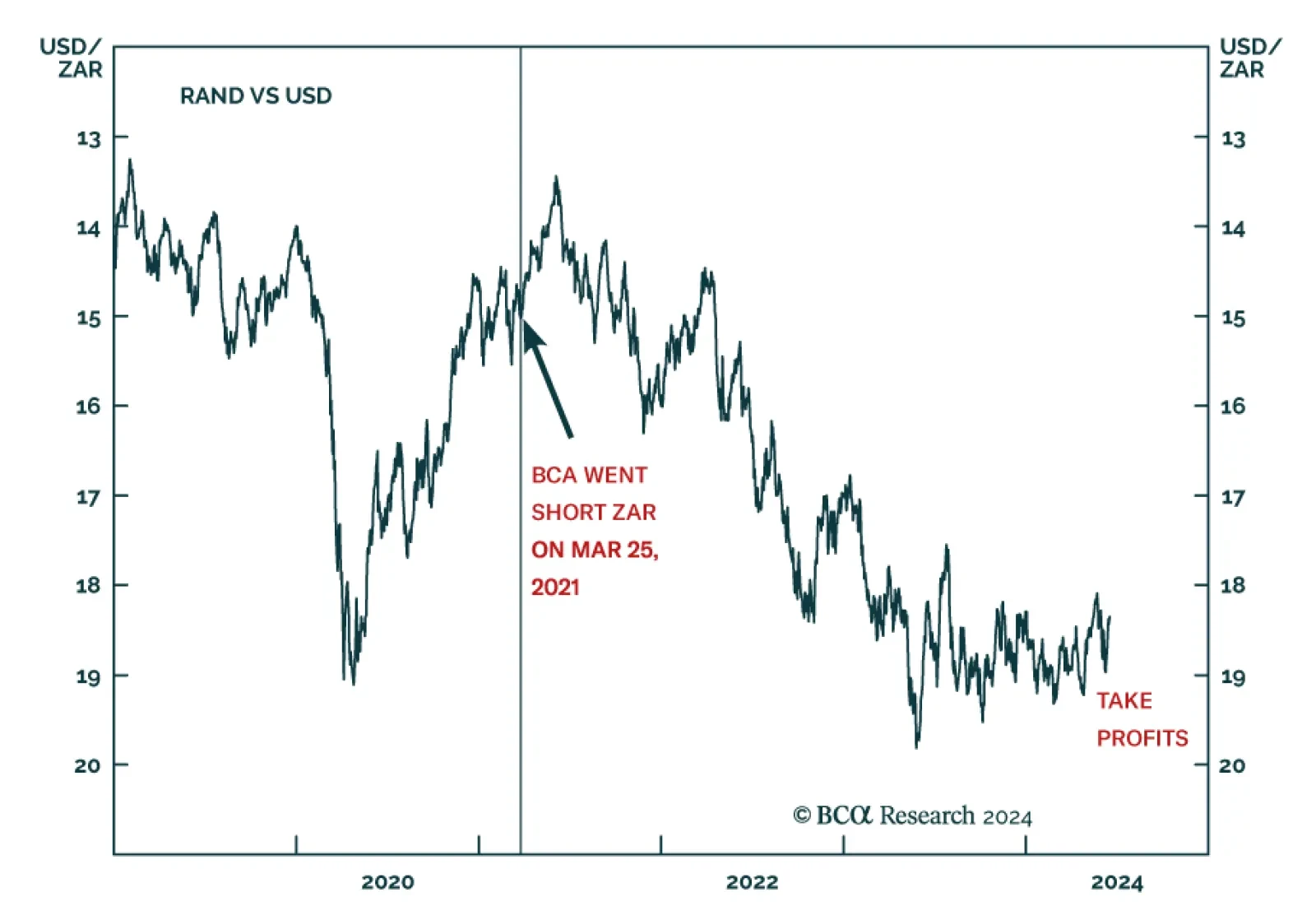

According to BCA Research’s Geopolitical Strategy service, the South African election presents a window of opportunity for productivity-boosting structural reforms, such as privatization, to coincide with monetary and…

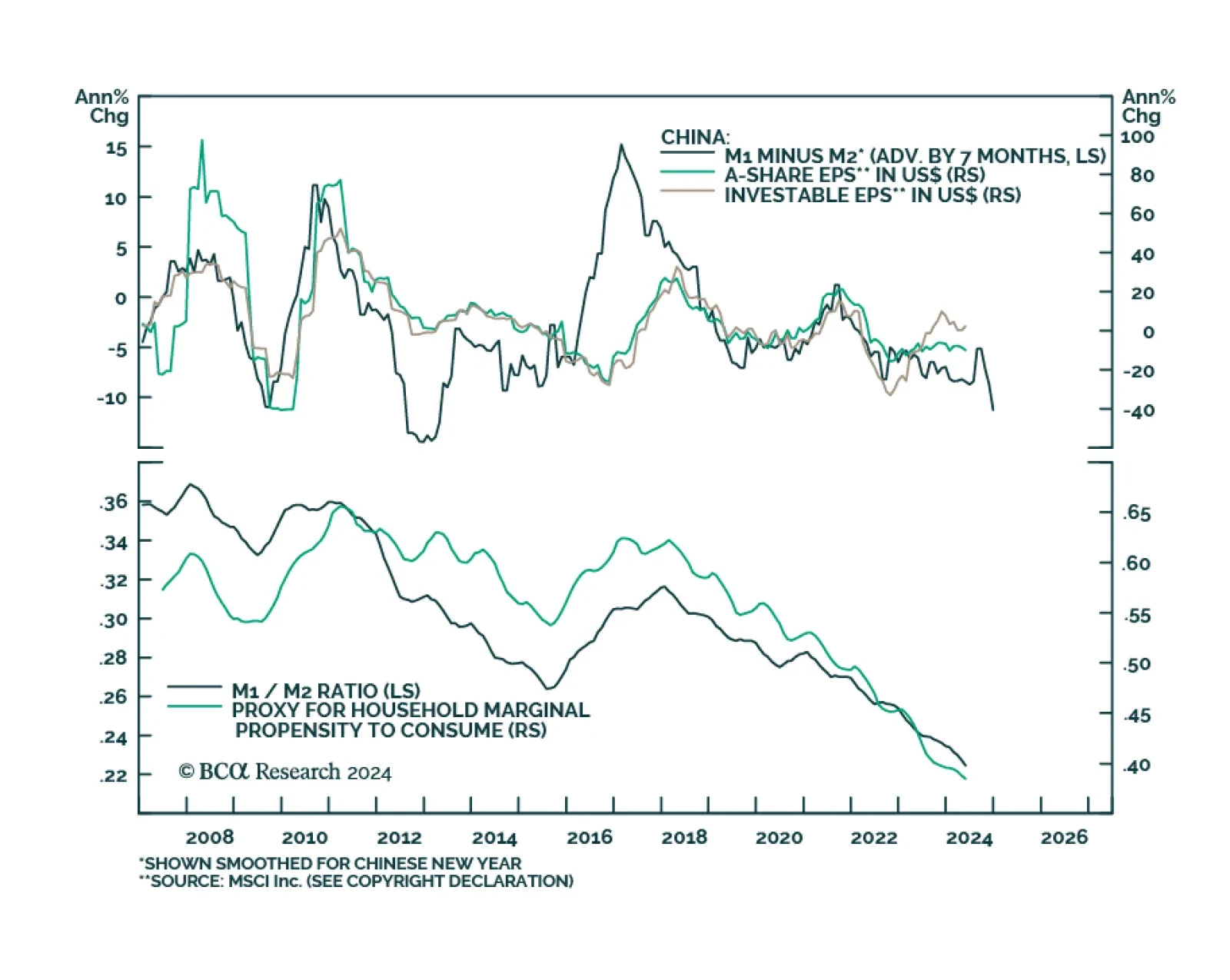

Chinese new loans grew from CNY 10.2 tr to CNY 11.1tr in May, disappointing expectations of CNY 11.3tr. Year-to-date aggregate financing also came short of anticipations, growing from CNY 12.7tr to CNY 14.8tr. Notably, the…

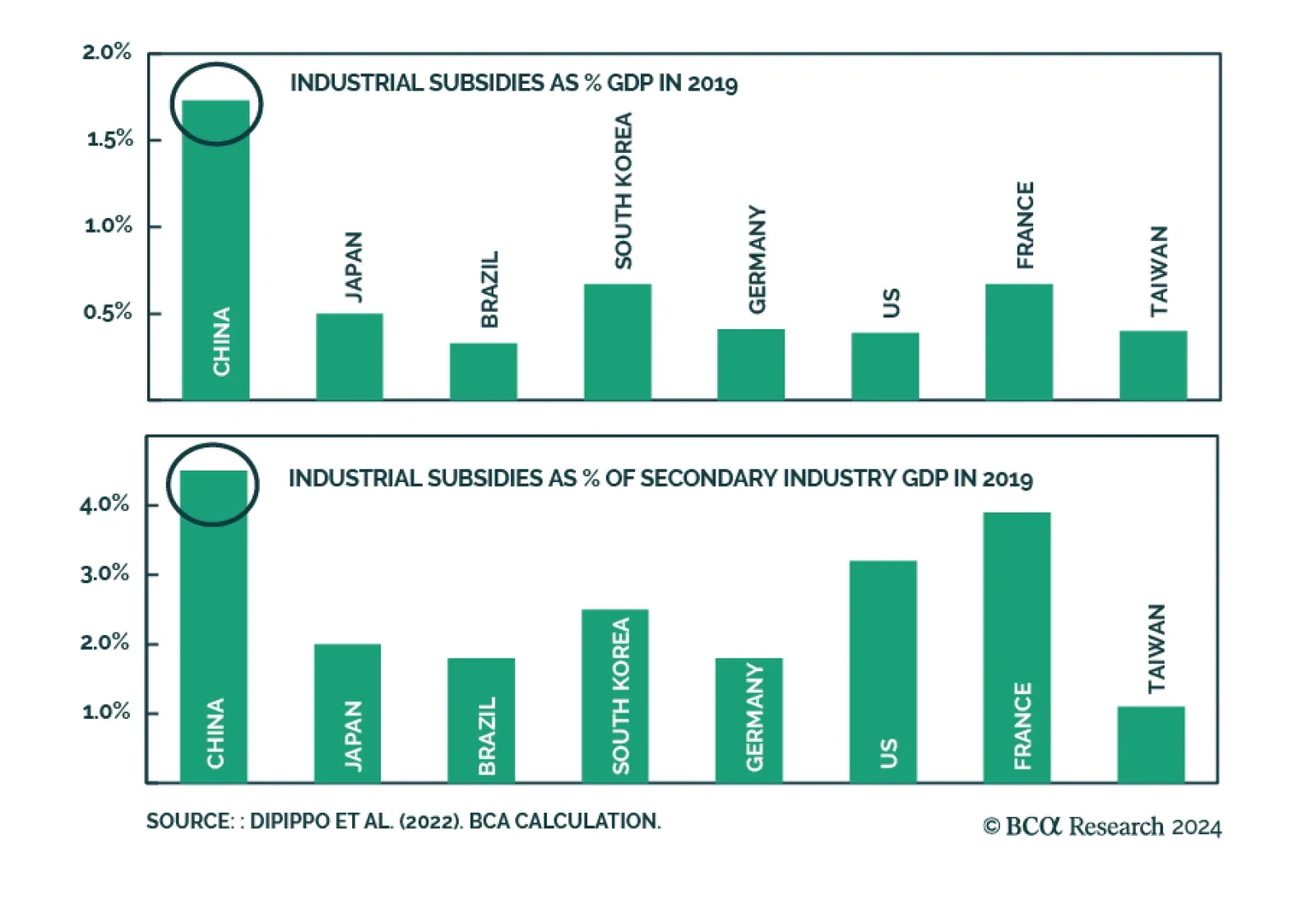

According to BCA Research’s China Investment Strategy service, it is an overstatement to assert that China’s subsidies are the main driver of its green energy industries’ competitiveness. It is commonly…

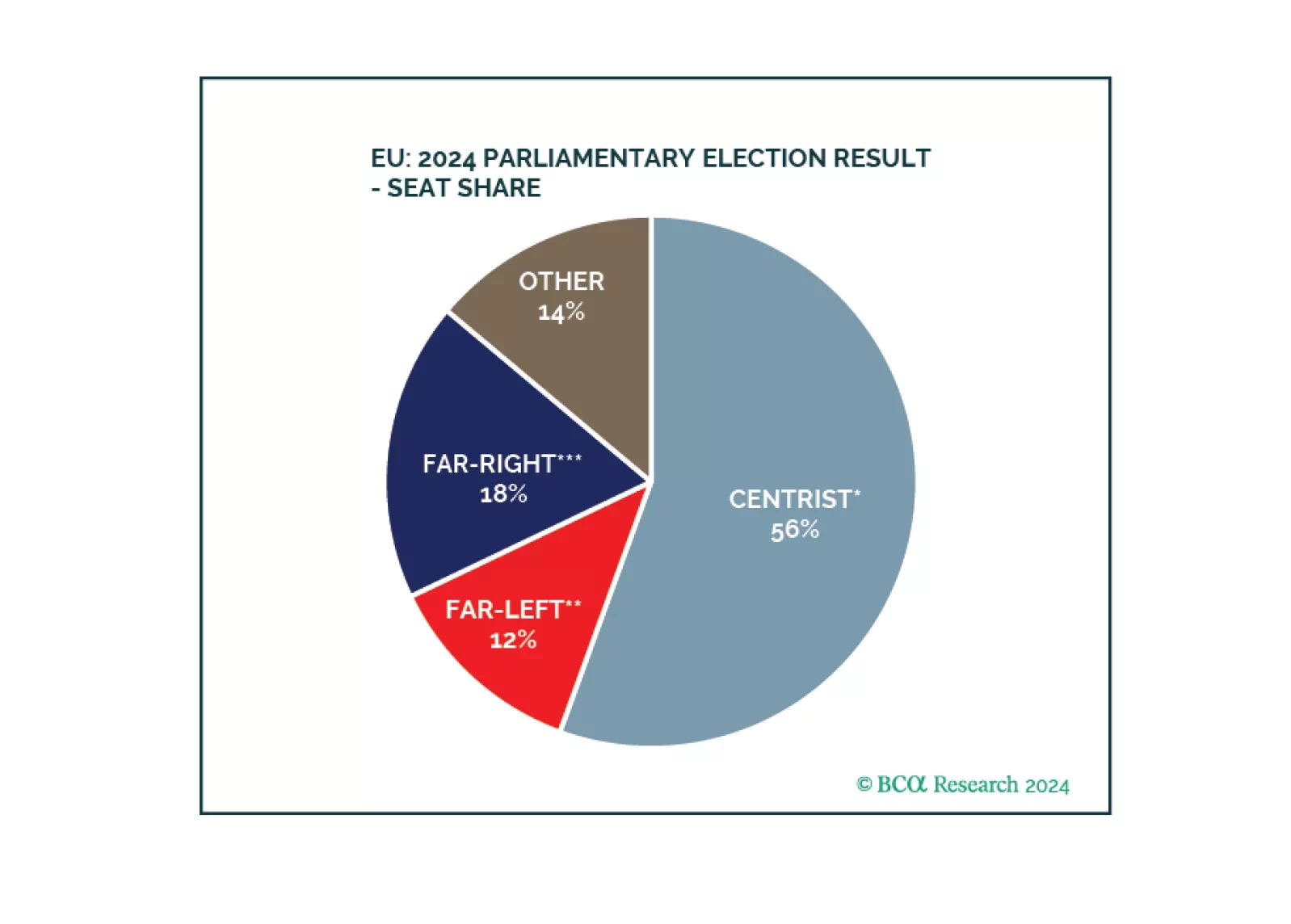

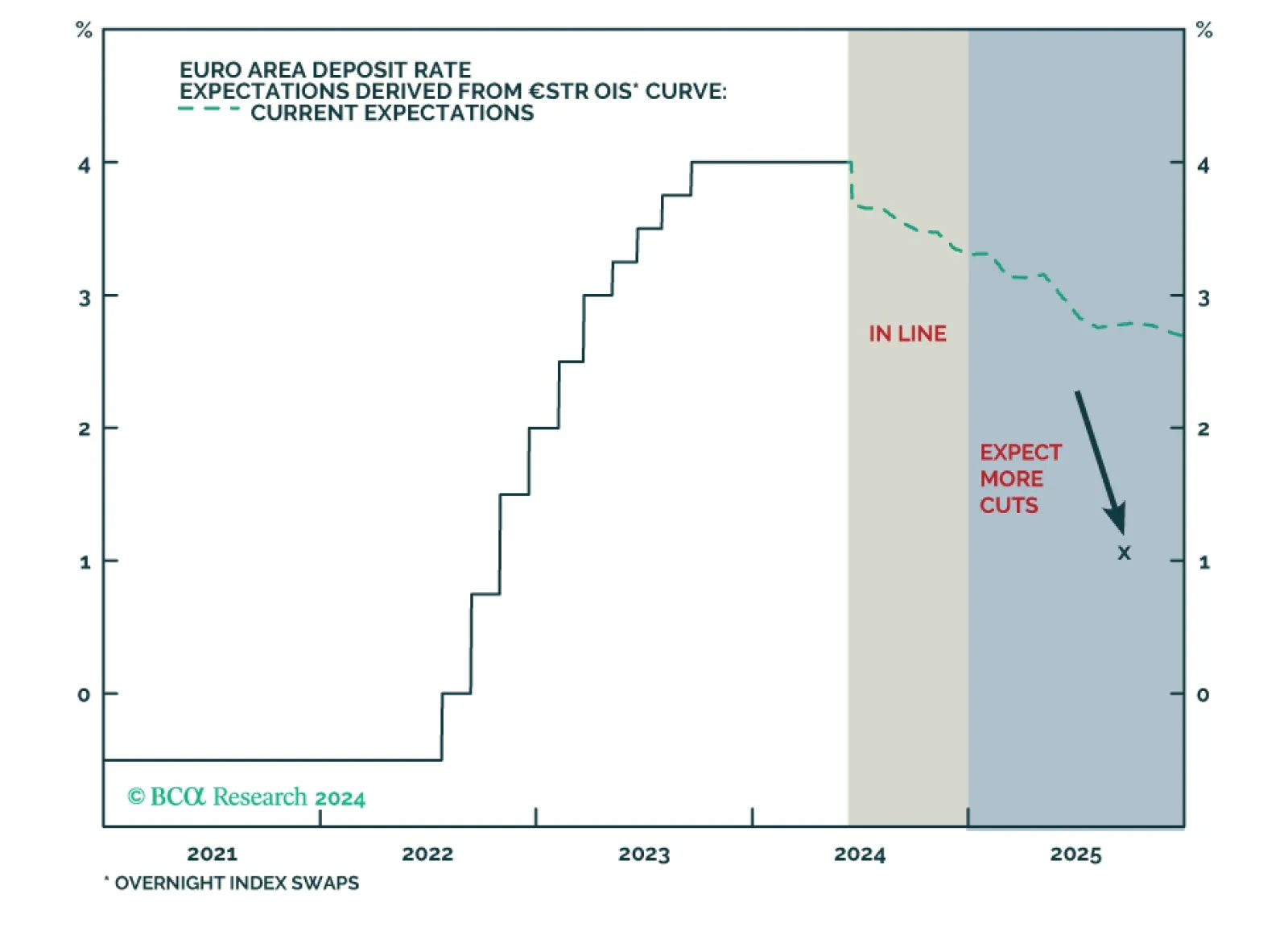

According to BCA Research’s Geopolitical Strategy service, the European parliamentary election was not an earthquake. It saw an improvement in right-leaning political groups and a deterioration in both centrist and left-…

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

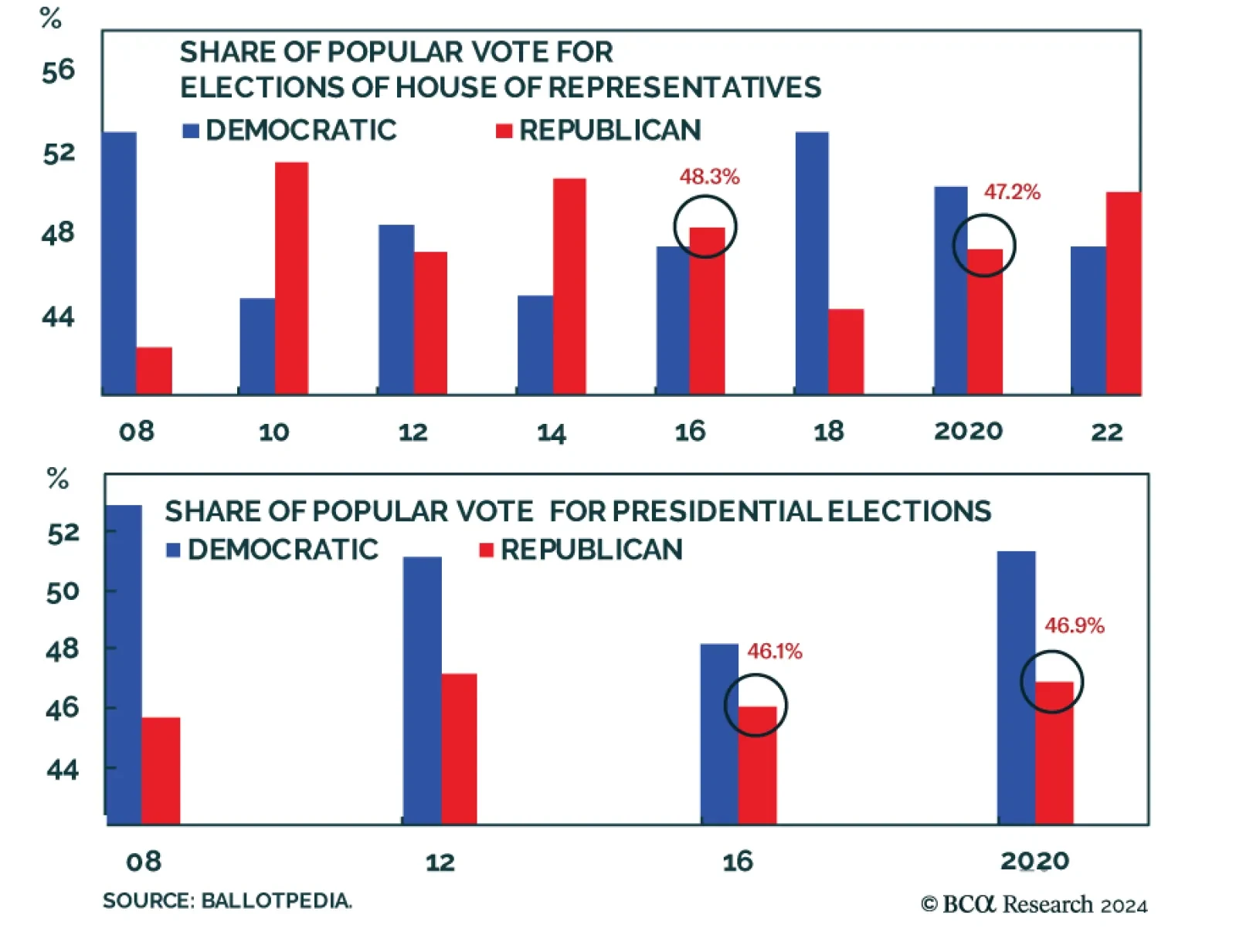

According to BCA Research’s US Political Strategy service, Republicans are more likely to win the Senate than the White House – and more likely to win either of these than the House. But Republicans are favored in…

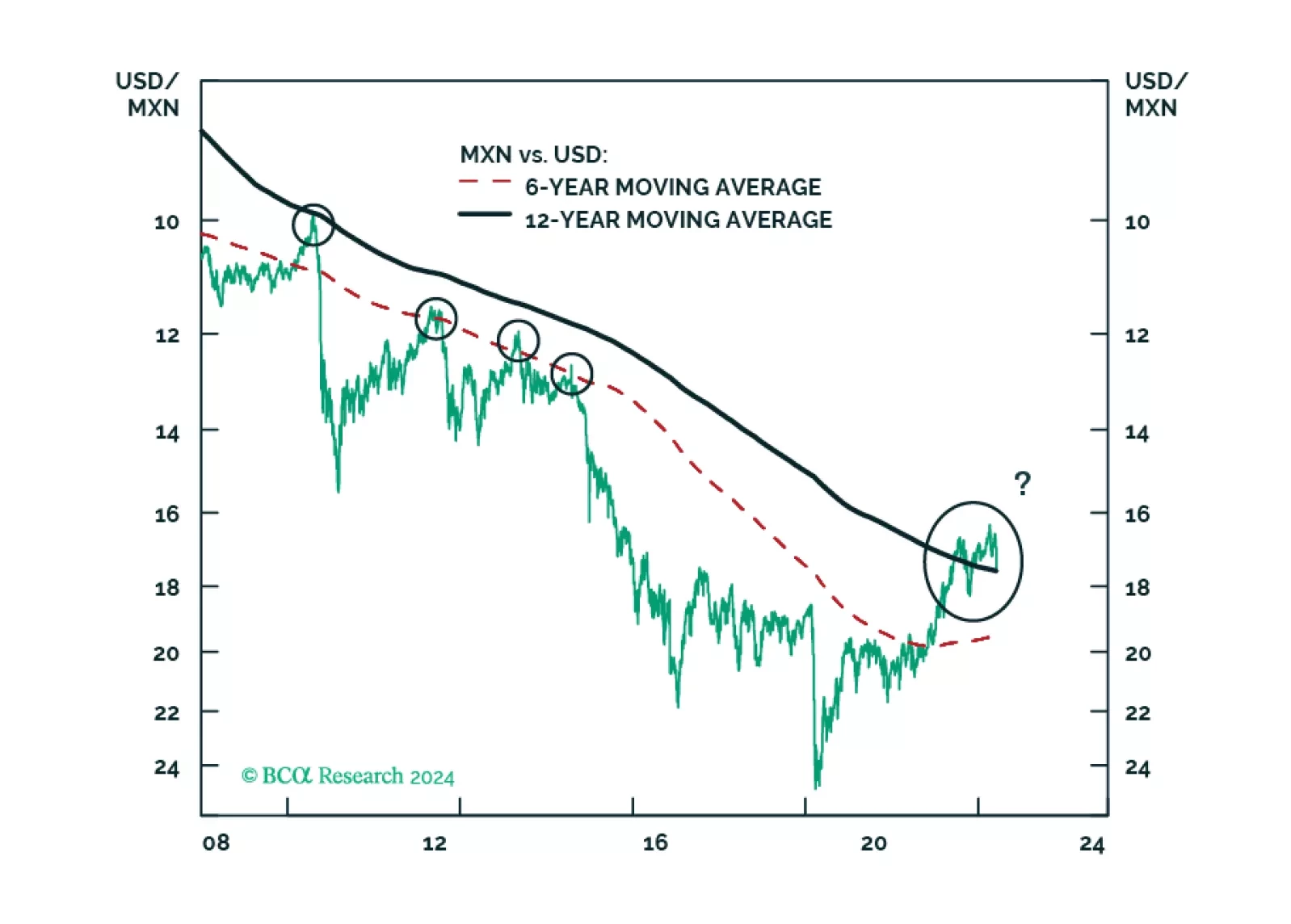

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

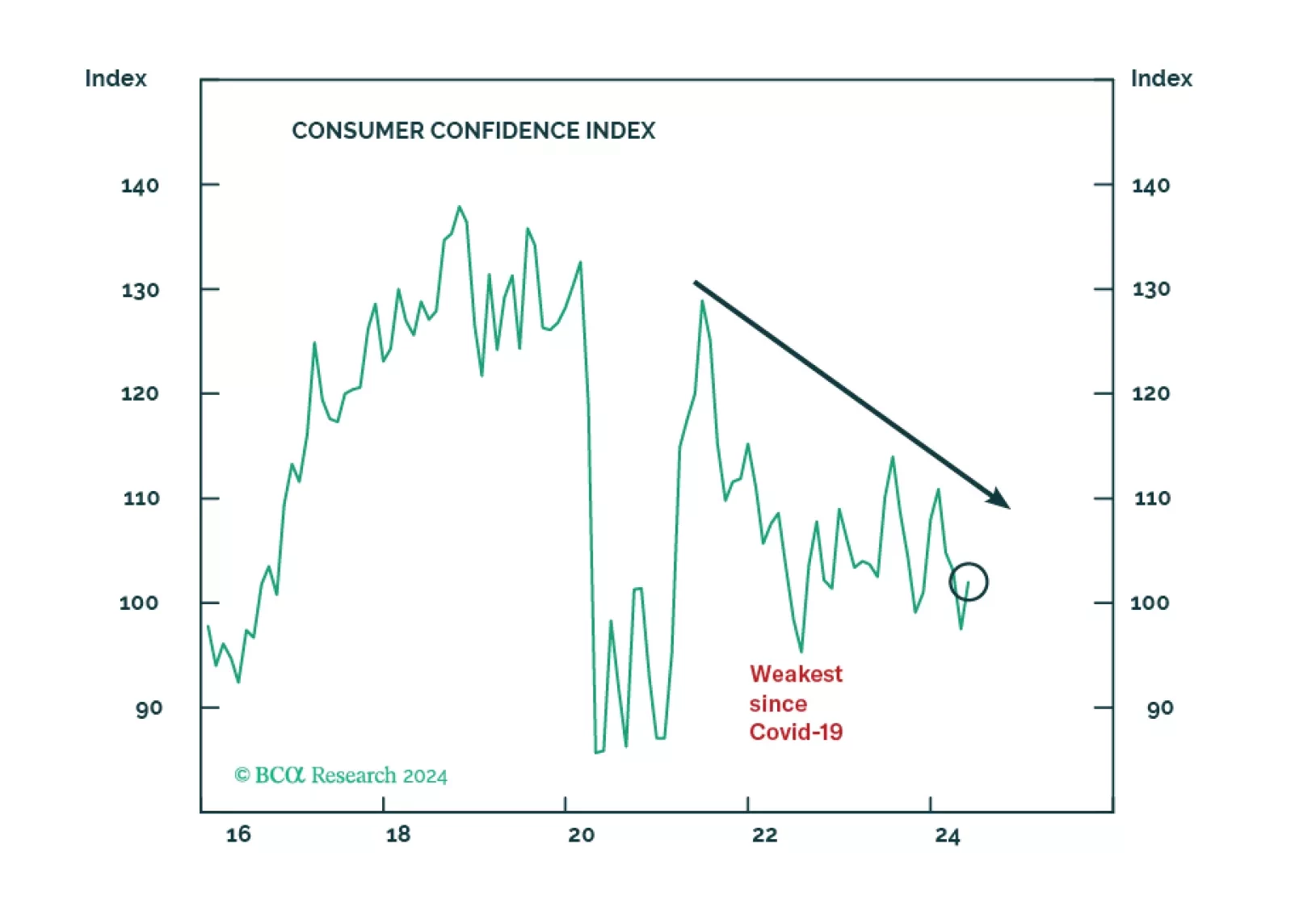

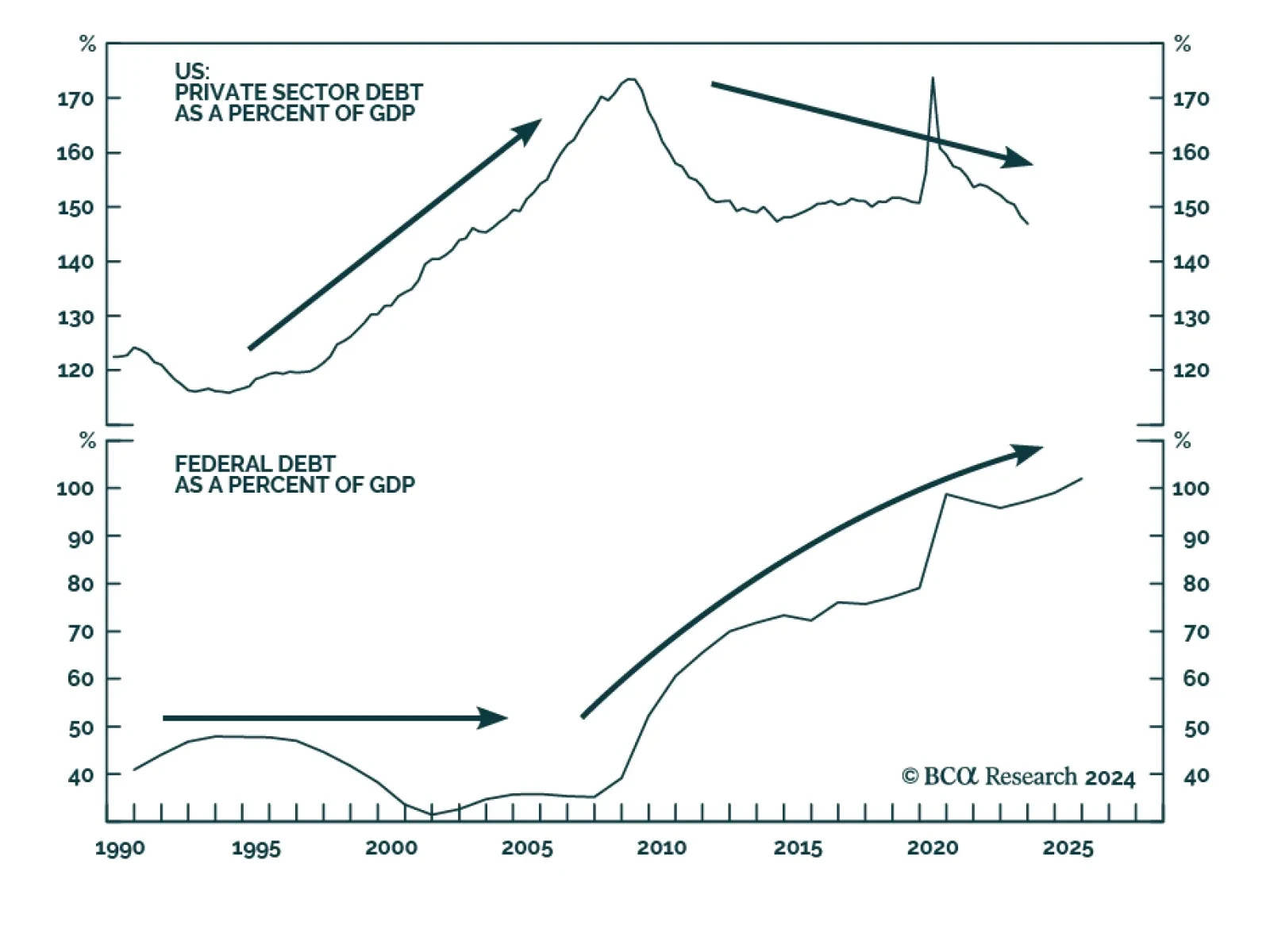

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly…

Favor defensive sectors, low-beta assets, and long-duration bonds until the election uncertainty is lifted one way or another over the next five months.