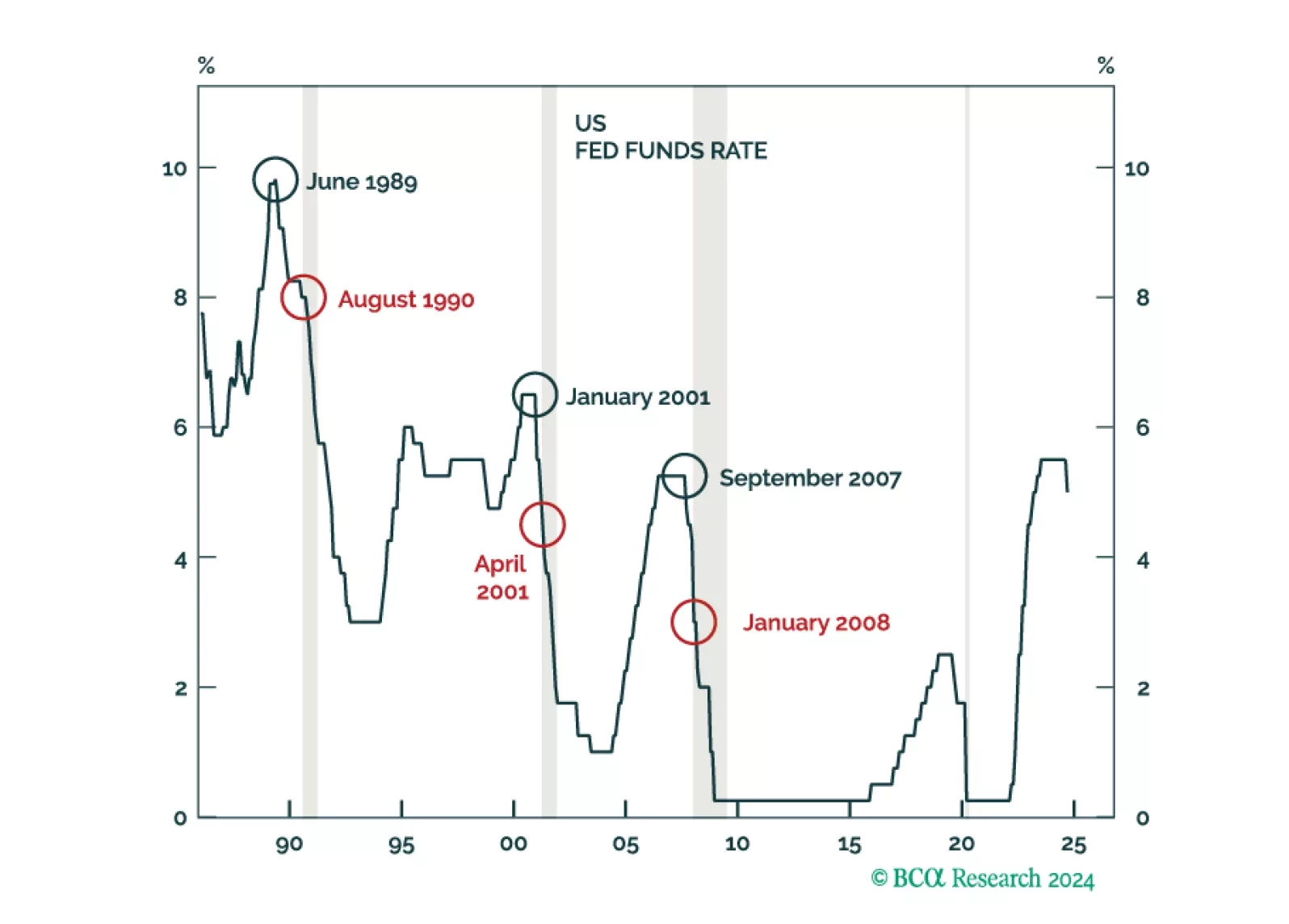

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

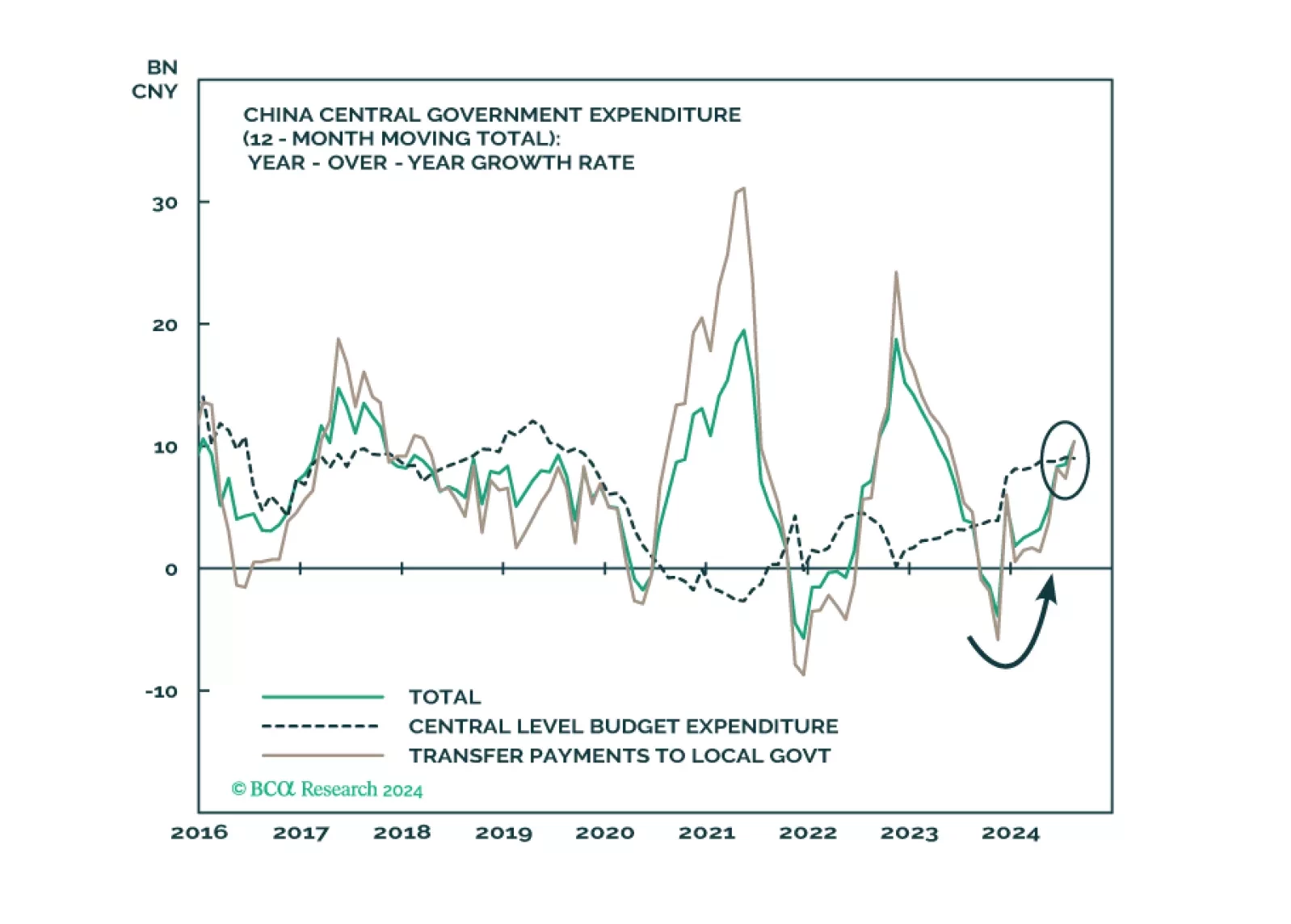

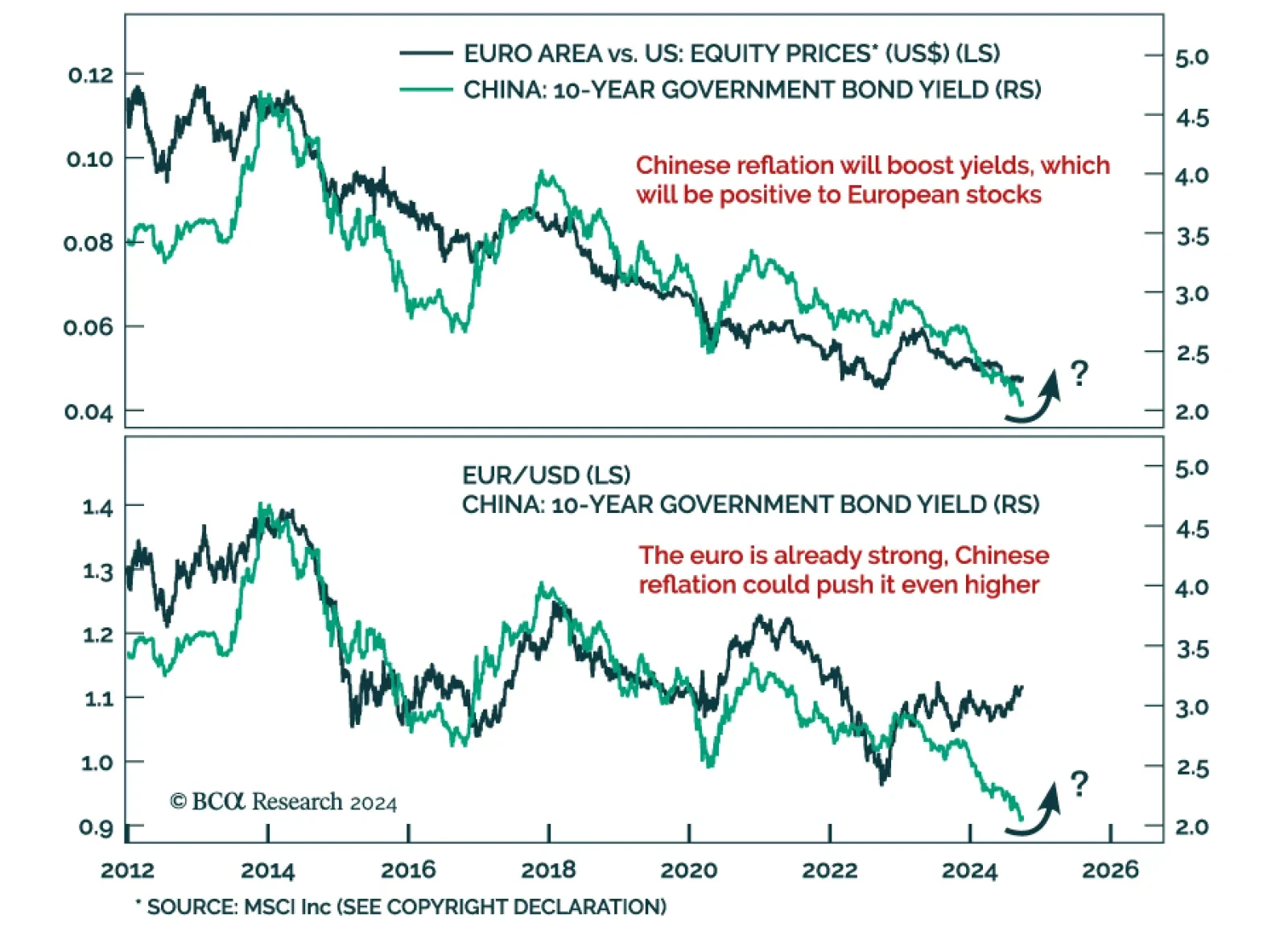

According to BCA Research’s European Investment Strategy service, the surprise fiscal announcement from China’s Politburo is a very different animal from previous stimulus attempts. Although the details are still…

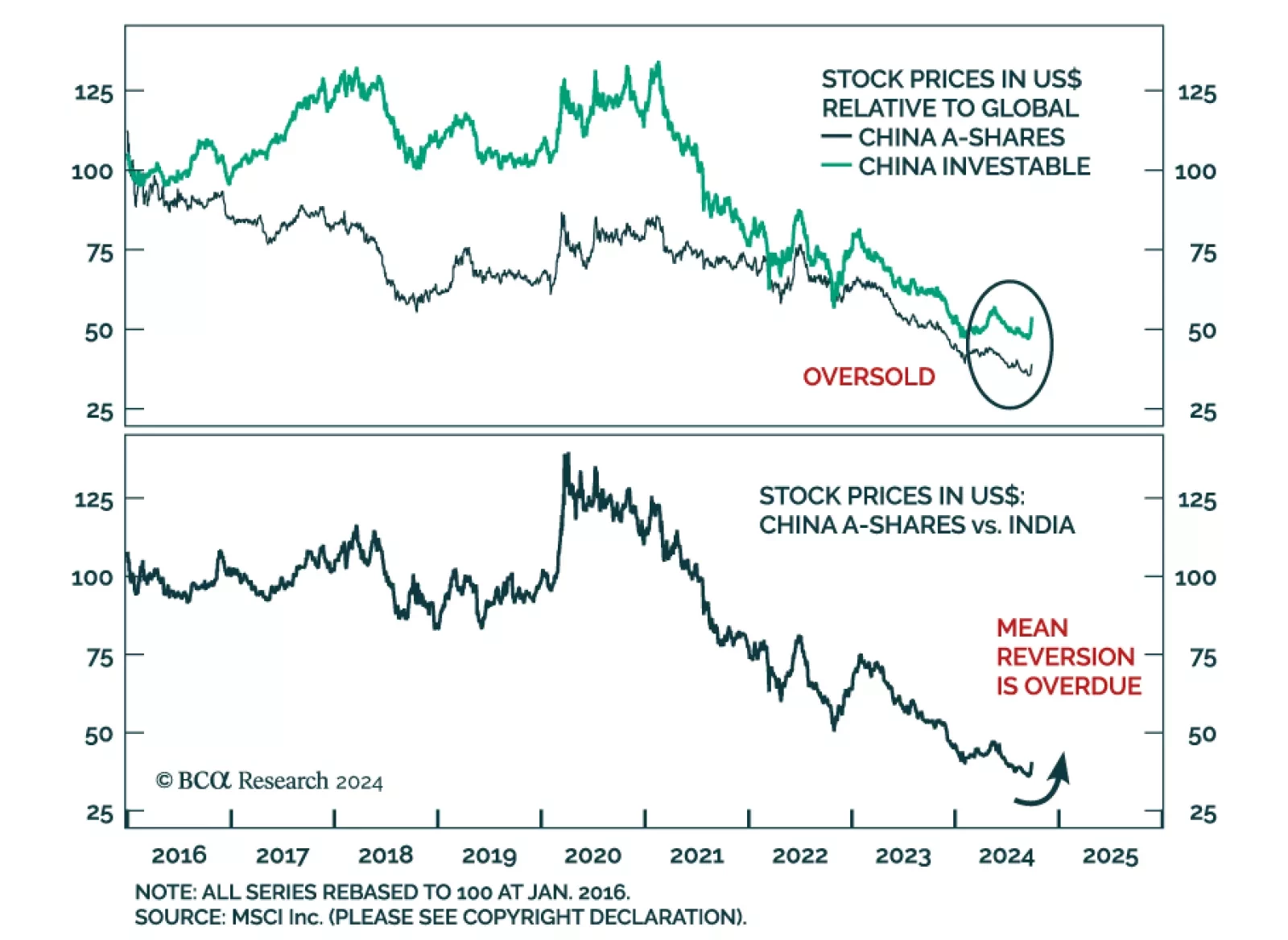

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

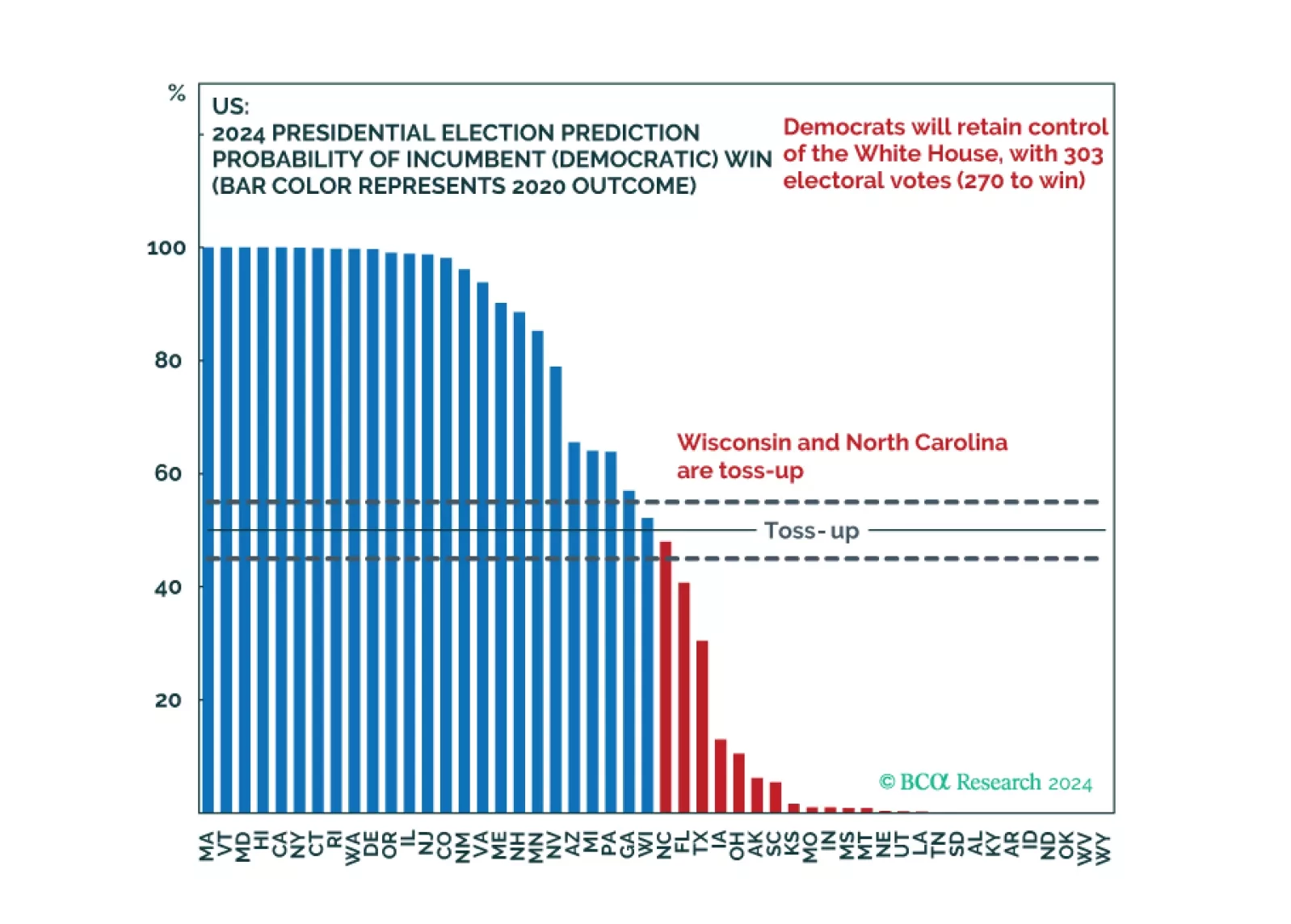

Our quant model shows Democrats winning the election at a 56% probability, with 303 electoral college votes. But swing state economies are slowing and Democrats’ odds in Michigan fell. Trump can win with Georgia, Michigan, plus one…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

BCA Research’s Geopolitical Strategy service introduced a Global Political Capital Index. Investors should favor countries with newly elected government, small government size, and ample room to cut policy rate. Ideally,…

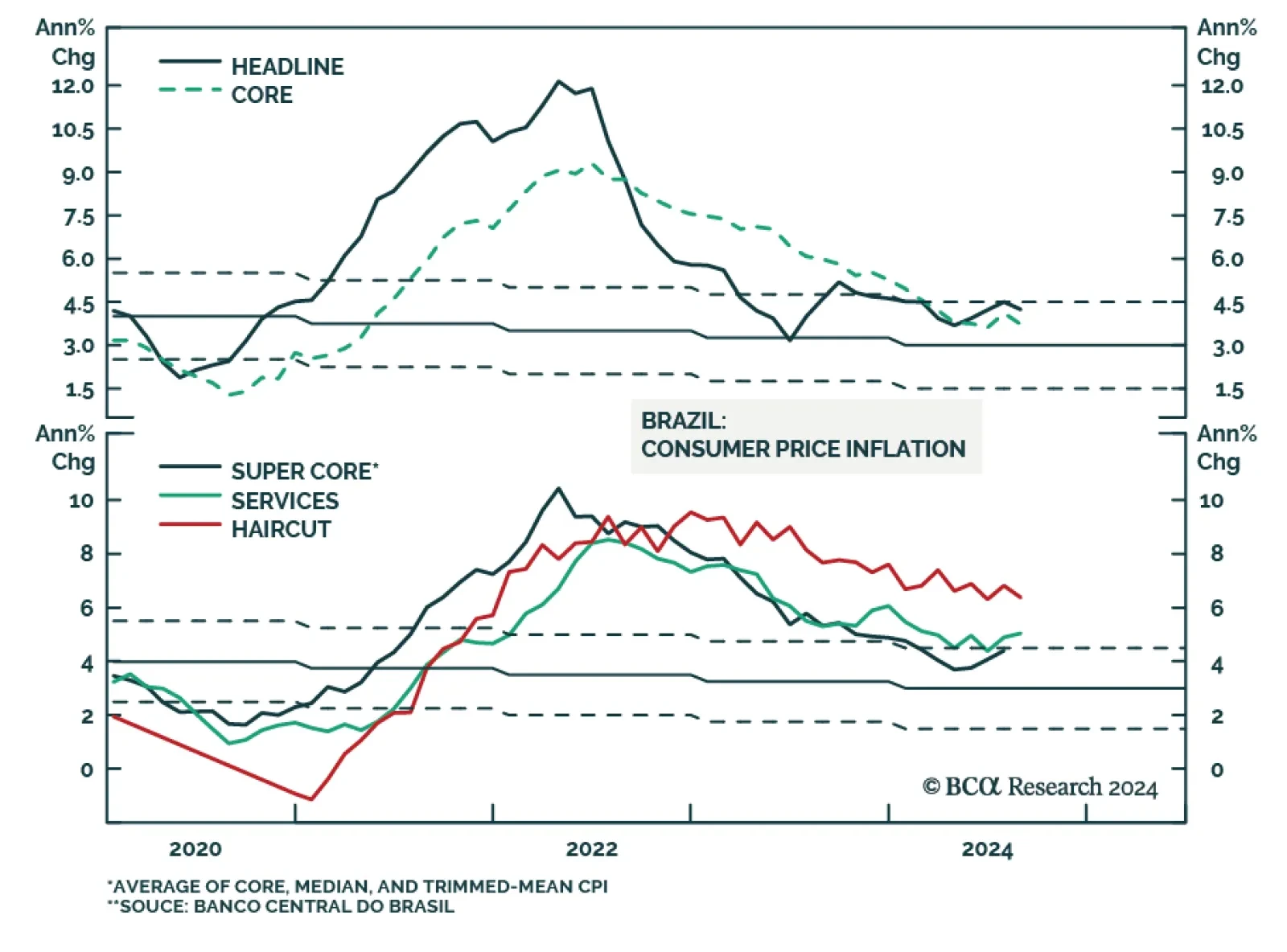

According to BCA Research’s Emerging Markets Strategy service, Brazil’s decision to raise interest rates is supported by recent economic data. Back in January of this year, they noted that Brazil would…

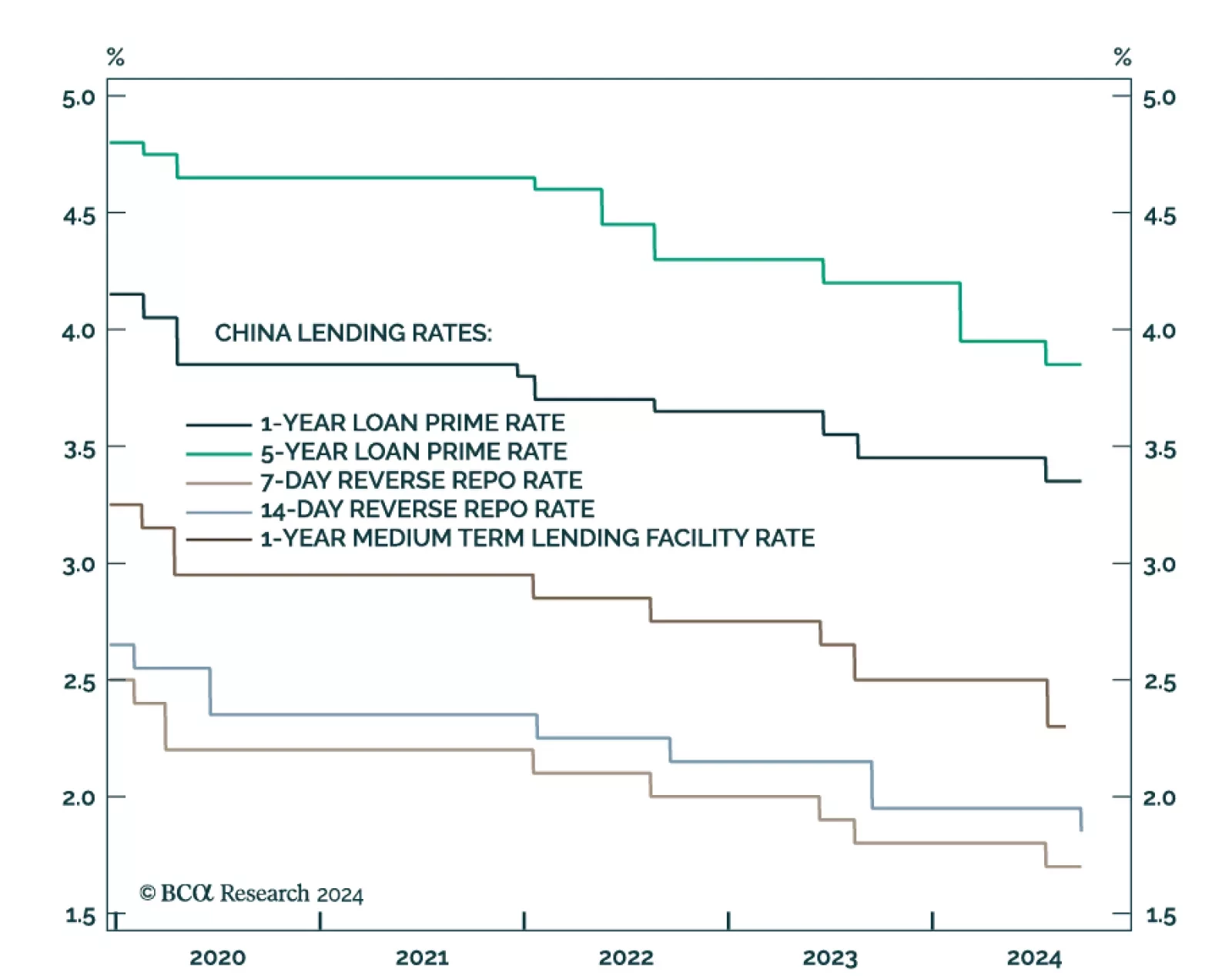

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

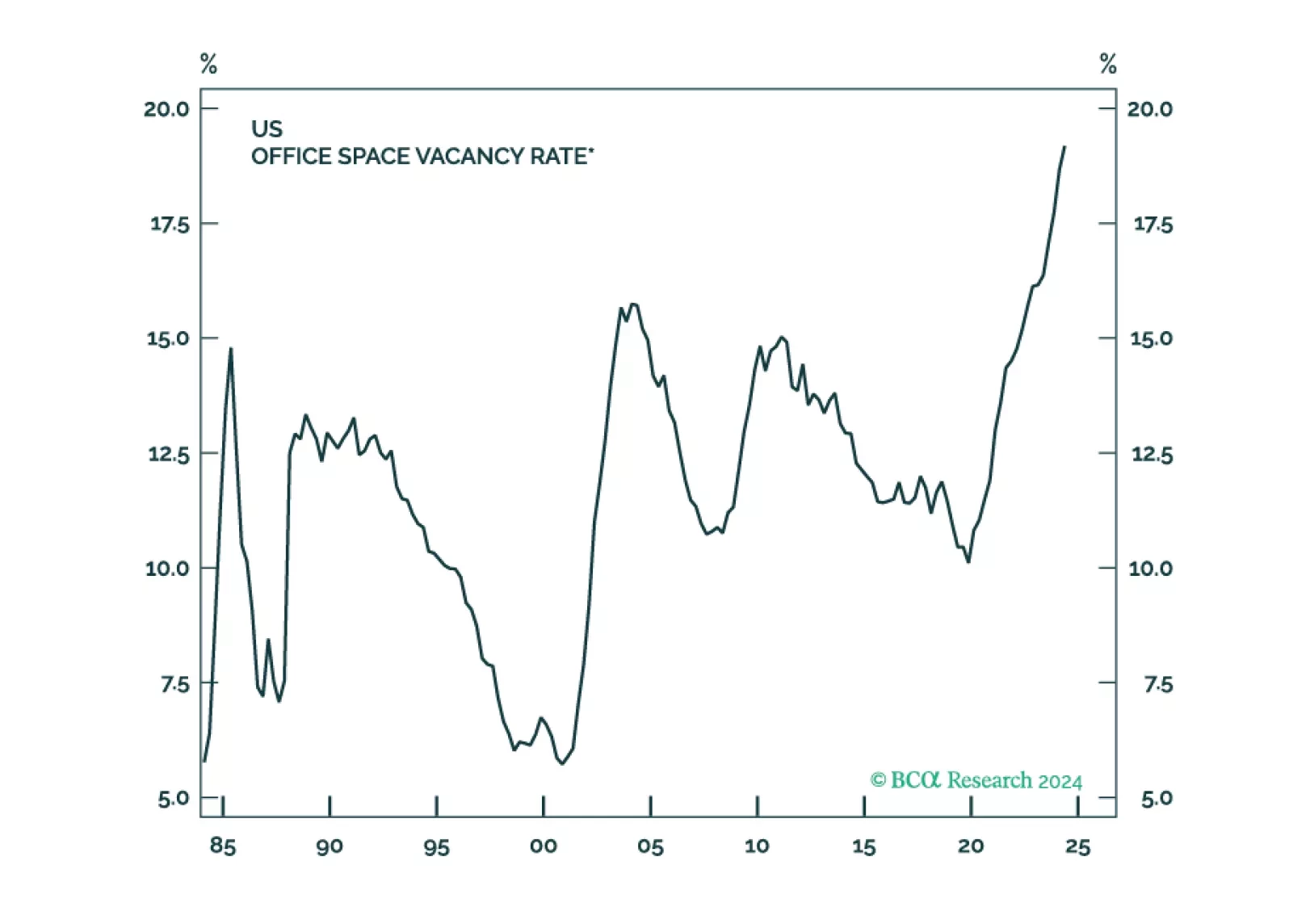

The US suffers from enough imbalances to produce a mild recession. Unfortunately, such a recession could lead to a significant bear market in stocks, just as it did during the very mild 2001 recession.

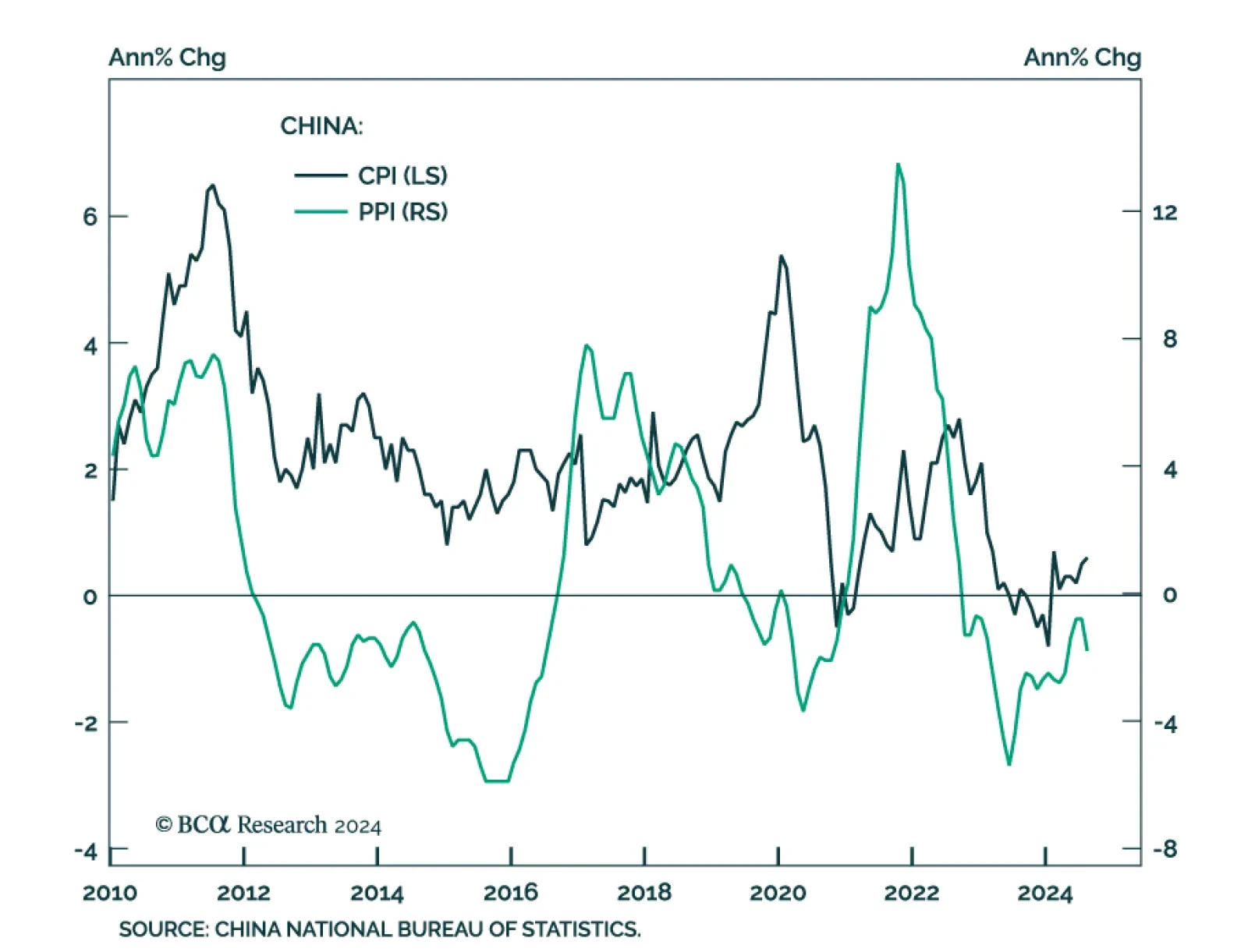

China’s CPI and PPI both surprised to the downside in August. Consumer prices grew from 0.5% y/y to 0.6%, below the 0.7% anticipated. However, a 2.8% y/y surge in food prices (the fastest pace so far this year)…